- No category

Case Study 1 - Financial statement analysis

Related documents.

Add this document to collection(s)

You can add this document to your study collection(s)

Add this document to saved

You can add this document to your saved list

Suggest us how to improve StudyLib

(For complaints, use another form )

Input it if you want to receive answer

Discover the Top 75 Free Courses for August

Udemy Announces Layoffs Without Saying ‘Layoffs’

Udemy’s latest ‘Strategic Business Update’ uses corporate euphemisms to signal job cuts while pivoting to enterprise clients.

- 9 Best Kubernetes Courses for 2024

- [2024] 300+ Free Google Certifications

- 10 Best Free Programming Courses for 2024

- 7 Best Reverse Engineering Courses for 2024

- 10 Best Organic Chemistry Courses for 2024

600 Free Google Certifications

Most common

- graphic design

- machine learning

Popular subjects

Computer Science

Web Development

Communication Skills

Popular courses

Matrix Algebra for Engineers

A Life of Happiness and Fulfillment

Managing Conflicts on Projects with Cultural and Emotional Intelligence

Organize and share your learning with Class Central Lists.

View our Lists Showcase

Financial Statement Analysis Courses and Certifications

Learn Financial Statement Analysis, earn certificates with paid and free online courses from MIT, University of Pennsylvania, University of Michigan, Georgia Tech and other top universities around the world. Read reviews to decide if a class is right for you.

- Accounting Courses

- Corporate Finance Courses

- Financial Reporting Courses

- Investment Analysis Courses

- Valuation Courses

- Financial Modeling Courses

- Data Analytics Courses

- Business Strategy Courses

- With certificate (105)

- Free course (62)

- With free certificate (1)

- University course only (59)

- Beginner (58)

- Intermediate (17)

- Advanced (3)

- 1 - 2 hours (11)

- 2 - 5 hours (16)

- 5 - 10 hours (17)

- 10+ hours (64)

- English (111)

- Chinese (1)

- Indonesian (2)

- Japanese (2)

- Portuguese (1)

- Spanish (11)

- Turkish (1)

Level I CFA® Prep Course 2023 - Financial Statement Analysis

Deep dive into FRA with the Bestselling CFA® prep course updated for 2023 exam | With visual learning + Quizzes

- 8 hours 1 minute

- Paid Course

TECEP Security Analysis & Portfolio Management: Study Guide & Test Prep

Comprehensive study guide covering investment fundamentals, securities markets, valuation methods, risk management, and portfolio analysis to prepare for the TECEP Security Analysis and Portfolio Management exam.

Corporate Financial Statement Analysis

Learn the ins and outs of financial statement analysis—the examination of relationships among financial statement numbers—to gain insights into your company's past and future.

- LinkedIn Learning

- Free Trial Available

Accounting Analytics

Explore how financial and non-financial data drive performance, forecast scenarios, and inform strategy. Learn to analyze ratios, detect earnings management, use big data models, and link metrics to financial outcomes.

- 9 hours 47 minutes

- Free Online Course (Audit)

Financial Acumen for Non-Financial Managers

Explore financial statement analysis, cash flow reporting, and linking non-financial metrics to performance. Gain practical skills to assess financial drivers and forecast scenarios for strategic decision-making.

- 8 hours 57 minutes

Financial Accounting

How do investors, creditors, and other users analyze financial statements to assess corporate performance? Learn financial accounting, how to read financial statements, and how to gather inputs to valuation models.

- 12 weeks, 10-14 hours a week

Business Foundations

Develop essential business skills in marketing, accounting, operations, and finance. Apply knowledge to real-world challenges through a capstone project, preparing for career transitions or entrepreneurship.

- 30 weeks, 2 hours a week

Introduction to Finance and Accounting

Comprehensive introduction to corporate finance and accounting, covering time value of money, risk-return, asset valuation, financial statements, and analysis. Practical Excel-based approach for real-world applications in personal and corporate finance.

- 22 weeks, 2 hours a week

Accounting for Decision Making

Explore financial decision-making through accounting principles, financial statements, and ratio analysis. Gain practical skills to interpret business performance and make informed strategic choices.

- 1 day 5 hours 34 minutes

Auditing I: Conceptual Foundations of Auditing

Intensive introduction to financial-statement auditing concepts, focusing on auditors' responsibilities, risk assessment, and reporting. Covers professional ethics, audit quality, and decision-making in auditing environments.

- 1 day 4 hours 7 minutes

Financial Accounting Fundamentals

Master financial accounting essentials: record transactions, prepare and analyze key financial statements, and gain insights into a company's financial health through hands-on practice with a small business case study.

- 13 hours 37 minutes

Corporate Finance I: Measuring and Promoting Value Creation

Learn to measure and promote value creation using key finance principles, financial ratios, valuation techniques, and risk assessment. Master skills for sound investment decisions and performance evaluation in corporate finance.

- 1 day 37 minutes

Investment Banking: Financial Analysis and Valuation

Gain practical skills in financial statement analysis and valuation techniques used by industry professionals for investment banking and corporate finance careers.

- 13 hours 39 minutes

Financial Management

Develop an integrated framework for strategic financial decision-making, covering accounting, investments, and corporate finance. Gain skills in financial analysis, portfolio management, and risk assessment.

