Process Costing

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on June 08, 2023

Fact Checked

Why Trust Finance Strategists?

Table of Contents

Process costing: definition.

A process costing system accumulates the costs of a production process and assigns them to the products that the business outputs. A production report has to be made under the process costing system.

Process costing is applied to determine the cost of production in industries where products pass through different phases of production before completion.

Under process costing, there is a finished product at each stage. This becomes the raw material of the subsequent stage until the final stage of completion.

Process costing is generally used in industries that deal with chemicals, distilled products, canned products, food products, oil refineries, edible oils, soap, paper, textiles, and others.

Process Costing: Explanation

Process costing refers to a type of costing procedure commonly adopted by factories. In process costing, there is continuous or mass production and ongoing costs, which are accumulated regularly.

The following five conditions are favorable for the use of process costing:

- Production of a single output in a plant.

- Division of a plant into different processes and departments. Each process is responsible for the manufacture of a single product.

- Processing a single product for a scheduled time, followed by successive runs of other products. Here, costs are calculated separately for each run.

- Production of several products that are produced simultaneously from the same process.

- Division of a factory into separate operations, each performing standard protocols and procedures.

- Costs are calculated process-wise.

Characteristics of Process Costing

The main characteristics of process costing are:

- Continuous production.

- The end product is the result of a sequence of processes.

- Homogeneous products with identical and standardized features ensure quality.

- The processing sequence is specific and predetermined.

- The finished products outputted from one process are used as the raw materials for the next process, which happens until completion.

General Principles of Process Costing

The following are the general principles of process costing:

- All expenses— direct and indirect —are accumulated and classified according to the process.

- Process-wise records are maintained, including those relating to the quantity of production, scrap, wastage, etc.

- To determine the average cost per unit for the period, the total cost of each process is divided by the total production.

- The cost of the process is transferred along with the transfer of the product to another process.

- Production and inventories are computed in terms of completed products.

- The cost of normal spoilage , wastage , etc. is included in product cost.

Features of Process Costing

The main features of process costing include:

- Production is divided into various stages (known as processes) and each process is carried out by separate cost centers or departments.

- Production is continuous and the final product or end product is the result of a sequence of processes or operations.

- The finished product of each process is treated as the raw material for the subsequent process.

- The units of the commodity produced are homogeneous and identical in nature.

- The cost of production per unit is the average cost, which is obtained by dividing the total process cost by the total number of units manufactured.

- The sequence of processes and operations employed is pre-determined.

- There is an indispensable loss in the production process ("normal loss"). This may be due to the qualities of the material used for production (e.g., losses from evaporation). The normal loss is absorbed by the cost of good units.

- The processing of raw material may lead to joint products and by-products .

- Abnormal losses and gains may occur. These are treated separately under process costing.

- Inter-process profits are also kept in mind when transferring the output at market price to another process. This indicates the market price and can be helpful to identify inefficiencies and losses in a process.

- The concept of equivalent production is also considered under process costing. Under this concept, when some units are in the semi-finished stage, they should be expressed in terms of equivalent completed units or effective units.

- Profit and loss are calculated after considering the opening and closing balances of finished stock. Process accounts are helpful for the valuation of raw materials, work-in-progress , and finished goods. Stocks are shown in the balance sheet .

To summarize, W. Big offered an informative remark:

The fundamental principle involved in process cost accounts is simple. A separate account is opened for each process … to which all expenditure incurred thereon is charged.

The author continued:

When the process or operation has been completed, the partially worked out product is passed into a process stock account, from which it will be requisitioned as and when required by the next process; or it may become automatically the raw material of the next process and be charged to the process account immediately.

Use of Process Costing

Industries that may benefit from the use of process costing are:

- Those producing a single product: These industries are those which are engaged in producing electric power, gas, water, steam, cement, rubber, paper, etc.

- Those producing a variety of products: These industries use the same production facilities. Such industries include foundries, laundries, and flour mills.

- Those producing a variety of products but using separate facilities: Instead of using the same production facilities, such industries may be known as extractive (e.g., mining).

Process Costing Procedure

Under process costing, the procedure used to manufacture a product is divided into well-defined processes. A separate account is opened for each process to which all incurred costs are charged.

The total number of units produced during a given period is calculated. By dividing the total cost of a process by the total number of units produced, the cost per unit can be obtained.

The finished material of one process constitutes the raw material of the next. Therefore, as the finished material is transferred to the next process, the cost of each process is also transferred, until it ends in the finished stock account.

Calculating Unit Cost Under Process Costing

Calculating the unit cost for any work performed during a period is a key part of a production report.

A student's first thought is that this is easy—just divide the total cost by the number of units produced. However, the presence of work-in-process inventories causes problems.

You cannot calculate the total output of the period by just taking the sum of completed units and work in process (ending inventory) because units in the work-in-process inventory are not 100% complete.

This problem is handled through the concept of equivalent units of production . The process costing procedure is explained in more detail in the next example.

A product passes through three processes: Process A, Process B, and Process C. 1,000 tons of the commodity were produced at the following costs:

Required: Assume that there was no work-in-progress (i.e., not at the beginning or at the end). Show the process costs for each process and the total cost of the finished product.

Cost per unit = Cost of input / Output

= $6,000 / 1,000 tons

= $6 per ton

Cost per unit = $15,000 / 1,000 tons = $15 per ton

Cost per unit = $27,000 / 1,000 tons = $27 per ton

Process Costing FAQs

What is process costing.

Process Costing, also called job-order costing, assigns total manufacturing costs to the units being produced. Process Costing is a system of product cost allocation used in merchandising and industry. The main objective is to allocate total manufacturing costs to the various products according to the proportion of resources consumed by each product.

What are the benefits of process costing?

The main benefit of Process Costing is that it provides information that can be used to make critical business decisions. For example, managers using this system can assess profit margin by product and isolate problem products before they become major issues. Process Costing also allows companies to set prices according to production costs.

What is the difference between process costing and job-order costing?

While both systems produce a cost of goods sold for a given period, Process Costing focuses on the product's progression through various stages of production. Job-order costing focuses on a specific product or service produced for a given customer. Process costs are expensed as incurred; job-order costs are capitalized. Process costs represent a higher level of accuracy than job-order costing, but they are also more complex and time consuming to develop.

How is process costing useful?

Process Costing helps companies make critical decisions based on accurate information. It allows companies to track product cost performance by production location or department—information that can be used to help determine which products are most profitable.

Can process costing be applied to service industries?

Yes, many services are produced in a manner similar to manufacturing goods. For example, when an airline provides transportation for passengers the way it would produce any product.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Our Services

- Financial Advisor

- Estate Planning Lawyer

- Insurance Broker

- Mortgage Broker

- Retirement Planning

- Tax Services

- Wealth Management

Ask a Financial Professional Any Question

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

To ensure one vote per person, please include the following info, great thank you for voting., get in touch with a financial advisor, submit your info below and someone will get back to you shortly..

principlesofaccounting.com

Process Costing

- Goals Achievement

- Fill in the Blanks

- Multiple Choice

For example, oil is used to produce gasoline. Oil is pumped from the ground, transported, refined, and placed in storage. Throughout the process it is stirred, cracked, and blended so that it is not possible to trace a tank of gasoline back to a specific barrel of oil.

How would one associate the cost of barrels of crude oil with specific gallons of finished gasoline? One would logically try to develop a mathematical approach that would divide the total cost of all oil and allocate it in some proportion to all the gallons of gasoline. This is the essence of process costing . Process costing is methodology used to allocate the total costs of production to homogenous units produced via a continuous process that usually involves multiple steps or departments.

