- Privacy Policy

Home » Questionnaire – Definition, Types, and Examples

Questionnaire – Definition, Types, and Examples

Table of Contents

Questionnaire

Definition:

A Questionnaire is a research tool or survey instrument that consists of a set of questions or prompts designed to gather information from individuals or groups of people.

It is a standardized way of collecting data from a large number of people by asking them a series of questions related to a specific topic or research objective. The questions may be open-ended or closed-ended, and the responses can be quantitative or qualitative. Questionnaires are widely used in research, marketing, social sciences, healthcare, and many other fields to collect data and insights from a target population.

History of Questionnaire

The history of questionnaires can be traced back to the ancient Greeks, who used questionnaires as a means of assessing public opinion. However, the modern history of questionnaires began in the late 19th century with the rise of social surveys.

The first social survey was conducted in the United States in 1874 by Francis A. Walker, who used a questionnaire to collect data on labor conditions. In the early 20th century, questionnaires became a popular tool for conducting social research, particularly in the fields of sociology and psychology.

One of the most influential figures in the development of the questionnaire was the psychologist Raymond Cattell, who in the 1940s and 1950s developed the personality questionnaire, a standardized instrument for measuring personality traits. Cattell’s work helped establish the questionnaire as a key tool in personality research.

In the 1960s and 1970s, the use of questionnaires expanded into other fields, including market research, public opinion polling, and health surveys. With the rise of computer technology, questionnaires became easier and more cost-effective to administer, leading to their widespread use in research and business settings.

Today, questionnaires are used in a wide range of settings, including academic research, business, healthcare, and government. They continue to evolve as a research tool, with advances in computer technology and data analysis techniques making it easier to collect and analyze data from large numbers of participants.

Types of Questionnaire

Types of Questionnaires are as follows:

Structured Questionnaire

This type of questionnaire has a fixed format with predetermined questions that the respondent must answer. The questions are usually closed-ended, which means that the respondent must select a response from a list of options.

Unstructured Questionnaire

An unstructured questionnaire does not have a fixed format or predetermined questions. Instead, the interviewer or researcher can ask open-ended questions to the respondent and let them provide their own answers.

Open-ended Questionnaire

An open-ended questionnaire allows the respondent to answer the question in their own words, without any pre-determined response options. The questions usually start with phrases like “how,” “why,” or “what,” and encourage the respondent to provide more detailed and personalized answers.

Close-ended Questionnaire

In a closed-ended questionnaire, the respondent is given a set of predetermined response options to choose from. This type of questionnaire is easier to analyze and summarize, but may not provide as much insight into the respondent’s opinions or attitudes.

Mixed Questionnaire

A mixed questionnaire is a combination of open-ended and closed-ended questions. This type of questionnaire allows for more flexibility in terms of the questions that can be asked, and can provide both quantitative and qualitative data.

Pictorial Questionnaire:

In a pictorial questionnaire, instead of using words to ask questions, the questions are presented in the form of pictures, diagrams or images. This can be particularly useful for respondents who have low literacy skills, or for situations where language barriers exist. Pictorial questionnaires can also be useful in cross-cultural research where respondents may come from different language backgrounds.

Types of Questions in Questionnaire

The types of Questions in Questionnaire are as follows:

Multiple Choice Questions

These questions have several options for participants to choose from. They are useful for getting quantitative data and can be used to collect demographic information.

- a. Red b . Blue c. Green d . Yellow

Rating Scale Questions

These questions ask participants to rate something on a scale (e.g. from 1 to 10). They are useful for measuring attitudes and opinions.

- On a scale of 1 to 10, how likely are you to recommend this product to a friend?

Open-Ended Questions

These questions allow participants to answer in their own words and provide more in-depth and detailed responses. They are useful for getting qualitative data.

- What do you think are the biggest challenges facing your community?

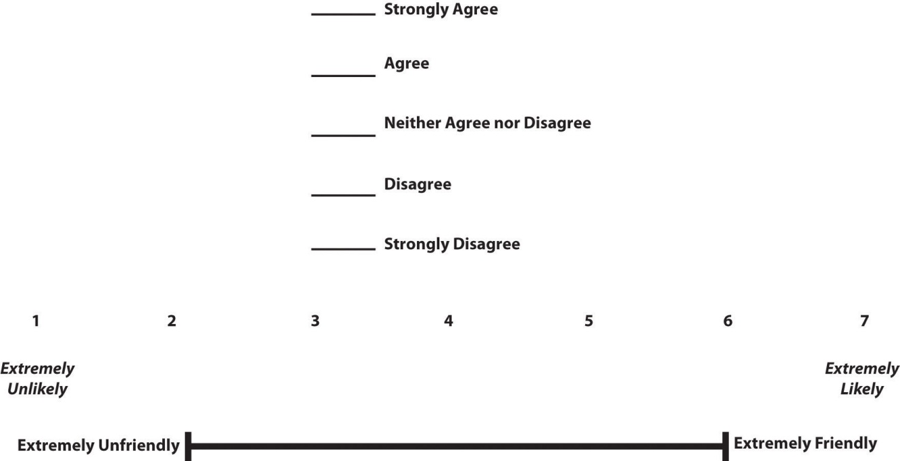

Likert Scale Questions

These questions ask participants to rate how much they agree or disagree with a statement. They are useful for measuring attitudes and opinions.

How strongly do you agree or disagree with the following statement:

“I enjoy exercising regularly.”

- a . Strongly Agree

- c . Neither Agree nor Disagree

- d . Disagree

- e . Strongly Disagree

Demographic Questions

These questions ask about the participant’s personal information such as age, gender, ethnicity, education level, etc. They are useful for segmenting the data and analyzing results by demographic groups.

- What is your age?

Yes/No Questions

These questions only have two options: Yes or No. They are useful for getting simple, straightforward answers to a specific question.

Have you ever traveled outside of your home country?

Ranking Questions

These questions ask participants to rank several items in order of preference or importance. They are useful for measuring priorities or preferences.

Please rank the following factors in order of importance when choosing a restaurant:

- a. Quality of Food

- c. Ambiance

- d. Location

Matrix Questions

These questions present a matrix or grid of options that participants can choose from. They are useful for getting data on multiple variables at once.

| The product is easy to use | ||||

| The product meets my needs | ||||

| The product is affordable |

Dichotomous Questions

These questions present two options that are opposite or contradictory. They are useful for measuring binary or polarized attitudes.

Do you support the death penalty?

How to Make a Questionnaire

Step-by-Step Guide for Making a Questionnaire:

- Define your research objectives: Before you start creating questions, you need to define the purpose of your questionnaire and what you hope to achieve from the data you collect.

- Choose the appropriate question types: Based on your research objectives, choose the appropriate question types to collect the data you need. Refer to the types of questions mentioned earlier for guidance.

- Develop questions: Develop clear and concise questions that are easy for participants to understand. Avoid leading or biased questions that might influence the responses.

- Organize questions: Organize questions in a logical and coherent order, starting with demographic questions followed by general questions, and ending with specific or sensitive questions.

- Pilot the questionnaire : Test your questionnaire on a small group of participants to identify any flaws or issues with the questions or the format.

- Refine the questionnaire : Based on feedback from the pilot, refine and revise the questionnaire as necessary to ensure that it is valid and reliable.

- Distribute the questionnaire: Distribute the questionnaire to your target audience using a method that is appropriate for your research objectives, such as online surveys, email, or paper surveys.

- Collect and analyze data: Collect the completed questionnaires and analyze the data using appropriate statistical methods. Draw conclusions from the data and use them to inform decision-making or further research.

- Report findings: Present your findings in a clear and concise report, including a summary of the research objectives, methodology, key findings, and recommendations.

Questionnaire Administration Modes

There are several modes of questionnaire administration. The choice of mode depends on the research objectives, sample size, and available resources. Some common modes of administration include:

- Self-administered paper questionnaires: Participants complete the questionnaire on paper, either in person or by mail. This mode is relatively low cost and easy to administer, but it may result in lower response rates and greater potential for errors in data entry.

