- MAY 16, 2024

What Is Empirical Research? Definition, Types & Samples in 2024

by Imed Bouchrika, Phd

Co-Founder and Chief Data Scientist

How was the world formed? Are there parallel universes? Why does time move forward but never in reverse? These are longstanding questions that have yet to receive definitive answers up to now.

In research, these are called empirical questions, which ask about how the world is, how the world works, etc. Such questions are addressed by a corresponding type of study—called empirical research or the empirical method—which is concerned with actual events and phenomena.

What is an empirical study? Research is empirical if it seeks to find a general story or explanation, one that applies to various cases and across time. The empirical approach functions to create new knowledge about the way the world actually works. This article discusses the empirical research definition, concepts, types, processes, and other important aspects of this method. It also tackles the importance of identifying evidence in research .

I. What is Empirical Research?

A. definitions.

What is empirical evidence? Empirical research is defined as any study whose conclusions are exclusively derived from concrete, verifiable evidence. The term empirical basically means that it is guided by scientific experimentation and/or evidence. Likewise, a study is empirical when it uses real-world evidence in investigating its assertions.

This research type is founded on the view that direct observation of phenomena is a proper way to measure reality and generate truth about the world (Bhattacharya, 2008). And by its name, it is a methodology in research that observes the rules of empiricism and uses quantitative and qualitative methods for gathering evidence.

For instance, a study is being conducted to determine if working from home helps in reducing stress from highly-demanding jobs. An experiment is conducted using two groups of employees, one working at their homes, the other working at the office. Each group was observed. The outcomes derived from this research will provide empirical evidence if working from home does help reduce stress or not. This also applies to entrepreneurs when they use a small business idea generator instead of manual procedures.

It was the ancient Greek medical practitioners who originated the term empirical ( empeirikos which means “experienced") when they began to deviate from the long-observed dogmatic principles to start depending on observed phenomena. Later on, empiricism pertained to a theory of knowledge in philosophy, which follows the belief that knowledge comes from evidence and experience derived particularly using the senses.

What ancient philosophers considered empirical research pertained to the reliance on observable data to design and test theories and reach conclusions. As such, empirical research is used to produce knowledge that is based on experience. At present, the word “empirical" pertains to the gathering of data using evidence that is derived through experience or observation or by using calibrated scientific tools.

Most of today’s outstanding empirical research outputs are published in prestigious journals. These scientific publications are considered high-impact journals because they publish research articles that tend to be the most cited in their fields.

II. Types and Methodologies of Empirical Research

Empirical research is done using either qualitative or quantitative methods.

Qualitative research Qualitative research methods are utilized for gathering non-numerical data. It is used to determine the underlying reasons, views, or meanings from study participants or subjects. Under the qualitative research design, empirical studies had evolved to test the conventional concepts of evidence and truth while still observing the fundamental principles of recognizing the subjects beings studied as empirical (Powner, 2015).

This method can be semi-structured or unstructured. Results from this research type are more descriptive than predictive. It allows the researcher to write a conclusion to support the hypothesis or theory being examined.

Due to realities like time and resources, the sample size of qualitative research is typically small. It is designed to offer in-depth information or more insight regarding the problem. Some of the most popular forms of methods are interviews, experiments, and focus groups.

Quantitative research Quantitative research methods are used for gathering information via numerical data. This type is used to measure behavior, personal views, preferences, and other variables. Quantitative studies are in a more structured format, while the variables used are predetermined.

Data gathered from quantitative studies is analyzed to address the empirical questions. Some of the commonly used quantitative methods are polls, surveys, and longitudinal or cohort studies.

There are situations when using a single research method is not enough to adequately answer the questions being studied. In such cases, a combination of both qualitative and quantitative methods is necessary. Also, papers can also make use of both primary and secondary research methods

III. Qualitative Empirical Research Methods

Some research question examples need to be gathered and analyzed qualitatively or quantitatively, depending on the nature of the study. These not only supply answers to empirical questions but also outline one’s scope of work . Here are the general types of qualitative research methods.

Observational Method

This involves observing and gathering data from study subjects. As a qualitative approach, observation is quite personal and time-intensive. It is often used in ethnographic studies to obtain empirical evidence.

The observational method is a part of the ethnographic research design, e.g., archival research, survey, etc. However, while it is commonly used for qualitative purposes, observation is also utilized for quantitative research, such as when observing measurable variables like weight, age, scale, etc.

One remarkable observational research was conducted by Abbott et al. (2016), a team of physicists from the Advanced Laser Interferometer Gravitational-Wave Observatory who examined the very first direct observation of gravitational waves. According to Google Scholar’s (2019) Metrics ranking, this study is among the most highly cited articles from the world’s most influential journals (Crew, 2019).

This method is exclusively qualitative and is one of the most widely used (Jamshed, 2014). Its popularity is mainly due to its ability to allow researchers to obtain precise, relevant information if the correct questions are asked.

This method is a form of a conversational approach, where in-depth data can be obtained. Interviews are commonly used in the social sciences and humanities, such as for interviewing resource persons.

This method is used to identify extensive information through an in-depth analysis of existing cases. It is typically used to obtain empirical evidence for investigating problems or business studies.

When conducting case studies, the researcher must carefully perform the empirical analysis, ensuring the variables and parameters in the current case are similar to the case being examined. From the findings of a case study, conclusions can be deduced about the topic being investigated.

Case studies are commonly used in studying the experience of organizations, groups of persons, geographic locations, etc.

Textual Analysis

This primarily involves the process of describing, interpreting, and understanding textual content. It typically seeks to connect the text to a broader artistic, cultural, political, or social context (Fairclough, 2003).

A relatively new research method, textual analysis is often used nowadays to elaborate on the trends and patterns of media content, especially social media. Data obtained from this approach are primarily used to determine customer buying habits and preferences for product development, and designing marketing campaigns.

Focus Groups

A focus group is a thoroughly planned discussion guided by a moderator and conducted to derive opinions on a designated topic. Essentially a group interview or collective conversation, this method offers a notably meaningful approach to think through particular issues or concerns (Kamberelis & Dimitriadis, 2011).

This research method is used when a researcher wants to know the answers to “how," “what," and “why" questions. Nowadays, focus groups are among the most widely used methods by consumer product producers for designing and/or improving products that people prefer.

IV. Quantitative Empirical Research Methods

Quantitative methods primarily help researchers to better analyze the gathered evidence. Here are the most common types of quantitative research techniques:

A research hypothesis is commonly tested using an experiment, which involves the creation of a controlled environment where the variables are maneuvered. Aside from determining the cause and effect, this method helps in knowing testing outcomes, such as when altering or removing variables.

Traditionally, experimental, laboratory-based research is used to advance knowledge in the physical and life sciences, including psychology. In recent decades, more and more social scientists are also adopting lab experiments (Falk & Heckman, 2009).

Survey research is designed to generate statistical data about a target audience (Fowler, 2014). Surveys can involve large, medium, or small populations and can either be a one-time event or a continuing process

Governments across the world are among the heavy users of continuing surveys, such as for census of populations or labor force surveys. This is a quantitative method that uses predetermined sets of closed questions that are easy to answer, thus enabling the gathering and analysis of large data sets.

In the past, surveys used to be expensive and time-consuming. But with the advancement in technology, new survey tools like social media and emails have made this research method easier and cheaper.

Causal-Comparative research

This method leverages the strength of comparison. It is primarily utilized to determine the cause and effect relationship among variables (Schenker & Rumrill, 2004).

For instance, a causal-comparative study measured the productivity of employees in an organization that allows remote work setup and compared that to the staff of another organization that does not offer work from home arrangements.

Cross-sectional research

While the observation method considers study subjects at a given point in time, cross-sectional research focuses on the similarity in all variables except the one being studied.

This type does not allow for the determination of cause-effect relationships since subjects are now observed continuously. A cross-sectional study is often followed by longitudinal research to determine the precise causes. It is used mainly by pharmaceutical firms and retailers.

