What is a Business Plan? Definition, Tips, and Templates

Published: June 28, 2024

Years ago, I had an idea to launch a line of region-specific board games. I knew there was a market for games that celebrated local culture and heritage. I was so excited about the concept and couldn't wait to get started.

But my idea never took off. Why? Because I didn‘t have a plan. I lacked direction, missed opportunities, and ultimately, the venture never got off the ground.

And that’s exactly why a business plan is important. It cements your vision, gives you clarity, and outlines your next step.

In this post, I‘ll explain what a business plan is, the reasons why you’d need one, identify different types of business plans, and what you should include in yours.

Table of Contents

What is a business plan?

What is a business plan used for.

- Business Plan Template [Download Now]

Purposes of a Business Plan

What does a business plan need to include, types of business plans.

.webp)

Free Business Plan Template

The essential document for starting a business -- custom built for your needs.

- Outline your idea.

- Pitch to investors.

- Secure funding.

- Get to work!

Download Free

All fields are required.

You're all set!

Click this link to access this resource at any time.

A business plan is a comprehensive document that outlines a company's goals, strategies, and financial projections. It provides a detailed description of the business, including its products or services, target market, competitive landscape, and marketing and sales strategies. The plan also includes a financial section that forecasts revenue, expenses, and cash flow, as well as a funding request if the business is seeking investment.

The business plan is an undeniably critical component to getting any company off the ground. It's key to securing financing, documenting your business model, outlining your financial projections, and turning that nugget of a business idea into a reality.

The purpose of a business plan is three-fold: It summarizes the organization’s strategy in order to execute it long term, secures financing from investors, and helps forecast future business demands.

Business Plan Template [ Download Now ]

Don't forget to share this post!

Related articles.

18 of My Favorite Sample Business Plans & Examples For Your Inspiration

23 of My Favorite Free Marketing Newsletters

![business plan activity meaning The 8 Best Free Flowchart Templates [+ Examples]](https://www.hubspot.com/hubfs/free-flowchart-template-1-20240716-6679104-1.webp)

The 8 Best Free Flowchart Templates [+ Examples]

![business plan activity meaning 7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]](https://www.hubspot.com/hubfs/gantt-chart-1-20240625-3861486-1.webp)

7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]

![business plan activity meaning How to Write an Executive Summary Execs Can't Ignore [+ 5 Top Examples]](https://www.hubspot.com/hubfs/executive-summary-example_5.webp)

How to Write an Executive Summary Execs Can't Ignore [+ 5 Top Examples]

20 Free & Paid Small Business Tools for Any Budget

Maximizing Your Social Media Strategy: The Top Aggregator Tools to Use

The Content Aggregator Guide for 2024

16 Best Screen Recorders to Use for Collaboration

2 Essential Templates For Starting Your Business

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

Business Plan Example and Template

Learn how to create a business plan

What is a Business Plan?

A business plan is a document that contains the operational and financial plan of a business, and details how its objectives will be achieved. It serves as a road map for the business and can be used when pitching investors or financial institutions for debt or equity financing .

A business plan should follow a standard format and contain all the important business plan elements. Typically, it should present whatever information an investor or financial institution expects to see before providing financing to a business.

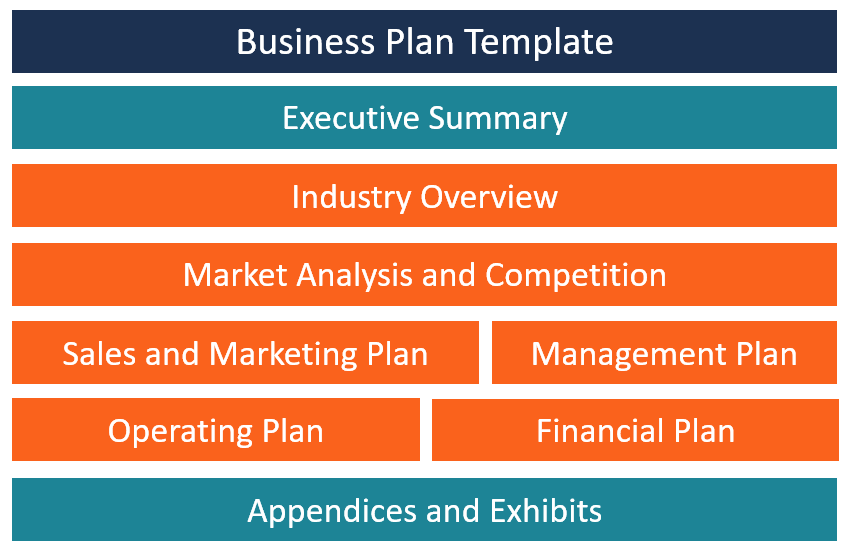

Contents of a Business Plan

A business plan should be structured in a way that it contains all the important information that investors are looking for. Here are the main sections of a business plan:

1. Title Page

The title page captures the legal information of the business, which includes the registered business name, physical address, phone number, email address, date, and the company logo.

2. Executive Summary

The executive summary is the most important section because it is the first section that investors and bankers see when they open the business plan. It provides a summary of the entire business plan. It should be written last to ensure that you don’t leave any details out. It must be short and to the point, and it should capture the reader’s attention. The executive summary should not exceed two pages.

3. Industry Overview

The industry overview section provides information about the specific industry that the business operates in. Some of the information provided in this section includes major competitors, industry trends, and estimated revenues. It also shows the company’s position in the industry and how it will compete in the market against other major players.

4. Market Analysis and Competition

The market analysis section details the target market for the company’s product offerings. This section confirms that the company understands the market and that it has already analyzed the existing market to determine that there is adequate demand to support its proposed business model.

Market analysis includes information about the target market’s demographics , geographical location, consumer behavior, and market needs. The company can present numbers and sources to give an overview of the target market size.

A business can choose to consolidate the market analysis and competition analysis into one section or present them as two separate sections.