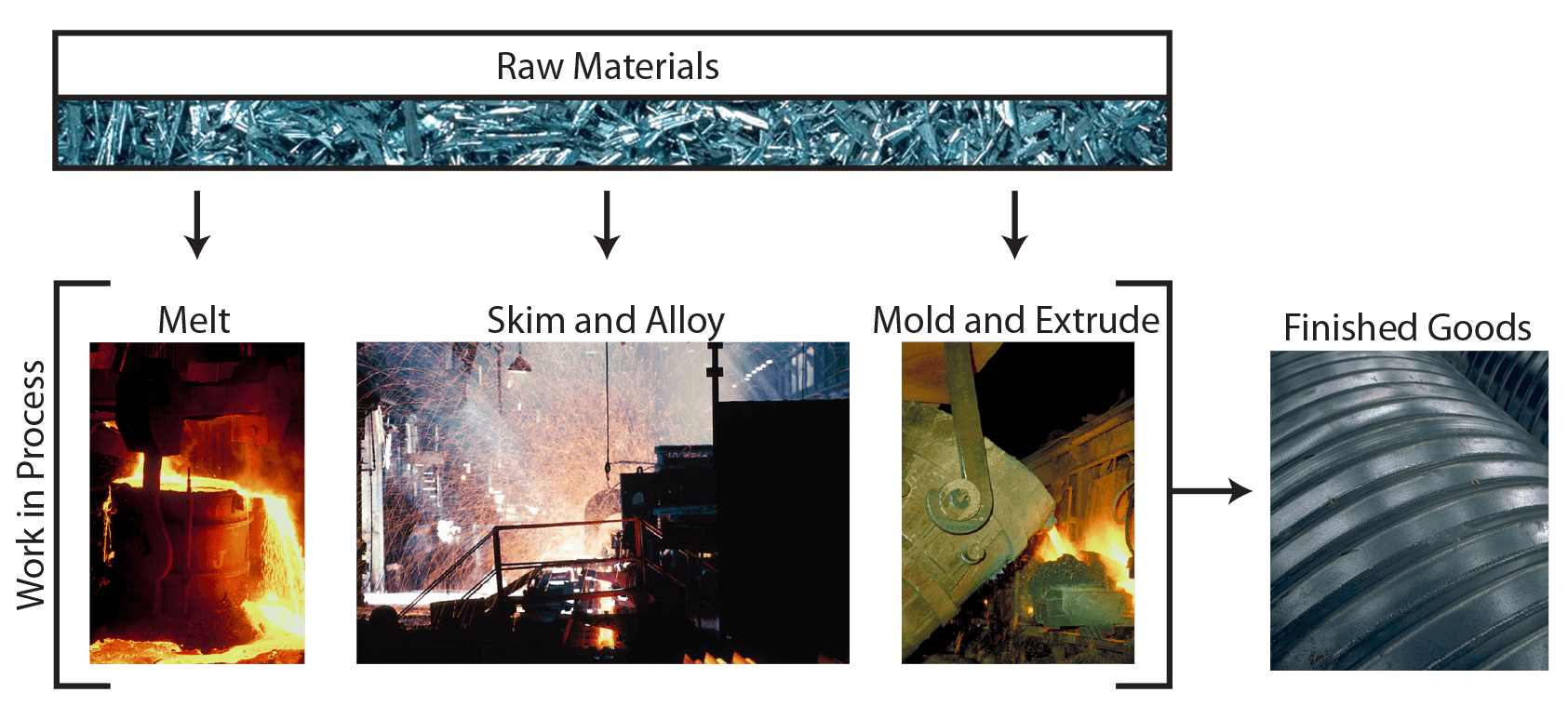

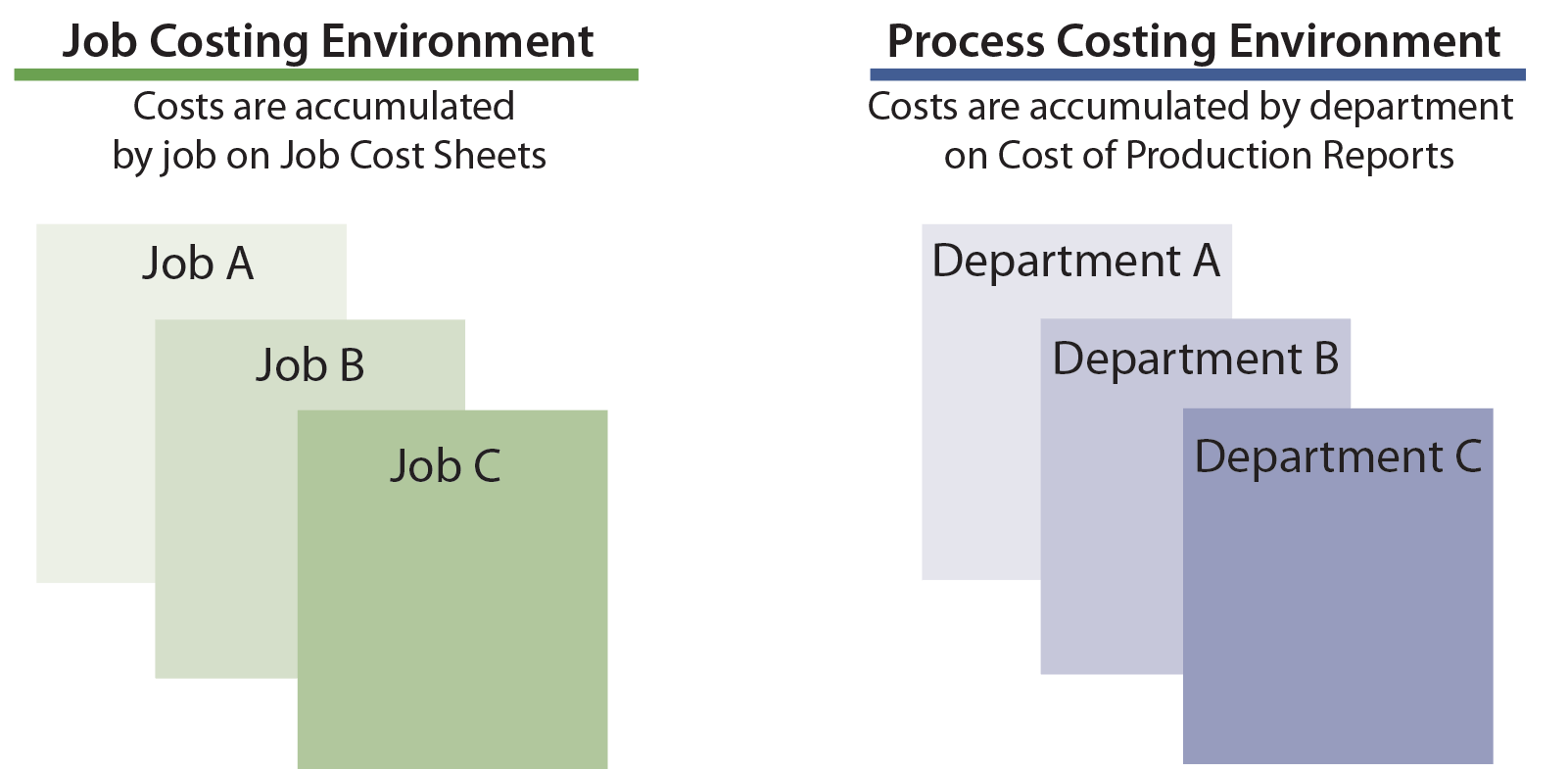

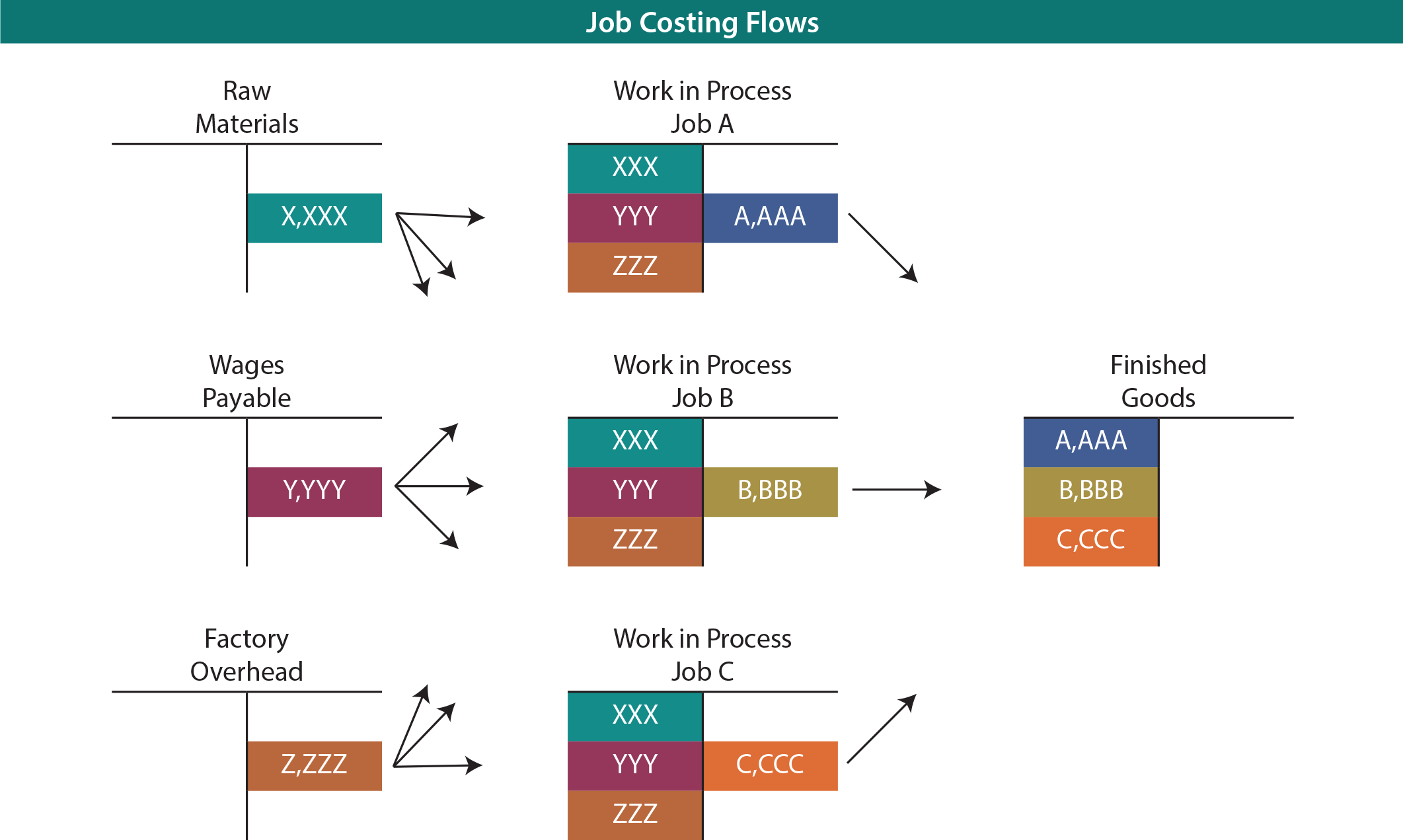

The cost flow concepts from the prior chapter are useful in understanding process costing. The reason is that the same cost flow concepts and accounts will be evident. That is, material, labor, and factory overhead will still occur and still be assigned to work in process. And, amounts assigned to work in process will in turn make their way to finished goods. The debits/credits and financial statement outcomes are very similar. The big difference between job costing and process costing arises in the work in process “units.” Remember, under job costing, costs were captured for each job (recall the discussion about job cost sheets and subsidiary amounts for each job). Under process costing, the costs are captured for each process or department. Think about a steel production factory. The basic processes for producing steel are to (1) melt iron ore (along with perhaps processed coal/coke and limestone), then (2) skim the material while adding alloys to adjust for tensile strength and flexibility, and finally (3) oxygen blast and extrude the material into its finished form (I-Beams, sheet steel, coils, etc.). Below is a representative graphic:

Comparing Job And Process Costing

Note in the above graphic the familiar inventory categories relating to raw materials, work in process, and finished goods. However, rather than observing work in process as being made up of many individual/discrete jobs , see that it instead consists of individual/discrete processes like melting, skimming, and extruding. Material can be introduced into each process. Ore is introduced in the melting stage, alloys in the skimming stage, etc. (this is equally true for labor and overhead). This necessitates the employment of a separate Work in Process account for each major manufacturing activity. Examine the graphic below that compares job and process costing, noting in particular the difference in how costs are shifted out of work in process. Process costing entails handing off accumulated costs from one department to the next.

Cost Of Production Report

With a job costing system, the costs of each job are tabulated on a job cost sheet. A similar tabulation of costs is needed for process costing but with emphasis on costs by department. The cost report that is prepared for each department is termed a cost of production report . The cost of production report provides comprehensive information on the material, labor, and overhead incurred within each department during a period. It is the primary source document for determining how those costs are allocated to actual production. Before looking more closely at the specific content of a cost of production report, it is first necessary to introduce a new concept called “equivalent units.”

| Did you learn? |

|---|

| Describe the approach to accumulating product cost using a job costing system. |

| Describe the fundamental characteristics of a process costing system. |

| Compare and contrast process costing and job order costing systems. |

| Describe the steps in applying process costing. |

Your Article Library

Essay on process costing | accounting.

ADVERTISEMENTS:

In this essay we will discuss about Process Costing. After reading this essay you will learn about: 1. Concept of Process Costing 2. Features of Process Costing 3. Application 4. Basic Procedure 5. Advantages 6. Limitations 7. Inter-Process Profit 8. Methods.

- Methods used in Apportioning Total Process Costs

Essay # 1. Concept of Process Costing :

