Bookkeeping Business Plan Template

Written by Dave Lavinsky

Bookkeeping Business Plan

You’ve come to the right place to create your Bookkeeping business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Bookkeeping companies.

Below is a template to help you create each section of your Bookkeeping business plan.

Executive Summary

Business overview.

Pacific Bookkeeping is a new bookkeeping firm located in Seattle, Washington. The firm will focus on providing expert bookkeeping services and exceptional customer service. We will help both small businesses and individuals and provide them with tax preparation, forecasting, budgeting, and other bookkeeping/accounting services.

Pacific Bookkeeping is led by Rebecca Stone, an experienced accountant who has been managing a large bookkeeping firm in Seattle, Washington for the past ten years. She graduated from Washington State University with an accounting degree and has been working at a large payroll firm since then, starting at an entry-level position and working her way up to a management-level role. Her experience and education have fully equipped her to run her own local bookkeeping firm.

Product Offering

Pacific Bookkeeping will provide a full range of bookkeeping services for individuals and small businesses. Some of these services include:

- Recording invoices

- Tax filing and preparation

- Financial reporting

- Payroll processing

- Monitoring accounts receivable

- Documenting receipts

- Forecasting

- Customer analysis

Customer Focus

Pacific Bookkeeping will primarily serve individuals and small businesses in the Seattle, Washington area. The city is home to over four million residents and around 100,000 businesses and many of them have a need for professional bookkeeping services. We will offer a wide variety of bookkeeping services in order to serve as many customers as we can in this target market.

Management Team

Pacific Bookkeeping is led by Rebecca Stone, an experienced accountant who has been working at a large bookkeeping firm in Seattle, Washington for the past ten years. She graduated from Washington State University with an accounting degree and then began working at the firm, starting at an entry-level position and working her way up to a management-level role. Though she has never run an accounting firm of her own, her experience has given her an in-depth knowledge of the bookkeeping industry, including the operations side (e.g., running day-to-day operations) and the business management side (e.g., staffing, marketing, etc.).

Success Factors

Pacific Bookkeeping will be able to achieve success by offering the following competitive advantages:

- Location: Pacific Bookkeeping is centrally located in the community, which provides ease of access for clients. The firm’s office will be located between the retail and business districts, making it accessible to a larger customer base.

- Competitive pricing: Pacific Bookkeeping’s pricing is more affordable than its closest competitors.

- Management: The management team has years of accounting experience that allows the company to market to and serve clients in a much more sophisticated manner than competitors.

- Relationships: Having lived in the community for over 20 years, Rebecca Stone knows all of the local leaders, newspapers, and other influencers. As such, it will be relatively easy for Pacific Bookkeeping to build brand awareness and an initial customer base.

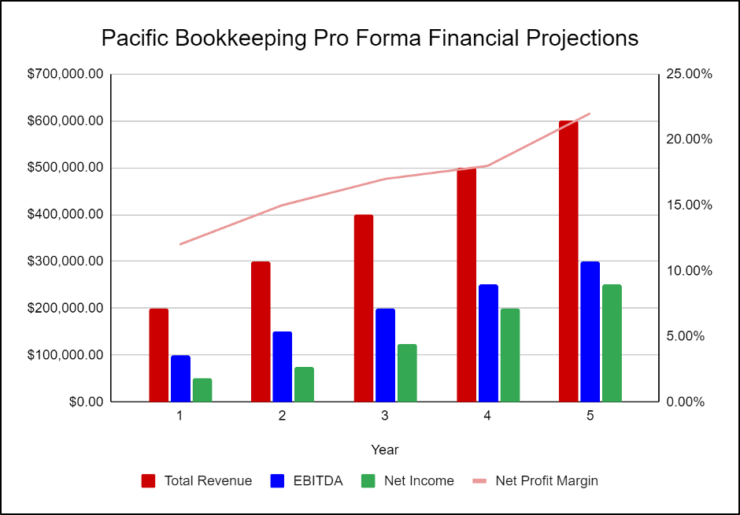

Financial Highlights

Pacific Bookkeeping is seeking a total funding of $200,000 of debt capital to open its bookkeeping firm. Funding will also be dedicated towards three months of overhead costs including the payroll of the staff, rent, and marketing costs. The breakout of the funding is below:

- Office space build-out: $20,000

- Office equipment, supplies, and materials: $10,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $10,000

- Working capital: $10,000

Company Overview

Who is pacific bookkeeping, pacific bookkeeping’s history.

Once her market analysis was complete, Rebecca Stone began surveying local office spaces for lease and identified an ideal location for the bookkeeping firm. Rebecca Stone incorporated Pacific Bookkeeping as a Limited Liability Corporation in January 2023.

Once the lease is finalized on the office space, interior design work can begin to make the office an appealing place to meet with clients.

Since incorporation, the company has achieved the following milestones:

- Located available office space for rent that is ideal for the bookkeeping firm

- Developed the company’s name, logo, and website

- Hired an interior decorating company to design and furnish the office

- Determined equipment and necessary supplies

- Began recruiting key employees

Pacific Bookkeeping’s Services

Industry analysis.

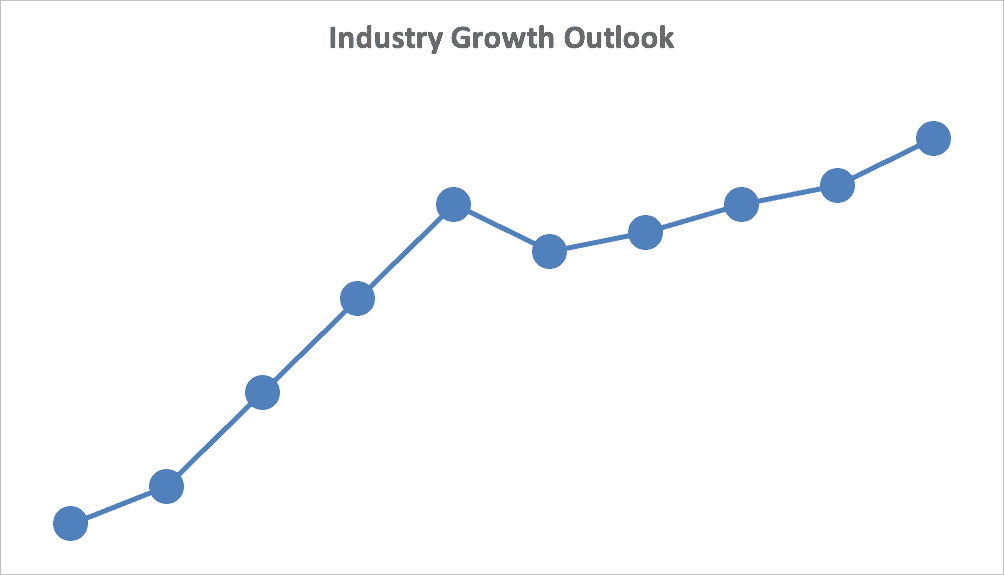

The United States Bookkeeping Industry is forecast to generate more than $66B this year. According to research reports, the largest bookkeeping firm in America generates approximately $9.5B annually. There are currently over 1.5M bookkeepers employed throughout the United States.

The top bookkeeping firms industry-wide are Automatic Data Processing (ADP) ($9.5B in annual revenue), Intuit ($7.8B in annual revenue), and Paychex ($4.0 in annual revenue). All other bookkeeping firms in the United States combined generate approximately $43.5B in annual revenue. An estimated 42% of industry revenue is generated through payroll services. Additional services such as billing, general accounting, tax preparation, and bookkeeping make up the remainder.