- 35 weeks, 4 hours a week

Understanding Financial Statements: Company Performance

Learn to read and interpret income statements, understand financial performance metrics, and gain insights into company profitability through real-world examples and expert analysis.

- 12 hours 23 minutes

Never Stop Learning.

Get personalized course recommendations, track subjects and courses with reminders, and more.

Financial Statement Analysis Coursera Quiz Answers

Get financial statement analysis coursera quiz answers, table of contents, financial statement analysis week 01 quiz answers, reconciliation types and processes practice quiz.

Q1. If your account balances don’t match at the end of the month, which of the following steps should you take to find the error? Select all that apply.

Q2. If I use the balance sheet approach for reconciling the books each month, all of the following accounts would be reconciled except:

Q3. The reconciliation process can help with the following except:

Reconciliation Source Documentation Types Practice Quiz

Q1. The original records that prove a specific transaction took place are referred to as:

Report Reconciliations vs Transactional Reconciliations Practice Quiz

Q2. Which of the following best describes the Report Method of Reconciliation?

Quiz : Understanding Reconciliations Assessment

Q1. True or False: Reconciliation is the process by which a business verifies its books with external account statements or data to ensure they match and reflect accurate business dealings.

Q2. Stan is in the process of performing a month-end close-out for his business, Lock ‘n Key. He noticed that his cash account indicates a difference of $25 from his bank statement. The following are strategies he can use to reconcile his books, except:

Q5. Which of the following accounts can be reconciled using the report reconciliation method? (S elect all that apply )

Q9. Zapata is preparing her annual taxes for her retail clothing business, La Calidad. She has been performing quarterly reconciliations of all her accounts and is about to do her final quarterly review. She begins with an analytical review and then digs deeper if a discrepancy is noted. Review the source documents and statements below to answer the questions.

What is the difference being reconciled between the ending balance of the bank statement and the ending balance recorded on the books for April 30th, 2019? ( format your answer as xxxxxx-no decimals, commas, or $ signs )

What is the amount that should be listed on line L? ( format your answer as xxxxxx-no decimals, commas, or $ signs )

Which of the following amounts is the correct amount for Line I?

Sassafras Day Spa and Salon is closing its books and preparing a bank reconciliation for the following items:

What is the correct adjusted cash balance amount that should be listed on lines E and M to reconcile this account?

Q19. Which of the following best describes the Transactional Method of Reconciliation?

Q20. Which of the following best describes the Report Method of Reconciliation?

Financial Statement Analysis Week 02 Quiz Answers

Income statement practice quiz.

Q4. If Amy’s Aroma’s operating expenses in 2020 were $45,000, and in 2019 they were $37,000, what would the percent change be? (hint, remember the formula: 𝚫% = $recent year – $older year / $older year x 100)

Interpreting the Balance Sheet Practice Quiz

Interpret the statement of cash flows practice quiz.

Q1. Which section of the Statement of Cash Flows would you look to find cash flows related to inventory?

Q3. Which would be considered deferred revenue?

Quiz : Financial Statements Assessment

Q1. If operating expenses in 2020 (recent year) were $55,000 and in 2019 (older year) they were $36,000, what would the percent change be? Hint: remember the formula: (($recent year – $older year) / $older year) x 100 = 𝚫% ( enter your answer as a whole number without punctuation )

Q13. Where would you locate Deferred Revenues on the Balance Sheet?

Financial Statement Analysis Week 03 Quiz Answers

Balance sheet practice quiz, business communications practice quiz, quiz : analyzing key reports and transactions assessment.

Q16. Superior Suits recorded a cash flow from operations of $48,750 and net sales of $87,000. What is their Operating Cash Flow Margin ratio? ( enter your answer as a decimal and round to the nearest hundredth, example x.xx )

Financial Statement Analysis Week 04 Quiz Answers

Reconciliations practice quiz, workflow practice quiz.

Key Reports Practice Quiz

Quiz : Reconciliations and Financial Analysis Assessment

Q15. If the ACH deposit on 3/30/20 was transposed in the journal as $147.23 instead of $174.23, but no other errors occurred in the entry, which journal entry below corrects this error?

Get All Course Quiz Answers of Intuit Bookkeeping Professional Certificate

Newsletter updates, leave a reply cancel reply, related posts, transacting on the blockchain quiz answers – networking funda, market research and analysis for tech industries quiz answers, the growth mindset coursera quiz answers – networking funda, trending now.

financial statement analysis coursera week 4 quiz answers

Reconciliations practice quiz, 1. which of the following are types of source documents that might be needed to perform a vendor account reconciliation select all that apply..

