- Open access

- Published: 20 April 2024

A proposed multidimensional model for predicting financial distress: an empirical study on Egyptian listed firms

- Noha Adel Mohamed Abdelkader ORCID: orcid.org/0009-0000-5647-0472 1 &

- Hayam Hassan Wahba 1

Future Business Journal volume 10 , Article number: 42 ( 2024 ) Cite this article

1021 Accesses

Metrics details

Although there has been a growing interest by researchers worldwide over the past decades to identify the factors pertaining to corporate financial distress and to develop financial distress prediction models that serve as early warning signs to the various firm stakeholders, notably to date, studies that were conducted were context specific and cannot be objectively generalized to other countries and rendered mixed inconclusive results. Therefore, the main objective of this study is to thoroughly investigate the factors that affect corporate financial distress in Egypt and to develop a multidimensional financial distress prediction model. Using comprehensive data of EGX100 listed firms, the researcher examines the role played by financial ratios, market-based indicators, macroeconomic factors, and corporate governance mechanisms in modeling corporate financial distress. Empirical results indicate that after controlling for the COVID-19 effects, the most significant financial ratios in predicting corporate financial distress are the working capital to total assets ratio, earnings before interest and taxes to total assets ratio, and the sales to total assets ratio. Such ratios are negatively related to the likelihood of corporate financial distress. However, the market value of equity to total liabilities ratio, and GDP growth rate have a positive impact on the likelihood of financial distress. However, the retained earnings to total assets ratio, the corporate governance mechanisms, the firm market capitalization, the interest rate, and the consumer price index are insignificant in predicting corporate financial distress in the Egyptian context. The resulting model demonstrates outstanding classification accuracy at around 96%.

Introduction

Corporate financial distress identification and prediction has been a topic of major interest for academics and practitioners for decades, owing to its importance for the different stakeholders including investors, business partners, debtors, creditors, management, employees, auditors, suppliers, retailers, insurance companies, government regulators, and the economy as a whole [ 1 , 2 ].

The terms corporate financial distress, insolvency, financial failure, default, and bankruptcy have been used interchangeably in the literature to refer to the situation where the firm can no longer meet its financial obligations [ 3 ]. Previous studies endorsed various delineations of financial distress comprising low interest coverage ratio, proof of layoffs, restructurings, failure to pay dividends, inability of cashflows to fulfill due long-term obligations, negative earnings before interest and taxes, a decline in market capitalization, or negative net income before interest and taxes [ 4 ]. Financial distress precedes bankruptcy, can be inferred as the possibility of bankruptcy, which is costly in direct and indirect ways, and should therefore be identified early and prevented [ 5 ].

Researchers have tremendously tried to investigate the factors pertaining to corporate financial distress, using financial ratios, market-price indicators, macroeconomic factors, corporate governance attributes and managerial variables, and to derive econometric models for its identification and prediction in different contexts over the years that serve as early warning signs to the various stakeholders by employing univariate analysis, multivariate discriminant analysis, logit and probit regression, dynamic time-varying hazard models, and artificial intelligence neural networks.

For instance, financial ratio analysis has pioneered the empirical work in identifying and predicting the probability of corporate financial distress [ 6 , 7 , 8 , 9 ]. Several researchers employed accounting-based data to derive econometric models for assessing the likelihood of financial failure [ 10 , 11 ]. Nevertheless, accounting-based indicators of financial distress are backward-looking and, therefore, insufficient in predicting financial failure.

Complementary to this, market-based models enhance the predictive power of financial distress models as they consider a comprehensive mix of financial information, allow for measuring “a finer partition of time,” and can directly account for volatility [ 12 ].

In addition, macroeconomic variables define the overall economic environment in which firms operate and significantly affect their performance and profits. The probability of financial distress rises during times of recession due to the reduction in sales, cash flows, and profitability. Incorporating the impact of changes in interest rates, inflation rates, and monetary policy is therefore crucial in understanding the effect of economic uncertainties on financial distress risk [ 3 ].

Furthermore, good corporate governance practices alleviate agency conflicts and protect shareholders’ interests, thereby, enhance corporate performance by increasing market value, reducing the cost of capital, and improving corporate strategic decisions, and hence, reduce the likelihood of financial distress [ 13 ].

As such, the main objective of this study is to thoroughly investigate the factors that affect corporate financial distress in Egypt. Using comprehensive data of EGX100 listed firms, the researcher examines factors pertaining to financial distress including financial ratios, market-price indicators, macroeconomic variables, and corporate governance attributes. Based on a review of the determinants of corporate financial distress and studies on financial distress prediction, such potential factors allow for modeling corporate financial distress and developing a multidimensional model for predicting corporate financial distress in Egypt.

Literature review

Financial distress identification and prediction is pivotal to multiple stakeholders including creditors, investors, suppliers, and regulators and allows corrective actions to be taken before the company exhibits bankruptcy.

There is no commonly accepted definition for financial distress. Financial distress is considered as the “likelihood of bankruptcy” and can be viewed as continuum extending from financial weakness to default, which could be incurred as a result of poor management decisions, market maturity, increased competition, new technologies, insufficient cash inflows, or a decrease in demand [ 14 ]. As such, defining and measuring corporate financial distress is challenging due to the discretionary and insufficient classification criteria. Accordingly, corporate financial distress is still an ambiguous term that does not directly translate into an absolute state like bankruptcy or insolvency [ 1 , 15 , 16 ].

For instance, Pindado et al. [ 17 ] argued that default can be viewed as a more restricted postulation than financial distress. They introduced a financially based definition of financial distress based on the insufficiency of operating cash flows to satisfy financial expenses and a decline in market value. Whereas Koh et al. [ 5 ] postulated that a company is deemed to be in distress if its earnings before interest, taxes, depreciation, and amortization (EBITDA) are less than its financial expenses in any two successive years, or when Taffler’s Z-score is negative after two positive scores.

In addition, Ong et al. [ 18 ], Alifiah [ 19 ], and Ahmad [ 20 ] defined a firm as financially distressed in terms of restructuring and arrangement, debt restructuring, and deteriorating financial conditions in accordance with the Malaysian laws. Oz and Yelkenci [ 21 ] employed negative stock return, restructuring, and low credit score classifications for identifying financial distress.

Meanwhile, numerous researchers employed Altman’s model Z-scores in identifying financially distressed firms [ 22 , 23 , 24 , 25 , 26 ]. Furthermore, Waqas and Md-Rus [ 27 ] used the State Bank of Pakistan definition of financial distress where a company is classified as financially distressed after three successive years of negative value of equity. Ogachi et al. [ 28 ] identified the company as financially distressed in the year it was delisted due to financial distress.

However, Zhang et al. [ 29 ] and Li et al. [ 30 ] used special treatment criteria required by China’s securities industry to denote financially distressed companies where a listed firm qualified for special treatment when it reported negative net profit for two successive years, or it failed to release its annual report, or due to the likelihood of dissolution, reorganization, settlement, or bankruptcy liquidation.

Furthermore, other adverse outcomes have been utilized to denote financially distressed firms in terms of inactivity, mergers, suspension, dissolution, liquidation, bankruptcy along with negative net income for three successive years [ 31 ], if the interest coverage ratio was zero or negative for two successive years [ 10 ], when the company reported financial losses, had not paid out dividends, and book value exceeded market value of the firms for two successive years [ 32 ], if the firm reported negative net income for two or more successive years [ 33 ], or if it reported negative earnings per share [ 34 , 35 , 36 ].

Besides, Kliestik et al. [ 37 ] considered a company as insolvent if it had negative earnings after taxes, indicator of financial independence less than 0.04, current ratio below 1, firm’s liabilities exceed firm’s assets, or at least two liabilities that were more than 30 days past due from various creditors.

More importantly, numerous recent studies adopted the financial distress definition developed by [ 17 ] where a firm is classified as financially distressed when EBITDA are less than financial expenses for two successive years along with a decline in market capitalization [ 13 , 38 , 39 ].

