What is inflation?

Inflation has been top of mind for many over the past few years. But how long will it persist? In June 2022, inflation in the United States jumped to 9.1 percent, reaching the highest level since February 1982. The inflation rate has since slowed in the United States , as well as in Europe , Japan , and the United Kingdom , particularly in the final months of 2023. But even though global inflation is higher than it was before the COVID-19 pandemic, when it hovered around 2 percent, it’s receding to historical levels . In fact, by late 2022, investors were predicting that long-term inflation would settle around a modest 2.5 percent. That’s a far cry from fears that long-term inflation would mimic trends of the 1970s and early 1980s—when inflation exceeded 10 percent.

Get to know and directly engage with senior McKinsey experts on inflation.

Ondrej Burkacky is a senior partner in McKinsey’s Munich office, Axel Karlsson is a senior partner in the Stockholm office, Fernando Perez is a senior partner in the Miami office, Emily Reasor is a senior partner in the Denver office, and Daniel Swan is a senior partner in the Stamford, Connecticut, office.

Inflation refers to a broad rise in the prices of goods and services across the economy over time, eroding purchasing power for both consumers and businesses. Economic theory and practice, observed for many years and across many countries, shows that long-lasting periods of inflation are caused in large part by what’s known as an easy monetary policy . In other words, when a country’s central bank sets the interest rate too low or increases money growth too rapidly, inflation goes up. As a result, your dollar (or whatever currency you use) will not go as far today as it did yesterday. For example: in 1970, the average cup of coffee in the United States cost 25 cents; by 2019, it had climbed to $1.59. So for $5, you would have been able to buy about three cups of coffee in 2019, versus 20 cups in 1970. That’s inflation, and it isn’t limited to price spikes for any single item or service; it refers to increases in prices across a sector, such as retail or automotive—and, ultimately, a country’s economy.

How does inflation affect your daily life? You’ve probably seen high rates of inflation reflected in your bills—from groceries to utilities to even higher mortgage payments. Executives and corporate leaders have had to reckon with the effects of inflation too, figuring out how to protect margins while paying more for raw materials.

But inflation isn’t all bad. In a healthy economy, annual inflation is typically in the range of two percentage points, which is what economists consider a sign of pricing stability. When inflation is in this range, it can have positive effects: it can stimulate spending and thus spur demand and productivity when the economy is slowing down and needs a boost. But when inflation begins to surpass wage growth, it can be a warning sign of a struggling economy.

Looking for direct answers to other complex questions?

Inflation may be declining in many markets, but there’s still uncertainty ahead: without a significant surge in productivity, Western economies may be headed for a period of sustained inflation or major economic reset , as Japan has experienced in the first decades of the 21st century.

What does seem to be changing are leaders’ attitudes. According to the 2023 year-end McKinsey Global Survey on economic conditions , respondents reported less fear about inflation as a risk to global and domestic economic growth . But this sentiment varies significantly by region: European respondents were most concerned about the effects of inflation, whereas respondents in North America offered brighter views.

What causes inflation?

Monetary policy is a critical driver of inflation over the long term. The current high rate of inflation is a result of increased money supply , high raw materials costs , labor mismatches , and supply disruptions —exacerbated by geopolitical conflict .

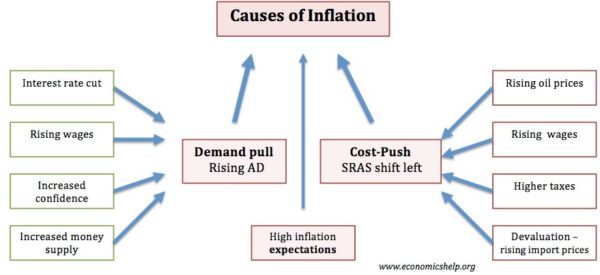

In general, there are two primary types, or causes, of short-term inflation:

- Demand-pull inflation occurs when the demand for goods and services in the economy exceeds the economy’s ability to produce them. For example, when demand for new cars recovered more quickly than anticipated from its sharp dip at the beginning of the COVID-19 pandemic, an intervening shortage in the supply of semiconductors made it hard for the automotive industry to keep up with this renewed demand. The subsequent shortage of new vehicles resulted in a spike in prices for new and used cars.

- Cost-push inflation occurs when the rising price of input goods and services increases the price of final goods and services. For example, commodity prices spiked sharply during the pandemic as a result of radical shifts in demand, buying patterns, cost to serve, and perceived value across sectors and value chains. To offset inflation and minimize impact on financial performance, industrial companies were forced to increase prices for end consumers.

Learn more about McKinsey’s Growth, Marketing & Sales Practice.

What are some periods in history with high inflation?

Economists frequently compare the current inflationary period with the post–World War II era , when price controls, supply problems, and extraordinary demand in the United States fueled double-digit inflation gains—peaking at 20 percent in 1947—before subsiding at the end of the decade. Consumption patterns today have been similarly distorted, and supply chains have been disrupted by the pandemic.

The period from the mid-1960s through the early 1980s in the United States, sometimes called the “Great Inflation,” saw some of the country’s highest rates of inflation, with a peak of 14.8 percent in 1980. To combat this inflation, the Federal Reserve raised interest rates to nearly 20 percent. Some economists attribute this episode partially to monetary policy mistakes rather than to other causes, such as high oil prices. The Great Inflation signaled the need for public trust in the Federal Reserve’s ability to lessen inflationary pressures.

Inflation isn’t solely a modern-day phenomenon, of course. One very early example of inflation comes from Roman times, from around 200 to 300 CE. Roman leaders were struggling to fund an army big enough to deal with attackers from multiple fronts. To help, they watered down the silver in their coinage, causing the value of money to slowly fall—and inflation to pick up. This led merchants to raise their prices, causing widespread panic. In response, the emperor Diocletian issued what’s now known as the Edict on Maximum Prices, a series of price and wage controls designed to stop the rise of prices and wages (one helpful control was a maximum price for a male lion). But because the edict didn’t address the root cause of inflation—the impure silver coin—it didn’t fix the problem.

How is inflation measured?

Statistical agencies measure inflation first by determining the current value of a “basket” of various goods and services consumed by households, referred to as a price index. To calculate the rate of inflation over time, statisticians compare the value of the index over one period with that of another. Comparing one month with another gives a monthly rate of inflation, and comparing from year to year gives an annual rate of inflation.

In the United States, the Bureau of Labor Statistics publishes its Consumer Price Index (CPI), which measures the cost of items that urban consumers buy out of pocket. The CPI is broken down by region and is reported for the country as a whole. The Personal Consumption Expenditures (PCE) price index —published by the US Bureau of Economic Analysis—takes into account a broader range of consumer spending, including on healthcare. It is also weighted by data acquired through business surveys.

How does inflation affect consumers and companies differently?

Inflation affects consumers most directly, but businesses can also feel the impact:

- Consumers lose purchasing power when the prices of items they buy, such as food, utilities, and gasoline, increase. This can lead to household belt-tightening and growing pessimism about the economy .

- Companies lose purchasing power and risk seeing their margins decline , when prices increase for inputs used in production. These can include raw materials like coal and crude oil , intermediate products such as flour and steel, and finished machinery. In response, companies typically raise the prices of their products or services to offset inflation, meaning consumers absorb these price increases. The challenge for many companies is to strike the right balance between raising prices to cover input cost increases while simultaneously ensuring that they don’t raise prices so much that they suppress demand.

How can organizations respond to high inflation?

During periods of high inflation, companies typically pay more for materials , which decreases their margins. One way for companies to offset losses and maintain margins is by raising prices for consumers. However, if price increases are not executed thoughtfully, companies can damage customer relationships and depress sales —ultimately eroding the profits they were trying to protect.

When done successfully, recovering the cost of inflation for a given product can strengthen relationships and overall margins. There are five steps companies can take to ADAPT (adjust, develop, accelerate, plan, and track) to inflation:

- Adjust discounting and promotions and maximize nonprice levers. This can include lengthening production schedules or adding surcharges and delivery fees for rush or low-volume orders.

- Develop the art and science of price change. Instead of making across-the-board price changes, tailor pricing actions to account for inflation exposure, customer willingness to pay, and product attributes.