5. Sales and Marketing Plan

The sales and marketing plan details how the company plans to sell its products to the target market. It attempts to present the business’s unique selling proposition and the channels it will use to sell its goods and services. It details the company’s advertising and promotion activities, pricing strategy, sales and distribution methods, and after-sales support.

6. Management Plan

The management plan provides an outline of the company’s legal structure, its management team, and internal and external human resource requirements. It should list the number of employees that will be needed and the remuneration to be paid to each of the employees.

Any external professionals, such as lawyers, valuers, architects, and consultants, that the company will need should also be included. If the company intends to use the business plan to source funding from investors, it should list the members of the executive team, as well as the members of the advisory board.

7. Operating Plan

The operating plan provides an overview of the company’s physical requirements, such as office space, machinery, labor, supplies, and inventory . For a business that requires custom warehouses and specialized equipment, the operating plan will be more detailed, as compared to, say, a home-based consulting business. If the business plan is for a manufacturing company, it will include information on raw material requirements and the supply chain.

8. Financial Plan

The financial plan is an important section that will often determine whether the business will obtain required financing from financial institutions, investors, or venture capitalists. It should demonstrate that the proposed business is viable and will return enough revenues to be able to meet its financial obligations. Some of the information contained in the financial plan includes a projected income statement , balance sheet, and cash flow.

9. Appendices and Exhibits

The appendices and exhibits part is the last section of a business plan. It includes any additional information that banks and investors may be interested in or that adds credibility to the business. Some of the information that may be included in the appendices section includes office/building plans, detailed market research , products/services offering information, marketing brochures, and credit histories of the promoters.

Business Plan Template

Here is a basic template that any business can use when developing its business plan:

Section 1: Executive Summary

- Present the company’s mission.

- Describe the company’s product and/or service offerings.

- Give a summary of the target market and its demographics.

- Summarize the industry competition and how the company will capture a share of the available market.

- Give a summary of the operational plan, such as inventory, office and labor, and equipment requirements.

Section 2: Industry Overview

- Describe the company’s position in the industry.

- Describe the existing competition and the major players in the industry.

- Provide information about the industry that the business will operate in, estimated revenues, industry trends, government influences, as well as the demographics of the target market.

Section 3: Market Analysis and Competition

- Define your target market, their needs, and their geographical location.

- Describe the size of the market, the units of the company’s products that potential customers may buy, and the market changes that may occur due to overall economic changes.

- Give an overview of the estimated sales volume vis-à-vis what competitors sell.

- Give a plan on how the company plans to combat the existing competition to gain and retain market share.

Section 4: Sales and Marketing Plan

- Describe the products that the company will offer for sale and its unique selling proposition.

- List the different advertising platforms that the business will use to get its message to customers.

- Describe how the business plans to price its products in a way that allows it to make a profit.

- Give details on how the company’s products will be distributed to the target market and the shipping method.

Section 5: Management Plan

- Describe the organizational structure of the company.

- List the owners of the company and their ownership percentages.

- List the key executives, their roles, and remuneration.

- List any internal and external professionals that the company plans to hire, and how they will be compensated.

- Include a list of the members of the advisory board, if available.

Section 6: Operating Plan

- Describe the location of the business, including office and warehouse requirements.

- Describe the labor requirement of the company. Outline the number of staff that the company needs, their roles, skills training needed, and employee tenures (full-time or part-time).

- Describe the manufacturing process, and the time it will take to produce one unit of a product.

- Describe the equipment and machinery requirements, and if the company will lease or purchase equipment and machinery, and the related costs that the company estimates it will incur.

- Provide a list of raw material requirements, how they will be sourced, and the main suppliers that will supply the required inputs.

Section 7: Financial Plan

- Describe the financial projections of the company, by including the projected income statement, projected cash flow statement, and the balance sheet projection.

Section 8: Appendices and Exhibits

- Quotes of building and machinery leases

- Proposed office and warehouse plan

- Market research and a summary of the target market

- Credit information of the owners

- List of product and/or services

Related Readings

Thank you for reading CFI’s guide to Business Plans. To keep learning and advancing your career, the following CFI resources will be helpful:

- Corporate Structure

- Three Financial Statements

- Business Model Canvas Examples

- See all management & strategy resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Business Plan, Step by Step

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is a business plan?

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

LLC Formation

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

On a similar note...

Find small-business financing

Compare multiple lenders that fit your business

- Customer Reviews

- Net 30 Account

- Wise Services

- Steps & Timeline

- Work at a Glance

- Market Research at a Glance

- Business Plan Writing Services

- Bank Business Plan

- Investor Business Plan

- Franchise Business Plan

- Cannabis Business Plan

- Strategic Business Plan

- Corporate Business Plan

- Merge and Acquisition Business Plan (M&A)

- Private Placement Memorandums (PPM)

- Sample Business Plans

- Professional Feasibility Study

- PowerPoint Presentations

- Pitch Deck Presentation Services

- Business Plan Printing

- Market Research

- L-1 Business Plan

- E-2 Business Plan

- EB-5 Business Plan

- EB-5 Regional Centers

- Immigration Attorneys

- Nonprofit Business Plan

- Exit Business Planning

- Business Planning

- Business Formation

- Business License

- Business Website

- Business Branding

- Business Bank Account

- Digital Marketing

- Business Funding Resources

- Small Business Loans

- Venture Capital

- Net 30 Apply

What is a business plan? Definition, Purpose, and Types

In the world of business, a well-thought-out plan is often the key to success. This plan, known as a business plan, is a comprehensive document that outlines a company’s goals, strategies , and financial projections. Whether you’re starting a new business or looking to expand an existing one, a business plan is an essential tool.

As a business plan writer and consultant , I’ve crafted over 15,000 plans for a diverse range of businesses. In this article, I’ll be sharing my wealth of experience about what a business plan is, its purpose, and the step-by-step process of creating one. By the end, you’ll have a thorough understanding of how to develop a robust business plan that can drive your business to success.

What is a business plan?

