Have an account?

Suggestions for you See more

9th - 12th

Marketing promotion test review, sales process cycle, market research, 9th - 10th , decisions, decisions, decisions, introduction to entrepreneurship, 10th - 12th , entrepreneurship final.

Business Plan Math - Reading Quiz

11th - 12th grade.

10 questions

Introducing new Paper mode

No student devices needed. Know more

What is the term used for a 3-5 year forecast of your income and expenses?

Financial model

Profits and losses

Spreadsheet

What is an example of a monthly, recurring expense?

Lease down payment

What is the type of pricing determined largely by what other companies in your industry are charging?

Competitors' pricing

Value-based pricing

Simple pricing

Cost-plus pricing

What is the rate at which the business grows or increases revenue from sales?

Profit margin

Monthly profit

Growth percentage

Examples of direct costs are:

Utilities and rent

Labor and material costs

Pricing your product based how a customer perceives the product is called:

Sales revenue is calculated by:

Number of sales multiplied by average customer sale dollar amount

Sales price multiplied by cost of goods sold

Number of sales multiplied by cost of goods sold

True or False: Net profit is greater than gross profit.

Starting a company in which you only spend money that is absolutely necessary at each point in time is called a:

Lean startup

Sole proprietor

Growth startup

What is the description of each axis on a breakeven chart?

Profit and volume

Sales and expenses

Direct costs and indirect costs

Explore all questions with a free account

Continue with email

Continue with phone

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

Chapter 13: Solutions to Exercises

13.1: calculating interest and principal components.

- A lump sum of $100,000 is placed into an investment annuity to make end-of-month payments for 20 years at 4% compounded semi-annually. a) What is the size of the monthly payment? b) Calculate the principal portion of the 203rd payment. c) Calculate the interest portion of the 76th payment. d) Calculate the total interest received in the fifth year. e) Calculate the principal portion of the payments made in the seventh year.

a) What is the size of the monthly payment?

[latex]N = (\text{Number of Years}) \times (\text{Payments Per Year})[/latex] [latex]N = 20 \times 12 = 240 \;\text{payments}[/latex] [latex]I/Y = 4[/latex] [latex]P/Y = 12[/latex] [latex]C/Y = 2[/latex] [latex]PV = -100,\!000[/latex] [latex]FV = 0[/latex] [latex]PV = -100,\!000[/latex] [latex]CPT\; PMT =\$604.2464648[/latex]

Make sure to reinput PMT =$604.25 (Input as a positive value rounded to 2 decimal places).

b) Calculate the principal portion of the 203rd payment.

2nd AMORT P1 = 203 P2 = 203 ↓ ↓ PRN = $533.03

c) Calculate the interest portion of the 76th payment.

2nd AMORT P1 = 76 P2 = 76 ↓ ↓ ↓ INT = $253.73

d) Calculate the total interest received in the fifth year.

Year 1: payments 1 – 12 Year 2: payments 13 – 24 Year 3: payments 25 – 36 Year 4: payments 37 – 48 Year 5: payments 49 – 60

2nd AMORT P1 = 49 (Starting with payment 49) P2 = 60 (Ending with payment 60) ↓ ↓ ↓ INT = $3,332.61

e) Calculate the principal portion of the payments made in the seventh year .

Year 1: payments 1 – 12 Year 2: payments 13 – 24 Year 3: payments 25 – 36 Year 4: payments 37 – 48 Year 5: payments 49 – 60 Year 6: payments 61 – 72 Year 7: payments 73 – 84

2nd AMORT P1 = 73 P2 = 84 ↓ ↓ PRN = $4,241.39

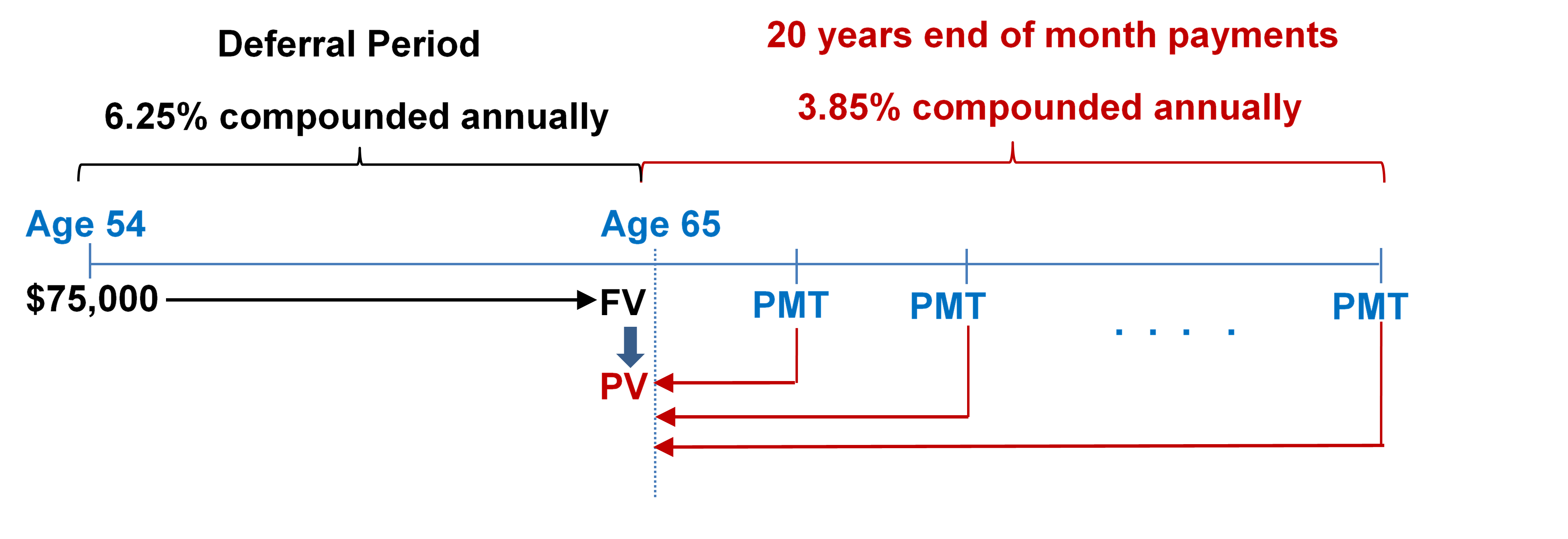

- At the age of 54, Hillary just finished all the arrangements on her parents’ estate. She is going to invest her $75,000 inheritance at 6.25% compounded annually until she retires at age 65, and then she wants to receive month-end payments for the following 20 years. The income annuity is expected to earn 3.85% compounded annually. a) What are the principal and interest portions for the first payment of the income annuity? b) What is the portion of interest earned on the payments made in the second year of the income annuity? c) By what amount is the principal of the income annuity reduced in the fifth year?

a) What are the principal and interest portions for the first payment of the income annuity?