Process costing is such a separate method of costing which refers to a costing of operations or process involved in converting raw material into finished goods or products. It is suitable for those types of business where continuous and mass production of homogeneous products is produced.

In process costing particular attention is given to:

(a) cost relating to the process,

(b) period for which cost for the process is collected,

(c) complete and incomplete units produced during the period and

(d) unit cost of the process for the period.

Essay # 2. Features of Process Costing :

(i) The products are produced in one or more process.

(ii) The products are of standardised and homogeneous nature.

(iii) When a product is produced through more than one process, then the output of each process will be input of the next process.

(iv) The cost of one process is transferred to next process.

(v) The total cost of each process after deducting Scrap value is divided by the total Production units to obtain Cost per Unit in the process.

Essay # 3. Application of Process Costing :

Process costing can be used in a large variety of industries. It is very suitable for such industries where the product is manufactured through a continuous sequence of operations.

Generally, the process costings are used in the following types of industries:

(i) Textile and Chemical Industries.

(ii) Manufacturing Industries like iron and steel, cement, paper mill, soap-making etc.

(iii) Mining Industries—coal, oil etc.

(iv) Public utility services—such as gas, electricity, water supply etc.

Essay # 4. Basic Procedure for Process Costing:

1. The industry should be divided into distinct process centre and an account should be maintained for each process centre.

2. All costs relating to each process are recorded at the end of the period.

3. Average cost per unit is found out by dividing total cost of each process by total production. In order to get average unit cost, normal loss in production and incomplete units at the beginning and at the end of the period are taken into consideration.

4. Cost of one process is transferred to the subsequent process so that total cost and unit cost of products are accumulated.

Essay # 5. Advantages of Process Costing :

1. Costs are computed at the end of a particular period.

2. Average costs are easily computed.

3. It involves less clerical work than job costing.

4. Cost data are available process or department-wise for exercising managerial control.

5. It helps the management in determining or fixing up price quotations.

Essay # 6. Limitations of Process Costing :

(i) The whole concept of Process Costing is based on average cost and therefore these are not of much use for effective control.

(ii) Computation of average cost becomes more complicated when more than one type of product is produced.

(iii) Process costing system presumes that production activity of a factory is divided according to processes or departments. A process or department is an organisational entity or section of a firm, in which specific and repetitive work is done. Thus process becomes a practical unit in a plant for purpose of supervision of production. Often process is an unsatisfactory unit for cost accounting purposes.

Following illustration will be helpful to understand the treatment of Normal Loss, Abnormal Loss and Abnormal Gain.

Essay # 7. Inter-Process Profit:

In some cases the output of one process is transferred to the next process by adding certain percentage of profit and this profit is called the inter-process profit. The main logic behind this is to charge to the next process not at the cost of the transferor but at its market selling price.