- Online questionnaires: Participants complete the questionnaire on a website or through email. This mode is convenient for both researchers and participants, as it allows for fast and easy data collection. However, it may be subject to issues such as low response rates, lack of internet access, and potential for fraudulent responses.

- Telephone surveys: Trained interviewers administer the questionnaire over the phone. This mode allows for a large sample size and can result in higher response rates, but it is also more expensive and time-consuming than other modes.

- Face-to-face interviews : Trained interviewers administer the questionnaire in person. This mode allows for a high degree of control over the survey environment and can result in higher response rates, but it is also more expensive and time-consuming than other modes.

- Mixed-mode surveys: Researchers use a combination of two or more modes to administer the questionnaire, such as using online questionnaires for initial screening and following up with telephone interviews for more detailed information. This mode can help overcome some of the limitations of individual modes, but it requires careful planning and coordination.

Example of Questionnaire

Title of the Survey: Customer Satisfaction Survey

Introduction:

We appreciate your business and would like to ensure that we are meeting your needs. Please take a few minutes to complete this survey so that we can better understand your experience with our products and services. Your feedback is important to us and will help us improve our offerings.

Instructions:

Please read each question carefully and select the response that best reflects your experience. If you have any additional comments or suggestions, please feel free to include them in the space provided at the end of the survey.

1. How satisfied are you with our product quality?

- Very satisfied

- Somewhat satisfied

- Somewhat dissatisfied

- Very dissatisfied

2. How satisfied are you with our customer service?

3. How satisfied are you with the price of our products?

4. How likely are you to recommend our products to others?

- Very likely

- Somewhat likely

- Somewhat unlikely

- Very unlikely

5. How easy was it to find the information you were looking for on our website?

- Somewhat easy

- Somewhat difficult

- Very difficult

6. How satisfied are you with the overall experience of using our products and services?

7. Is there anything that you would like to see us improve upon or change in the future?

…………………………………………………………………………………………………………………………..

Conclusion:

Thank you for taking the time to complete this survey. Your feedback is valuable to us and will help us improve our products and services. If you have any further comments or concerns, please do not hesitate to contact us.

Applications of Questionnaire

Some common applications of questionnaires include:

- Research : Questionnaires are commonly used in research to gather information from participants about their attitudes, opinions, behaviors, and experiences. This information can then be analyzed and used to draw conclusions and make inferences.

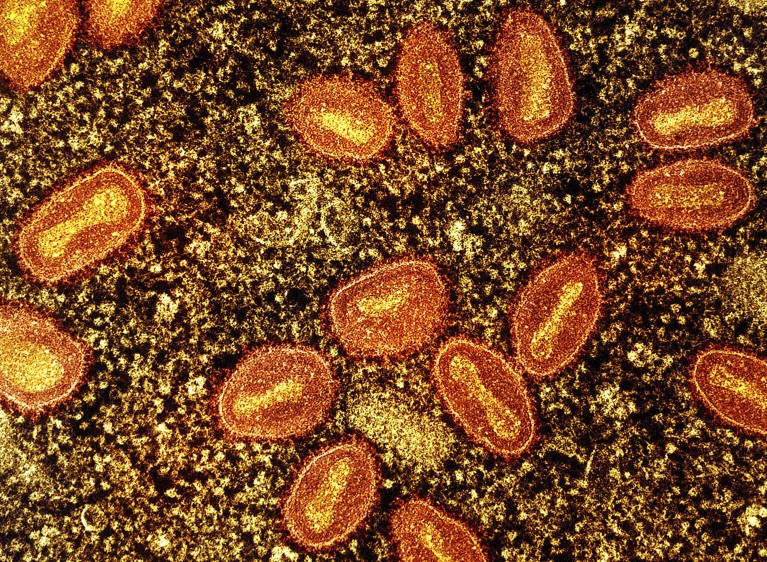

- Healthcare : In healthcare, questionnaires can be used to gather information about patients’ medical history, symptoms, and lifestyle habits. This information can help healthcare professionals diagnose and treat medical conditions more effectively.

- Marketing : Questionnaires are commonly used in marketing to gather information about consumers’ preferences, buying habits, and opinions on products and services. This information can help businesses develop and market products more effectively.

- Human Resources: Questionnaires are used in human resources to gather information from job applicants, employees, and managers about job satisfaction, performance, and workplace culture. This information can help organizations improve their hiring practices, employee retention, and organizational culture.

- Education : Questionnaires are used in education to gather information from students, teachers, and parents about their perceptions of the educational experience. This information can help educators identify areas for improvement and develop more effective teaching strategies.

Purpose of Questionnaire

Some common purposes of questionnaires include:

- To collect information on attitudes, opinions, and beliefs: Questionnaires can be used to gather information on people’s attitudes, opinions, and beliefs on a particular topic. For example, a questionnaire can be used to gather information on people’s opinions about a particular political issue.

- To collect demographic information: Questionnaires can be used to collect demographic information such as age, gender, income, education level, and occupation. This information can be used to analyze trends and patterns in the data.

- To measure behaviors or experiences: Questionnaires can be used to gather information on behaviors or experiences such as health-related behaviors or experiences, job satisfaction, or customer satisfaction.

- To evaluate programs or interventions: Questionnaires can be used to evaluate the effectiveness of programs or interventions by gathering information on participants’ experiences, opinions, and behaviors.

- To gather information for research: Questionnaires can be used to gather data for research purposes on a variety of topics.

When to use Questionnaire

Here are some situations when questionnaires might be used:

- When you want to collect data from a large number of people: Questionnaires are useful when you want to collect data from a large number of people. They can be distributed to a wide audience and can be completed at the respondent’s convenience.

- When you want to collect data on specific topics: Questionnaires are useful when you want to collect data on specific topics or research questions. They can be designed to ask specific questions and can be used to gather quantitative data that can be analyzed statistically.

- When you want to compare responses across groups: Questionnaires are useful when you want to compare responses across different groups of people. For example, you might want to compare responses from men and women, or from people of different ages or educational backgrounds.

- When you want to collect data anonymously: Questionnaires can be useful when you want to collect data anonymously. Respondents can complete the questionnaire without fear of judgment or repercussions, which can lead to more honest and accurate responses.

- When you want to save time and resources: Questionnaires can be more efficient and cost-effective than other methods of data collection such as interviews or focus groups. They can be completed quickly and easily, and can be analyzed using software to save time and resources.

Characteristics of Questionnaire

Here are some of the characteristics of questionnaires:

- Standardization : Questionnaires are standardized tools that ask the same questions in the same order to all respondents. This ensures that all respondents are answering the same questions and that the responses can be compared and analyzed.

- Objectivity : Questionnaires are designed to be objective, meaning that they do not contain leading questions or bias that could influence the respondent’s answers.

- Predefined responses: Questionnaires typically provide predefined response options for the respondents to choose from, which helps to standardize the responses and make them easier to analyze.

- Quantitative data: Questionnaires are designed to collect quantitative data, meaning that they provide numerical or categorical data that can be analyzed using statistical methods.

- Convenience : Questionnaires are convenient for both the researcher and the respondents. They can be distributed and completed at the respondent’s convenience and can be easily administered to a large number of people.

- Anonymity : Questionnaires can be anonymous, which can encourage respondents to answer more honestly and provide more accurate data.

- Reliability : Questionnaires are designed to be reliable, meaning that they produce consistent results when administered multiple times to the same group of people.

- Validity : Questionnaires are designed to be valid, meaning that they measure what they are intended to measure and are not influenced by other factors.

Advantage of Questionnaire

Some Advantage of Questionnaire are as follows:

- Standardization: Questionnaires allow researchers to ask the same questions to all participants in a standardized manner. This helps ensure consistency in the data collected and eliminates potential bias that might arise if questions were asked differently to different participants.