Step 1: Find [latex]FV[/latex].

[latex]N = (\text{Number of Years}) \times (\text{Payments Per Year})[/latex] [latex]N = 11 \times 1 = 11 \;\text{payments}[/latex] [latex]I/Y = 6.25[/latex] [latex]P/Y = 1[/latex] [latex]C/Y = 1[/latex] [latex]PV = 75,\!000[/latex] [latex]PMT = 0[/latex] [latex]PV = 75,\!000[/latex] [latex]CPT\; FV =-\$146,\!109.88[/latex]

Step 2: Find [latex]PMT[/latex].

[latex]N = (\text{Number of Years}) \times (\text{Payments Per Year})[/latex] [latex]N = 20 \times 12 = 240 \;\text{payments}[/latex] [latex]I/Y = 3.85[/latex] [latex]P/Y = 12[/latex] [latex]C/Y = 1[/latex] [latex]PV = \$146,\!109.88[/latex] [latex]FV = 0[/latex] [latex]PV = \$146,\!109.88[/latex] [latex]CPT\; PMT =-868.83224[/latex]

Make sure to reinput PMT = -868.83 (Input as a negative value rounded to 2 decimal places).

2nd AMORT P1 = 1 P2 = 1 ↓ ↓ PRN = $408.13 INT = $460.70

b) What is the portion of interest earned on the payments made in the second year of the income annuity?

2nd AMORT P1 = 13 P2 = 24 ↓ ↓ ↓ INT = $5,250.65

c) By what amount is the principal of the income annuity reduced in the fifth year?

2nd AMORT P1 = 49 P2 = 60 ↓ ↓ PRN = $5,796.37

- Art Industries just financed a $10,000 purchase at 5.9% compounded annually. It fixes the loan payment at $300 per month. a) How long will it take to pay the loan off? b) What are the interest and principal components of the 16th payment? c) For tax purposes, Art Industries needs to know the total interest paid for payments 7 through 18. Calculate the amount.

a) How long will it take to pay the loan off?

[latex]I/Y = 5.9[/latex] [latex]P/Y = 12[/latex] [latex]C/Y = 1[/latex] [latex]PV = 10,\!000[/latex] [latex]PMT=-300[/latex] [latex]FV= 0[/latex] [latex]CPT\; N =36.402469\;\text{rounded up to}\; 37\;\text{ monthly payments}[/latex]

[latex]\begin{align} \text{Number of years}&=\frac{37}{12}\\ &= 3.08\overline{3}\\ &=3\;\text{years and}\; 0.08\overline{3}\times 12=1\; \text{month} \end{align}[/latex]

3 years, 1 month

b) What are the interest and principal components of the 16th payment?

2nd AMORT P1 = 16 P2 = 16 ↓ ↓ PRN = $270.84 INT = $29.16

c) For tax purposes, Art Industries needs to know the total interest paid for payments 7 through 18. Calculate the amount.

2nd AMORT P1 = 7 P2 = 18 ↓ ↓ ↓ INT = $403.33

13.2: Calculating the Final Payment

- Semi-annual payments are to be made against a $97,500 loan at 7.5% compounded semi-annually with a 10-year amortization. a) What is the amount of the final payment? b) Calculate the principal and interest portions of the payments in the final two years.

Step 1 : Find the regular payment.

[latex]N = (\text{Number of Years}) \times (\text{Payments Per Year})[/latex] [latex]N = 10 \times 2 = 20 \;\text{payments}[/latex] [latex]I/Y = 7.5[/latex] [latex]P/Y = 2[/latex] [latex]C/Y = 2[/latex] [latex]PV = 97,\!500[/latex] [latex]FV = 0[/latex] [latex]CPT\; PMT = -\$7,\!016.30449[/latex]

Make sure to reinput PMT = -7,016.30 (Input as a negative value rounded to 2 decimal places).

Step 2: Use the AMORT function to find the BAL on the last line (payment 20).

2nd AMORT P1 = 20 P2 = 20 ↓ BAL = $0.130277

Step 3: Find the Final Payment

Final Payment = $7,016.30 + $0.130277 = $7,016.43.

Year 9: payments 17-18 Year 10: payments 19-20

2nd AMORT P1 = 17 P2 = 20 ↓ BAL = $0.130277 (*added to payment of $7,016.30 = $7,016.43) PRN = $25,619.18861 (* add BAL: $25,619.18861 + $0.130277 = $25,619.32) INT = $2,446.011387

Therefore, PRN = $25,619.32; INT = $2,446.01.

- A $65,000 trust fund is set up to make end-of-year payments for 15 years while earning 3.5% compounded quarterly. a) What is the amount of the final payment? b) Calculate the principal and interest portion of the payments in the final three years.

[latex]N = (\text{Number of Years}) \times (\text{Payments Per Year})[/latex] [latex]N = 15 \times 1 = 15 \;\text{payments}[/latex] [latex]I/Y = 3.5[/latex] [latex]P/Y = 1[/latex] [latex]C/Y = 4[/latex] [latex]PV = 65,\!000[/latex] [latex]FV = 0[/latex] [latex]CPT\; PMT = -\$5,\!662.190832[/latex]

Make sure to reinput PMT = -5,662.19 (Input as a negative value rounded to 2 decimal places).

Step 2: Use the AMORT function to find the BAL on the last line (payment 15)

2nd AMORT P1 = 15 P2 = 15 ↓ BAL = $0.016114

Final Payment = $5,662.19 + $0.016114 = $5,662.21.

2nd AMORT P1 = 13 P2 = 15 ↓ BAL = $0.016114 (*added to payment of $5,662.19 = $5,662.21) PRN = $15,849.40807 (* add BAL: $15,849.40807 + $0.016114 = $15,849.42) INT = $1,137.161928

Therefore, PRN = $15,849.42; INT = $1,137.16.