One of the biggest challenges for bookkeeping firms is the ability to keep up with changes in regulations. Additional hurdles include recruiting and retaining high-quality employees, keeping up with evolving technology, and acquiring new clients.

However, despite the challenges, the bookkeeping industry is expected to grow significantly throughout the rest of the decade. According to Data Intelo, the industry is expected to grow at a compound annual growth rate of 9.5% from now until 2030. This large growth shows that bookkeeping services are still in high demand, meaning that Pacific Bookkeeping has a solid chance of succeeding and maintaining a profit.

Customer Analysis

Demographic profile of target market.

Pacific Bookkeeping will serve individuals and small businesses in the community of Seattle, Washington, and its surrounding areas. Seattle has thousands of individuals and small businesses that would benefit from affordable bookkeeping services.

The precise demographics for Seattle, Washington are:

| Total | Percent | |

|---|---|---|

| Total population | 1,680,988 | 100% |

| Male | 838,675 | 49.9% |

| Female | 842,313 | 50.1% |

| 20 to 24 years | 114,872 | 6.8% |

| 25 to 34 years | 273,588 | 16.3% |

| 35 to 44 years | 235,946 | 14.0% |

| 45 to 54 years | 210,256 | 12.5% |

| 55 to 59 years | 105,057 | 6.2% |

| 60 to 64 years | 87,484 | 5.2% |

| 65 to 74 years | 116,878 | 7.0% |

| 75 to 84 years | 52,524 | 3.1% |

Customer Segmentation

Pacific Bookkeeping will primarily target the following customer profiles:

- Individuals

- Small businesses and nonprofits

- Government organizations

Competitive Analysis

Direct and indirect competitors.

Pacific Bookkeeping will face competition from other companies with similar business profiles. A description of each competitor company is below.

Young & Mitchell

Founded in the 1930s, Young & Mitchell has intentionally remained a small business so that the core group of professionals within the company could get to intimately know each one of their clients. The company is one of the leading tax firms in the Four State Region and offers financial guides and tax tools for individuals for free. Listed below is an outline of the services that the company offers according to its website:

- Tax Preparation and Planning Services

- Assurance and Advisory Services

- Estate and Trust Planning and Tax Preparation

- Bookkeeping/Write-up

- IRS Representation

- Accounting Services

- Audits, Reviews, and Compilation

- QuickBooks Accounting Help and Assistance

- Entity Selection and Restructuring

- Payroll Services

A Plus General Bookkeeping Services

A Plus General Bookkeeping Services is a bookkeeping firm that specializes in financial strategy and consulting for businesses of all sizes. The firm has been in business for over a decade and has acquired a loyal client base.

Clients may work with accountants in person, over the phone, through email, on video conferencing software, or completely through a new digital application. Although this firm has an excellent track record for service, it is also the most expensive bookkeeping company on the market.

Smith Brothers Accounting

Established in 1974, Smith Brothers Accounting is a privately held accountant practice that offers a wide variety of financial services including tax planning and preparation, payroll processing, financial planning, and small business accounting. Smith Brothers Accounting serves individuals and businesses.

Smith Brothers Accounting Services:

- Business Services

- Tax Services

- Individual Services

- Notary Services

Competitive Advantage

Pacific Bookkeeping will be able to offer the following advantages over the competition:

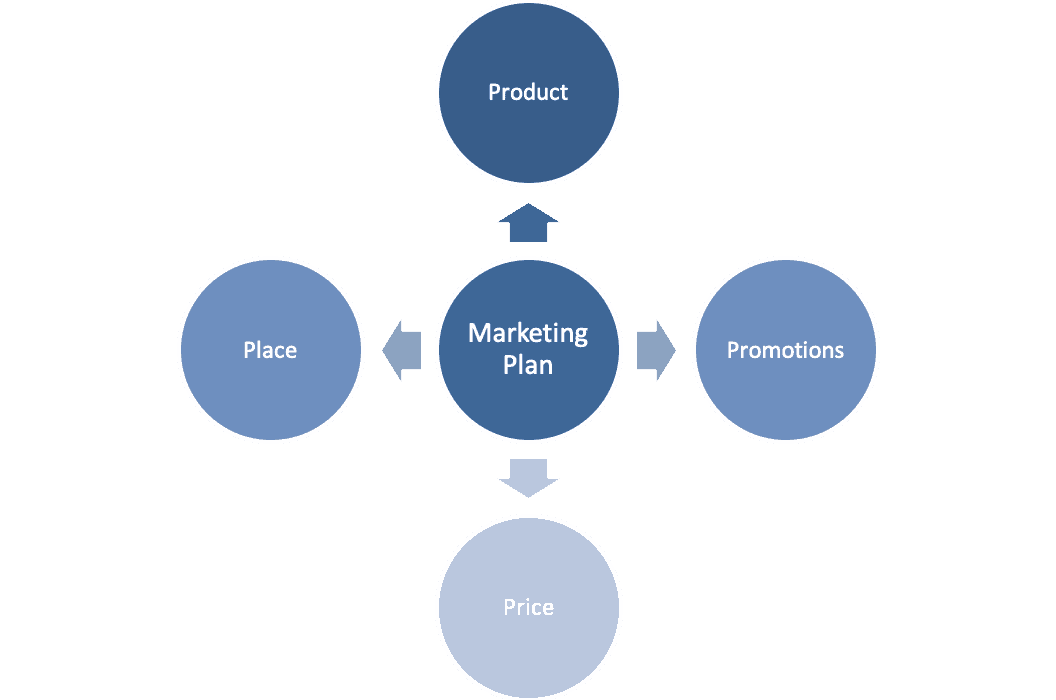

Marketing Plan

Brand & value proposition.

Pacific Bookkeeping will offer a unique value proposition to its clientele:

- Client-focused bookkeeping services

- Service built on long-term relationships

- Thorough knowledge of the latest regulations

- Big-firm expertise in a small-firm environment

Promotions Strategy

The promotions strategy for Pacific Bookkeeping is as follows:

Pacific Bookkeeping understands that the best promotion comes from satisfied customers. The company will encourage its clients to refer others by providing economic or financial incentives for every new client produced. This strategy will increase in effectiveness after the business has already been established.

Website/SEO

Pacific Bookkeeping will invest heavily in developing a professional website that displays all of the features and benefits of the bookkeeping company. It will also invest heavily in SEO so that the brand’s website will appear at the top of search engine results.

Social Media Marketing

Social media is one of the most cost-effective and practical marketing methods for improving brand visibility. The company will use social media to develop engaging content and post customer reviews that will increase audience awareness and loyalty.

Special Offers

Offers and incentives are an excellent approach to assisting businesses in replenishing the churn in their customer base that they lose each year. The company will introduce special offers to attract new clients and encourage repeat business.

Pacific Bookkeeping’s pricing will be moderate so consumers feel they receive great value when purchasing the bookkeeping services. The client can expect to receive quality bookkeeping services at a more affordable price than what they pay at other accounting firms.

Operations Plan

The following will be the operations plan for Pacific Bookkeeping.

Operation Functions:

- Rebecca Stone is the Owner and CEO of Pacific Bookkeeping. She will be in charge of the executive and operations aspects of the business. She will also provide bookkeeping services for her initial clients until she hires a full staff of accountants, bookkeepers, and tax preparation professionals.

