- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Creating Brand Value

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading Change and Organizational Renewal

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

Setting Business Goals & Objectives: 4 Considerations

- 31 Oct 2023

Setting business goals and objectives is important to your company’s success. They create a roadmap to help you identify and manage risk , gain employee buy-in, boost team performance , and execute strategy . They’re also an excellent marker to measure your business’s performance.

Yet, meeting those goals can be difficult. According to an Economist study , 90 percent of senior executives from companies with annual revenues of one billion dollars or more admitted they failed to reach all their strategic goals because of poor implementation. In order to execute strategy, it’s important to first understand what’s attainable when developing organizational goals and objectives.

If you’re struggling to establish realistic benchmarks for your business, here’s an overview of what business goals and objectives are, how to set them, and what you should consider during the process.

Access your free e-book today.

What Are Business Goals and Objectives?

Business objectives dictate how your company plans to achieve its goals and address the business’s strengths, weaknesses, and opportunities. While your business goals may shift, your objectives won’t until there’s an organizational change .

Business goals describe where your company wants to end up and define your business strategy’s expected achievements.

According to the Harvard Business School Online course Strategy Execution , there are different types of strategic goals . Some may even push you and your team out of your comfort zone, yet are important to implement.

For example, David Rodriguez, global chief human resources officer at Marriott, describes in Strategy Execution the importance of stretch goals and “pushing people to not accept today's level of success as a final destination but as a starting point for what might be possible in the future.”

It’s important to strike a balance between bold and unrealistic, however. To do this, you must understand how to responsibly set your business goals and objectives.

Related: A Manager’s Guide To Successful Strategy Implementation

How to Set Business Goals and Objectives

While setting your company’s business goals and objectives might seem like a simple task, it’s important to remember that these goals shouldn’t be based solely on what you hope to achieve. There should be a correlation between your company’s key performance indicators (KPIs)—quantifiable success measures—and your business strategy to justify why the goal should, and needs to, be achieved.

This is often illustrated through a strategy map —an illustration of the cause-and-effect relationships that underpin your strategy. This valuable tool can help you identify and align your business goals and objectives.

“A strategy map gives everyone in your business a road map to understand the relationship between goals and measures and how they build on each other to create value,” says HBS Professor Robert Simons in Strategy Execution .

While this roadmap can be incredibly helpful in creating the right business goals and objectives, a balanced scorecard —a tool to help you track and assess non-financial measures—ensures they’re achievable through your current business strategy.

“Ask yourself, if I picked up a scorecard and examined the measures on that scorecard, could I infer what the business's strategy was,” Simon says. “If you've designed measures well, the answer should be yes.”

According to Strategy Execution , these measures are necessary to ensure your performance goals are achieved. When used in tandem, a balanced scorecard and strategy map can also tell you whether your goals and objectives will create value for you and your customers.

“The balanced scorecard combines the traditional financial perspective with additional perspectives that focus on customers, internal business processes, and learning and development,” Simons says.

These four perspectives are key considerations when setting your business goals and objectives. Here’s an overview of what those perspectives are and how they can help you set the right goals for your business.

4 Things to Consider When Setting Business Goals and Objectives

1. financial measures.

It’s important to ensure your plans and processes lead to desired levels of economic value. Therefore, some of your business goals and objectives should be financial.

Some examples of financial performance goals include:

- Cutting costs

- Increasing revenue

- Improving cash flow management

“Businesses set financial goals by building profit plans—one of the primary diagnostic control systems managers use to execute strategy,” Simons says in Strategy Execution . “They’re budgets drawn up for business units that have both revenues and expenses, and summarize the anticipated revenue inflows and expense outflows for a specified accounting period.”

Profit plans are essential when setting your business goals and objectives because they provide a critical link between your business strategy and economic value creation.

According to Simons, it’s important to ask three questions when profit planning:

- Does my business strategy generate enough profit to cover costs and reinvest in the business?

- Does my business generate enough cash to remain solvent through the year?

- Does my business create sufficient financial returns for investors?

By mapping out monetary value, you can weigh the cost of different strategies and how likely it is you’ll meet your company and investors’ financial expectations.

2. Customer Satisfaction

To ensure your business goals and objectives aid in your company’s long-term success, you need to think critically about your customers’ satisfaction. This is especially important in a world where customer reviews and testimonials are crucial to your organization’s success.

“Everything that's important to the business, we have a KPI and we measure it,” says Tom Siebel, founder, chairman, and CEO of C3.ai, in Strategy Execution . “And what could be more important than customer satisfaction?”

Unlike your company’s reputation, measuring customer satisfaction has a far more personal touch in identifying what customers love and how to capitalize on it through future strategic initiatives .

“We do anonymous customer satisfaction surveys every quarter to see how we're measuring up to our customer expectations,” Siebel says.

While this is one example, your customer satisfaction measures should reflect your desired market position and focus on creating additional value for your audience.

Related: 3 Effective Methods for Assessing Customer Needs

3. Internal Business Processes

Internal business processes is another perspective that should factor into your goal setting. It refers to several aspects of your business that aren’t directly affected by outside forces. Since many goals and objectives are driven by factors such as business competition and market shifts, considering internal processes can create a balanced business strategy.

“Our goals are balanced to make sure we’re holistically managing the business from a financial performance, quality assurance, innovation, and human talent perspective,” says Tom Polen, CEO and president of Becton Dickinson, in Strategy Execution .

According to Strategy Execution , internal business operations are broken down into the following processes:

- Operations management

- Customer management

While improvements to internal processes aren’t driven by economic value, these types of goals can still reap a positive return on investment.

“We end up spending much more time on internal business process goals versus financial goals,” Polen says. “Because if we take care of them, the financial goals will follow at the end of the day.”

4. Learning and Growth Opportunities

Another consideration while setting business goals and objectives is learning and growth opportunities for your team. These are designed to increase employee satisfaction and productivity.

According to Strategy Execution , learning and growth opportunities touch on three types of capital:

- Human: Your employees and the skills and knowledge required for them to meet your company’s goals

- Information: The databases, networks, and IT systems needed to support your long-term growth

- Organization: Ensuring your company’s leadership and culture provide people with purpose and clear objectives

Employee development is a common focus for learning and growth goals. Through professional development opportunities , your team will build valuable business skills and feel empowered to take more risks and innovate.

To create a culture of innovation , it’s important to ensure there’s a safe space for your team to make mistakes—and even fail.

“We ask that people learn from their mistakes,” Rodriguez says in Strategy Execution . “It's really important to us that people feel it’s safe to try new things. And all we ask is people extract their learnings and apply it to the next situation.”

Achieve Your Business Goals

Business goals aren’t all about your organization’s possible successes. It’s also about your potential failures.

“When we set goals, we like to imagine a bright future with our business succeeding,” Simons says in Strategy Execution . “But to identify your critical performance variables, you need to engage in an uncomfortable exercise and consider what can cause your strategy to fail.”

Anticipating potential failures isn’t easy. Enrolling in an online course—like HBS Online’s Strategy Execution —can immerse you in real-world case studies of past strategy successes and failures to help you better understand where these companies went wrong and how to avoid it in your business.

Do you need help setting your business goals and objectives? Explore Strategy Execution —one of our online strategy courses —and download our free strategy e-book to gain the insights to create a successful strategy.

About the Author

How To Set Business Goals (+ Examples for Inspiration)

Updated: July 22, 2024

Published: October 24, 2023

You’re a business owner — the captain of your own ship. But how do you ensure you’re steering your company in the right direction?

Without clear-cut goals and a plan to reach them, you risk setting your sails on the course of dangerous icebergs.

Table of contents:

- What are business goals?

Why business goals are important

How to set business goals, tips to achieve business goals, business goals examples, what are business goals .

Business goals are the desired outcomes that an organization aims to achieve within a specific time frame. These goals help define the purpose and direction of the company, guiding decision-making and resource allocation. They can be short-term or long-term objectives , aligned with the company’s mission and vision.