- Mirabel Wholesale has a retail client that is struggling and wants to make instalments against its most recent invoice for $133,465.32. Mirabel works out a plan at 12.5% compounded monthly with beginning-of-month payments for two years. a) What will be the amount of the final payment? b) Calculate the principal and interest portions of the payments for the entire agreement.

[latex]N = (\text{Number of Years}) \times (\text{Payments Per Year})[/latex] [latex]N = 2 \times 12= 24 \;\text{payments}[/latex] [latex]I/Y = 12.5[/latex] [latex]P/Y = 12[/latex] [latex]C/Y = 12[/latex] [latex]PV = 133,\!465.32[/latex] [latex]FV = 0[/latex] [latex]CPT\; PMT = -\$6,\!248.793434[/latex]

Make sure to reinput PMT = -6,248.79 (Input as a negative value rounded to 2 decimal places).

Step 2: Use the AMORT function to find the BAL on the last line (payment 24)

2nd AMORT P1 = 24 P2 = 24 ↓ BAL = $0.093078

Final Payment = $6,248.79 + $0.093078 = $6,248.88.

2nd AMORT P1 = 1 P2 = 24 ↓ BAL = $0.093078 (*added to payment of $6,248.79 = $6,248.88) PRN = $133,465.2269 (* add BAL: $133,465.2269 + $0.093078 = $133,465.32) INT = $16,505.73308

Therefore, PRN = $133,465.32; INT = $16,505.73.

13.3: Amortization Schedules

- A farmer purchased a John Deere combine for $369,930. The equipment dealership sets up a financing plan to allow for end-of-quarter payments for the next two years at 7.8% compounded monthly. Construct a complete amortization schedule and calculate the total interest.

[latex]N = (\text{Number of Years}) \times (\text{Payments Per Year})[/latex] [latex]N = 2 \times 4= 8 \;\text{payments}[/latex] [latex]I/Y = 7.8[/latex] [latex]P/Y = 4[/latex] [latex]C/Y = 12[/latex] [latex]PV = 369,\!930[/latex] [latex]FV = 0[/latex] [latex]CPT\; PMT = -\$50,\!417.92645[/latex]

Make sure to reinput PMT = -50,417.93 (Input as a negative value rounded to 2 decimal places).

Step 2: Use the AMORT function to fill out the table.

| 0 | n/a | n/a | n/a | $369,930.00 |

| 1 | $50,417.93 | $7,260.63 | $43,157.30 | $326,772.70 |

| 2 | $50,417.93 | $6,413.58 | $44,004.35 | $282,768.34 |

| 3 | $50,417.93 | $5,549.90 | $44,868.03 | $237,900.31 |

| 4 | $50,417.93 | $4,669.28 | $45,748.65 | $192,151.66 |

| 5 | $50,417.93 | $3,771.37 | $46,646.56 | $145,505.09 |

| 6 | $50,417.93 | $2,855.83 | $47,562.10 | $97,942.99 |

| 7 | $50,417.93 | $1,922.33 | $48,495.60 | $49,447.39 |

| 8 | $50,417.90 | $970.51 | $49,447.39 | $0.00 |

Step 3: Adjust for the “missing pennies” (noted in bold italics ) and total the interest.

| 0 | $369,930.00 | |||

| 1 | $50,417.93 | $7,260.63 | $43,157.30 | $326,772.70 |

| 2 | $50,417.93 | $282,768.34 | ||

| 3 | $50,417.93 | $5,549.90 | $44,868.03 | $237,900.31 |

| 4 | $50,417.93 | $4,669.28 | $45,748.65 | $192,151.66 |

| 5 | $50,417.93 | $145,505.09 | ||

| 6 | $50,417.93 | $2,855.83 | $47,562.10 | $97,942.99 |

| 7 | $50,417.93 | $1,922.33 | $48,495.60 | $49,447.39 |

| 8 | $50,417.90 | $970.51 | $49,447.39 | $0.00 |

| Total | $403,343.41 | $369,930.00 |

- Ron and Natasha had Oasis Leisure and Spa install an in-ground swimming pool for $51,000. The financing plan through the company allows for end-of-month payments for two years at 6.9% compounded quarterly. Ron and Natasha instruct Oasis to round their monthly payment upward to the next dollar amount evenly divisible by $500. Create a schedule for the first three payments, payments seven through nine, and the last three payments.

[latex]N = (\text{Number of Years}) \times (\text{Payments Per Year})[/latex] [latex]N = 2 \times 12= 24 \;\text{payments}[/latex] [latex]I/Y = 6.9[/latex] [latex]P/Y = 12[/latex] [latex]C/Y = 4[/latex] [latex]PV = 51,\!000[/latex] [latex]FV = 0[/latex] [latex]CPT\; PMT = -\$2,\!280.18[/latex]

Make sure to reinput PMT = – $2,500 ($2,280.18 rounded up to $2,500).

Step 2 : Recalculate N with new PMT.

[latex]I/Y = 6.9[/latex] [latex]P/Y = 12[/latex] [latex]C/Y = 4[/latex] [latex]PV = 51,\!000[/latex] [latex]PMT = -2,\!500[/latex] [latex]FV = 0[/latex] [latex]CPT\; N = 21.753021\; \text{rounded up to}\; 22\; \text{monthly payments}[/latex]

Step 3: Use the AMORT function to fill out the table.

| 0 | $51,000.00 | |||

| 1 | $2,500.00 | $291.58 | $2,208.42 | $48,791.58 |

| 2 | $2,500.00 | $278.95 | $2,221.05 | $46,570.53 |

| 3 | $2,500.00 | $266.26 | $2,233.74 | $44,336.79 |

| ……. | ||||

| $37,558.64 | ||||

| 7 | $2,500.00 | $214.73 | $2,285.27 | $35,273.37 |

| 8 | $2,500.00 | $201.67 | $2,298.33 | $32,975.04 |

| 9 | $2,500.00 | $188.53 | $2,311.47 | $30,663.56 |

| ……… | ||||

| $6,809.38 | ||||

| 20 | $2,500.00 | $38.93 | $2,461.07 | $4,348.31 |

| 21 | $2,500.00 | $24.86 | $2,475.14 | $1,873.17 |

| 22 | $1,883.88 | $10.71 | $1,873.17 | $0.00 |

Step 4: Adjust for the “missing pennies” (noted in bold italics ) and total the interest.