- Order Reciept

- Credit Card Statement

- Bank Statement

2. The following are types of common errors except:

- Error of Omission

- Error of Original Entry

- Error of Law

- Error of Commission

3. True or False: All accounts can be reconciled.

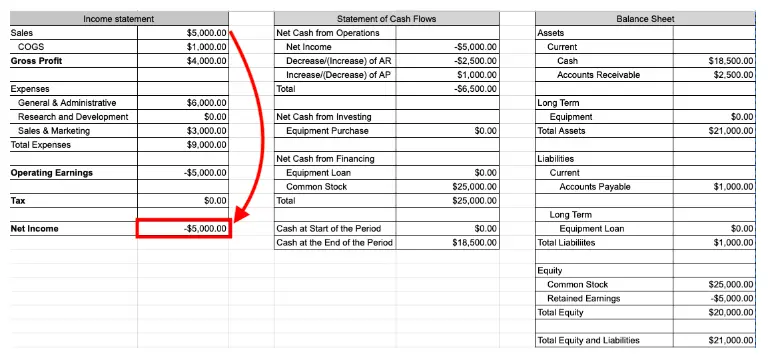

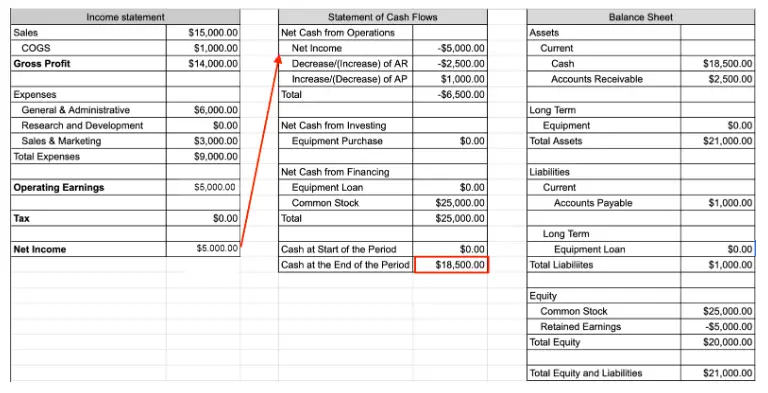

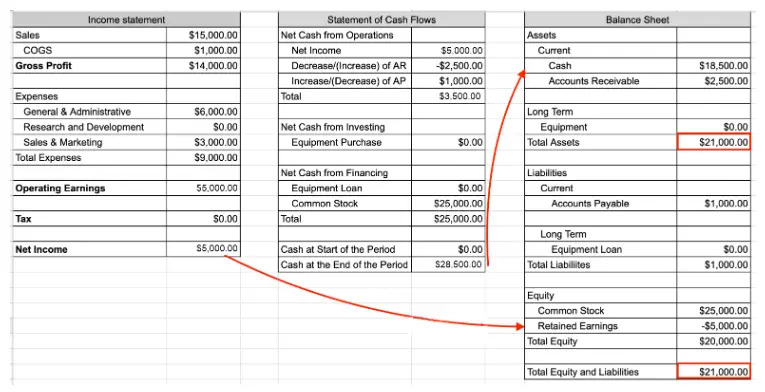

Workflow practice quiz, 4. upon reviewing the financial statements, you have determined that the sales revenue listed on the financial statements is incorrect and should actually be $15,000 instead of $5,000. assuming all other accounts are accurate, what would the new net income be (enter your answer as a whole number and don't use punctuation, example $7,800 would be 7800).

5. After reviewing and revising the income statement, you have determined that the new Net Income is now $5,000. Using this information, revise the Statement of Cash Flow to determine what the new Cash at the End of the Period would be? (enter your answer as a whole number and don't use punctuation, example $7,800 would be 7800)

6. Now that the Income Statement and the Statement of Cash Flow are updated, the Balance Sheet needs to be updated. Using the new balances, revise the Balance Sheet to determine the new balances for the Total Assets and Total Equity and Liability. (enter your answer as a whole number and don't use punctuation, example $7,800 would be 7800)

Key Reports Practice Quiz

7. if you wanted to view how much a company owes and if payments are overdue, which report group would you run.

- Customers and Receivables

- Jobs, Time, and Mileage

- Company and Financial

- Vendors and Payables

8. Which ratio would you calculate to view a business's capacity to generate adequate income to repay interest on its debt?

- Debt to Asset Ratio

- Coverage Ratio

- Return on Total Assets Ratio

Shuffle Q/A 1

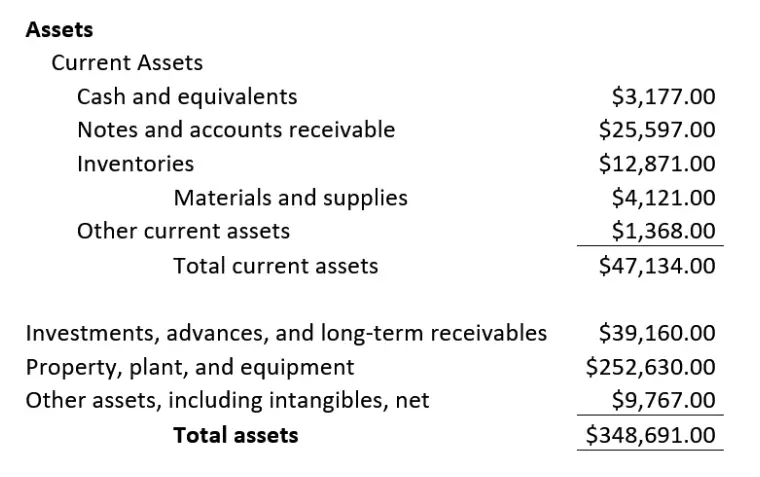

9. using the following balance sheet, calculate the return on assets ratio using the total assets for the average. (enter your answer as a decimal and round to the nearest thousandths, example x.xxx) income from operations as found on the income statement was $19,710..