Free Business Startup kit

9 templates to help you brainstorm a business name, develop your business plan, and pitch your idea to investors.

- Business Name Brainstorming Workbook

- Business Plan Template

- Business Startup Cost Calculator

Download Free

All fields are required.

You're all set!

Click this link to access this resource at any time.

Operating a business using your gut and feelings will only get you so far. If you’re looking to build a sustainable company, then you need to set goals in advance and follow through with them.

Here’s what goal setting can do to make your business a success:

- Give your business direction. Business goals align everyone toward a common purpose and ensure all efforts and resources are directed toward achieving specific outcomes.

- Keep everyone motivated to keep pushing forward. Goals provide employees with a sense of purpose and motivation. According to research from BiWorldwide, goal setting makes employees 14.2x more inspired at work and 3.6x more likely to be committed to the organization.

- Create benchmarks to work toward (and above). Goals provide a basis for measuring and evaluating the performance of the organization. They serve as benchmarks to assess progress, identify areas of improvement, and make informed decisions about resource allocation and strategy adjustments .

- Prioritize activities and allocate resources effectively. Goals help you identify the most important initiatives, ensuring that time, money, and effort are invested in activities that align with the overall objectives.

- Make continuous organizational improvements. Goals drive continuous improvement by setting targets for growth and progress. They encourage businesses to constantly evaluate their performance, identify areas for refinement, and implement strategies to enhance efficiency and effectiveness.

Nothing creates solidarity among teams and departments like shared goals. So be sure to get everyone involved to boost camaraderie.

Setting business goals requires careful consideration and planning. By defining specific and measurable targets, you can track progress and make necessary adjustments along the way.

Here are the steps to effectively set business goals.

Step 1: Identify key areas to improve in your business

Start by assessing the current state of your organization. Identify areas that require improvement or growth. This could include increasing revenue, expanding your customer base, improving employee satisfaction, or enhancing product offerings.

Step 2: Choose specific and measurable goals

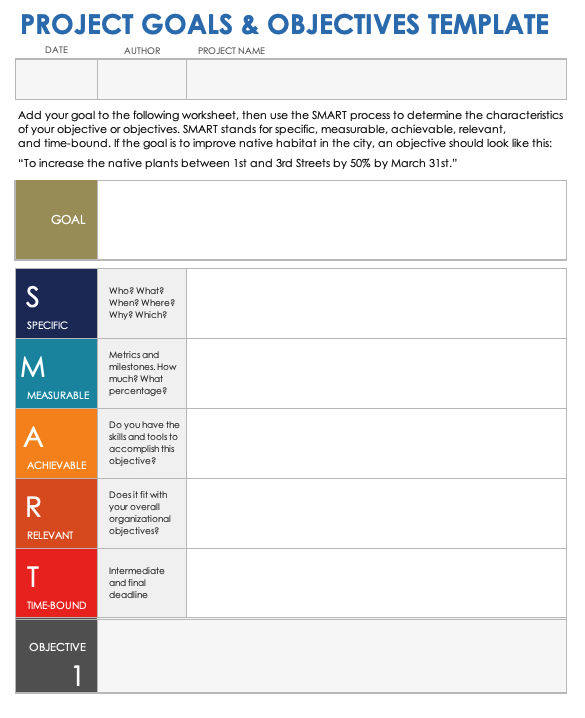

Setting clear and specific goals is essential. Use the SMART goal framework to ensure your goals are Specific, Measurable, Achievable, Relevant, and Time-bound. For example, instead of setting a vague goal like “increase revenue,” set a specific goal like “increase revenue by 15% in the next quarter.”

Step 3: Prioritize which goals to tackle first

Not all goals are equally important or urgent. Evaluate the impact and feasibility of each goal and prioritize them accordingly. By ranking your goals, you can focus your efforts and resources on the most critical objectives.

Step 4: Break down your goals into smaller milestones

Breaking down each goal into smaller, manageable tasks makes them more attainable. Assign responsibilities and set deadlines for each step. This approach helps track progress and ensures accountability.

Step 5: Decide what your Key Performance Indicators (KPIs) will be

Key Performance Indicators (KPIs) are metrics used to measure progress toward your goals. Set realistic and relevant KPIs that align with your objectives. For example, if your goal is to increase customer acquisition, a relevant KPI could be the number of new customers acquired per month.

Now that you have set your business goals, it’s time to take action and work toward achieving them. Here are some tips to help you stay on track:

1. Write down your action plan

Develop a detailed plan of action for each goal. Identify the necessary resources, strategies, and milestones to achieve them. A well-defined action plan provides a road map for success.

2. Foster a culture that’s goal-oriented

Encourage your employees to embrace and contribute to your goals. Foster a culture that values goal setting and achievement. Recognize and reward individuals or teams that make significant progress toward the goals.

3. Regularly track and evaluate progress

Monitor the progress toward each goal and make adjustments as needed. Use project management tools or software to track and visualize progress. Regularly review and evaluate your performance to ensure you’re on the right track.

4. Seek feedback and adapt

Gather feedback from employees, customers, and stakeholders. Their insights can provide valuable perspectives and help you refine your goals and strategies. Adapt your approach based on feedback to increase your chances of success.

5. Stay focused and motivated (even when you fail)

Staying motivated to achieve goals is difficult, especially when you come up short or fail. But don’t let this set you back. Continue pushing forward with your goals or readjust the direction as needed. Then do whatever you can to avoid distractions so you stay committed to your action plan.

Also, remember to celebrate small wins and milestones along the way to keep your team motivated and engaged.

Free SMART Goal Template

A free template to help you create S.M.A.R.T. goals for marketing campaign success.

- Set your goals

- Calculate your metrics

- Evaluate your success

To provide inspiration, here are some examples of common business goals:

1. Revenue growth

Revenue growth is a business goal that focuses on increasing the overall income generated by the company. Setting a specific target percentage increase in revenue can create a measurable goal to work toward.

Strategies for achieving revenue growth may include:

- Expanding the customer base through targeted marketing campaigns

- Improving customer retention and loyalty

- Upselling or cross-selling to existing customers

- Increasing the average order value by offering premium products or services

Example: A retail company sets a goal to increase its revenue by 10% in the next fiscal year. To achieve this, it implements several strategies, including launching a digital marketing campaign to attract new customers, offering personalized discounts and promotions to encourage repeat purchases, and introducing a premium product line to increase the average order value.

2. Customer acquisition

Customer acquisition focuses on expanding the customer base by attracting new customers to the business. Setting a specific goal for the number of new customers helps businesses track their progress and measure the effectiveness of their marketing efforts.

Strategies for customer acquisition may include:

- Running targeted advertising campaigns

- Implementing referral programs to incentivize existing customers to refer new ones

- Forming strategic partnerships with complementary businesses to reach a wider audience

Example: A software-as-a-service (SaaS) company aims to acquire 1k new customers in the next quarter. To achieve this, it launches a social media marketing campaign targeting its ideal customer profile, offers a referral program where existing customers receive a discount for referring new customers, and forms partnerships with industry influencers to promote its product.

3. Employee development

Employee development goals focus on enhancing the skills and knowledge of employees to improve their performance and contribute to the organization’s growth. By setting goals for employee training and skill development, businesses can create a culture of continuous learning and provide opportunities for career advancement.

Strategies for employee development may include:

- Offering training programs

- Providing mentorship opportunities

- Sponsoring professional certifications

- Creating a career development plan for each employee

Example: A technology company aims to have 80% of its employees complete at least one professional certification within the next year. To achieve this, it offers financial support and study materials for employees interested in obtaining certifications, provides dedicated study time during working hours, and celebrates employees’ achievements upon certification completion.

4. Product development

Product development goals focus on creating and improving products or services to meet customer needs and stay competitive in the market. Setting goals for product development can prioritize your efforts and so you can allocate resources effectively.

