How to Write a Financial Analysis Report for Your Business

In this Article

Is your business worth investing in? For most of you, the answer is a definitive 'Yes.' But in the business world, talk is cheap. So if you want to attract investors, you'll need to be able to walk the talk, i.e., put your money where your mouth is.

There's no better way to do that than with a financial analysis report. After all, numbers don't lie. They're the smoking gun investors need before investing in your business.

Want to learn how to write a financial analysis report that attracts investors? This article covers six simple steps to follow. But first:

What is a financial analysis report?

A financial analysis report shows the financial performance of your business over a specified period of time, usually on a quarterly or yearly basis. It's like a medical report but for your business's financial health.

In several countries, financial reporting is a requirement. The Securities and Exchange Commission requires companies to disseminate these digital reports to their shareholders in the United States. In addition, these financial reports are usually made available to the public if they're publicly-listed companies

A financial analysis report is invaluable to both you and your stakeholders. Let's discuss why you need it in the next section.

How does a financial analysis report help?

To make the right financial decisions for your business, you need data. This helps you lay a solid foundation for future performance and economic growth opportunities.

However, you need to be able to keep track of and make sense of all your financial data. That's where a financial analysis report comes in. It helps you organize, analyze, and paint a clearer picture of your business's cash flow and allows for seamless management of business expenses too.

Aside from those, here are a couple of more reasons why you need a financial analysis report:

Ensures transparency

A financial analysis report is easy on the eyes. It's a watered-down version of your finances that communicates essential data you need to make financial decisions.

You ensure the transparency your stakeholders want, too.

Tracks cash flow

Generally, financial reports help you understand cash inflows and outflows . For example, if you know your affiliate sales and operating expenses, the cost of getting links to increase website traffic , social media marketing campaign expenditure, and the money coming in, you can make better financial decisions.

The information can help with debt ratios, budgeting, debt-to-asset financial ratio analysis, and calculating profit margins.

Suggested Reads: 10 Ways to Improve Your Business's Finance Position

Allows for data-driven forecasting

Historical and real-time financial data help create financial models to predict future financial performance. These reports help you identify trends, patterns, and problems. As a result, you can plan for them early enough.

Simplifies taxation

To create a financial analysis report, you must have all your data in a single document. It becomes easier for you to do your taxes, saves you time, and reduces the chances of making errors. Moreover, it's an official document that the Internal Revenue Service can use to calculate your taxes.

At the end of the day, the goal of a financial report is to provide insight into your organization's finances. Then, using both historical and current data, you can set SMART business goals to make better decisions for future performance.

Finally, it's essential to consider the ongoing nature of financial analysis and the need for periodic reviews. Implementing a project review process allows you to regularly assess the financial health of your business, identify any emerging trends or issues, and make informed adjustments to your financial strategies. This continuous evaluation ensures that your financial analysis remains up-to-date and relevant, providing you and your stakeholders with accurate insights into your business's performance.

Suggested Reads: 2022 Business Expense Categories Cheat Sheet: Top 15 Tax-Deductible Categories

Benefits of a periodic financial analysis

Financial analysis makes it easy for you to identify the strengths and weaknesses of your business. Using that information will not only help your business grow but also thrive. What's more, doing financial analysis over specific periods helps you stay on top of your game by:

Helping manage debts

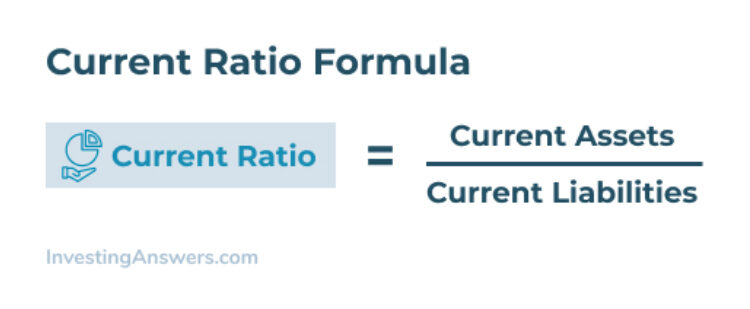

A periodic financial analysis includes a financial ratio analysis; specifically, a Liquidity Ratio called the Current Ratio Analysis. The Current Ratio is the sum of all your current assets divided by the sum of your current liabilities. It shows if you're liquid enough to meet your upcoming debts. So, if you aren't, you can adjust your financial strategy the soonest.

Determining profitability

When you perform a periodic financial analysis, you can determine your company's profitability and make regular adjustments. A profitability ratio is a financial metric that can help you cut production costs and boost your bottom line.

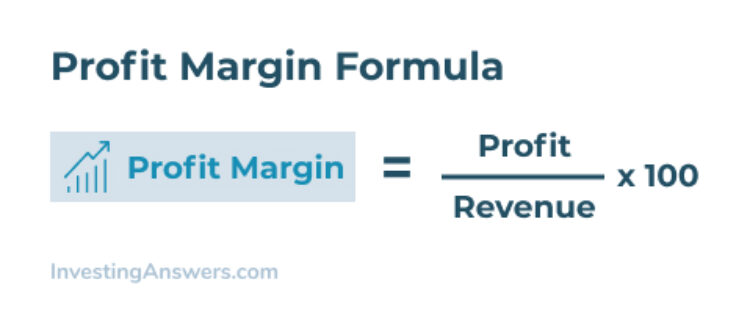

You can use a profitability ratio (featured below) to determine your profit margin on sales, i.e., your gross profit margin. Here's the formula.

It's your sales revenue minus the total cost of goods sold (COGS) divided by revenue.

Managing inventory

Another perk of doing financial analysis over a specific period is that it helps you better manage inventory . This way, you ensure it's always enough to meet projected sales. You do this using a financial management ratio called the Inventory Turnover Ratio.

Calculate the Turnover Ratio by dividing your total sale by your inventory.

Checking stability and revenue growth

The results of a periodic financial analysis yield your debt-to-equity ratio, too. It's a financial metric that shows how you've raised capital for your business. You want to check your stability and revenue growth every step of the way to determine whether your business is viable in the long run.

The debt-equity ratio is calculated by dividing your total liabilities by your shareholder's equity. It's usually included when you write a financial analysis report.

Generally speaking, the higher your debt-equity ratio, the higher the risk, and vice versa. Investors use this financial metric to check your company's stability and ability to raise money to grow.

Optimizing for growth

Financial analysis over specific periods helps you identify opportunities to optimize operational efficiency for revenue growth. That is, regular annual reports help you spot patterns and trends. This allows you to nip problematic areas in the bud and prepare in advance.

For instance, you can adjust seasonal sales fluctuations, variable costs, etc.

How to write a financial analysis report

Now that you understand a financial analysis report's 'what' and 'why,' it's time to look at the 'how.'

Here's how to write a financial analysis report:

1. Give an overview of the company

The first section of your financial analysis report is the company overview. Here, you want to highlight the potential of your business. It's pretty much what you do in a business plan . Investors rely on your company overview to understand your competitive edge.

The question you want to answer here is - is your business worth the investment you're asking for? Think of the introductions in business plans or on Shark Tank to give you a better idea. As a general rule of thumb, you want to use plain language when writing your description.

You want to share, in brief, your history, business model, type of organization, description, etc. You can share what sector you're in as well as the size and scale of your business.

Featured below is an excellent example of a fictional company's overview.

Start by reviewing your quarterly or yearly financing activities, financial data, and statements. Then go through published business studies and industry-specific trade journals.

You should consider adding a snippet about how you compare to the industry average among your competitors. Like a business plan, you want to show potential investors why they should choose you. You can use Porter's Five Forces model to analyze your competition.

2. Write sales forecast and other vital sections

It pays to be as precise and comprehensive as possible when writing the main content. So, you’ll need to organize your data and, sometimes, make some calculations yourself. For instance, when writing your sales forecast , you need your sales data for the past three years before you organize it in financial reporting software or spreadsheets. Tally the data on a yearly, monthly (for the 1st year), and quarterly (for the last two years) basis.

You can write this part using a spreadsheet. But feel free to use financial reporting software if spreadsheets aren’t your cup of tea.

There are other sections you should create for your report’s main body.

Let’s look at them one by one:

- Expense budget

With your sales forecast in place, it's time to figure out how much it'll cost. When setting up your expense budget , ensure it includes variable costs like your marketing budget and fixed costs like rent. In addition, you'll need to create an estimate for items like interest and taxes.

- Cash flow statement

A cash flow statement summarizes all the money or its equal coming in (cash inflow) or leaving (cash outflow) a business. To create one, you need historical financial data or project it one year ahead if you're starting. Don't forget your cash flow statement is connected to your invoice.