- Efficiency: Questionnaires can be administered to a large number of people at once, making them an efficient way to collect data from a large sample.

- Anonymity: Participants can remain anonymous when completing a questionnaire, which may make them more likely to answer honestly and openly.

- Cost-effective: Questionnaires can be relatively inexpensive to administer compared to other research methods, such as interviews or focus groups.

- Objectivity: Because questionnaires are typically designed to collect quantitative data, they can be analyzed objectively without the influence of the researcher’s subjective interpretation.

- Flexibility: Questionnaires can be adapted to a wide range of research questions and can be used in various settings, including online surveys, mail surveys, or in-person interviews.

Limitations of Questionnaire

Limitations of Questionnaire are as follows:

- Limited depth: Questionnaires are typically designed to collect quantitative data, which may not provide a complete understanding of the topic being studied. Questionnaires may miss important details and nuances that could be captured through other research methods, such as interviews or observations.

- R esponse bias: Participants may not always answer questions truthfully or accurately, either because they do not remember or because they want to present themselves in a particular way. This can lead to response bias, which can affect the validity and reliability of the data collected.

- Limited flexibility: While questionnaires can be adapted to a wide range of research questions, they may not be suitable for all types of research. For example, they may not be appropriate for studying complex phenomena or for exploring participants’ experiences and perceptions in-depth.

- Limited context: Questionnaires typically do not provide a rich contextual understanding of the topic being studied. They may not capture the broader social, cultural, or historical factors that may influence participants’ responses.

- Limited control : Researchers may not have control over how participants complete the questionnaire, which can lead to variations in response quality or consistency.

About the author

Muhammad Hassan

Researcher, Academic Writer, Web developer

You may also like

Applied Research – Types, Methods and Examples

Experimental Design – Types, Methods, Guide

Basic Research – Types, Methods and Examples

Exploratory Research – Types, Methods and...

Explanatory Research – Types, Methods, Guide

Case Study – Methods, Examples and Guide

How to Design Effective Research Questionnaires for Robust Findings

As a staple in data collection, questionnaires help uncover robust and reliable findings that can transform industries, shape policies, and revolutionize understanding. Whether you are exploring societal trends or delving into scientific phenomena, the effectiveness of your research questionnaire can make or break your findings.

In this article, we aim to understand the core purpose of questionnaires, exploring how they serve as essential tools for gathering systematic data, both qualitative and quantitative, from diverse respondents. Read on as we explore the key elements that make up a winning questionnaire, the art of framing questions which are both compelling and rigorous, and the careful balance between simplicity and depth.

Table of Contents

The Role of Questionnaires in Research

So, what is a questionnaire? A questionnaire is a structured set of questions designed to collect information, opinions, attitudes, or behaviors from respondents. It is one of the most commonly used data collection methods in research. Moreover, questionnaires can be used in various research fields, including social sciences, market research, healthcare, education, and psychology. Their adaptability makes them suitable for investigating diverse research questions.

Questionnaire and survey are two terms often used interchangeably, but they have distinct meanings in the context of research. A survey refers to the broader process of data collection that may involve various methods. A survey can encompass different data collection techniques, such as interviews , focus groups, observations, and yes, questionnaires.

Pros and Cons of Using Questionnaires in Research:

While questionnaires offer numerous advantages in research, they also come with some disadvantages that researchers must be aware of and address appropriately. Careful questionnaire design, validation, and consideration of potential biases can help mitigate these disadvantages and enhance the effectiveness of using questionnaires as a data collection method.

Structured vs Unstructured Questionnaires

Structured questionnaire:.

A structured questionnaire consists of questions with predefined response options. Respondents are presented with a fixed set of choices and are required to select from those options. The questions in a structured questionnaire are designed to elicit specific and quantifiable responses. Structured questionnaires are particularly useful for collecting quantitative data and are often employed in surveys and studies where standardized and comparable data are necessary.

Advantages of Structured Questionnaires:

- Easy to analyze and interpret: The fixed response options facilitate straightforward data analysis and comparison across respondents.

- Efficient for large-scale data collection: Structured questionnaires are time-efficient, allowing researchers to collect data from a large number of respondents.

- Reduces response bias: The predefined response options minimize potential response bias and maintain consistency in data collection.

Limitations of Structured Questionnaires:

- Lack of depth: Structured questionnaires may not capture in-depth insights or nuances as respondents are limited to pre-defined response choices. Hence, they may not reveal the reasons behind respondents’ choices, limiting the understanding of their perspectives.

- Limited flexibility: The fixed response options may not cover all potential responses, therefore, potentially restricting respondents’ answers.

Unstructured Questionnaire:

An unstructured questionnaire consists of questions that allow respondents to provide detailed and unrestricted responses. Unlike structured questionnaires, there are no predefined response options, giving respondents the freedom to express their thoughts in their own words. Furthermore, unstructured questionnaires are valuable for collecting qualitative data and obtaining in-depth insights into respondents’ experiences, opinions, or feelings.

Advantages of Unstructured Questionnaires:

- Rich qualitative data: Unstructured questionnaires yield detailed and comprehensive qualitative data, providing valuable and novel insights into respondents’ perspectives.

- Flexibility in responses: Respondents have the freedom to express themselves in their own words. Hence, allowing for a wide range of responses.

Limitations of Unstructured Questionnaires:

- Time-consuming analysis: Analyzing open-ended responses can be time-consuming, since, each response requires careful reading and interpretation.

- Subjectivity in interpretation: The analysis of open-ended responses may be subjective, as researchers interpret and categorize responses based on their judgment.

- May require smaller sample size: Due to the depth of responses, researchers may need a smaller sample size for comprehensive analysis, making generalizations more challenging.

Types of Questions in a Questionnaire

In a questionnaire, researchers typically use the following most common types of questions to gather a variety of information from respondents:

1. Open-Ended Questions:

These questions allow respondents to provide detailed and unrestricted responses in their own words. Open-ended questions are valuable for gathering qualitative data and in-depth insights.

Example: What suggestions do you have for improving our product?

2. Multiple-Choice Questions

Respondents choose one answer from a list of provided options. This type of question is suitable for gathering categorical data or preferences.

Example: Which of the following social media/academic networking platforms do you use to promote your research?

- ResearchGate

- Academia.edu

3. Dichotomous Questions

Respondents choose between two options, typically “yes” or “no”, “true” or “false”, or “agree” or “disagree”.

Example: Have you ever published in open access journals before?

4. Scaling Questions

These questions, also known as rating scale questions, use a predefined scale that allows respondents to rate or rank their level of agreement, satisfaction, importance, or other subjective assessments. These scales help researchers quantify subjective data and make comparisons across respondents.

There are several types of scaling techniques used in scaling questions:

i. Likert Scale:

The Likert scale is one of the most common scaling techniques. It presents respondents with a series of statements and asks them to rate their level of agreement or disagreement using a range of options, typically from “strongly agree” to “strongly disagree”.For example: Please indicate your level of agreement with the statement: “The content presented in the webinar was relevant and aligned with the advertised topic.”

- Strongly Agree

- Strongly Disagree

ii. Semantic Differential Scale:

The semantic differential scale measures respondents’ perceptions or attitudes towards an item using opposite adjectives or bipolar words. Respondents rate the item on a scale between the two opposites. For example:

- Easy —— Difficult

- Satisfied —— Unsatisfied

- Very likely —— Very unlikely

iii. Numerical Rating Scale:

This scale requires respondents to provide a numerical rating on a predefined scale. It can be a simple 1 to 5 or 1 to 10 scale, where higher numbers indicate higher agreement, satisfaction, or importance.

iv. Ranking Questions:

Respondents rank items in order of preference or importance. Ranking questions help identify preferences or priorities.

Example: Please rank the following features of our app in order of importance (1 = Most Important, 5 = Least Important):

- User Interface

- Functionality

- Customer Support

By using a mix of question types, researchers can gather both quantitative and qualitative data, providing a comprehensive understanding of the research topic and enabling meaningful analysis and interpretation of the results. The choice of question types depends on the research objectives , the desired depth of information, and the data analysis requirements.