Strategies for product development may include:

- Conducting market research to identify customer preferences and trends

- Gathering customer feedback through surveys or focus groups

- Investing in research and development to create new products or enhance existing ones

- Collaborating with customers or industry experts to co-create innovative solutions

Example: An electronics company sets a goal to launch three new product lines within the next year. To achieve this, it conducts market research to identify emerging trends and customer demands, gathers feedback from its target audience through surveys and usability testing, allocates resources to research and development teams for product innovation, and collaborates with external design agencies to create visually appealing and user-friendly products.

5. Social responsibility

Social responsibility goals focus on making a positive impact on society or the environment. These goals go beyond financial success and emphasize the importance of ethical and sustainable business practices. Setting goals for social responsibility allows businesses to align their values with their actions and contribute to causes that resonate with their stakeholders.

Strategies for social responsibility may include:

- Implementing sustainable practices to reduce environmental impact

- Donating a percentage of profits to charitable organizations

- Supporting local communities through volunteer programs

- Promoting diversity and inclusion within the organization

Example: A clothing retailer aims to reduce its carbon footprint by 20% in the next two years. To achieve this, it implements sustainable practices, such as using eco-friendly materials, optimizing packaging to minimize waste, and partnering with ethical manufacturers. It also donates a percentage of its profits to an environmental conservation organization.

Don't forget to share this post!

Powerful and easy-to-use sales software that drives productivity, enables customer connection, and supports growing sales orgs

How to Set Small Business Goals

8 min. read

Updated January 4, 2024

How happy are you with your business’s performance? Are you patting yourself on the back, having nailed every goal?

If the answer is no, you’re like many business owners who struggle to hit business targets. You know exactly what you want—a bigger business, larger per-customer sales, more leads, higher profits—but you struggle to meet your goals.

In this article, we’ll show you how to set clear and actionable business goals to help you reach your full potential as an entrepreneur.

How to set achievable business goals

There is always so much to do when you’re a business owner. You need to find new clients, keep your existing clients happy, manage your finances, streamline your processes, and motivate your employees—all at the same time. Here’s how you sort through all that clutter and set goals to move the needle.

1. Clarify the goals you’ll prioritize

To ensure you don’t waste time and money—you must know your top priorities when setting company goals for the year. These should be clear opportunities or issues that show the most significant potential to grow your business.

So, how do you identify them?

A SWOT analysis provides a simple but effective framework. You’ll look at your business and competitors to identify potential advantages and shortcomings that can set you apart.

If you’re an up-and-running business, you’ll find additional value by reviewing your financial statements and forecasts .

- Where did you over or underperform?

- Is your cash on hand what you expected?

- Are you overspending in any areas?

Answering questions like these will help you understand your current financial position. From there, you can dig deeper into specific departments, initiatives, line items, etc., and uncover what opportunities are worth tackling in the next year.

Example: You run a local salon, and during your review, there was an immediate red flag—revenue is down. Exploring a bit further, you found that the average order value of each customer had decreased and that the number of new customers was far lower than the previous year.

Considering those issues, you develop the following business goals:

- Introduce new product offerings and add-ons to increase revenue from existing clients.

- Increase client base by targeting local office workers.

Please note: These aren’t goals yet! They are your key areas to focus on. After you’ve discussed them with your team—which we’ll cover next—you’ll turn them into SMART goals (specific, measurable goals) to ensure that you’ll take action on them.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

2. Review these goals with your team

Your team is out there every day, working on your products or talking to clients. They are the people who can tell you what’s working and what’s not, what’s holding your business back, and where you should be focusing your efforts and setting your business goals for the year ahead.

So, once you’ve selected what you think should be the top goals for your business, sit down with your employees, and get their feedback. They may agree or have valuable insights that you haven’t considered.

By involving your employees in the goal-setting process, you make them feel valued and engaged while at the same time ensuring your goals are realistic and achievable.

Dig deeper: How to set team goals that actually work

3. Make your goals SMART

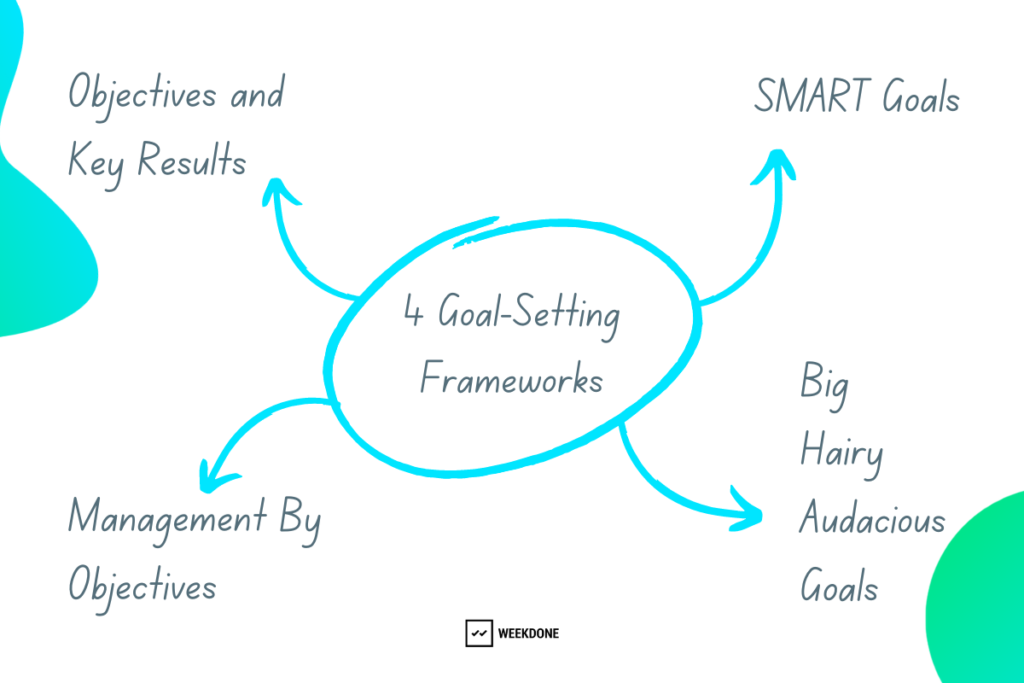

You have two to three business goals. Now, it’s time to make them actionable. While you can use several different goal-setting frameworks to do this, we recommend SMART goals:

- Specific: What exactly are you going to do?

- Measurable: How will you know if you are succeeding?

- Achievable: How will you implement the goal?

- Relevant: Does the goal connect to your overall objectives?

- Timely: When will you achieve the goal by?

Let’s take one of our business goals and turn it into a SMART goal.

Original idea: Increase client base by targeting local office workers.

- Specific: Gain 20 new customers from the surrounding office buildings.

- Measurable: Measure progress by tracking the number of new customers won and profits made while maintaining our existing customer base.

- Achievable: We will create a customized sales promotion, which we will publicize via leaflets and flyers in the office building.

- Relevant: This will help us increase the number of new customers, thus growing the salon business and profits.

- Timely: We will achieve this by the end of Q2 2024.

Dig deeper: How to set SMART business goals

4. Set key performance indicators (KPIs)

The SMART goal format should give you an idea of your timeline and what it will take to achieve your goal. However, you need to establish how you’ll measure your progress. One of the most common ways to do this is by adopting Key Performance Indicators (KPIs) .

These numerical values, like the number of new clients from a specific campaign or monthly sales targets, indicate whether the goal is within reach. While creating SMART goals, you’ll define relevant KPIs, ensuring they align with company and individual objectives.

For example, a salon might have overall KPIs related to customer acquisition from a campaign, while a stylist might focus on customer satisfaction and spending KPIs.

Dig deeper: 12 tips for choosing effective KPIs

5. Set a structure to review and revise

If you want to make something happen, you need to create a schedule and build good habits around it.

If you want to get healthier, you need to add exercise to your schedule, plan time to cook healthy meals, and so on. You should treat your business goals the same way. You need to schedule the actions you’ll take to reach your KPIs.