In this respect, financial distress prediction models have evolved over time, from univariate discriminant analysis to artificial intelligence, and from bankruptcy prediction; ex post perspective, to the evaluation of corporate financial distress; ex ante perspective while continuing to focus on the early warning signs of financial distress [ 1 ]. Moreover, artificial intelligence techniques such as decision trees, fuzzy set theory, case-based reasoning, genetic algorithms, support vector machines, and neural networks have been utilized to predict financial distress since the 1990s in an attempt to address the limitations of univariate, multivariate, and logit regressions [ 40 ]. However, such techniques do not provide information to assess the significance of the predictor variables [ 41 ].

Financial ratios and financial distress prediction

The accounting-based models estimate profitability, liquidity, and solvency ratios using financial data and are frequently employed to examine the significance of relying on financial statements information to accurately assess the risk of financial distress [ 41 ].

In this regard, Altman Z-score model variables are still widely used as a primary or supporting tool for bankruptcy or financial distress analysis and prediction. The widespread application of the Z-Score model and its determining variables for assessing financial distress and carrying out robustness tests suggests that it is acceptable as a fair, straightforward, and consistent indicator of financial distress [ 42 ]. Several empirical studies showed that ratios from Atlman’s original model are significant predictors of financial distress [ 27 , 38 , 42 , 43 , 44 , 45 ]. As such, the following hypothesis is formulated:

Financial ratios are significant predictors of corporate financial distress.

Market-based indicators and financial distress prediction

Empirical literature on the determinants of financial distress suggests that stronger inferences could be attained by integrating both financial and market-based indicators in modeling financial distress [ 3 , 10 , 12 , 17 , 46 , 47 ].

Typically, financial distress is associated with declining stock prices due to negative market valuations [ 17 ]. Empirical studies by [ 10 , 48 ] demonstrated that firm share price and market capitalization were significant predictors of corporate financial distress reflecting investor confidence in the firm’s stock. Accordingly, the following hypothesis is formulated:

Market-based indicators significantly affect the likelihood of financial distress.

Macroeconomic variables and financial distress prediction

Furthermore, financial distress could arise from non-financial causes, pertaining to macroeconomic conditions and subsequent effects on firm industry sector [ 1 ].

Macroeconomic variables affect the likelihood of financial distress through the effect of economic growth, interest rates, and credit policy [ 42 ]. Accordingly, interest rate, inflation rate, political stability and violence absence, employment rate, GDP growth rate, and consumer price index have widely been incorporated in the literature of predicting corporate financial distress [ 10 , 32 , 38 , 44 , 48 , 49 , 50 ].

In this regard, previous empirical studies rendered mixed results. For instance, Alifiah [ 19 ] and Mohamed [ 10 ] found that interest rates were significant positive predictors of the likelihood of corporate financial distress, whereas Li et al. [ 30 ] and Zhang et al. [ 29 ] demonstrated that interest rates negatively affected the likelihood of financial distress. Nevertheless, Agrawal and Maheshwari [ 51 ] pinpointed insignificant effects of interest rates on the probability of financial distress.

Besides, Charalambakis and Garrett [ 44 ] found that GDP growth rate negatively affected the likelihood of financial distress. Meanwhile, Alifiah [ 19 ], Shahwan and Fadel [ 32 ], and Li et al. [ 30 ] found that GDP growth rate was an insignificant predictor of financial distress.

Furthermore, studies by El-Ansary and Bassam [ 38 ], Li et al. [ 30 ], and Fernández-Gámez et al. [ 50 ] demonstrated that as the consumer price index increased, the likelihood of corporate financial distress increased. However, Agrawal and Maheshwari [ 51 ] found a negative relationship between consumer price index and the likelihood of financial distress, whereas Alifiah [ 19 ] and Mohamed [ 10 ] found that consumer price index was insignificant in predicting financial distress. Jones [ 48 ] showed that the consumer price index was the least significant predictor of corporate financial distress. Therefore, the following hypothesis is postulated:

Macroeconomic variables have an impact on financial distress prediction.

Corporate governance practices and financial distress prediction

Empirical research confirmed the negative relationship between corporate governance mechanisms and the likelihood of financial distress [ 26 , 48 ]. Corporate governance variables affecting financial distress include board characteristics, CEO characteristics, and ownership structure [ 3 ]. Specifically, the auditor type and CEO compensation were shown to be considered among the most significant determinants of financial distress [ 48 ].

In addition, previous empirical studies found that the board of directors’ independence was a significant negative predictor of the likelihood of corporate financial distress [ 30 , 35 , 39 , 52 ]. Furthermore, empirical previous research pinpointed that the presence of female members on the board of directors was negatively related to the likelihood of corporate financial distress [ 24 , 35 , 36 ]. Li et al. [ 30 ] further showed that institutional investors’ ownership was negatively related to the likelihood of corporate financial distress. Moreover, Shahwan [ 26 ] found that ownership type was significant in estimating financial distress. In addition, the percentage of stock owned by the top five stockholders, ownership structure, and ownership concentration were highlighted as significant determinants of corporate financial distress [ 48 ]. Issuing special shares was found to be a significant predictor of corporate financial distress [ 52 ].

More importantly, it has been concluded that corporate governance mechanisms do not function in a vacuum, and hence, all the attributes of corporate governance should be evaluated collectively [ 53 ]. Hence, the following hypothesis is presented:

Corporate governance practices have a significant negative effect on the probability of financial distress.

Multivariable models and financial distress prediction

Analysis of the previous studies on financial distress prediction shows that the most significant variables widely employed in financial distress prediction fall under four main dimensions which are: the financial ratios, market-based indicators, macroeconomic variables, and corporate governance mechanisms. A review of empirical literature conducted by Habib et al. [ 3 ] classified the determinants of financial distress into firm-level fundamental, macroeconomic, and firm-level corporate governance indicators and recommended the development of more comprehensive models incorporating possibly all three categories in a study.

According to Altman et al. [ 42 ], no single financial distress model can be applied in every context. Hence, there is an indispensable need to study financial distress in different countries. A one-size-fits-all approach is irrelevant in studying the determinants of financial distress in differing contexts [ 13 ]. The best financial distress prediction model would combine financial, corporate governance indicators, and macroeconomic variables [ 30 ].

Based on the literature review on financial distress prediction, it becomes clear that previous empirical studies have adopted different approaches in an attempt to capture the early warning signs of financial distress. In addition, the statistical models developed rendered mixed country specific results and incorporated different sets of variables pertaining to variable dimensions. Furthermore, very few studies on financial distress prediction were conducted in Egypt and only focused on specific industry sectors and specific dimensions [ 22 , 26 , 32 , 38 ]. Given the significance of corporate financial distress prediction that has been highlighted by global financial crises, developing a multidimensional model for financial distress prediction in the Egyptian context is the motive for this study. Therefore, the following hypothesis is developed:

A multidimensional econometric model incorporating various dimensions can predict financial distress.

Research methodology

The multidimensional model building approach involved designating the most parsimonious model that captured the desired level of explanation and prediction with as few predictor variables as possible resulting in a more numerically stable and a straightforward to implement model since the estimated standard errors of a model increase with the number of variables and the model's reliance on the observable data increases [ 54 ]. Accordingly, only the significant predictor variables from each dimension were carefully entered, insignificant variables eliminated, and the final model was refitted and verified repeatedly till all of the significant variables were included in the final model. The significance of individual variables and the overall model fit, and accuracy were then evaluated before using it as the final model for inferential functions.

Sampling and data collection procedures

The population of the study is all the firms listed on EGX100 index for the period 2016 to 2021. This population has been selected for many reasons. First, listed firms were selected for data availability since the multidimensional model incorporates financial, market, and corporate governance data. Listed firms are required to prepare and periodically publish their financial statements and corporate governance reports.

Second, the sample of the study includes all the companies listed on EGX100 for sixteen different industry sectors, excluding banks and firms in non-bank financial services sectors for their unique financial characteristics, which averts choice-based sample bias [ 4 , 9 ]. Third, the data for the research variables were collected for the period 2016 to 2021 as has been suggested by Altman et al. [ 42 ] to include firm data from recent years that do not represent multiple business cycles different from the financial distress years. Furthermore, in order to ensure the accuracy of results, firms having fewer than 4 years of historical data were excluded from the sample.