This helps to assess the profitability in respect of each product. On the other hand, the system creates unnecessary problem in respect of valuation of closing stock and unrealised profit on the same.

The provision for unrealised profit on closing stock for each process can be calculated by using the simple formula:

Value of Closing Stock × Total Profit on the Process/Total Cost to the Process.

Essay # 8. Methods Used in Apportioning Total Process Costs:

The terminology define joint cost: ‘The cost of providing two or more products or services whose production could not, for physical reasons, be segregated’. In short, joint cost means all costs incurred prior to the point of separation.

The apportionment of joint cost is very important for finding out total cost of each joint product. The basis of allocation must be rational and reasonable. Unless the joint costs are properly and reasonably apportioned to different joint products produced, the costs of joint products produced, the costs of joint products will vary considerably and this will affect –

(i) Valuation of closing inventory

(ii) Pricing of products

(iii) Profit or loss on sale of different products

Although there are no scientific methods of apportionment of joint costs, the following methods are generally used in apportioning total process costs:

(i) Average unit cost method,

(ii) Physical units methods,

(iii) Survey method,

(iv) Standard cost method,

(v) Contributory margin method,

(vi) Market value method:

(a) At point of separation.

(b) After further processing.

(c) Net realisable value.

Average Unit Cost Method:

Under this method total process cost (up to the point of separation) are divided by total units produced to get average cost per unit of production.

Average cost per unit = Total Joint cost up to the point of separation/Total units produced

According to this method no effort is made to calculate separate costs for each of the joint products. This method is simple and can be applied where processes are common and homogeneous in nature. But if the end products are heterogeneous in nature and cannot be expressed in some common units, in this case this method cannot be applicable.

Illustration :

Average cost per unit = Total Joint cost/Total units produced

= 60,000/2,000 + 800+1,200 = 60,000/4,000 = Rs. 15

Joint cost apportioned to three products would be:

Physical Units Method:

Under this method joint cost is apportioned to different products on the basis of some physical units like raw materials, weight, labour hours etc. Though this method is technically sound, but this method is not applicable in many cases such as when products are expressed in different units.

The price of coal is Rs. 200 per tonne. Direct labour and overhead costs of point of split- off are Rs. 75 and Rs. 25.

Survey Method:

In this method joint costs are apportioned to joint products after considering the important factors like volume, selling price, technical side etc. Accordingly, percentage or points value are assigned to individual products to consider their relative importance.

This method is, to some extent, more equitable than Average Cost and Physical unit’s method. Here the combined factors relating to production and marketing are given due consideration.

Illustration:

Total pre-separation cost Rs. 40,000

Production:

Product A – 1,000

Product B – 2,000

Product C – 3,000

Apportion the joint costs to the products if the value assigned for A, B and C are Rs. 4, 5 and 2 per unit, respectively.

Working Notes:

Total joint cost = Rs. 40,000

Apportionment of Joint cost

Product A = 4,000/20,000 × 40,000 = Rs. 8,000

Product B = 10,000/20,000 × 40,000 = Rs. 20,000

Product C = 6,000/20,000 × 40,000 = Rs. 12,000

Standard Cost Method:

Under this method, the by-products are valued at a standard rate which is pre-determined. It may be based on technical assessment and scientific analysis. Here the standard cost of main product would reflect changes, but that of by-product is credited to the process account of the main product. By this method, cost control of main product can be exercised effectively.

Contributory Margin Method:

This method uses the technique of marginal costing for the apportionment of joint cost. Under this method at first the total joint costs are segregated into two parts—variable and fixed. The variable parts are apportioned on the basis of average cost or physical unit’s method, and fixed part is apportioned on the basis of total contribution made by various products.

XYZ Ltd. obtains three joint products A, B and C from a process of manufacture. From the following information apportion the joint costs A, B and C under contributory margin method:

Total variable costs = 2,000 + 3,000 + 2,000

= Rs. 7,000

Total output = 1,000

. . . Per unit pre-separation variable cost = Rs. 7,000/1,000 = Rs. 7

Now fixed cost of Rs. 8,200 should be apportioned to joint products A, B and C on the basis of total contribution by the following way:

Market Value Method :

Under the market value method each type of joint product is charged for ‘what the traffic can bear’. According to this method, the number of units of each product manufactured is multiplied by the product’s selling price to obtain the sales value of production. Joint costs are apportioned in the ratio of sales value of individual products. There are some limitations of this method.

These limitations are:

(i) In the determination of relative selling price a number of problems come up.

(ii) Selling price of joint product may not be an accurate indicator of cost incurred up to their point of separation.

(iii) If the price of some products are stable and other products are changeable, then this method will give different costs of joint product for different periods. Therefore the share of joint cost will change without the change of cost structure.

Market value may mean any of the following:

(a) Market value at separation point.

(b) Market value after further processing.

(a) Market value at separation point:

Under this method market value of the joint product at the point of separation is ascertained and joint cost is apportioned in the ratio of sales value. This method is effective where further processing of products incurs disproportionate costs.

(b) Market Value after further Processing:

This method is easy to operate because selling price of the various joint products (after further processing) will be readily available. Pre-separation costs are apportioned on the basis of Market value after further processing. This method is, however, unfair where further processing costs of production are disproportionate.

Working notes:

Ratio A = 8,000/20,000 = 2/5; Ratio B = 8,000/20,000 = 2/5; Ratio C = 4,000/20,000 = 1/5

(c) Net Realisable value or Reverse Cost Method:

Under this method, from the sales value of joint products:

(a) the estimated profit,

(b) selling and distribution cost, and

(c) post-separation costs are deducted.

The resultant figure is net realisable value of joint products and joint costs are apportioned in the ratio of net realisable values.

A factory produces three products X, Y and Z, which produces from a joint process. Joint cost Rs. 12,000

Further Processing Cost:

Joint Cost should be borned by

Product A = 20,000/70,000 × 12,000 = 3,429

Product B = 20,000/70,000 × 12,000 = 3,429

Product C = 30,000/70,000 × 12,000 = 5,142

Related Articles:

- Difference between Job Costing and Process Costing

- Difference between Job Costing and Process Costing | Specific Order Costing

Comments are closed.

Module 7: Costing Methods

Flow of costs (process costing), learning outcomes.

- Explain the flow of costs in a process costing system

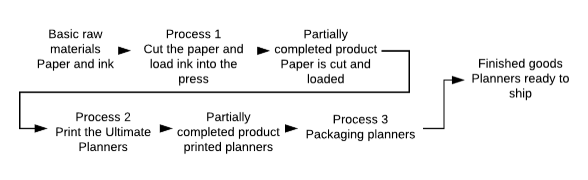

The flow of costs in the process costing system is similar to in a job-costing system, but let’s review with our Ultimate Planner example:

In the process planning we will cost by process. Process 1 involved preparing the raw materials for printing, process 2 is the actual printing, and process 3 is packaging the planners to be moved to finished goods inventory. Costing is simpler in this system because rather than having to prepare a costing sheet for many products, we only need to do costing for three departments or processes.

We start with the basic inputs:

- Raw materials

- Manufacturing overhead

Manufacturing overhead will be estimated, just as in the job costing method, but will need to be recorded as incurred. The clearing account will be used to accumulate the actual costs, and a reconciliation will be done at the end of each period.

A processing department is a unit where work is performed on a product and where materials, labor or overhead are added to the product. In the case of our planner, we first add the raw materials, then we add labor to process the raw materials, next conclude with additional labor to package the finished product to prepare it for shipment. These will be the three processes used for costing. Each business will have different processing departments, depending on the product they are making.

Each of these processing departments will be a work-in-process center. So a job costing system may have only one work-in-process, while a process costing system will have several. In the Ultimate Planner example, there will be three WIP accounts.

Raw materials, labor and overhead can be added during any process. So the costs in Process 2 will include everything happening in that process, plus the costs that are attached to the partially completed product transferred in from Process 1. These are called transferred-in costs.