| 0 | $51,000.00 | |||

| 1 | $2,500.00 | $291.58 | $2,208.42 | $48,791.58 |

| 2 | $2,500.00 | $278.95 | $2,221.05 | $46,570.53 |

| 3 | $2,500.00 | $266.26 | $2,233.74 | $44,336.79 |

| ……. | ||||

| $37,558.64 | ||||

| 7 | $2,500.00 | $214.73 | $2,285.27 | $35,273.37 |

| 8 | $2,500.00 | $201.67 | $2,298.33 | $32,975.04 |

| 9 | $2,500.00 | $30,663.56 | ||

| ……… | ||||

| $6,809.38 | ||||

| 20 | $2,500.00 | $38.93 | $2,461.07 | $4,348.31 |

| 21 | $2,500.00 | $24.86 | $2,475.14 | $1,873.17 |

| 22 | $1,883.88 | $10.71 | $1,873.17 | $0.00 |

| Total | $21,883.88 | $20,367.67 |

- Hillary acquired an antique bedroom set recovered from a European castle for $118,000. She will finance the purchase at 7.95% compounded annually through a plan allowing for payments of $18,000 at the end of every quarter. a) Create a complete amortization schedule and indicate her total interest paid. b) Recreate the complete amortization schedule if Hillary pays two additional top-up payments consisting of 10% of the principal remaining after her third payment as well as her fifth payment. What amount of interest does she save?

Step 1: Find [latex]N[/latex].

[latex]I/Y = 7.95[/latex] [latex]P/Y = 4[/latex] [latex]C/Y = 1[/latex] [latex]PMT = -18,\!000[/latex] [latex]PV = 118,\!000[/latex] [latex]FV = 0[/latex] [latex]CPT\; N = 7.076614\; \text{rounded up to}\; 8\; \text{quarterly payments}[/latex]

Step 2: Use the AMORT function to fill out the table.

| 0 | $118,000.00 | |||

| 1 | $18,000.00 | $2,278.41 | $15,721.59 | $102,278.41 |

| 2 | $18,000.00 | $1,974.85 | $16,025.15 | $86,253.25 |

| 3 | $18,000.00 | $1,665.42 | $16,334.58 | $69,918.68 |

| 4 | $18,000.00 | $1,350.03 | $16,649.97 | $53,268.71 |

| 5 | $18,000.00 | $1,028.54 | $16,971.46 | $36,297.25 |

| 6 | $18,000.00 | $700.85 | $17,299.15 | $18,998.09 |

| 7 | $18,000.00 | $366.83 | $17,633.17 | $1,364.92 |

| 8 | $1,391.27 | $26.35 | $1,364.92 | $0.00 |

| 0 | $118,000.00 | |||

| 1 | $18,000.00 | $2,278.41 | $15,721.59 | $102,278.41 |

| 2 | $18,000.00 | $86,253.25 | ||

| 3 | $18,000.00 | $69,918.68 | ||

| 4 | $18,000.00 | $1,350.03 | $16,649.97 | $53,268.71 |

| 5 | $18,000.00 | $1,028.54 | $16,971.46 | $36,297.25 |

| 6 | $18,000.00 | $18,998.09 | ||

| 7 | $18,000.00 | $366.83 | $17,633.17 | $1,364.92 |

| 8 | $1,391.27 | $26.35 | $1,364.92 | $0.00 |

| Total |

Step 1: Use the AMORT function to fill out the table.

| 0 | $0.00 | $118,000.00 | ||

| 1 | $18,000.00 | $2,278.41 | $15,721.59 | $102,278.41 |

| 2 | $18,000.00 | $1,974.85 | $16,025.15 | $86,253.25 |

| 3 | $18,000.00+$6,991.87* =$24,991.87 | $1,665.42 | $16,334.58+$6,991.87 =$23,326.45 | $62,926.81 |

| 4 | $18,000.00 | $1,215.02 | $16,784.98 | $46,141.83 |

| 5 | $18,000.00+$2,903.28** =$20,903.28 | $890.93 | $17,109.07+$2,903.28 =$20,012.35 | $26,129.48 |

| 6 | $18,000.00 | $504.52 | $17,495.48 | $8,634.01 |

| 7 | $8,800.72 | $166.71 | $8,634.01 | $0.00 |

*The balance after the third payment was $69,918.68. 10% of this amount is $6,991.87. **The balance after the fifth payment was $29,032.76. 10% of this amount is $2,903.28.

Step 2: Adjust for the “missing pennies” (noted in bold italics ) and total the interest.

| 0 | $0.00 | $118,000.00 | ||

| 1 | $18,000.00 | $2,278.41 | $15,721.59 | $102,278.41 |

| 2 | $18,000.00 | $86,253.25 | ||

| 3 | $24,991.87 | $62,926.81 | ||

| 4 | $18,000.00 | $1,215.02 | $16,784.98 | $46,141.83 |

| 5 | $20,903.28 | $890.93 | $20,012.35 | $26,129.48 |

| 6 | $18,000.00 | $8,634.01 | ||

| 7 | $8,800.72 | $166.71 | $8,634.01 | $0.00 |

| Total |

From Question 18a, amount of interest paid was $9,391.27. Interest Saved = $9,391.27 − $8,695.87 = $695.40.

13.4: Special Application – Mortgages

- Three years ago, Phalatda took out a mortgage on her new home in Kelowna for $628,200 less a $100,000 down payment at 6.49% compounded semi-annually. She is making monthly payments over her three-year term based on a 30-year amortization. At renewal, she is able to obtain a new mortgage on a four-year term at 6.19% compounded semi-annually while continuing with monthly payments and the original amortization timeline. Calculate the following: a) Interest and principal portions in the first term. b) New mortgage payment amount in the second term. c) Balance remaining after the second term.

Step 1 : Find the initial payment.