Methods of Administering Questionnaires

There are several methods for administering questionnaires, and the choice of method depends on factors such as the target population, research objectives , convenience, and resources available. Here are some common methods of administering questionnaires:

Each method has its advantages and limitations. Online surveys offer convenience and a large reach, but they may be limited to individuals with internet access. Face-to-face interviews allow for in-depth responses but can be time-consuming and costly. Telephone surveys have broad reach but may be limited by declining response rates. Researchers should choose the method that best suits their research objectives, target population, and available resources to ensure successful data collection.

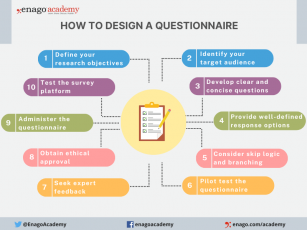

How to Design a Questionnaire

Designing a good questionnaire is crucial for gathering accurate and meaningful data that aligns with your research objectives. Here are essential steps and tips to create a well-designed questionnaire:

1. Define Your Research Objectives : Clearly outline the purpose and specific information you aim to gather through the questionnaire.

2. Identify Your Target Audience : Understand respondents’ characteristics and tailor the questionnaire accordingly.

3. Develop the Questions :

- Write Clear and Concise Questions

- Avoid Leading or Biasing Questions

- Sequence Questions Logically

- Group Related Questions

- Include Demographic Questions

4. Provide Well-defined Response Options : Offer exhaustive response choices for closed-ended questions.

5. Consider Skip Logic and Branching : Customize the questionnaire based on previous answers.

6. Pilot Test the Questionnaire : Identify and address issues through a pilot study .

7. Seek Expert Feedback : Validate the questionnaire with subject matter experts.

8. Obtain Ethical Approval : Comply with ethical guidelines , obtain consent, and ensure confidentiality before administering the questionnaire.

9. Administer the Questionnaire : Choose the right mode and provide clear instructions.

10. Test the Survey Platform : Ensure compatibility and usability for online surveys.

By following these steps and paying attention to questionnaire design principles, you can create a well-structured and effective questionnaire that gathers reliable data and helps you achieve your research objectives.

Characteristics of a Good Questionnaire

A good questionnaire possesses several essential elements that contribute to its effectiveness. Furthermore, these characteristics ensure that the questionnaire is well-designed, easy to understand, and capable of providing valuable insights. Here are some key characteristics of a good questionnaire:

1. Clarity and Simplicity : Questions should be clear, concise, and unambiguous. Avoid using complex language or technical terms that may confuse respondents. Simple and straightforward questions ensure that respondents interpret them consistently.

2. Relevance and Focus : Each question should directly relate to the research objectives and contribute to answering the research questions. Consequently, avoid including extraneous or irrelevant questions that could lead to data clutter.

3. Mix of Question Types : Utilize a mix of question types, including open-ended, Likert scale, and multiple-choice questions. This variety allows for both qualitative and quantitative data collections .

4. Validity and Reliability : Ensure the questionnaire measures what it intends to measure (validity) and produces consistent results upon repeated administration (reliability). Validation should be conducted through expert review and previous research.

5. Appropriate Length : Keep the questionnaire’s length appropriate and manageable to avoid respondent fatigue or dropouts. Long questionnaires may result in incomplete or rushed responses.

6. Clear Instructions : Include clear instructions at the beginning of the questionnaire to guide respondents on how to complete it. Explain any technical terms, formats, or concepts if necessary.

7. User-Friendly Format : Design the questionnaire to be visually appealing and user-friendly. Use consistent formatting, adequate spacing, and a logical page layout.

8. Data Validation and Cleaning : Incorporate validation checks to ensure data accuracy and reliability. Consider mechanisms to detect and correct inconsistent or missing responses during data cleaning.

By incorporating these characteristics, researchers can create a questionnaire that maximizes data quality, minimizes response bias, and provides valuable insights for their research.

In the pursuit of advancing research and gaining meaningful insights, investing time and effort into designing effective questionnaires is a crucial step. A well-designed questionnaire is more than a mere set of questions; it is a masterpiece of precision and ingenuity. Each question plays a vital role in shaping the narrative of our research, guiding us through the labyrinth of data to meaningful conclusions. Indeed, a well-designed questionnaire serves as a powerful tool for unlocking valuable insights and generating robust findings that impact society positively.

Have you ever designed a research questionnaire? Reflect on your experience and share your insights with researchers globally through Enago Academy’s Open Blogging Platform . Join our diverse community of 1000K+ researchers and authors to exchange ideas, strategies, and best practices, and together, let’s shape the future of data collection and maximize the impact of questionnaires in the ever-evolving landscape of research.

Frequently Asked Questions

A research questionnaire is a structured tool used to gather data from participants in a systematic manner. It consists of a series of carefully crafted questions designed to collect specific information related to a research study.

Questionnaires play a pivotal role in both quantitative and qualitative research, enabling researchers to collect insights, opinions, attitudes, or behaviors from respondents. This aids in hypothesis testing, understanding, and informed decision-making, ensuring consistency, efficiency, and facilitating comparisons.

Questionnaires are a versatile tool employed in various research designs to gather data efficiently and comprehensively. They find extensive use in both quantitative and qualitative research methodologies, making them a fundamental component of research across disciplines. Some research designs that commonly utilize questionnaires include: a) Cross-Sectional Studies b) Longitudinal Studies c) Descriptive Research d) Correlational Studies e) Causal-Comparative Studies f) Experimental Research g) Survey Research h) Case Studies i) Exploratory Research

A survey is a comprehensive data collection method that can include various techniques like interviews and observations. A questionnaire is a specific set of structured questions within a survey designed to gather standardized responses. While a survey is a broader approach, a questionnaire is a focused tool for collecting specific data.

The choice of questionnaire type depends on the research objectives, the type of data required, and the preferences of respondents. Some common types include: • Structured Questionnaires: These questionnaires consist of predefined, closed-ended questions with fixed response options. They are easy to analyze and suitable for quantitative research. • Semi-Structured Questionnaires: These questionnaires combine closed-ended questions with open-ended ones. They offer more flexibility for respondents to provide detailed explanations. • Unstructured Questionnaires: These questionnaires contain open-ended questions only, allowing respondents to express their thoughts and opinions freely. They are commonly used in qualitative research.

Following these steps ensures effective questionnaire administration for reliable data collection: • Choose a Method: Decide on online, face-to-face, mail, or phone administration. • Online Surveys: Use platforms like SurveyMonkey • Pilot Test: Test on a small group before full deployment • Clear Instructions: Provide concise guidelines • Follow-Up: Send reminders if needed

Thank you, Riya. This is quite helpful. As discussed, response bias is one of the disadvantages in the use of questionnaires. One way to help limit this can be to use scenario based questions. These type of questions may help the respondents to be more reflective and active in the process.

Thank you, Dear Riya. This is quite helpful.

Great insights there Doc

Rate this article Cancel Reply

Your email address will not be published.

Enago Academy's Most Popular Articles

- Promoting Research

Graphical Abstracts Vs. Infographics: Best practices for using visual illustrations for increased research impact

Dr. Sarah Chen stared at her computer screen, her eyes staring at her recently published…

- Publishing Research

10 Tips to Prevent Research Papers From Being Retracted

Research paper retractions represent a critical event in the scientific community. When a published article…

- Industry News

Google Releases 2024 Scholar Metrics, Evaluates Impact of Scholarly Articles

Google has released its 2024 Scholar Metrics, assessing scholarly articles from 2019 to 2023. This…

![questionnaire of research paper What is Academic Integrity and How to Uphold it [FREE CHECKLIST]](https://www.enago.com/academy/wp-content/uploads/2024/05/FeatureImages-59-210x136.png)

Ensuring Academic Integrity and Transparency in Academic Research: A comprehensive checklist for researchers

Academic integrity is the foundation upon which the credibility and value of scientific findings are…

- Reporting Research

How to Optimize Your Research Process: A step-by-step guide

For researchers across disciplines, the path to uncovering novel findings and insights is often filled…

Choosing the Right Analytical Approach: Thematic analysis vs. content analysis for…

Comparing Cross Sectional and Longitudinal Studies: 5 steps for choosing the right…

Research Recommendations – Guiding policy-makers for evidence-based decision making

Sign-up to read more

Subscribe for free to get unrestricted access to all our resources on research writing and academic publishing including:

- 2000+ blog articles

- 50+ Webinars

- 10+ Expert podcasts

- 50+ Infographics

- 10+ Checklists

- Research Guides

We hate spam too. We promise to protect your privacy and never spam you.