A business plan is a roadmap for your business. It outlines your goals, strategies, and how you plan to achieve them. It’s a living document that you can update as your business grows and changes.

Looking for someone to write a business plan?

Find professional business plan writers for your business success.

Purposes of a Business Plan

These are the following purpose of business plan:

- Attract investors and lenders: If you’re seeking funding for your business , a business plan is a must-have. Investors and lenders want to see that you have a clear plan for how you’ll use their money to grow your business and generate revenue.

- Get organized and stay on track: Writing a business plan forces you to think through all aspects of your business, from your target market to your marketing strategy. This can help you identify any potential challenges and opportunities early on, so you can develop a plan to address them.

- Make better decisions: A business plan can help you make better decisions about your business by providing you with a framework to evaluate different options. For example, if you’re considering launching a new product, your business plan can help you assess the potential market demand, costs, and profitability.

What are the essential components of a business plan?

Executive summary

The executive summary is the most important part of your business plan, even though it’s the last one you’ll write. It’s the first section that potential investors or lenders will read, and it may be the only one they read. The executive summary sets the stage for the rest of the document by introducing your company’s mission or vision statement, value proposition, and long-term goals.

Business description or overview

The business description section of your business plan should introduce your business to the reader in a compelling and concise way. It should include your business name, years in operation, key offerings, positioning statement, and core values (if applicable). You may also want to include a short history of your company.

Product and price

In this section, the company should describe its products or services , including pricing, product lifespan, and unique benefits to the consumer. Other relevant information could include production and manufacturing processes, patents, and proprietary technology.

Competitive analysis

Every industry has competitors, even if your business is the first of its kind or has the majority of the market share. In the competitive analysis section of your business plan, you’ll objectively assess the industry landscape to understand your business’s competitive position. A SWOT analysis is a structured way to organize this section.

Target market

Your target market section explains the core customers of your business and why they are your ideal customers. It should include demographic, psychographic, behavioral, and geographic information about your target market.

Marketing plan

Marketing plan describes how the company will attract and retain customers, including any planned advertising and marketing campaigns . It also describes how the company will distribute its products or services to consumers.

After outlining your goals, validating your business opportunity, and assessing the industry landscape, the team section of your business plan identifies who will be responsible for achieving your goals. Even if you don’t have your full team in place yet, investors will be impressed by your clear understanding of the roles that need to be filled.

Financial plan

In the financial plan section,established businesses should provide financial statements , balance sheets , and other financial data. New businesses should provide financial targets and estimates for the first few years, and may also request funding.

Funding requirements

Since one goal of a business plan is to secure funding from investors , you should include the amount of funding you need, why you need it, and how long you need it for.

- Tip: Use bullet points and numbered lists to make your plan easy to read and scannable.

Access specialized business plan writing service now!

Types of business plan.

Business plans can come in many different formats, but they are often divided into two main types: traditional and lean startup. The U.S. Small Business Administration (SBA) says that the traditional business plan is the more common of the two.

Lean startup business plans

Lean startup business plans are short (as short as one page) and focus on the most important elements. They are easy to create, but companies may need to provide more information if requested by investors or lenders.

Traditional business plans

Traditional business plans are longer and more detailed than lean startup business plans, which makes them more time-consuming to create but more persuasive to potential investors. Lean startup business plans are shorter and less detailed, but companies should be prepared to provide more information if requested.

Need Guidance with Your Business Plan?

Access 14 free business plan samples!

How often should a business plan be reviewed and revised?

A business plan should be reviewed and revised at least annually, or more often if the business is experiencing significant changes. This is because the business landscape is constantly changing, and your business plan needs to reflect those changes in order to remain relevant and effective.

Here are some specific situations in which you should review and revise your business plan:

- You have launched a new product or service line.

- You have entered a new market.

- You have experienced significant changes in your customer base or competitive landscape.

- You have made changes to your management team or organizational structure.

- You have raised new funding.

What are the key elements of a lean startup business plan?

A lean startup business plan is a short and simple way for a company to explain its business, especially if it is new and does not have a lot of information yet. It can include sections on the company’s value proposition, major activities and advantages, resources, partnerships, customer segments, and revenue sources.

What are some of the reasons why business plans don't succeed?

- Unrealistic assumptions: Business plans are often based on assumptions about the market, the competition, and the company’s own capabilities. If these assumptions are unrealistic, the plan is doomed to fail.

- Lack of focus: A good business plan should be focused on a specific goal and how the company will achieve it. If the plan is too broad or tries to do too much, it is unlikely to be successful.

- Poor execution: Even the best business plan is useless if it is not executed properly. This means having the right team in place, the necessary resources, and the ability to adapt to changing circumstances.

- Unforeseen challenges: Every business faces challenges that could not be predicted or planned for. These challenges can be anything from a natural disaster to a new competitor to a change in government regulations.

What are the benefits of having a business plan?

- It helps you to clarify your business goals and strategies.

- It can help you to attract investors and lenders.

- It can serve as a roadmap for your business as it grows and changes.

- It can help you to make better business decisions.

How to write a business plan?

There are many different ways to write a business plan, but most follow the same basic structure. Here is a step-by-step guide:

- Executive summary.

- Company description.

- Management and organization description.

- Financial projections.

How to write a business plan step by step?

Start with an executive summary, then describe your business, analyze the market, outline your products or services, detail your marketing and sales strategies, introduce your team, and provide financial projections.

Why do I need a business plan for my startup?

A business plan helps define your startup’s direction, attract investors, secure funding, and make informed decisions crucial for success.

What are the key components of a business plan?

Key components include an executive summary, business description, market analysis, products or services, marketing and sales strategy, management and team, financial projections, and funding requirements.

Can a business plan help secure funding for my business?

Yes, a well-crafted business plan demonstrates your business’s viability, the use of investment, and potential returns, making it a valuable tool for attracting investors and lenders.