[latex]N = (\text{Number of Years}) \times (\text{Payments Per Year})[/latex] [latex]N = 30 \times 12 = 360 \;\text{payments}[/latex] [latex]I/Y = 6.49[/latex] [latex]P/Y = 12[/latex] [latex]C/Y = 2[/latex] [latex]FV = 0[/latex] [latex]PV = 628,\!200 − 100,\!000 = 528,\!200[/latex] [latex]CPT\; PMT =-\$3,\!305.288742[/latex]

Make sure to reinput PMT = -3,305.29 (Input as a negative value rounded to 2 decimal places).

Step 2: Use the AMORT function to find the BAL on the after the first term (payment 1-36).

2nd AMORT P1 = 1 P2 = 36 ↓ BAL = $508,947.54

2nd AMORT P1 = 1 P2 = 36 ↓ ↓ PRN = $19,252.46 INT = $99,737.98

[latex]N = (\text{Number of Years}) \times (\text{Payments Per Year})[/latex] [latex]N = 27 \times 12 = 324 \;\text{payments}[/latex] [latex]I/Y = 6.19[/latex] [latex]P/Y = 12[/latex] [latex]C/Y = 2[/latex] [latex]FV = 0[/latex] [latex]PV = 508,\!947.54[/latex] [latex]CPT\; PMT =-\$3,\!211.32429[/latex]

Make sure to reinput PMT = -3,211.32 (Input as a negative value rounded to 2 decimal places).

Use the AMORT function to find the BAL on the after the second term (payment 1-48).

2nd AMORT P1 = 1 P2 = 48 ↓ BAL = $475,372.69

- The Verhaeghes have signed a three-year closed fixed rate mortgage with a 20-year amortization and monthly payments. They negotiated an interest rate of 4.84% compounded semi-annually. The terms of the mortgage allow for the Verhaeghes to make a single top-up payment at any one point throughout the term. The mortgage principal was $323,000 and 18 months into the term they made one top-up payment of $20,000. a)What is the balance remaining at the end of the term? b)By what amount was the interest portion reduced by making the top-up payment?

[latex]N = (\text{Number of Years}) \times (\text{Payments Per Year})[/latex] [latex]N = 20 \times 12 = 240 \;\text{payments}[/latex] [latex]I/Y = 4.84[/latex] [latex]P/Y = 12[/latex] [latex]C/Y = 2[/latex] [latex]FV = 0[/latex] [latex]PV = 323,\!000[/latex] [latex]CPT\; PMT =-\$2,\!094.701842[/latex]

Make sure to reinput PMT = -2,094.70 (Input as a negative value rounded to 2 decimal places).

Step 2: Use the AMORT function to find the BAL on the after the first 18 months.

2nd AMORT P1 = 1 P2 = 18 ↓ BAL = $308,009.80

Step 3: Find New Balance after $20,000 top-up payment.

New Balance = $308,009.80 − $20,000 = $288,009.80. Reinput PV = $288,009.80.

Step 4: Use the AMORT function to find the BAL on the after the last 18 months of the first term.

2nd AMORT P1 = 1 P2 = 18 ↓ BAL = $270,417.34

Step 1: Find Original BAL paid without top-up payment (payments 1-36).

Reinput PV = $323,000

2nd AMORT P1 = 1 P2 = 36 ↓ BAL = $291,904.76

Step 2: Find Interest Difference.

[latex]\begin{align} \text{Interest Difference}&=\$291,\!904.76 − \$270,\!417.34 − \$20,\!000\\ &= \$1,\!487.42 \end{align}[/latex]

- Fifteen years ago, Clarissa’s initial principal on her mortgage was $408,650. She set up a 30-year amortization, and in her first 10-year term of monthly payments her mortgage rate was 7.7% compounded semi-annually. Upon renewal, she took a further five-year term with monthly payments at a mortgage rate of 5.69% compounded semi-annually. Today, she renews the mortgage but shortens the amortization period by five years when she sets up a three-year closed fixed rate mortgage of 3.45% compounded semi-annually with monthly payments. What principal will she borrow in her third term and what is the remaining balance at the end of the term? What total interest portion and principal portion will she have paid across all 18 years?

Step 1 : Find the initial payment for 10-year term.

[latex]N = (\text{Number of Years}) \times (\text{Payments Per Year})[/latex] [latex]N = 30 \times 12 = 360 \;\text{payments}[/latex] [latex]I/Y = 7.7[/latex] [latex]P/Y = 12[/latex] [latex]C/Y = 2[/latex] [latex]FV = 0[/latex] [latex]PV = 408,\!650[/latex] [latex]CPT\; PMT =-\$2,\!879.565159[/latex]

Make sure to reinput PMT = -2,879.57 (Input as a negative value rounded to 2 decimal places).

Step 2: Use the AMORT function to find the BAL on the after the 10-year term (payments 1-120).

2nd AMORT P1 = 1 P2 = 120 ↓ BAL = $355,303.81

Step 3 : Find the payment for 5-year term.

[latex]N = (\text{Number of Years}) \times (\text{Payments Per Year})[/latex] [latex]N = 20 \times 12 = 240 \;\text{payments}[/latex] [latex]I/Y = 5.69[/latex] [latex]P/Y = 12[/latex] [latex]C/Y = 2[/latex] [latex]FV = 0[/latex] [latex]PV = 355,\!303.81[/latex] [latex]CPT\; PMT =-\$2,\!468.979621[/latex]

Make sure to reinput PMT = -2,468.98 (Input as a negative value rounded to 2 decimal places).

Step 4: Use the AMORT function to find the BAL on the after the 5-year term (payments 1-120).

2nd AMORT P1 = 1 P2 = 60 ↓ BAL = $299,756.24

Step 5 : Find the payment for 3-year term with amortization period shortened by 5 years. Number of years remaining = 15 – 5 = 10.

[latex]N = (\text{Number of Years}) \times (\text{Payments Per Year})[/latex] [latex]N = 10 \times 12 = 120 \;\text{payments}[/latex] [latex]I/Y = 3.45[/latex] [latex]P/Y = 12[/latex] [latex]C/Y = 2[/latex] [latex]FV = 0[/latex] [latex]PV =299,\!756.24[/latex] [latex]CPT\; PMT =-\$2,\!953.710318[/latex]

Make sure to reinput PMT = -2,953.71 (Input as a negative value rounded to 2 decimal places).

Step 6: Use the AMORT function to find the BAL on the after the 3-year term (payments 1-36).