- Accelerate decision making tenfold. Establish an “inflation council” that includes dedicated cross-functional, inflation-focused decision makers who can act quickly and nimbly on customer feedback.

- Plan options beyond pricing to reduce costs. Use “value engineering” to reimagine a portfolio and provide cost-reducing alternatives to price increases.

- Track execution relentlessly. Create a central supporting team to address revenue leakage and to manage performance rigorously. Traditional performance metrics can be less reliable when inflation is high .

Beyond pricing, a variety of commercial and technical levers can help companies deal with price increases in an inflationary market , but other sectors may require a more tailored response to pricing.

Learn more about our Financial Services , Industrials & Electronics , Operations , Strategy & Corporate Finance , and Growth, Marketing & Sales Practices.

How can CEOs help protect their organizations against uncertainty during periods of high inflation?

In today’s uncertain environment, in which organizations have a much wider range of stakeholders, leaders must think about performance beyond short-term profitability. CEOs should lead with the complete business cycle and their complete slate of stakeholders in mind.

CEOs need an inflation management playbook , just as central bankers do. Here are some important areas to keep in mind while scripting it:

- Design. Leaders should motivate their organizations to raise the profile of design to a C-suite topic. Design choices for products and services are critical for responding to price volatility, scarcity of components, and higher production and servicing costs.

- Supply chain. The most difficult task for CEOs may be convincing investors to accept supply chain resiliency as the new table stakes. Given geopolitical and economic realities, supply chain resiliency has become a crucial goal for supply chain leaders, alongside cost optimization.

- Procurement. CEOs who empower their procurement organizations can raise the bar on value-creating contributions. Procurement leaders have told us time and again that the current market environment is the toughest they’ve experienced in decades. CEOs are beginning to recognize that purchasing leaders can be strategic partners by expanding their focus beyond cost cutting to value creation.

- Feedback. A CEO can take a lead role in playing back the feedback the organization is hearing. In today’s tight labor market, CEOs should guide their companies to take a new approach to talent, focusing on compensation, cultural factors, and psychological safety .

- Pricing. Forging new pricing relationships with customers will test CEOs in their role as the “ultimate integrator.” Repricing during inflationary times is typically unpleasant for companies and customers alike. With setting new prices, CEOs have the opportunity to forge deeper relationships with customers, by turning to promotions, personalization , and refreshed communications around value.

- Agility. CEOs can strive to achieve a focus based more on strategic action and less on firefighting. Managing the implications of inflation calls for a cross-functional, disciplined, and agile response.

A practical example: How is inflation affecting the US healthcare industry?

Consumer prices for healthcare have rarely risen faster than the rate of inflation—but that’s what’s happening today. The impact of inflation on the broader economy has caused healthcare costs to rise faster than the rate of inflation. Experts also expect continued labor shortages in healthcare—gaps of up to 450,000 registered nurses and 80,000 doctors —even as demand for services continues to rise. This drives up consumer prices and means that higher inflation could persist. McKinsey analysis as of 2022 predicted that the annual US health expenditure is likely to be $370 billion higher by 2027 because of inflation.

This climate of risk could spur healthcare leaders to address productivity, using tech levers to boost productivity while also reducing costs. In order to weather the storm, leaders will need to quickly set high aspirations, align their organizations around them, and execute with speed .

What is deflation?

If inflation is one extreme of the pricing spectrum, deflation is the other. Deflation occurs when the overall level of prices in an economy declines and the purchasing power of currency increases. It can be driven by growth in productivity and the abundance of goods and services, by a decrease in demand, or by a decline in the supply of money and credit.

Generally, moderate deflation positively affects consumers’ pocketbooks, as they can purchase more with less money. However, deflation can be a sign of a weakening economy, leading to recessions and depressions. While inflation reduces purchasing power, it also reduces the value of debt. During a period of deflation, on the other hand, debt becomes more expensive. And for consumers, investments such as stocks, corporate bonds, and real estate become riskier.

A recent period of deflation in the United States was the Great Recession, between 2007 and 2008. In December 2008, more than half of executives surveyed by McKinsey expected deflation in their countries, and 44 percent expected to decrease the size of their workforces.

When taken to their extremes, both inflation and deflation can have significant negative effects on consumers, businesses, and investors.

For more in-depth exploration of these topics, see McKinsey’s Operations Insights collection. Learn more about Operations consulting , and check out operations-related job opportunities if you’re interested in working at McKinsey.

Articles referenced:

- “ Investing in productivity growth ,” March 27, 2024, Jan Mischke , Chris Bradley , Marc Canal, Olivia White , Sven Smit , and Denitsa Georgieva

- “ Economic conditions outlook during turbulent times, December 2023 ,” December 20, 2023

- “ Forward Thinking on why we ignore inflation—from ancient times to the present—at our peril with Stephen King ,” November 1, 2023

- “ Procurement 2023: Ten CPO actions to defy the toughest challenges ,” March 6, 2023, Roman Belotserkovskiy , Carolina Mazuera, Marta Mussacaleca , Marc Sommerer, and Jan Vandaele

- “ Why you can’t tread water when inflation is persistently high ,” February 2, 2023, Marc Goedhart and Rosen Kotsev

- “ Markets versus textbooks: Calculating today’s cost of equity ,” January 24, 2023, Vartika Gupta, David Kohn, Tim Koller , and Werner Rehm

- “ Inflation-weary Americans are increasingly pessimistic about the economy ,” December 13, 2022, Gonzalo Charro, Andre Dua , Kweilin Ellingrud , Ryan Luby, and Sarah Pemberton

- “ Inflation fighter and value creator: Procurement’s best-kept secret ,” October 31, 2022, Roman Belotserkovskiy , Ezra Greenberg , Daphne Luchtenberg, and Marta Mussacaleca

- “ Prime Numbers: Rethink performance metrics when inflation is high ,” October 28, 2022, Vartika Gupta, David Kohn, Tim Koller , and Werner Rehm

- “ The gathering storm: The threat to employee healthcare benefits ,” October 20, 2022, Aditya Gupta , Akshay Kapur , Monisha Machado-Pereira , and Shubham Singhal

- “ Utility procurement: Ready to meet new market challenges ,” October 7, 2022, Roman Belotserkovskiy , Abhay Prasanna, and Anton Stetsenko

- “ The gathering storm: The transformative impact of inflation on the healthcare sector ,” September 19, 2022, Addie Fleron, Aneesh Krishna , and Shubham Singhal

- “ Pricing during inflation: Active management can preserve sustainable value ,” August 19, 2022, Niels Adler and Nicolas Magnette

- “ Navigating inflation: A new playbook for CEOs ,” April 14, 2022, Asutosh Padhi , Sven Smit , Ezra Greenberg , and Roman Belotserkovskiy

- “ How business operations can respond to price increases: A CEO guide ,” March 11, 2022, Andreas Behrendt , Axel Karlsson , Tarek Kasah, and Daniel Swan

- “ Five ways to ADAPT pricing to inflation ,” February 25, 2022, Alex Abdelnour , Eric Bykowsky, Jesse Nading, Emily Reasor , and Ankit Sood

- “ How COVID-19 is reshaping supply chains ,” November 23, 2021, Knut Alicke , Ed Barriball , and Vera Trautwein

- “ Navigating the labor mismatch in US logistics and supply chains ,” December 10, 2021, Dilip Bhattacharjee , Felipe Bustamante, Andrew Curley, and Fernando Perez

- “ Coping with the auto-semiconductor shortage: Strategies for success ,” May 27, 2021, Ondrej Burkacky , Stephanie Lingemann, and Klaus Pototzky

This article was updated in April 2024; it was originally published in August 2022.

Want to know more about inflation?

Related articles.

What is supply chain?