- Estimate for net profit

Tally your net profit using your sales forecast, expense budget, and cash flow statement data. Your net profit margin is your gross margin less taxes, interest, and expenses. Try and be as precise as possible since this can stand in as your profit and loss (P&L) statement .

- Estimate for assets and liabilities

Your next step is to calculate your company's net worth. How? By managing your assets and liabilities, i.e., those items that don't appear in your P&L statement.

To do that, ballpark your monthly cash on hand. That is, equipment, inventory, land, and accounts receivable. Then sum up your liabilities, i.e., outstanding loan debts and accounts payable.

- Break-even point

The last step in writing a company financial analysis report is calculating your break-even point. That's where your business expenses match your sales volume. Use the formula below to find your three-year sales forecast; this will help you find your break-even point.

Needless to say, if you're operating a profitable business model, then your company's revenue should be higher than your operating expenses. Again, this information helps reassure potential investors of your business' stability and revenue growth potential.

Refrain from assuming that people know the concepts you'll discuss in your report. Instead, define them in general terms first before you start talking about specifics.

3. Determine the company's valuation

The company valuation part is one of the most critical sections of your financial analysis report. Why? Because it helps potential investors see the value of investing in your company.

To determine your business' valuation is to find your company's value. You do this by analyzing your company data, including all the data you have discussed. There are three main ways to do it, i.e., using the following:

- Discounted Cash Flow (DCF) Analysis

- Book Value Analysis

- Relative Value Method

The goal here is to outline your current assets and liabilities. Moreover, the above techniques help you determine your business' stocks and current value. To do this, most accountants or financial officers use insights from and final average accounts of your balance sheet.

4. Perform risk analysis

Risk analysis helps potential investors see your company's investment potential. That includes both current and future risks. You can start risk analysis by running a SWOT analysis .

But remember that your SWOT analysis is microscopic. So for the best results in your valuation, combine it with other techniques. For example, doing a PESTLE analysis . Here's a template you can use for that:

A PESTLE analysis gives you more details and offers two main benefits. First, it helps you understand your marketing environment and other macro factors that affect your company's financials.

5. Include summaries of financial statements

When writing the financial analysis report of a company, you need to include a brief overview of your company's financial statements. To do this, summarize each component of the 3-statement model:

Let's discuss each of them:

Cash flow statement. Potential investors look at your cash flow statement summary for two reasons. One, it lets them see if you make enough money to settle your debts. Two, it helps them decide whether your company is worth investing in.

Income statement . A summary of this does two things. First, it shows you gaps in increasing operating profit by allowing you to boost sales revenue , reduce cost, or both. It's also an income statement showing how effective your strategies are at the start of your financial year.

Balance sheet. The balance sheet shows your debt coverage and asset liquidity in real time. The difference between assets and liabilities gives you the 'owner's equity.' Here's an example of a balance sheet:

Note that summarizing each of these three components doesn't mean just including tables in your report. Instead, explain what the data means in paragraph form, too.

6. Summarize the entire report

The last section of the financial analysis report of a company is a summary. You want to share your final views about the company and your opinion on whether it's a profit or loss. That said, be sure to substantiate all your claims.

That means having evidence containing factual data, financial accounts, and proven financial theories. You can also include the outlook of the company. That is the type of organization, industry trends, economic growth strategies, and how they'll affect the company.

In conclusion

By now, you should understand the value of a company financial analysis report and how to write one. Not only does it show you the financial health status of a company, but it's also the smoking gun investors look for before investing in any business.

To any organization, a financial analysis report is a compass to optimize operational efficiency for growth. It is also a crucial part in portfolio management especially when you need to open your business up to other stakeholders.

Summarising, to write a financial analysis report, you need to:

Write your company overview , sales forecast, and other essential sections. Once those are out of the way, you can perform company valuation and risk analysis. Then, all that's left is to summarize what was discussed.

Daryl Bush is the Business Development Manager at Authority.Builders . The company helps businesses acquire more customers through improved online search rankings. He has extensive knowledge of SEO and business development.

Stay updated with Fyle by signing up for our newsletter

What Are Real-Time Feeds, and Why Do They Matter

Quickbooks payments: overview, credit card processing fees and rates.

How To Record And Categorize Credit Card Payments In Quickbooks Online

Expense Reconciliation: How Does it Work?

Close books faster with Fyle. Schedule a demo now.

What is Financial Statement Analysis?

Why is analyzing financial statements important, how to conduct a financial statement analysis, 1. income statement analysis, 2. balance sheet and leverage ratios, 3. cash flow statement analysis, 4. rates of return and profitability analysis, the value of analyzing financial statements, additional resources, analyzing financial statements: key metrics and methods.

Guide to analyzing financial statements for financial analysts

Financial statement analysis is the process of evaluating a company’s financial health and performance by reviewing its financial statements, including the income statement, balance sheet, and cash flow statement.

This analysis involves using various metrics and methods to assess profitability, liquidity, solvency, and efficiency, helping stakeholders make informed decisions about the financial status of a company.

Financial statement analysis offers a clear and comprehensive view of a company’s financial health for both internal stakeholders, such as the finance team and business leaders, and external stakeholders, such as investors. This analysis helps stakeholders identify key insights into a company’s performance. It also keeps finance professionals, and investors informed about business and market trends, enabling better decision-making.

In addition, evaluating key financial ratios such as profitability, liquidity, and solvency helps finance teams and business leaders assess resource management and progress toward financial goals. Investors also use ratio analysis to gauge a company’s financial health and growth potential for informed investment decisions.

The benefits of performing financial statement analysis include:

- Informed Decision Making: Financial statement analysis provides necessary insights to business leaders for making strategic decisions, such as expanding operations, investing in new projects, or cutting costs.

- Performance Evaluation: Company leadership and investors can track the business’s financial performance over time, identifying strengths and areas for improvement.

- Risk Management: By understanding financial vulnerabilities, company leadership can take proactive steps to mitigate risks, such as cash flow issues or excessive debt.

- Investor Confidence: Detailed financial analysis helps attract and retain investors by demonstrating transparency and the company’s ability to generate returns.

- Regulatory Compliance: Regular financial analysis and reporting ensures that businesses meet legal and regulatory requirements, reducing the risk of penalties, fines, or reputational damage.

Key Highlights

- One of the main tasks of a financial analyst is to analyze a company’s financial statements, including the income statement, balance sheet, and cash flow statement.

- The main goal of financial analysis is to measure a company’s financial performance over time and against its peers.

- Analysts use data from their financial statement analysis to build financial models that allow them to forecast metrics like revenue, expenses, and profitability.

One of the main tasks of an analyst is to perform an extensive analysis of financial statements . This free guide breaks down the most important types and techniques of financial statement analysis.

This guide is designed to be useful for both beginners and advanced finance professionals, with the main topics covering: (1) the income statement, (2) the balance sheet, (3) the cash flow statement, and (4) rates of return.

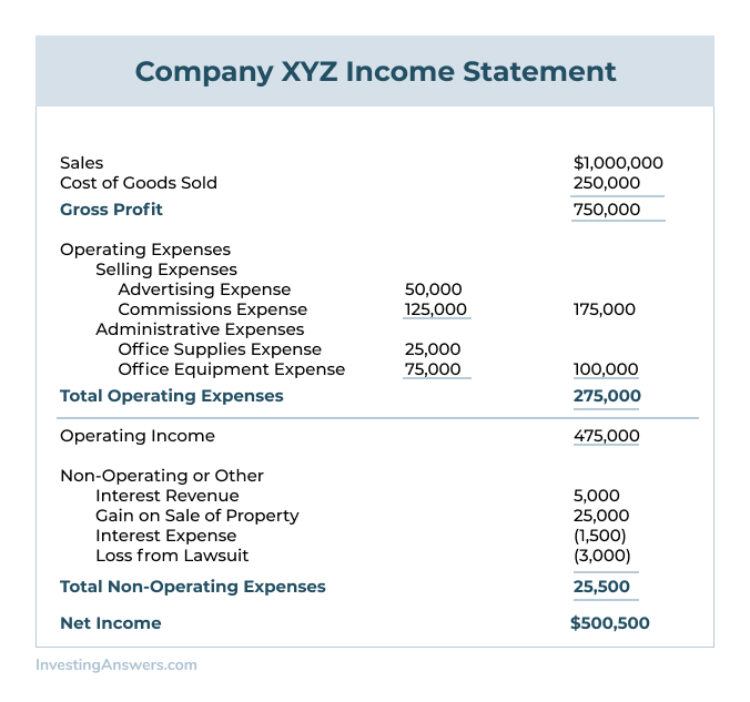

Most analysts start their financial statement analysis with the income statement . Intuitively, this is usually the first thing we think about with a business. We often ask questions such as, “How much revenue does it have?” “Is it profitable?” and “What are the margins like?”