- AI in Academia

- Career Corner

- Diversity and Inclusion

- Infographics

- Expert Video Library

- Other Resources

- Enago Learn

- Upcoming & On-Demand Webinars

- Peer Review Week 2024

- Open Access Week 2023

- Conference Videos

- Enago Report

- Journal Finder

- Enago Plagiarism & AI Grammar Check

- Editing Services

- Publication Support Services

- Research Impact

- Translation Services

- Publication solutions

- AI-Based Solutions

- Thought Leadership

- Call for Articles

- Call for Speakers

- Author Training

- Edit Profile

I am looking for Editing/ Proofreading services for my manuscript Tentative date of next journal submission:

In your opinion, what is the most effective way to improve integrity in the peer review process?

Designing a Questionnaire for a Research Paper: A Comprehensive Guide to Design and Develop an Effective Questionnaire

Taherdoost, H. (2022). Designing a Questionnaire for a Research Paper: A Comprehensive Guide to Design and Develop an Effective Questionnaire, Asian Journal of Managerial Science, 11(1): 8-16. DOI: https://doi.org/10.51983/ajms-2022.11.1.3087

Posted: 5 Dec 2022

Hamed Taherdoost

Hamta Group

Date Written: August 1, 2022

A questionnaire is an important instrument in a research study to help the researcher collect relevant data regarding the research topic. It is significant to ensure that the design of the questionnaire is arranged to minimize errors. However, researchers commonly face challenges in designing an effective questionnaire including its content, appearance and usage that leads to inappropriate and biased findings in a study. This paper aims to review the main steps to design a questionnaire introducing the process that starts with defining the information required for a study, then continues with the identification of the type of survey and types of questions, writing questions and building the construct of the questionnaire. It also develops the demand to pre-test the questionnaire and finalizing the questionnaire to conduct the survey.

Keywords: Questionnaire, Academic Survey, Questionnaire Design, Research Methodology

Suggested Citation: Suggested Citation

Hamed Taherdoost (Contact Author)

Hamta group ( email ).

Vancouver Canada

Do you have a job opening that you would like to promote on SSRN?

Paper statistics, related ejournals, social sciences education ejournal.

Subscribe to this fee journal for more curated articles on this topic

Libraries & Media eJournal

- What is New

- Download Your Software

- Behavioral Research

- Software for Consumer Research

- Software for Human Factors R&D

- Request Live Demo

- Contact Sales

Sensor Hardware

We carry a range of biosensors from the top hardware producers. All compatible with iMotions

iMotions for Higher Education

Imotions for business.

How to Map and Analyze a Customer Journey

Consumer Behavioral Analysis

Morten Pedersen

Deciphering Consumer Motivation with Biosensors

Consumer Insights

News & Events

- iMotions Lab

- iMotions Online

- Eye Tracking

- Eye Tracking Screen Based

- Eye Tracking VR

- Eye Tracking Glasses

- Eye Tracking Webcam

- FEA (Facial Expression Analysis)

- Voice Analysis

- EDA/GSR (Electrodermal Activity)

- EEG (Electroencephalography)

- ECG (Electrocardiography)

- EMG (Electromyography)

- Respiration

- iMotions Lab: New features

- iMotions Lab: Developers

- EEG sensors

- Sensory and Perceptual

- Consumer Inights

- Human Factors R&D

- Work Environments, Training and Safety

- Customer Stories

- Published Research Papers

- Document Library

- Customer Support Program

- Help Center

- Release Notes

- Contact Support

- Partnerships

- Mission Statement

- Ownership and Structure

- Executive Management

- Job Opportunities

Publications

- Newsletter Sign Up

How to Design a Questionnaire

Bryn Farnsworth

In this guide on how to design a questionnaire, we take you through what a good questionnaire is, how to perfect your design and questions, as well as how best to implement the questionnaire in your research. At the end of the guide, readers will have a thorough understanding of how to design a questionnaire, as well as have the opportunity to download our experimental design guide for free for future reference when building studies and experiments.

Table of Contents

If you want to find out something about a person, you’d usually just ask them. If you want to ask a few questions for a group of people, maybe you’d get together as a group. If you want to do research on the answers, you’d give them a questionnaire.

Questionnaires are a crucial part of research. There are many other tools that are used to find out about how people think, feel, and act, but the act of asking remains central to finding out what people explicitly think.

While questionnaires have likely been used for hundreds of years [1], the first recorded instance arose from the result of the work of Adolphe Quetelet , a French polymath, in 1835. He was interested in applying the same rigorous methodologies applied to natural science as to the humanities. By recording – through questionnaires (well, technically surveys) – the physical characteristics of soldiers, he essentially invented the field of sociology. This all goes to say: questionnaires can be powerful things.

Despite the lengthy and illustrious history of questionnaires, they are still not used necessarily in the right way. There remain various ways to carry out such work, and many pitfalls abound.

Below, we will define what a questionnaire actually is (including what separates it from surveys), and provide a guide to making one in the best possible way.

What are questionnaires?

Questionnaires are a set of written questions designed to gather standardized information about the opinions, preferences, experiences, intentions, and behavior of individuals, and can be devised for the purposes of a scientific study. Traditionally, they have been said to contrast with surveys in the sense that they do not collect mass data for further analysis, however the terms are largely used interchangeably these days (and many research studies also use them together).

While questionnaires provide a comparatively cheap, prompt, and efficient means of obtaining large amounts of information, questionnaire design is a multistage process that requires attention to a number of aspects at the same time to gather the information you seek. Why exactly is that?

Depending on the kind of information you aim to acquire, questions need to be asked in varying degrees of detail and in specific ways.

Given the same topic, it’s rather likely that different researchers will come up with different questionnaires that vary widely in their choice of questions, a line of questioning, use of open-ended questions, and length.

Question everything – what makes a good questionnaire?

Basically, well-designed questionnaires are highly structured to allow the same types of information to be collected from a large number of respondents in the same way and for data to be analyzed quantitatively .

Open and Closed Questionnaire Formats

Among others, the design of your questionnaire will depend on whether you choose an open format to collect exploratory information or a closed format to acquire quantitative data.

Advantages of open format:

- Allows to explore the range of possible topics arising from your research question

- Supports the understanding and generation of hypotheses on a topic

Advantages of closed format (multiple choice):

- Easy and quick to complete

- Ensures all respondents receive same stimuli

- Easy to record and analyze results quantitatively

Now how should you go about it? Planning and preparation are key. Although questionnaire design can seem simple at the surface, there are several components you want to make sure you get right. Before you know how to exactly phrase your questions, you need to define the goals and aims of your research, understand who you’ll be talking to, and design everything accordingly. Below, we go through exactly how to do this.

Six steps to good questionnaire design

#1: identify your research aims and the goal of your questionnaire.

What kind of information do you want to gather with your questionnaire? What is your main objective?

Ideally, there are already existing questionnaires that have been validated by published research that you can use (or maybe just to borrow a couple of ideas from). This can occur frequently within psychological research, as there is a broad range of research being carried out in a variety of different fields.