2nd AMORT P1 = 1 P2 = 36 ↓ BAL = $220,328.74

Start of 3rd term principal = $299,756.24. Remaining balance at end of 3rd term = $220,328.74.

[latex]\begin{align} \text{Total principal across all}\;18\;\text{years}&=\$408,\!650 - \$220,\!328.74\\ &= \$188,\!321.26 \end{align}[/latex]

[latex]\text{Total interest across all}\;18\;\text{years}[/latex] [latex]=(120 \times 2,\!879.57) + (60 \times 2,\!468.98) + (36 \times 2,\!953.71) - 188,\!321.26[/latex] [latex]= \$411,\!499.50[/latex]

Image Description

Figure 13.1.2: Timeline: Deferral period from age 54 until age 65 at 6.25% compounded annually. Starting at age 55, 20 years end of month payments of PMT at 3.85% compounded annually. $75,000 at age 54 brought to age 65 as FV. At age 65 the FV becomes the PV for the stream of PMT’s brought back to age 65. [ Back to Figure 13.1.2 ]

Business Math: A Step-by-Step Handbook Abridged Copyright © 2022 by Sanja Krajisnik; Carol Leppinen; and Jelena Loncar-Vines is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License , except where otherwise noted.

Share This Book

- Create A Quiz

- Relationship

- Personality

- Harry Potter

- Online Exam

- Entertainment

- Training Maker

- Survey Maker

- Brain Games

- ProProfs.com

Business Finance Quizzes, Questions & Answers

Are you ready to put your business finance knowledge to the test? Get ready for an engaging and interactive experience with our Business Finance Quizzes & Trivia! Whether you're a seasoned entrepreneur, a budding financial professional, or just someone interested in the world of business, our quizzes are designed to challenge and entertain you. Step into the exciting world of business finance as you explore various topics such as financial statements, investment analysis, risk management, and more. With our quizzes, you'll have the opportunity to showcase your expertise, learn new concepts, and have fun along the way. Imagine competing against friends or colleagues, challenging each other to see who has the sharpest business finance acumen. Our quizzes feature a variety of question formats, including multiple-choice, true or false, and fill-in-the-blanks, ensuring a diverse and engaging experience. Not only will you test your knowledge, but you'll also discover interesting facts and tidbits about the world of business finance. Expand your understanding of key concepts, industry trends, and successful financial strategies while enjoying an interactive and fun-filled quiz session. Business finance doesn't have to be all numbers and spreadsheets. Our quizzes infuse excitement and entertainment into the subject, making it a stimulating and enjoyable learning experience. So, gather your friends, colleagues, or fellow finance enthusiasts, and embark on a journey of discovery and friendly competition with our Business Finance Quizzes & Trivia. Who will emerge as the ultimate business finance whiz? Let's find out!

Sort By Grade

Top trending quizzes.

Popular Topics

Recent quizzes.

- Show all results for " "

Business Math Fundamentals Quiz

More actions.

- PDF Questions

- Make a copy

Podcast Beta

Questions and answers, which of the following is not a key aspect of business math.

- Developing marketing strategies (correct)

- Understanding percentages

- Calculating profit and loss

- Balancing the books

If a company's revenue is $500,000 and the total cost of producing goods or services is $350,000, what is the company's profit?

- $150,000 (correct)

If a company's market share increased by 20% last year, and its initial market share was 30%, what is its current market share?

- 36% (correct)

If a company's credit side is $100,000 and its debit side is $95,000, what must be done to balance the books?

<p>Increase the debit side by $5,000</p> Signup and view all the answers

If a company borrows $100,000 at an annual interest rate of 6% compounded annually, how much interest will it pay in the first year?

<p>$6,000</p> Signup and view all the answers

If a company's revenue increased by 15% from the previous year, and its expenses increased by 10%, what is the impact on the company's profitability?

<p>Profitability increased</p> Signup and view all the answers

Which of the following is NOT a primary application of business math?

<p>Developing algorithms for natural language processing</p> Signup and view all the answers

If a company has a current inventory level of 5,000 units, and the expected monthly demand is 1,200 units, what is the optimal reorder point if the lead time for replenishment is 2 months and the company wants to maintain a safety stock of 500 units?

<p>3,400 units</p> Signup and view all the answers

If a company's current ratio (current assets / current liabilities) is 1.5, and its quick ratio (cash + marketable securities + accounts receivable / current liabilities) is 0.8, what is the approximate value of its inventory as a fraction of its current assets?

<p>2/3</p> Signup and view all the answers

If a company's fixed costs are $50,000 per month, and its variable costs are $10 per unit produced, what is the breakeven point in units if the selling price is $25 per unit?

<p>3,000 units</p> Signup and view all the answers

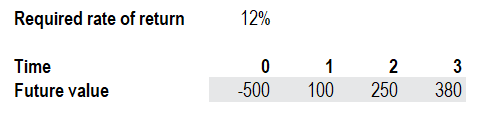

A company is considering two mutually exclusive projects. Project A has an initial investment of $100,000 and is expected to generate cash flows of $30,000 per year for 5 years. Project B has an initial investment of $150,000 and is expected to generate cash flows of $50,000 per year for 4 years. If the company's required rate of return is 10%, which project should it choose based on the net present value (NPV) method?

<p>Project B</p> Signup and view all the answers

A company is considering three different pricing strategies for a new product. If the price is set at $100, the expected demand is 10,000 units. If the price is set at $80, the expected demand is 15,000 units. If the price is set at $60, the expected demand is 20,000 units. The variable cost per unit is $40, and the fixed costs are $200,000. Which pricing strategy will maximize the company's profit?

<p>$80 pricing strategy</p> Signup and view all the answers

Study Notes

Business math.

Business math refers to the practical application of mathematical concepts and principles to business situations. It is concerned with solving problems related to accounting, finance, economics, management, marketing, and other areas within commercial operations. Here are some key aspects of business math:

Calculating Profit and Loss

Profit and loss calculations are crucial in business math. They help determine the efficiency of a business and the potential for future growth. Profit is calculated by subtracting the total cost of producing goods or services from the revenue generated.

Balancing the Books

Accounting involves balancing the books, which is a fundamental part of business math. This means ensuring that the sum of the debit and credit sides of a company's financial records are equal. Balancing the books is necessary for accurate financial reporting and decision-making.