Reconciliations and Financial Analysis Assessment

10. when completing the reconciliation form, what amount should be listed as the (+/-) adjustment to books on the balance per book's side, share the love share this content.

- Opens in a new window

You Might Also Like

Week 3 – oops and other essential concepts : shuffle q/a 2, week 1 – introduction to complex data relationships, week 2 – escalate incidents – shuffle q/a 2, leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

Coursera – BI Essentials for Finance Analysts (Power BI Edition) Specialization

Download Coursera – BI Essentials for Finance Analysts (Power BI Edition) Specialization Links:

- Download Coursera – BI Essentials for Finance Analysts (Tableau Edition) Specialization

- Download Coursera – Data Skills for Excel Professionals Specialization

- Download Financial Reporting & Analysis w Ms Excel Power Pivot & DAX

- Download Financial Reporting & Analysis w Ms Excel Power Pivot & DAX (Updated)

- Download Microsoft Power BI for Data Analysts from zero to Advanced

- Download Microsoft Excel for Financial Analysts

- Download Coursera – Microsoft Power BI Data Analyst Professional Certificate

- Download Coursera – Data Analysis with R Specialization

Don't have an account? Sign up now

Already have an account login, get 10% off on your next order.

Subscribe now to get your discount coupon *Only correct email will be accepted

(Approximately ~ 0.0 Page)

Total Price

Thank you for your email subscription. Check your email to get Coupon Code.

Coursera Case Study Solution

Posted by John Berg on Feb-16-2018

Introduction

Coursera Case Study is included in the Harvard Business Review Case Study. Therefore, it is necessary to touch HBR fundamentals before starting the Coursera case analysis. HBR will help you assess which piece of information is relevant. Harvard Business review will also help you solve your case. Thus, HBR fundamentals assist in easily comprehending the case study description and brainstorming the Coursera case analysis. Also, a major benefit of HBR is that it widens your approach. HBR also brings new ideas into the picture which would help you in your Coursera case analysis.

To write an effective Harvard Business Case Solution, a deep Coursera case analysis is essential. A proper analysis requires deep investigative reading. You should have a strong grasp of the concepts discussed and be able to identify the central problem in the given HBR case study. It is very important to read the HBR case study thoroughly as at times identifying the key problem becomes challenging. Thus by underlining every single detail which you think relevant, you will be quickly able to solve the HBR case study as is addressed in Harvard Business Case Solution.

Problem Identification

The first step in solving the HBR Case Study is to identify the problem. A problem can be regarded as a difference between the actual situation and the desired situation. This means that to identify a problem, you must know where it is intended to be. To do a Coursera case study analysis and a financial analysis, you need to have a clear understanding of where the problem currently is about the perceived problem.

For effective and efficient problem identification,

- A multi-source and multi-method approach should be adopted.

- The problem identified should be thoroughly reviewed and evaluated before continuing with the case study solution.

- The problem should be backed by sufficient evidence to make sure a wrong problem isn't being worked upon.

Problem identification, if done well, will form a strong foundation for your Coursera Case Study. Effective problem identification is clear, objective, and specific. An ambiguous problem will result in vague solutions being discovered. It is also well-informed and timely. It should be noted that the right amount of time should be spent on this part. Spending too much time will leave lesser time for the rest of the process.

Coursera Case Analysis

Once you have completed the first step which was problem identification, you move on to developing a case study answers. This is the second step which will include evaluation and analysis of the given company. For this step, tools like SWOT analysis, Porter's five forces analysis for Coursera, etc. can be used. Porter’s five forces analysis for Coursera analyses a company’s substitutes, buyer and supplier power, rivalry, etc.

To do an effective HBR case study analysis, you need to explore the following areas:

1. Company history:

The Coursera case study consists of the history of the company given at the start. Reading it thoroughly will provide you with an understanding of the company's aims and objectives. You will keep these in mind as any Harvard Business Case Solutions you provide will need to be aligned with these.

2. Company growth trends:

This will help you obtain an understanding of the company's current stage in the business cycle and will give you an idea of what the scope of the solution should be.

3. Company culture:

Work culture in a company tells a lot about the workforce itself. You can understand this by going through the instances involving employees that the HBR case study provides. This will be helpful in understanding if the proposed case study solution will be accepted by the workforce and whether it will consist of the prevailing culture in the company.

Coursera Financial Analysis

The third step of solving the Coursera Case Study is Coursera Financial Analysis. You can go about it in a similar way as is done for a finance and accounting case study. For solving any Coursera case, Financial Analysis is of extreme importance. You should place extra focus on conducting Coursera financial analysis as it is an integral part of the Coursera Case Study Solution. It will help you evaluate the position of Coursera regarding stability, profitability and liquidity accurately. On the basis of this, you will be able to recommend an appropriate plan of action. To conduct a Coursera financial analysis in excel,

- Past year financial statements need to be extracted.

- Liquidity and profitability ratios to be calculated from the current financial statements.

- Ratios are compared with the past year Coursera calculations

- Company’s financial position is evaluated.

Another way how you can do the Coursera financial analysis is through financial modelling. Financial Analysis through financial modelling is done by:

- Using the current financial statement to produce forecasted financial statements.

- A set of assumptions are made to grow revenue and expenses.

- Value of the company is derived.

Financial Analysis is critical in many aspects:

- Decision Making and Strategy Devising to achieve targeted goals- to determine the future course of action.