Quick Links

- Investor Business Plans

- M&A Business Plan

- Private Placement

- Feasibility Study

- Hire a Business Plan Writer

- Business Valuation Calculator

- Business Plan Examples

- Real Estate Business Plan

- Business Plan Template

- Business Plan Pricing Guide

- Business Plan Makeover

- SBA Loans, Bank Funding & Business Credit

- Finding & Qualifying for Business Grants

- Leadership for the New Manager

- Content Marketing for Beginners

- All About Crowdfunding

- EB-5 Regional Centers, A Step-By-Step Guide

- Logo Designer

- Landing Page

- PPC Advertising

- Business Entity

- Business Licensing

- Virtual Assistant

- Business Phone

- Business Address

- E-1 Visa Business Plan

- EB1-A Visa Business Plan

- EB1-C Visa Business Plan

- EB2-NIW Business Plan

- H1B Visa Business Plan

- O1 Visa Business Plan

- Business Brokers

- Merger & Acquisition Advisors

- Franchisors

Proud Sponsor of

- 1-800-496-1056

- (613) 800-0227

- +44 (1549) 409190

- +61 (2) 72510077

| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

How To Write A Business Plan (2024 Guide)

Updated: Apr 17, 2024, 11:59am

Table of Contents

Brainstorm an executive summary, create a company description, brainstorm your business goals, describe your services or products, conduct market research, create financial plans, bottom line, frequently asked questions.

Every business starts with a vision, which is distilled and communicated through a business plan. In addition to your high-level hopes and dreams, a strong business plan outlines short-term and long-term goals, budget and whatever else you might need to get started. In this guide, we’ll walk you through how to write a business plan that you can stick to and help guide your operations as you get started.

Featured Partners

ZenBusiness

$0 + State Fees

Varies By State & Package

On ZenBusiness' Website

On LegalZoom's Website

Northwest Registered Agent

$39 + State Fees

On Northwest Registered Agent's Website

$0 + State Fee

On Formations' Website

Drafting the Summary

An executive summary is an extremely important first step in your business. You have to be able to put the basic facts of your business in an elevator pitch-style sentence to grab investors’ attention and keep their interest. This should communicate your business’s name, what the products or services you’re selling are and what marketplace you’re entering.

Ask for Help

When drafting the executive summary, you should have a few different options. Enlist a few thought partners to review your executive summary possibilities to determine which one is best.

After you have the executive summary in place, you can work on the company description, which contains more specific information. In the description, you’ll need to include your business’s registered name , your business address and any key employees involved in the business.

The business description should also include the structure of your business, such as sole proprietorship , limited liability company (LLC) , partnership or corporation. This is the time to specify how much of an ownership stake everyone has in the company. Finally, include a section that outlines the history of the company and how it has evolved over time.

Wherever you are on the business journey, you return to your goals and assess where you are in meeting your in-progress targets and setting new goals to work toward.

Numbers-based Goals

Goals can cover a variety of sections of your business. Financial and profit goals are a given for when you’re establishing your business, but there are other goals to take into account as well with regard to brand awareness and growth. For example, you might want to hit a certain number of followers across social channels or raise your engagement rates.

Another goal could be to attract new investors or find grants if you’re a nonprofit business. If you’re looking to grow, you’ll want to set revenue targets to make that happen as well.

Intangible Goals

Goals unrelated to traceable numbers are important as well. These can include seeing your business’s advertisement reach the general public or receiving a terrific client review. These goals are important for the direction you take your business and the direction you want it to go in the future.

The business plan should have a section that explains the services or products that you’re offering. This is the part where you can also describe how they fit in the current market or are providing something necessary or entirely new. If you have any patents or trademarks, this is where you can include those too.

If you have any visual aids, they should be included here as well. This would also be a good place to include pricing strategy and explain your materials.

This is the part of the business plan where you can explain your expertise and different approach in greater depth. Show how what you’re offering is vital to the market and fills an important gap.

You can also situate your business in your industry and compare it to other ones and how you have a competitive advantage in the marketplace.

Other than financial goals, you want to have a budget and set your planned weekly, monthly and annual spending. There are several different costs to consider, such as operational costs.

Business Operations Costs

Rent for your business is the first big cost to factor into your budget. If your business is remote, the cost that replaces rent will be the software that maintains your virtual operations.

Marketing and sales costs should be next on your list. Devoting money to making sure people know about your business is as important as making sure it functions.

Other Costs

Although you can’t anticipate disasters, there are likely to be unanticipated costs that come up at some point in your business’s existence. It’s important to factor these possible costs into your financial plans so you’re not caught totally unaware.

Business plans are important for businesses of all sizes so that you can define where your business is and where you want it to go. Growing your business requires a vision, and giving yourself a roadmap in the form of a business plan will set you up for success.

How do I write a simple business plan?

When you’re working on a business plan, make sure you have as much information as possible so that you can simplify it to the most relevant information. A simple business plan still needs all of the parts included in this article, but you can be very clear and direct.

What are some common mistakes in a business plan?

The most common mistakes in a business plan are common writing issues like grammar errors or misspellings. It’s important to be clear in your sentence structure and proofread your business plan before sending it to any investors or partners.

What basic items should be included in a business plan?

When writing out a business plan, you want to make sure that you cover everything related to your concept for the business, an analysis of the industry―including potential customers and an overview of the market for your goods or services―how you plan to execute your vision for the business, how you plan to grow the business if it becomes successful and all financial data around the business, including current cash on hand, potential investors and budget plans for the next few years.

- Best VPN Services

- Best Project Management Software

- Best Web Hosting Services

- Best Antivirus Software

- Best LLC Services

- Best POS Systems

- Best Business VOIP Services

- Best Credit Card Processing Companies

- Best CRM Software for Small Business

- Best Fleet Management Software

- Best Business Credit Cards

- Best Business Loans

- Best Business Software

- Best Business Apps

- Best Free Software For Business

- How to Start a Business

- How To Make A Small Business Website

- How To Trademark A Name

- What Is An LLC?

- How To Set Up An LLC In 7 Steps

- What is Project Management?