While this can be quite common, it’s not always the case. It might, for example, be rather difficult to find or reuse existing questionnaires for commercial applications. In this case, you might still be able to draw inspiration from pre-existing research, although greater care in the following steps will likely be needed.

Interested in Human Behavior and Psychology?

Sign up to our newsletter to get the latest articles and research send to you

#2: Define your target respondents

Clearly, you can’t test everyone – it’s rather plausible that there have to be certain restrictions with respect to the target audience of your questionnaire. The selection of groups is a key factor for maximizing the robustness of your study.

Another aspect to consider is whether you want to run multiple questionnaire sessions over a longer period of time with a single group ( longitudinal design ), or if you want to present your questionnaire once to two or more groups ( cross-sectional design ).

While the former allows you to analyze how the questionnaire results of the group change over time, the latter delivers insights into differences among groups.

#3: Develop questions

Smart questions are the cornerstone of every questionnaire. To make them work, they have to be phrased in a way that prevents any misunderstandings or ambiguities.

It’s often a lost cause trying to analyze data from a questionnaire where people have mixed things up, selected incorrect answers or haven’t been able to read or understand the questions at all.

It makes a significant difference whether you want to hand a questionnaire to children, adults, or maybe even elderly participants. It’s important to consider the cognitive, attentional, and sensory competencies of your target group – handing out long questionnaires with a huge amount of questions in small letter print and complicated phrasing might be too taxing for many participant groups.

Additionally, remember to avoid jargon or technical language – the text needs to be fully understood by anyone completing the questionnaire.

#4: Choose your question type

There’s a wide variety in how to phrase questions. In explorative questionnaires, you will find mainly open questions, where participants can fill in any answer (this makes sense whenever you try to gain an understanding of the topics associated with your research question).

By contrast, quantitative questionnaires primarily include closed-questions, which have been predefined by the researcher either in form of multiple choice answers or rating scales (such as the Likert scale ).

Here’s one example:

Open question:

“What did you like about the webinar?”

Closed question:

“The webinar was useful.”

[ ] Strongly agree

[ ] Agree

[ ] Cannot decide

[ ] Disagree

[ ] Strongly disagree

As is usually the case, both types of questions have benefits and drawbacks that are worth considering in order to come up with a solid questionnaire design that does the trick for you.

Besides open and closed-format questions, there are several other types of questions that you can use in your questionnaire.

#5: Design question sequence and overall layout

After optimizing each question separately it is time to improve the overall flow and layout of the questionnaire.

Are there transitions from one question to the next? Are follow-up questions placed correctly? Are skip-rules implemented (if needed) so that participants can skip questions that do not apply to them?

Keep up with the latest in human behavior research and technological developments

#6: Run a pilot

This stage is crucial for evaluation and optimization purposes. Any questionnaire should be handed to a representative sample of your target audience before you go further with it.

During piloting, you can identify issues in readability and understanding, in phrasing and overall arrangement. It could be helpful to discuss the questionnaire with pilot participants to better understand their experience. Also, keep in mind to evaluate your pilot data statistically to make sure that the analytic procedures of interest truly can be applied to the data.

I hope this post helps you set out your questionnaire or survey design. If you’d like to learn more about the fundamentals of experimental design, then download our free guide below.

Free 44-page Experimental Design Guide

For Beginners and Intermediates

- Introduction to experimental methods

- Respondent management with groups and populations

- How to set up stimulus selection and arrangement

[1] Gault, R. (1907). A History of the Questionnaire Method of Research in Psychology. The Pedagogical Seminary , 14(3), 366-383. doi: 10.1080/08919402.1907.10532551

Last edited

About the author

See what is next in human behavior research

Follow our newsletter to get the latest insights and events send to your inbox.

Related Posts

Roles of Independent and Dependent Variables in Research

Participant Recruitment for Human Behavior Studies: Strategies, Challenges, and Considerations

How to manage data quality

Paolo Masulli

Why are citations important in science?

You might also like these.

What is Structural Equation Modeling?

The Human Factors Dirty Dozen: From Aviation to Automotive

Human Factors

Jessica Justinussen

Case Stories

Explore Blog Categories

Best Practice

Collaboration, product guides, product news, research fundamentals, research insights, 🍪 use of cookies.

We are committed to protecting your privacy and only use cookies to improve the user experience.

Chose which third-party services that you will allow to drop cookies. You can always change your cookie settings via the Cookie Settings link in the footer of the website. For more information read our Privacy Policy.

- gtag This tag is from Google and is used to associate user actions with Google Ad campaigns to measure their effectiveness. Enabling this will load the gtag and allow for the website to share information with Google. This service is essential and can not be disabled.

- Livechat Livechat provides you with direct access to the experts in our office. The service tracks visitors to the website but does not store any information unless consent is given. This service is essential and can not be disabled.

- Pardot Collects information such as the IP address, browser type, and referring URL. This information is used to create reports on website traffic and track the effectiveness of marketing campaigns.

- Third-party iFrames Allows you to see thirdparty iFrames.

An official website of the United States government

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

- Publications

- Account settings

- My Bibliography

- Collections

- Citation manager

Save citation to file

Email citation, add to collections.

- Create a new collection

- Add to an existing collection

Add to My Bibliography

Your saved search, create a file for external citation management software, your rss feed.

- Search in PubMed

- Search in NLM Catalog

- Add to Search

How to Design and Validate A Questionnaire: A Guide

Affiliations.

- 1 Department of Pharmacology, Government Institute of Medical Sciences, Greater Noida, Uttar Pradesh, 201310, India.

- 2 Department of Pharmacology, AIIMS, Jodhpur, Rajasthan, 342005, India.

- 3 Department of Gynaecology and Obstetrics, AIIMS Jodhpur, Rajasthan, India.

- PMID: 30084336

- DOI: 10.2174/1574884713666180807151328

Background: A questionnaire is a commonly used data collection method and is a very crucial part of the research. However, designing a questionnaire can be a daunting task for postgraduate students.

Methods: This manuscript illustrates the various steps required in questionnaire designing and provides an insight into the essentials of questionnaire construction and validation. Data from a questionnaire should be able to comprehend the objectives of the study; else it may lead to wrong interpretation or bias, decreased power of study and inability to generalize the study results.

Conclusion: Since it is equally important to verify the usefulness of the designed questionnaire, the article briefly describes the process of psychometric evaluation of a questionnaire.

Keywords: Questionnaire validation; WOMAC; pragmatic research; psychometric assessment; questionnaire designing; validity..

Copyright© Bentham Science Publishers; For any queries, please email at [email protected].

PubMed Disclaimer

Similar articles

- Psychometric properties of the Farsi version of Attitudes to Aging Questionnaire in Iranian older adults. Rejeh N, Heravi-Karimooi M, Vaismoradi M, Griffiths P, Nikkhah M, Bahrami T. Rejeh N, et al. Clin Interv Aging. 2017 Sep 22;12:1531-1542. doi: 10.2147/CIA.S139321. eCollection 2017. Clin Interv Aging. 2017. PMID: 29026291 Free PMC article.

- Validation of the spanish version of the Roland-Morris questionnaire. Kovacs FM, Llobera J, Gil Del Real MT, Abraira V, Gestoso M, Fernández C, Primaria Group KA. Kovacs FM, et al. Spine (Phila Pa 1976). 2002 Mar 1;27(5):538-42. doi: 10.1097/00007632-200203010-00016. Spine (Phila Pa 1976). 2002. PMID: 11880841

- The Nordic Musculoskeletal Questionnaire: cross-cultural adaptation into Turkish assessing its psychometric properties. Kahraman T, Genç A, Göz E. Kahraman T, et al. Disabil Rehabil. 2016 Oct;38(21):2153-60. doi: 10.3109/09638288.2015.1114034. Epub 2016 Jan 4. Disabil Rehabil. 2016. PMID: 26726840

- The assessment of fatigue: a practical guide for clinicians and researchers. Dittner AJ, Wessely SC, Brown RG. Dittner AJ, et al. J Psychosom Res. 2004 Feb;56(2):157-70. doi: 10.1016/S0022-3999(03)00371-4. J Psychosom Res. 2004. PMID: 15016573 Review.