- Getting credit from suppliers depending on the leverage position- creditors will be confident to supply on credit if less company debt.

- Influence on Investment Decisions- buying and selling of stock by investors.

Thus, it is a snapshot of the company and helps analysts assess whether the company's performance has improved or deteriorated. It also gives an insight about its expected performance in future- whether it will be going concern or not. Coursera Financial analysis can, therefore, give you a broader image of the company.

Coursera NPV

Coursera's calculations of ratios only are not sufficient to gauge the company performance for investment decisions. Instead, investment appraisal methods should also be considered. Coursera NPV calculation is a very important one as NPV helps determine whether the investment will lead to a positive value or a negative value. It is the best tool for decision making.

There are many benefits of using NPV:

- It takes into account the future value of money, thereby giving reliable results.

- It considers the cost of capital in its calculations.

- It gives the return in dollar terms simplifying decision making.

The formula that you will use to calculate Coursera NPV will be as follows:

Present Value of Future Cash Flows minus Initial Investment

Present Value of Future cash flows will be calculated as follows:

PV of CF= CF1/(1+r)^1 + CF2/(1+r)^2 + CF3/(1+r)^3 + …CFn/(1+r)^n

where CF = cash flows r = cost of capital n = total number of years.

Cash flows can be uniform or multiple. You can discount them by Coursera WACC as the discount rate to arrive at the present value figure. You can then use the resulting figure to make your investment decision. The decision criteria would be as follows:

- If Present Value of Cash Flows is greater than Initial Investment, you can accept the project.

- If Present Value of Cash Flows is less than Initial Investment, you can reject the project.

Thus, calculation of Coursera NPV will give you an insight into the value generated if you invest in Coursera. It is a very reliable tool to assess the feasibility of an investment as it helps determine whether the cash flows generated will help yield a positive return or not.

However, it would be better if you take various aspects under consideration. Thus, apart from Coursera’s NPV, you should also consider other capital budgeting techniques like Coursera’s IRR to evaluate and fine-tune your investment decisions.

Coursera DCF

Once you are done with calculating the Coursera NPV for your finance and accounting case study, you can proceed to the next step, which involves calculating the Coursera DCF. Discounted cash flow (DCF) is a Coursera valuation method used to estimate the value of an investment based on its future cash flows. For a better presentation of your finance case solution, it is recommended to use Coursera excel for the DCF analysis.

To calculate the Coursera DCF analysis, the following steps are required:

- Calculate the expected future cash inflows and outflows.

- Set-off inflows and outflows to obtain the net cash flows.

- Find the present value of expected future net cash flows using a discount rate, which is usually the weighted-average cost of capital (WACC).

- If the value calculated through Coursera DCF is higher than the current cost of the investment, the opportunity should be considered

- If the current cost of the investment is higher than the value calculated through DCF, the opportunity should be rejected

Coursera DCF can also be calculated using the following formula:

DCF= CF1/(1+r)^1 + CF2/(1+r)^2 + CF3/(1+r)^3 + …CFn/(1+r)^n

In the formula:

- CF= Cash flows

- R= discount rate (WACC)

Coursera WACC

When making different Coursera's calculations, Coursera WACC calculation is of great significance. WACC calculation is done by the capital composition of the company. The formula will be as follows:

Weighted Average Cost of Capital = % of Debt * Cost of Debt * (1- tax rate) + % of equity * Cost of Equity

You can compute the debt and equity percentage from the balance sheet figures. For the cost of equity, you can use the CAPM model. Cost of debt is usually given. However, if it isn't mentioned, you can calculate it through market weighted average debt. Coursera’s WACC will indicate the rate the company should earn to pay its capital suppliers. Coursera WACC can be analysed in two ways:

- From the company's perspective, it can be analysed as the cost to be paid to the capital providers also known as Cost of Capital

- From an investor' perspective, if the expected return on the investment exceeds Coursera WACC, the investor will go ahead with the investment as a positive value would be generated.

Coursera IRR

After calculating the Coursera WACC, it is necessary to calculate the Coursera IRR as well, as WACC alone does not say much about the company’s overall situation. Coursera IRR will add meaning to the finance solution that you are working on. The internal rate of return is a tool used in investment appraisal to calculate the profitability of prospective investments. IRR calculations are dependent on the same formula as Coursera NPV.

There are two ways to calculate the Coursera IRR.

- By using a Coursera Excel Spreadsheet: There are in-built formulae for calculating IRR.

IRR= R + [NPVa / (NPVa - NPVb) x (Rb - Ra)]

In this formula:

- Ra= lower discount rate chosen

- Rb= higher discount rate chosen

- NPVa= NPV at Ra

- NPVb= NPV at Rb

Coursera IRR impacts your finance case solution in the following ways:

- If IRR>WACC, accept the alternative

- If IRR<WACC, reject the alternative

Coursera Excel Spreadsheet

All your Coursera calculations should be done in a Coursera xls Spreadsheet. A Coursera excel spreadsheet is the best way to present your finance case solution. The Coursera Calculations should be presented in Coursera excel in such a way that the analysis and results can be distinguished to the viewers. The point of Coursera excel is to present large amounts of data in clear and consumable ways. Presenting your data is also going to make sure that you don't have misinterpretations of the data.