- Rebecca is joined by Rhonda Wolfe who will be the company’s Administrative Assistant. She will help Rebecca with the administrative functions of the business.

- Rebecca is also joined by Samual Wright. He will act as the Marketing Manager and manage all the marketing and advertising functions for Pacific Bookkeeping.

- As the firm grows and takes on more clients, Rebecca will hire a team of experienced accountants, bookkeepers, and tax preparation professionals to help with the company’s service functions.

Milestones:

Pacific Bookkeeping will have the following milestones completed in the next six months.

- 3/202X Finalize lease agreement

- 4/202X Design and build out Pacific Bookkeeping

- 5/202X Hire and train initial staff

- 6/202X Kickoff of promotional campaign

- 7/202X Launch Pacific Bookkeeping

- 8/202X Reach break-even

Financial Plan

Key revenue & costs.

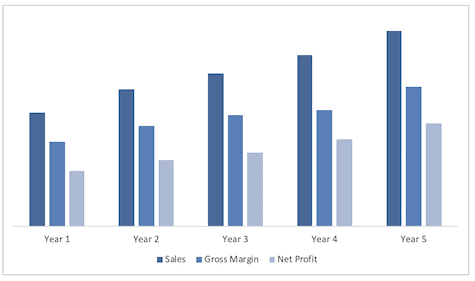

Pacific Bookkeeping’s revenues will come primarily from its bookkeeping services. The major costs for the company will include the salaries of the staff, marketing spending, and the rent for a prime location in Seattle.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and pay off the startup business loan.

- Annual rent: $50,000

- Year 3: 100

- Year 4: 125

- Year 5: 150

Financial Projections

Income statement.

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| Revenues | ||||||

| Total Revenues | $360,000 | $793,728 | $875,006 | $964,606 | $1,063,382 | |

| Expenses & Costs | ||||||

| Cost of goods sold | $64,800 | $142,871 | $157,501 | $173,629 | $191,409 | |

| Lease | $50,000 | $51,250 | $52,531 | $53,845 | $55,191 | |

| Marketing | $10,000 | $8,000 | $8,000 | $8,000 | $8,000 | |

| Salaries | $157,015 | $214,030 | $235,968 | $247,766 | $260,155 | |

| Initial expenditure | $10,000 | $0 | $0 | $0 | $0 | |

| Total Expenses & Costs | $291,815 | $416,151 | $454,000 | $483,240 | $514,754 | |

| EBITDA | $68,185 | $377,577 | $421,005 | $481,366 | $548,628 | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| EBIT | $41,025 | $350,417 | $393,845 | $454,206 | $521,468 | |

| Interest | $23,462 | $20,529 | $17,596 | $14,664 | $11,731 | |

| PRETAX INCOME | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Use of Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Taxable Income | $17,563 | $329,888 | $376,249 | $439,543 | $509,737 | |

| Income Tax Expense | $6,147 | $115,461 | $131,687 | $153,840 | $178,408 | |

| NET INCOME | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 |

Balance Sheet

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| ASSETS | ||||||

| Cash | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 | |

| Accounts receivable | $0 | $0 | $0 | $0 | $0 | |

| Inventory | $30,000 | $33,072 | $36,459 | $40,192 | $44,308 | |

| Total Current Assets | $184,257 | $381,832 | $609,654 | $878,742 | $1,193,594 | |

| Fixed assets | $180,950 | $180,950 | $180,950 | $180,950 | $180,950 | |

| Depreciation | $27,160 | $54,320 | $81,480 | $108,640 | $135,800 | |

| Net fixed assets | $153,790 | $126,630 | $99,470 | $72,310 | $45,150 | |

| TOTAL ASSETS | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 | |

| LIABILITIES & EQUITY | ||||||

| Debt | $315,831 | $270,713 | $225,594 | $180,475 | $135,356 | |

| Accounts payable | $10,800 | $11,906 | $13,125 | $14,469 | $15,951 | |

| Total Liability | $326,631 | $282,618 | $238,719 | $194,944 | $151,307 | |

| Share Capital | $0 | $0 | $0 | $0 | $0 | |

| Retained earnings | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| Total Equity | $11,416 | $225,843 | $470,405 | $756,108 | $1,087,437 | |

| TOTAL LIABILITIES & EQUITY | $338,047 | $508,462 | $709,124 | $951,052 | $1,238,744 |

Cash Flow Statement

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| CASH FLOW FROM OPERATIONS | ||||||

| Net Income (Loss) | $11,416 | $214,427 | $244,562 | $285,703 | $331,329 | |

| Change in working capital | ($19,200) | ($1,966) | ($2,167) | ($2,389) | ($2,634) | |

| Depreciation | $27,160 | $27,160 | $27,160 | $27,160 | $27,160 | |

| Net Cash Flow from Operations | $19,376 | $239,621 | $269,554 | $310,473 | $355,855 | |

| CASH FLOW FROM INVESTMENTS | ||||||

| Investment | ($180,950) | $0 | $0 | $0 | $0 | |

| Net Cash Flow from Investments | ($180,950) | $0 | $0 | $0 | $0 | |

| CASH FLOW FROM FINANCING | ||||||

| Cash from equity | $0 | $0 | $0 | $0 | $0 | |

| Cash from debt | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow from Financing | $315,831 | ($45,119) | ($45,119) | ($45,119) | ($45,119) | |

| Net Cash Flow | $154,257 | $194,502 | $224,436 | $265,355 | $310,736 | |

| Cash at Beginning of Period | $0 | $154,257 | $348,760 | $573,195 | $838,550 | |

| Cash at End of Period | $154,257 | $348,760 | $573,195 | $838,550 | $1,149,286 |

Bookkeeping Business Plan FAQs

What is a bookkeeping business plan.

A bookkeeping business plan is a plan to start and/or grow your bookkeeping business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Bookkeeping business plan using our Bookkeeping Business Plan Template here .

What are the Main Types of Bookkeeping Businesses?

There are a number of different kinds of bookkeeping businesses , some examples include: Traditional Bookkeeping and Accounting Business, Tax Preparation Services, Payroll Services, and Billing Services.

How Do You Get Funding for Your Bookkeeping Business Plan?

Bookkeeping businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Bookkeeping Business?

Starting a bookkeeping business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Bookkeeping Business Plan - The first step in starting a business is to create a detailed bookkeeping business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your bookkeeping business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your bookkeeping business is in compliance with local laws.

3. Register Your Bookkeeping Business - Once you have chosen a legal structure, the next step is to register your bookkeeping business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your bookkeeping business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Bookkeeping Equipment & Supplies - In order to start your bookkeeping business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your bookkeeping business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful bookkeeping business:

- How to Start a Bookkeeping Business

Bookkeeping Business Plan Template

Written by Dave Lavinsky

Bookkeeping Business Plan

Over the past 20+ years, we have helped over 9,000 entrepreneurs create business plans to start and grow their bookkeeping companies. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through a bookkeeping business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is a Bookkeeping Business Plan?

A business plan provides a snapshot of your business as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for a Bookkeeping Business

If you’re looking to start your own bookkeeping business or grow an established business, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your bookkeeping business in order to improve your chances of success. Your business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Bookkeeping Startups

With regards to funding, the main sources of funding for a bookkeeping business are personal savings, credit cards, bank loans, and angel investors. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financials are reasonable. But they will want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business.

The second most common form of funding for a bookkeeping company is angel investors. Angel investors are wealthy individuals who will write you a check. They will either take equity in return for their funding or, like a bank, they will give you a loan.