In order to answer these questions, and much more, we will dive into the income statement to get started.

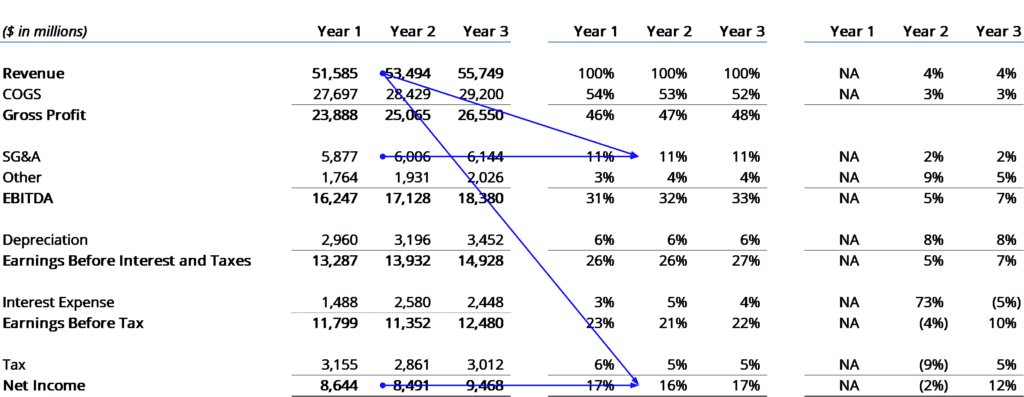

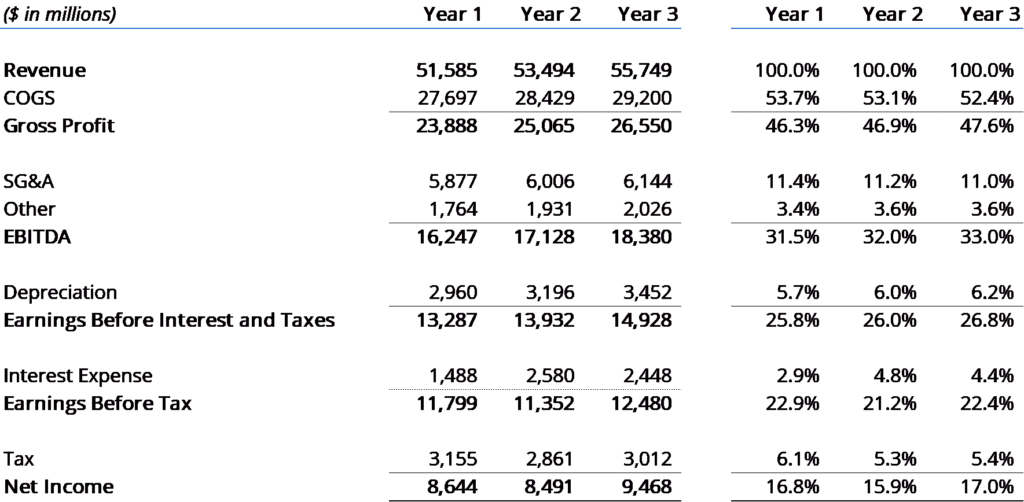

There are two main types of analysis we will perform: vertical analysis and horizontal analysis.

Vertical Analysis

With vertical analysis , we will look up and down the income statement to see how every line item compares to revenue as a percentage.

For example, in the income statement shown below, we have the total dollar amounts and the percentages, which make up the vertical analysis.

As you see in the above example, we do a thorough analysis of the income statement by seeing each line item as a proportion of revenue .

The key metrics we look at are:

- Cost of Goods Sold (COGS) as a percent of revenue

- Gross profit as a percent of revenue

- Depreciation as a percent of revenue

- Selling General & Administrative ( SG&A ) as a percent of revenue

- Interest as a percent of revenue

- Earnings Before Tax (EBT) as a percent of revenue

- Tax as a percent of revenue

- Net earnings as a percent of revenue

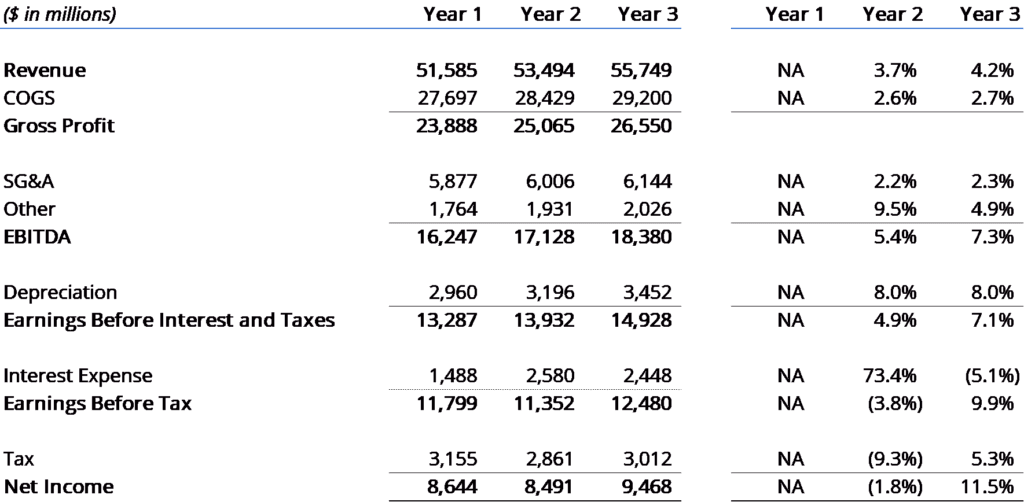

Horizontal Analysis

Now it’s time to look at a different way to evaluate the income statement. With horizontal analysis , we look at the year-over-year (YoY) change in each line item.

In order to perform this exercise, you need to take the value in Period N and divide it by the value in Period N-1 and then subtract 1 from that number to get the percent change.

For the below example, revenue in Year 3 was $55,749, and in Year 2, it was $53,494. The YoY change in revenue is equal to $55,749 / $53,494 minus one, which equals 4.2%.

Let’s move on to the balance sheet . In this section of financial statement analysis, we will evaluate the operational efficiency of the business. We will take several items on the income statement and compare them to accounts on the balance sheet.

The balance sheet metrics can be divided into several categories, including liquidity, leverage, and operational efficiency.

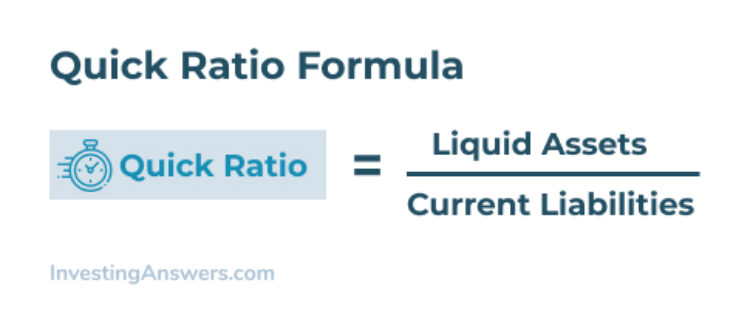

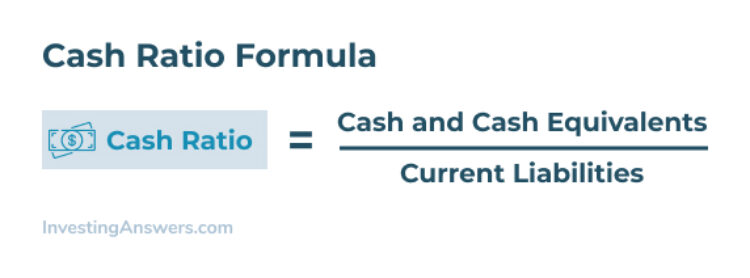

The main liquidity ratios for a business are:

- Quick ratio

- Current ratio

- Net working capital

The main leverage ratios are:

- Debt to equity

- Debt to capital

- Debt to EBITDA

- Interest coverage

- Fixed charge coverage ratio

The main operating efficiency ratios are:

- Inventory turnover

- Accounts receivable days

- Accounts payable days

- Total asset turnover

- Net asset turnover

Using the above financial ratios, we can determine how efficiently a company is generating revenue and how quickly it’s selling inventory.

We can also use the financial ratios derived from the balance sheet and compare them historically versus industry averages or competitors. This comparison will help you assess the solvency and leverage of a business.