To make your Coursera calculations sheet more meaningful, you should:

- Think about the order of the Coursera xls worksheets in your finance case solution

- Use more Coursera xls worksheets and tables as will divide the data that you are looking at in sections.

- Choose clarity overlooks

- Keep your timeline consistent

- Organise the information flow

- Clarify your sources

The following tips and bits should be kept in mind while preparing your finance case solution in a Coursera xls spreadsheet:

- Avoid using fixed numbers in formulae

- Avoid hiding data

- Useless and meaningful colours, such as highlighting negative numbers in red

- Label column and rows

- Correct your alignment

- Keep formulae readable

- Strategically freeze header column and row

Coursera Ratio analysis

After you have your Coursera calculations in a Coursera xls spreadsheet, you can move on to the next step which is ratio analysis. Ratio analysis is an analysis of information in the form of figures contained in the financial statements of a company. It will help you evaluate various aspects of a company's operating and financial performance which can be done in Coursera Excel.

To conduct a ratio analysis that covers all financial aspects, divide the analysis as follows:

- Liquidity Ratios: Liquidity ratios gauge a company's ability to pay off its short-term debt. These include the current ratio, quick ratio, and working capital ratio.

- Solvency ratios: Solvency ratios match a company's debt levels with its assets, equity, and earnings. These include the debt-equity ratio, debt-assets ratio, and interest coverage ratio.

- Profitability Ratios: These show how effectively a company can generate profits through its operations. Profit margin, return on assets, return on equity, return on capital employed, and gross margin ratio is examples of profitability ratios.

- Efficiency ratios: Efficiency ratios analyse how efficiently a company uses its assets and liabilities to boost sales and increase profits.

- Coverage Ratios: These ratios measure a company's ability to make the interest payments and other obligations associated with its debts. Examples include times interest earned ratio and debt-service coverage ratio.

- Market Prospect Ratios: These include dividend yield, P/E ratio, earnings per share, and dividend payout ratio.

Coursera Valuation

Coursera Valuation is a very fundamental requirement if you want to work out your Harvard Business Case Solution. Coursera Valuation includes a critical analysis of the company's capital structure – the composition of debt and equity in it, and the fair value of its assets. Common approaches to Coursera valuation include

- DDM is an appropriate method if dividends are being paid to shareholders and the dividends paid are in line with the earnings of the company.

- FCFF is used when the company has a combination of debt and equity financing.

- FCFE, on the other hand, shows the cash flow available to equity holders only.

These three methods explained above are very commonly used to calculate the value of the firm. Investment decisions are undertaken by the value derived.

Coursera calculations for projected cash flows and growth rates are taken under consideration to come up with the value of firm and value of equity. These figures are used to determine the net worth of the business. Net worth is a very important concept when solving any finance and accounting case study as it gives a deep insight into the company's potential to perform in future.

Alternative Solutions

After doing your case study analysis, you move to the next step, which is identifying alternative solutions. These will be other possibilities of Harvard Business case solutions that you can choose from. For this, you must look at the Coursera case analysis in different ways and find a new perspective that you haven't thought of before.

Once you have listed or mapped alternatives, be open to their possibilities. Work on those that:

- need additional information

- are new solutions

- can be combined or eliminated

After listing possible options, evaluate them without prejudice, and check if enough resources are available for implementation and if the company workforce would accept it.

For ease of deciding the best Coursera case solution, you can rate them on numerous aspects, such as:

- Feasibility

- Suitability

- Flexibility

Implementation

Once you have read the Coursera HBR case study and have started working your way towards Coursera Case Solution, you need to be clear about different financial concepts. Your Mondavi case answers should reflect your understanding of the Coursera Case Study.

You should be clear about the advantages, disadvantages and method of each financial analysis technique. Knowing formulas is also very essential or else you will mess up with your analysis. Therefore, you need to be mindful of the financial analysis method you are implementing to write your Coursera case study solution. It should closely align with the business structure and the financials as mentioned in the Coursera case memo.

You can also refer to Coursera Harvard case to have a better understanding and a clearer picture so that you implement the best strategy. There are a number of benefits if you keep a wide range of financial analysis tools at your fingertips.

- Your Coursera HBR Case Solution would be quite accurate

- You will have an option to choose from different methods, thus helping you choose the best strategy.

Recommendation and Action Plan

Once you have successfully worked out your financial analysis using the most appropriate method and come up with Coursera HBR Case Solution, you need to give the final finishing by adding a recommendation and an action plan to be followed. The recommendation can be based on the current financial analysis. When making a recommendation,

- You need to make sure that it is not generic and it will help in increasing company value

- It is in line with the case study analysis you have conducted

- The Coursera calculations you have done support what you are recommending

- It should be clear, concise and free of complexities

Also, adding an action plan for your recommendation further strengthens your Coursera HBR case study argument. Thus, your action plan should be consistent with the recommendation you are giving to support your Coursera financial analysis. It is essential to have all these three things correlated to have a better coherence in your argument presented in your case study analysis and solution which will be a part of Coursera Case Answer.

Arbaugh, W. (2000). Windows of vulnerability: A case study analysis. Retrieved from Colorado State University Web site: http://www.cs.colostate.edu/~cs635/Windows_of_Vulnerability.pdf

Choi, J. J., Ju, M., Kotabe, M., Trigeorgis, L., & Zhang, X. T. (2018). Flexibility as firm value driver: Evidence from offshore outsourcing. Global Strategy Journal, 8(2), 351-376.