Finish Your Business Plan Today!

How to write a business plan for a bookkeeping company.

Your business plan should include 10 sections as follows:

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of business you are operating and the status; for example, are you a startup, do you have a bookkeeping business that you would like to grow, or are you operating a chain of bookkeeping companies.

Next, provide an overview of each of the subsequent sections of your plan. For example, give a brief overview of the bookkeeping business industry. Discuss the type of business you are operating. Detail your direct competitors. Give an overview of your target market. Provide a snapshot of your marketing strategy. Identify the key members of your team. And offer an overview of your financial plan.

Company Analysis

In your company analysis, you will detail the type of bookkeeping business you are operating.

For example, you might operate one of the following types:

- Traditional Bookkeeping and Accounting Business : the traditional bookkeeping and accounting business can provide the entire range of bookkeeping services, including maintaining journals and ledgers, balancing and reconciling accounts, preparing payroll, preparing and filing taxes, and providing billing and collection services.

- Tax Preparation Services : this type of bookkeeping business primarily prepares, reviews, and/or files tax returns and supplementary documents.

- Payroll Services : this type of bookkeeping business typically collects payroll information, processes paychecks, processes withholdings, and files reports.

- Billing Services : this type of bookkeeping business deals with sending bills and collecting payments.

In addition to explaining the type of business you operate, the Company Analysis section of your business plan needs to provide background on the business.

Include answers to question such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include sales goals you’ve reached, new store openings, etc.

- Your legal structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry analysis, you need to provide an overview of the bookkeeping business.

While this may seem unnecessary, it serves multiple purposes.

First, researching the bookkeeping industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your strategy particularly if your research identifies market trends. For example, it would be helpful to ensure your plan takes into account the seasonal nature of certain services such as tax preparation.

The following questions should be answered in the industry analysis section:

- How big is the bookkeeping industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential market for your bookkeeping business. You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section must detail the customers you serve and/or expect to serve.

The following are examples of customer segments : families, entrepreneurs, businesses, retirees, etc.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of bookkeeping business you operate. Clearly, families would want different pricing and product options and would respond to different marketing promotions than established businesses.

Try to break out your target market in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the customers you seek to serve. Because most bookkeeping companies primarily serve customers living in the same city or town, such demographic information is easy to find on government websites.

Psychographic profiles explain the wants and needs of your target customers. The more you can understand and define these needs, the better you will do in attracting and retaining your business clients.

Finish Your Bookkeeping Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other bookkeeping services and companies.

Indirect competitors are other options that customers have to purchase from that aren’t direct competitors. This includes accountants, companies’ internal accounting departments, professional employer organizations, and entrepreneurs/individuals doing their own bookkeeping. You need to mention such competition to show you understand that not everyone engages in bookkeeping services.

With regards to direct competition, you want to detail the other bookkeeping companies with which you compete. Most likely, your direct competitors will be bookkeeping companies located very close to your location.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What types of customers do they serve?

- What services do they offer?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide superior bookkeeping services?

- Will you provide bookkeeping services that your competitors don’t offer?

- Will you make it easier or faster for customers to acquire your services?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a bookkeeping business plan, you should include the following:

Product : in the product section, you should reiterate the type of business that you documented in your Company Analysis. Then, detail the specific products you will be offering. For example, in addition to account reconciliation, will you offer services such as tax preparation?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections, you are presenting the services you offer and their prices.

Place : Place refers to the location of your business. Document your location and mention how the location will impact your success. Discuss how your location might provide a steady stream of customers.

Promotions : the final part is the promotions section. Here you will document how you will drive customers to your location(s). The following are some promotional methods you might consider:

- Email marketing to prospective clients

- Advertising in local papers and magazines

- Reaching out to local bloggers and websites

- Social media advertising

- Pay per click advertising

- Local radio advertising

- Banner ads at local venues

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your bookkeeping business such as serving customers, procuring supplies, keeping the office clean, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to serve your 1,000th customer, or when you hope to reach $X in sales. It could also be when you expect to hire your Xth employee or launch a new location.

Management Team

To demonstrate your bookkeeping business’s ability to succeed as a business, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in the bookkeeping or accounting business. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in bookkeeping businesses and/or successfully running small businesses.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenues and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you serve 10 customers per week or 20? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets While balance sheets include much information, to simplify them to the key items you need to know about, balance sheets show your assets and liabilities. For instance, if you spend $100,000 on building out your bookkeeping business, that will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a bank writes you a check for $100.000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement Your cash flow statement will help determine how much money you need to start or grow your business and make sure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

In developing your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a bookkeeping or accounting business:

- Location build-out including design fees, construction, etc.

- Cost of equipment like computers and software

- Cost of maintaining an adequate amount of office supplies

- Payroll or salaries paid to staff

- Business insurance

- Taxes and permits

- Legal expenses

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your office design blueprint or location lease.

Bookkeeping Business Plan Summary

Putting together a business plan for your bookkeeping business is a worthwhile endeavor. If you follow the template above, by the time you are done, you will have an expert bookkeeping business plan; download it to PDF to show banks and investors. You will really understand the bookkeeping business, your competition, and your customers. You will have developed a marketing plan and will really understand what it takes to launch and grow a successful bookkeeping business.

Don’t you wish there was a faster, easier way to finish your Bookkeeping business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how a Growthink business plan consultant can create your business plan for you.

Other Helpful Business Plan Articles & Templates

Free Accounting and Bookkeeping Sample Business Plan PDF

1 min. read

Updated February 26, 2024

Looking for a free, downloadable accounting and bookkeeping sample business plan PDF to help you create a business plan of your own? Bplans has you covered.

Keep in mind that you don’t need to find a sample business plan that exactly matches your business. Whether you’re launching a larger accounting business in a bustling city or a smaller neighborhood office, the details will be different, but the bones of the plan will be the same.

Are you writing a business plan for your accounting firm because you’re seeking a loan? Is your primary concern building a clear roadmap for growth? Either way, you’re going to want to edit and customize it so it fits your particular company.

No two accounting businesses are alike. Your strategy will be different if you’re partnering with other CPAs, rather than working independently, for example. So take the time to create your own financial forecasts and do enough market research so you have a solid plan for success.

- What should you include in an accounting and bookkeeping business plan?

Your accounting business plan doesn’t need to be hundreds of pages—keep it as short and concise as you can. You’ll probably want to include each of these sections: executive summary, company summary and funding needs, products and services, marketing plan, management team, financial plan, and appendix.

One of the things that makes an accounting business plan different than some other service-based business plans is that you might decide to only work with businesses and not with individuals.

You may offer different tiers of service to different types of clients. If that’s the case, make sure you include ideas like up-selling small businesses from hourly consultation to quarter contracts.

Download this accounting and bookkeeping sample business plan PDF for free right now, or visit Bplans’ gallery of more than 550 sample business plans if you want more options.

There are plenty of reasons accounting business owners can benefit from writing a business plan —you’ll need one if you’re seeking a loan or investment.

Even if you’re not seeking funding, the process of thinking through every aspect of your business will help you make sure you’re not overlooking anything critical as you grow.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Kody Wirth is a content writer and SEO specialist for Palo Alto Software—the creator's of Bplans and LivePlan. He has 3+ years experience covering small business topics and runs a part-time content writing service in his spare time.