How business operations can respond to price increases: A CEO guide

Five ways to ADAPT pricing to inflation

Presentations made painless

- Get Premium

100 Inflation Essay Topic Ideas & Examples

Inside This Article

Inflation is a key economic indicator that affects the purchasing power of consumers and the overall health of an economy. As such, it is a popular topic for essays and research papers in economics, finance, and related fields. If you are looking for inspiration for your next inflation essay, look no further. Here are 100 inflation essay topic ideas and examples to help you get started:

- The causes and effects of inflation

- The relationship between inflation and unemployment

- The impact of inflation on interest rates

- The role of the Federal Reserve in controlling inflation

- The differences between demand-pull and cost-push inflation

- The effects of hyperinflation on a country's economy

- The impact of inflation on fixed income earners

- The relationship between inflation and the stock market

- The effects of inflation on real estate prices

- The impact of inflation on international trade

- The role of inflation expectations in shaping economic behavior

- The effects of inflation on poverty and income inequality

- The impact of inflation on retirement savings

- The relationship between inflation and economic growth

- The effects of inflation on consumer spending

- The role of inflation in shaping monetary policy decisions

- The impact of inflation on business investment

- The effects of inflation on government finances

- The relationship between inflation and currency exchange rates

- The impact of inflation on the cost of living

- The effects of inflation on social welfare programs

- The role of inflation in causing economic recessions

- The impact of inflation on international competitiveness

- The effects of inflation on the environment

- The relationship between inflation and financial stability

- The role of inflation in shaping government policy decisions

- The impact of inflation on entrepreneurship and innovation

- The effects of inflation on consumer confidence

- The relationship between inflation and technological advancement

- The impact of inflation on the healthcare industry

- The effects of inflation on the education sector

- The role of inflation in shaping consumer behavior

- The impact of inflation on the agricultural sector

- The relationship between inflation and social mobility

- The effects of inflation on urban development

- The role of inflation in shaping labor market dynamics

- The impact of inflation on small businesses

- The effects of inflation on the tourism industry

- The relationship between inflation and government regulations

- The impact of inflation on infrastructure development

- The role of inflation in shaping energy policy

- The effects of inflation on the manufacturing sector

- The relationship between inflation and the digital economy

- The impact of inflation on the gig economy

- The effects of inflation on the sharing economy

- The role of inflation in shaping consumer preferences

- The impact of inflation on the automotive industry

- The relationship between inflation and the housing market

- The effects of inflation on the retail sector

- The impact of inflation on the hospitality industry

- The role of inflation in shaping supply chain dynamics

- The effects of inflation on the fashion industry

- The relationship between inflation and the art market

- The impact of inflation on the entertainment industry

- The effects of inflation on the music industry

- The role of inflation in shaping the sports industry

- The relationship between inflation and the gaming industry

- The impact of inflation on the film industry

- The effects of inflation on the publishing industry

- The role of inflation in shaping the food and beverage industry

- The impact of inflation on the beauty and personal care industry

- The effects of inflation on the health and wellness industry

- The relationship between inflation and the pharmaceutical industry

- The impact of inflation on the technology industry

- The effects of inflation on the telecommunications industry

- The role of inflation in shaping the media industry

- The relationship between inflation and the advertising industry

- The impact of inflation on the e-commerce industry

- The effects of inflation on the transportation industry

- The role of inflation in shaping the logistics industry

- The impact of inflation on the energy industry

- The effects of inflation on the renewable energy industry

- The relationship between inflation and the oil and gas industry

- The impact of inflation on the mining industry

- The effects of inflation on the construction industry

- The role of inflation in shaping the real estate industry

- The relationship between inflation and the property market

- The impact of inflation on the architecture and design industry

- The effects of inflation on the engineering industry

- The role of inflation in shaping the manufacturing industry

- The effects of inflation on the aerospace industry

- The relationship between inflation and the defense industry

- The impact of inflation on the security industry

- The effects of inflation on the law enforcement industry

- The role of inflation in shaping the healthcare industry

- The impact of inflation on the medical devices industry

- The effects of inflation on the biotechnology industry

- The role of inflation in shaping the life sciences industry

- The impact of inflation on the education industry

- The effects of inflation on the e-learning industry

- The relationship between inflation and the edtech industry

- The impact of inflation on the publishing industry

- The effects of inflation on the media and entertainment industry

- The role of inflation in shaping the sports and recreation industry

- The relationship between inflation and the leisure and travel industry

- The impact of inflation on the tourism and hospitality industry

- The effects of inflation on the food and beverage industry

- The role of inflation in shaping the retail and consumer goods industry

These are just a few examples of the many possible topics you could explore in an inflation essay. Whether you are interested in the macroeconomic implications of inflation or its effects on specific industries, there is no shortage of interesting and important questions to investigate. So pick a topic that interests you, do some research, and start writing!

Want to research companies faster?

Instantly access industry insights

Let PitchGrade do this for me

Leverage powerful AI research capabilities

We will create your text and designs for you. Sit back and relax while we do the work.

Explore More Content

- Privacy Policy

- Terms of Service

© 2024 Pitchgrade

Essay on Inflation

Students are often asked to write an essay on Inflation in their schools and colleges. And if you’re also looking for the same, we have created 100-word, 250-word, and 500-word essays on the topic.

Let’s take a look…

100 Words Essay on Inflation

Understanding inflation.

Inflation is when prices of goods and services rise over time. This means you need more money to buy the same things. It’s like a slow-motion robbery!

Causes of Inflation

Inflation is often due to increased production costs or increased demand for goods and services. When people want more of something, and it’s scarce, prices go up.

Impact of Inflation

Inflation affects everyone. If your income doesn’t increase as fast as inflation, you’ll have less buying power. But, if you’re a business owner, you might be able to raise prices and make more money.

Controlling Inflation

Governments try to control inflation by adjusting interest rates, taxes, and government spending. It’s a tricky balancing act to keep inflation low but not too low.

250 Words Essay on Inflation

Inflation, a crucial economic concept, refers to the rate at which the general level of prices for goods and services is rising, subsequently eroding purchasing power. It’s an indicator of the economic health of a nation, with moderate inflation signifying a growing economy.

The Causes of Inflation

Inflation generally occurs due to two primary factors: demand-pull and cost-push inflation. Demand-pull inflation transpires when demand for goods and services surpasses their supply. On the other hand, cost-push inflation arises when the costs of production escalate, causing producers to increase prices to maintain profit margins.

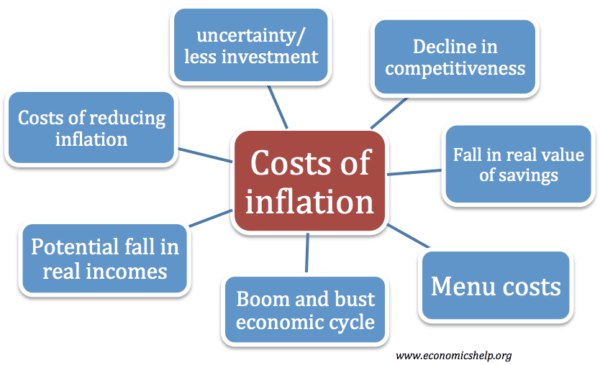

Effects of Inflation

Inflation impacts various aspects of the economy. It erodes the purchasing power of money, causing consumers to spend more for the same goods or services. Inflation can also create uncertainty in the economy, affecting investment and saving decisions. However, moderate inflation can stimulate spending and investment, driving economic growth.

Managing Inflation

Central banks attempt to control inflation through monetary policy. By adjusting interest rates, they influence the level of spending and investment in the economy. Higher interest rates typically reduce spending, curbing inflation. Conversely, lower interest rates stimulate spending, potentially leading to inflation.

Inflation is a complex and multifaceted subject. Understanding its causes, effects, and the measures to control it is essential for both macroeconomic stability and individual financial well-being. As future leaders, it’s crucial for us as students to grasp these concepts to make informed decisions in our professional and personal lives.

500 Words Essay on Inflation

Introduction to inflation.

Inflation is primarily caused by an increase in the money supply that outpaces economic growth. Ever since the end of the gold standard, governments have had the ability to create money at will. If a nation’s money supply grows too rapidly compared to its production of goods and services, prices will increase, leading to inflation.

Additionally, inflation can be spurred by demand-pull conditions, where demand for goods and services exceeds their supply. Cost-push inflation, on the other hand, occurs when the costs of production increase, causing producers to raise prices to maintain their profit margins.

Impacts of Inflation

Moreover, inflation can harm savers if the inflation rate surpasses the interest rate on their savings. It also favors borrowers, as the real value of their debt diminishes over time. This redistribution of wealth from savers to borrowers can lead to social and economic inequalities.

Central banks use monetary policy to control inflation. They adjust the money supply by setting interest rates and through open market operations. By raising interest rates, central banks can decrease the money supply, making borrowing more expensive and slowing economic activity, thereby reducing inflation.