It’s a great idea to put regular (possibly monthly) business plan review meetings on your company calendar now This will help you set, revisit and revise specific short-and-long-term business goals and objectives.

To make these meetings less overwhelming, try and automate as much as possible. Use a calendar for both you and your staff, and add reminders and online task management software to organize tasks, set deadlines, and prompt you for repeat actions.

Dig deeper: How to develop a strategic action plan

- The importance of setting business goals

Why are goals important? Here are a few reasons:

Goals provide clarity

There are plenty of things that you want to accomplish as a business owner. But what tasks are most important? How do you know if you’re making progress?

Setting well-structured goals will help you prioritize work, establish a direction, and provide a framework to measure success. No more random assignments or distractions—just a clear idea of what you want to achieve and how you’ll get there.

Goals motivate and align your team

Aimlessly taking on work does not lead to success. Without a set goal, there’s no shining beacon ahead that you’re trying to reach. And no milestones on the way there to celebrate and keep you going.

Having company and team goals provides greater motivation. It also makes it far easier to set individual goals that connect each employee’s work to that larger objective.

Goals provide a structure to measure success

Setting goals requires you to consider what metrics you’ll use to measure success. Doing this upfront makes tracking your progress much more manageable and lets you know if you’re still on track.

Skipping the goal-setting process means your ideas of success will remain vague and aimless. You’ll be more likely to run down unproductive rabbit holes and may never actually realize your aspirations.

Goals help your business grow

Much like writing a business plan increases your chances of successfully launching a business —setting goals increases your chances of achieving regular business growth. You’ll have well-structured ideas of where you want to go, how to get there, and if you’re progressing.

And by continuing to set, review, and revise your goals—you’ll speed up the process and avoid costly mistakes.

- Types of business goals

The goal-setting process in this article focused primarily on long-term business performance goals—the kind you’ll set once a year. These broader goals may focus on any of the following:

Financial goals

Whether it’s achieving a specific net profit margin or finding ways to cut back on certain expenses—these goals focus on growing or maintaining financial health.

Customer-related goals

These goals are all about better serving your target customer. This may include improving customer service, increasing repeat purchases, or expanding your clientele.

Operational goals

Sometimes, you’ll find savings by optimizing current workflows. This could mean reducing product production times, eliminating error rates, or streamlining your supply chain.

Marketing and sales goals

Marketing and sales goals can be broad, like boosting brand awareness, or very specific, like improving specific channel sales or launching a new marketing campaign.

Employee and team goals

These are goals focused on reducing employee turnover, boosting team spirit, or furthering education to keep everyone at the top of their game.

Sustainability and social responsibility goals

These are goals that may not directly impact your bottom line. Instead, they focus on accomplishing an altruistic mission such as shrinking your carbon footprint or giving back to the community.

Innovation and development goals

Far more opportunistic and research-based goals that could include launching a new product, embracing the latest tech, or venturing into new markets.

Compliance and risk management goals

Goals to ensure your operations meet all legal requirements and have strategies in place to dodge financial and operational pitfalls.

- Choosing the right goals is a process

Selecting goals and creating a plan to reach them takes time. Even by following the steps in this article, there’s no guarantee that you’ll select the best opportunity and be able to efficiently pursue it.

That’s why the review process is so crucial. Rather than pursuing a goal that won’t make an impact, you can quickly pivot if you realize something isn’t working.

Goal setting is just the start, and plenty of other ways to better manage and grow your business.

- Create a business strategy

- Manage during a crisis

- Selling your business

Kody Wirth is a content writer and SEO specialist for Palo Alto Software—the creator's of Bplans and LivePlan. He has 3+ years experience covering small business topics and runs a part-time content writing service in his spare time.

Table of Contents

- How to set business goals

Related Articles

6 Min. Read

How to Create a Financial Contingency Plan for Your Business

7 Min. Read

How to Set Smart Business Goals for Your Small Business

Rules of Thumb Business Valuation Methods Explained

9 Min. Read

How to Run a Full Financial Audit of Your Business and Optimize Spending

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Product overview

- All features

- Latest feature release

- App integrations

CAPABILITIES

- project icon Project management

- Project views

- Custom fields

- Status updates

- goal icon Goals and reporting

- Reporting dashboards

- workflow icon Workflows and automation

- portfolio icon Resource management

- Capacity planning

- Time tracking

- my-task icon Admin and security

- Admin console

- asana-intelligence icon Asana AI

- list icon Personal

- premium icon Starter

- briefcase icon Advanced

- Goal management

- Organizational planning

- Campaign management

- Creative production

- Content calendars

- Marketing strategic planning

- Resource planning

- Project intake

- Product launches

- Employee onboarding

- View all uses arrow-right icon

- Project plans

- Team goals & objectives

- Team continuity

- Meeting agenda

- View all templates arrow-right icon

- Work management resources Discover best practices, watch webinars, get insights

- Customer stories See how the world's best organizations drive work innovation with Asana

- Help Center Get lots of tips, tricks, and advice to get the most from Asana

- Asana Academy Sign up for interactive courses and webinars to learn Asana

- Developers Learn more about building apps on the Asana platform

- Community programs Connect with and learn from Asana customers around the world

- Events Find out about upcoming events near you

- Partners Learn more about our partner programs

- Asana for nonprofits Get more information on our nonprofit discount program, and apply.

Featured Reads

- 65 strategic goals for your company (wi ...

65 strategic goals for your company (with examples)

Strategic goals are a critical part of your strategic plan. In order to achieve your long-term goals, you need a clear sense of where you want to go—and an easy way to share those goals with your team. In this article, we take a look at the difference between strategic goals and other goal setting methodologies, then offer 65 example metrics and strategic goals you can use to get started.

Goal-setting is a critical part of your business strategy. You want to make sure your team is cohesively moving in the right direction—and goals are a great way to do that.

But in order for goals to be effective, they need to be measurable. The important thing isn’t just to create goals, but to create strategic goals that help you accomplish your overall company mission.

In this article, we’ll walk you through when to set strategic goals—vs. other types of goals—and how to do so.

What is a strategic goal?

Because strategic goals are closely connected to strategic planning, they tend to be three to five year goals. But the most important part of setting a strategic goal is to identify where you want to go, and what goals you need to achieve to get there.

Unlock the true business value of Asana

Discover IDC's insights on how Asana helps businesses overcome tool overload, streamline decision-making, and boost productivity. Learn how Asana delivers 57% more on-time projects, 82% higher employee satisfaction, and an impressive ROI.

How strategic goals compare to other business processes

There are a lot of different strategy and goal setting frameworks you can use. Here’s how strategic goals differ from other types of goals.

Strategic goals vs. strategic planning

Strategic planning is the process of defining the direction your company wants to go in the next three to five years. A strategic plan includes longer term goals, strategic goals, and shorter-term goals that describe how you’ll achieve your strategic goals. The strategic planning process is typically run by decision-makers and stakeholders.

Part of defining your strategic plan is coming up with strategic goals. Your strategic plan should also include customer insights, a SWOT analysis , your company values , your organization’s competitive advantages, specific goals on a quarterly or yearly timeline, and a high-level project roadmap if you have one.

Strategic goals vs. strategic management

Strategic management is the organization and execution of business resources in order to achieve your company goals. These usually help you implement your overall organizational strategy.

Strategic goals, on the other hand, are generally three to five year objectives that tie closely to your strategic plan.

Think of strategic goals as the specific things you want to achieve in three to five years. These strategic goals are part of your strategic plan, which provides more context and direction for why your company wants to move in that direction. Your strategic plan fuels your strategic management process, which is how you’ll actually achieve those goals.

Strategic goals vs. strategic objectives

The difference between strategic goals and strategic objectives is somewhat subjective. In general, objectives tend to be more specific than goals—some people argue that objectives are always quantitative, while goals can be either qualitative or quantitative.