Longitudinal study

A longitudinal method of research is used for understanding the traits or behavior of a subject under observation after repeatedly testing the subject over a certain period of time. Data collected using this method can be qualitative or quantitative in nature.

A commonly-used form of longitudinal research is the cohort study. For instance, in 1951, a cohort study called the British Doctors Study (Doll et al., 2004) was initiated, which compared smokers and non-smokers in the UK. The study continued through 2001. As early as 1956, the study gave undeniable proof of the direct link between smoking and the incidence of lung cancer.

Correlational research

This method is used to determine the relationships and prevalence among variables (Curtis et al., 2016). It commonly employs regression as the statistical treatment for predicting the study’s outcomes, which can only be a negative, neutral, or positive correlation.

A classic example of empirical research with correlational research is when studying if high education helps in obtaining better-paying jobs. If outcomes indicate that higher education does allow individuals to have high-salaried jobs, then it follows that people with less education tend to have lower-paying jobs.

V. Steps for Conducting Empirical Research

Since empirical research is based on observation and capturing experiences, it is important to plan the steps to conduct the experiment and how to analyze it. This will enable the researcher to resolve problems or obstacles, which can occur during the experiment.

Step #1: Establishing the research objective

In this initial step, the researcher must be clear about what he or she precisely wants to do in the study. He or she should likewise frame the problem statement, plans of action, and determine any potential issues with the available resources, schedule, etc. for the research.

Most importantly, the researcher must be able to ascertain whether the study will be more beneficial than the cost it will incur.

Step #2: Reviewing relevant literature and supporting theories

The researcher must determine relevant theories or models to his or her research problem. If there are any such theories or models, they must understand how it can help in supporting the study outcomes.

Relevant literature must also be consulted. The researcher must be able to identify previous studies that examined similar problems or subjects, as well as determine the issues encountered.

Step #3: Framing the hypothesis and measurement

The researcher must frame an initial hypothesis or educated guess that could be the likely outcome. Variables must be established, along with the research context.

Units of measurements should also be defined, including the allowable margin of errors. The researcher must determine if the selected measures will be accepted by other scholars.

Step #4: Defining the research design, methodology, and data collection techniques

Before proceeding with the study, the researcher must establish an appropriate approach for the research. He or she must organize experiments to gather data that will allow him or her to frame the hypothesis.

The researcher should also decide whether he or she will use a nonexperimental or experimental technique to perform the study. Likewise, the type of research design will depend on the type of study being conducted.

Finally, the researcher must determine the parameters that will influence the validity of the research design. Data gathering must be performed by selecting suitable samples based on the research question. After gathering the empirical data, the analysis follows.

Step #5: Conducting data analysis and framing the results

Data analysis is done either quantitatively or qualitatively. Depending on the nature of the study, the researcher must determine which method of data analysis is the appropriate one, or whether a combination of the two is suitable.

The outcomes of this step determine if the hypothesis is supported or rejected. This is why data analysis is considered as one of the most crucial steps in any research undertaking.

Step #6: Making conclusions

A report must be prepared in that it presents the findings and the entire research proceeding. If the researcher intends to disseminate his or her findings to a wider audience, the report will be converted into an article for publication. Aside from including the typical parts from the introduction and literature view, up to the methods, analysis, and conclusions, the researcher should also make recommendations for further research on his or her topic.

To ensure the originality and credibility of the report or research, it is essential to employ a plagiarism checker. By using a reliable plagiarism checker, the researcher can verify the uniqueness of their work and avoid any unintentional instances of plagiarism. This step helps maintain the integrity of the research and ensures that the recommendations for further research are based on the researcher’s own original insights. Incorporating a plagiarism checker into the writing process provides an additional layer of assurance and professionalism, enhancing the impact of the report or article in the academic community. Educators can also check the originality of their students’ research by utilizing a free plagiarism checker for teachers .

VI. Empirical Research Cycle

The empirical research cycle is composed of five phases, with each one considered as important as the next phase (de Groot, 1969). This rigorous and systematic method can consistently capture the process of framing hypotheses on how certain subjects behave or function and then testing them versus empirical data. It is considered to typify the deductive approach to science.

These are the five phases of the empirical research cycle:

1. Observation

During this initial phase, an idea is triggered for presenting a hypothesis. It involves the use of observation to gather empirical data. For example :

Consumers tend to consult first their smartphones before buying something in-store .

2. Induction

Inductive reasoning is then conducted to frame a general conclusion from the data gathered through observation. For example:

As mentioned earlier, most consumers tend to consult first their smartphones before buying something in-store .

A researcher may pose the question, “Does the tendency to use a smartphone indicate that today’s consumers need to be informed before making purchasing decisions?" The researcher can assume that is the case. Nonetheless, since it is still just a supposition, an experiment must be conducted to support or reject this hypothesis.

The researcher decided to conduct an online survey to inquire about the buying habits of a certain sample population of buyers at brick-and-mortar stores. This is to determine whether people always look at their smartphones first before making a purchase.

3. Deduction

This phase enables the researcher to figure out a conclusion out of the experiment. This must be based on rationality and logic in order to arrive at particular, unbiased outcomes. For example:

In the experiment, if a shopper consults first his or her smartphone before buying in-store, then it can be concluded that the shopper needs information to help him or her make informed buying decisions .

This phase involves the researcher going back to the empirical research steps to test the hypothesis. There is now the need to analyze and validate the data using appropriate statistical methods.

If the researcher confirms that in-store shoppers do consult their smartphones for product information before making a purchase, the researcher has found support for the hypothesis. However, it should be noted that this is just support of the hypothesis, not proof of a reality.

5. Evaluation

This phase is often neglected by many but is actually a crucial step to help keep expanding knowledge. During this stage, the researcher presents the gathered data, the supporting contention/s, and conclusions.

The researcher likewise puts forth the limitations of the study and his hypothesis. In addition, the researcher makes recommendations for further studies on the same topic with expanded variables.

VII. Advantages and Disadvantages of Empirical Research

Since the time of the ancient Greeks, empirical research had been providing the world with numerous benefits. The following are a few of them:

- Empirical research is used to validate previous research findings and frameworks.

- It assumes a critical role in enhancing internal validity.

- The degree of control is high, which enables the researcher to manage numerous variables.

- It allows a researcher to comprehend the progressive changes that can occur, and thus enables him to modify an approach when needed.

- Being based on facts and experience makes a research project more authentic and competent.

Disadvantages

Despite the many benefits it brings, empirical research is far from perfect. The following are some of its drawbacks:

- Being evidence-based, data collection is a common problem especially when the research involves different sources and multiple methods.

- It can be time-consuming, especially for longitudinal research.

- Requesting permission to perform certain methods can be difficult, especially when a study involves human subjects.

- Conducting research in multiple locations can be very expensive.

- The propensity of even seasoned researchers to incorrectly interpret the statistical significance. For instance, Amrhein et al. (2019) made an analysis of 791 articles from five journals and found that half incorrectly interpreted that non-significance indicates zero effect.

VIII. Samples of Empirical Research

There are many types of empirical research. And, they can take many formsfrom basic research to action research like community project efforts. Here are some notable empirical research examples:

Professional Research

- Research on Information Technology

- Research on Infectious Diseases

- Research on Occupational Health Psychology

- Research on Infection Control

- Research on Cancer

- Research on Mathematical Science

- Research on Environmental Science

- Research on Genetics

- Research on Climate Change

- Research on Economics

Student Research

- Thesis for B.S. in Computer Science & Engineering

- Thesis for B.S. in Geography

- Thesis for B.S. in Architecture

- Thesis for Master of Science in Electrical Engineering & Computer Science

- Thesis for Master of Science in Artificial Intelligence

- Thesis for Master of Science in Food Science and Nutrition

- Dissertation for Ph.D. in Marketing

- Dissertation for Ph.D. in Social Work

- Dissertation for Ph.D. in Urban Planning

Since ancient times until today, empirical research remains one of the most useful tools in man’s collective endeavor to unlock life’s mysteries. Using meaningful experience and observable evidence, this type of research will continue helping validate myriad hypotheses, test theoretical models, and advance various fields of specialization.