Inflation is an intricate part of our economic systems. It is a double-edged sword that can stimulate economic growth when mild, but can also lead to economic instability when it becomes too high. Understanding inflation is crucial for policymakers, investors, and consumers alike as it influences our decisions and shapes our economic reality. By effectively managing inflation, governments can promote economic stability and growth, thereby improving the standard of living for their citizens.

If you’re looking for more, here are essays on other interesting topics:

Apart from these, you can look at all the essays by clicking here .

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Economic essays on inflation

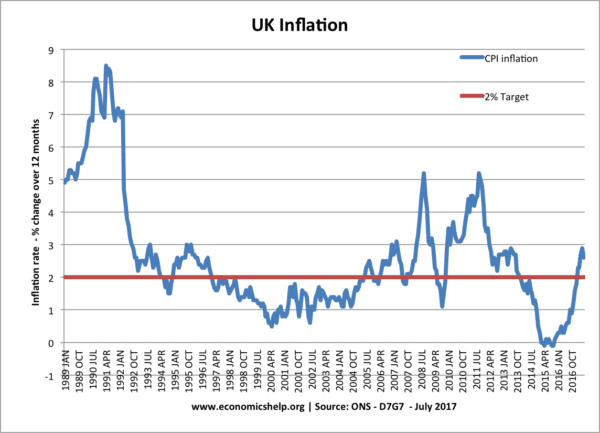

- Definition – Inflation – Inflation is a sustained rise in the cost of living and average price level.

- Causes Inflation – Inflation is caused by excess demand in the economy, a rise in costs of production, rapid growth in the money supply.

- Costs of Inflation – Inflation causes decline in value of savings, uncertainty, confusion and can lead to lower investment.

- Problems measuring inflation – why it can be hard to measure inflation with changing goods.

- Different types of inflation – cost-push inflation, demand-pull inflation, wage-price spiral,

- How to solve inflation . Policies to reduce inflation, including monetary policy, fiscal policy and supply-side policies.

- Trade off between inflation and unemployment . Is there a trade-off between the two, as Phillips Curve suggests?

- The relationship between inflation and the exchange rate – Why high inflation can lead to a depreciation in the exchange rate.

- What should the inflation target be? – Why do government typically target inflation of 2%

- Deflation – why falling prices can lead to negative economic growth.

- Monetarist Theory – Monetarist theory of inflation emphasises the role of the money supply.

- Criticisms of Monetarism – A look at whether the monetarist theory holds up to real-world scenarios.

- Money Supply – What the money supply is.

- Can we have economic growth without inflation?

- Predicting inflation

- Link between inflation and interest rates

- Should low inflation be the primary macroeconomic objective?

See also notes on Unemployment

Facing down a surprising U.S. inflation surge

Kennedy School experts in public finance and economic policy weigh in on the causes and responses to the highest American consumer price jump in three decades.

Inflation in the United States has jumped to the highest level in 30 years, reaching 6.2% in October as measured by the Consumer Price Index. The COVID-19 pandemic has fueled consumer demand for goods and services at a time when supply lines are constrained and many industries have been affected by staff shortages. The inflation surge has generated intense political debate on the causes and the appropriate response.

We asked several economists and public finance experts at Harvard Kennedy School—all of whom have held senior federal government economics roles—to offer brief perspectives on how they view the underlying issues and the key policy choices facing the Biden administration and Congress.

- Linda Bilmes - Inflation's impact at the state and local level

- Karen Dynan - Weighing the uncertainties

- Jeffrey Frankel - Inflation Do's and Don'ts

- Jason Furman - Supply and demand challenges

- Lawrence H. Summers - Biden team needs to signal its concern about inflation

Inflation risks also lie ahead for state and local governments

On the revenue side, income and sales tax receipts will largely keep pace with inflation, so moderate inflation is unlikely to have a major impact. However, if inflation leads to sharply higher interest rates that lead to a stock market sell-off, then states that are highly dependent on capital gains taxes (such as California and New Jersey) may suffer. Another area of vulnerability could be property taxes, especially states where increases in assessed values or in property taxes are capped, as with California’s Prop. 13. These prevent rising house prices feeding through into state revenues, and are also the major revenue source for local governments.

On the expense side, the biggest risk is rising wages, which consume the largest share of state budgets. We could see public sector unions pushing for a return of “CPI-plus” language in new labor agreements. This would automatically bake in the cost of higher inflation to local expenditures. In addition, high inflation could significantly weaken state pension plans, many of which assume that future wage increases will be only 2%. Most of the current generation of local pension managers have little experience with inflation. They need to begin adjusting their portfolios now to prevent erosion of their asset bases.

Linda Bilmes is the Daniel Patrick Moynihan Lecturer in Public Policy and previously served as Assistant Secretary of Commerce.

What's certain is just how many uncertainties lie ahead

What is not clear is how quickly these issues will resolve. The size and persistence of demand/supply imbalances has repeatedly surprised us, in part because virus caseloads have stayed unexpectedly high. We have only a limited understanding of why so many would-be workers are staying out of the labor force, making it hard to predict how many will return and how quickly. We are not sure how much inflation expectations have risen (a critical determinant of whether higher inflation sticks) because of measurement difficulties.

This uncertainty makes it difficult for monetary policymakers to know when they need to begin raising rates to avoid letting inflation stay at undesirably high levels. Given that they may need to revise their views quickly based on incoming data, it is especially important that they communicate the high degree of uncertainty. Surprising financial markets with an abrupt unexpected change in policy could lead to a rapid decline in asset prices that causes a significant setback in the economic recovery.

Karen Dynan is a professor of the practice of economics and former chief economist of the U.S. Treasury.

Some inflation-fighting do's and don'ts

Let’s start with two don'ts.

- Don’t do what Federal Reserve Chair Arthur Burns and President Richard Nixon did in 1971, in order to help the president’s reelection: They responded to moderate 5% to 6 % inflation with a combination of rapid monetary stimulus and doomed wage-price controls. The lid was blown off the boiling pot a few years later; the inflation rate jumped above 12%.

- Don’t do what Donald Trump did on April 2, 2020 , to help out American oil producers: He persuaded Saudi Arabia that OPEC must cut oil output and raise prices.

- Continue to fight in the Senate for a fully funded social spending bill (“Build Back Better”).

- Let imports into the country more easily. They are a safety valve for an overheated economy. Trump put up a lot of import tariffs , which raise prices to consumers—sometimes directly, as with washing machines, and sometimes indirectly, as with steel and aluminum, which are important inputs into autos and countless other goods. With or without foreign reciprocation, U.S. trade liberalization could bring prices down quickly in many supply-constrained sectors.

- Similarly, facilitating orderly immigration would help alleviate the shortage of workers that employers in some sectors are experiencing.

- Further vaccination would increase the supply of labor, through several possible channels. One channel would be to keep children in school, allowing more parents to go back to work. Another channel is to alleviate worker’s fears of infection in the workplace.

Jeffrey Frankel is the James W. Harpel Professor of Capital Formation and Growth and was a member of the Council of Economic Advisors from 1983-1984 and 1996-1999.

Supply and demand—and the Federal Reserve’s key role

Economists like to explain everything with demand and supply, and the concepts work well here. Demand is likely to remain high, fueled by households with healthy balance sheets, continued fiscal support, and very low interest rates. No one knows how long it will take supply to recover, or even whether it will fully recover, but it could be at least a year. The combination of strong demand and weak supply will likely keep inflation uncomfortably high.

President Biden can do a little about inflation by helping with port capacity and other supply-chain measures. Even better would be dropping President Trump’s tariffs on China. But these steps would only be small. The main agency charged with controlling inflation is the Federal Reserve. They are right to continue to be focused on the millions of people without jobs but should recalibrate towards incorporating more concern for inflation into their policy stance, including setting a default of more rate increases in 2022, something it can call off if inflation and/or employment is well below what we are currently expecting.

Jason Furman is the Aetna Professor of the Practice of Economic Policy and previously was chair of the Council of Economic Advisors under President Obama.