Table of Contents

Related Articles

6 Min. Read

Free Agriculture Sample Business Plan PDF + How to Write

13 Min. Read

How to Write an Online Fitness Business Plan

How to Write a Fix-and-Flip Business Plan + Free Template PDF

12 Min. Read

How to Write a Food Truck Business Plan (2024 + Template)

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Start a Bookkeeping Business

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Even as the nature of business changes, one job that is always in demand is bookkeeping. Bookkeepers are essential for other businesses to thrive, making sure that they’re keeping track of their financials correctly and on the right track to grow.

In this guide, we’ll review how to start a bookkeeping business, including what you need to do to get set up, how to price your services, how to find your customers and how to fund your business if need be.

What does a bookkeeper do?

A bookkeeper is an instrumental part of any business operation. A company hires a bookkeeper to manage and organize its finances, including detailing and categorizing all transactions. They help small-business owners get a handle on their cash flow — one of the most important barometers for a healthy business. They will also often help businesses produce crucial financial statements such as the profit and loss statement and balance sheet.

Keep in mind, though, bookkeepers differ from accountants as they cannot file taxes or perform audits like certified public accountants. Bookkeepers also aren’t required to have an accounting degree. While they can receive certifications through training programs, they can also simply acquire on-the-job experience to establish their bookkeeping business.

Typical bookkeeping services include:

Managing a business’s finances through business accounting software.

Manage accounts payable and receivable.

Help businesses with an overview of their finances to help them understand their habits.

Generate financial statements.

How to start a bookkeeping business in 8 steps

The good news is that learning how to start a bookkeeping business isn’t hard. Follow these steps to launch your bookkeeping business in no time.

1. Pick your market and niche

A bookkeeper’s work is applicable across many different types of industries — after all, every business needs to track and optimize its finances. However, to help market your business and set it apart amongst the competition, you may decide to specialize in a specific industry.

This could help you build credibility inside that segment, as well as help you hone your skills. Additionally, determining your target audience will be simple if you have a specialty. To help determine your niche, you should also research the market to determine what bookkeeping businesses are already established and which industries they serve.

2. Write a business plan

Regardless of the type of business you run, all business owners should write a business plan . That, of course, includes bookkeepers.

A business plan involves outlining your plans for your company in detail. It is a comprehensive document that explains not only your services but also your market and the competitive advantage you’ll have in your business. You’ll create projections and make plans for your growth. This document does tend to be lengthy, but it’s important to do. It’ll help you focus your business and run efficiently out of the gate.

There are two pieces of the business plan that deserve a little extra consideration.

Choose a business name

Your business name will be the first impression for potential clients, so you’ll want to consider this very carefully. What do you hope to communicate with your name? Is it your expertise, your specialty, your personality?

Before you choose your business name , make sure someone else isn’t already using it, lest clients get confused. Also, run the name by a few people to see the impression they get of it. Once you have your finalists, run the names through your secretary of state’s business name database to make sure it’s available.

Consider certification

As we mentioned above, you don’t technically need to be certified to run a bookkeeping business. You might, however, want to consider becoming a certified public bookkeeper , or CPB, which signals to clients that you have professional-level skills and might be an important part of how you differentiate yourself in a competitive market.

Certification is also available within certain software products, too — for instance, you can get certified in QuickBooks.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

3. Register your business and get insured

Once you’ve picked a business name, the next step is to register your business and make things official. The exact process will vary depending on how you plan on structuring your business and where you’re planning to do business. You’ll want to look up the exact rules for how to register your business with your secretary of state’s office.

Choose a business entity

A major part of registering your business and opening up shop is choosing a business entity. This will govern how you pay taxes as a small-business owner, but also what kind of liability protection you have in case something goes wrong and how you’ll structure your business.

If you’re just starting a bookkeeping business, it’s likely that you’ll just be working solo, at least for the beginning. Consider starting your search into business entities for bookkeepers by looking into sole proprietors and LLCs. The latter could be a great option if you might bring in some help down the line.

Obtain insurance

It’s not compulsory, but you might want to look into insurance for your bookkeeping business. This can help protect you from costly liability in case you make a mistake on your customers’ books — which can be a huge hit to your business and, in some cases, your personal finances — if you aren’t insured. Common business insurance policies for bookkeepers include things such as professional liability and general liability.

4. Choose your bookkeeping software

This one is a no-brainer: Your bookkeeping software will be the foundation of your business. You have lots of options for the best bookkeeping software, so look into them carefully.

If you are overwhelmed, however, or simply want to use the overwhelming favorite, you should consider using QuickBooks Online—this is one of the most popular accounting software providers on the market and is used by many small and large businesses alike. Another popular option is Xero, but there are plenty of bookkeeping apps to choose from. You can get certified in each of these programs, which can not only help you become a power user but can also help you market yourself as an expert.

5. Set up your business infrastructure

When you’re learning how to start a bookkeeping business, you’ll find that there are a few key pieces of infrastructure you’ll need to kick off. Carefully think about setting up the following:

Many clients will look for your website to find out about you and your experience. If you’re specifically running a totally virtual business, a website is extra important since it can demonstrate to clients your skills. And luckily, there are plenty of website builders to make creating your website a breeze.

Client database management

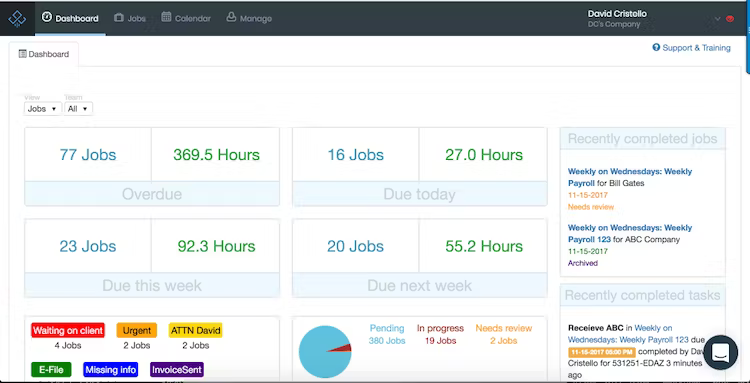

As you grow your client roster, you’ll want to make sure you're tracking them effectively and completely. You can use a CRM and project management tool in which you can set up your own workflow. You can also look into specific accounting practice management software, some of which integrate directly into software such as QuickBooks Online.

File-sharing

If your clients will be sending you things such as receipts or statements, you might want to consider the tool that you’ll use to share files. A popular option is Dropbox, in which you can create a shared folder that both you and your clients have access to.

Business bank account

You’ll also want to make sure that you set up a business bank account to keep your business finances separate from your personal finances. This is crucial for taxes as well as personal liability protection.

Start with a business checking account and, as your business grows, you may also opt for a business savings account to let your excess funds earn interest. Both traditional, brick-and-mortar banks and online institutions offer attractive banking options, so shop around before deciding where you want to park your hard-earned money.

6. Price your services

Figuring out what to charge is any small-business owner’s greatest challenge. Too little and you aren’t fairly compensated for your work; too much and you’ll have a tough time competing with other bookkeeping businesses.

PayScale, a site that tracks salaries and rates, puts the average hourly rate for a bookkeeper around $17 per hour ($10 on the low end and $24 on the high end). You might also want to look into freelance and for-hire contractor sites, such as UpWork or Fiverr, where people list their rates. Find bookkeepers that are similar in your skill set and experience to help gauge what you should be charging.