Whether you use the terminology strategic goals vs. objectives , it’s critical to make sure your goals are specific, measurable, and actionable.

Strategic goals vs. big hairy audacious goals (BHAGs)

Big Hairy Audacious Goals (BHAGs) are long-term goals that typically take between 10 and 25 years to complete. These are industry-defining goals, like Microsoft’s famous goal to put "a computer on every desk and in every home."

Not every organization has—or needs—BHAGs. Depending on your business strategy, a vision statement might be enough. Whether or not you set BHAGs, strategic goals are shorter-term goals that help you accomplish these bigger, ambitious goals.

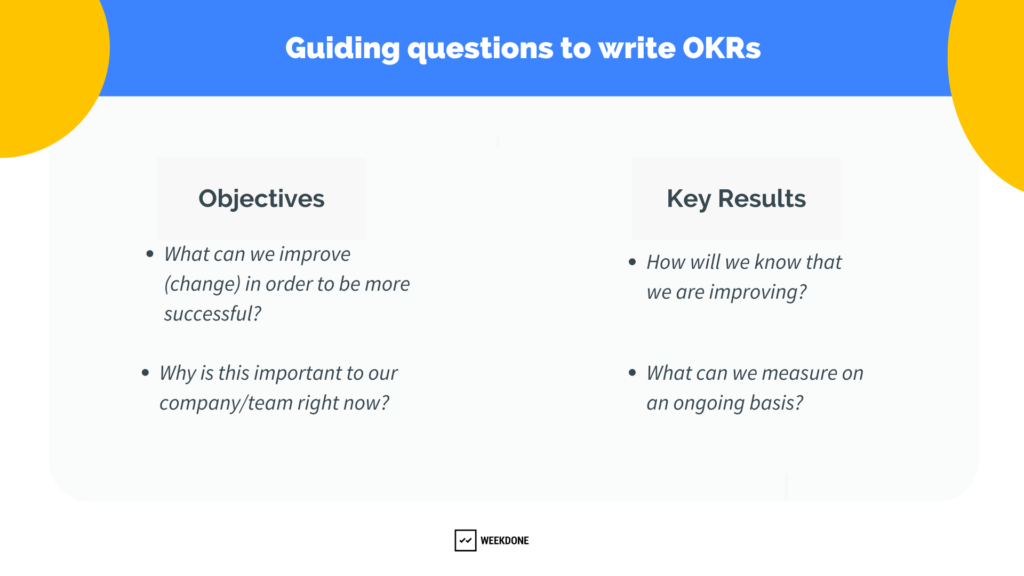

Strategic goals vs. OKRs

OKRs , which stands for Objectives and Key Results, is a goal setting methodology developed by Andy Grove that follows a simple but flexible framework:

I will [objective] as measured by [key result] .

OKRs can span multiple years, but most commonly these are one to two year objectives that help your company accomplish your larger strategic plan. In a typical OKR structure, your OKRs feed into your broader strategic goals.

Strategic goals vs. KPIs

KPIs, or key performance indicators , are qualitative measures of how you’re progressing. Like OKRs, KPIs tend to be shorter in time frame than strategic goals. This is partially due to the fact that KPIs are nearly always quantitative. Achieving several long-term KPIs helps you achieve your broader three to five year strategic goals.

Strategic goals vs. business goals

Business goals are predetermined targets that organizations plan to achieve in a specific amount of time. Technically, strategic goals—along with BHAGs, OKRs, and KPIs—are a type of business goal.

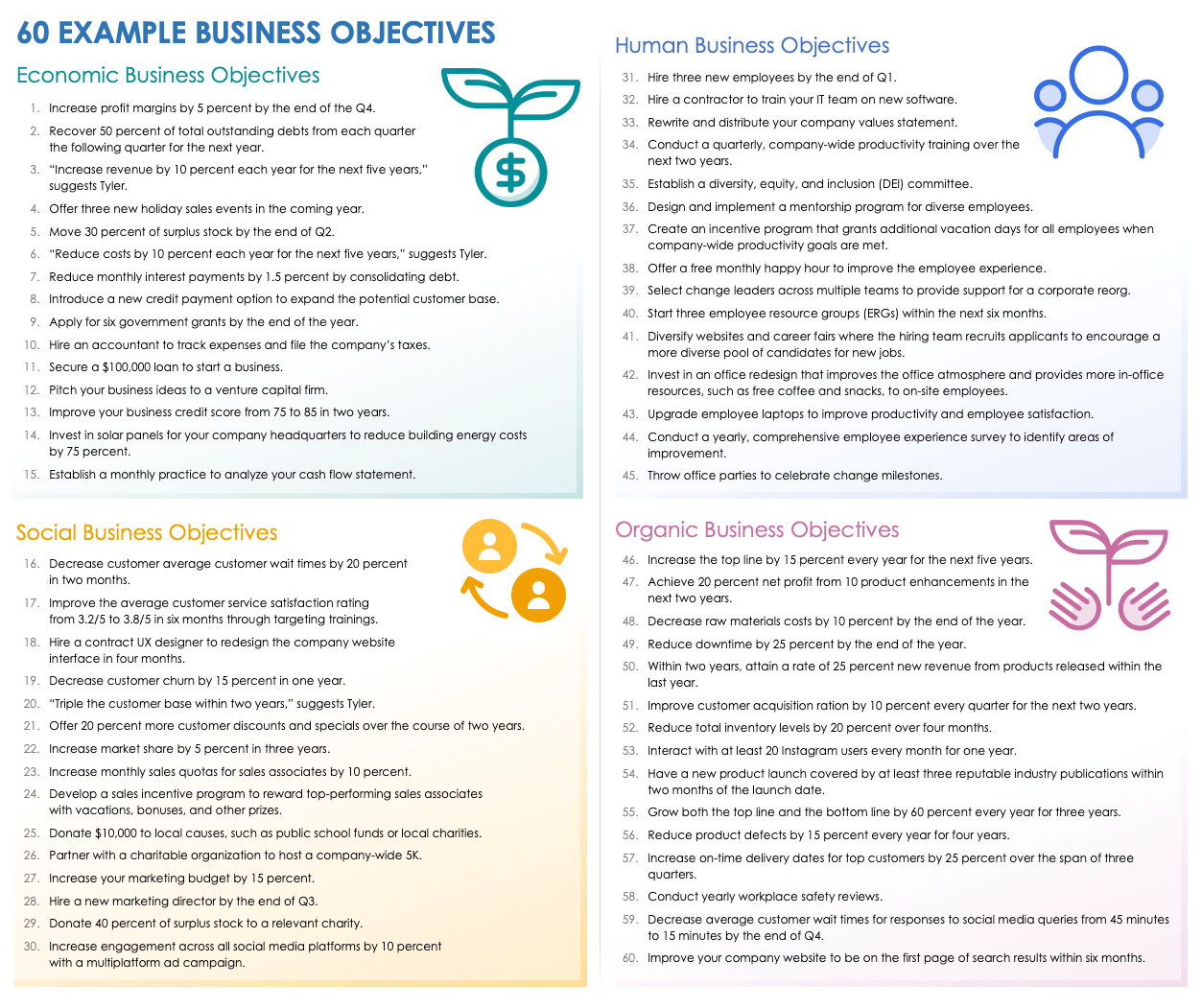

65 example strategic metrics and goals

If you’ve never written a strategic goal before, it’s helpful to check out common goals. Though your strategic goals are unique to your strategic plan, use these examples as templates to create measurable, actionable goals with clear success metrics.

Set strategic goals that are:

Simply phrased

Easy to track

For more tips on what constitutes a good goal, read our article on how to write SMART goals .

Keep in mind that these goals should be achievable in three to five years. For shorter goals, consider setting OKRs or KPIs instead. For longer goals, check out vision statements and BHAGs .