Practice Questions

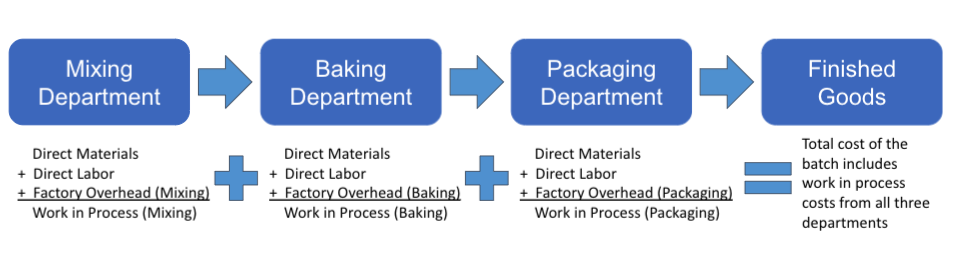

Process costing involves recording product costs for each manufacturing department (or process) as the product moves through. Each department has its own Work in Process and Factory Overhead accounts that include the department names, as follows:

| Department | Work in Process account | Factory Overhead account |

| Mixing | Work in Process – Mixing | Factory Overhead – Mixing |

| Baking | Work in Process – Baking | Factory Overhead – Baking |

| Packaging | Work in Process – Packaging | Factory Overhead – Packaging |

The batch moves from one department to the next. Materials, labor, and factory overhead costs are added in each department. The sum of the departmental work in process costs is the total cost of the batch that is transferred to Finished Goods.

The diagram above shows the cost flows in a process cost system that processes the products in a specified sequential order. That is, the production and processing of products begin in the Mixing Department. From the Mixing Department, products go to the Baking Department. From the Baking Department, products go to the Packing Department. Each Department inputs direct materials and further processes the products. Then the Packaging Department transfers the products to Finished Goods Inventory.

- Flow of Costs (Process Costing). Authored by : Freedom Learning Group. Provided by : Lumen Learning. License : CC BY: Attribution

- Principles of Managerial Accounting. Authored by : Christine Jonick. Located at : https://ung.edu/university-press/books/managerial-accounting.php . License : CC BY-SA: Attribution-ShareAlike

- Accounting Principles: A Business Perspective. Authored by : James Don Edwards, University of Georgia & Roger H. Hermanson, Georgia State University. Provided by : Endeavour International Corporation. Project : The Global Text Project. License : CC BY: Attribution

- Chocolate chip cookies. Provided by : Unsplash. Located at : https://unsplash.com/photos/G4zLsxLIpAA . License : CC0: No Rights Reserved

Trending Courses

Course Categories

Certification Programs

- Free Courses

Budgeting Resources

- Free Practice Tests

- On Demand Webinars

Process Costing

Published on :

21 Aug, 2024

Blog Author :

Edited by :

Ashish Kumar Srivastav

Reviewed by :

Dheeraj Vaidya

What is Process Costing?

Process costing is a method wherein the products go through two or more processes. The costs are assigned/charged to individual processes or operations, averaged over the number of units produced during the said period. It is used commonly in manufacturing units like paper, steel, soaps, medicines, vegetable oils, paints, rubber, chemical, etc. use this method widely.

A product may be manufactured through one process or more than one process. If two or more processes are involved in manufacturing one finished product, the question arises, "which process has consumed the expense?" The answer lies within process costing. It helps identify the specific cost assigned to each process. It enables the management to further decision making.

Table of contents

#1 - weighted average method of process costing, #2 - standard cost, #3 - first-in-first-out, step#1 - record of inventory, step #2 - conversion of work in process inventory, step #3 - calculation of inventory costs, step #4 - calculation of per-unit cost of inventory, step #5 - allocation of costs, examples of process costing, when is process costing system suitable, recommended articles.

- Process pricing is an approach that involves putting the items through two or more processes. A cost average across the number of units produced over the specified period is applied to particular processes or operations.

- Process costing is of three types. These include the average weighted method of process costing, standard costs, and First-In-First-Out methods.

- The process starts with the recording of inventory, followed by conversion of work in process inventory, calculation of inventory costs, calculation of the per-unit cost of inventory, and ends at the allocation of costs.

- Process costing is appropriate for industries where the output is continuous and uniform. Additionally, the entire production process is standardized.

Here the actual cost is divided by the weighted average of products produced. This calculation is simple as compared to any other method. A weighted average of units means the summation of the product of the rate and quantity of each item.

Here the actual cost of units is not considered; instead, it follows a standard costing method. Standard cost assumes the cost of certain materials as per management estimate. Any difference in standard & actual costs is recorded separately under the variance account

This method assigns the expense of first inputs to the processes in the order of production. However, it does not precisely identify which a lot of raw material is taken for production and its procurement rate.

Steps of Process Costing

This step involves the identification of inventory at the end of each process. The organization can identify such inventory by physically counting the units or through software inbuilt into the manufacturing process. In addition, the costs of inventory under each process are also identified at this change.

Apply the percentage of completion to the units which are under any process & not yet completed the production. Say 80,000 units of soaps are under process & these are 60% completed. Then the equivalent completed units are 80,000*60% i.e. 48,000 units.

Here, the organisation calculates the direct cost and indirect costs in the production phase. These costs are accumulated from the first process to the last process. The said is then bifurcated into an inventory of complete products & inventory of products that are under process.

We calculate this by dividing the total cost by equivalent completed units in the production phase. The cost per unit calculated here reflects the cost of only completed units. The basis of equivalent units can be the weighted average, standard cost, or first-in-first-out inventory method.

The per-unit costs are then split according to the number of units completed & units that are under process.

The entity has provided the following information & wants to calculate the cost involved in each manufacturing step. Also, it intends to calculate the value of closing inventory.

Process costing is suitable for industries where the product is continuous and the end products are identical. Also, the entire process of production is standardized. In such industries, the production cycle is standardized & even the quantum of the normal loss of inputs & outputs is quantified earlier. In case of abnormal expense, it is a charge to the profit & loss account directly and not to any individual process.

Industries such as cement, soaps, steel, paper, chemicals, medicines, vegetable oils, rubber, etc., use this method to assign the costs.

- Each plant is divided into several processes/centers. Each such division is a stage of production or process. Thus, we first clearly identify the cost centers.

- Direct & indirect costs are assigned and accumulated to each process in the factory.

- The output of one process may become input for another process.

- The finished products are identical & cannot be easily distinguished unless batch coding is done.

- The production process is continuous for all days in the year except for regular breakdown hours required to maintain the machinery.

- The total cost of production is divided among each process on a suitable basis.

- The company is required to keep records for each production process, such as units or costs introduced in each process and passed on to the next stage of production.

- The production may result in joint products or by-products.

Process cost allows an organisation to assigns the cost to different steps in the production phase. It helps management in decision making. The organisation can use this method to identify the relevant costs (i.e., direct and indirect costs) for each process, and no abnormal expenses are charged to any process.

Frequently Asked Questions (FAQs)

There are three types of process costing. The average weighted method divides the actual cost by the weighted average of products produced; the Standard costing method doesn’t consider the actual cost, and the First-In-First-Out method assigns the expense of first inputs to the processes in the order of production.

The procedure begins with the inventory recording, continues with the conversion of work-in-progress inventory, calculates inventory costs, calculates the inventory per unit, and concludes with the cost allocation.

The manufacturing cycle is standardized across several sectors, and even the amount of typical input and output loss is estimated in advance. For example, this approach allocates costs in cement, soaps, steel, paper, chemicals, pharmaceuticals, vegetable oils, rubber, etc.

This article has guided the process costing system and its definition. We discuss its features, types, steps, suitability, and examples here. You may learn more about financing from the following articles –

- Average Cost

- Controllable Costs

- Conversion Cost

- Switching Cost

5.1 Compare and Contrast Job Order Costing and Process Costing

As you’ve learned, job order costing is the optimal accounting method when costs and production specifications are not identical for each product or customer but the direct material and direct labor costs can easily be traced to the final product. Job order costing is often a more complex system and is appropriate when the level of detail is necessary, as discussed in Job Order Costing . Examples of products manufactured using the job order costing method include tax returns or audits conducted by a public accounting firm, custom furniture, or, in a comprehensive example, semitrucks. At the Peterbilt factory in Denton, Texas, the company can build over 100,000 unique versions of their semitrucks without making the same truck twice.