Remember that the amount that you charge should be contingent on your years of experience, specialization in industries, certifications you carry and your area. And, of course, your rate isn’t fixed — you can always change it if you feel like you’re not priced correctly.

7. Find your customers

Marketing is so important, no matter the type of business you own. The savviest small-business marketers are the ones who figure out exactly who their customers are and advertise directly to them.

You’ll want to think up a unique selling proposition for your business: For instance, are you touting your experience? Your industry specialization? Your focus on local business? This will all help you come up with the most creative ways to market yourself, which may include direct mail or radio ads, social media ads, email campaigns, or any number of other strategies.

Look into our comprehensive guide to small-business marketing, which will cover how to reach people through SEO, search ads, social media and more.

And never forget the power of word-of-mouth referrals — and don’t be too shy to ask for them.

8. Understand your funding options

If you’re starting out small, it’s likely you won’t need a large amount of business funding — you can always explore options down the line if, say, you open a brick-and-mortar office and hire multiple employees.

For now, though, you’ll likely want to get a business credit card to fund your bookkeeping business. This will give you the spending power to set up your company and put all of your business expenses in one place. That’s not only important for separating your business and personal finances, but can help you with your own bookkeeping come tax season.

There are lots of different types of business credit cards to look into, including options with 0% introductory APR periods, so if you have a few startup costs you can’t cover with savings, you can treat this type of card like an interest-free loan. Just make sure you have a plan to pay off the balance before the introductory offer ends and a variable APR sets in.

LLC Formation

The bottom line

One final thought on how to set up a bookkeeping business: Make sure that you grow as the businesses around you do, too. That doesn’t mean you have to take on more clients, but rather grow your knowledge and network.

Keep your skills up to date, evolve the depth in which you know your preferred platforms and stay apprised as their features change, as well. You can always attend professional events, too, such as conferences and networking events. Don’t forget that investing in your business means investing in yourself.

This article originally appeared on JustBusiness, a subsidiary of NerdWallet.

On a similar note...

Need a business plan? Call now:

Talk to our experts:

- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB1 Business Plan

- EB2 Visa Business Plan

- EB5 Business Plan

- Innovator Founder Visa Business Plan

- UK Start-Up Visa Business Plan

- UK Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Start-Up Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

Franchise Business Planning

- Landlord Business Plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- eCommerce business plan

- Online Boutique Business Plan

- Daycare business plan

- Mobile Application Business Plan

- Restaurant business plan

- Food Delivery Business Plan

- Real Estate Business Plan

- Business Continuity Plan

- Buy Side Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Templates

Bookkeeping Business Plan Sample

Published Mar.28, 2019

Updated Apr.19, 2024

By: Noor Muhammad

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

Table of Content

Do you want to start accounting and bookkeeping business plan?

A bookkeeping business requires you to manage your expenses and income, prepare tax returns for clients and process payrolls. You should learn how to approach clients and create a bookkeeping business plan template to get your business up and running. One thing you should not overlook is looking for an ideal banking partner. You should write a business plan before starting your business.

When a business plan is needed to acquire funding, the value it provides is all about the overall process. You need considering every aspect, like services and products, you are going to sell, the way you will market your offerings, and your competition. Here are some of the major items you should include in your business plan –

Executive Summary

When writing a bookkeeping services business plan template, the executive summary is a very important part. You need writing the overall review of your company business. You need describing your services to your clients. It will need investment in staff and marketing for the overall growth of your business to include the complementary range of your business. This segment of the business plan helps you in starting your own bookkeeping business . You need to do an in-depth and detailed analysis of your business strengths and weaknesses and ensure it has great odds of success.

- What services do you offer?

This way, your company can definitely provide bookkeeping services to your clients along with management accounting, tax accounting, as well as QuickBooks installation and services. You can also further expand to offer bookkeeping services for small businesses. You may want to offer quality and reliable services like Accounts Payable/Receivable, General Ledger, Billing & Collections, Payroll Management, Tax Preparation and Filling State, Federal and Local Forms.

- Who buys your product?

As a licensed and standard bookkeeping firm, you can offer a huge range of consulting solutions to a huge range of clients’ base. Your target market may be ranging from different industries and sizes. This way, you may want to target NGOs, Mom and Pop stores, Blue Chip companies, Hotels and Restaurants, Religious Organizations, Sports Organizations, Schools and others.

- How he implement business management?

Proper planning needs well-trained staff and efficient management team enough to run your business. You need describing the efficiency of your business partners and staff.

- What target of this business?

Here, you need describing your measurable goals. You should have a well-defined target and measurable elements to ensure the success of your business.

Company Summary

Financial services are quite a large industry and bookkeeping is one of the active segments of the businesses, which includes recording financial transactions in business. It is a kind of financial accounting process. The payroll and bookkeeping services industry has plenty of small business operators which serve many clients from start-ups to well-established ones.

Bookkeeping industry is a mature stage of growth. If you are wondering how to start a bookkeeping service business plan , it is very helpful to know how to outsource your human resource functions like payroll etc. to focus your attention on core business operations. The bookkeeping is a large and active industry especially in developed countries like USA, Canada, UK, France, Italy, Japan, China, etc. There are around 285,212 licensed and registered bookkeeping companies in the US alone.

- Who is owner of this company?

You need telling the ownership of your company, like a sole proprietorship, partnership, etc.

- Why you have started Bookkeeping business plan?

Bookkeepers usually keep transactions like sales, purchases, payments, and receipts by the organization or person. Your purpose to start this business may be related to one of these things.

- How you have to start the Bookkeeping business plan?

For doing this, you can partner with smaller companies also engaged in financial services, such as auditing firms, tax consulting firms, and others.

Here is the data in table containing the costs-

| Current Assets | |||

| Cash | $15,000 | $17,500 | $20,000 |

| Accounts Receivable | $4,167 | $6,250 | $7,292 |

| Other Current Assets | $5,000 | $5,000 | $5,000 |

| Long-term Assets | |||

| Long-term Assets | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Total Assets | $24,167 | $28,750 | $32,292 |

| Current Liabilities | |||

| Accounts Payable | $4,583 | $5,625 | $6,896 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities (interest free) | $0 | $0 | $0 |

| Long-term Liabilities | $0 | $0 | $0 |

| Paid-in Capital | $10,000 | $10,000 | $10,000 |

| Retained Earnings | ($10,417) | ($51,875) | ($83,554) |

| Earnings | $20,000 | $65,000 | $98,950 |

| Total Capital and Liabilities | $24,167 | $28,750 | $32,292 |

| Other Inputs | |||

| Payment Days | 30 | 30 | 30 |

| Sales on Credit | $50,000 | $75,000 | $87,500 |

| Receivables Turnover | 12 | 12 | 12 |

Services for customers

When creating an accounting business plan template , you need to describe what services you have on offer. Establishing the clientele of the accounting business takes time. It takes words of mouth, referrals, and recommendations for new clients to select your services. You may look at the advertisements or Yellow Pages to figure out the services your business can offer. Then you can add further information and pricing.

You should be prepared well to make profits from your industry. As a general overview of <strong>how to start a business plan template for home bookkeeping</strong>, you may offer the following services.

- Tax services like Tax Planning, Tax Preparation, addressing tax issues (IRS issues, payroll problems, bankruptcy, audit representation etc.)

- Cost Accountant/Management services like Cost and Margin analysis, Audits, Credit Card Processing setup, and Financial Projection

- QuickBooks training, QuickBooks setup, etc.