Biden team needs to signal its determination to address inflation

Simultaneously, the Administration should signal that a concern about inflation will inform its policies generally. Measures already taken to reduce port bottlenecks may have limited effect but are a clear positive step. Buying inexpensively should take priority over buying American. Tariff reduction is the most important supply-side policy the administration could undertake to combat inflation. Raising fossil fuel supplies, such as the recent deployment of the Strategic Petroleum Reserve, is crucial. And financial regulators need to step up and be attentive to the pockets of speculative excess that are increasingly evident in financial markets.

Excessive inflation and a sense that it was not being controlled helped elect Richard Nixon and Ronald Reagan, and risks bringing Donald Trump back to power. While an overheating economy is a relatively good problem to have compared to a pandemic or a financial crisis, it will metastasize and threaten prosperity and public trust unless clearly acknowledged and addressed.

Lawrence H. Summers is Charles W. Eliot University Professor , Weil Director of the Mossavar-Rahmani Center for Business and Government, and president emeritus of Harvard University. His government positions included Secretary of the Treasury in the Clinton Administration and Director of the National Economic Council under President Obama. Portions of this essay were excerpted from a Washington Post column .

Banner image by AP Photo/Noah Berger; inline image by Xinhua via Getty Images; faculty portraits by Martha Stewart

More from HKS

Helping homeowners during the covid-19 pandemic: lessons from the great recession, democratizing the federal regulatory process: a blueprint to strengthen equity, dignity, and civic engagement through executive branch action, economic inequality and insecurity: policies for an inclusive economy.

Get smart & reliable public policy insights right in your inbox.

Essay on Inflation: Meaning, Measurement and Causes

Let us make in-depth study of the meaning, measurement and causes of inflation.

Meaning of Inflation:

By inflation we mean a general rise in prices. To be more correct, inflation is a persistent rise in general price level rather than a once-for-all rise in it.

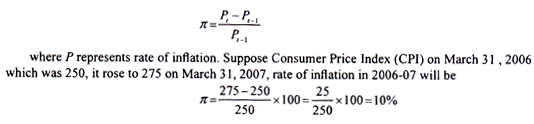

Rate of inflation is either measured by the percentage change in wholesale price index number (WPI) over a period or by percentage change in consumer price index number (CPI).

Opinion surveys conducted in India and the United States reveal that inflation is the most important concern of the people as it affects their standard of living adversely A high rate of inflation erodes the real incomes of the people. A high rate of inflation makes the life of the poor people miserable. It is therefore described as anti-poor, inflation redistributes income and wealth in favour of the rich.

ADVERTISEMENTS:

Thus, it makes the rich richer and the poor poorer. Above all, a high rate inflation adversely effects output and encourages investment in unproductive channels such as purchase of gold, silver, jewellery and real estate. Therefore, it adversely affects long-run economic growth, especially in developing countries like India. Inflation has therefore been described ‘as enemy number one’.

Measurement of Rate of Inflation:

Inflation has been one of the important problems facing the economies of the world. Precisely stated, inflation is the rate of change of general price level during a period of time. And the general price level in a period is the result of inflation in the past. Through rate of inflation economists measures the cost of living in an economy. Let us explain how rate of inflation is measured. Suppose P i X represents the price level on 31st March 2006 and P represents the price level on 31st March 2007. Then the rate of inflation in year 2006-07 will be equal to

Thus, rate of inflation during 2006-07 will be 10 per cent. This is called point-to-point inflation rate. There are 52 weeks in a year, average of price indexes of 52 weeks of a year (say 2005-06) can be calculated to compare the average of price indexes of 52 weeks of year 2006-07 and find the inflation rate on the basis of average weekly price levels of a year. In both these ways rate of inflation in different years is measured and compared.

It is evident from above that price level in a period is measured by a price index. There are several commodities in an economy which are produced and consumed by the people. It is through construction of a weighted price index that economists aggregate money prices of several commodities which are assigned different weights.

In India the wholesale price Index (WPI) of all commodities with base year 1993-94 price level at the end of fiscal year is used to measure rate of inflation and is widely reported in the media. Since the wholesale price index does not truly indicate the cost of living, separate Consumer Price Index (CPI) for agricultural labourers and Consumer Price Index (CPI) for industrial workers (with base 1982 = 100) at the end of fiscal year are constructed to measure rate of inflation.

In constructing the Consumer Price Index (CPI) the price of a basket of goods which a typical consumer, industrial worker or agricultural labourer as the case may be are taken into account.

What Causes Inflation?

1. keynes’s view:.

Classical economists thought that it was the quantity of money in the economy that determined the general price level in the economy. According to them, rate of inflation depends on the growth of money supply in the economy. Keynes criticized the ‘ Quantity Theory of Money’ and showed that expansion in money supply did not always lead to inflation or rise in price level.

Keynes who before the Second World War explained that involuntary unemployment and depression were due to the deficiency of aggregate demand, during the war period when price rose very high he explained that inflation was due to excessive aggregate demand. Thus, Keynes put forward what is now called demand-pull theory of inflation.

Demand – Pull Inflation

Thus, according to Keynes, inflation is caused by a situation whereby the pressure of aggregate demand for goods and services exceeds the available supply of output (both begging counted at the prices ruling at the beginning of a period). In such a situation, rise in price level is the natural consequence.

Now, this imbalance between aggregate demand and supply may be the result of more than one force at work. As we know aggregate demand is the sum of consumers’ spending on consumer goods and services, government spending on consumer goods and services and net investment being planned by the entrepreneurs.

But excess of aggregate demand over aggregate supply does not explain persistent rise in prices, year after year. An important factor which feeds inflation is wage-price spiral. Wage-price spiral operates as follows: A rise in prices reduces the real consumption of the wage earners. They will, therefore, press for higher money wages to compensate them for the higher cost of living. Now, an increase in wages, if granted, will raise the prime cost of production and, therefore, entrepreneurs will raise the prices of their products to recover the increment in cost.

This will add fuel to the inflationary fire. A further rise in prices raises the cost of living still further and the workers ask for still higher wages. In this way, wages and prices chase each other and the process of inflationary rise in prices gathers momentum. If unchecked, this may lead to hyper-inflation which signifies a state of affairs where wages and prices chase each other at a very quick speed.

2. Monetarist View:

The Keynesian explanation of demand-pull inflation is important to note that both the original quantity theorists and the modem monetarists, prominent among whom is Milton Friedman, explain inflation in terms of excess demand for goods and services. But there is an important difference between the monetarist view of demand-pull inflation and the Keynesian view of it. Keynes explained inflation as arising out of real sector forces.

In his model of inflation excess demand comes into being as a result of autonomous increase in expenditure on investment and consumption or increase in government expenditure. That is, the increase in aggregate expenditure or demand occurs independent of any increase in the supply of money.

On the other hand, monetarists explain the emergence of excess demand and the resultant rise in prices on account of the increase in money supply in the economy. To quote Milton Friedman, a Nobel Laureate in economics. “Inflation is always and everywhere a monetary phenomenon…… and can be produced only by a more rapid increase in the quantity of money than in output.”

Friedman holds that when money supply is increased in the economy, then there emerges an excess supply of real money balances with the public over their demand for money. This disturbs the monetary equilibrium. In order to restore the equilibrium the public will reduce the money balances by increasing expenditure on goods and services.

Thus, according to Friedman and other modern quantity theorists, the excess supply of real monetary balances results in the increase in aggregate demand for goods and services. If there is no proportionate increase in output, then extra money supply leads to excess demand for goods and services. This causes inflation or rise in prices. Thus, according to monetarists let by Prof. Milton Friedman, excess creation of money supply is the main factor responsible for inflation.

Cost-Push Inflation:

Even when there is no increase in aggregate demand, prices may still rise. This may happen if the costs, particularly the wage costs, increase. Now, as the level of employment increases, the demand for workers rises progressively so that the bargaining position of the workers is enhanced. To exploit this situation, they may ask for an increase in wage rates which are not justifiable either on grounds of a prior rise in productivity or cost of living.

The employers in a situation of high demand and employment are more agreeable to concede to these wage claims because they hope to pass on these rises in costs to the consumers in the form of rise in prices. Therefore, when inflation is caused by rise in wages or hike in other input costs such as rise in prices of raw materials, rise in prices of petroleum products, it is called cost-push inflation. If this happens we have another inflationary factor at work.