Process costing is the optimal costing system when a standardized process is used to manufacture identical products and the direct material, direct labor, and manufacturing overhead cannot be easily or economically traced to a specific unit. Process costing is used most often when manufacturing a product in batches. Each department or production process or batch process tracks its direct material and direct labor costs as well as the number of units in production. The actual cost to produce each unit through a process costing system varies, but the average result is an adequate determination of the cost for each manufactured unit. Examples of items produced and accounted for using a form of the process costing method could be soft drinks, petroleum products, or even furniture such as chairs, assuming that the company makes batches of the same chair, instead of customizing final products for individual customers.

For example, small companies, such as David and William’s, and large companies, such as Nabisco , use similar cost-determination processes. In order to understand how much each product costs—for example, Oreo cookies— Nabisco uses process costing to track the direct materials, direct labor, and manufacturing overhead used in the manufacturing of its products. Oreo production has six distinct steps or departments: (1) make the cookie dough, (2) press the cookie dough into a molding machine, (3) bake the cookies, (4) make the filling and apply it to the cookies, (5) put the cookies together into a sandwich, and (6) and place the cookies into plastic trays and packages. Each department keeps track of its direct materials used and direct labor incurred, and manufacturing overhead applied to facilitate determining the cost of a batch of Oreo cookies.

As previously mentioned, process costing is used when similar items are produced in large quantities. As such, many individuals immediately associate process costing with assembly line production. Process costing works best when products cannot be distinguished from each other and, in addition to obvious production line products like ice cream or paint, also works for more complex manufacturing of similar products like small engines. Conversely, products in a job order cost system are manufactured in small quantities and include custom jobs such as custom manufacturing products. They can also be legal or accounting tasks, movie production, or major projects such as construction activities.

The difference between process costing and job order costing relates to how the costs are assigned to the products. In either costing system, the ability to obtain and analyze cost data is needed. This results in the costing system selected being the one that best matches the manufacturing process.

A job order cost system is often more expensive to maintain than a basic process costing system, since there is a cost associated with assigning the individual material and labor to the product. Thus, a job order cost system is used for custom jobs when it is easy to determine the cost of materials and labor used for each job. A process cost system is often less expensive to maintain and works best when items are identical and it is difficult to trace the exact cost of materials and labor to the final product. For example, assume that your company uses three production processes to make jigsaw puzzles. The first process glues the picture on the cardboard backing, the second process cuts the puzzle into pieces, and the final process loads the pieces into the boxes and seals them. Tracing the complete costs for the batch of similar puzzles would likely entail three steps, with three separate costing system components. In this environment, it would be difficult and not economically feasible to trace the exact materials and the exact labor to each individual puzzle; rather, it would be more efficient to trace the costs per batch of puzzles.

The costing system used typically depends on whether the company can most efficiently and economically trace the costs to the job (favoring job order costing system) or to the production department or batch (favoring a process costing system).

While the costing systems are different from each other, management uses the information provided to make similar managerial decisions, such as setting the sales price. For example, in a job order cost system, each job is unique, which allows management to establish individual prices for individual projects. Management also needs to establish a sales price for a product produced with a process costing system, but this system is not designed to stop the production process and individually cost each batch of a product, so management must set a price that will work for many batches of the product.

In addition to setting the sales price, managers need to know the cost of their products in order to determine the value of inventory, plan production, determine labor needs, and make long- and short-term plans. They also need to know the costs to determine when a new product should be added or an old product removed from production.

In this chapter, you will learn when and why process costing is used. You’ll also learn the concepts of conversion costs and equivalent units of production and how to use these for calculating the unit and total cost of items produced using a process costing system.

Basic Managerial Accounting Terms Used in Job Order Costing and Process Costing

Regardless of the costing system used, manufacturing costs consist of direct material, direct labor, and manufacturing overhead. Figure 5.2 shows a partial organizational chart for Rock City Percussion, a drumstick manufacturer. In this example, two groups—administrative and manufacturing—report directly to the chief financial officer (CFO). Each group has a vice president responsible for several departments. The organizational chart also shows the departments that report to the production department, illustrating the production arrangement. The material storage unit stores the types of wood used (hickory, maple, and birch), the tips (nylon and felt), and packaging materials.

Understanding the company’s organization is an important first step in any costing system. Next is understanding the production process. The most basic drumstick is made of hickory and has a wooden tip. When the popular size 5A stick is manufactured, the hickory stored in the materials storeroom is delivered to the shaping department where the wood is cut into pieces, shaped into dowels, and shaped into the size 5A shape while under a stream of water. The sticks are dried, and then sent to the packaging department, where the sticks are embossed with the Rock City Percussion logo, inspected, paired, packaged, and shipped to retail outlets such as Guitar Center . The manufacturing process is described in Figure 5.3 .

The different units within Rock City Percussion illustrate the two main cost categories of a manufacturing company: manufacturing costs and administrative costs.

Link to Learning

Understanding the full manufacturing process for a product helps with tracking costs. This video on how drumsticks are made shows the production process for drumsticks at one company, starting with the raw wood and ending with packaging.

Manufacturing Costs

Manufacturing costs or product costs include all expenses required to manufacture the product: direct materials, direct labor, and manufacturing overhead. Since process costing assigns the costs to each department, the inventory at the end of the period includes the finished goods inventory, and the work in process inventory for each manufacturing department. For example, using the departments shown in Figure 5.3 , raw materials inventory is the cost paid for the materials that remain in the storeroom until requested.

While still in production, the work in process units are moved from one department to the next until they are completed, so the work in process inventory includes all of the units in the shaping and packaging departments. When the units are completed, they are transferred to finished goods inventory and become costs of goods sold when the product is sold.

When assigning costs to departments, it is important to separate the product costs from the period costs , which are those that are typically related with a particular time period, instead of attached to the production of an asset. Management often needs additional information to make decisions and needs the product costs further categorized as prime costs or conversion costs ( Figure 5.4 ). Prime costs are costs that include the primary (or direct) product costs: direct material and direct labor. Conversion costs are the costs necessary to convert direct materials into a finished product: direct labor and manufacturing overhead, which includes other costs that are not classified as direct materials or direct labor, such as plant insurance, utilities, or property taxes. Also, note that direct labor is considered to be a component of both prime costs and conversion costs.

Job order costing tracks prime costs to assign direct material and direct labor to individual products (jobs). Process costing also tracks prime costs to assign direct material and direct labor to each production department (batch). Manufacturing overhead is another cost of production, and it is applied to products (job order) or departments (process) based on an appropriate activity base.

Ethical Considerations

The unethical bakery accountant 1 , 2.

According to the Federal Bureau of Investigation (FBI), “Sandy Jenkins was a shy, daydreaming accountant at the Collin Street Bakery , the world’s most famous fruitcake company. He was tired of feeling invisible, so he started stealing—and got a little carried away.” Being unethical netted the accountant ten years in federal prison, and his wife Kay was sentenced to five years’ probation and 100 hours of community service, and she was required to write a formal apology to the bakery. According to the FBI, “Jenkins spent over $11 million on a Black American Express card alone—roughly $98,000 per month over the course of the scheme—for a couple that had a legitimate income, through the Bakery, of approximately $50,000 per year.”

How did this happen? Texas Monthly reports that Sandy found a way to write unapproved checks in the accounting system. He implemented his accounting system and created checks that were “signed” by the owner of the company, Bob McNutt. McNutt was perplexed as to why his bakery was not more profitable year after year. The accountant was stealing the money while making the stolen checks appear to be paying for material costs or operating costs. According to Texas Monthly , “Once Sandy was sure that nobody had noticed the first fraudulent check, he tried it again. And again and again. Each time, Sandy would repeat the scheme, pairing his fraudulent check with one that appeared legitimate. Someone would have to closely examine the checks to see any discrepancies, and that seemed unlikely.” The multimillion dollar fraud was exposed when another accountant looked closely at the checks and noticed discrepancies.