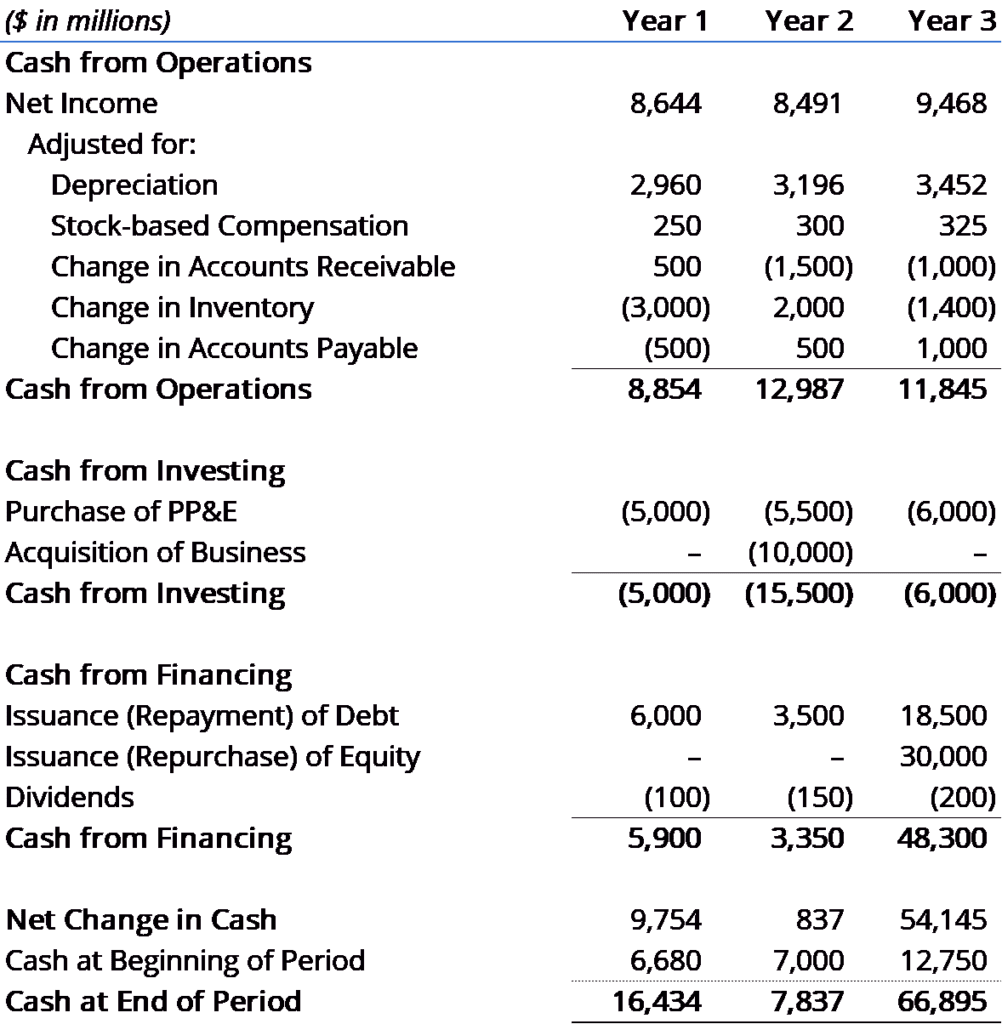

With the income statement and balance sheet under our belt, let’s look at the cash flow statement and all the insights it tells us about the business.

The cash flow statement will help us understand the inflows and outflows of cash over the time period we’re looking at.

Cash flow statement overview

The cash flow statement, or statement of cash flow, consists of three components:

- Cash from operations

- Cash used in investing

- Cash from financing

Each of these three sections tells us a unique and important part of the company’s sources and uses of cash over a specific time period.

Many investors consider the cash flow statement the most important indicator of a company’s performance.

Today, investors quickly flip to this section to see if the company is actually making money or not and what its funding requirements are.

It’s important to understand how different ratios can be used to properly assess the operation of an organization from a cash management standpoint.

Below is an example of the cash flow statement and its three main components. Linking the 3 statements together in Excel is the building block of financial modeling.

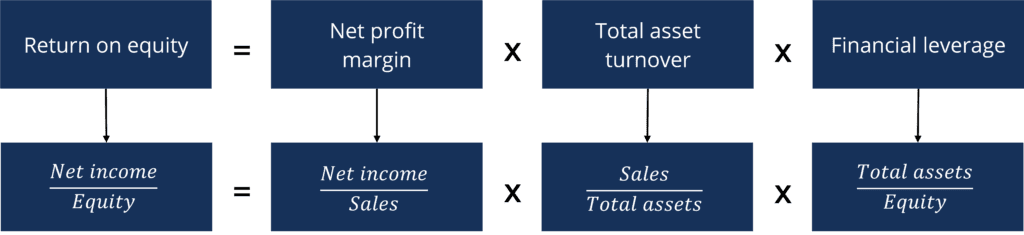

In this part of our analysis of financial statements, we unlock the drivers of financial performance with ratio analysis. By using a “pyramid” of ratios, we are able to demonstrate how you can determine the profitability, efficiency, and leverage drivers for any business.

This is the most advanced section of our financial analysis course , and we recommend that you watch a demonstration of how professionals perform this analysis.

The course includes a hands-on case study and Excel templates that can be used to calculate individual ratios and a pyramid of ratios from any set of financial statements.

The key insights to be derived from the pyramid of ratios include:

- Return on equity ratio (ROE)

- Profitability, efficiency, and leverage ratios

- Primary, secondary, and tertiary ratios

- Dupont analysis

By constructing the pyramid of ratios, you will gain an extremely solid understanding of the business and its financial statements.

Analyzing financial statements is essential for understanding a company’s financial position and future potential. It allows corporate finance professionals to uncover patterns and trends, informing strategic decisions and ensuring alignment with financial goals. Additionally, this analysis helps finance teams identify risks early and take corrective actions to maintain the financial stability of their companies.

In addition, financial statement analysis is the first step investors take when evaluating a company’s profitability and viability as an investment. It provides a clear view of the company’s financial health, including profitability, liquidity, and debt management, building investor confidence in the company’s ability to generate returns and manage obligations. Ultimately, financial statement analysis guides internal strategies and attracts external investment by showcasing financial strength and resilience.

How to Link the 3 Financial Statements

AI-Enhanced Financial Analysis

Financial Ratios Definitive Guide

Mastering Financial Statement Aggregation and Analysis

See all accounting resources

See all financial modeling resources

CFI is a global provider of financial modeling courses and of the FMVA Certification . CFI’s mission is to help all professionals improve their technical skills. If you are a student or looking for a career change, the CFI website has many free resources to help you jumpstart your Career in Finance. If you are seeking to improve your technical skills, check out some of our most popular courses. Below are some additional resources for you to further explore:

- Careers

- CFI’s Most Popular Courses

- All CFI Resources

- Finance Terms

The Financial Modeling Certification

Analyst certification fmva® program.

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation . CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?

Excel Tutorial

Launch CFI’s Excel Course now

to take your career to the next level and move up the ladder!

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

- Formatting Styles

Financial Statement Analysis

Checked : Mark A. , Curtis H.

Latest Update 21 Jan, 2024

Table of content

The components of the financial statement

1. the balance sheet, 2. the income statement, 3. the cash flow table.

- Understanding a company's financial statements in 5 points

Financial statement objectives

Evaluate performance and plan for the future, assess the financial strength of a business, analyze the solvency of the organization.

To analyze the performance and manage the growth of a company, financial statements are a handy tool.

A financial statement is a summary document drawn up periodically. Information on performance, financial and accounting situation, and the development of a company from one accounting year to the next appears.

It is presented in an organized and standardized manner and is based on the following concepts and obligations:

- Faithful image and compliant with IFRS (International Financial Reporting Standards, which have been the accounting standard applicable to companies listed on the European market since 2005). The financial statements must be structured and presented in a clear manner and in accordance with the transactions and the facts.

- Going concern: financial statements must be prepared on the assumption that the company will continue its activities for an indefinite period

- Commitment accounting: Expenses and income must be allocated to the period during which they were incurred and attach these funds at the close

- Consistency of presentation: The presentation and classification of items in the financial statements must remain unchanged from one financial year to the next unless there are changes imposed by IFRS standards

- Relative importance and grouping: each significant category of similar elements must be presented separately in the financial statements unless they are not significant

- Non-offsetting of assets, liabilities, charges, and income: Assets, liabilities, charges, and income should not be offset against each other unless required by an IFRS standard

- Comparative information with the previous period: the financial statements must give corresponding information from previous years to allow users to compare the financial situation and the performance of a company over time

is a basic summary table which gives an image of the company's financial situation during a period and presents three main elements:

- The asset: economic resources controlled by the company from which it expects future economic benefits, or simply what the company has

- Liabilities: obligation to do or pay, which represents a negative value for the company, or what the company has to pay

- Equity: net worth of the company resulting from the difference between assets and liabilities.

commonly called the statement of comprehensive income or PP (loss and profit), is an accounting document that gives an image of the company's economic performance over a given period in terms of gains or losses.