Strategic goals: finance

Financial strategic goals typically center around a few different important financial metrics, including:

1. Increasing revenue

2. Attaining or maintaining profitability

3. Growing shareholder value

4. Diversifying your revenue streams

5. Becoming a financially sustainable company

6. Reducing production costs

7. Increasing profit margin

8. Setting revenue targets for new products

9. Reducing department-specific budgets

10. Influencing the percentage of local vs. international sales

Examples of financial strategic goals

These examples do not represent Asana’s goals, and are merely included here for educational purposes.

11. Increase total revenue by $10M in the next three years.

12. Reduce cost by 12% to become a profitable company by 2024.

13. Grow a specific product’s revenue to 30% of overall business revenue within the next five years.

14. Reduce marketing budget by 10% in the next three years.

15. Update our sales profile so 50% of our sales are international by 2026.

Strategic goals: customer-focused

Strategic goals that focus on your customers can help you break into a new market or further develop a trustworthy brand. These metrics can include:

16. Reducing customer churn

17. Measurably increasing customer satisfaction

18. Increasing the number of new customers

19. Increasing customer retention

20. Offering great customer value

21. Boosting customer outreach

22. Increasing customer conversion rates

23. Breaking into new customer segments

24. Increasing the number of returning customers

25. Decreasing the percentage of returned products

Examples of strategic goals focused on customer metrics

26. Increase net promoter score (NPS) by three points in the next year, and 10 points in the next five years.

27. Capture 23% market share by 2025.

28. Provide the best customer experience in the market—measured based on reaction time, customer sentiment, and brand tracking.

29. Increase customer retention by 3% every year.

30. Reduce the percentage of returned products to 2% by 2023.

Strategic goals: growth

On an organizational level, growth refers to how your company expands and develops. Growth metrics include:

31. Increasing market share

32. Breaking into new markets

33. Developing new products, features, or services

34. Increasing operational reliability and/or compliance

35. Increasing company velocity

36. Opening new locations

37. Building your brand on social media

38. Increasing website traffic

39. Acquiring a new company

Examples of strategic goals about growth

40. Open 12 new locations within the next four years.

41. Increase market share to 8% by 2026.

42. Reach 5M followers on social media (including Instagram and Twitter).

43. Increase web traffic to 300K visitors per year by 2024.

44. Start three new product streams by 2027.

Strategic goals: internal

You can also set strategic goals focusing on your internal company goals. Example employee-centric metrics can include:

45. Increasing employee retention

46. Adding new team members

47. Building a healthy organizational culture

48. Implementing a performance review cycle

49. Standardizing titles and/or levels

50. Improving cross-functional productivity

51. Spinning up a project management office (PMO) to standardize processes

52. Attracting the best talent

53. Building high-performing teams

54. Investing in personal and professional development

55. Reducing burnout and impostor syndrome

56. Building employee-focused training programs

57. Reducing employee turnover

58. Improving workplace safety

59. Building better facilities management

Examples of internal strategic goals

60. Add 20 new team members within the next four years.

61. Increase overall engagement scores by 7% based on yearly surveys.

62. Increase new hire referrals to 5,000 team members per year by 2026.

63. Develop and circulate new company values by 2023.

64. Implement a biannual performance review cycle within the next three years.

65. Attain maximum workplace safety score rating within the next three years.

How Asana uses work management to effectively manage goals

Learn how Asana's Head of Organizational Strategy helps teams set, track, and achieve their goals.

Achieve your goals with goal tracking technology

Once you develop your goals, you need a clear way to track, measure, and communicate those goals. Too often, teams set great goals and then don’t know how to track those goals over time.

Instead of letting your goals collect dust in a slide deck or spreadsheet somewhere, use goal tracking technology to connect your strategic goals to your team’s daily work. With Asana , you can track long-term goals, as well as the shorter-term objectives that feed into those goals.

Related resources

What's the difference between accuracy and precision?

How Asana streamlines strategic planning with work management

What is management by objectives (MBO)?

7 steps to complete a social media audit (with template)

- Sources of Business Finance

- Small Business Loans

- Small Business Grants

- Crowdfunding Sites

- How to Get a Business Loan

- Small Business Insurance Providers

- Best Factoring Companies

- Types of Bank Accounts

- Best Banks for Small Business

- Best Business Bank Accounts

- Open a Business Bank Account

- Bank Accounts for Small Businesses

- Free Business Checking Accounts

- Best Business Credit Cards

- Get a Business Credit Card

- Business Credit Cards for Bad Credit

- Build Business Credit Fast

- Business Loan Eligibility Criteria

- Small-Business Bookkeeping Basics

- How to Set Financial Goals

- Business Loan Calculators

- How to Calculate ROI

- Calculate Net Income

- Calculate Working Capital

- Calculate Operating Income

- Calculate Net Present Value (NPV)

- Calculate Payroll Tax

How to Write a Business Plan in 9 Steps (+ Template and Examples)

Every successful business has one thing in common, a good and well-executed business plan. A business plan is more than a document, it is a complete guide that outlines the goals your business wants to achieve, including its financial goals . It helps you analyze results, make strategic decisions, show your business operations and growth.

If you want to start a business or already have one and need to pitch it to investors for funding, writing a good business plan improves your chances of attracting financiers. As a startup, if you want to secure loans from financial institutions, part of the requirements involve submitting your business plan.

Writing a business plan does not have to be a complicated or time-consuming process. In this article, you will learn the step-by-step process for writing a successful business plan.

You will also learn what you need a business plan for, tips and strategies for writing a convincing business plan, business plan examples and templates that will save you tons of time, and the alternatives to the traditional business plan.

Let’s get started.

What Do You Need A Business Plan For?

Businesses create business plans for different purposes such as to secure funds, monitor business growth, measure your marketing strategies, and measure your business success.

1. Secure Funds

One of the primary reasons for writing a business plan is to secure funds, either from financial institutions/agencies or investors.

For you to effectively acquire funds, your business plan must contain the key elements of your business plan . For example, your business plan should include your growth plans, goals you want to achieve, and milestones you have recorded.

A business plan can also attract new business partners that are willing to contribute financially and intellectually. If you are writing a business plan to a bank, your project must show your traction , that is, the proof that you can pay back any loan borrowed.

Also, if you are writing to an investor, your plan must contain evidence that you can effectively utilize the funds you want them to invest in your business. Here, you are using your business plan to persuade a group or an individual that your business is a source of a good investment.

2. Monitor Business Growth

A business plan can help you track cash flows in your business. It steers your business to greater heights. A business plan capable of tracking business growth should contain:

- The business goals

- Methods to achieve the goals

- Time-frame for attaining those goals

A good business plan should guide you through every step in achieving your goals. It can also track the allocation of assets to every aspect of the business. You can tell when you are spending more than you should on a project.

You can compare a business plan to a written GPS. It helps you manage your business and hints at the right time to expand your business.

3. Measure Business Success

A business plan can help you measure your business success rate. Some small-scale businesses are thriving better than more prominent companies because of their track record of success.

Right from the onset of your business operation, set goals and work towards them. Write a plan to guide you through your procedures. Use your plan to measure how much you have achieved and how much is left to attain.

You can also weigh your success by monitoring the position of your brand relative to competitors. On the other hand, a business plan can also show you why you have not achieved a goal. It can tell if you have elapsed the time frame you set to attain a goal.

4. Document Your Marketing Strategies

You can use a business plan to document your marketing plans. Every business should have an effective marketing plan.

Competition mandates every business owner to go the extraordinary mile to remain relevant in the market. Your business plan should contain your marketing strategies that work. You can measure the success rate of your marketing plans.

In your business plan, your marketing strategy must answer the questions:

- How do you want to reach your target audience?

- How do you plan to retain your customers?

- What is/are your pricing plans?

- What is your budget for marketing?

How to Write a Business Plan Step-by-Step

1. create your executive summary.

The executive summary is a snapshot of your business or a high-level overview of your business purposes and plans . Although the executive summary is the first section in your business plan, most people write it last. The length of the executive summary is not more than two pages.