- Selection and use of content experts for instrument development. Grant JS, Davis LL. Grant JS, et al. Res Nurs Health. 1997 Jun;20(3):269-74. doi: 10.1002/(sici)1098-240x(199706)20:3 3.0.co;2-g. Res Nurs Health. 1997. PMID: 9179180 Review.

- Oral care of intubated patients, challenging task of ICU nurses: a survey of knowledge, attitudes and practices. Asadi N, Jahanimoghadam F. Asadi N, et al. BMC Oral Health. 2024 Aug 10;24(1):925. doi: 10.1186/s12903-024-04652-5. BMC Oral Health. 2024. PMID: 39127638 Free PMC article.

- The Moderation Effect of Approach Motivation Between Schizotypy and Creative Ideational Behavior. Wang L, Pei Y, Zhu Y, Long H, Pang W. Wang L, et al. Psychol Res Behav Manag. 2024 May 9;17:1947-1960. doi: 10.2147/PRBM.S441013. eCollection 2024. Psychol Res Behav Manag. 2024. PMID: 38742225 Free PMC article.

- Effects of Wildfire Events on California Radiation Oncology Clinics and Patients. Lichter KE, Baniel CC, Do I, Medhat Y, Avula V, Nogueira LM, Bates JE, Paulsson A, Malik N, Hiatt RA, Yom SS, Mohamad O. Lichter KE, et al. Adv Radiat Oncol. 2023 Oct 22;9(3):101395. doi: 10.1016/j.adro.2023.101395. eCollection 2024 Mar. Adv Radiat Oncol. 2023. PMID: 38304108 Free PMC article.

- The German version of the mHealth App Usability Questionnaire (GER-MAUQ): Translation and validation study in patients with cardiovascular disease. Tacke T, Nohl-Deryk P, Lingwal N, Reimer LM, Starnecker F, Güthlin C, Gerlach FM, Schunkert H, Jonas S, Müller A. Tacke T, et al. Digit Health. 2024 Jan 31;10:20552076231225168. doi: 10.1177/20552076231225168. eCollection 2024 Jan-Dec. Digit Health. 2024. PMID: 38303970 Free PMC article.

- Enhancing Human Papillomavirus Vaccination Rates through Better Knowledge? Insights from a Survey among German Medical Students. Aksoy C, Reimold P, Schumann A, Schneidewind L, Karschuck P, Flegar L, Leitsmann M, Heers H, Huber J, Zacharis A, Ihrig A. Aksoy C, et al. Urol Int. 2024;108(2):153-158. doi: 10.1159/000536257. Epub 2024 Jan 19. Urol Int. 2024. PMID: 38246131 Free PMC article.

Publication types

- Search in MeSH

LinkOut - more resources

Full text sources.

- Bentham Science Publishers Ltd.

- Ingenta plc

Other Literature Sources

- scite Smart Citations

- Citation Manager

NCBI Literature Resources

MeSH PMC Bookshelf Disclaimer

The PubMed wordmark and PubMed logo are registered trademarks of the U.S. Department of Health and Human Services (HHS). Unauthorized use of these marks is strictly prohibited.

Have a language expert improve your writing

Run a free plagiarism check in 10 minutes, generate accurate citations for free.

- Knowledge Base

- Starting the research process

- 10 Research Question Examples to Guide Your Research Project

10 Research Question Examples to Guide your Research Project

Published on October 30, 2022 by Shona McCombes . Revised on October 19, 2023.

The research question is one of the most important parts of your research paper , thesis or dissertation . It’s important to spend some time assessing and refining your question before you get started.

The exact form of your question will depend on a few things, such as the length of your project, the type of research you’re conducting, the topic , and the research problem . However, all research questions should be focused, specific, and relevant to a timely social or scholarly issue.

Once you’ve read our guide on how to write a research question , you can use these examples to craft your own.

| Research question | Explanation |

|---|---|

| The first question is not enough. The second question is more , using . | |

| Starting with “why” often means that your question is not enough: there are too many possible answers. By targeting just one aspect of the problem, the second question offers a clear path for research. | |

| The first question is too broad and subjective: there’s no clear criteria for what counts as “better.” The second question is much more . It uses clearly defined terms and narrows its focus to a specific population. | |

| It is generally not for academic research to answer broad normative questions. The second question is more specific, aiming to gain an understanding of possible solutions in order to make informed recommendations. | |

| The first question is too simple: it can be answered with a simple yes or no. The second question is , requiring in-depth investigation and the development of an original argument. | |

| The first question is too broad and not very . The second question identifies an underexplored aspect of the topic that requires investigation of various to answer. | |

| The first question is not enough: it tries to address two different (the quality of sexual health services and LGBT support services). Even though the two issues are related, it’s not clear how the research will bring them together. The second integrates the two problems into one focused, specific question. | |

| The first question is too simple, asking for a straightforward fact that can be easily found online. The second is a more question that requires and detailed discussion to answer. | |

| ? dealt with the theme of racism through casting, staging, and allusion to contemporary events? | The first question is not — it would be very difficult to contribute anything new. The second question takes a specific angle to make an original argument, and has more relevance to current social concerns and debates. |

| The first question asks for a ready-made solution, and is not . The second question is a clearer comparative question, but note that it may not be practically . For a smaller research project or thesis, it could be narrowed down further to focus on the effectiveness of drunk driving laws in just one or two countries. |

Note that the design of your research question can depend on what method you are pursuing. Here are a few options for qualitative, quantitative, and statistical research questions.

| Type of research | Example question |

|---|---|

| Qualitative research question | |

| Quantitative research question | |

| Statistical research question |

Other interesting articles

If you want to know more about the research process , methodology , research bias , or statistics , make sure to check out some of our other articles with explanations and examples.

Methodology

- Sampling methods

- Simple random sampling

- Stratified sampling

- Cluster sampling

- Likert scales

- Reproducibility

Statistics

- Null hypothesis

- Statistical power

- Probability distribution

- Effect size

- Poisson distribution

Research bias

- Optimism bias

- Cognitive bias

- Implicit bias

- Hawthorne effect

- Anchoring bias

- Explicit bias

Cite this Scribbr article

If you want to cite this source, you can copy and paste the citation or click the “Cite this Scribbr article” button to automatically add the citation to our free Citation Generator.

McCombes, S. (2023, October 19). 10 Research Question Examples to Guide your Research Project. Scribbr. Retrieved September 1, 2024, from https://www.scribbr.com/research-process/research-question-examples/

Is this article helpful?

Shona McCombes

Other students also liked, writing strong research questions | criteria & examples, how to choose a dissertation topic | 8 steps to follow, evaluating sources | methods & examples, get unlimited documents corrected.