It provides information on what the business has gained and spent and then indicates whether it has made a profit or a loss during the accounting period.

It is the difference between the products, which are the operations that increase the wealth of the company and the charges, which are the consumption of resources that impoverishes the company. The income statement provides useful information on the company's dynamics and its ability to generate profit as well as its positioning in relation to its competitors.

details and explains the change in cash during the entire accounting year. These are the company's bottom-line inflows and outflows for paying off debts and purchasing the products it needs.

The flows are classified into three categories:

- The flows linked to the company's operational activity: They define the variation of the company's liquidities held by the company linked to its main activity.

- Flows linked to investment activities: They represent all the expenses and income associated with acquisitions and disposals of fixed assets.

- Cash flows linked to financing activities: They mainly relate to capital increases and reductions, the payment of dividends to shareholders, and the obtaining or repayment of financial loans.

- The statement of changes in equity indicates all the transactions that affect an enterprise's total equity during an accounting year. It identifies the wealth created and/or potentially available to shareholders.

- The appendices are mandatory or significant documents intended to clarify the reading of the balance sheet and the income statement. It also provides useful qualitative information, but absent from the financial statements. For instance, the accounting practices and standards on which the financial statements are established, provisions, pension funds, discontinued operations, dispute resolution, disposal of tangible capital assets, the number of dividends proposed or decided, etc. as well as any other relevant information that could impact the company.

No single financial statement gives a complete picture of the business. They are all linked. The change in assets and liabilities arising from the balance sheet corresponds to the charges and income appearing in the income statement, which determines the company's gains or losses. The cash flows provide additional information on the liquid assets listed in the balance sheet. Financial statements are a valuable source of information for investors and donors for economic decision-making.

Understanding a company's financial statements in 5 points

The financial statements of a company show its economic situation in different aspects. A management tool, these summary documents allow members of the board of directors and managers to make informed decisions in the light of complete and reliable information and to provide third parties with a true picture of the company's situation. Here's how to understand a company's financial statements in 5 points. Three main documents

There are three main types of financial statements:

- the balance sheet which presents a photograph of the assets (assets), debts (liabilities), and assets of shareholders or associates (equity) of the company at the end of the past financial year

- the income statement which lists the revenues (products) and expenses (expenses) over a year

- the statement of changes in a financial position which provides information on the company's operating, financing and investing activities

Quebec law imposes an obligation on companies to present financial statements for the year ended during the annual general meeting. The board of directors has a photograph of the company's economic situation and a report on the past year of activity. The financial statements provide:

- business assets and liabilities

- The charges.

But financial statements also have other uses:

- they help the manager make informed decisions

- they serve as the basis for establishing the price during a transfer

- they allow investors and lenders to analyze the company's situation before deciding to inject funds or finance the development of the activity

- they support an insurance compensation claim in the event of a business interruption linked to a disaster

The income statement lists the company's revenues and expenses over a year. It allows you to see whether the financial year is profitable or loss-making and, in particular, to compare each item of expenditure and each category of product with the forecast budget and previous years. Thus, the organization can determine whether the strategic plans are being followed or whether they require a reassessment or even a modification.

The income statement also serves as the basis for establishing the budgets for the coming years by integrating changes linked to the economic situation (increase in the prices of raw materials, the cost of labor, etc.) and managerial decisions (such as an example of hiring or, on the contrary, job cuts, changes of premises, the opening or closing of a department).

We Will Write an Essay for You Quickly

In addition to revealing the assets and liabilities of a company, the balance sheet also provides information on the equity of the organization and makes it possible to analyze its financial solidity as well as its capacity to absorb any operating losses.

The statement of changes in financial position is an indicator of a company's cash flows from operating, investing, and financing activities. It allows:

- collect information on accounts receivable and payable

- monitor purchases and sales of fixed assets

- to examine the methods of financing purchases and the repayment of debts

These elements help to assess the liquidity and the solvency of the company and to determine its capacity to self-finance and to repay its debts.

The annual production of financial statements does not only satisfy a legal obligation. It provides economic data relating to the company's state and development, which helps the manager make informed decisions. It gives a true and complete picture of the organization's situation to third parties.

Looking for a Skilled Essay Writer?

- University of California, Los Angeles (UCLA) Bachelor of Arts

No reviews yet, be the first to write your comment

Write your review

Thanks for review.

It will be published after moderation

Latest News

What happens in the brain when learning?

10 min read

20 Jan, 2024

How Relativism Promotes Pluralism and Tolerance

Everything you need to know about short-term memory

Financial Statement Analysis

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on June 08, 2023

Fact Checked

Why Trust Finance Strategists?

Table of Contents

What is financial statement analysis.

Financial statement analysis is one of the most fundamental practices in financial research and analysis.

In layman’s terms, it is the process of analyzing financial statements so that decision-makers have access to the right data.

Financial statement analysis is also used to take the pulse of a business. Since statements center on a company’s key financial details, they are useful for evaluating activities.

This is essential to understanding the firm’s overall performance.

What Are Financial Statements?

According to the American Institute of Public Accounts, financial statements are prepared for the following purposes:

- Presenting a periodical review or report on the progress made by the management

- Dealing with the status of investments in the business and the results achieved during the period under review

Financial statements reflect a combination of recorded facts, accounting conventions, and personal judgments.

The judgments and conventions that are applied are dependent on the competence and integrity of those who make them and on their adherence to generally accepted accounting principles (GAAP) and conventions.

Public companies are forced to keep track of their financial statements in very specific ways through a balance sheet, income statement, and cash flow statement.

However, private companies often underestimate the importance of these statements because they are not required to keep track of them. It’s not that they don’t create them, but they typically don’t use them to their full benefit.

Let’s consider the following important financial documents:

- Balance Sheet: Details a company’s value based on its assets , liabilities , and shareholder equity . We can learn a lot about the efficiency of a business’s operations from its short-term cash flow and accounts receivable.

- Income Statement: An income statement breaks down a company’s earnings by comparing expenses and revenue . It is broken down into separate categories that businesses can use to help them identify profitable areas.

- Cash Flow Statement : This report shows a company’s cash flow in terms of operational activities, financial ventures, and investments .

Tools and Techniques Used For Financial Statement Analysis

Financial statement analysis is centered on the balance sheet, income statement, and cash flow statement. It is the best way to gauge the overall health of a business.

There are several tools and techniques with which this is done, including:

- Fundamental Analysis: This analytical practice is used on a company’s most basic financial levels. It shows the health of the business on a financial level and helps provide insight into the overall value.

- DuPont Analysis: This tool is used to help companies prevent conclusions that are misleading. Sometimes, looking at sheer profitability doesn’t tell the whole story, so DuPont Analysis is used to create a detailed assessment.

- Horizontal Analysis: Here, we compare financial ratios, a specified benchmark, and a specified line item over a specific period. This allows firms to examine changes that have been made and compare them with other behaviors.

- Vertical Analysis: This financial analytical practice shows items within the financial statement as a percentage of the base figure. It’s simple, so it’s the method that most businesses prefer.

Value of Financial Statement Analysis When Analyzing and Reporting Financial Statements

Now that we’ve gone over some of the basics, let’s dive deeper into financial research and analysis. Here’s what makes financial statement analysis such a powerful tool.

Identifying the Industry’s Economic Characteristics

Financial statement analysis can identify several important factors in a business’s marketplace, sometimes finding smaller niches that are other methods miss.

We can use financial statement analysis to determine market size, compare competitors , and investigate the growth rate of a market as it relates to a variable such as spending.

It’s also possible to look beyond your own company and find out how others are faring in new markets before you decide to invest in them.

Another powerful tool that a lot of brands are using is product differentiation analysis. This method crunches financial numbers to see how well a brand’s products and prices are holding up against others in the same market.

There are several factors at play here, including distribution, purchasing, and advertising costs .

Identifying Company Strategies

All entrepreneurs understand the importance of finding the right strategy to meet the needs of their business. They spend a lot of time searching for the perfect one.

When you break it all down, the blueprint is usually the same, whether it’s developing a business plan or developing advanced strategies. That blueprint is defined by data.