With new forms of deadly diseases and other problems continuing to plague man’s existence, finding effective medical interventions and relevant solutions had never been more important. This is among the reasons why empirical research had assumed a more prominent role in today’s society.

This article was able to discuss the different empirical research methods, the steps for conducting empirical research, the empirical research cycle, and notable examples. All of these contribute to supporting the larger societal cause to help understand how the world really works and make it a better place. Furthermore, being factually accurate is a big part of the criteria of good research , and it serves as the heart of empirical research.

Key Insights

- Definition of Empirical Research: Empirical research is based on verifiable evidence derived from observation and experimentation, aiming to understand how the world works.

- Origins: The concept of empirical research dates back to ancient Greek medical practitioners who relied on observed phenomena rather than dogmatic principles.

- Types and Methods: Empirical research can be qualitative (e.g., interviews, case studies) or quantitative (e.g., surveys, experiments), depending on the nature of the data collected and the research question.

- Empirical Research Cycle: Consists of observation, induction, deduction, testing, and evaluation, forming a systematic approach to generating and testing hypotheses.

- Steps in Conducting Empirical Research: Includes establishing objectives, reviewing literature, framing hypotheses, designing methodology, collecting data, analyzing data, and making conclusions.

- Advantages: Empirical research validates previous findings, enhances internal validity, allows for high control over variables, and is fact-based, making it authentic and competent.

- Disadvantages: Data collection can be challenging and time-consuming, especially in longitudinal studies, and interpreting statistical significance can be problematic.

- Applications: Used across various fields such as IT, infectious diseases, occupational health, environmental science, and economics. It is also prevalent in student research for theses and dissertations.

- What is the primary goal of empirical research? The primary goal of empirical research is to generate knowledge about how the world works by relying on verifiable evidence obtained through observation and experimentation.

- How does empirical research differ from theoretical research? Empirical research is based on observable and measurable evidence, while theoretical research involves abstract ideas and concepts without necessarily relying on real-world data.

- What are the main types of empirical research methods? The main types of empirical research methods are qualitative (e.g., interviews, case studies, focus groups) and quantitative (e.g., surveys, experiments, cross-sectional studies).

- Why is the empirical research cycle important? The empirical research cycle is important because it provides a structured and systematic approach to generating and testing hypotheses, ensuring that the research is thorough and reliable.

- What are the steps involved in conducting empirical research? The steps involved in conducting empirical research include establishing the research objective, reviewing relevant literature, framing hypotheses, defining research design and methodology, collecting data, analyzing data, and making conclusions.

- What are the advantages of empirical research? The advantages of empirical research include validating previous findings, enhancing internal validity, allowing for high control over variables, and being based on facts and experiences, making the research authentic and competent.

- What are some common challenges in conducting empirical research? Common challenges in conducting empirical research include difficulties in data collection, time-consuming processes, obtaining permissions for certain methods, high costs, and potential misinterpretation of statistical significance.

- In which fields is empirical research commonly used? Empirical research is commonly used in fields such as information technology, infectious diseases, occupational health, environmental science, economics, and various academic disciplines for student theses and dissertations.

- Can empirical research use both qualitative and quantitative methods? Yes, empirical research can use both qualitative and quantitative methods, often combining them to provide a comprehensive understanding of the research problem.

- What role does empirical research play in modern society? Empirical research plays a crucial role in modern society by validating hypotheses, testing theoretical models, and advancing knowledge across various fields, ultimately contributing to solving complex problems and improving the quality of life.

- Abbott, B., Abbott, R., Abbott, T., Abernathy, M., & Acernese, F. (2016). Observation of Gravitational Waves from a Binary Black Hole Merger. Physical Review Letters, 116 (6), 061102. https://doi.org/10.1103/PhysRevLett.116.061102

- Akpinar, E. (2014). Consumer Information Sharing: Understanding Psychological Drivers of Social Transmission . (Unpublished Ph.D. dissertation). Erasmus University Rotterdam, Rotterdam, The Netherlands. http://hdl.handle.net/1765/1

- Altmetric (2020). The 2019 Altmetric top 100. Altmetric .

- Amrhein, V., Greenland, S., & McShane, B. (2019). Scientists rise up against statistical significance. Nature, 567 , 305-307. https://doi.org/10.1038/d41586-019-00857-9

- Amrhein, V., Trafimow, D., & Greenland, S. (2019). Inferential statistics as descriptive statistics: There is no replication crisis if we don’t expect replication. The American Statistician, 73 , 262-270. https://doi.org/10.1080/00031305.2018.1543137

- Arute, F., Arya, K., Babbush, R. et al. (2019). Quantum supremacy using a programmable superconducting processor. Nature, 574 , 505510. https://doi.org/10.1038/s41586-019-1666-5

- Bhattacharya, H. (2008). Empirical Research. In L. M. Given (ed.), The SAGE Encyclopedia of Qualitative Research Methods . Thousand Oaks, CA: Sage, 254-255. https://dx.doi.org/10.4135/9781412963909.n133

- Cohn, A., Maréchal, M., Tannenbaum, D., & Zund, C. (2019). Civic honesty around the globe. Science, 365 (6448), 70-73. https://doi.org/10.1126/science.aau8712

- Corbin, J., & Strauss, A. (2015). Basics of Qualitative Research: Techniques and Procedures for Developing Grounded Theory, 4th ed . Thousand Oaks, CA: Sage. ISBN 978-1-4129-9746-1

- Crew, B. (2019, August 2). Google Scholar reveals its most influential papers for 2019. Nature Index .

- Curtis, E., Comiskey, C., & Dempsey, O. (2016). Importance and use of correlational research. Nurse Researcher, 23 (6), 20-25. https://doi.org/10.7748/nr.2016.e1382

- Dashti, H., Jones, S., Wood, A., Lane, J., & van Hees, V., et al. (2019). Genome-wide association study identifies genetic loci for self-reported habitual sleep duration supported by accelerometer-derived estimates. Nature Communications, 10 (1). https://doi.org/10.1038/s41467-019-08917-4

- de Groot, A.D. (1969). Methodology: foundations of inference and research in the behavioral sciences. In Psychological Studies, 6 . The Hague & Paris: Mouton & Co. Google Books

- Doll, R., Peto, R., Boreham, J., & Isabelle Sutherland, I. (2004). Mortality in relation to smoking: 50 years’ observations on male British doctors. BMJ, 328 (7455), 1519-33. https://doi.org/10.1136/bmj.38142.554479.AE

- Fairclough, N. (2003). Analyzing Discourse: Textual Analysis for Social Research . Abingdon-on-Thames: Routledge. Google Books

- Falk, A., & Heckman, J. (2009). Lab experiments are a major source of knowledge in the social sciences. Science, 326 (5952), pp. 535-538. https://doi.org/10.1126/science.1168244

- Fowler, F.J. (2014). Survey Research Methods, 5th ed . Thousand Oaks, CA: Sage. WorldCat

- Gabriel, A., Manalo, M., Feliciano, R., Garcia, N., Dollete, U., & Paler J. (2018). A Candida parapsilosis inactivation-based UV-C process for calamansi (Citrus microcarpa) juice frink. LWT Food Science and Technology, 90 , 157-163. https://doi.org/10.1016/j.lwt.2017.12.020

- Gallus, S., Bosetti, C., Negri, E., Talamini, R., Montella, M., et al. (2003). Does pizza protect against cancer? International Journal of Cancer, 107 (2), pp. 283-284. https://doi.org/10.1002/ijc.11382

- Ganna, A., Verweij, K., Nivard, M., Maier, R., & Wedow, R. (2019). Large-scale GWAS reveals insights into the genetic architecture of same-sex sexual behavior. Science, 365 (6456). https://doi.org/10.1126/science.aat7693

- Gedik, H., Voss, T., & Voss, A. (2013). Money and Transmission of Bacteria. Antimicrobial Resistance and Infection Control, 2 (2). https://doi.org/10.1186/2047-2994-2-22