Selling and Administrative Expenses

Selling and administrative (S&A) expenses are period costs, which means that they are recorded in the period in which they were incurred. Selling and administrative expenses typically are not directly assigned to the items produced or services provided and include costs of departments not directly associated with manufacturing but necessary to operate the business. The selling costs component of S&A expenses is related to the promotion and sale of the company’s products, while administrative expenses are related to the administration of the company. Some examples of S&A expenses include marketing costs; administration building rent; the chief executive officer’s salary expense; and the accounting, payroll, and data processing department expenses.

These general rules for S&A expenses, however, have their exceptions. For example, some items that are classified as overhead, such as plant insurance, are period costs but are classified as overhead and are attached to the items produced as product costs.

The expense recognition principle is the primary reason to separate the costs of production from the other expenses of the company. This principle requires costs to be recorded in the period in which they are incurred. The costs are expensed when matched to the revenue with which they are associated; this is commonly referred to as having the expenses follow the revenues .

Period costs are expensed during the period in which they are incurred; this allows a company to apply the administrative and other expenses shown on the income statement to the same period in which the company earns income. Under generally accepted accounting principles (GAAP), separating the production costs and assigning them to the department results in the costs of the product staying with the work in process inventory for each department. This follows the expense recognition principle because the cost of the product is expensed when revenue from the sale is recognized.

Equivalent Units

In a process cost system, costs are maintained by each department, and the method for determining the cost per individual unit is different than in a job order costing system. Rock City Percussion uses a process cost system because the drumsticks are produced in batches, and it is not economically feasible to trace the direct labor or direct material, like hickory, to a specific drumstick. Therefore, the costs are maintained by each department, rather than by job, as they are in job order costing.

How does an organization determine the cost of each unit in a process costing environment? The costs in each department are allocated to the number of units produced in a given period. This requires determination of the number of units produced, but this is not always an easy process. At the end of the accounting period, there typically are always units still in production, and these units are only partially complete. Think of it this way: At midnight on the last day of the month, all accounting numbers need to be determined in order to process the financial statements for that month, but the production process does not stop at the end of each accounting period. However, the number of units produced must be calculated at the end of the accounting period to determine the number of equivalent units , or the number of units that would have been produced if the units were produced sequentially and in their entirety in a particular time period. The number of equivalent units is different from the number of actual units and represents the number of full or whole units that could have been produced given the amount of effort applied. To illustrate, consider this analogy. You have five large pizzas that each contained eight slices. Your friends served themselves, and when they were finished eating, there were several partial pizzas left. In equivalent units, determine how many whole pizzas are left if the remaining slices are divided as shown in Figure 5.5 .

- Pie 1 had one slice

- Pie 2 had two slices

- Pie 3 had two slices

- Pie 4 had three slices

- Pie 5 had eight slices

Together, there are sixteen slices left. Since there are eight slices per pizza, the leftover pizza would be considered two full equivalent units of pizzas. The equivalent unit is determined separately for direct materials and for conversion costs as part of the computation of the per-unit cost for both material and conversion costs.

Major Characteristics of Process Costing

Process costing is the optimal system for a company to use when the production process results in many similar units. It is used when production is continuous or occurs in large batches and it is difficult to trace a particular input cost to a specific individual product.

For example, before David and William found ways to make five large cookies per batch, their family always made one large cookie per batch. In order to make five cookies at a time, they had to gather the ingredients and baking materials, including five bowls and five cookie sheets. The exact amount of ingredients for one large cookie was mixed in each separate bowl and then placed on the cookie sheet. When this method was used, it was easy to establish that exactly one egg, two cups of flour, three-quarter cup of chocolate chips, three-quarter cup of sugar, one-quarter teaspoon salt, and so forth, were in each cookie. This made it easy to determine the exact cost of each cookie. But if David and William used one bowl instead of five bowls, measured the ingredients into it and then divided the dough into five large cookies, they could not know for certain that each cookie has exactly two cups of flour. One cookie may have 1 7/8 cups and another may have 1 15/16 cups, and one cookie may have a few more chocolate chips than another. It is also impossible to trace the chocolate chips from each bag to each cookie because the chips were mixed together. These variations do not affect the taste and are not important in this type of accounting. Process costing is optimal when the products are relatively homogenous or indistinguishable from one another, such as bottles of vegetable oil or boxes of cereal.

Often, process costing makes sense if the individual costs or values of each unit are not significant. For example, it would not be cost effective for a restaurant to make each cup of iced tea separately or to track the direct material and direct labor used to make each eight-ounce glass of iced tea served to a customer. In this scenario, job order costing is a less efficient accounting method because it costs more to track the costs per eight ounces of iced tea than the cost of a batch of tea. Overall, when it is difficult or not economically feasible to track the costs of a product individually, process costing is typically the best cost system to use.

Process costing can also accommodate increasingly complex business scenarios. While making drumsticks may sound simple, an immense amount of technology is involved. Rock City Percussion makes 8,000 hickory sticks per day, four days each week. The sticks made of maple and birch are manufactured on the fifth day of the week. It is difficult to tell the first drumstick made on Monday from the 32,000th one made on Thursday, so a computer matches the sticks in pairs based on the tone produced.

Process costing measures and assigns the costs to the associated department. The basic 5A hickory stick consists only of hickory as direct material. The rest of the manufacturing process involves direct labor and manufacturing overhead, so the focus is on properly assigning those costs. Thus, process costing works well for simple production processes such as cereal, rubber, and steel, and for more complicated production processes such as the manufacturing of electronics and watches, if there is a degree of similarity in the production process.

In a process cost system, each department accumulates its costs to compute the value of work in process inventory, so there will be a work in process inventory for each manufacturing or production department as well as an inventory cost for finished goods inventory. Manufacturing departments are often organized by the various stages of the production process. For example, blending, baking, and packaging could each be categorized as manufacturing or production departments for the cookie producer, while cutting, assembly, and finishing could be manufacturing or production departments with accompanying costs for a furniture manufacturer. Each department, or process, will have its own work in process inventory account, but there will only be one finished goods inventory account.

There are two methods used to compute the values in the work in process and finished goods inventories. The first method is the weighted-average method, which includes all costs (costs incurred during the current period and costs incurred during the prior period and carried over to the current period). This method is often favored, because in the process cost production method there often is little product left at the end of the period and most has been transferred out. The second method is the first-in, first-out (FIFO) method, which calculates the unit costs based on the assumption that the first units sold come from the prior period’s work in process that was carried over into the current period and completed. After these units are sold, the newer completed units can then be sold. The theory is similar to the FIFO inventory valuation process that you learned about in Inventory . (Since the FIFO process costing method is more complicated than the weighted-average method, the FIFO method is typically covered in more advanced accounting courses.)

With processing, it is difficult to establish how much of each material, and exactly how much time is in each unit of finished product. This will require the use of the equivalent unit computation, and management selects the method (weighted average or FIFO) that best fits their information system.

Process costing can also be used by service organizations that provide homogeneous services and often do not have inventory to value, such as a hotel reservation system. Although they have no inventory, the hotel might want to know its costs per reservation for a period. They could allocate the total costs incurred by the reservation system based on the number of inquiries they served. For example, assume that in a year they incurred costs of $200,000 and served 50,000 potential guests. They could determine an average cost by dividing costs by number of inquiries, or $200,000/50,000 = $4.00 per potential guest.

In the case of a not-for-profit company, the same process could be used to determine the average costs incurred by a department that performs interviews. The department’s costs would be allocated based on the number of cases processed. For example, assume a not-for-profit pet adoption organization has an annual budget of $180,000 and typically matches 900 shelter animals with new owners each year. The average cost would be $200 per match.

Similarities between Process Costing and Job Order Costing

Both process costing and job order costing maintain the costs of direct material, direct labor, and manufacturing overhead. The process of production does not change because of the costing method. The costing method is chosen based on the production process.