Fourth, financial ratios and market capitalization data were calculated using data from Bloomberg and Refinitiv Eikon databases, the published companies’ financial statements, and Egypt for Information Dissemination. The macroeconomic indicators data were calculated using data from Refinitiv Eikon database. The corporate governance index score data were calculated using publicly available firm data collected from board of directors and shareholders structure disclosure forms in accordance with article (30) of disclosure requirements chapter, the board of directors’ report in accordance with article (40) of corporate governance, minority rights and financial statements chapter, the notes to the financial statements, the shareholders reports from Refinitiv Eikon database, and Egypt for Information Dissemination.

Variables and measurement

The selection of variables is based upon the assessment and analysis of previous studies on corporate financial distress prediction which showed that the most significant variables widely employed in financial distress prediction fall under four main dimensions which are: the financial ratios, market-based indicators, macroeconomic variables, and corporate governance mechanisms.

Dependent variable

The dependent variable is the likelihood of financial distress (FD), which is determined using two metrics based on the literature review of previous studies and data availability. Firstly, the firm is classified as financially distressed in the year that follows the fulfillment of two criteria; its earnings before interest, taxes, depreciation, and amortization (EBITDA) are lower than its financial expenses for two successive years along with a fall in its market value for those two years [ 17 ]. This is in line with numerous empirical studies [ 13 , 38 , 39 ] that adopted the financial distress definition developed by Pindado et al. [ 17 ]. Secondly, the firm is classified as financially distressed in the year that follows two successive years of reported negative earnings before interest and taxes (EBIT), which increases concerns regarding the effectiveness of company performance [ 38 , 55 ].

Independent variables

Independent variables represent four dimensions. In the first dimension, financial ratios from Altman Z-score model are employed; namely the working capital to total assets ratio, retained earnings to total assets ratio, earnings before interest and taxes to total assets ratio, market value of equity to total liabilities ratio, and sales to total assets ratio. In the second dimension, market-based indicators include market capitalization, which is the product of the price per share multiplied by the number of outstanding shares. The third dimension represents macroeconomic indicators which comprise interest rates, GDP growth rates, and consumer price index. The fourth dimension encompasses corporate governance mechanisms where a corporate governance index score is calculated from the answers to 14 questions collected from secondary publicly available firm data on disclosure and transparency, board composition and structure, shareholders rights and investor relations, and firm’s ownership structure following Shahwan [ 26 ] and adapted from Lima and Sanvicente [ 56 ], Varshney et al. [ 57 ] (See “Appendix”).

The outbreak of the Covid-19 pandemic resulted in negative economic conditions worldwide with the first reported case in Egypt in February 2020. The lockdowns worldwide along with partial lockdowns in Egypt resulted in aggregate effects on economic slowdown [ 58 ] that led to capital outflows of about $16 billion, a decline in tourism revenues, exports, remittances, and Suez Canal revenues [ 59 ]. According to the OECD report on the COVID-19 crisis in Egypt, the pandemic resulted in declining business activities, monthly loss of tourism-related revenues at about $1 billion USD, decreased domestic spending, capital outflows, declining remittances, falling exports and Suez Canal revenues, declining foreign direct investment, and deterioration in financial markets performance as EGX30 declined by around 40% [ 60 ]. Moreover, the services sector declined by 10.9%, and the industry sector fell by 8.3% [ 58 ].

In response, the Central Bank of Egypt cut interest rates by 4% to ease the strains on the financial market and stimulate economic activity. Besides, a number of extraordinary financial sector actions were announced to ensure a steady flow of credit across the economy, including as greater access to credit at favorable interest rates and a 6-month debt moratorium on current credit, to relieve pressure on borrowers and ensure liquidity for the most affected industries [ 61 ] .

Hence, the COVID-19 pandemic is likely to have a significant effect on the firm’s likelihood of financial distress. As such, the model is re-estimated incorporating a dummy control variable for COVID-19 years to ensure robust results. Table 1 presents the definition of variables and measurement methods.

This resulted in a final sample of 472 observations for 79 firms (2016–2021) in 16 different industry sectors. Financially distressed observations pertain to 20 firms that represent 25.32% of the sample, whereas non-financially distressed observations are for 59 firms that account for 74.68% of the whole sample. The panel dataset is comprised of 53 financially distressed firm year observations, accounting for 11.23% of the whole sample and 419 non-financially distressed firm year observations, accounting for 88.77% of the sample. The percentage of the financially distressed observations is consistent with previous empirical studies in financial distress prediction [ 21 , 44 , 62 ].

Table 2 presents the distribution of the sample among the industry sectors and shows that the most financially distressed sectors are the Travel and leisure sector, Real Estate sector, and the Shipping and Transportation Services sector. Meanwhile, the health care and pharmaceuticals sector, the industrial goods, services, and automobiles sector, the energy and support services sector, the trade and distributors sector, and the education services sector are non-financially distressed.

Data analysis methodology and model specification

Previous empirical studies showed that the most prevalent econometric models used in financial distress prediction were discriminant analysis and logit regression models [ 37 ]. Logistic regression is employed owing to its flexibility and modeling power as it overcomes the problems of heteroscedasticity and handles nonlinear impacts between the independent and dependent variables. As such, logistic regression outperforms discriminant analysis as it does not require assumptions related to the equality of the variance covariance matrix, allows for the inclusion of dummy variables, and yields comparable results with regard to classification accuracy and diagnostic measures [ 63 ]. Furthermore, logistic regression outperforms neural networks in terms of prediction accuracy [ 62 ]. Logistic regression is employed since the dependent variable is binary.

where P (FD) refers to the probability of corporate financial distress; \({\text{WCTA}}\) is the firm’s working capital to total assets ratio; \({\text{RETA}}\) is the firm’s retained earnings to total assets ratio; \({\text{EBITTA}}\) is the firm’s earnings before interest and taxes to total assets ratio; \({\text{MVETL}}\) is the firm’s market value of equity to total liabilities ratio; \({\text{SalesTA}}\) is the firm’s sales to total assets ratio; \({\text{lnMcap}}\) is the natural logarithm of market capitalization; \({\text{IR}}\) is the annual interest rate; \({\text{GDP}}\) is the GDP growth rate; \({\text{CPI}}\) is the consumer price index; \({\text{CGI}}\) is the corporate governance index score; \(\varepsilon \) is the error term.

Results and discussion

Stata/MP version 17 software is used for all the statistical analyses.

Descriptive statistics

Table 3 presents the descriptive statistics of the study variables. The mean, median, and standard deviation are presented for the non-financially distressed years, the financially distressed years, and for the whole sample. The mean and median values are higher for the non-financially distressed firms than for the financially distressed firms for all the variables except for the MVETL ratio and the GDP growth rate.

The mean market value of equity to total liabilities ratio, which relates to the firm’s leverage, signifies the degree to which the value of the stock would fall upon financial distress, and reflects investors’ confidence in the firm’s stock, is higher for financially distressed than for non-financially distressed firms indicating inefficient market response and inappropriate fundamental valuation. This implies that financially distressed firms are more financially leveraged relative to their market capitalization denoting overvaluation.

The average annual GDP growth rate is 5.491% for the whole sample. The mean value of the GDP growth rate is higher in financially distressed years than in non-financially distressed years. This could be interpreted as firms are more likely to seek debt to expand their operations when the economy is growing and thus, more likely to face financial distress with increased leverage.

Logistic regression analysis and hypotheses testing

Table 4 presents the logistic regression results and Table 5 summarizes the hypotheses testing results. All the models are statistically significant as the likelihood ratio chi square (LR \({{\varvec{X}}}^{2}\) ) [ 64 ] is significant with p value less than 0.01.

Testing the significance of the financial variables

Model 1 tests the hypothesis that financial ratios are significant predictors of corporate financial distress. Results show the statistically significant variables that affect the likelihood of financial distress with p values less than 5%. Findings indicate that the working capital to total assets ratio, the earnings before interest and taxes to total assets ratio, and the sales to total assets ratio are negatively related to the likelihood of financial distress. These findings are in line with previous empirical studies of numerous researchers [ 25 , 38 , 43 ].

Meanwhile, the retained earnings to total assets ratio are positively related to the likelihood of financial distress. This is contrary to the results of the previous studies of [ 27 , 38 , 44 , 45 ] who found an inverse relationship between the firm’s retained earnings to total assets ratio and the likelihood of financial distress. A possible explanation is that even though higher levels of retained earnings indicate profitability, this could also suggest inefficiency in reinvesting profits into growth opportunities which increases the likelihood of financial distress.