DeBoeuf, D., Lee, H., Johnson, D., & Masharuev, M. (2018). Purchasing power return, a new paradigm of capital investment appraisal. Managerial Finance, 44(2), 241-256.

Delaney, C. J., Rich, S. P., & Rose, J. T. (2016). A Paradox within the Time Value of Money: A Critical Thinking Exercise for Finance Students. American Journal of Business Education, 9(2), 83-86.

Easton, M., & Sommers, Z. (2018). Financial Statement Analysis & Valuation. Seattle: amazon.com.

Gotze, U., Northcott, D., & Schuster, P. (2016). Investment Appraisal. Berlin: Springer.

Greco, S., Figueira, J., & Ehrgott, M. (2016). Multiple criteria decision analysis. New York: Springer.

Hawkins, D. (1997). Corporate financial reporting and analysis: Text and cases. Homewood, IL: Irwin/McGraw-Hill.

Hribar, P., Melessa, S., Mergenthaler, R., & Small, R. C. (2018). An Examination of the Relative Abilities of Earnings and Cash Flows to Explain Returns and Market Values. Rotman School of Management Working Paper, 10-15.

Kaszas, M., & Janda, K. (2018). The Impact of Globalization on International Finance and Accounting. In Indirect Valuation and Earnings Stability: Within-Company Use of the Earnings Multiple (pp. 161-172). Berlin, Germany: Springer, Cham.

King, R., & Levine, R. (1993). Finance and growth: Schumpeter might be right. The quarterly journal of economics, 108(3), 717-737.

Kraus, S., Kallmuenzer, A., Stieger, D., Peters, M., & Calabrò, A. (2018). Entrepreneurial paths to family firm performance. Journal of Business Research, 88, 382-387.

Laaksonen, O., & Peltoniemi, M. (2018). The essence of dynamic capabilities and their measurement. International Journal of Management Reviews, 20(2), 184-205.

Lamberton, D. (2011). Introduction to stochastic calculus applied to finance. UK: Chapman and Hall.

Landier, A. (2015). The WACC fallacy: The real effects of using a unique discount rate. The Journal of Finance, 70(3), 1253-1285.

Lee, L., Kerler, W., & Ivancevich, D. (2018). Beyond Excel: Software Tools and the Accounting Curriculum. AIS Educator Journal, 13(1), 44-61.

Li, W. S. (2018). Strategic Value Analysis: Business Valuation. In Strategic Management Accounting. Singapore: Springer.

Magni, C. (2015). Investment, financing and the role of ROA and WACC in value creation. European Journal of Operational Research, 244(3), 855-866.

Marchioni, A., & Magni, C. A. (2018). Sensitivity Analysis and Investment Decisions: NPV-Consistency of Straight-Line Rate of Return. Department of Economics.

Metcalfe, J., & Miles, I. (2012). Innovation systems in the service economy: measurement and case study analysis. Berlin, Germany: Springer Science & Business Media.

Oliveira, F. B., & Zotes, L. P. (2018). Valuation methodologies for business startups: a bibliographical study and survey. Brazilian Journal of Operations & Production Management, 15(1), 96-111.

Pellegrino, R., Costantino, N., & Tauro, D. (2018). Supply Chain Finance: A supply chain-oriented perspective to mitigate commodity risk and pricing volatility. Journal of Purchasing and Supply Management, 1-10.

Pham, T. N., & Alenikov, T. (2018). The importance of Weighted Average Cost of Capital in investment decision-making for investors of corporations in the healthcare industry.

Smith, K. T., Betts, T. K., & Smith, L. M. (2018). Financial analysis of companies concerned about human rights. International Journal of Business Excellence, 14(3), 360-379.

Teresa, M. G. (2018). How the Equity Terminal Value Influences the Value of the Firm. Journal of Business Valuation and Economic Loss Analysis, 13(1).

Yang, Y., Pankow, J., Swan, H., Willett, J., Mitchell, S. G., Rudes, D. S., & Knight, K. (2018). Preparing for analysis: a practical guide for a critical step for procedural rigour in large-scale multisite qualitative research studies. Quality and Quantity, 52(2), 815-828.

Warning! This article is only an example and cannot be used for research or reference purposes. If you need help with something similar, please submit your details here .

9416 Students can’t be wrong

PhD Experts

Amanda William

There was not even the repetition of words in the assignment. Like this writing service!

Elias Tommaso

I have used this service twice and am very happy with the results. This website is absolutely easy to use. Thanks!

Federica Thomas

Highly recommended! I’m extremely satisfied with this service. Thanks!

Lyana Koppany

The support team responded to all my questions. Very professional behaviour. Will appoint this service in the near future. Grateful!

Calculate the Price

(approx ~ 0.0 page), total price €0, next articles.