Percentages

Percentages are used frequently in business math. They help in calculating the increase or decrease in a company's profitability, market share, or other key performance indicators. Understanding percentages is crucial for making informed decisions in business.

Interest Rates

Interest rates play a significant role in business math. They help businesses understand the cost of borrowing money, the potential return on investments, and the overall financial health of a company. Interest rates are used in various financial calculations, such as calculating the total cost of a loan or assessing the profitability of an investment.

Cost Accounting

Cost accounting involves analyzing and allocating costs to different products or services within a business. This helps businesses understand their costs and pricing strategies. Cost accounting is a critical part of business math, as it helps companies make informed decisions about product pricing and resource allocation.

Inventory Management

Inventory management is another aspect of business math. It involves tracking the flow of inventory, predicting future demand, and managing the cost of holding inventory. Effective inventory management is essential for maintaining customer satisfaction and minimizing costs.

Financial Analysis

Financial analysis is a complex area of business math. It involves interpreting financial statements, calculating financial ratios, and making predictions about future financial performance. Financial analysis is crucial for making informed decisions about a company's future growth and profitability.

Decision Making

Business math provides the tools and techniques necessary for making informed decisions in business. By understanding the principles of business math, businesses can make better decisions about pricing, production, inventory, and other critical aspects of their operations.

In conclusion, business math is a vital aspect of commercial operations. It provides the tools and techniques necessary for making informed decisions, managing finances, and assessing performance. Understanding business math is essential for any individual or organization involved in commercial activities.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.

Description

Test your knowledge of key aspects of business math including profit and loss calculations, balancing the books, percentages, interest rates, cost accounting, inventory management, financial analysis, and decision making. This quiz covers essential concepts for individuals and organizations involved in commercial activities.

More Quizzes Like This

Introduction to Deposits in Business Math

Gr 11 Math Lit: Ch 3.10 Break Even Analysis

Gr 11 Wiskunde: Depresiasie Quiz en Flashcards

Gr 11 Math lit: Ch 3.10 Break even Analysis

Upgrade to continue

Today's Special Offer

Save an additional 20% with coupon: SAVE20

Upgrade to a paid plan to continue

Trusted by top students and educators worldwide

We are constantly improving Quizgecko and would love to hear your feedback. You can also submit feature requests here: feature requests.

Create your free account

By continuing, you agree to Quizgecko's Terms of Service and Privacy Policy .

Finance Test

Assess your knowledge on finance concepts, definitions, and calculations

This Finance Test is designed to help you assess your knowledge of important finance concepts, terminology definitions, and frequently used calculations. We strongly encourage any students who are planning or are beginning their FMVA certification program to take this test to determine whether you will need to take the prerequisite finance courses including Reading Financial Statements , Introduction to Corporate Finance , and Math for Corporate Finance . This is also a useful resource for employers to examine the technical knowledge of the candidates during a finance interview.

If you pass this test with 80% or above (16 questions or more), it is likely that you have a strong background in finance and are good to go ahead with our core courses!

Finance Test Questions

- The discount rate is always higher when you invest now than in the future

- The discount rate is always higher when you invest in the future than now

- The money you have now is worth less today than an identical amount you would receive in the future

- The money you have now is worth more today than an identical amount you would receive in the future

- FV = PV/(1+r)^n

- FV = PV/(1+r)*n

- FV = PV x (1+r)^n

- FV = PV x (1+r)*n

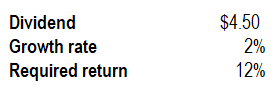

- An investment that has no definite end and a stream of cash payments that continues forever

- A stream of cash flows that start one year from today and continue while growing by a constant growth rate

- A series of equal payments at equal time periods and guaranteed for a fixed number of years

- A series of unequal payments at equal time periods which are guaranteed for a fixed number of years

- The amount borrowed by the issuer of the bond and returned to the investors when the bond matures

- The overall return earned by the bond investor when the bond matures

- The difference between the amount borrowed by the issuer of bond and the amount returned to investors at maturity

- The size of the coupon investors receive on an annual basis

- Trading at par

- Trading at a premium

- Trading at a discount

- Trading below par

- Coupon Rate > Current Yield > Yield to Maturity

- Coupon Rate

- Coupon Rate = Current Yield = Yield to Maturity

- The cash flows that occur earlier are more valuable than cash flows that occur later

- The cash flows that occur earlier are less valuable than cash flows that occur later

- The longer the time cash flows are invested, the more valuable they are in the future

- The future value of cash flows are always higher than the present value of the cash flows

- The market value of equity of the business

- The book value of equity of the business

- The entire value of the business without giving consideration to its capital structure

- The entire value of the business considering its capital structure

- Total assets/Net debt x Cost of debt + Total assets/Equity x Cost of equity

- Net debt/Equity x Cost of debt + Equity/Net debt x Cost of equity

- Net debt x Cost of debt + Equity x Cost of equity

- Net debt/Total assets x Cost of debt + Equity/Total assets x Cost of equity

- Private equity funds are pools of capital invested in companies which represent an opportunity for high rate of return

- Exit strategies for private equity funds include Initial Public Offerings (IPOs) and leveraged buyout (LBO)

- Venture capital is an example of private equity funds

- Private equity funds are usually invested for unlimited time periods

- Best efforts

- Firm commitment

- All-or-none

- Full-purchase

- Equity > Subordinated debt > Senior debt

- Suborindated debt > Senior debt > Equity

- Senior debt > Subordinated debt > Equity

- Senior debt > Equity > Subordinated debt

- Repayment of long-term debt

- Issuance of equity

- Investments in businesses

- Payment of dividends

- Equity Capital + Retained Earnings

- Equity Capital - Total Liabilities

- Total Assets - Total Liabilities

- Current Assets - Current Liabilities

- Goodwill needs to be evaluated for impairment yearly

- Goodwill is treated as a tangible asset in accounting

- Goodwill is a result of purchasing a company for a price higher than the fair market value of the target company's net assets

- Goodwill can be comprised of things such as good reputation, loyal client base, and brand recognition

More about CFI

Thank you for visiting our Test Center and for taking this Finance Test.

CFI is the official global provider of the Financial Modeling and Valuation Analyst (FMVA)™ certification program , designed to transform anyone into a world-class financial analyst. Enroll now to gain the skills you need to take your career to the next level. Also, see all our valuation resources.