Furthermore, results indicate that the market value of equity to total liabilities is positively related to the likelihood of financial distress, which contrasts the findings of [ 6 , 34 ].

Testing the significance of the corporate governance mechanisms

Model 2 tests the hypothesis that corporate governance practices have a significant effect on the probability of financial distress. Results indicate that an increase in the corporate governance index score reduces the likelihood of financial distress and is statistically significant with p value less than 0.01. Such findings conform with the studies conducted by [ 13 , 24 , 26 , 30 , 36 , 48 , 52 ].

Testing the significance of the market indicators

Model 3 tests the hypothesis that market-based indicators significantly affect the likelihood of financial distress. Results indicate that the firm market capitalization is a significant predictor of the likelihood of financial distress with a p value less than 0.01, which is similar to the results indicated by [ 48 ]. As the market capitalization of the firm increases, the likelihood of financial distress decreases.

Testing the significance of the macroeconomic variables

Model 4 tests the hypothesis that macroeconomic variables have an impact on financial distress prediction. Results indicate that interest rates and GDP growth rates are significant predictors of the likelihood of financial distress with p values less than 0.01. Interest rates are negatively related to the likelihood of financial distress. This is in line with the findings of [ 29 , 30 ]. However, GDP growth rate is positively related to the probability of financial distress. This is in contrast to the findings of [ 44 ] who found a negative effect and [ 19 , 30 , 32 ] who reported an insignificant effect. The consumer price index is insignificant, in line with the results of the studies conducted by [ 10 , 19 ].

Testing the multidimensional model

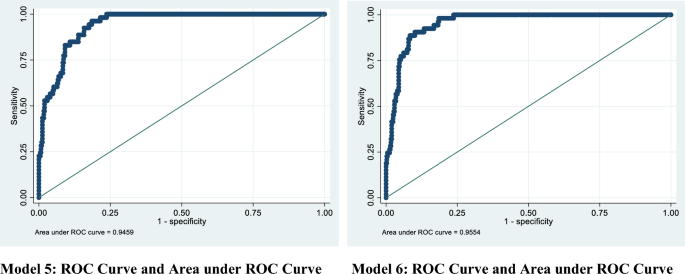

Models 5 and 6 test the hypothesis that the multidimensional econometric model incorporating various dimensions can predict financial distress. Model 5 is the initial multidimensional model with all the significant financial, market, macroeconomic, and corporate governance variables. Model 6 is the multidimensional model after controlling for COVID-19 effects.

The likelihood ratio test (LR test), which tests whether model 5 is nested within model 6, and Wald test are significant with p values less than 0.05 indicating that including COVID-19 control variable creates statistically significant improvement in the fit of the model.

Results indicate that both models are statistically significant as the likelihood ratio chi square (LR \({{\varvec{X}}}^{2}\) ) [ 64 ] is significant with p value less than 0.01. The results indicate that the most significant financial ratios in predicting financial distress are the working capital to total assets ratio, earnings before interest and taxes to total assets ratio, the sales to total assets ratio, and the market value of equity to total liabilities ratio.

In particular, the working capital to total assets ratio negatively affects the likelihood of corporate financial distress. This can be explained as this ratio relates to the firm’s ability to meet short-term financial obligations through current assets and reflects the firm’s liquidity in proportion to its size. Accordingly, a firm in financial distress would demonstrate decreasing working capital to total assets ratio. This finding is consistent with several empirical previous studies that confirmed the negative relationship between the firm’s working capital to total assets ratio and the likelihood of financial distress [ 27 , 31 , 32 , 38 , 42 , 43 , 45 , 50 ].

Results also show that as the firm’s earnings before interest and taxes to total assets ratio decrease, the likelihood of corporate financial distress increases. This finding is reasonable as this ratio is a measure of operating efficiency, reflecting the firm’s profitability from its operations. This is in line with the previous empirical studies of [ 25 , 27 , 38 , 42 , 43 , 45 , 65 ].

As for the sales to total assets ratio, which is a measure of asset turnover and reflects the efficiency of the firm’s management in generating revenues from assets; contributing to the firm’s profitability, the findings confirm the negative effect of this ratio on the probability of corporate financial distress. Such finding is in line with the previous empirical studies of [ 18 , 25 , 31 , 34 , 38 , 43 , 66 ].

Interestingly, the results reveal that the market value of equity to total liabilities ratio is directly related to the likelihood of financial distress. One possible explanation lies in the market efficiency level of emerging economies like Egypt and irrational, suboptimal investment decisions since this financial ratio relates to the firm’s leverage and incorporates the market aspect reflected in stock prices. This finding supports the results reported by [ 67 ] who found that the market value of equity to total liabilities ratio was a significant predictor of corporate financial distress. This is, however, in contrary to the findings of [ 34 ] who found that the market value of equity to total liabilities ratio negatively affected the probability of financial distress.

Furthermore, the findings result in evidence to indicate that the GDP growth rate has a significant and positive effect on the likelihood of corporate financial distress. This can be justified as during the higher economic growth periods, firms are encouraged to expand their operations and hence, need more credit to finance their expansion and investment opportunities and the debt ratio is positively correlated with the likelihood of financial distress. This is in contrast to the findings of [ 44 ] who found a negative effect and [ 19 , 30 , 32 ] who reported an insignificant effect.

The firm’s retained earnings to total assets ratio are shown to have an insignificant effect on the likelihood of financial distress. This is in contrast to the findings of [ 27 , 38 , 42 , 43 , 44 , 45 ] who found an inverse relationship between the firm’s retained earnings to total assets ratio and the likelihood of financial distress. This shows that after considering the external effects of the economic conditions as measured by the GDP growth rate, the retained earnings to total assets ratio becomes insignificant in predicting the likelihood of corporate financial distress. This might be attributable to potential collinearity between the retained earnings to total assets ratio and GDP growth rate as companies retain more earnings during periods of high economic growth. As such, the final model might struggle to isolate the independent effect of each. Accordingly, the positive influence of the retained earnings ratio on the likelihood of financial distress might be overshadowed by the even stronger influence of the GDP growth rate.

Firm’s conformance to corporate governance mechanisms related to disclosure and transparency, board of directors’ characteristics, ownership and control structure, and rights of shareholders and investor relations is shown to be insignificant in predicting the probability of financial distress. This can be explained as the average corporate governance index score, which reflects the strength of corporate governance mechanisms, was quite low at 63.4%. This result is consistent with the findings of studies within the Egyptian context by [ 26 ]. Nevertheless, this result contradicts the findings in other contexts. For instance, the study conducted by [ 13 ] on Spanish firms found that conformity with the recommendations regarding the board of directors was significant in decreasing the probability of financial failure. The study by [ 56 ] showed that good corporate governance practices promote transparency and thereby reduces the cost of capital for firms, contributes to operating performance, and increases the company’s market value. The study by [ 36 ] showed that the percentage of females on the board negatively affected the likelihood of financial distress in India. In the European context, [ 24 ] found that the proportion of female directors on the board and board independence were inversely related to the probability of financial distress.

In addition, results indicate that firms with large market capitalization are less likely to experience financial distress, which is in line with the results of previous empirical studies of [ 10 , 48 ]. This finding is reasonable since financial distress is associated with declining stock prices due to negative market valuations [ 17 ]. Nevertheless, after controlling for COVID-19 years, this variable is insignificant. This could be attributable to the disrupted market valuation and the government interventions and support during the COVID-19 pandemic.

The results further indicate that interest rates negatively influence the likelihood of corporate financial distress, denoting that rising interest rates discourage firms from seeking more loans due to the high cost of debt and thereby reduces the likelihood of financial distress. Such finding is in line with the findings of [ 29 , 30 ] and in contrast to the findings by [ 10 , 19 ] who demonstrated that interest rates were significant positive predictors of the likelihood of corporate financial distress. However, this effect is shown to be insignificant, after controlling for COVID-19 effects. Such finding is similar to the results demonstrated by [ 51 ]. The negative influence of interest rates on financial distress likely became insignificant after controlling for the COVID-19 effects due to the Central bank interventions by lowering interest rates, firms prioritizing survival over considerations for long-term consequences of higher debt, and government support during the pandemic.