- Gonzalez-Morales, M. G., Kernan, M. C., Becker, T. E., & Eisenberger, R. (2018). Defeating abusive supervision: Training supervisors to support subordinates. Journal of Occupational Health Psychology, 23 (2), 151-162. https://dx.doi.org/10.1037/ocp0000061

- Google (2020). The 2019 Google Scholar Metrics Ranking . Google Scholar

- Greenberg, D., Warrier, V., Allison, C., & Baron-Cohen, S. (2018). Testing the Empathizing-Systemising theory of sex differences and the Extreme Male Brain theory of autism in half a million people. PNAS, 115 (48), 12152-12157. https://doi.org/10.1073/pnas.1811032115

- Grullon, D. (2019). Disentangling time constant and time-dependent hidden state in time series with variational Bayesian inference . (Unpublished master’s thesis). Massachusetts Institute of Technology, Cambridge, MA. https://hdl.handle.net/1721.1/124572

- He, K., Zhang, X., Ren, S., & Sun, J. (2016). Deep residual learning for image recognition. The IEEE Conference on Computer Vision and Pattern Recognition (CVPR) , 770-778. https://doi.org/10.1109/CVPR.2016.90

- Hviid, A., Hansen, J., Frisch, M., & Melbye, M. (2019). Measles, mumps, rubella vaccination, and autism: A nationwide cohort study. Annals of Internal Medicine, 170 (8), 513-520. https://doi.org/10.7326/M18-2101

- Jamshed, S. (2014). Qualitative research method-interviewing and observation. Journal of Basic and Clinical Pharmacy, 5 (4), 87-88. https://doi.org/10.4103/0976-0105.141942

- Jamshidnejad, A. (2017). Efficient Predictive Model-Based and Fuzzy Control for Green Urban Mobility . (Unpublished Ph.D. dissertation). Delft University of Technology, Delft, Netherlands. DUT

- Kamberelis, G., & Dimitriadis, G. (2011). Focus groups: Contingent articulations of pedagogy, politics, and inquiry. In N. Denzin & Y. Lincoln (Eds.), The SAGE Handbook of Qualitative Research (pp. 545-562). Thousand Oaks, CA: Sage. ISBN 978-1-4129-7417-2

- Knowles-Smith, A. (2017). Refugees and theatre: an exploration of the basis of self-representation . (Unpublished undergraduate thesis). University College London, London, UK. UCL

- Kulp, S.A., & Strauss, B.H. (2019). New elevation data triple estimates of global vulnerability to sea-level rise and coastal flooding. Nature Communications, 10 (4844), 1-12. https://doi.org/10.1038/s41467-019-12808-z

- LeCun, Y., Bengio, Y. & Hinton, G. (2015). Deep learning. Nature, 521 , 436444. https://doi.org/10.1038/nature14539

- Levitt, H. M., Bamberg, M., Creswell, J. W., Frost, D. M., Josselson, R., & Suarez-Orozco, C. (2018). Journal article reporting standards for qualitative primary, qualitative meta-analytic, and mixed methods research in psychology: The APA Publications and Communications Board task force report. American Psychologist, 73 (1), 26-46. https://doi.org/10.1037/amp0000151

- Long, J., Shelhamer, E., & Darrell, T. (2015). Fully convolutional networks for semantic segmentation. 2015 IEEE Conference on Computer Vision and Pattern Recognition (CVPR) , 3431-3440. https://doi.org/10.1109/CVPR.2015.7298965

- Martindell, N. (2014). DCDN: Distributed content delivery for the modern web . (Unpublished undergraduate thesis). University of Washington, Seattle, WA. CSE-UW

- Mora, T. (2019). Transforming Parking Garages Into Affordable Housing . (Unpublished undergraduate thesis). University of Arkansas-Fayetteville, Fayetteville, AK. UARK

- Ng, M., Fleming, T., Robinson, M., Thomson, B., & Graetz, N. (2014). Global, regional, and national prevalence of overweight and obesity in children and adults during 19802013: a systematic analysis for the Global Burden of Disease Study 2013. The Lancet, 384 (9945), 766-781. https://doi.org/10.1016/S0140-6736(14)60460-8

- Ogden, C., Carroll, M., Kit, B., & Flegal, K. (2014). Prevalence of Childhood and Adult Obesity in the United States, 2011-2012. JAMA, 311 (8), 806-14. https://doi.org/10.1001/jama.2014.732

- Powner, L. (2015). Empirical Research and Writing: A Political Science Student’s Practical Guide . Thousand Oaks, CA: Sage, 1-19. https://dx.doi.org/10.4135/9781483395906

- Ripple, W., Wolf, C., Newsome, T., Barnard, P., & Moomaw, W. (2020). World scientists’ warning of a climate emergency. BioScience, 70 (1), 8-12. https://doi.org/10.1093/biosci/biz088

- Schenker, J., & Rumrill, P. (2004). Causal-comparative research designs. Journal of Vocational Rehabilitation, 21 (3), 117-121.

- Shereen, M., Khan, S., Kazmi, A., Bashir, N., & Siddique, R. (2020). COVID-19 infection: Origin, transmission, and characteristics of human coronaviruses. Journal of Advanced Research, 24 , 91-98. https://doi.org/10.1016/j.jare.2020.03.005

- Sipola, C. (2017). Summarizing electricity usage with a neural network . (Unpublished master’s thesis). University of Edinburgh, Edinburgh, Scotland. Project-Archive

- Szegedy, C., Liu, W., Jia, Y., Sermanet, P., Reed, S., Anguelov, D., Erhan, D., Vanhoucke, V., & Rabinovich, A. (2015). Going deeper with convolutions. 2015 IEEE Conference on Computer Vision and Pattern Recognition (CVPR) , 1-9. https://doi.org/10.1109/CVPR.2015.7298594

- Taylor, S. (2017). Effacing and Obscuring Autonomy: the Effects of Structural Violence on the Transition to Adulthood of Street Involved Youth . (Unpublished Ph.D. dissertation). University of Ottawa, Ottawa, Canada. UOttawa

- Vosoughi, S., Roy, D., & Aral, S. (2018). The spread of true and false news online. Science, 359 (6380), 1146-1151. https://doi.org/10.1126/science.aap9559

Related Articles

How to Write a Thesis Statement for a Research Paper in 2024: Steps and Examples

How to Write a Research Paper Abstract in 2024: Guide With Examples

72 Scholarship Statistics: 2024 Data, Facts & Analysis

What Is a University Dissertation: 2024 Structure, Challenges & Writing Tips

Web-Based Research: Tips For Conducting Academic Research

How to Write Research Methodology in 2024: Overview, Tips, and Techniques

EasyChair : Tutorial of how to request an installation for Conference Management System

Levels of Evidence in Research: Examples, Hierachies & Practice in 2024

How to Write a Research Question in 2024: Types, Steps, and Examples

How to Write a Research Proposal in 2024: Structure, Examples & Common Mistakes

Needs Analysis in 2024: Definition, Importance & Implementation

Importing references from google scholar to bibtex.

How to Become a Preschool Teacher in Georgia: Requirements & Certification in 2024

How to Become a Preschool Teacher in Alaska: Requirements & Certification in 2024

Most Affordable Online Master's in Artificial Intelligence Degree Programs for 2024

How to Become a Preschool Teacher in Kansas: Requirements & Certification in 2024

How to Become a Preschool Teacher in Missouri: Requirements & Certification in 2024

How to Become a Preschool Teacher in Maryland: Requirements & Certification in 2024

How to Become a Preschool Teacher in Ohio: Requirements & Certification in 2024

How to Become a Preschool Teacher in Kentucky: Requirements & Certification in 2024

How to Become a Preschool Teacher in Hawaii: Requirements & Certification in 2024

Recently published articles.