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

IMAGES

VIDEO

COMMENTS

Learn how to plan your business math with Quizlet flashcards. Master key concepts like breakeven volume, budget, direct costs and more.

Olha_Shytets1. virtual business business math plan. 15 terms. Victoria_Hamrick2. Entrepreneurship Math Final. 30 terms. ChristinaChan001. 1 / 5. Study with Quizlet and memorize flashcards containing terms like Break even volume, Budget, Financial model and more.

Business Plan Math - Math Quiz quiz for 11th grade students. Find other quizzes for Business and more on Quizizz for free! ... Personal Finance Basics Vocabulary 337 plays 9th - 12th Build your own quiz. ... Show Answers. See Preview. 1. Multiple Choice. Edit. 30 seconds. 1 pt. Production space in a building costs $22 per sq ft per year. You ...

Our business math trivia quizzes cover a wide range of topics, from calculating profit margins and analyzing sales data to deciphering complex financial statements and exploring investment strategies. With each quiz, you'll dive deeper into the intricate world of business mathematics, unlocking new levels of understanding and confidence.

Business Plan Math - Reading Quiz quiz for 11th grade students. Find other quizzes for Business and more on Quizizz for free! ... Financial model . Profits and losses. Spreadsheet. 2. Multiple Choice. Edit. 2 minutes. 1 pt. What is an example of a monthly, recurring expense? ... Answer choices . Tags . Answer choices . Tags . Explore all ...

Correct Answer (s) A. Executive Summary. B. Financial Plan. Explanation. The components of a business plan include an Executive Summary and a Financial Plan. The Executive Summary provides a concise overview of the business plan, highlighting the key points and objectives.

A farmer purchased a John Deere combine for $369,930. The equipment dealership sets up a financing plan to allow for end-of-quarter payments for the next two years at 7.8% compounded monthly. Construct a complete amortization schedule and calculate the total interest. Solution: Step 1: Find the regular payment. Mode = END

The correct answer for each question is indicated by a . 1: Which term refers to a set of documents outlining the financial facts about a new business? Need a Hint? A) contracts: B) financial audit: C) forecast: D) financial plan ... financial plan: B) financial forecast: C) financial outlook: D)

Financing & Business Planning Math Quiz QUESTION 7 of 10: A business owner has two loans from the local bank. One of the loans is a three-year loan with a principal of $75,000 and an annual interest rate of 5%. The other is a one-year loan with a principal of $21,000 and an annual interest rate of 4.5%.

Business IQ - Test Your Finance, Vocabulary, Investing Knoweldge. This will test your knowledge of finance, investing, financial vocabulary, business, companies and economics. It will then rank you into 1 of 5 tiers of business knowledge. Questions: 30 | Attempts: 4611 | Last updated: Mar 22, 2023. Sample Question. Junk bond king. John Gutfreund.

Finance and Business Mathematics Quiz 1. Compounding. Click the card to flip 👆. keeping an increase (return) on your initial principal "invested" rather than taking it out and using it. A way to more quickly increase your investment over time. Click the card to flip 👆.

Test your knowledge of key aspects of business math including profit and loss calculations, balancing the books, percentages, interest rates, cost accounting, inventory management, financial analysis, and decision making. This quiz covers essential concepts for individuals and organizations involved in commercial activities.

Finance Test Questions. 1. The concept of present value relates to the idea that *. The discount rate is always higher when you invest now than in the future. The discount rate is always higher when you invest in the future than now. The money you have now is worth less today than an identical amount you would receive in the future.

Business Financial Planning Formulas. DRAFT. 12th grade . Played 0 times. 0% average accuracy. Mathematics, Business. 30 minutes ago by. soothingbrush54_43740. 0. Save. Share. Edit. Edit. Business Financial Planning Formulas DRAFT. 30 minutes ago by. ... This quiz is incomplete! To play this quiz, please finish editing it. Delete Quiz .

Mathematics for Business and Personal Finance ... Personal Finance Tools; Tax Preparation; Career Links; Internet Activities; Test-Taking Tips; Job-Finding Tools and Tips; Math Facts, Tools, and Tips; Homework Hints; ... Business Administration Home Product Info Site Map Contact Us:

Television Advertising Costs. Section 16.7: Pricing. Page 613: Review and Assessment. Page 621: Practice Test. Exercise 8. Find step-by-step solutions and answers to Mathematics for Business and Personal Finance - 9780078805059, as well as thousands of textbooks so you can move forward with confidence.

Total Instructional Time. The instructional time for RETAILING ranges from 24 hours (simulation exercises only) to 35 hours (simulation exercises, reading assignments , reading quizzes, and math quizzes). You can configure your course to include or exclude reading assignments (3.7 hours), reading quizzes (1.8 hours) and math quizzes (5.5 hours).

Test. Expert Solutions. Q-Chat. Live. Blast. ... Business Plan Math. Flashcards; Learn; Test; Match; Q-Chat; Get a hint. Breakeven volume. The cumulative volume at which you begin to make a net profit. ... Financial model. A 3-5 year forecast of your income and expenses, profits and losses, and so on.

Financing & Business Planning Reading Quiz QUESTION 4 of 10: True or False: Loans from family and friends represent the largest source of funding for new businesses. a) True b) False ... The correct answer is: b) False Explanation: Loans from family and friends are often considered as a source of funding for new businesses, but they do not ...

The costs associated with opening and operating a new business for a period of time, usually one year. Unpaid work, mental and physical, that a business owner puts into a business, increasing its value. A statement of an individual's personal financial status. Any tangible item of value an individual owns.

Play this game to review Mathematics. What is financing? Preview this quiz on Quizizz. Quiz. Business Finance Quiz. DRAFT. 12th grade . Played 10 times. 65% average accuracy. Mathematics. 8 days ago by. raymondeguzman2784_30417. 0. Save. Edit. Edit. Business Finance Quiz DRAFT.

About the Financial Math test. Sustainable growth for many businesses depends on accurate financial information. At the core of this financial information is financial math: functions, computations, and arithmetic related to financial information. Proper business decision-making is supported by various mathematical analyses and computations.

ATM. An unattended machine (outside some banks) that dispenses money when a personal coded card is used. See more. Study with Quizlet and memorize flashcards containing terms like Basic Needs, Everyday Living, Goals and more.