✔ Free APA citation check included ✔ Unlimited document corrections ✔ Specialized in correcting academic texts

- Utility Menu

Harvard University Program on Survey Research

- Questionnaire Design Tip Sheet

This PSR Tip Sheet provides some basic tips about how to write good survey questions and design a good survey questionnaire.

| 40 KB |

PSR Resources

- Managing and Manipulating Survey Data: A Beginners Guide

- Finding and Hiring Survey Contractors

- How to Frame and Explain the Survey Data Used in a Thesis

- Overview of Cognitive Testing and Questionnaire Evaluation

- Sampling, Coverage, and Nonresponse Tip Sheet

- Introduction to Surveys for Honors Thesis Writers

- PSR Introduction to the Survey Process

- Related Centers/Programs at Harvard

- General Survey Reference

- Institutional Review Boards

- Select Funding Opportunities

- Survey Analysis Software

- Professional Standards

- Professional Organizations

- Major Public Polls

- Survey Data Collections

- Major Longitudinal Surveys

- Other Links

- PRO Courses Guides New Tech Help Pro Expert Videos About wikiHow Pro Upgrade Sign In

- EDIT Edit this Article

- EXPLORE Tech Help Pro About Us Random Article Quizzes Request a New Article Community Dashboard This Or That Game Happiness Hub Popular Categories Arts and Entertainment Artwork Books Movies Computers and Electronics Computers Phone Skills Technology Hacks Health Men's Health Mental Health Women's Health Relationships Dating Love Relationship Issues Hobbies and Crafts Crafts Drawing Games Education & Communication Communication Skills Personal Development Studying Personal Care and Style Fashion Hair Care Personal Hygiene Youth Personal Care School Stuff Dating All Categories Arts and Entertainment Finance and Business Home and Garden Relationship Quizzes Cars & Other Vehicles Food and Entertaining Personal Care and Style Sports and Fitness Computers and Electronics Health Pets and Animals Travel Education & Communication Hobbies and Crafts Philosophy and Religion Work World Family Life Holidays and Traditions Relationships Youth

- Browse Articles

- Learn Something New

- Quizzes Hot

- Happiness Hub

- This Or That Game

- Train Your Brain

- Explore More

- Support wikiHow

- About wikiHow

- Log in / Sign up

- Education and Communications

How to Develop a Questionnaire for Research

Last Updated: July 21, 2024 Fact Checked

This article was co-authored by Alexander Ruiz, M.Ed. . Alexander Ruiz is an Educational Consultant and the Educational Director of Link Educational Institute, a tutoring business based in Claremont, California that provides customizable educational plans, subject and test prep tutoring, and college application consulting. With over a decade and a half of experience in the education industry, Alexander coaches students to increase their self-awareness and emotional intelligence while achieving skills and the goal of achieving skills and higher education. He holds a BA in Psychology from Florida International University and an MA in Education from Georgia Southern University. There are 12 references cited in this article, which can be found at the bottom of the page. This article has been fact-checked, ensuring the accuracy of any cited facts and confirming the authority of its sources. This article has been viewed 593,313 times.

A questionnaire is a technique for collecting data in which a respondent provides answers to a series of questions. [1] X Research source To develop a questionnaire that will collect the data you want takes effort and time. However, by taking a step-by-step approach to questionnaire development, you can come up with an effective means to collect data that will answer your unique research question.

Designing Your Questionnaire

- Come up with a research question. It can be one question or several, but this should be the focal point of your questionnaire.

- Develop one or several hypotheses that you want to test. The questions that you include on your questionnaire should be aimed at systematically testing these hypotheses.

- Dichotomous question: this is a question that will generally be a “yes/no” question, but may also be an “agree/disagree” question. It is the quickest and simplest question to analyze, but is not a highly sensitive measure.

- Open-ended questions: these questions allow the respondent to respond in their own words. They can be useful for gaining insight into the feelings of the respondent, but can be a challenge when it comes to analysis of data. It is recommended to use open-ended questions to address the issue of “why.” [2] X Research source

- Multiple choice questions: these questions consist of three or more mutually-exclusive categories and ask for a single answer or several answers. [3] X Research source Multiple choice questions allow for easy analysis of results, but may not give the respondent the answer they want.

- Rank-order (or ordinal) scale questions: this type of question asks your respondent to rank items or choose items in a particular order from a set. For example, it might ask your respondents to order five things from least to most important. These types of questions forces discrimination among alternatives, but does not address the issue of why the respondent made these discriminations. [4] X Research source

- Rating scale questions: these questions allow the respondent to assess a particular issue based on a given dimension. You can provide a scale that gives an equal number of positive and negative choices, for example, ranging from “strongly agree” to “strongly disagree.” [5] X Research source These questions are very flexible, but also do not answer the question “why.”

- Write questions that are succinct and simple. You should not be writing complex statements or using technical jargon, as it will only confuse your respondents and lead to incorrect responses.

- Ask only one question at a time. This will help avoid confusion

- Asking questions such as these usually require you to anonymize or encrypt the demographic data you collect.

- Determine if you will include an answer such as “I don’t know” or “Not applicable to me.” While these can give your respondents a way of not answering certain questions, providing these options can also lead to missing data, which can be problematic during data analysis.

- Put the most important questions at the beginning of your questionnaire. This can help you gather important data even if you sense that your respondents may be becoming distracted by the end of the questionnaire.

- Only include questions that are directly useful to your research question. [8] X Trustworthy Source Food and Agricultural Organization of the United Nations Specialized agency of the United Nations responsible for leading international efforts to end world hunger and improve nutrition Go to source A questionnaire is not an opportunity to collect all kinds of information about your respondents.

- Avoid asking redundant questions. This will frustrate those who are taking your questionnaire.

- Consider if you want your questionnaire to collect information from both men and women. Some studies will only survey one sex.

- Consider including a range of ages in your target demographic. For example, you can consider young adult to be 18-29 years old, adults to be 30-54 years old, and mature adults to be 55+. Providing the an age range will help you get more respondents than limiting yourself to a specific age.

- Consider what else would make a person a target for your questionnaire. Do they need to drive a car? Do they need to have health insurance? Do they need to have a child under 3? Make sure you are very clear about this before you distribute your questionnaire.

- Consider an anonymous questionnaire. You may not want to ask for names on your questionnaire. This is one step you can take to prevent privacy, however it is often possible to figure out a respondent’s identity using other demographic information (such as age, physical features, or zipcode).

- Consider de-identifying the identity of your respondents. Give each questionnaire (and thus, each respondent) a unique number or word, and only refer to them using that new identifier. Shred any personal information that can be used to determine identity.

- Remember that you do not need to collect much demographic information to be able to identify someone. People may be wary to provide this information, so you may get more respondents by asking less demographic questions (if it is possible for your questionnaire).

- Make sure you destroy all identifying information after your study is complete.

Writing your questionnaire

- My name is Jack Smith and I am one of the creators of this questionnaire. I am part of the Department of Psychology at the University of Michigan, where I am focusing in developing cognition in infants.

- I’m Kelly Smith, a 3rd year undergraduate student at the University of New Mexico. This questionnaire is part of my final exam in statistics.

- My name is Steve Johnson, and I’m a marketing analyst for The Best Company. I’ve been working on questionnaire development to determine attitudes surrounding drug use in Canada for several years.

- I am collecting data regarding the attitudes surrounding gun control. This information is being collected for my Anthropology 101 class at the University of Maryland.

- This questionnaire will ask you 15 questions about your eating and exercise habits. We are attempting to make a correlation between healthy eating, frequency of exercise, and incidence of cancer in mature adults.

- This questionnaire will ask you about your recent experiences with international air travel. There will be three sections of questions that will ask you to recount your recent trips and your feelings surrounding these trips, as well as your travel plans for the future. We are looking to understand how a person’s feelings surrounding air travel impact their future plans.

- Beware that if you are collecting information for a university or for publication, you may need to check in with your institution’s Institutional Review Board (IRB) for permission before beginning. Most research universities have a dedicated IRB staff, and their information can usually be found on the school’s website.

- Remember that transparency is best. It is important to be honest about what will happen with the data you collect.

- Include an informed consent for if necessary. Note that you cannot guarantee confidentiality, but you will make all reasonable attempts to ensure that you protect their information. [11] X Research source

- Time yourself taking the survey. Then consider that it will take some people longer than you, and some people less time than you.

- Provide a time range instead of a specific time. For example, it’s better to say that a survey will take between 15 and 30 minutes than to say it will take 15 minutes and have some respondents quit halfway through.

- Use this as a reason to keep your survey concise! You will feel much better asking people to take a 20 minute survey than you will asking them to take a 3 hour one.

- Incentives can attract the wrong kind of respondent. You don’t want to incorporate responses from people who rush through your questionnaire just to get the reward at the end. This is a danger of offering an incentive. [12] X Research source

- Incentives can encourage people to respond to your survey who might not have responded without a reward. This is a situation in which incentives can help you reach your target number of respondents. [13] X Research source