Generally, there are nine sections in a business plan, the executive summary should condense essential ideas from the other eight sections.

A good executive summary should do the following:

- A Snapshot of Growth Potential. Briefly inform the reader about your company and why it will be successful)

- Contain your Mission Statement which explains what the main objective or focus of your business is.

- Product Description and Differentiation. Brief description of your products or services and why it is different from other solutions in the market.

- The Team. Basic information about your company’s leadership team and employees

- Business Concept. A solid description of what your business does.

- Target Market. The customers you plan to sell to.

- Marketing Strategy. Your plans on reaching and selling to your customers

- Current Financial State. Brief information about what revenue your business currently generates.

- Projected Financial State. Brief information about what you foresee your business revenue to be in the future.

The executive summary is the make-or-break section of your business plan. If your summary cannot in less than two pages cannot clearly describe how your business will solve a particular problem of your target audience and make a profit, your business plan is set on a faulty foundation.

Avoid using the executive summary to hype your business, instead, focus on helping the reader understand the what and how of your plan.

View the executive summary as an opportunity to introduce your vision for your company. You know your executive summary is powerful when it can answer these key questions:

- Who is your target audience?

- What sector or industry are you in?

- What are your products and services?

- What is the future of your industry?

- Is your company scaleable?

- Who are the owners and leaders of your company? What are their backgrounds and experience levels?

- What is the motivation for starting your company?

- What are the next steps?

Writing the executive summary last although it is the most important section of your business plan is an excellent idea. The reason why is because it is a high-level overview of your business plan. It is the section that determines whether potential investors and lenders will read further or not.

The executive summary can be a stand-alone document that covers everything in your business plan. It is not uncommon for investors to request only the executive summary when evaluating your business. If the information in the executive summary impresses them, they will ask for the complete business plan.

If you are writing your business plan for your planning purposes, you do not need to write the executive summary.

2. Add Your Company Overview

The company overview or description is the next section in your business plan after the executive summary. It describes what your business does.

Adding your company overview can be tricky especially when your business is still in the planning stages. Existing businesses can easily summarize their current operations but may encounter difficulties trying to explain what they plan to become.

Your company overview should contain the following:

- What products and services you will provide

- Geographical markets and locations your company have a presence

- What you need to run your business

- Who your target audience or customers are

- Who will service your customers

- Your company’s purpose, mission, and vision

- Information about your company’s founders

- Who the founders are

- Notable achievements of your company so far

When creating a company overview, you have to focus on three basics: identifying your industry, identifying your customer, and explaining the problem you solve.

If you are stuck when creating your company overview, try to answer some of these questions that pertain to you.

- Who are you targeting? (The answer is not everyone)

- What pain point does your product or service solve for your customers that they will be willing to spend money on resolving?

- How does your product or service overcome that pain point?

- Where is the location of your business?

- What products, equipment, and services do you need to run your business?

- How is your company’s product or service different from your competition in the eyes of your customers?

- How many employees do you need and what skills do you require them to have?

After answering some or all of these questions, you will get more than enough information you need to write your company overview or description section. When writing this section, describe what your company does for your customers.

The company description or overview section contains three elements: mission statement, history, and objectives.

- Mission Statement

The mission statement refers to the reason why your business or company is existing. It goes beyond what you do or sell, it is about the ‘why’. A good mission statement should be emotional and inspirational.

Your mission statement should follow the KISS rule (Keep It Simple, Stupid). For example, Shopify’s mission statement is “Make commerce better for everyone.”

When describing your company’s history, make it simple and avoid the temptation of tying it to a defensive narrative. Write it in the manner you would a profile. Your company’s history should include the following information:

- Founding Date

- Major Milestones

- Location(s)

- Flagship Products or Services

- Number of Employees

- Executive Leadership Roles

When you fill in this information, you use it to write one or two paragraphs about your company’s history.

Business Objectives

Your business objective must be SMART (specific, measurable, achievable, realistic, and time-bound.) Failure to clearly identify your business objectives does not inspire confidence and makes it hard for your team members to work towards a common purpose.

3. Perform Market and Competitive Analyses to Proof a Big Enough Business Opportunity

The third step in writing a business plan is the market and competitive analysis section. Every business, no matter the size, needs to perform comprehensive market and competitive analyses before it enters into a market.

Performing market and competitive analyses are critical for the success of your business. It helps you avoid entering the right market with the wrong product, or vice versa. Anyone reading your business plans, especially financiers and financial institutions will want to see proof that there is a big enough business opportunity you are targeting.

This section is where you describe the market and industry you want to operate in and show the big opportunities in the market that your business can leverage to make a profit. If you noticed any unique trends when doing your research, show them in this section.

Market analysis alone is not enough, you have to add competitive analysis to strengthen this section. There are already businesses in the industry or market, how do you plan to take a share of the market from them?

You have to clearly illustrate the competitive landscape in your business plan. Are there areas your competitors are doing well? Are there areas where they are not doing so well? Show it.

Make it clear in this section why you are moving into the industry and what weaknesses are present there that you plan to explain. How are your competitors going to react to your market entry? How do you plan to get customers? Do you plan on taking your competitors' competitors, tap into other sources for customers, or both?

Illustrate the competitive landscape as well. What are your competitors doing well and not so well?

Answering these questions and thoughts will aid your market and competitive analysis of the opportunities in your space. Depending on how sophisticated your industry is, or the expectations of your financiers, you may need to carry out a more comprehensive market and competitive analysis to prove that big business opportunity.

Instead of looking at the market and competitive analyses as one entity, separating them will make the research even more comprehensive.

Market Analysis

Market analysis, boarding speaking, refers to research a business carried out on its industry, market, and competitors. It helps businesses gain a good understanding of their target market and the outlook of their industry. Before starting a company, it is vital to carry out market research to find out if the market is viable.

The market analysis section is a key part of the business plan. It is the section where you identify who your best clients or customers are. You cannot omit this section, without it your business plan is incomplete.

A good market analysis will tell your readers how you fit into the existing market and what makes you stand out. This section requires in-depth research, it will probably be the most time-consuming part of the business plan to write.

- Market Research

To create a compelling market analysis that will win over investors and financial institutions, you have to carry out thorough market research . Your market research should be targeted at your primary target market for your products or services. Here is what you want to find out about your target market.

- Your target market’s needs or pain points

- The existing solutions for their pain points

- Geographic Location

- Demographics

The purpose of carrying out a marketing analysis is to get all the information you need to show that you have a solid and thorough understanding of your target audience.

Only after you have fully understood the people you plan to sell your products or services to, can you evaluate correctly if your target market will be interested in your products or services.

You can easily convince interested parties to invest in your business if you can show them you thoroughly understand the market and show them that there is a market for your products or services.

How to Quantify Your Target Market

One of the goals of your marketing research is to understand who your ideal customers are and their purchasing power. To quantify your target market, you have to determine the following:

- Your Potential Customers: They are the people you plan to target. For example, if you sell accounting software for small businesses , then anyone who runs an enterprise or large business is unlikely to be your customers. Also, individuals who do not have a business will most likely not be interested in your product.

- Total Households: If you are selling household products such as heating and air conditioning systems, determining the number of total households is more important than finding out the total population in the area you want to sell to. The logic is simple, people buy the product but it is the household that uses it.

- Median Income: You need to know the median income of your target market. If you target a market that cannot afford to buy your products and services, your business will not last long.

- Income by Demographics: If your potential customers belong to a certain age group or gender, determining income levels by demographics is necessary. For example, if you sell men's clothes, your target audience is men.

What Does a Good Market Analysis Entail?

Your business does not exist on its own, it can only flourish within an industry and alongside competitors. Market analysis takes into consideration your industry, target market, and competitors. Understanding these three entities will drastically improve your company’s chances of success.

You can view your market analysis as an examination of the market you want to break into and an education on the emerging trends and themes in that market. Good market analyses include the following:

- Industry Description. You find out about the history of your industry, the current and future market size, and who the largest players/companies are in your industry.