Besides the increase in wages of labour without any increase in its productivity, or rise in costs of other inputs there is another factor responsible for cost-push inflation. This is the increase in the profit margins by the firms working under monopolistic or oligopolistic conditions and as a result charging higher prices from the consumers. In the former case when the cause of cost-push inflation is the rise in wages it is called wage-push inflation and in the latter case when the cause of cost-push inflation is the rise in profit margins, it is called profit-push inflation.

In addition to the rise in wage rate of labour and increase in profit margin, in the seventies the other cost-push factors (also called supply shocks) causing increase in marginal cost of production became more prominent in bringing about rise in prices. During the seventies, rise in prices of raw materials, especially energy inputs such a hike in crude oil prices made by OPEC resulted in rise in prices of petroleum products.

For example, sharp rise in world oil prices during 1973-75 and again in 1979-80 produced significant cost-push factor which caused inflation not only in Indian but all over the world. Now, in June-August 2004 again the world oil prices have greatly risen. As a result, in India prices of petrol, diesel, cooking gas were raised by petroleum companies. This is tending to raise the rate of inflation.

Related Articles:

- Essay on the Causes of Inflation (473 Words)

- Demand Pull Inflation and Cost Push Inflation | Money

- Difference between Demand Inflation and Cost Inflation

- Cost-Push Inflation and Demand-Pull or Mixed Inflation

Numbers, Facts and Trends Shaping Your World

Read our research on:

Full Topic List

Regions & Countries

- Publications

- Our Methods

- Short Reads

- Tools & Resources

Read Our Research On:

In the U.S. and around the world, inflation is high and getting higher

Two years ago, with millions of people out of work and central bankers and politicians striving to lift the U.S. economy out of a pandemic-induced recession , inflation seemed like an afterthought. A year later, with unemployment falling and the inflation rate rising, many of those same policymakers insisted that the price hikes were “transitory” – a consequence of snarled supply chains, labor shortages and other issues that would right themselves sooner rather than later.

Now, with the inflation rate higher than it’s been since the early 1980s, Biden administration officials acknowledge that they missed their call . According to the latest report from the Bureau of Labor Statistics, the annual inflation rate in May was 8.6%, its highest level since 1981, as measured by the consumer price index . Other inflation metrics also have shown significant increases over the past year or so, though not quite to the same extent as the CPI.

With inflation in the United States running at its highest levels in some four decades, Pew Research Center decided to compare the U.S. experience with those of other countries, especially its peers in the developed world. An earlier version of this post was published in November 2021.

The Center relied primarily on data from the Organization for Economic Cooperation and Development (OECD), most of whose 38 member states are highly developed democracies. The OECD collects a wide range of data about its members, facilitating cross-national comparisons. We chose to use quarterly inflation measures, both because they’re less volatile than monthly figures and because they were available for all but one OECD country (Costa Rica, which joined the OECD in May 2021). Quarterly inflation data also were available for seven non-OECD countries with sizable national economies, so we included them in the analysis as well.

For each country, we calculated year-over-year inflation rates going back to the first quarter of 2010 and ending in the first quarter of this year. We also calculated how much those rates had risen or fallen since the start of the COVID-19 pandemic in the first quarter of 2020.

To get a sense of longer-term inflation trends in the U.S., we analyzed two measures besides the commonly cited consumer price index: The Consumer Price Index Retroactive Series (R-CPI-U-RS) from the Bureau of Labor Statistics, and the Personal Consumption Expenditures Price Index from the Bureau of Economic Analysis.

Inflation in the United States was relatively low for so long that, for entire generations of Americans, rapid price hikes may have seemed like a relic of the distant past. Between the start of 1991 and the end of 2019, year-over-year inflation averaged about 2.3% a month, and exceeded 5.0% only four times. Today, Americans rate inflation as the nation’s top problem , and President Joe Biden has said addressing the problem is his top domestic priority .

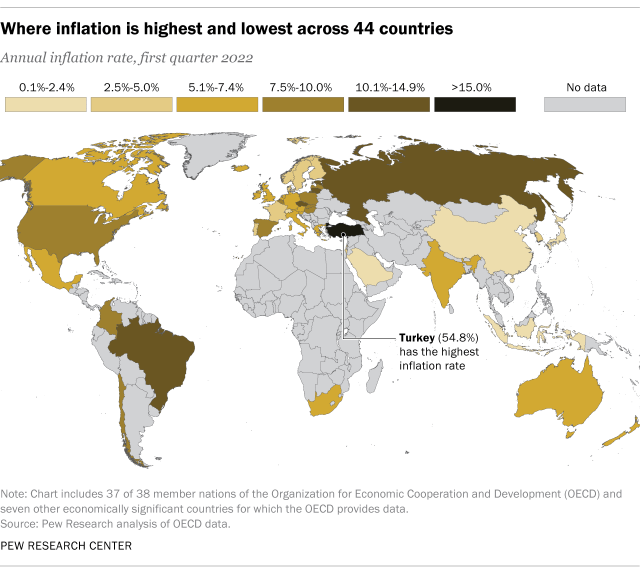

But the U.S. is hardly the only place where people are experiencing inflationary whiplash. A Pew Research Center analysis of data from 44 advanced economies finds that, in nearly all of them, consumer prices have risen substantially since pre-pandemic times.

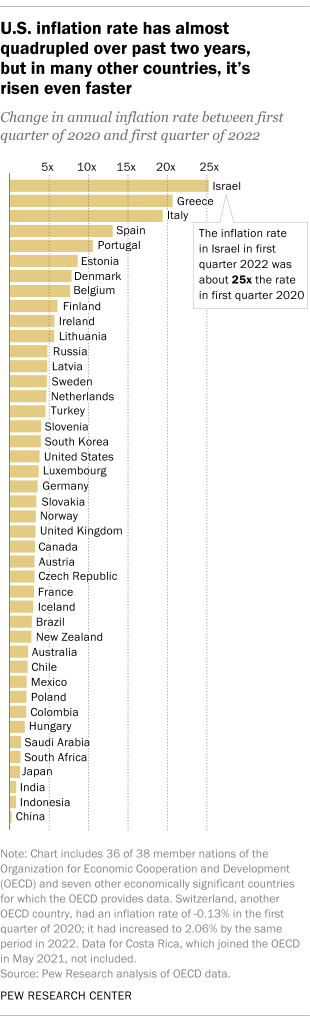

In 37 of these 44 nations, the average annual inflation rate in the first quarter of this year was at least twice what it was in the first quarter of 2020, as COVID-19 was beginning its deadly spread. In 16 countries, first-quarter inflation was more than four times the level of two years prior. (For this analysis, we used data from the Organization for Economic Cooperation and Development, a group of mostly highly developed, democratic countries. The data covers 37 of the 38 OECD member nations, plus seven other economically significant countries.)

Among the countries studied, Turkey had by far the highest inflation rate in the first quarter of 2022: an eye-opening 54.8%. Turkey has experienced high inflation for years, but it shot up in late 2021 as the government pursued unorthodox economic policies , such as cutting interest rates rather than raising them.

The country where inflation has grown fastest over the past two years is Israel. The annual inflation rate in Israel had been below 2.0% (and not infrequently negative) every quarter from the start of 2012 through mid-2021; in the first quarter of 2020, the rate was 0.13%. But after a relatively mild recession , Israel’s consumer price index began rising quickly: It averaged 3.36% in the first quarter of this year, more than 25 times the inflation rate in the same period in 2020.

Besides Israel, other countries with very large increases in inflation between 2020 and 2022 include Italy, which saw a nearly twentyfold increase in the first quarter of 2022 compared with two years earlier (from 0.29% to 5.67%); Switzerland, which went from ‑0.13% in the first quarter of 2020 to 2.06% in the same period of this year; and Greece, a country that knows something about economic turbulence . Following the Greek economy’s near-meltdown in the mid-2010s, the country experienced several years of low inflation – including more than one bout of deflation, the last starting during the first spring and summer of the pandemic. Since then, however, prices have rocketed upward: The annual inflation rate in Greece reached 7.44% in this year’s first quarter – nearly 21 times what it was two years earlier (0.36%).

Annual U.S. inflation in the first quarter of this year averaged just below 8.0% – the 13th-highest rate among the 44 countries examined. The first-quarter inflation rate in the U.S. was almost four times its level in 2020’s first quarter.