Furthermore, results indicate that the consumer price index is insignificant in predicting corporate financial distress, which is in in line with the results of the studies conducted by [ 10 , 19 ]. On the contrary, studies by [ 30 , 38 , 50 ] demonstrated that as the consumer price index increased, the likelihood of corporate financial distress increased. However, Agrawal and Maheshwari [ 51 ] found a negative relationship between consumer price index and the likelihood of financial distress. Jones [ 48 ], however, found that the consumer price index was the least significant predictor of corporate financial distress. This finding can be attributable to the interconnected effects of GDP growth rate, interest rate, and consumer price index. High GDP growth increases demand leading to inflation captured by the CPI, which drives increases in interest rates to reduce inflation. In addition, the changes in the consumer price index do not reflect whether the firms will respond by raising prices, negotiating with suppliers or adopting cost saving strategies. As such, when considering the GDP growth rate, interest rate, and consumer price index, the CPI’s contribution to predicting financial distress might become statistically insignificant as its effects might already be reflected in the GDP growth rate and interest rate.

The results also show that both models fit reasonably well as the Pearson \({X}^{2}\) and Hosmer–Lemeshow \({X}^{2}\) goodness-of-fit tests were not significant with p values exceeding 0.1.

Model 6 incorporating COVID-19 effects demonstrates a better model fit since McFadden’s Pseudo \({R}^{2}\) value is 0.5214, McKelvey and Zavoina’s \({R}^{2}\) is equal to 0.984, and Cragg and Uhler’s \({R}^{2}\) value is 0.609 compared to values of 0.5075, 0.965, and 0.596 for Model 5, respectively.

The Akaike information criteria (AIC) and the Schwartz or Bayesian information criterion (BIC) are lower for Model 6, indicating that Model 6 is a better specified model.

Model classification accuracy is assessed through the area under the receiver operating characteristic (ROC) curve. Model 6 further outperforms model 5 in terms of classification accuracy since the area under ROC curve is 0.9554 for Model 6 compared to 0.9459 for Model 5. Moreover, the model accuracy ratio is higher for Model 6 at a value of 0.9108 compared to 0.8918 for Model 5.

Model validation and post-estimation tests

Normality test, correlation analysis, and multicollinearity diagnostics.

The normality of the predictor variables is examined with the Shapiro–Wilk test. The p value for the variables is less than 5%, meaning that the null hypothesis that the variables are normally distributed cannot be accepted. Spearman correlation matrix is thus developed to examine the direction and strength of the relationships between the predictor variables in Table 6 .

Results indicate that the highest statistically significant correlation is between the earnings before interest and taxes to total assets ratio and the sales to total assets ratio with a correlation coefficient of 0.5498, indicating a positive moderate correlation.

Table 6 also presents multicollinearity diagnostics. The variance inflation factor is below 2 for all the predictor variables, the mean variance inflation factor is 1.24, and tolerance exceeds 0.6 for all the predictor variables; indicating the absence of multicollinearity.

Conclusion, recommendations, limitations, and future research

The main objective of this study was to thoroughly investigate the factors that affect corporate financial distress in Egypt and to develop a multidimensional model for its prediction. In order to achieve the research objectives, comprehensive data of listed firms on EGX100 for the years 2016 to 2021 were employed in logistic regression analysis to estimate the probability of financial distress. Based on the literature review, hypotheses related to four dimensions that affect corporate financial distress were formulated and a multidimensional model for predicting financial distress was developed. This involved financial ratios, market-based indicators, macroeconomic factors, and corporate governance mechanisms.

The final model empirical results, after controlling for the COVID-19 effects, indicated that the most significant financial ratios in predicting corporate financial distress were the working capital to total assets ratio, earnings before interest and taxes to total assets ratio, and the sales to total assets ratio. Such ratios were negatively related to the likelihood of corporate financial distress. Whereas the market value of equity to total liabilities ratio, and GDP growth rate had a positive impact on the likelihood of financial distress. The retained earnings to total assets ratio, the corporate governance index score, the firm market capitalization, the interest rate, and the consumer price index were insignificant in predicting corporate financial distress in the Egyptian context.

Implications and practical recommendations

This research introduces a multidimensional model for identifying and mitigating financial distress risks, with valuable insights for various stakeholders.

The results indicate significant negative effects of the working capital to total assets ratio, earnings before interest and taxes to total assets ratio, and the sales to total assets ratio on the likelihood of corporate financial distress. This highlights the importance of analyzing financial ratios like working capital to total assets, profitability (EBIT/total assets), and asset turnover (sales/total assets) to assess a company's financial health. Investors can use these ratios alongside industry benchmarks to make informed investment decisions and avoid firms with high financial distress risk. Besides, creditors can benefit from analyzing those financial ratios to assess a company’s financial health in the light of the macroeconomic conditions to make sound lending decisions. In addition, companies should focus on efficiently managing the working capital, maintaining a high level of operating efficiency, and efficiently managing the firm’s assets to generate profits in order to improve their financial health and reduce the risk of financial distress.

The findings also show that the market value of equity to total liabilities ratio has a significant positive effect on the likelihood of corporate financial distress. In this respect, policies should be devised to improve market efficiency and ensure rational well-informed investment decisions by investors. Policymakers can leverage such findings to implement comprehensive financial literacy programs for investors. This can reduce poor investment choices and promote fair market valuation, ultimately improving overall market efficiency.

Results further indicate that the GDP growth rate has a positive impact on the likelihood of financial distress. In this regard, companies should continuously monitor and adapt to the changing economic conditions to make informed financial decisions that mitigate risks associated with external macroeconomic factors.

The findings also provide evidence that the corporate governance index mechanisms are insignificant in predicting financial distress in Egypt. The average corporate governance index score, which reflects the strength of corporate governance mechanisms, was quite low at 63.4%. This emphasizes the need for stronger corporate governance practices, particularly regarding disclosure, board structure, ownership control, and shareholder rights. Policymakers can encourage stricter regulations and best practices to enhance corporate governance, leading to better financial performance for companies, boosting investor confidence and facilitating better financing decisions by creditors. Furthermore, companies should ensure consistently updating all the financial and corporate governance information on their websites.

Limitations and future research

As with other empirical studies, this research has some limitations. The first is related to the sample size and generalizability, as the study sample was selected from the listed firms on EGX100 index for the period 2016 to 2021 excluding banks and firms in financial services sectors. The reasons for this were data availability, time, and cost involved in data collection. This implies that the study results are only applicable to the listed firms on EGX100 in the Egyptian context, which poses potential limitations in terms of its representativeness of the broader Egyptian corporate landscape. In this regard, the researcher suggests the inclusion of more firms in future studies from different market indices and similar emerging economies with a longer time span and possibly clustering them according to industry sectors and firm size.

The second limitation is concerned with the definition of the study variables, their measurement, and the estimation technique which were mainly based on the review of literature and data availability. The adoption of different measurement methods could lead to different results. In this respect, the researcher encourages future studies to compare the results when different measurement methods are employed.

The third limitation is hindered by data constraints as the proposed multidimensional model has not been validated using an external dataset or in a different time period. This can be explained as logistic regression employs maximum likelihood estimation method which maximizes the probability that an outcome will happen, necessitating large sample size more than 400 [ 63 ]. However, the model has been estimated for the whole study period and then re-estimated after controlling for the COVID-19 years to ensure robust results, thus, indirectly validating the model by isolating pre-pandemic trends. Accordingly, future research should incorporate broader and more diverse datasets covering more firms and longer timeframes. In addition, the researcher emphasizes the need for readily accessible, standardized databases encompassing financial, corporate governance, macroeconomic, and market data which would enhance research generalizability and accessibility.

Besides, the researcher recommends investigating the interaction effect between the financial, market, macroeconomic, corporate governance variables, and examining bidirectional relationships with the likelihood of corporate financial distress, which could enrich the dataset and lead to more robust results. In addition, the impact of exchange rate fluctuations on the likelihood of corporate financial distress should be assessed in future studies. Moreover, future studies could explore the effect of board managerial attributes on the likelihood of corporate financial distress. Furthermore, different estimation techniques could be compared in terms of validity and accuracy.