Best Master’s in Speech Language Pathology Programs for 2024

Best Nurse Practitioner Programs in Alabama 2024 – Accredited Schools Online & Campus

Most In-Demand Education Careers in 2024

How to Become a Licensed Counselor (LPC) in Kentucky in 2024

How to Become a Licensed Counselor (LPC) in Maine in 2024

Best Online Associate Degrees in Computer Science: A Guide to Online Programs for 2024

Best Nurse Practitioner Programs in Montana 2024 – Accredited Schools Online & Campus

Best Nurse Practitioner Programs in Indiana 2024 - Accredited Schools Online & Campus

Best 12-Month FNP Programs (Online & Campus) for 2024

Best Shortest Online PMHNP Certificate Programs for 2024

Best Online Master’s Program in Forensic Psychology: Guide to Online Programs for 2024

What Can You Do with a Digital Marketing Degree: 2024 Costs & Job Opportunities

Best Nursing Certifications to Consider for 2024

Linguistics Jobs in 2024: Careers, Salary Range, and Requirements

Best Online Radiologic Technology Programs in 2024

Most Affordable Online Doctorates in Education for 2024

Best Psychology Schools in Wisconsin – 2024 Accredited Colleges & Programs

Best Online Nursing Programs in North Carolina – 2024 Accredited RN to BSN Programs

Top 50 US Colleges that Pay Off the Most in 2024

How to Become a Middle School Math Teacher in Georgia: Requirements & Certification in 2024

Best LPN Programs in Oregon – Accredited Online LPN Programs in 2024

Newsletter & conference alerts.

Research.com uses the information to contact you about our relevant content. For more information, check out our privacy policy .

Thank you for subscribing!

Confirmation email sent. Please click the link in the email to confirm your subscription.

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case AskWhy Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Market Research

Empirical Research: Definition, Methods, Types and Examples

Content Index

Empirical research: Definition

Empirical research: origin, quantitative research methods, qualitative research methods, steps for conducting empirical research, empirical research methodology cycle, advantages of empirical research, disadvantages of empirical research, why is there a need for empirical research.

Empirical research is defined as any research where conclusions of the study is strictly drawn from concretely empirical evidence, and therefore “verifiable” evidence.

This empirical evidence can be gathered using quantitative market research and qualitative market research methods.

For example: A research is being conducted to find out if listening to happy music in the workplace while working may promote creativity? An experiment is conducted by using a music website survey on a set of audience who are exposed to happy music and another set who are not listening to music at all, and the subjects are then observed. The results derived from such a research will give empirical evidence if it does promote creativity or not.

LEARN ABOUT: Behavioral Research

You must have heard the quote” I will not believe it unless I see it”. This came from the ancient empiricists, a fundamental understanding that powered the emergence of medieval science during the renaissance period and laid the foundation of modern science, as we know it today. The word itself has its roots in greek. It is derived from the greek word empeirikos which means “experienced”.

In today’s world, the word empirical refers to collection of data using evidence that is collected through observation or experience or by using calibrated scientific instruments. All of the above origins have one thing in common which is dependence of observation and experiments to collect data and test them to come up with conclusions.

LEARN ABOUT: Causal Research

Types and methodologies of empirical research

Empirical research can be conducted and analysed using qualitative or quantitative methods.

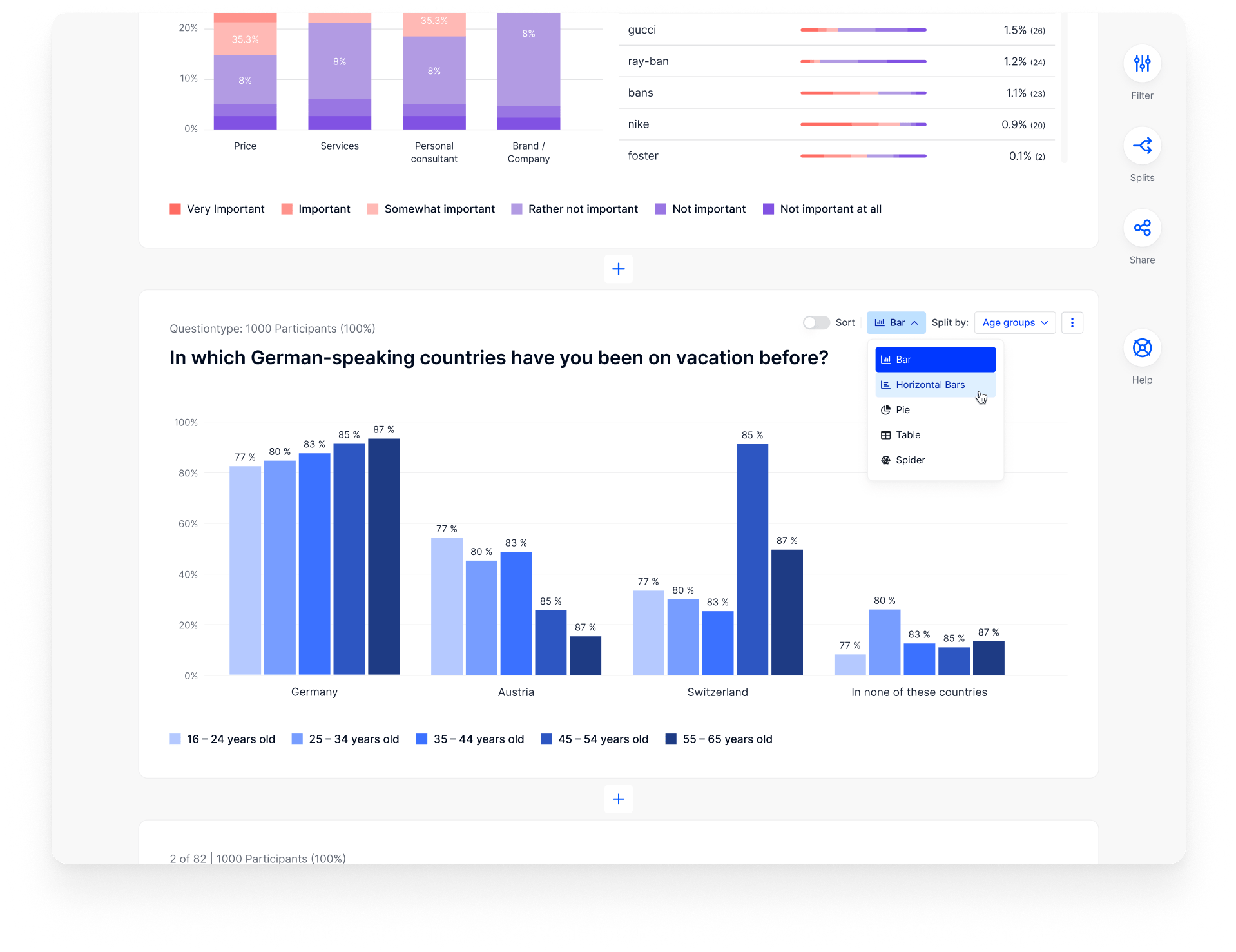

- Quantitative research : Quantitative research methods are used to gather information through numerical data. It is used to quantify opinions, behaviors or other defined variables . These are predetermined and are in a more structured format. Some of the commonly used methods are survey, longitudinal studies, polls, etc

- Qualitative research: Qualitative research methods are used to gather non numerical data. It is used to find meanings, opinions, or the underlying reasons from its subjects. These methods are unstructured or semi structured. The sample size for such a research is usually small and it is a conversational type of method to provide more insight or in-depth information about the problem Some of the most popular forms of methods are focus groups, experiments, interviews, etc.

Data collected from these will need to be analysed. Empirical evidence can also be analysed either quantitatively and qualitatively. Using this, the researcher can answer empirical questions which have to be clearly defined and answerable with the findings he has got. The type of research design used will vary depending on the field in which it is going to be used. Many of them might choose to do a collective research involving quantitative and qualitative method to better answer questions which cannot be studied in a laboratory setting.

LEARN ABOUT: Qualitative Research Questions and Questionnaires

Quantitative research methods aid in analyzing the empirical evidence gathered. By using these a researcher can find out if his hypothesis is supported or not.

- Survey research: Survey research generally involves a large audience to collect a large amount of data. This is a quantitative method having a predetermined set of closed questions which are pretty easy to answer. Because of the simplicity of such a method, high responses are achieved. It is one of the most commonly used methods for all kinds of research in today’s world.