Regardless of the absolute level of inflation in each country, most show variations on the same basic pattern: relatively low levels before the COVID-19 pandemic struck in the first quarter of 2020; flat or falling rates for the rest of that year and into 2021, as many governments sharply curtailed most economic activity; and rising rates starting in mid- to late 2021, as the world struggled to get back to something approaching normal.

But there are exceptions to that general dip-and-surge pattern. In Russia, for instance, inflation rates rose steadily throughout the pandemic period before surging in the wake of its invasion of Ukraine . In Indonesia, inflation fell early in the pandemic and has remained at low levels. Japan has continued its years-long struggle with inflation rates that are too low . And in Saudi Arabia, the pattern was reversed: The inflation rate surged during the pandemic but then fell sharply in late 2021; it’s risen a bit since, but still is just 1.6%.

Inflation doesn’t appear to be done with the developed world just yet. An interim report from the OECD found that April’s inflation rate ran ahead of March’s figure in 32 of the group’s 38 member countries.

- COVID-19 & the Economy

- Economic Conditions

Drew DeSilver is a senior writer at Pew Research Center .

Wealth Surged in the Pandemic, but Debt Endures for Poorer Black and Hispanic Families

Key facts about the wealth of immigrant households during the covid-19 pandemic, 10 facts about u.s. renters during the pandemic, after dropping in 2020, teen summer employment may be poised to continue its slow comeback, covid-19 pandemic pinches finances of america’s lower- and middle-income families, most popular.

901 E St. NW, Suite 300 Washington, DC 20004 USA (+1) 202-419-4300 | Main (+1) 202-857-8562 | Fax (+1) 202-419-4372 | Media Inquiries

Research Topics

- Email Newsletters

ABOUT PEW RESEARCH CENTER Pew Research Center is a nonpartisan, nonadvocacy fact tank that informs the public about the issues, attitudes and trends shaping the world. It does not take policy positions. The Center conducts public opinion polling, demographic research, computational social science research and other data-driven research. Pew Research Center is a subsidiary of The Pew Charitable Trusts , its primary funder.

© 2024 Pew Research Center

Home — Essay Samples — Economics — Inflation — The Rise of Inflation Rate in the Us

The Rise of Inflation Rate in The Us

- Categories: American Government Economic Growth Inflation

About this sample

Words: 1605 |

Published: Jul 15, 2020

Words: 1605 | Pages: 4 | 9 min read

Table of contents

Introduction, financial measures in the us government's inflationary rise, recommedation, what are some factors that contribute to the rise in inflation, how did the inflation affect the market, implementation of additional monetary easing (so-called qe 3), purchase policies of mbs newly decided at fomc in september.

Cite this Essay

To export a reference to this article please select a referencing style below:

Let us write you an essay from scratch

- 450+ experts on 30 subjects ready to help

- Custom essay delivered in as few as 3 hours

Get high-quality help

Prof Ernest (PhD)

Verified writer

- Expert in: Government & Politics Economics

+ 120 experts online

By clicking “Check Writers’ Offers”, you agree to our terms of service and privacy policy . We’ll occasionally send you promo and account related email

No need to pay just yet!

Related Essays

1 pages / 401 words

1 pages / 464 words

2 pages / 793 words

1 pages / 324 words

Remember! This is just a sample.

You can get your custom paper by one of our expert writers.

121 writers online

Still can’t find what you need?

Browse our vast selection of original essay samples, each expertly formatted and styled

Related Essays on Inflation

This essay explores the provisions and impacts of the Inflation Reduction Act, analyzing its effects on inflation rates, economic growth, distributional outcomes, and sector-specific implications. It outlines how the act [...]

Fuel prices are a topic of perennial concern and discussion, as they have far-reaching implications for individuals, businesses, and economies worldwide. This essay delves into the complex subject of fuel prices, examining the [...]

Theories of inflation in economics encompass a diverse range of perspectives that seek to explain the complex phenomenon of sustained increases in the general price level of goods and services. Inflation is a critical economic [...]

Inflation management is a critical aspect of macroeconomic policy, particularly in times of unforeseen challenges. The years 2023-2024 have presented a myriad of complex macroeconomic issues, including but not limited to the [...]

The occurrence of grade inflation is affecting the quality of education throughout the system. A lot of students, at every level of education, are promoted to higher grades even though they are unqualified for that grade. Grade [...]

A moderate rate of inflation is sometimes considered to be essential but it varies from country to country and from time to time but as the rate of inflation crosses the desirable limit, certain measures are undertaken to [...]

Related Topics

By clicking “Send”, you agree to our Terms of service and Privacy statement . We will occasionally send you account related emails.

Where do you want us to send this sample?

By clicking “Continue”, you agree to our terms of service and privacy policy.

Be careful. This essay is not unique

This essay was donated by a student and is likely to have been used and submitted before

Download this Sample

Free samples may contain mistakes and not unique parts

Sorry, we could not paraphrase this essay. Our professional writers can rewrite it and get you a unique paper.

Please check your inbox.

We can write you a custom essay that will follow your exact instructions and meet the deadlines. Let's fix your grades together!

Get Your Personalized Essay in 3 Hours or Less!

We use cookies to personalyze your web-site experience. By continuing we’ll assume you board with our cookie policy .

- Instructions Followed To The Letter

- Deadlines Met At Every Stage

- Unique And Plagiarism Free

Inflation: What It Is and How to Control Inflation Rates

What you need to know about the purchasing power of money and how it changes

- Search Search Please fill out this field.

What Is Inflation?

Understanding inflation, types of inflation.

- Impact on Prices

- Protecting Your Finances

Types of Price Indexes

- Pros and Cons

- Controlling Inflation

- Deflation and Disinflation

The Bottom Line

:max_bytes(150000):strip_icc():format(webp)/jason_mugshot__jason_fernando-5bfc261946e0fb00260a1cea.jpg)

Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom.

:max_bytes(150000):strip_icc():format(webp)/E7F37E3D-4C78-4BDA-9393-6F3C581602EB-2c2c94499d514e079e915307db536454.jpeg)

- Inflation: What It Is and How to Control Inflation Rates CURRENT ARTICLE

- 9 Common Effects of Inflation

- How to Profit From Inflation

- When Is Inflation Good for the Economy?

- How Does Current Cost of Living Compare to 20 Years Ago?

- Why Are P/E Ratios Higher When Inflation Is Low?

- What Causes Inflation and Who Profits From It?

- Understand the Different Types of Inflation

- Wage Push Inflation

- Cost-Push Inflation

- Cost-Push Inflation vs. Demand-Pull Inflation: What's the Difference?

- Inflation vs. Stagflation: What's the difference?

- What is the Relationship Between Inflation and Interest Rates?

- Inflation's Impact on Stock Returns

- How Does Inflation Affect Fixed-Income Investments?

- How Inflation Affects Your Cost of Living

- How Inflation Impacts Your Savings

- How Inflation Eats Away at Your Retirement Income

- What Impact Does Inflation Have on the Dollar Value Today?

- Inflation and Economic Recovery

- Hyperinflation

- Why Didn't Quantitative Easing Lead to Hyperinflation?

- Worst Cases of Hyperinflation in History

- How the Great Inflation of the 1970s Happened

- Stagflation

- Purchasing Power

- Consumer Price Index (CPI)

- Why Is the Consumer Price Index Controversial?

- Core Inflation

- Headline Inflation

- GDP Price Deflator

- Inflation Accounting

- Inflation-Adjusted Return

- Inflation Targeting

- Real Economic Growth Rate

- Real Gross Domestic Product (GDP)

- Real Income

- Real Interest Rate

- Real Rate of Return

- Wage-Price Spiral

Inflation is a gradual loss of purchasing power that is reflected in a broad rise in prices for goods and services over time. The inflation rate is calculated as the average price increase of a basket of selected goods and services over one year. High inflation means that prices are increasing quickly, while low inflation means that prices are growing more slowly. Inflation can be contrasted with deflation, which occurs when prices decline and purchasing power increases.

Inflation Meaning

Inflation means a rise in prices for goods and services, which results in purchasing power declining over time.

Key Takeaways

- Inflation measures how quickly the prices of goods and services are rising.

- Inflation is classified into three types: demand-pull inflation, cost-push inflation, and built-in inflation.