Lastly, comparative studies could be performed incorporating data from other emerging economies to assess the role of financial ratios, market-based indicators, macroeconomic variables, and corporate governance attributes in predicting financial distress and to develop a more comprehensive multidimensional model for corporate financial distress prediction in the emerging countries.

Availability of data and materials

The datasets generated and analyzed during the current study are not publicly available as the data for the research variables was obtained from companies’ financial statements, board of directors and shareholders structure disclosure forms in accordance with article (30) of disclosure requirements chapter, the board of directors’ report in accordance with article (40) of corporate governance, minority rights and financial statements chapter, the notes to the financial statements, Egypt for Information Dissemination, Mubasher Website, Bloomberg and Refinitiv Eikon Databases, and as such require permissions for reuse or publish of data. Data are, however, available from the authors upon reasonable request.

Abbreviations

Earnings before interest and taxes

Earnings before interest, taxes, depreciation, and amortization

Gross domestic product

Organization for economic cooperation and development

- Financial distress

Working capital to total assets ratio

Retained earnings to total assets ratio

Earnings before interest and taxes to total assets ratio

Market value of equity to total liabilities ratio

Sales to total assets ratio

Natural logarithm of market capitalization

Interest rate

Corporate governance index score

Consumer price index

Chief Executive Officer

Akaike information criteria

Bayesian information criteria

Variance inflation factor

Receiver operating characteristic

Area under curve

Agostini M (2018) Corporate financial distress: going concern evaluation in both international and US contexts. Springer, New York

Book Google Scholar

Zhou L, Lu D, Fujita H (2015) The performance of corporate financial distress prediction models with features selection guided by domain knowledge and data mining approaches. Knowl-Based Syst 85:52–61

Article Google Scholar

Habib A, Costa MD, Huang HJ, Bhuiyan MBU, Sun L (2020) Determinants and consequences of financial distress: review of the empirical literature. Account Finance 60:1023–1075

Platt HD, Platt MB (2006) Understanding differences between financial distress and bankruptcy. Rev Appl Econ 2(1076-2016–87135):141–157

Google Scholar

Koh S, Durand RB, Dai L, Chang M (2015) Financial distress: lifecycle and corporate restructuring. J Corp Finance 33:19–33

Altman EI (1968) Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. J Finance 23(4):589–609

Beaver WH (1966) Financial ratios as predictors of failure. J Account Res 4:71–111

Ohlson JA (1980) Financial ratios and the probabilistic prediction of bankruptcy. J Account Res 18:109–131

Zmijewski ME (1984) Methodological issues related to the estimation of financial distress prediction models. J Account Res 22:59–82

Mohamed SS (2020) Suggested model for explaining financial distress in Egypt: toward a comprehensive model. In: Financial issues in emerging economies: special issue including selected papers from II international conference on economics and finance, 2019, Bengaluru, India. Emerald Publishing Limited

Sayari N, Mugan CS (2017) Industry specific financial distress modeling. BRQ Bus Res Q 20(1):45–62

Beaver WH, McNichols MF, Rhie JW (2005) Have financial statements become less informative? Evidence from the ability of financial ratios to predict bankruptcy. Rev Account Stud 10(1):93–122

Bravo-Urquiza F, Moreno-Ureba E (2021) Does compliance with corporate governance codes help to mitigate financial distress? Res Int Bus Finance 55:101344

Chenchehene J (2019) Corporate governance and financial distress prediction in the UK (Doctoral dissertation, Bournemouth University).

Altman EI, Hotchkiss E (2006) Corporate financial distress & bankruptcy, 3rd edn. Wiley, Hoboken

Sun J, Li H, Chang PC, He KY (2016) The dynamic financial distress prediction method of EBW-VSTW-SVM. Enterp Inf Syst 10(6):611–638

Pindado J, Rodrigues L, de la Torre C (2008) Estimating financial distress likelihood. J Bus Res 61(9):995–1003

Ong SW, Yap VC, Khong RW (2011) Corporate failure prediction: a study of public listed companies in Malaysia. Manag Finance 37:553–564

Alifiah MN (2014) Prediction of financial distress companies in the trading and services sector in Malaysia using macroeconomic variables. Procedia Soc Behav Sci 129:90–98

Ahmad AH (2019) What factors discriminate reorganized and delisted distressed firms: evidence from Malaysia. Finance Res Lett 29(C):50–56

Oz IO, Yelkenci T (2017) A theoretical approach to financial distress prediction modeling. Manag Finance 43(2):212–230

Dissanayke TDSH, Somathilake HMDN, Madushanka K, Wickramasinghe D, Cooray N (2017) Board configuration on financial distress. GSJ 5(5):107

Gandhy F (2019) Analysis of financial ratio to predict financial distress conditions (empirical study on manufacturing companies listed on the indonesia stock exchange for 2014–2017). Int J Bus Manag Invent (IJBMI) 8(6):27–34

García CJ, Herrero B (2021) Female directors, capital structure, and financial distress. J Bus Res 136:592–601

Selassie EG, Tarekegn G, Ufo A (2016) Analysis of financial distress and its determinants in selected SMEs in Wolaita zone. Global J Manag Bus Res 16(8):35–41

Shahwan TM (2015) The effects of corporate governance on financial performance and financial distress: evidence from Egypt. Corporate Governance

Waqas H, Md-Rus R (2018) Predicting financial distress: importance of accounting and firm-specific market variables for Pakistan’s listed firms. Cogent Econ Finance 6(1):1545739

Ogachi D, Ndege R, Gaturu P, Zoltan Z (2020) Corporate bankruptcy prediction model, a special focus on listed companies in Kenya. J Risk Financ Manag 13(3):47

Zhang X, Ouyang R, Liu D, Xu L (2020) Determinants of corporate default risk in China: The role of financial constraints. Econ Model 92:87–98

Li Z, Crook J, Andreeva G, Tang Y (2020) Predicting the risk of financial distress using corporate governance measures. Pac-Basin Finance J 68:101334

Ashraf S, Félix EG, Serrasqueiro Z (2020) Development and testing of an augmented distress prediction model: a comparative study on a developed and an emerging market. J Multinatl Financ Manag 57:100659

Shahwan TM, Fadel MA (2020) Machine learning models and financial distress prediction of small and medium-sized firms: Evidence from Egypt. J Alex Univ Administr Sci 57(1):344–305

Yendrawati R, Adiwafi N (2020) Comparative analysis of Z-score, Springate, and Zmijewski models in predicting financial distress conditions. J Contemp Account 2(2):72–80

Chabachib M, Kusmaningrum RH, Hersugondo H (2019) Financial distress prediction in Indonesia. WSEAS Trans Bus Econ 16:251–260

Kristanti FT, Rahayu S, Huda AN (2016) The determinant of financial distress on Indonesian family firm. Procedia Soc Behav Sci 219:440–447

Mittal S et al (2018) Females’ representation in the boardroom and their impact on financial distress: an evidence from family businesses in India. Indian J Corp Gov 11(1):35–44

Kliestik T, Valaskova K, Lazaroiu G, Kovacova M, Vrbka J (2020) Remaining financially healthy and competitive: the role of financial predictors. J Compet 12(1):74

El-Ansary O, Bassam L (2019) Predicting financial distress for listed MENA firms. Int J Account Financ Report 9(2):51–75

Manzaneque M, Priego AM, Merino E (2016) Corporate governance effect on financial distress likelihood: evidence from Spain. Rev Contab 19(1):111–121

Yu Q, Miche Y, Séverin E, Lendasse A (2014) Bankruptcy prediction using extreme learning machine and financial expertise. Neurocomputing 128:296–302

Pozzoli M, Paolone F (2017) Corporate financial distress: a study of the Italian manufacturing industry. Springer, New York

Altman EI, Iwanicz-Drozdowska M, Laitinen EK, Suvas A (2017) Financial distress prediction in an international context: a review and empirical analysis of Altman’s Z-score model. J Int Financ Manag Acc 28(2):131–171

Alaminos D, Del Castillo A, Fernández MÁ (2016) A global model for bankruptcy prediction. PLoS ONE 11(11):e0166693

Charalambakis EC, Garrett I (2019) On corporate financial distress prediction: What can we learn from private firms in a developing economy? Evidence from Greece. Rev Quant Financ Acc 52(2):467–491