The only difference between the two is that a business strategy is focused more on the future and the development of the business.

Once a strategy is established, then it has to be measured. The only true way to get accurate results is to compare financials.

Most strategies evolve, and financial analysis helps steer us in the right direction. For example, a detailed financial statement analysis will reveal the direction your company is moving. It will be the first indicator if growth is not where you want it to be.

Assessing the Quality of a Company’s Financial Statements

All businesses must have a method of efficiently analyzing their financial statements. This process requires three key points of understanding that must always be accounted for.

These can all be found through a sound financial statement analysis.

- Businesses must identify the economic characteristics of their industry and compare their finances to the average.

- Companies must be able to identify which strategies are profitable and which are not.

- Businesses must be able to gauge the quality of their financial statements.

Inaccurate financial statements are common in small businesses. If left unchecked, this will lead down a path of ruin.

Financial research and analysis are the best way to ensure that these valuable reports are steering your growth in the right direction.

Analyzing Profitability and Identifying Potential Business Risks

Every business strategy has risks, and the majority of those risks are felt on a financial level. Therefore, it’s important for businesses to devise ways to identify and mitigate these risks.

While it’s not possible to avoid every risk, we can identify them before they cause too much damage. This is done by keeping a close eye on profitability.

Noteworthily, then, financial statement analysis helps you to keep track of profitability ratios, enabling you to truly measure the overall value of a strategy moving forward.

Preparing Financial Statement Forecasts

Forecasts are how companies predict the direction in which their business is heading. These forecasts need to be aligned with the company’s overall goals.

Income , cash flow, and balance sheets must all be closely monitored to ensure that they are aligned with the organization’s overall growth objectives.

Financial statement analysis is the practice that the world’s leading businesses engage in to stay ahead of their competitors.

Financial Statement Analysis FAQs

What is financial statement analysis.

Financial Statement Analysis is the process of analyzing a company’s financial statements and using this information to gauge its performance over time, assess its current condition, and make predictions about future performance.

Why is Financial Statement Analysis important?

Financial Statement Analysis is an essential tool for investors and financial professionals as it can help them better understand a company’s financial health and improve their decision-making processes when making investments or loan decisions.

What types of Financial Statements are analyzed?

The three main financial statements used in Financial Statement Analysis are the Balance Sheet, Income Statement, and Cash Flow statement.

What analysis techniques are used to review Financial Statements?

Common analysis techniques used in Financial Statement Analysis include trend analysis, vertical and horizontal analyses, ratio analysis, and cash flow statement analysis.

What information can be gathered through Financial Statement Analysis?

Financial Statement Analysis can provide insights into a company’s financial position, performance over time, liquidity and solvency, profitability, the efficiency of operations, and more. It can also be used to assess the quality of accounting practices and risk levels.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Are Bonds Current Assets?

- Are Buildings Noncurrent Assets?

- Are Construction Works-In-Progress a Current Asset?

- Are Debt Investments Current Assets?

- Are Fixed Assets Current Assets?

- Are Intangible Assets Current Assets?

- Are Investments Current Assets?

- Are Marketable Securities Current Assets?

- Are Office Supplies a Current Asset?

- Are Supplies a Current Asset?

- Carrying Value or Book Value

- Chart of Accounts

- Combined Leverage

- Components of the Balance Sheet

- Creative Accounting

- Current Liabilities on the Balance Sheet

- Difference Between Trial Balance and Balance Sheet

- Effects of Transactions on a Balance Sheet

- Enterprise Value Formula & Calculation

- Financial Leverage

- Functions and Limitations of Balance Sheet

- Funds From Operations (FFO)

- Horizontal Analysis of Financial Statements

- Income Statement Analysis

- Indifference Analysis

- Is a Loan a Current Asset?

- Is a Patent a Noncurrent Asset?

- Is Accounts Payable a Current Asset?

- Is Accounts Receivable a Current Asset?

- Is Accounts Receivable a Material Component of a Company’s Total Current Assets?

Ask a Financial Professional Any Question

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

To ensure one vote per person, please include the following info, great thank you for voting., get in touch with a financial advisor, submit your info below and someone will get back to you shortly..

Financial Statement Analysis for Beginners

Financial statement analysis is the process of evaluating a company’s financial information in order to make informed economic decisions. It involves the review and analysis of income statements, balance sheets, cash flow statements, statements of shareholders’ equity, and any other relevant financial statements.

Financial statement analysis is an essential tool that is used by analysts, investors and internal decision makers to better understand a company’s financial position, performance, and growth potential. In this article, you’ll learn how to analyze a financial statement using real-world financial statement analysis examples.

The Three Essential Financial Statements

In order to perform a financial statement analysis, you’ll need to refer to three essential financial statements: balance sheet , income statement , and cash flow statement .

1. The Balance Sheet

The balance sheet (also called the statement of financial position), provides insight into a company's financial position at a given date. On this financial statement, you'll find an overview of the company's assets, liabilities, and shareholders' equity. These sections highlight the value of what the company has to work with, what it owes, and what is owned by shareholders.

2. The Income Statement

The income statement (often called a profit and loss statement) provides an overview of a company’s revenues, expenses, gains, and losses over a given period. This financial statement is often used to analyze a company’s financial position, operations, efficiency, and performance in relation to competitors in its industry.

3. The Cash Flow Statement

The cash flow statement (also called the statement of cash flows) summarizes a company’s cash inflows and outflows over a given period. It identifies the company’s sources and uses for its cash (e.g. operations, investments, financing), which helps to measure how well the company manages its cash position.

Financial Statement Analysis Example for a Balance Sheet

Balance sheets are important financial statements that offer valuable insights into a company’s financial position at a specific point in time.

A balance sheet analysis provides insight into a company’s financial position - value of assets owned, amount of money owed, etc. - at a specific point in time. This information helps analysts, investors, and decision-makers gauge the potential profitability of investing in that company.

What to Look for on the Balance Sheet

During a balance sheet analysis, there are a number of important items to pay attention to under assets, liabilities, and shareholders’ equity.

The assets section covers all economic resources owned by a company. While this section is important as a whole, there are a few particular items that warrant extra attention:

Cash can be a good indicator of a company’s ability to generate sales, get paid, and manage its purchases and debt obligations. The amount of cash on a company’s balance sheet can also reveal how well it could handle an unexpected downturn or repay immediate debts.

However, it’s important to note that some businesses don’t rely on a significant amount of cash to operate, instead choosing to reinvest cash to increase their future earnings potential.

Accounts Receivable

Accounts receivable provides insight into a company’s ability to collect the money it is owed. If sales remain steady or grow and accounts receivable decreases each year (compared to previous years), the company is likely doing a good job at collecting its money. On the other hand, if accounts receivable increases each year, the company may not be collecting its payments efficiently.

The inventory section on a balance sheet details a company’s raw materials, works in progress, and completed inventory. This information is essential for measuring cost of goods sold (COGS), inventory turnover rate, days inventory outstanding, and other metrics that are used to evaluate operational efficiency and profitability. However, this section merely highlights the value of a company’s inventory without consideration for things such as obsolescence, spoilage, and shrinkage.

Liabilities

The liabilities section summarizes all of the financial obligations a company has to outside parties. Investors generally prefer companies that have fewer liabilities than assets, but there are a few other important things to look out for:

Accounts Payable

The accounts payabl e section summarizes the amount of money a company owes to its vendors or suppliers. It includes short-term debts for products or services rendered such as inventory, utility bills, and other invoices.

Accounts payable is important to analysts and investors because it helps them understand how a company balances credit and cash purchases, how long it takes to pay its bills, and how much money is earmarked for its short-term debt obligations.

Short-term Debt

The short-term debt/current liability account details the total amount of debt that a company must repay within the next 12 months. It includes items such as accounts payable, salaries owed, taxes to be paid, short-term loans, lease payments, and more.

These debts are incurred in relation to a company’s primary business activities and are often referred to as operating debts. This section is an important consideration for analysts, creditors, and investors as it used to gauge a company’s liquidity and ability to meet short-term financial obligations.

Long-term Debt

The long-term debt section summarizes a company’s outstanding debts due at least 12 months in the future. It includes items such as loans, mortgages, bonds, lease obligations, and more.

Long-term debts are generally incurred through activities related to raising capital and are often referred to as financing debt. The long-term debt section is important for analysts and investors as it helps them understand a company’s long-term financial commitments, capital structure, and leverage.

Shareholders’ Equity

The shareholders’ equity section represents the total value of the company that is available to shareholders after all debts have been paid. Therefore, the value of shareholders’ equity is the equivalent of the company’s assets less its liabilities.