- How To Write An Effective Business Proposal

What Is SNMP? Simple Network Management Protocol Explained

What Is A Single-Member LLC? Definition, Pros And Cons

What Is Penetration Testing? Definition & Best Practices

What Is Network Access Control (NAC)?

What Is Network Segmentation?

How To Start A Business In Louisiana (2024 Guide)

Julia is a writer in New York and started covering tech and business during the pandemic. She also covers books and the publishing industry.

- Search Search Please fill out this field.

- Building Your Business

What Is a Business Plan?

Business Plan Explained in Less Than 5 Minutes

:max_bytes(150000):strip_icc():format(webp)/KhadijaKhartit-4f144e2b63ee4dd4af60ac8a02233c50.jpg)

Definition and Examples of a Business Plan

How a business plan works, types of business plans, business plan vs. business model.

Geber86 / Getty Images

A business plan is a detailed written document that describes your business’s activities, goals, and strategy. A strong plan outlines everything from the products a company sells to the executive summary to the overall management. In essence, a business plan should guide a founder’s actions through each stage of growth

Think of your business plan as a road map. It documents the various stages of starting and running your business, including business activities and objectives. Business plans create the structure you need to make decisions by outlining the financial and operational goals you’re striving toward.

One of the most common reasons for crafting a business plan is to attract investors—and, in return, receive funding. As an early stage company, for example, you may leverage your business plan to convince investors or banks that your entity is credible and worthy of funding. The business plan should prove that their money will be returned .

A business plan can also be useful for when a well-developed company goes through a merger or acquisition . As outlined by the U.S. Small Business Administration (SBA), a merger creates a new entity via the combination of two businesses. An acquisition, on the other hand, is when a company is purchased and absorbed into an existing business. In either case, a business plan helps establish relationships between business entities, making a merger or acquisition more likely.

- Alternate name : Strategic plan

A business plan is a formalized outline of the business operations, finances, and goals you aim to achieve to be a successful company. When designing a business plan, companies have leeway for how long, short, or detailed it can be. So long as it outlines the foundational aspects of the business, in most cases, it will be effective.

The most common type of business plan is a traditional business plan. This style tends to have the following common elements, generally in this order.

- Executive summary : Tells your reader why your company will be successful. Includes the company’s mission statement , product information, and basics regarding the business structure.

- Company description : Where you brag about your entity’s strengths. Answer the question, what problem is your team solving?

- Market analysis : A deep dive into your industry and the competition. Consider why competitors are successful. How can your offering do it better? If applicable, how can you enhance the experience for the consumer?

- Management plan : Outlines leadership structure of the company and may be best detailed as a chart. This way, readers can see exactly who is planning to run the company and how they will impact growth.

- Marketing and sales plan : Details how you’ll attract consumers with your product or service, and how you will retain those customers. All strategies outlined in this section, such as the use of digital marketing , will be referenced in your financial plan.

- Funding request : For those companies asking for funding, this is where you’ll detail the amount of funding you’ll need to achieve your goals. Clearly explain how much you need and what it will be used for.

- Financial plan : Convinces the reader that your company is financially stable and can turn a profit . You will need to include a balance sheet , an income statement, and the cash flow statement (or cash flow projection, in the case of a new venture).

- Appendix : Where any supporting documents, such as legal documents, licenses of employees, and pictures of the product will be included.

Your company’s business plan should fit your needs, which will often depend on what stage of growth you are in. If you are considering starting a new venture, for example, writing a detailed business plan can help prove if your concept is viable or not.

If your business is seeking financial capital, though, you will want your business plan to be investor-ready. This will require you to have a funding request section, which would be placed right above your financial plan.

You should avoid using lofty terms or technical jargon that those outside your team won’t understand. A business plan is meant to be shared with those inside and outside your organization. Simple and effective language is best.

Your business’s stage impacts the length and detail of a business plan. As discussed, a traditional plan follows a detailed structure, from the executive summary to the appendix. It is a lengthier document, often amounting to dozens of pages, and is often used when seeking funding to prove business viability. In most cases, crafting a traditional plan will take lots of due diligence work.

The other main type of business plan is a lean startup plan. A lean startup plan is much more high-level and shorter than the traditional version. Companies just starting development will often create a lean startup plan to help them navigate where they should start. These can be as short as one or two pages.

A lean plan will include the following elements.

- Key partnerships : Notes other services or businesses you will work with, such as manufacturers and suppliers.

- Key activities and resources : Outlines how your company will gain a competitive advantage and create value for your consumers. Resources you may leverage include capital, staff, or intellectual property.

- Value proposition : Clearly defines the unique value your company offers.

- Customer relationships : Details the customer experience from start to finish.

- Channels : How will you stay connected with your customers? Detail those methods here.

- Cost structure and revenue streams : Details the most significant costs you will face as well as how your business will actually make money.

Remember that business plans are meant to change as your company grows or pivots. You should actively review and edit your business plan to keep it up to date with business activities. For example, you may start with a lean plan and move to a traditional plan when you hit the fundraising stage.

| Describes a business’s operations and objectives, including financial goals | Describes the method by which a company generates profits |

| Is the structure of the business | Is the foundation of the business |

| Sections include mission statement, market analysis, and financial plan | Examples include retailer, franchise, and distributor |

| Needs review and revisions over time | Needs review and revisions over time |

A business plan may often be confused with a business model, and it is easy to understand why. Simply put, a business plan is the holistic overview of the business, while a business model is a skeleton for how money will be made.

Key Takeaways

- A business plan is a comprehensive document that outlines a business’s operations, finances, and goals. It guides the business’s day-to-day decisions.

- A business plan is necessary for your company’s success, as it creates a path to scalability.

- There are two main types of business plans: a traditional business plan and a lean startup plan.

- A traditional business plan will be essential when you begin to seek debt or equity capital for your company.

U.S. Small Business Administration. “ Merge and Acquire Businesses .” Accessed June 8, 2021.