Cındık Z, Armutlulu IH (2021) A revision of Altman Z-score model and a comparative analysis of Turkish companies’ financial distress prediction. National Account Rev 3(2):237–255

Hillegeist SA, Keating EK, Cram DP, Lundstedt KG (2004) Assessing the probability of bankruptcy. Rev Account Stud 9(1):5–34

Shumway T (2001) Forecasting bankruptcy more accurately: a simple hazard model. J Bus 74(1):101–124

Jones S (2017) Corporate bankruptcy prediction: a high dimensional analysis. Rev Account Stud 22(3):1366–1422

Boratyńska K, Grzegorzewska E (2018) Bankruptcy prediction in the agribusiness sector: lessons from quantitative and qualitative approaches. J Bus Res 89:175–181

Fernández-Gámez MÁ, Soria JAC, Santos JAC, Alaminos D (2020) European country heterogeneity in financial distress prediction: an empirical analysis with macroeconomic and regulatory factors. Econ Model 88:398–407

Agrawal K, Maheshwari Y (2014) Default risk modelling using macroeconomic variables. J Indian Bus Res 6:270–285

Liang D, Tsai CF, Lu HYR, Chang LS (2020) Combining corporate governance indicators with stacking ensembles for financial distress prediction. J Bus Res 120:137–146

Wahba H (2015) The joint effect of board characteristics on financial performance: empirical evidence from Egypt. Rev Account Finance 14(1):20–40

Hosmer DW Jr, Lemeshow S, Sturdivant RX (2013) Applied logistic regression, vol 398. Wiley, New Jersey

John K, Lang LH, Netter J (1992) The voluntary restructuring of large firms in response to performance decline. J Finance 47(3):891–917

Lima BF, Sanvicente AZ (2013) Quality of corporate governance and cost of equity in Brazil. J Appl Corp Finance 25(1):72–80

Varshney P, Kaul VK, and Vasal VK (2012) Corporate governance index and firm performance: empirical evidence from India. Available at SSRN 2103462

Breisinger C, Raouf M, Wiebelt M, Kamaly A, Karara M (2020) Impact of COVID-19 on the Egyptian economy: economic sectors, jobs, and households. international food policy research institute, Washington. MENA Policy Note 6:1–12

International Monetary Fund (2020) Retrieved from https://www.imf.org/en/News/Articles/2020/07/09/na070920-egypt-takes-proactive-approach-to-limit-the-pandemics-fallout

The Organisation for Economic Co-operation and Development (2020) Retrieved from https://www.oecd.org/mena/competitiveness/The-Covid-19-Crisis-in-Egypt.pdf

International Monetary Fund (2021) Retrieved from https://www.imf.org/en/News/Articles/2021/07/14/na070621-egypt-overcoming-the-covid-shock-and-maintaining-growth

Zizi Y, Jamali-Alaoui A, El Goumi B, Oudgou M, El Moudden A (2021) An optimal model of financial distress prediction: a comparative study between neural networks and logistic regression. Risks 9(11):200

Hair JF, Black WC, Babin BJ, Anderson RE, Tatham RL (2014) Pearson new international edition. Multivariate data analysis, 7th edn. Pearson Education Limited Harlow, Essex

Pregibon D (1981) Logistic regression diagnostics. Ann Stat 9(4):705–724

Lukason O, Laitinen EK (2018) Failure of exporting and non-exporting firms: do the financial predictors vary? Rev Int Bus Strategy 28(3/4):317–330

Chen CC, Chen CD, Lien D (2020) Financial distress prediction model: the effects of corporate governance indicators. J Forecast 39(8):1238–1252

Çolak MS (2021) A new multivariate approach for assessing corporate financial risk using balance sheets. Borsa İstanbul Rev 21(3):239–255

Download references

Acknowledgements

Not applicable.

Funding has not been sought nor received for this article.

Author information

Authors and affiliations.

Business Administration Department, Faculty of Business, Ain Shams University, Cairo, Egypt

Noha Adel Mohamed Abdelkader & Hayam Hassan Wahba

You can also search for this author in PubMed Google Scholar

Contributions

NA has contributed to the study design, writing the introduction and literature review, data collection, methodology, data analysis, interpretation of results, implications, and conclusion. HW has contributed to the conception, the design of the study, provided guidance on developing the article, collecting and interpreting data, discussion of results and implications, substantively revised the paper, and approved the submitted version. Both authors have jointly read, reviewed, and approved the submitted version.

Corresponding author

Correspondence to Noha Adel Mohamed Abdelkader .

Ethics declarations

Ethics approval and consent to participate, consent for publication, competing interests.

Prof. Hayam Hassan Wahba is an editorial board member. The authors declare that they have no other competing interests.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The corporate governance questionnaire questions

Disclosure and transparency:

Does the firm use one of the Big Four international auditing firms?

Does the firm disclose the amount of executives’ compensations?

Does the firm disclose its governance structures and policies?

Board of directors’ characteristics:

Does the Board have more than 50 percent external directors (non-executive directors)?

Does the Board contain at least one-third of the members as independent members?

Are Board committees chaired by independent members?

Do Board committees consist of at least three non-executive board members the majority of whom are independent?

Does the Board contain female members?

Shareholder rights and investor relations:

Is there an institutional investor with at least 5 percent of the firm’s equity?

Does the firm exercise the one-share one-vote rule indiscriminately?

Ownership and control structure:

Does the firm disclose its ownership structure?

Do controlling shareholders hold less than 70 percent of voting rights?

Does the firm have employee stock options?

Is there an ownership concentration where at least 5 percent of the firm’s equity ownership is held by an investor?

( Source [ 26 ] adapted from [ 56 , 57 ].

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/ .

Reprints and permissions

About this article

Cite this article.

Abdelkader, N.A.M., Wahba, H.H. A proposed multidimensional model for predicting financial distress: an empirical study on Egyptian listed firms. Futur Bus J 10 , 42 (2024). https://doi.org/10.1186/s43093-024-00328-2

Download citation

Received : 27 February 2024

Accepted : 04 April 2024

Published : 20 April 2024

DOI : https://doi.org/10.1186/s43093-024-00328-2

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Logistic regression

- Financial ratios

- Market indicators

- Macroeconomic factors

- Corporate governance

Advertisement

Deep Learning-Based Model for Financial Distress Prediction

- Original Research

- Published: 25 May 2022

Cite this article

- Mohamed Elhoseny ORCID: orcid.org/0000-0001-6347-8368 1 , 2 ,

- Noura Metawa 3 , 4 ,

- Gabor Sztano 5 &

- Ibrahim M. El-hasnony 1

7996 Accesses

14 Citations

Explore all metrics

Predicting bankruptcies and assessing credit risk are two of the most pressing issues in finance. Therefore, financial distress prediction and credit scoring remain hot research topics in the finance sector. Earlier studies have focused on the design of statistical approaches and machine learning models to predict a company's financial distress. In this study, an adaptive whale optimization algorithm with deep learning (AWOA-DL) technique is used to create a new financial distress prediction model. The goal of the AWOA-DL approach is to determine whether a company is experiencing financial distress or not. A deep neural network (DNN) model called multilayer perceptron based predictive and AWOA-based hyperparameter tuning processes are used in the AWOA-DL method. Primarily, the DNN model receives the financial data as input and predicts financial distress. In addition, the AWOA is applied to tune the DNN model's hyperparameters, thereby raising the predictive outcome. The proposed model is applied in three stages: preprocessing, hyperparameter tuning using AWOA, and the prediction phase. A comprehensive simulation took place on four datasets, and the results pointed out the supremacy of the AWOA-DL method over other compared techniques by achieving an average accuracy of 95.8%, where the average accuracy equals 93.8%, 89.6%, 84.5%, and 78.2% for compared models.

Similar content being viewed by others

A multi-layer perceptron approach to financial distress prediction with genetic algorithm.

A novel method for financial distress prediction based on sparse neural networks with \(L_{1/2}\) regularization

Prediction of Financial Distress for Electricity Sectors Using Data Mining

Explore related subjects.

- Artificial Intelligence

Avoid common mistakes on your manuscript.