Previously, surveys were taken face to face only with maybe a recorder. However, with advancement in technology and for ease, new mediums such as emails , or social media have emerged.

For example: Depletion of energy resources is a growing concern and hence there is a need for awareness about renewable energy. According to recent studies, fossil fuels still account for around 80% of energy consumption in the United States. Even though there is a rise in the use of green energy every year, there are certain parameters because of which the general population is still not opting for green energy. In order to understand why, a survey can be conducted to gather opinions of the general population about green energy and the factors that influence their choice of switching to renewable energy. Such a survey can help institutions or governing bodies to promote appropriate awareness and incentive schemes to push the use of greener energy.

Learn more: Renewable Energy Survey Template Descriptive Research vs Correlational Research

- Experimental research: In experimental research , an experiment is set up and a hypothesis is tested by creating a situation in which one of the variable is manipulated. This is also used to check cause and effect. It is tested to see what happens to the independent variable if the other one is removed or altered. The process for such a method is usually proposing a hypothesis, experimenting on it, analyzing the findings and reporting the findings to understand if it supports the theory or not.

For example: A particular product company is trying to find what is the reason for them to not be able to capture the market. So the organisation makes changes in each one of the processes like manufacturing, marketing, sales and operations. Through the experiment they understand that sales training directly impacts the market coverage for their product. If the person is trained well, then the product will have better coverage.

- Correlational research: Correlational research is used to find relation between two set of variables . Regression analysis is generally used to predict outcomes of such a method. It can be positive, negative or neutral correlation.

LEARN ABOUT: Level of Analysis

For example: Higher educated individuals will get higher paying jobs. This means higher education enables the individual to high paying job and less education will lead to lower paying jobs.

- Longitudinal study: Longitudinal study is used to understand the traits or behavior of a subject under observation after repeatedly testing the subject over a period of time. Data collected from such a method can be qualitative or quantitative in nature.

For example: A research to find out benefits of exercise. The target is asked to exercise everyday for a particular period of time and the results show higher endurance, stamina, and muscle growth. This supports the fact that exercise benefits an individual body.

- Cross sectional: Cross sectional study is an observational type of method, in which a set of audience is observed at a given point in time. In this type, the set of people are chosen in a fashion which depicts similarity in all the variables except the one which is being researched. This type does not enable the researcher to establish a cause and effect relationship as it is not observed for a continuous time period. It is majorly used by healthcare sector or the retail industry.

For example: A medical study to find the prevalence of under-nutrition disorders in kids of a given population. This will involve looking at a wide range of parameters like age, ethnicity, location, incomes and social backgrounds. If a significant number of kids coming from poor families show under-nutrition disorders, the researcher can further investigate into it. Usually a cross sectional study is followed by a longitudinal study to find out the exact reason.

- Causal-Comparative research : This method is based on comparison. It is mainly used to find out cause-effect relationship between two variables or even multiple variables.

For example: A researcher measured the productivity of employees in a company which gave breaks to the employees during work and compared that to the employees of the company which did not give breaks at all.

LEARN ABOUT: Action Research

Some research questions need to be analysed qualitatively, as quantitative methods are not applicable there. In many cases, in-depth information is needed or a researcher may need to observe a target audience behavior, hence the results needed are in a descriptive analysis form. Qualitative research results will be descriptive rather than predictive. It enables the researcher to build or support theories for future potential quantitative research. In such a situation qualitative research methods are used to derive a conclusion to support the theory or hypothesis being studied.

LEARN ABOUT: Qualitative Interview

- Case study: Case study method is used to find more information through carefully analyzing existing cases. It is very often used for business research or to gather empirical evidence for investigation purpose. It is a method to investigate a problem within its real life context through existing cases. The researcher has to carefully analyse making sure the parameter and variables in the existing case are the same as to the case that is being investigated. Using the findings from the case study, conclusions can be drawn regarding the topic that is being studied.

For example: A report mentioning the solution provided by a company to its client. The challenges they faced during initiation and deployment, the findings of the case and solutions they offered for the problems. Such case studies are used by most companies as it forms an empirical evidence for the company to promote in order to get more business.

- Observational method: Observational method is a process to observe and gather data from its target. Since it is a qualitative method it is time consuming and very personal. It can be said that observational research method is a part of ethnographic research which is also used to gather empirical evidence. This is usually a qualitative form of research, however in some cases it can be quantitative as well depending on what is being studied.

For example: setting up a research to observe a particular animal in the rain-forests of amazon. Such a research usually take a lot of time as observation has to be done for a set amount of time to study patterns or behavior of the subject. Another example used widely nowadays is to observe people shopping in a mall to figure out buying behavior of consumers.

- One-on-one interview: Such a method is purely qualitative and one of the most widely used. The reason being it enables a researcher get precise meaningful data if the right questions are asked. It is a conversational method where in-depth data can be gathered depending on where the conversation leads.

For example: A one-on-one interview with the finance minister to gather data on financial policies of the country and its implications on the public.

- Focus groups: Focus groups are used when a researcher wants to find answers to why, what and how questions. A small group is generally chosen for such a method and it is not necessary to interact with the group in person. A moderator is generally needed in case the group is being addressed in person. This is widely used by product companies to collect data about their brands and the product.

For example: A mobile phone manufacturer wanting to have a feedback on the dimensions of one of their models which is yet to be launched. Such studies help the company meet the demand of the customer and position their model appropriately in the market.

- Text analysis: Text analysis method is a little new compared to the other types. Such a method is used to analyse social life by going through images or words used by the individual. In today’s world, with social media playing a major part of everyone’s life, such a method enables the research to follow the pattern that relates to his study.

For example: A lot of companies ask for feedback from the customer in detail mentioning how satisfied are they with their customer support team. Such data enables the researcher to take appropriate decisions to make their support team better.

Sometimes a combination of the methods is also needed for some questions that cannot be answered using only one type of method especially when a researcher needs to gain a complete understanding of complex subject matter.

We recently published a blog that talks about examples of qualitative data in education ; why don’t you check it out for more ideas?

Learn More: Data Collection Methods: Types & Examples

Since empirical research is based on observation and capturing experiences, it is important to plan the steps to conduct the experiment and how to analyse it. This will enable the researcher to resolve problems or obstacles which can occur during the experiment.

Step #1: Define the purpose of the research

This is the step where the researcher has to answer questions like what exactly do I want to find out? What is the problem statement? Are there any issues in terms of the availability of knowledge, data, time or resources. Will this research be more beneficial than what it will cost.

Before going ahead, a researcher has to clearly define his purpose for the research and set up a plan to carry out further tasks.

Step #2 : Supporting theories and relevant literature

The researcher needs to find out if there are theories which can be linked to his research problem . He has to figure out if any theory can help him support his findings. All kind of relevant literature will help the researcher to find if there are others who have researched this before, or what are the problems faced during this research. The researcher will also have to set up assumptions and also find out if there is any history regarding his research problem

Step #3: Creation of Hypothesis and measurement

Before beginning the actual research he needs to provide himself a working hypothesis or guess what will be the probable result. Researcher has to set up variables, decide the environment for the research and find out how can he relate between the variables.

Researcher will also need to define the units of measurements, tolerable degree for errors, and find out if the measurement chosen will be acceptable by others.

Step #4: Methodology, research design and data collection

In this step, the researcher has to define a strategy for conducting his research. He has to set up experiments to collect data which will enable him to propose the hypothesis. The researcher will decide whether he will need experimental or non experimental method for conducting the research. The type of research design will vary depending on the field in which the research is being conducted. Last but not the least, the researcher will have to find out parameters that will affect the validity of the research design. Data collection will need to be done by choosing appropriate samples depending on the research question. To carry out the research, he can use one of the many sampling techniques. Once data collection is complete, researcher will have empirical data which needs to be analysed.

LEARN ABOUT: Best Data Collection Tools

Step #5: Data Analysis and result

Data analysis can be done in two ways, qualitatively and quantitatively. Researcher will need to find out what qualitative method or quantitative method will be needed or will he need a combination of both. Depending on the unit of analysis of his data, he will know if his hypothesis is supported or rejected. Analyzing this data is the most important part to support his hypothesis.