In the event of liquidation, equity owners receive payments after debt holders, making this section important for analysts and investors.

Retained Earnings

The resulting value can be positive or negative, representing how the company managed its profits. It is important for analysts, investors, and lenders because it provides insight into the company’s financial stability, how it handles future growth, and how it manages its cash flow.

Paid-in Capital

The paid-in capital section summarizes the amount of money a company generates from selling stock directly to investors. It includes funds received from the direct sale of common stock or preferred stock. It does not include exchanges between investors on the secondary market.

The section also includes additional paid-in capital (which is the amount of money investors paid for stock beyond its par value). A high level of paid-in capital indicates significant interest or confidence in the company, which makes it a useful indicator for analysts and investors.

5 Important Balance Sheet Financial Ratios

After analyzing the sections mentioned above, use financial ratios to extract deeper insights from a company’s balance sheet. These useful tools can help you transform raw data into information about liquidity, efficiency, and more.

1. Current Ratio

The current ratio (also called the working capital ratio) measures a company's ability to meet its short-term debt obligations using its current assets. It indicates how many times current liabilities can be covered by current assets, making it an effective measure of a company's liquidity.

How to Calculate Current Ratio

2. Quick Ratio

Also called the acid-test ratio, the quick ratio gauges a company's ability to cover its current liabilities using only its most liquid assets. It indicates how many times the company's current liabilities can be covered by its most liquid assets such as cash, cash equivalents, and marketable securities.

Quick Ratio Formula

3. Cash Ratio

The cash ratio measures a company’s ability to pay its current liabilities using only its cash and cash equivalents . Expressed as a value, the cash ratio indicates how many times the company’s cash and cash equivalents can cover its current liabilities.

Cash Ratio Formula

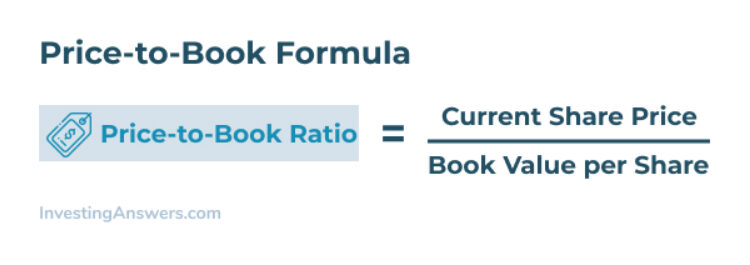

4. Price-to-Book Ratio

The price-to-book ratio measures a company's share price relative to its book value, revealing the price investors must pay for each dollar of book value.

How to Calculate Price-to-Book Ratio

The resulting value is used for comparisons against other companies and industries.

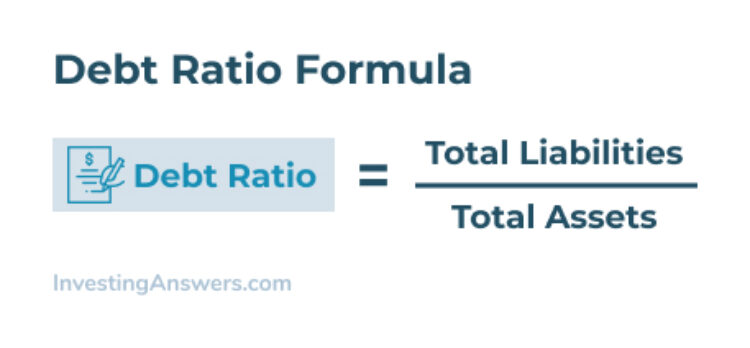

5. Debt Ratio

The debt ratio measures a company’s debt relative to its assets, providing valuable insights into how assets are funded and the degree to which its assets can be used to cover financial obligations.

Debt Ratio Formula

How to Analyze Debt Ratio

A value greater than one indicates that the company has more debt than assets, where a value less than one indicates that it has more assets than debt.

The Balance Sheet Equation

The balance sheet equation states that the left side (assets) and right side (liabilities + shareholders' equity) of a balance sheet will be equal or 'in balance'. This is the case because the company’s assets have been financed through either debt or equity, so assets = debt + equity.

Balance Sheet Example

You can use the information from the balance sheet to analyze different aspects of a company. All of the information is easily accessible, so it’s up to you to read through the sections that are important to your analysis and/or calculate financial ratios based on the data.

.jpg)

Financial Statement Analysis Example for the Income Statement

An income statement provides insight into a company's revenues, expenses, gains, and losses in a given period. This information is particularly useful for investors and analysts as it can help them track a company’s performance, profitability, efficiency, and more.

There are a few particular sections to pay extra attention to:

Also called net earnings, net income is one of the most important lines on the income statement. This highlights the amount of profit or loss the company generated over the specified period. It is one of the most common indicators of a company’s profitability, making it extremely useful for analysts and investors. Net income can also be used to make other calculations, such as earnings per share, net profit margin, and retained earnings.

The Easiest Way to Find Net Income

Net income (“the bottom line”) is one of the most important bits of information on an income statement as it highlights the amount a company earns after accounting for expenses. In other words, it is the profit or loss generated over a specific period.

.jpg)

Operating Expenses

The operating expenses section summarizes all expenses incurred through regular business activities such as rent, payroll, inventory costs, marketing, administrative fees. It highlights the amount of money required to operate the company.

The operating expenses section directly affects the company’s bottom line and is also used to calculate its operating income. It also provides insight into cost efficiency and profitability, which is especially important to analysts and investors.

Gross Profit

The gross profit highlights the amount of revenue generated from sales (minus the costs incurred to achieve those sales). In other words, it shows how much profit a company makes after accounting for the cost of goods sold.

The gross profit represents revenues net of costs such as materials, labor, transaction fees, equipment, and shipping, but before deducting for operating expenses such as marketing costs, administrative fees, etc. This section is important to analysts and investors because it is used to measure a company’s efficiency of converting production inputs (e.g. labor, materials) into finished products (e.g. goods, services).

Income Statement Example

5 Important Income Statement Financial Ratios

Just like the balance sheet, there are important financial ratios that can be calculated using information from the income statement. Here are some examples:

1. Profit Margin

Profit margin is one of the most important financial ratios for analysts and investors as it measures a company’s profitability. Averages can vary between companies and industries. As a rule of thumb, a 5% profit margin is low, 10% is average, and 20% is good.

Profit Margin Formula

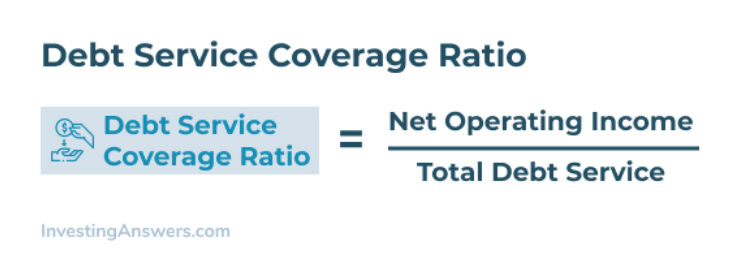

2. Debt Service Coverage Ratio (DSCR)

The debt service coverage ratio is frequently used by analysts and investors to assess a company’s credit risk and debt capacity. A value greater than one means that the company has enough operating income to cover its short-term debt obligations at least once, whereas a number less than one means that it does not.

Debt Service Coverage Ratio Formula

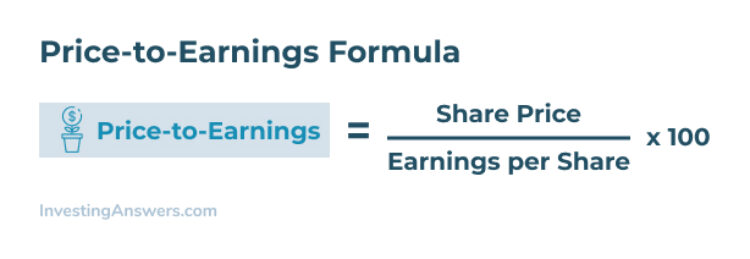

3. Price-to-Earnings Ratio

The price-to-earnings (P/E) ratio is another popular financial ratio that is used to determine whether a company’s share price is undervalued, overvalued, or fairly priced. While there is no benchmark for what makes a 'good' P/E ratio, a higher value can indicate that a stock is overvalued, whereas a lower value can indicate that it is undervalued.