1 Introduction

Because of the impacts of the COVID-19 outbreak, many businesses are facing financial difficulties. (Abedin et al., 2021 ) Usually, economic downturns are part of companies' long-term business activity, and problems may be discovered in time and solved adequately. Due to its nature, financial distress is predictable with several types of models. (Uthayakumar et al., 2020a ) Generally, businesses could perceive possible threats by analyzing country-, industry, and firm-level information on economic stance. To assist companies in dispersing and avoiding financial threats effectively and in a timely manner, economic crises warning systems have great importance in companies’ risk management. Several researchers have developed early warning economic models in various sectors; however, the precision of these methods still needs to be enhanced (Ghisellini & Ulgiati, 2020 ; Liu & Arunkumar, 2019 ; Sankhwar et al., 2020 ).

Now, many related pieces of literature use arithmetical models for building an economic crisis earlier warning system or employ different techniques for assessment (Ashraf et al., 2019 ; Bluwstein et al., 2020 ; Shajalal et al., 2021 ). Also, these studies use a comparative approach and use 2 NN methods for establishing economic crises earlier warning systems (Metawa et al., 2021 ; Yang & Yang, 2020 ). This 2 NN model includes RPROP NN and SVM. Such results could recommend the domestic economic sectors and offer a foundation for financial management for public investments. Currently, the ML algorithm has been extensively employed in the fields of company economic distress predictions. But, many algorithms regard economic distress predictions as a more straightforward dichotomy problem and frequently neglect the timeline of the financial distress epidemic in real-time. Also, the possible relations among tags and features may not be deliberated. Worthy economic distress predictions should be efficient and realistic (Chatzis et al., 2018 ; Huang & Yen, 2019 ; Petropoulos et al., 2020 ).

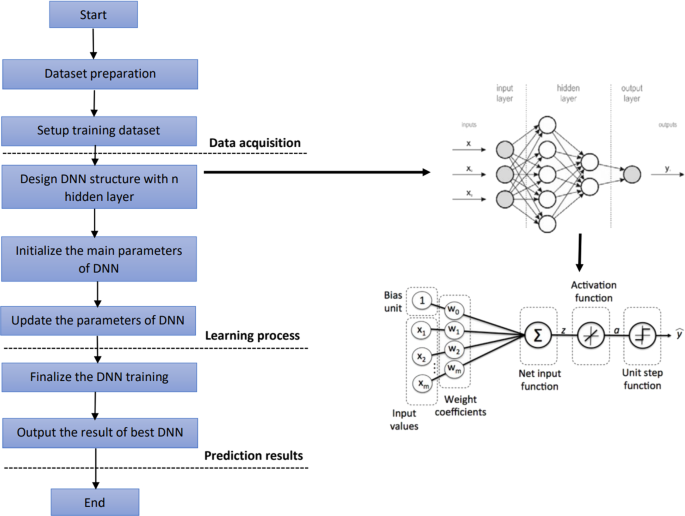

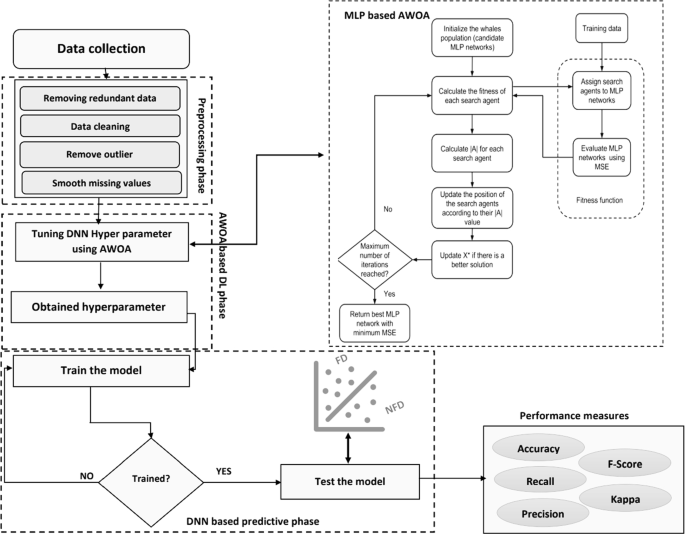

In this study, a new financial distress prediction model uses an adaptive whale optimization algorithm with deep learning (AWOA-DL) technique, including multi-layer perceptron (MLP) and optimization algorithm. Population-based WOA is capable of avoiding local optimums and finding a solution that is optimal globally. With these advantages, WOA is an ideal algorithm for solving a wide range of constrained and unconstrained optimization problems in practical applications without the need for structural reform of the algorithm. The WOA is used for fine-tuning the parameters of the MLP so producing the parameters that maximize the performance of the MLP with better accuracy. It is now easier to fine-tune MLP parameters with the help of the WOA, which allows for more precision.

The goal of the AWOA-DL approach is to determine whether a company is experiencing financial distress or not. The proposed AWOA-DL technique predicts a company's financial distress in four stages, each of which is described in detail below. The data collection phase is responsible for gathering the datasets that will be used to evaluate the performance of the proposed model. Second, the data preprocessing stage improves the quality of the data collected before moving on to the other steps of the model. Preprocessing removes incomplete samples, missing data, and null values. Because all financial indicators are based on company characteristics, this method can be used globally. Third, the AWOA-based parameter optimization phase fine-tunes the hyperparameters of the MLP model in preparation for the final step. We will use sigmoid transfer functions to train the networks to predict distress. The AWOA-DL technique combines deep neural network (DNN) prediction with AWOA hyperparameter tuning. The DNN, including the MLP model, predicts financial distress using financial data. The last step is to use deep neural networks (DNNs) to predict the company data class labels (DF or NFD).

We examine the performance of real-time and dynamically changing structures in four different datasets in this work. The studies in this work primarily aim to give researchers clear guidance on constructing a reliable deep learning model for predicting future financial difficulties. FD is for the financially distressed firm, while NFD stands for the non-financially distressed corporation. The study's findings indicate that the proposed model has a significantly higher prediction accuracy than conventional machine learning models.

This article is structured as follows. The next section discusses research into financial distress prediction. Section 3 discusses the tools and techniques employed in greater detail. Section 4 introduces and clarifies the model being discussed. Section 5 describes, optimizes, analyzes, and compares the prediction performance of all of the chosen deep models. Section 6 presents a robust model for predicting financial distress using deep neural networks and concludes with recommendations.

2 Related work

The logistic regression models (Ohlson, 1980 ; Sun et al., 2014 ), and discriminant analysis (Altman, 1968 ) are examples of early and conventional statistical models that have been used in distress prediction. As seen above, these basic linear processes are impractical since they are very simple when it comes to developing a good model for generating real-time predictions, as seen above. To better predict bank hardship, researchers in the Gulf Cooperation Council created a simple hazard model (Maghyereh & Awartani, 2014 ). Other methods, such as machine learning utilizing data mining techniques like Logistic Regression (Min & Lee, 2005 ; Sun et al., 2017 ) and Support Vector Machines (Chandra et al., 2009 ; Cleofas-Sánchez et al., 2016 ; Hall & Holmes, 2003 ; Moula et al., 2017 ; Serre et al., 2007 ) were explored. An evaluation of the performance of machine learning algorithms for predicting financial hardship in publicly traded Chinese enterprises was completed in 2015 by Serre et al. ( 2007 ). Yu et al. ( 2020 ) developed an advanced complicated network method for simulating an interbank network using general risks contagion, which considered the balance sheet of all banks, where they could find when the economic institution has an adequate capital reserve to avoid risks contagion. Cascade default is also made in the simulations based on the distinct crises triggering (target default) method. They utilize ML methods for identifying the synthetic feature of the networks. Appiahene et al. ( 2020 ) presented an integrated DEA using 3 ML methods in calculating bank performance and efficiency with 444 Ghanaian bank branches, DMUs. The outcomes are related to the respective efficacy rating attained from the DEA. Lastly, the predictive accuracy of the 3 ML algorithms is related. The result recommended that the DT and its C5.0 algorithms provide an optimal prediction method. Samitas et al. ( 2020 ) studied on EWS model by exploring potential contagion threats according to the structure economic network. Earlier warnings indicators enhance average crisis predictive model performances. The network analyses and ML algorithm found proof of contagion risks on the date in which they observed considerable expansion in centralities and correlations.