- THE TENDLEY CONTRACT Confidential Instructions For The Schools Case Solution

- THE TENDLEY CONTRACT Confidential Information For The Consultant Case Solution

- Grove Scholars Program: Putting Rungs Back On The Ladder Case Solution

- Math For Strategists Case Solution

- Harvard Business School Social Enterprise Initiative At The Ten Year Mark Case Solution

- Harold Morton And The Rivendell Board (B) Case Solution

- Seacoast Science Center: Sailing The Shoals Case Solution

- Fulton County School System: Implementing The Balanced Scorecard Case Solution

- Chicago Public Education Fund (A) Case Solution

- How Do Firms Change Their Strategies Successfully? Advanced Competitive Strategy, Module Note For Students Case Solution

Previous Articles

- Teach For America 2005 Case Solution

- The Ethics Of Fundraising (A): Santa In Spring Chimney Hung Stockings Overflow Case Solution

- NewSchools Venture Fund In 2004: At A Crossroads Case Solution

- AmCham Of Nicaragua: Sponsorship Program Case Solution

- Asahi Net: Bringing Innovation To Education Case Solution

- Learning Co. Case Solution

- BSL: A Business School In Transition (C) Outcomes Case Solution

- Globalization Of HBS Case Solution

- Designing The Thinker Of The Future Case Solution

- Natura And Matilde: Friendly Neighbors Case Solution

Be a great writer or hire a greater one!

Academic writing has no room for errors and mistakes. If you have BIG dreams to score BIG, think out of the box and hire Case48 with BIG enough reputation.

Our Guarantees

Zero plagiarism, best quality, qualified writers, absolute privacy, timely delivery.

Interesting Fact

Most recent surveys suggest that around 76 % students try professional academic writing services at least once in their lifetime!

Allow Our Skilled Essay Writers to Proficiently Finish Your Paper.

We are here to help. Chat with us on WhatsApp for any queries.

Customer Representative

IMAGES

COMMENTS

In the final course of this certificate, you will apply your skills towards financial statement analysis. If you have the foundational concepts of accounting under your belt, you are ready to put them into action in this course. Here, you will learn how to reconcile different types of accounts, check for accuracy, and troubleshoot errors.

Financial Statement Analysis Coursera: All Quiz Answers For Week 1-4 | Intuit Academy Bookkeeping | In this video, I provide all of the answers to the quizzes for the first four weeks of the ...

Coursera - Intuit: Reconciliations and Financial Analysis Assessment Black Pearl 13 subscribers Subscribed 19 3.7K views 2 years ago ...more

Case Study - 1: Financial statement analysis. The purpose of this case study is to teach students to analyze financial statements and be able to quickly identify. issues and come up with intelligent questions to explore those issues. BACKGROUND OF THE COMPANY.

Find helpful learner reviews, feedback, and ratings for Financial Statement Analysis from Intuit. Read stories and highlights from Coursera learners who completed Financial Statement Analysis and wanted to share their experience. The course taught important ways to analyze business finances. It gave real business examples.

Study with Quizlet and memorize flashcards containing terms like When current amounts are expressed as a percentage of a prior period amount, this is referred to as:, The following is an advantage of financial statement analysis using percentages:, Blackstone's operating results for its most recent operating years are shown below: Using year 1 as the base period, what is the appropriate common ...

Learn to analyze financial statements, reconcile accounts, and apply analytical methods to inform business decisions. Develop skills in cash control, statement interpretation, and quantitative analysis for assessing business health.

financial statement analysis coursera week 4 quiz answers || Intuit Academy Bookkeeping Theanswershome 1.5K subscribers Subscribed 0 478 views 8 months ago #bookkeeping #certificate #coursera

Master financial accounting essentials: record transactions, prepare and analyze key financial statements, and gain insights into a company's financial health through hands-on practice with a small business case study.

Get Financial Statement Analysis Coursera Quiz Answers, this course is a part of Intuit Bookkeeping Professional Certificate on Coursera for free.

In the final course of this certificate, you will apply your skills towards financial statement analysis. If you have the foundational concepts of accounting under your belt, you are ready to put them into action in this course. Here, you will learn how to reconcile different types of accounts, check for accuracy, and troubleshoot errors.

financial statement analysis coursera week 4 quiz answers - Application and Practice with Reconciliations and Financial Analysis

A thorough knowledge of financial statements and company reports is crucial to becoming a world-class financial analyst. In this course, learn how to read and understand financial statements. We use real company annual reports and financial statements to better understand and analyze the financial strength of a company and help us make more ...

After completing a case study on financial statement analysis in both Power BI and Excel, you\'ll be able to compare and contrast the merits of each tool, and how to move data between them. Applied Learning Project The specialization finishes with a case study to recreate a set of Financial Statements in Power BI.

Today we introduced our case study company called Legacy Clothing, a department store selling men's, women's, and children's clothing and other related items. We learned how to perform financial analysis for our subject company, including vertical analysis and horizontal analysis on Legacy Clothing's income statement and balance sheet. We also performed ratio analysis, calculating ...

In summary, here are 10 of our most popular financial statements courses. Introduction to Financial Accounting: University of Pennsylvania. Create a Financial Statement using Microsoft Excel: Coursera Project Network. Financial Statement Analysis: Intuit.

The third step of solving the Coursera Case Study is Coursera Financial Analysis. You can go about it in a similar way as is done for a finance and accounting case study.

Abstract The main source of information for financial analysis is the financial statements. Analyzing financial statements helps in making the best decisions possible by maximizing profit and minimizing costs. This paper analyzes the income statement and balance sheet for the manufacturing company Kamila in Kosovo.