How To Calculate Price-To-Earnings Ratio

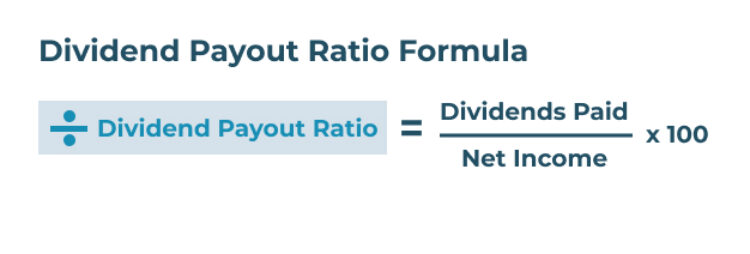

4. Dividend Payout Ratio

The dividend payout ratio is a useful metric that measures the amount of dividends a company pays to its shareholders in relation to its net income.

This metric is useful for analysts and investors because it provides insight into a company’s earnings stability and approach to future growth. Ratios can vary between companies and industries, but generally speaking, well-established companies have higher dividend payout ratios while younger companies have lower ratios as they reinvest more of their earnings.

How To Calculate Dividend Payout Ratio

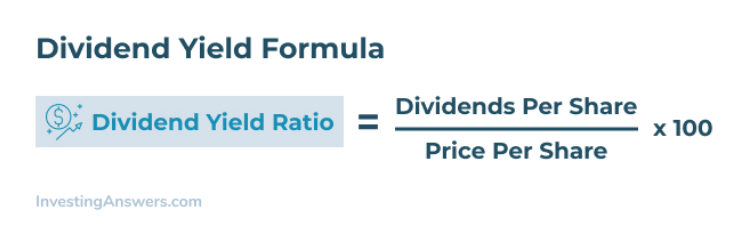

5. Dividend Yield

Dividend yield measures a company's annual dividend payout in relation to its stock price. It highlights the value of dividends that shareholders receive for each dollar of company stock they own. It is useful for measuring return on investment , especially for investors who prioritize dividend payouts over capital gains.

How to Calculate Dividend Yield

Financial Statement Analysis Example for The Cash Flow Statement

The cash flow statement measures a company's liquidity , solvency, turnover, and financial health, so it's an important consideration when doing a thorough financial statement analysis.

The cash flow statement provides an overview of how a company generates and spends cash over a given period. It breaks down company cash activities into three categories: operating activities, investing activities, and financing activities, which can help investors and analysts understand how the company manages its cash and generates revenue.

What to Look for on The Cash Flow Statement

The cash flow statement presents useful information about a company’s cash inflows and outflows, broken down into three categories. Here’s what to look for:

Operating Activities

The operating activities section summarizes all cash inflows and outflows resulting from regular business activities. It is generally the primary source of a company's cash and is therefore often considered the most important section on the cash flow statement. A positive (inflows greater than outflows) cash flow from operating activities can indicate that the company’s operation is in good financial health.

Investing Activities

The investing activities section covers all cash inflows and outflows resulting from a company’s investments: the purchase or sale of assets and loans lent out and repaid, , as well as payments for business acquisitions.

This section is generally composed of cash outflows (since cash is being spent to purchase investments), but cash inflows will occur when the company divests and receives cash for the sale of an investment.

Every company handles investing activities differently, so it is difficult to gauge financial health on this section alone. However, purchases of equipment, property, and other assets are generally a good sign as they indicate that a company is healthy enough to invest in future growth.

Financing Activities

Financing activities include any cash inflows or outflows involving debt, equity , and dividends. In other words, it summarizes all transactions related to funding the company. It highlights the movement of cash between the company and its owners, investors, lenders, and creditors, and provides insight into how borrowing affects company cash flow.

A positive cash flow from financing activities means that the company has received cash (for example, issuing stock), whereas a negative cash flow indicates that it has paid out cash (for example, making dividend payments).

Bottom Line

The last line on a cash flow statement, the bottom line indicates whether the company had a positive or negative net cash flow for the given period. It is calculated by adding the cash flows from the company’s operating, investing, and financing activities. When the net cash flow is added to the company’s beginning cash, the resulting value indicates how much cash the company has available at the end of the year.

How To Find Net Increase Or Net Decrease

.jpg)

Cash Flow Statement Example

.jpg)

Remember: Financial Statement Analysis Isn’t an Exact Science

Financial statement analysis is a great way to make more informed decisions, but it’s not an exact science. Accounting methods can vary, numbers can be based on projections, and important factors (such as management quality) are not taken into account. Therefore, financial statement analysis doesn’t always show the full picture.

The main value comes from the data found on these financial statements, which can be used to calculate financial ratios, make comparisons to competitors, and/or track performance over time.

This is especially true for beginner investors who may not be familiar with each of the statements, industry averages, implications from the analysis, and so on. It’s important to do your own initial research, but consider hiring a professional before making any serious investment decisions.

Related Articles

How Did Warren Buffett Get Rich? 4 Key Stocks to Follow

5 Money Moves That Made Warren Buffett Rich Warren Buffett is perhaps the most famous investor in the world, amassing a fortune of over $80 billion during his lifetime. His ...

How Sean Quinn Went from Billionaire to Bankruptcy

Sean Quinn was once the richest man in Ireland. In 2008, Forbes estimated Quinn's riches reached $6 billion. Today, however, he owes Anglo Irish Bank $2.7 billion and in ...

After A Huge Sell-Off, Here's Where The Market's Heading

A nearly 2% pullback for the S&P 500 shouldn’t be of much concern. The fact that index had risen for five straight months prior to the pullback suggests a bit of ...

- Robo Advisors - Here's Why 15+ Million People Have Already Opened Up Accounts

- How to Profit from Real Estate Without Becoming a Landlord

- Personal Capital - Our #1 Choice for Free Financial Planning Tools

- Fundrise - 23% Returns Last Year from Real Estate - Get Started with Just $10

- CrowdStreet - 18.5% Average IRR from Real Estate (Accredited Investors Only)

Home — Essay Samples — Business — Accounting — The Analysis of Financial Performance

The Analysis of Financial Performance

- Categories: Accounting

About this sample

Words: 532 |

Published: Nov 16, 2018

Words: 532 | Page: 1 | 3 min read

Works Cited

- Anthony, R. N., & Govindarajan, V. (2007). Management control systems. New York: McGraw-Hill/Irwin.

- Brealey, R. A., Myers, S. C., & Marcus, A. J. (2017). Fundamentals of corporate finance. McGraw-Hill Education.

- Cochin International Airport Limited. (2021). About us.

- Financial Accounting Standards Board. (2010). Conceptual framework for financial reporting: Chapter 3: Qualitative characteristics of useful financial information. https://www.fasb.org/resources/ccurl/635/789/FASB%20Conceptual%20Framework%202010.pdf

- Financial Reporting Council. (2018). Guidance on the strategic report: Non-financial reporting regulations. https://www.frc.org.uk/getattachment/c3ba29c9-968d-40c5-a072-5de5aae7b90d/Guidance-on-the-Strategic-Report.pdf

- Financial Stability Board. (2017). Thematic review on the implementation of the legal entity identifier: Summary report. https://www.fsb.org/wp-content/uploads/P170317-1.pdf

- Gitman, L. J. (2018). Principles of managerial finance. Pearson.

- Helfert, E. A. (2017). Financial analysis: Tools and techniques: A guide for managers. McGraw-Hill Education.

- Kieso, D. E., Weygandt, J. J., & Warfield, T. D. (2016). Intermediate accounting. Wiley.

- Securities and Exchange Commission. (2019). Beginners' guide to financial statements.

Cite this Essay

To export a reference to this article please select a referencing style below:

Let us write you an essay from scratch

- 450+ experts on 30 subjects ready to help

- Custom essay delivered in as few as 3 hours

Get high-quality help

Prof Ernest (PhD)

Verified writer

- Expert in: Business

+ 120 experts online

By clicking “Check Writers’ Offers”, you agree to our terms of service and privacy policy . We’ll occasionally send you promo and account related email

No need to pay just yet!

Related Essays

2 pages / 754 words

3 pages / 1585 words

1 pages / 660 words

2 pages / 1027 words

Remember! This is just a sample.

You can get your custom paper by one of our expert writers.

121 writers online

Still can’t find what you need?

Browse our vast selection of original essay samples, each expertly formatted and styled

Related Essays on Accounting

Accounting is a profession that has been around for centuries and has evolved tremendously over time. It is a valuable profession that requires unique skills and knowledge, provides various opportunities, and plays a crucial [...]

Accounting is the language of business, and the role of accounting in ensuring the stewardship of resources is of utmost importance. Stewardship in accounting refers to the responsibility of managing and protecting the assets [...]

In conclusion, my career as an accountant has been a symphony of numbers, a harmonious blend of precision, analysis, and ethical responsibility. Through this essay, I have attempted to convey the multifaceted nature of this [...]