Along with these, your accountants may add these bookkeeping solutions –

- Sales tax processing

- Payroll processing

- Accounts receivable (invoicing, entry, collection, deposits etc.)

- Accounts payable (bill payments, entry)

- Bank Reconciliations

- Financial statement preparation

- Inventory Management

To add further value to your offerings, your accountant or bookkeeping manager may audit and supervise the work of bookkeepers, answer their queries, and provide quality service. They will also review QuickBooks reports and files to ensure they follow the formats properly and are prepared well.

Marketing Analysis of Accounting and Bookkeeping Business Plan

The market for small accounting business consists of almost every small business in the US. As businesses grow larger than a sole proprietorship, they usually need an expert solution with tax preparation and additional bookkeeping and accounting solutions. Even most of the non-employer proprietorships need accounting services at least once. When most small businesses have CEOs or bookkeepers for full time, some even outsource these services. When making home based bookkeeping business plan template, you need to consider the following questions –

- Who is the targeted audience of accounting and bookkeeping business?

Promotion activities in your business also vary according to your target market. When it comes to choosing an accountant, there is a great importance of referrals and words of mouth among all market segments. There are certain efforts you need to take to stimulate business when starting your own bookkeeping business plan home . You need creating a cost-effective business campaign, based on publicity, direct marketing, advertising, and customer reward program.

- What business target should company achieve?

Your business target clarifies what you want to achieve in your specific goals. You need to have a well-defined target with measurable elements to make an effective goal. There are different types of goals, and your plan should have a variety of goals. There are two different categories of goals for many businesses – marketing and financial targets. You need to tailor your objectives to cover the overall bookkeeping business.

- How much will be the average price of the product?

Here, you need to describe how much you are going to charge for your services. You should consider fee structure for your business clients according to their unique needs. On average, you may charge $55 on an hourly basis for businesses for accounting services. There is a base fee range of $50 to $125 for personal/housing tax preparation. There are also charges for filing in the schedules and forms involved. The personal consulting is also priced at an hourly rate of $25.

Referrals are the effective and most important parts of your business. Therefore, you need to be more aggressive in attracting new clients in the first few years, which will pass on the words and your business, can start experiencing natural growth. Useful and constructive planning needs a broad and detailed understanding of changes, which take place in the market where your company has competition, or want to compete.

SALES FORECAST

| Unit Prices | 2010 | 2011 | 2012 |

| Tax Preparations | $750.00 | $750.00 | $750.00 |

| Cost Accounting Analysis | $1,000.00 | $1,000.00 | $1,000.00 |

| QuickBooks Services | $300.00 | $300.00 | $300.00 |

| Bookkeeping Hours | $30.00 | $30.00 | $30.00 |

| Sales | |||

| Tax Preparations | $93,600 | $97,500 | $101,250 |

| Cost Accounting Analysis | $60,300 | $63,000 | $65,000 |

| QuickBooks Services | $17,100 | $17,700 | $18,600 |

| Bookkeeping Hours | $47,100 | $117,750 | $235,500 |

| Direct Unit Costs | 2010 | 2011 | 2012 |

| Tax Preparations | $37.50 | $37.50 | $37.50 |

| Cost Accounting Analysis | $30.00 | $30.00 | $30.00 |

| QuickBooks Services | $0.00 | $0.00 | $0.00 |

| Bookkeeping Hours | $15.00 | $15.00 | $15.00 |

| Direct Cost of Sales | |||

| Tax Preparations | $4,680 | $4,875 | $5,063 |

| Cost Accounting Analysis | $1,809 | $1,890 | $1,950 |

| QuickBooks Services | $0 | $0 | $0 |

| Bookkeeping Hours | $23,550 | $58,875 | $117,750 |

| Subtotal Direct Cost of Sales | $30,039 | $65,640 | $124,763 |

You also have to consider the ever-changing and thriving financial markets when starting your own bookkeeping business home . You need considering detailed technical skills in different disciplines like financial analysis, tax, sales, managing growth, and marketing, which are the important components to assess the risks and opportunities in a company.

- Who are your competitors?

When writing a business plan tamplate for bookkeeping business , you need to explain how you are going to stand out in competition. You may want to have detailed technical skills in different disciplines like financial analysis, tax, sales, managing growth, and marketing. These are the important components to assess the risks and opportunities for the company. Your management should develop disciplined planning and methodology to anticipate your economic needs and other important information.

- What is your sales strategy?

It is a strategy for business plan to sell your services to your existing clients, especially before your marketing efforts pay off with upcoming inquiries. You need to inform about the services to all the clients by phone. You may approach the clients through regular sales calls.

- What about your sales forecast?

When writing a business plan template for a bookkeeping business , describe the average cost of a project like tax services ($750), QuickBooks services ($300), and cost accounting ($1000). Bookkeeping services are charged on an hourly basis, i.e. $30 per hour.

Personnel Plan

When creating a business plan for accounting services , you might want to have a bookkeeping manager who will keep track of the work of bookkeepers. He will be in MS or MBA accounting program with years of bookkeeping and professional work experience, especially at the beginning of their graduate school program so they can work through two years of the program and be considered for a move to a full-time position in the third year.

| Bookkeeper training-period wages | $1,200 | $400 | $1,600 |

| Max Greenwood | $60,000 | $65,000 | $70,000 |

| Bookkeeper Manager | $24,000 | $28,800 | $48,000 |

| Benefits | $8,400 | $9,380 | $11,800 |

| Total Payroll | $93,600 | $103,580 | $131,400 |

The manager will also move from part-time to a full-time position in a few years to come. In the personnel plan, you need to explain about the staff you are going to hire and the team you have already.

- What staff would be needed for accounting and bookkeeping company?

In this part of the bookkeeping business plan template, explain what staff you would need for your company. You have to explain the key business members of your business. You need to explain whether you would hire full time or part-time staff. Will you need additional support staff to further expand your business? You need to explain key members of your business.

- What will be the average salary of your staff?

You will also have to explain the salary of your staff on average, along with office and other expenses during the first year. You can describe this part in detailed form.

Very professional

Had a great experience with OGS, especial ly Alex. Understood exactly what I wanted and did the job when promised. I was little skeptical about them at first but they definitely were amazing. Very happy with the work. I highly recommend them!

Financial Plan

This section of your bookkeeping company business plan consists of growth with positive cash flows with operations. It is unimportant to add owner investment or outside investment for business plan . The new line of business is not capital based and it will improve the fixed costs of business. Additional revenues from sales should cover it quickly. At least five clients use service without any problem, as they are all set to use bookkeeper or outsource their bookkeeping. Here are some of the assumptions of financial plan –

Important Assumptions

You need to describe your assumptions on the growth of your business over the next 2 to 3 years. You need to explain the working hours of your bookkeepers before reaching the capacity.

Break-even Analysis

It should be based on fixed costs behind running the business with old lines of your business. It is a significant rise from the breakeven point. You can describe your payroll, capacity, marketing activity, expenses of new bookkeeper, insurance, cost of sales etc.

Projected Profit and Loss

Here, you need to explain the proposed income and expenses of your business as well as the overall profit and loss. Also, explain how you are going to balance them.

Projected Cash Flow

You will need to explain the overall cost requirement in the first year and how you will balance out and get back to the positive cash flow in the next few years to come.