U.S. Small Business Administration. " Write Your Business Plan ." Accessed June 8, 2021.

Flash Sale Savings ⚡

up to 60% off LivePlan Premium. Save Now

0 results have been found for “”

Return to blog home

What Is a Business Plan? Definition and Planning Essentials Explained

Posted august 1, 2024 by kody wirth.

What is a business plan? It’s the roadmap for your business. The outline of your goals, objectives, and the steps you’ll take to get there. It describes the structure of your organization, how it operates, as well as the financial expectations and actual performance.

A business plan can help you explore ideas, successfully start a business, manage operations, and pursue growth. In short, a business plan is a lot of different things. It’s more than just a stack of paper and can be one of your most effective tools as a business owner.

Let’s explore the basics of business planning, the structure of a traditional plan, your planning options, and how you can use your plan to succeed.

What is a business plan?

A business plan is a document that explains how your business operates. It summarizes your business structure, objectives, milestones, and financial performance. Again, it’s a guide that helps you, and anyone else, better understand how your business will succeed.

Why do you need a business plan?

The primary purpose of a business plan is to help you understand the direction of your business and the steps it will take to get there. Having a solid business plan can help you grow up to 30% faster , and according to our own 2021 Small Business research working on a business plan increases confidence regarding business health—even in the midst of a crisis.

These benefits are directly connected to how writing a business plan makes you more informed and better prepares you for entrepreneurship. It helps you reduce risk and avoid pursuing potentially poor ideas. You’ll also be able to more easily uncover your business’s potential.

The biggest mistake you can make is not writing a business plan, and the second is never updating it. By regularly reviewing your plan, you can understand what parts of your strategy are working and those that are not.

That just scratches the surface of why having a plan is valuable. Check out our full write-up for fifteen more reasons why you need a business plan .

What can you do with your plan?

So what can you do with a business plan once you’ve created it? It can be all too easy to write a plan and just let it be. Here are just a few ways you can leverage your plan to benefit your business.

Test an idea

Writing a plan isn’t just for those who are ready to start a business. It’s just as valuable for those who have an idea and want to determine whether it’s actually possible. By writing a plan to explore the validity of an idea, you are working through the process of understanding what it would take to be successful.

Market and competitive research alone can tell you a lot about your idea.

- Is the marketplace too crowded?

- Is the solution you have in mind not really needed?

Add in the exploration of milestones, potential expenses, and the sales needed to attain profitability, and you can paint a pretty clear picture of your business’s potential.

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Document your strategy and goals

Understanding where you’re going and how you’re going to get there is vital for those starting or managing a business. Writing your plan helps you do that. It ensures that you consider all aspects of your business, know what milestones you need to hit, and can effectively make adjustments if that doesn’t happen.

With a plan in place, you’ll know where you want your business to go and how you’ve performed in the past. This alone prepares you to take on challenges, review what you’ve done before, and make the right adjustments.

Pursue funding

Even if you do not intend to pursue funding right away, having a business plan will prepare you for it. It will ensure that you have all of the information necessary to submit a loan application and pitch to investors.

So, rather than scrambling to gather documentation and write a cohesive plan once it’s relevant, you can keep it up-to-date and attempt to attain funding. Just add a use of funds report to your financial plan and you’ll be ready to go.

The benefits of having a plan don’t stop there. You can then use your business plan to help you manage the funding you receive. You’ll not only be able to easily track and forecast how you’ll use your funds but also easily report on how it’s been used.

Better manage your business

A solid business plan isn’t meant to be something you do once and forget about. Instead, it should be a useful tool that you can regularly use to analyze performance, make strategic decisions, and anticipate future scenarios. It’s a document that you should regularly update and adjust as you go to better fit the actual state of your business.

Doing so makes it easier to understand what’s working and what’s not. It helps you understand if you’re truly reaching your goals or if you need to make further adjustments. Having your plan in place makes that process quicker, more informative, and leaves you with far more time to actually spend running your business.

What should your business plan include?

The content and structure of your business plan should include anything that will help you use it effectively. That being said, there are some key elements that you should cover and that investors will expect to see.

Executive summary

The executive summary is a simple overview of your business and your overall plan. It should serve as a standalone document that provides enough detail for anyone—including yourself, team members, or investors—to fully understand your business strategy. Make sure to cover:

- The problem you’re solving

- A description of your product or service

- Your target market

- Organizational structure

- A financial summary

- Necessary funding requirements.

This will be the first part of your plan, but it’s easiest to write it after you’ve created your full plan.

Products & Services

When describing your products or services, you need to start by outlining the problem you’re solving and why what you offer is valuable. This is where you’ll also address current competition in the market and any competitive advantages your products or services bring to the table.

Lastly, outline the steps or milestones you’ll need to hit to launch your business successfully. If you’ve already achieved some initial milestones, like taking pre-orders or early funding, be sure to include them here to further prove your business’s validity.

Market analysis

A market analysis is a qualitative and quantitative assessment of the current market you’re entering or competing in. It helps you understand the industry’s overall state and potential, who your ideal customers are, the positioning of your competition, and how you intend to position your own business.

This helps you better explore the market’s long-term trends, what challenges to expect, and how you will need to introduce and even price your products or services.

Check out our full guide for how to conduct a market analysis in just four easy steps.

Marketing & sales

Here you detail how you intend to reach your target market. This includes your sales activities, general pricing plan, and the beginnings of your marketing strategy. If you have any branding elements, sample marketing campaigns, or messaging available—this is the place to add them.

Additionally, it may be wise to include a SWOT analysis that demonstrates your business or specific product/service position. This will showcase how you intend to leverage sales and marketing channels to deal with competitive threats and take advantage of any opportunities.

Check out our full write-up to learn how to create a cohesive marketing strategy for your business.

Organization & management

This section addresses the legal structure of your business, your current team, and any gaps that need to be filled. Depending on your business type and longevity, you’ll also need to include your location, ownership information, and business history.