In job order cost production, the costs can be directly traced to the job, and the job cost sheet contains the total expenses for that job. Process costing is optimal when the costs cannot be traced directly to the job. For example, it would be impossible for David and William to trace the exact amount of eggs in each chocolate chip cookie. It is also impossible to trace the exact amount of hickory in a drumstick. Even two sticks made sequentially may have different weights because the wood varies in density. These types of manufacturing are optimal for the process cost system.

The similarities between job order cost systems and process cost systems are the product costs of materials, labor, and overhead, which are used determine the cost per unit, and the inventory values. The differences between the two systems are shown in Table 5.1 .

| Job Order Costing | Process Costing |

|---|---|

| Product costs are traced to the product and recorded on each job’s individual job cost sheet. | Product costs are traced to departments or processes. |

| Each department tracks its expenses and adds them to the job cost sheet. As jobs move from one department to another, the job cost sheet moves to the next department as well. | Each department tracks its expenses, the number of units started or transferred in, and the number of units transferred to the next department. |

| Unit costs are computed using the job cost sheet. | Unit costs are computed using the departmental costs and the equivalent units produced. |

| Finished goods inventory includes the products completed but not sold, and all incomplete jobs are work in process inventory. | Finished goods inventory is the number of units completed at the per unit cost. Work in process inventory is the cost per unit and the equivalent units remaining to be completed. |

Concepts In Practice

Choosing between process costing and job order costing.

Process costing and job order costing are both acceptable methods for tracking costs and production levels. Some companies use a single method, while some companies use both, which creates a hybrid costing system. The system a company uses depends on the nature of the product the company manufactures.

Companies that mass produce a product allocate the costs to each department and use process costing. For example, General Mills uses process costing for its cereal, pasta, baking products, and pet foods. Job order systems are custom orders because the cost of the direct material and direct labor are traced directly to the job being produced. For example, Boeing uses job order costing to manufacture planes.

When a company mass produces parts but allows customization on the final product, both systems are used; this is common in auto manufacturing. Each part of the vehicle is mass produced, and its cost is calculated with process costing. However, specific cars have custom options, so each individual car costs the sum of the specific parts used.

Think It Through

Direct or indirect material.

Around Again is a wooden frame manufacturer. Wood and fastener metals are typically added at the beginning of the process and are easily tracked as direct material. Sometimes, after inspection, the product needs to be reworked and additional pieces are added. Because the frames have already been through each department, the additional work is typically minor and often entails simply adding an additional fastener to keep the back of the frame intact. Other times, all the frame needs is additional glue for a corner piece.

How does a company differentiate between direct and indirect material? Many direct material costs, as the wood in the frame, are easy to identify as direct costs because the material is identifiable in the final product. But not all readily identifiable material is a direct material cost.

Technology makes it easy to track costs as small as one fastener or ounce of glue. However, if each fastener had to be requisitioned and each ounce of glue recorded, the product would take longer to make and the direct labor cost would be higher. So, while it is possible to track the cost of each individual product, the additional information may not be worth the additional expense. Managerial accountants work with management to decide which products should be accounted for as direct material and tracked individually, versus which should be considered indirect material and allocated to the departments through overhead application.

Should Around Again consider the fasteners or glue added after inspection as direct material or indirect material?

- 1 Katy Vine. “Just Desserts.” Texas Monthly . October 2010. https://features.texasmonthly.com/editorial/just-desserts/

- 2 Federal Bureau of Investigation (FBI). “Former Collin Street Bakery Executive and Wife Sentenced.” September 16, 2015. https://www.fbi.gov/contact-us/field-offices/dallas/news/press-releases/former-collin-street-bakery-executive-and-wife-sentenced

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution-NonCommercial-ShareAlike License and you must attribute OpenStax.

Access for free at https://openstax.org/books/principles-managerial-accounting/pages/1-why-it-matters

- Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper

- Publisher/website: OpenStax

- Book title: Principles of Accounting, Volume 2: Managerial Accounting

- Publication date: Feb 14, 2019

- Location: Houston, Texas

- Book URL: https://openstax.org/books/principles-managerial-accounting/pages/1-why-it-matters

- Section URL: https://openstax.org/books/principles-managerial-accounting/pages/5-1-compare-and-contrast-job-order-costing-and-process-costing

© Jul 16, 2024 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

Verifying that you are not a robot...

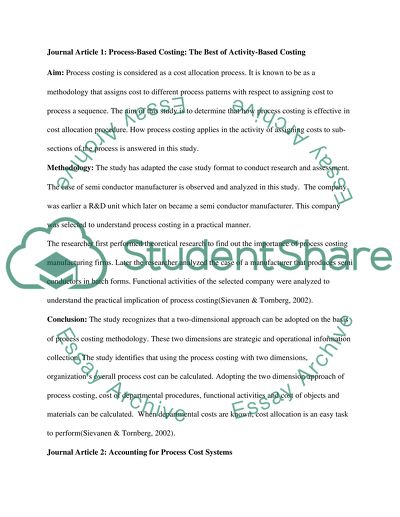

Job Order Costing to Process Costing Methods Essay

- To find inspiration for your paper and overcome writer’s block

- As a source of information (ensure proper referencing)

- As a template for you assignment

The system works best in

Method to use, reference list.

Job order costing can be defined as a method of allocating costs to cost units that are large and can be identified separately. The cost units should be able to be identified and related to a specific order. The products produced in this process should be related to a certain order or they are distinctive in nature. In this costing system, we have direct expenses, overheads, the order price, plants or assets that relate to the job and other costs that are specifically for the job. It is usually used for contract costing where a separate account is created for the contract. The approach of job costing involves identification of the job, identification of direct costs, selection overhead cost-allocation base and allocation of these costs (Cokins, 2001).

Process costing is the costing system where allocation of cost is to a process of production and units produced passes through many processes. In this costing system, the processes are well defined and the finished output of one process becomes the input of another. All costs both direct and indirect are charged to the process of production. It is used in those products with have continuous flow of identical products and it is hard to distinguish the units. The best examples of this include, oil refinery, paint manufacture, ink, textiles and many others.

In the process costing, there may be defects of products or services. A rate of defects regarded as normal in the past is no longer tolerable. Managers know that reducing defects reduces costs and makes their company more competitive. After defects have been discovered in process, rework, or scrap is possible. Defects of units are those products which are fully or partially completed but do not meet the standards required by customers for good units and that are discarded or sold for reduced price. If the can be improved they are returned to the system for reworking. Some amounts of spoilage, rework, or scrap are inherent in many production processes. An example of spoilage and rework occurs in the manufacture of high standards, but only at a considerable cost. Some amount of rock, which is scrap, is inevitable, but its volume can often be decreased (Michael and Tse, 2009).

Normal spoilage is spoilage inherent in particular production process that arises even under efficient operating conditions. Depending on the production process, management decides the spoilage it considers normal. Costs of normal spoilage are typically included, as a component of the costs of good units manufactured between good units cannot be made without also making some units that are spoiled (Eliyahu and Goldratt, 2004).

Abnormal spoilage is spoilage that would not arise under efficient operating conditions. It is not inherent in a particular process. The spoilage because of machine breakdowns and operator errors are abnormal spoilage. Abnormal spoilage is usually regarded as avoidable and controllable. Line operators and other plant personnel can generally decrease or eliminate abnormal spoilage by identifying reasons for machine breakdowns, accidents, and the like, and taking steps to prevent their recurrence. To highlight the effect of abnormal spoilage in a loss from Abnormal Spoilage account, this appears as a separate line item in the income statement.

We have already said that units of abnormal spoilage should be counted and recorded separately. These units can either be counted or not counted when computing output units-physical or equivalent- in a process costing system. An inspection point is the stage of the production cycle at which products are examined to occur at the stage of completion where inspection takes place. That is because spoilage is not defected. As a result, the spoiled units are assumed 100% complete with respect to direct materials (The ICFAI University, 2004).

The companies that use process costing are those companies that manufacture chemicals, soaps, spirits, paper, paint, oil products, biscuits, textiles and many companies that manufacture liquids.

Job costing is used in contracts and manufacturing of special orders.