- The most commonly used inflation indexes are the Consumer Price Index and the Wholesale Price Index.

- Inflation can be viewed positively or negatively depending on the individual viewpoint and rate of change.

- Those with tangible assets may like to see some inflation as that raises the value of their assets.

An increase in the money supply is the root of inflation, though this can play out through different mechanisms in the economy. A country’s money supply can be increased by the monetary authorities by:

- Printing and giving away more money to citizens

- Legally devaluing (reducing the value of) the legal tender currency

- Loaning new money into existence as reserve account credits through the banking system by purchasing government bonds from banks on the secondary market

Other causes of inflation include supply bottlenecks and shortages of key goods, which can push prices to rise.

When inflation occurs, money loses its purchasing power. This can occur across any sector or throughout an entire economy. The expectation of inflation itself can further sustain the devaluation of money. Workers may demand higher wages and businesses may charge higher prices, in anticipation of sustained inflation. This, in turn, reinforces the factors that push prices up.

Melissa Ling © Investopedia, 2019

Inflation can be classified into three types: demand-pull inflation, cost-push inflation, and built-in inflation.

Demand-Pull Effect

Demand-pull inflation occurs when an increase in the supply of money and credit stimulates the overall demand for goods and services to increase more rapidly than the economy’s production capacity. This increases demand and leads to price rises.

When people have more money, it leads to positive consumer sentiment. This, in turn, leads to higher spending, which pulls prices higher. It creates a demand-supply gap with higher demand and less flexible supply, which results in higher prices.

Cost-Push Effect

Cost-push inflation is a result of the increase in prices working through the production process inputs. When additions to the supply of money and credit are channeled into a commodity or other asset markets, costs for all kinds of intermediate goods rise. This is especially evident when there’s a negative economic shock to the supply of key commodities.

These developments lead to higher costs for the finished product or service and work their way into rising consumer prices. For instance, when the money supply is expanded, it creates a speculative boom in oil prices . This means that the cost of energy can rise and contribute to rising consumer prices, which is reflected in various measures of inflation.

Built-In Inflation

Built-in inflation is related to adaptive expectations or the idea that people expect current inflation rates to continue in the future. As the price of goods and services rises, people may expect a continuous rise in the future at a similar rate.

As such, workers may demand more costs or wages to maintain their standard of living. Their increased wages result in a higher cost of goods and services, and this wage-price spiral continues as one factor induces the other and vice versa.

How Inflation Impacts Prices

While it is easy to measure the price changes of individual products over time, human needs extend beyond just one or two products. Individuals need a big and diversified set of products as well as a host of services for living a comfortable life. They include commodities like food grains, metal, fuel, utilities like electricity and transportation, and services like healthcare , entertainment, and labor.

Inflation aims to measure the overall impact of price changes for a diversified set of products and services. It allows for a single value representation of the increase in the price level of goods and services in an economy over a specified time.

Prices rise, which means that one unit of money buys fewer goods and services. This loss of purchasing power impacts the cost of living for the common public which ultimately leads to a deceleration in economic growth. The consensus view among economists is that sustained inflation occurs when a nation’s money supply growth outpaces economic growth.

The increase in the Consumer Price Index for All Urban Consumers (CPI-U) over the 12 months ending July 2024 on an unadjusted basis. Prices increased by 0.2% on a seasonally adjusted basis in July 2024 from the previous month.

To combat this, the monetary authority (in most cases, the central bank ) takes the necessary steps to manage the money supply and credit to keep inflation within permissible limits and keep the economy running smoothly.

Theoretically, monetarism is a popular theory that explains the relationship between inflation and the money supply of an economy. For example, following the Spanish conquest of the Aztec and Inca empires, massive amounts of gold and silver flowed into the Spanish and other European economies. Since the money supply rapidly increased, the value of money fell, contributing to rapidly rising prices.

Inflation is measured in a variety of ways depending on the types of goods and services. It is the opposite of deflation , which indicates a general decline in prices when the inflation rate falls below 0%. Keep in mind that deflation shouldn’t be confused with disinflation , which is a related term referring to a slowing down in the (positive) rate of inflation.

Julie Bang / Investopedia

How to Protect Your Finances During Inflation

There are a range of measures that individuals can take to protect their finances against inflation. For instance, one may choose to invest in asset classes that outperform the market during inflationary times. This might include commodities like grain, beef, oil, electricity, and natural gas.

Commodity prices typically stay one step ahead of product prices, and price increases for commodities are often seen as an indicator of inflation to come. Commodities, which can also be volatile, are easily affected by natural disasters, geopolitics, or conflict.

Real estate income may also help buffer against inflation, as landlords can increase their rent to keep pace with the rise of prices overall.

The U.S. government also offers Treasury Inflation-Protected Securities (TIPS) , a type of security indexed to inflation to protect against declines in purchasing power.

Depending upon the selected set of goods and services used, multiple types of baskets of goods are calculated and tracked as price indexes. The most commonly used price indexes are the Consumer Price Index (CPI) and the Wholesale Price Index (WPI) .

The CPI is a measure that examines the weighted average of prices of a basket of goods and services that are of primary consumer needs. They include transportation, food, and medical care.

CPI is calculated by taking price changes for each item in the predetermined basket of goods and averaging them based on their relative weight in the whole basket. The prices in consideration are the retail prices of each item, as available for purchase by the individual citizens. CPI can impact the value of one currency against those of other nations.

Changes in the CPI are used to assess price changes associated with the cost of living , making it one of the most frequently used statistics for identifying periods of inflation or deflation. In the United States, the Bureau of Labor Statistics (BLS) reports the CPI each month and has calculated it as far back as 1913.

The CPI-U, which was introduced in 1978, represents the buying habits of approximately 88% of the noninstitutional population of the United States.

Wholesale Price Index (WPI)

The WPI is another popular measure of inflation. It measures and tracks the changes in the price of goods in the stages before the retail level.

While WPI items vary from one country to another, they mostly include items at the producer or wholesale level. For example, it includes cotton prices for raw cotton, cotton yarn, cotton gray goods, and cotton clothing.

Although many countries and organizations use the WPI, many other countries, including the U.S., use a similar variant called the Producer Price Index (PPI) .

Producer Price Index (PPI)

The PPI is a family of indexes that measures the average change in selling prices received by domestic producers of intermediate goods and services over time. The PPI measures price changes from the perspective of the seller and differs from the CPI, which measures price changes from the perspective of the buyer.

In all variants, the rise in the price of one component (say oil) may cancel out the price decline in another (say wheat) to a certain extent. Overall, each index represents the average weighted price change for the given constituents which may apply at the overall economy , sector, or commodity level.

The Formula for Measuring Inflation

The above-mentioned variants of price indexes can be used to calculate the value of inflation between two particular months (or years). While a lot of ready-made inflation calculators are already available on various financial portals and websites, it is always better to be aware of the underlying methodology to ensure accuracy with a clear understanding of the calculations. Mathematically,

Percent Inflation Rate = (Final CPI Index Value ÷ Initial CPI Value) × 100

Say you wish to know how the purchasing power of $10,000 changed between January 1975 and January 2024. One can find price index data on various portals in a tabular form. From that table, pick up the corresponding CPI figures for the given two months. For September 1975, it was 52.1 (initial CPI value), and for January 2024, it was 308.417 (final CPI value).

Plugging in the formula yields:

Percent Inflation Rate = (308.417 ÷ 52.1) × 100 = (5.9197) × 100 = 591.97%

Since you wish to know how much $10,000 from January 1975 would be worth in January 2024, multiply the inflation rate by the amount to get the changed dollar value:

Change in Dollar Value = 5.9197 × $10,000 = $59,197

This means that $10,000 in January 1975 will be worth $59,197 today. Essentially, if you purchased a basket of goods and services (as included in the CPI definition) worth $10,000 in 1975, the same basket would cost you $59,197 in January 2024.

Advantages and Disadvantages of Inflation

Inflation can be construed as either a good or a bad thing, depending upon which side one takes, and how rapidly the change occurs.

Individuals with tangible assets (like property or stocked commodities) priced in their home currency may like to see some inflation as that raises the price of their assets, which they can sell at a higher rate.

Inflation often leads to speculation by businesses in risky projects and by individuals who invest in company stocks because they expect better returns than inflation.