Basically, add any information that helps explain your organizational structure and how you operate. This section is particularly important for pitching to investors but should be included even if attempted funding is not in your immediate future.

Financial projections

Possibly the most important piece of your plan, your financials section is vital for showcasing your business’s viability. It also helps you establish a baseline to measure against and makes it easier to make ongoing strategic decisions as your business grows. This may seem complex, but it can be far easier than you think.

Focus on building solid forecasts, keep your categories simple, and lean on assumptions. You can always return to this section to add more details and refine your financial statements as you operate.

Here are the statements you should include in your financial plan:

- Sales and revenue projections

- Profit and loss statement

- Cash flow statement

- Balance sheet

The appendix is where you add additional detail, documentation, or extended notes that support the other sections of your plan. Don’t worry about adding this section at first; only add documentation that you think will benefit anyone reading your plan.

Types of business plans explained

While all business plans cover similar categories, the style and function depend on how you intend to use your business plan . So, to get the most out of your plan, it’s best to find a format that suits your needs. Here are a few common business plan types worth considering.

Traditional business plan

The tried-and-true traditional business plan (sometimes called a detailed business plan ) is a formal document meant for external purposes. It is typically required when applying for a business loan or pitching to investors.

It can also be used when training or hiring employees, working with vendors, or any other situation where the full details of your business must be understood by another individual.

A traditional business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix. We recommend only starting with this business plan format if you plan to immediately pursue funding and already have a solid handle on your business information.

Business model canvas

The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

The structure ditches a linear structure in favor of a cell-based template. It encourages you to build connections between every element of your business. It’s faster to write out and update and much easier for you, your team, and anyone else to visualize your business operations.

The business model canvas is really best for those exploring their business idea for the first time, but keep in mind that it can be difficult to actually validate your idea this way as well as adapt it into a full plan.

One-page business plan

The true middle ground between the business model canvas and a traditional business plan is the one-page business plan . Sometimes referred to as a lean plan, this format is a simplified version of the traditional plan that focuses on the core aspects of your business. It basically serves as a beefed-up pitch document and can be finished as quickly as the business model canvas.

By starting with a one-page plan, you give yourself a minimal document to build from. You’ll typically stick with bullet points and single sentences making it much easier to elaborate or expand sections into a longer-form business plan.

A one-page business plan is useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Growth plan

Now, the option that we here at LivePlan recommend is a growth plan . However, growth planning is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance.

It holds all of the benefits of the single-page plan, including the potential to complete it in as little as 27-minutes .

However, it’s even easier to convert into a more detailed business plan thanks to how heavily it’s tied to your financials. The overall goal of growth planning isn’t to just produce documents that you use once and shelve. Instead, the growth planning process helps you build a healthier company that thrives in times of growth and stable through times of crisis.

It’s faster, concise, more focused on financial performance, and ensures that your plan is always up-to-date.

How can you write your own business plan?

Now that you know the definition of a business plan, it’s time to write your own.

Get started by downloading our free business plan template or try a business plan builder like LivePlan for a fully guided experience and an AI-powered Assistant to help you write, generate ideas, and analyze your business performance.

No matter which option you choose, writing a business plan will set you up for success. You can use it to test an idea, figure out how you’ll start, and pursue funding. And if you review and revise your plan regularly, it can turn into your best business management tool.

Like this post? Share with a friend!

Posted in Business Plan Writing

Join over 1 million entrepreneurs who found success with liveplan, like this content sign up to receive more.

Subscribe for tips and guidance to help you grow a better, smarter business.

You're all set!

Exciting business insights and growth strategies will be coming your way each month.

We care about your privacy. See our privacy policy .

Plan Your Business

A well-written business plan is your path to a successful business. Learn to write, use, and improve your business plan with exclusive guides, templates, and examples.

What is a business plan?

- Types of plans

- How to write

Industry business plans

Explore Topics

How to Write a Business Plan

Noah Parsons

Jul. 29, 2024

Learn to write a detailed business plan that will impress investors and lenders—and provide a foundation to start, run, and grow a successful business.

Elon Glucklich

Aug. 1, 2024

Anthony St. Clair

Makenna Crocker

Free Download

Business Plan Template

A lender-approved fill-in-the-blanks resource crafted by business planning experts to help you write a great business plan.

Simple Business Plan Outline

Follow this detailed outline for a business plan to understand what the structure, details, and depth of a complete plan looks like.

550+ Sample Business Plans

Explore our industry-specific business plan examples to understand what details should be in your own plan.

How to Write a Nonprofit Business Plan

Angelique O'Rourke

May. 10, 2024

While a nonprofit business plan isn’t all that different from a traditional plan—there are unique considerations around fundraising, partnerships, and promotions that must be made.

How to Write a One-Page Business Plan

How to Write a Franchise Business Plan + Template

New to business planning? Start here

What should i include in my business plan.

You must have an executive summary, product/service description, market and competitive analysis, marketing and sales plan, operations overview, milestones, company overview, financial plan, and appendix.

Why should I write a business plan?

Businesses that write a business plan typically grow 30% faster because it helps them minimize risk, establish important milestones, track progress, and make more confident decisions.

What are the qualities of a good business plan?

A good business plan uses clear language, shows realistic goals, fits the needs of your business, and highlights any assumptions you’re making.

How long should my business plan be?

There is no target length for a business plan. It should be as long as you need it to be. A good rule of thumb is to go as short as possible, without missing any crucial information. You can always expand your business plan later.

How do I write a simple business plan?

Use a one-page business plan format to create a simple business plan. It includes all of the critical sections of a traditional business plan but can be completed in as little as 30 minutes.

What should I do before writing a business plan?

If you do anything before writing—figure out why you’re writing a business plan. You’ll save time and create a far more useful plan.

What is the first step in writing a business plan?

The first thing you’ll do when writing a business plan is describe the problem you’re solving and what your solution is.

What is the biggest mistake I can make when writing a business plan?

The worst thing you can do is not plan at all. You’ll miss potential issues and opportunities and struggle to make strategic decisions.