Step #6: Conclusion

A report will need to be made with the findings of the research. The researcher can give the theories and literature that support his research. He can make suggestions or recommendations for further research on his topic.

A.D. de Groot, a famous dutch psychologist and a chess expert conducted some of the most notable experiments using chess in the 1940’s. During his study, he came up with a cycle which is consistent and now widely used to conduct empirical research. It consists of 5 phases with each phase being as important as the next one. The empirical cycle captures the process of coming up with hypothesis about how certain subjects work or behave and then testing these hypothesis against empirical data in a systematic and rigorous approach. It can be said that it characterizes the deductive approach to science. Following is the empirical cycle.

- Observation: At this phase an idea is sparked for proposing a hypothesis. During this phase empirical data is gathered using observation. For example: a particular species of flower bloom in a different color only during a specific season.

- Induction: Inductive reasoning is then carried out to form a general conclusion from the data gathered through observation. For example: As stated above it is observed that the species of flower blooms in a different color during a specific season. A researcher may ask a question “does the temperature in the season cause the color change in the flower?” He can assume that is the case, however it is a mere conjecture and hence an experiment needs to be set up to support this hypothesis. So he tags a few set of flowers kept at a different temperature and observes if they still change the color?

- Deduction: This phase helps the researcher to deduce a conclusion out of his experiment. This has to be based on logic and rationality to come up with specific unbiased results.For example: In the experiment, if the tagged flowers in a different temperature environment do not change the color then it can be concluded that temperature plays a role in changing the color of the bloom.

- Testing: This phase involves the researcher to return to empirical methods to put his hypothesis to the test. The researcher now needs to make sense of his data and hence needs to use statistical analysis plans to determine the temperature and bloom color relationship. If the researcher finds out that most flowers bloom a different color when exposed to the certain temperature and the others do not when the temperature is different, he has found support to his hypothesis. Please note this not proof but just a support to his hypothesis.

- Evaluation: This phase is generally forgotten by most but is an important one to keep gaining knowledge. During this phase the researcher puts forth the data he has collected, the support argument and his conclusion. The researcher also states the limitations for the experiment and his hypothesis and suggests tips for others to pick it up and continue a more in-depth research for others in the future. LEARN MORE: Population vs Sample

LEARN MORE: Population vs Sample

There is a reason why empirical research is one of the most widely used method. There are a few advantages associated with it. Following are a few of them.

- It is used to authenticate traditional research through various experiments and observations.

- This research methodology makes the research being conducted more competent and authentic.

- It enables a researcher understand the dynamic changes that can happen and change his strategy accordingly.

- The level of control in such a research is high so the researcher can control multiple variables.

- It plays a vital role in increasing internal validity .

Even though empirical research makes the research more competent and authentic, it does have a few disadvantages. Following are a few of them.

- Such a research needs patience as it can be very time consuming. The researcher has to collect data from multiple sources and the parameters involved are quite a few, which will lead to a time consuming research.

- Most of the time, a researcher will need to conduct research at different locations or in different environments, this can lead to an expensive affair.

- There are a few rules in which experiments can be performed and hence permissions are needed. Many a times, it is very difficult to get certain permissions to carry out different methods of this research.

- Collection of data can be a problem sometimes, as it has to be collected from a variety of sources through different methods.

LEARN ABOUT: Social Communication Questionnaire

Empirical research is important in today’s world because most people believe in something only that they can see, hear or experience. It is used to validate multiple hypothesis and increase human knowledge and continue doing it to keep advancing in various fields.

For example: Pharmaceutical companies use empirical research to try out a specific drug on controlled groups or random groups to study the effect and cause. This way, they prove certain theories they had proposed for the specific drug. Such research is very important as sometimes it can lead to finding a cure for a disease that has existed for many years. It is useful in science and many other fields like history, social sciences, business, etc.

LEARN ABOUT: 12 Best Tools for Researchers

With the advancement in today’s world, empirical research has become critical and a norm in many fields to support their hypothesis and gain more knowledge. The methods mentioned above are very useful for carrying out such research. However, a number of new methods will keep coming up as the nature of new investigative questions keeps getting unique or changing.

Create a single source of real data with a built-for-insights platform. Store past data, add nuggets of insights, and import research data from various sources into a CRM for insights. Build on ever-growing research with a real-time dashboard in a unified research management platform to turn insights into knowledge.

LEARN MORE FREE TRIAL

MORE LIKE THIS

SWOT Analysis: What It Is And How To Do It?

Sep 27, 2024

SurveySparrow vs SurveyMonkey: Choosing the Right Survey Tool

Sep 26, 2024

User Behavior Analytics: What it is, Importance, Uses & Tools

Data Security: What it is, Types, Risk & Strategies to Follow

Sep 25, 2024

Other categories

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Tuesday CX Thoughts (TCXT)

- Uncategorized

- What’s Coming Up

- Workforce Intelligence

Researching and writing for Economics students

3 economics: methods, approaches, fields and relevant questions, 3.1 economic theory and empirical work: what is it.

What is economic theory and what can it do?

Unlike “theory” in some other social science disciplines, economic theory is mostly based on mathematical modelling and rigorous proof that certain conclusions or results can be derived from certain assumptions. But theory alone can say little about the real world.

In Economics: Models = Theory = Mathematics… for the most part.

What is empirical work and what can it do?

In contrast, empirical work gathers evidence from the real world, usually organized into systematic data sets.

It tries to bring evidence to refute or substantiate economics theory,

It tries to estimate parameters such as price elasticity or the government spending multiplier in specific contexts

It rigorously presents broad “stylized facts”, providing a clear picture of a market, industry, or situation

Much empirical work itself relies on assumptions, either assumptions from economic theory, or assumptions about the data itself, or both. But empirical work does not “prove” anything. Instead, it presents evidence in favour of or against certain hypotheses, estimates parameters, and can, using the classical statistical framework, reject (or fail to reject) certain null hypotheses. What “rejecting” means is “if the assumptions underlying my estimation technique are correct, then it is highly unlikely that the null hypothesis holds.”

3.2 Normative vs. Positive

The word ‘Normative’, also called ‘prescriptive’, often refers to what ought to be, what an ideal policy would be, or how to think about judging whether this is a justifiable welfare function.

“Positive” work claims to be value-neutral and to address what is or what must be going on in the real world. Most modern economists would probably claim their work is “positive”, and in this sense, “prescriptive” is often used as a pejorative, In my experience. However, prescriptive papers can be very valuable if done well.

Note: There is also another context in which you will hear the expression ‘normative analysis.’ This may also be used to describe microeconomic analysis derived from the axioms of rational optimising behavior; this describes much of what you have covered in your textbook. This dual meaning of the word ‘normative’ is admittedly confusing!

3.3 Theoretical vs. Empirical (techniques)

Papers that use theory (modeling) as a technique typically start from a series of assumptions and try to derive results simply from these assumptions. They may motivate their focus or assumptions using previous empirical work and anecdotes, but these papers do not use themselves data nor do they do what we call “econometrics”. Remember that in Economics “theory papers” are usually highly mathematical and formal.

Empirical papers use evidence from the real world, usually to test hypotheses, but also to generate description and help formulate ideas and hypotheses.

3.4 Theoretical vs. Applied (focus)

“Theoretical” can also be used to describe a paper’s focus; a theoretical paper in this sense will address fundamentals of economic modeling. In theory, these may be widely applied across a range of fields, but they do not typically address any single issue of policy or focus on a specific industry. These papers are often very difficult to read and there is argument about whether many such papers will ultimately “trickle-down” to having practical use. These papers typically used theory and modeling techniques rather than empirics. However some empirical papers may be aimed at addressing fundamental theoretical issues and parameters.

Papers with an “applied” focus will directly target a policy issue or a puzzle or question about the functioning of certain market or nonmarket interactions. Nearly all of the papers you will read and work on as an undergraduate are “applied” in this sense.

3.5 Categories of empirical approaches

“causal” vs. “descriptive”.