Projected Balance Sheet

If your new business succeeds as you expect, the net worth can improve in your business. Explain the debt of the business as well as external financing.

| Assets | |||

| Current Assets | |||

| Cash | $29,418 | $48,582 | $50,596 |

| Accounts Receivable | $10,730 | $14,560 | $20,680 |

| Other Current Assets | $5,000 | $5,000 | $5,000 |

| Long-term Assets | |||

| Long-term Assets | $0 | $0 | $0 |

| Accumulated Depreciation | $0 | $0 | $0 |

| Liabilities and Capital | 2010 | 2011 | 2012 |

| Current Liabilities | |||

| Accounts Payable | $10,708 | $12,418 | $18,663 |

| Current Borrowing | $0 | $0 | $0 |

| Other Current Liabilities | $0 | $0 | $0 |

| Long-term Liabilities | $0 | $0 | $0 |

| Paid-in Capital | $10,000 | $10,000 | $10,000 |

| Retained Earnings | $15,396 | $4,441 | ($14,276) |

| Earnings | $9,045 | $41,284 | $61,889 |

| Net Worth | $35,442 | $56,721 | $58,613 |

Business Ratios

You will need to explain the overall ratio of your assets with net worth. Explain how gross margins can be higher than averages.

| Sales Growth | 24.64% | 35.68% | 42.04% | 3.35% |

| Percent of Total Assets | ||||

| Accounts Receivable | 23.78% | 21.36% | 27.12% | 14.35% |

| Other Current Assets | 11.08% | 7.354% | 6.57% | 53.57% |

| Total Current Assets | 100.00% | 100.00% | 100.00% | 70.11% |

| Long-term Assets | 0.00% | 0.00% | 0.00% | 29.89% |

| Current Liabilities | 23.73% | 18.23% | 24.48% | 37.95% |

| Long-term Liabilities | 0.00% | 0.00% | 0.00% | 54.54% |

| Total Liabilities | 23.72% | 18.22% | 24.47% | 92.47% |

| Percent of Sales | ||||

| Sales | 100.00% | 100.00% | 100.00% | 100.00% |

| Gross Margin | 86.22% | 77.83% | 70.33% | 59.55% |

| Selling, General & Administrative Expenses | 82.09% | 63.88% | 55.61% | 28.36% |

| Advertising Expenses | 17.64% | 6.78% | 4.78% | 1.22% |

| Profit Before Interest and Taxes | 5.90% | 19.92% | 21.04% | 8.20% |

| Main Ratios | ||||

| Current | 4.22 | 5.49 | 4.10 | 1.25 |

| Quick | 4.20 | 5.50 | 4.12 | 1.19 |

| Total Debt to Total Assets | 23.70% | 18.20% | 24.48% | 92.48% |

| Pre-tax Return on Net Worth | 37.50% | 105.80% | 153.47% | 696.32% |

| Pre-tax Return on Assets | 28.60% | 86.56% | 115.90% | 52.40% |

| Additional Ratios | 2011 | 2012 | 2013 | |

| Net Profit Margin | 4.14% | 13.94% | 14.73% | n.a |

| Return on Equity | 26.27% | 74.08% | 107.43% | n.a |

| Activity Ratios | ||||

| Accounts Receivable Turnover | 10.15 | 10.15 | 10.15 | n.a |

| Collection Days | 28 | 30 | 30 | n.a |

| Accounts Payable Turnover | 10.75 | 12.14 | 12.14 | n.a |

| Payment Days | 29 | 28 | 25 | n.a |

| Total Asset Turnover | 4.82 | 4.33 | 5.50 | n.a |

| Debt Ratios | ||||

| Debt to Net Worth | 0.32 | 0.24 | 0.34 | n.a |

| Current Liab. to Liab. | 1 | 1 | 1 | n.a |

| Liquidity Ratios | ||||

| Net Working Capital | $32,441 | $53,724 | $55,613 | n.a |

| Interest Coverage | 0 | 0 | 0 | n.a |

| Additional Ratios | ||||

| Assets to Sales | 0.22 | 0.24 | 0.17 | n.a |

| Current Debt/Total Assets | 23% | 19% | 22% | n.a |

| Acid Test | 2.21 | 3.31 | 1.98 | n.a |

| Sales/Net Worth | 5.33 | 4.31 | 6.3 | n.a |

| Dividend Payout | 0 | 0.47 | 0.95 | n.a |

Download Bookkeeping Business Plan Sample in pdf

OGS capital writers specialize in business plan themes such as credit repair business plan , finance business plan , business plan for a financial advisor , holding company business plan , insurance agency business plan , insurance business plan and many other business plans.

OGSCapital’s team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Bowling Alley Business Plan Sample

Nightclub Business Plan (2024): A Comprehensive Guide

Rabbit Farming Business Plan

Beverages Business Plan

Private Schools Business Plan

Business Plan for a Lounge

Any questions? Get in Touch!

We have been mentioned in the press:

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search the site:

Bookkeeping Business Plan [Sample Template]

By: Author Tony Martins Ajaero

Home » Business ideas » Financial Service Industry » Accounting, Bookkeeping and Tax Preparation

Are you about starting a bookkeeping business ? If YES, here is a complete sample bookkeeping service business plan template & feasibility study you can use for FREE .

In case you didn’t know, there are loads of small businesses, mom and pop businesses, amongst a few without the faintest idea of any bookkeeping, payroll and accounting skills. These businesses struggle with their books a lot. Research shows that one of the reasons why many small businesses remain small and sometimes close shop is not because they don’t have clients or capital to run the business but because they fail to keep their books properly.

If you are an accountant, then you can leverage on this read to start your own bookkeeping and payroll services Business. You can be sure that your services would always be in demand by those small businesses that can’t afford to hire a full time accountant.

Suggested for You

- Tax Preparation Business Plan [Sample Template]

- Accounting Company Business Plan [Sample Template]

- Mobile Money Transfer Agency Business Plan [Sample Template]

- Investment Bank Business Plan [Sample Template]

- Private Banking Business Plan [Sample Template]

They know that it would save them cost and the good thing is that you can handle up to 20 clients per time depending on how organized and hardworking you are. Here is a sample bookkeeping business plan that will come in handy as you start your business;

A Sample Bookkeeping Service Business Plan Template

1. industry overview.

The financial services industry is indeed a broad industry and one of the active lines of businesses in the industry is bookkeeping and payroll services business. Bookkeeping is all about recording of financial transactions especially in businesses. It is part of the process of financial accounting in business.

The basic transactions that bookkeepers keep for businesses include purchases, sales, receipts, and payments by an individual person or an organization/corporation. Although there are quite a few standard methods of bookkeeping. Methods such as the single-entry bookkeeping system and the double-entry bookkeeping system are used.

The bookkeeping and payroll services industry has loads of small business operators servicing a wide range of clients ranging from start – ups to well established businesses. Basically, bookkeeping and payroll services firms offers outsourced payroll services for clients’ employees and basic bookkeeping services as requested.

The Bookkeeping and Payroll Services industry is indeed in a mature stage of its growth. The industry is characterized by growth in line with the overall outlook of the economy, consolidation from the largest players in the industry and wholehearted market acceptance of industry products and services.

The bookkeeping and payroll services line of business will continue to be in high demand by business establishment in the united states, most especially as the number of businesses and employees increases. Corporate organizations are also expected to continue to outsource their human resource functions such as payroll et al so as to focus their attention on their core area of operations.

The Bookkeeping and Payroll Services industry is indeed a large industry and pretty much active in countries such as United States of America, United Kingdom, France, Italy, Nigeria, South Africa Japan, China, Germany, and Canada et al.