- Overview of Target Market. You research your target market and its characteristics. Who are you targeting? Note, it cannot be everyone, it has to be a specific group. You also have to find out all information possible about your customers that can help you understand how and why they make buying decisions.

- Size of Target Market: You need to know the size of your target market, how frequently they buy, and the expected quantity they buy so you do not risk overproducing and having lots of bad inventory. Researching the size of your target market will help you determine if it is big enough for sustained business or not.

- Growth Potential: Before picking a target market, you want to be sure there are lots of potential for future growth. You want to avoid going for an industry that is declining slowly or rapidly with almost zero growth potential.

- Market Share Potential: Does your business stand a good chance of taking a good share of the market?

- Market Pricing and Promotional Strategies: Your market analysis should give you an idea of the price point you can expect to charge for your products and services. Researching your target market will also give you ideas of pricing strategies you can implement to break into the market or to enjoy maximum profits.

- Potential Barriers to Entry: One of the biggest benefits of conducting market analysis is that it shows you every potential barrier to entry your business will likely encounter. It is a good idea to discuss potential barriers to entry such as changing technology. It informs readers of your business plan that you understand the market.

- Research on Competitors: You need to know the strengths and weaknesses of your competitors and how you can exploit them for the benefit of your business. Find patterns and trends among your competitors that make them successful, discover what works and what doesn’t, and see what you can do better.

The market analysis section is not just for talking about your target market, industry, and competitors. You also have to explain how your company can fill the hole you have identified in the market.

Here are some questions you can answer that can help you position your product or service in a positive light to your readers.

- Is your product or service of superior quality?

- What additional features do you offer that your competitors do not offer?

- Are you targeting a ‘new’ market?

Basically, your market analysis should include an analysis of what already exists in the market and an explanation of how your company fits into the market.

Competitive Analysis

In the competitive analysis section, y ou have to understand who your direct and indirect competitions are, and how successful they are in the marketplace. It is the section where you assess the strengths and weaknesses of your competitors, the advantage(s) they possess in the market and show the unique features or qualities that make you different from your competitors.

Many businesses do market analysis and competitive analysis together. However, to fully understand what the competitive analysis entails, it is essential to separate it from the market analysis.

Competitive analysis for your business can also include analysis on how to overcome barriers to entry in your target market.

The primary goal of conducting a competitive analysis is to distinguish your business from your competitors. A strong competitive analysis is essential if you want to convince potential funding sources to invest in your business. You have to show potential investors and lenders that your business has what it takes to compete in the marketplace successfully.

Competitive analysis will s how you what the strengths of your competition are and what they are doing to maintain that advantage.

When doing your competitive research, you first have to identify your competitor and then get all the information you can about them. The idea of spending time to identify your competitor and learn everything about them may seem daunting but it is well worth it.

Find answers to the following questions after you have identified who your competitors are.

- What are your successful competitors doing?

- Why is what they are doing working?

- Can your business do it better?

- What are the weaknesses of your successful competitors?

- What are they not doing well?

- Can your business turn its weaknesses into strengths?

- How good is your competitors’ customer service?

- Where do your competitors invest in advertising?

- What sales and pricing strategies are they using?

- What marketing strategies are they using?

- What kind of press coverage do they get?

- What are their customers saying about your competitors (both the positive and negative)?

If your competitors have a website, it is a good idea to visit their websites for more competitors’ research. Check their “About Us” page for more information.

If you are presenting your business plan to investors, you need to clearly distinguish yourself from your competitors. Investors can easily tell when you have not properly researched your competitors.

Take time to think about what unique qualities or features set you apart from your competitors. If you do not have any direct competition offering your product to the market, it does not mean you leave out the competitor analysis section blank. Instead research on other companies that are providing a similar product, or whose product is solving the problem your product solves.

The next step is to create a table listing the top competitors you want to include in your business plan. Ensure you list your business as the last and on the right. What you just created is known as the competitor analysis table.

Direct vs Indirect Competition

You cannot know if your product or service will be a fit for your target market if you have not understood your business and the competitive landscape.

There is no market you want to target where you will not encounter competition, even if your product is innovative. Including competitive analysis in your business plan is essential.

If you are entering an established market, you need to explain how you plan to differentiate your products from the available options in the market. Also, include a list of few companies that you view as your direct competitors The competition you face in an established market is your direct competition.

In situations where you are entering a market with no direct competition, it does not mean there is no competition there. Consider your indirect competition that offers substitutes for the products or services you offer.

For example, if you sell an innovative SaaS product, let us say a project management software , a company offering time management software is your indirect competition.

There is an easy way to find out who your indirect competitors are in the absence of no direct competitors. You simply have to research how your potential customers are solving the problems that your product or service seeks to solve. That is your direct competition.

Factors that Differentiate Your Business from the Competition

There are three main factors that any business can use to differentiate itself from its competition. They are cost leadership, product differentiation, and market segmentation.

1. Cost Leadership

A strategy you can impose to maximize your profits and gain an edge over your competitors. It involves offering lower prices than what the majority of your competitors are offering.

A common practice among businesses looking to enter into a market where there are dominant players is to use free trials or pricing to attract as many customers as possible to their offer.

2. Product Differentiation

Your product or service should have a unique selling proposition (USP) that your competitors do not have or do not stress in their marketing.

Part of the marketing strategy should involve making your products unique and different from your competitors. It does not have to be different from your competitors, it can be the addition to a feature or benefit that your competitors do not currently have.

3. Market Segmentation

As a new business seeking to break into an industry, you will gain more success from focusing on a specific niche or target market, and not the whole industry.

If your competitors are focused on a general need or target market, you can differentiate yourself from them by having a small and hyper-targeted audience. For example, if your competitors are selling men’s clothes in their online stores , you can sell hoodies for men.

4. Define Your Business and Management Structure

The next step in your business plan is your business and management structure. It is the section where you describe the legal structure of your business and the team running it.

Your business is only as good as the management team that runs it, while the management team can only strive when there is a proper business and management structure in place.

If your company is a sole proprietor or a limited liability company (LLC), a general or limited partnership, or a C or an S corporation, state it clearly in this section.

Use an organizational chart to show the management structure in your business. Clearly show who is in charge of what area in your company. It is where you show how each key manager or team leader’s unique experience can contribute immensely to the success of your company. You can also opt to add the resumes and CVs of the key players in your company.

The business and management structure section should show who the owner is, and other owners of the businesses (if the business has other owners). For businesses or companies with multiple owners, include the percent ownership of the various owners and clearly show the extent of each others’ involvement in the company.

Investors want to know who is behind the company and the team running it to determine if it has the right management to achieve its set goals.

Management Team

The management team section is where you show that you have the right team in place to successfully execute the business operations and ideas. Take time to create the management structure for your business. Think about all the important roles and responsibilities that you need managers for to grow your business.

Include brief bios of each key team member and ensure you highlight only the relevant information that is needed. If your team members have background industry experience or have held top positions for other companies and achieved success while filling that role, highlight it in this section.

A common mistake that many startups make is assigning C-level titles such as (CMO and CEO) to everyone on their team. It is unrealistic for a small business to have those titles. While it may look good on paper for the ego of your team members, it can prevent investors from investing in your business.

Instead of building an unrealistic management structure that does not fit your business reality, it is best to allow business titles to grow as the business grows. Starting everyone at the top leaves no room for future change or growth, which is bad for productivity.

Your management team does not have to be complete before you start writing your business plan. You can have a complete business plan even when there are managerial positions that are empty and need filling.

If you have management gaps in your team, simply show the gaps and indicate you are searching for the right candidates for the role(s). Investors do not expect you to have a full management team when you are just starting your business.

Key Questions to Answer When Structuring Your Management Team

- Who are the key leaders?

- What experiences, skills, and educational backgrounds do you expect your key leaders to have?

- Do your key leaders have industry experience?

- What positions will they fill and what duties will they perform in those positions?