“Causal” papers try to get at whether one factor or event “A” can be seen to directly “cause” an outcome “B”. For example, “does an individual getting more years of schooling lead him or her to have higher income, on average?” A good way to think about this conception of causality is to consider the counterfactual: if a typical person who received a university degree had been randomly selected to not get this education, would her income have been lower than it now is? Similarly (but not identically) if the typical person without his education had been randomly input into a university program, would her income now be greater?

Since the real world does not usually present such clean experiments, “causal” empirical researchers rely on various techniques which usually themselves depend on" identification assumptions." See, for example, control strategies, difference in difference, and instrumental variables techniques.

“Descriptive” papers essentially aim to present a picture of “what the data looks like” in an informative way. Causal relationships may be suggested but the authors are not making a strong claim that they can identify these. They may present a data-driven portrait of an industry, of wealth and inequality in a country or globally over time, of particular patterns and trends in consumption, of a panel of governments’ monetary and fiscal policy, etc. They may focus on the ‘functional form’ of relationships in the data and the ‘residual’ or ‘error structure. They may hint at causal relationships or propose a governing model. They may identify a ’puzzle’ in the data (e.g., the ‘equity premium puzzle’) and propose potential explanations. They may use the data to ‘provide support’ for these explanations. 5 They may devote much of the paper to providing a theoretical explanation (remember, in Economics these are usually mathematical models) for the pattern. They may also run statistical tests and report confidence intervals; one can establish a ‘statistically significant’ relationship between two variables even if the relationship is not (necessarily) causal. This is particular important when one sees the data as subject to measurement error and/or as a sample from a larger population. E.g., just because age and wealth (or height and head-size, or political affiliation and food-preference) are strongly related to one another in a random representative sample of 10 people does not mean they are strongly related to one another in the entire population . 6

Structural vs. Reduced Form

This is a rather complicated issue, and there are long debates over the merits of each approach.

In brief, structural empirical papers might be said to use theory to derive necessary relationships between variables and appropriate functional forms, often as part of a system of questions describing a broad model. They then “take this model to the data”, and estimate certain parameters; these estimates rely on the key structural assumptions and the chosen functional form (which is often selected for convenience) holding in the real world. They may also try to check how “robust” the estimates are to alternate assumptions and forms. Structural estimates can then be used to make precise predictions and welfare calculations.

Reduced form work may begin with some theoretical modeling but it will not usually try to estimate the model directly. Reduced form work often involves estimating single equations which may be “partial equilibrium”, and they may often use linear regression and interpret it as a “best linear approximation” to the true unknown functional form. Reduced form researchers often claim that results are “more robust” than structural work, while proponents of structural work may claim that reduced form econometrics is not theoretically grounded and thus meaningless.

Most of you are likely to focus on reduced form empirical work.

Quantitative vs. qualitative (the latter is rare in economics)

Quantitative research deals with data that can be quantified, i.e., expressed in terms of numbers and strict categories, often with hierarchical relationships.

Qualitative research is rarely done in modern economics. It relies on “softer” forms of data like interviews that cannot be reduced to a number or parameter, and cannot be dealt with using statistical techniques.

3.6 Methodological research

Methodological research is aimed at producing and evaluating techniques and approaches that can be used by other researchers. Most methodological research in economics is done by econometricians, who develop and evaluate techniques for estimating relationships using data.

3.7 Fields of economics, and some classic questions asked in each field

Economics is about choices under conditions of scarcity, the interaction of individuals governments and firms, and the consequences of these. [citation needed]

Microeconomics

Preferences and choices under constraints ; e.g., “how do risk-averse individuals choose among a set of uncertain gambles?” … “How does consumption of leisure change in response to an increase in the VAT?”

Game theory, interactions ; … “How do individuals coordinate in ‘stag hunt’ games, and are these equilibria robust to small errors?”

Mechanism design and contract theory ; … “How can a performance scheme be designed to induce the optimal level of effort with asymmetric information about ability?”

Equilibrium ; … “Is the general equilibrium of an economy with indivisible goods Pareto optimal?”

Macroeconomics

Stabilisation ; … “how do changes in the level of government spending affect the changes in the rate of unemployment?”

Growth ; …“Why did GDP per capita increase in Western Europe between 1950 and 1980?”

Aggregates, stocks, and flows ; … “Does a trade deficit lead to the government budget deficit, or vice/versa, (or both, or neither)?”

Money and Banking … “Does deposit insurance decrease the likelihood of a bank run?”

Financial Economics (not as broad as the first two)

“Can an investor use publicly-available information be used to systematically earn supernormal profits?” (the Efficient Markets Hypothesis)

Econometrics (methods/technique)

“What is the lowest mean squared error unbiased estimator of a gravity equation?”

Experimental economics (a technique)

Do laboratory subjects (usually students) coordinate on the efficient equilibrium in `stag hunt’ games? Do stronger incentives increase their likelihood this type of play?

Behavioural economics (an alternate approach to micro)

“Can individual choices over time be rationalised by standard exponential discounting, or do they follow another model, such as time inconsistent preferences and hyperbolic discounting?”

Applied fields

Development.

“Has the legacy of British institutions increased or decrease the level of GDP in former colonies?”

“Do greater unemployment benefits increase the length of an unemployment spell, and if so, to what extent?”

“Does public support for education increase or decrease income inequality?”

“Why did the industrial revolution first occur in Britain rather than in another country?”

“Are protectionist infant industry policies’ usually successful in fostering growth?”

International

“Do floating (rather than fixed) exchange rates lead to macroeconomic instability?”

Environmental

“What is the appropriate discount rate to use for considering costly measures to reduce carbon emissions?”

Industrial Organization

“Do firms innovate more or less when they have greater market power in an industry?”

“Do ‘single payer’ health care plans like the NHS provide basic health care services more or less efficiently then policies of mandated insurance and regulated exchanges like in the Netherlands?”

A more extensive definition and discussion of fields is in Appendix A of “Writing Economics”

Do you know?…

Which type of analysis typically uses the most ‘difficult, formal’ maths? 7

- Microeconomic theory

- Applied econometric analysis

- Descriptive macroeconomics

Another use of data: ‘calibrating’ models aka ‘calibration exercises’; I will not discuss this at the moment. ↩

Sometimes this can be confusing, particularly when the data seems to represent the entire ‘population’ of interest, such as an industry’s price and sales data in a relevant period. Without getting into an extensive discussion of the meaning of probability and statistics, I will suggest that we can see this as a ‘sample of the prices and sales that could have ocurred in any possible universe, or over a period of many years’. Ouch, this gets thorny, and there are strong debates in the Statistics world about this stuff. ↩

Answer: 1. Microeconomic theory ↩

Empirical Research and the Development of Economic Science

MARC RIS BibTeΧ

Download Citation Data

More from NBER

In addition to working papers , the NBER disseminates affiliates’ latest findings through a range of free periodicals — the NBER Reporter , the NBER Digest , the Bulletin on Retirement and Disability , the Bulletin on Health , and the Bulletin on Entrepreneurship — as well as online conference reports , video lectures , and interviews .

- Feldstein Lecture

- Presenter: Cecilia E. Rouse

- Methods Lectures

- Presenter: Susan Athey

- Panel Discussion

- Presenters: Karen Dynan , Karen Glenn, Stephen Goss, Fatih Guvenen & James Pearce

- Architecture and Design

- Asian and Pacific Studies

- Business and Economics

- Classical and Ancient Near Eastern Studies

- Computer Sciences

- Cultural Studies

- Engineering

- General Interest

- Geosciences

- Industrial Chemistry

- Islamic and Middle Eastern Studies

- Jewish Studies

- Library and Information Science, Book Studies

- Life Sciences

- Linguistics and Semiotics

- Literary Studies

- Materials Sciences

- Mathematics

- Social Sciences

- Sports and Recreation

- Theology and Religion

- Publish your article

- The role of authors

- Promoting your article

- Abstracting & indexing

- Publishing Ethics

- Why publish with De Gruyter

- How to publish with De Gruyter