Business planning guides

Learn what a business plan is, why you need one, when to write it, and the fundamental elements that make it a unique tool for business success.

Types of business plans

Explore different business plan formats and determine which type best suits your needs.

How to write a business plan

A step-by-step guide to quickly create a working business plan.

Tips to write your business plan

A curated selection of business plan writing tips and best practices from our experienced in-house planning experts.

Explore industry-specific guides to learn what to focus on when writing your business plan.

Business planning FAQ

What is business planning?

Business planning is the act of sitting down to establish goals, strategies, and actions you intend to take to successfully start, manage, and grow a business.

What are the 7 steps of a business plan?

The seven steps to write a business plan include:

- Craft a brief executive summary

- Describe your products and services

- Conduct market research and compile data into a market analysis

- Describe your marketing and sales strategy

- Outline your organizational structure and management team

- Develop financial projections for sales, revenue, and cash flow

- Add additional documents to your appendix

What should a business plan include?

A traditional business plan should include:

- An executive summary

- Description of your products and services

- Market analysis

- Competitive analysis

- Marketing and sales plan

- Overview of business operations

- Milestones and metrics

- Description of your organization and management team

- Financial plan and forecasts

Do you really need a business plan?

You are more likely to start and grow into a successful business if you write a business plan.

A business plan helps you understand where you want to go with your business and what it will take to get there. It reduces your overall risk, helps you uncover your business’s potential, attracts investors, and identifies areas for growth.

Having a business plan ultimately makes you more confident as a business owner and more likely to succeed for a longer period of time.

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Starting a Business

- Growing a Business

- Small Business Guide

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Tips White Papers

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- United Kingdom

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

Business Plan

By Entrepreneur Staff

Business Plan Definition:

A written document describing the nature of the business, the sales and marketing strategy, and the financial background, and containing a projected profit and loss statement

A business plan is also a road map that provides directions so a business can plan its future and helps it avoid bumps in the road. The time you spend making your business plan thorough and accurate, and keeping it up-to-date, is an investment that pays big dividends in the long term.

Your business plan should conform to generally accepted guidelines regarding form and content. Each section should include specific elements and address relevant questions that the people who read your plan will most likely ask. Generally, a business plan has the following components:

Title Page and Contents A business plan should be presented in a binder with a cover listing the name of the business, the name(s) of the principal(s), address, phone number, e-mail and website addresses, and the date. You don't have to spend a lot of money on a fancy binder or cover. Your readers want a plan that looks professional, is easy to read and is well-put-together.

Include the same information on the title page. If you have a logo, you can use it, too. A table of contents follows the executive summary or statement of purpose, so that readers can quickly find the information or financial data they need.

Executive Summary The executive summary, or statement of purpose, succinctly encapsulates your reason for writing the business plan. It tells the reader what you want and why, right up front. Are you looking for a $10,000 loan to remodel and refurbish your factory? A loan of $25,000 to expand your product line or buy new equipment? How will you repay your loan, and over what term? Would you like to find a partner to whom you'd sell 25 percent of the business? What's in it for him or her? The questions that pertain to your situation should be addressed here clearly and succinctly.

The summary or statement should be no more than half a page in length and should touch on the following key elements:

- Business concept describes the business, its product, the market it serves and the business' competitive advantage.

- Financial features include financial highlights, such as sales and profits.

- Financial requirements state how much capital is needed for startup or expansion, how it will be used and what collateral is available.

- Current business position furnishes relevant information about the company, its legal form of operation, when it was founded, the principal owners and key personnel.

- Major achievements points out anything noteworthy, such as patents, prototypes, important contracts regarding product development, or results from test marketing that have been conducted.

Description of the Business The business description usually begins with a short explanation of the industry. When describing the industry, discuss what's going on now as well as the outlook for the future. Do the necessary research so you can provide information on all the various markets within the industry, including references to new products or developments that could benefit or hinder your business. Base your observations on reliable data and be sure to footnote and cite your sources of information when necessary. Remember that bankers and investors want to know hard facts--they won't risk money on assumptions or conjecture.

When describing your business, say which sector it falls into (wholesale, retail, food service, manufacturing, hospitality and so on), and whether the business is new or established. Then say whether the business is a sole proprietorship, partnership, C or Sub chapter S corporation. Next, list the business' principals and state what they bring to the business. Continue with information on who the business' customers are, how big the market is, and how the product or service is distributed and marketed.

Description of the Product or Service The business description can be a few paragraphs to a few pages in length, depending on the complexity of your plan. If your plan isn't too complicated, keep your business description short, describing the industry in one paragraph, the product in another, and the business and its success factors in two or three more paragraphs.

When you describe your product or service, make sure your reader has a clear idea of what you're talking about. Explain how people use your product or service and talk about what makes your product or service different from others available in the market. Be specific about what sets your business apart from those of your competitors.

Then explain how your business will gain a competitive edge and why your business will be profitable. Describe the factors you think will make it successful. If your business plan will be used as a financing proposal, explain why the additional equity or debt will make your business more profitable. Give hard facts, such as "new equipment will create an income stream of $10,000 per year" and briefly describe how.

Other information to address here is a description of the experience of the other key people in the business. Whoever reads your business plan will want to know what suppliers or experts you've spoken to about your business and their response to your idea. They may even ask you to clarify your choice of location or reasons for selling this particular product.

Market Analysis A thorough market analysis will help you define your prospects as well as help you establish pricing, distribution, and promotional strategies that will allow your company to be successful vis-à-vis your competition, both in the short and long term.

Begin your market analysis by defining the market in terms of size, demographics, structure, growth prospects, trends, and sales potential. Next, determine how often your product or service will be purchased by your target market. Then figure out the potential annual purchase. Then figure out what percentage of this annual sum you either have or can attain. Keep in mind that no one gets 100 percent market share, and that a something as small as 25 percent is considered a dominant share. Your market share will be a benchmark that tells you how well you're doing in light of your market-planning projections.