- Bankruptcy Basics

- Chapter 11 Bankruptcy

- Chapter 13 Bankruptcy

- Chapter 7 Bankruptcy

- Debt Collectors and Consumer Rights

- Divorce and Bankruptcy

- Going to Court

- Property & Exemptions

- Student Loans

- Taxes and Bankruptcy

- Wage Garnishment

Understanding the Assignment of Mortgages: What You Need To Know

3 minute read • Upsolve is a nonprofit that helps you get out of debt with education and free debt relief tools, like our bankruptcy filing tool. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Explore our free tool

A mortgage is a legally binding agreement between a home buyer and a lender that dictates a borrower's ability to pay off a loan. Every mortgage has an interest rate, a term length, and specific fees attached to it.

Written by Attorney Todd Carney . Updated November 26, 2021

If you’re like most people who want to purchase a home, you’ll start by going to a bank or other lender to get a mortgage loan. Though you can choose your lender, after the mortgage loan is processed, your mortgage may be transferred to a different mortgage servicer . A transfer is also called an assignment of the mortgage.

No matter what it’s called, this change of hands may also change who you’re supposed to make your house payments to and how the foreclosure process works if you default on your loan. That’s why if you’re a homeowner, it’s important to know how this process works. This article will provide an in-depth look at what an assignment of a mortgage entails and what impact it can have on homeownership.

Assignment of Mortgage – The Basics

When your original lender transfers your mortgage account and their interests in it to a new lender, that’s called an assignment of mortgage. To do this, your lender must use an assignment of mortgage document. This document ensures the loan is legally transferred to the new owner. It’s common for mortgage lenders to sell the mortgages to other lenders. Most lenders assign the mortgages they originate to other lenders or mortgage buyers.

Home Loan Documents

When you get a loan for a home or real estate, there will usually be two mortgage documents. The first is a mortgage or, less commonly, a deed of trust . The other is a promissory note. The mortgage or deed of trust will state that the mortgaged property provides the security interest for the loan. This basically means that your home is serving as collateral for the loan. It also gives the loan servicer the right to foreclose if you don’t make your monthly payments. The promissory note provides proof of the debt and your promise to pay it.

When a lender assigns your mortgage, your interests as the mortgagor are given to another mortgagee or servicer. Mortgages and deeds of trust are usually recorded in the county recorder’s office. This office also keeps a record of any transfers. When a mortgage is transferred so is the promissory note. The note will be endorsed or signed over to the loan’s new owner. In some situations, a note will be endorsed in blank, which turns it into a bearer instrument. This means whoever holds the note is the presumed owner.

Using MERS To Track Transfers

Banks have collectively established the Mortgage Electronic Registration System , Inc. (MERS), which keeps track of who owns which loans. With MERS, lenders are no longer required to do a separate assignment every time a loan is transferred. That’s because MERS keeps track of the transfers. It’s crucial for MERS to maintain a record of assignments and endorsements because these land records can tell who actually owns the debt and has a legal right to start the foreclosure process.

Upsolve Member Experiences

Assignment of Mortgage Requirements and Effects

The assignment of mortgage needs to include the following:

The original information regarding the mortgage. Alternatively, it can include the county recorder office’s identification numbers.

The borrower’s name.

The mortgage loan’s original amount.

The date of the mortgage and when it was recorded.

Usually, there will also need to be a legal description of the real property the mortgage secures, but this is determined by state law and differs by state.

Notice Requirements

The original lender doesn’t need to provide notice to or get permission from the homeowner prior to assigning the mortgage. But the new lender (sometimes called the assignee) has to send the homeowner some form of notice of the loan assignment. The document will typically provide a disclaimer about who the new lender is, the lender’s contact information, and information about how to make your mortgage payment. You should make sure you have this information so you can avoid foreclosure.

Mortgage Terms

When an assignment occurs your loan is transferred, but the initial terms of your mortgage will stay the same. This means you’ll have the same interest rate, overall loan amount, monthly payment, and payment due date. If there are changes or adjustments to the escrow account, the new lender must do them under the terms of the original escrow agreement. The new lender can make some changes if you request them and the lender approves. For example, you may request your new lender to provide more payment methods.

Taxes and Insurance

If you have an escrow account and your mortgage is transferred, you may be worried about making sure your property taxes and homeowners insurance get paid. Though you can always verify the information, the original loan servicer is responsible for giving your local tax authority the new loan servicer’s address for tax billing purposes. The original lender is required to do this after the assignment is recorded. The servicer will also reach out to your property insurance company for this reason.

If you’ve received notice that your mortgage loan has been assigned, it’s a good idea to reach out to your loan servicer and verify this information. Verifying that all your mortgage information is correct, that you know who to contact if you have questions about your mortgage, and that you know how to make payments to the new servicer will help you avoid being scammed or making payments incorrectly.

Let's Summarize…

In a mortgage assignment, your original lender or servicer transfers your mortgage account to another loan servicer. When this occurs, the original mortgagee or lender’s interests go to the next lender. Even if your mortgage gets transferred or assigned, your mortgage’s terms should remain the same. Your interest rate, loan amount, monthly payment, and payment schedule shouldn’t change.

Your original lender isn’t required to notify you or get your permission prior to assigning your mortgage. But you should receive correspondence from the new lender after the assignment. It’s important to verify any change in assignment with your original loan servicer before you make your next mortgage payment, so you don’t fall victim to a scam.

Attorney Todd Carney

Attorney Todd Carney is a writer and graduate of Harvard Law School. While in law school, Todd worked in a clinic that helped pro-bono clients file for bankruptcy. Todd also studied several aspects of how the law impacts consumers. Todd has written over 40 articles for sites such... read more about Attorney Todd Carney

Continue reading and learning!

It's easy to get debt help

Choose one of the options below to get assistance with your debt:

Considering Bankruptcy?

Our free tool has helped 14,467+ families file bankruptcy on their own. We're funded by Harvard University and will never ask you for a credit card or payment.

Private Attorney

Get a free evaluation from an independent law firm.

Learning Center

Research and understand your options with our articles and guides.

Already an Upsolve user?

Bankruptcy Basics ➜

- What Is Bankruptcy?

- Every Type of Bankruptcy Explained

- How To File Bankruptcy for Free: A 10-Step Guide

- Can I File for Bankruptcy Online?

Chapter 7 Bankruptcy ➜

- What Are the Pros and Cons of Filing Chapter 7 Bankruptcy?

- What Is Chapter 7 Bankruptcy & When Should I File?

- Chapter 7 Means Test Calculator

Wage Garnishment ➜

- How To Stop Wage Garnishment Immediately

Property & Exemptions ➜

- What Are Bankruptcy Exemptions?

- Chapter 7 Bankruptcy: What Can You Keep?

- Yes! You Can Get a Mortgage After Bankruptcy

- How Long After Filing Bankruptcy Can I Buy a House?

- Can I Keep My Car If I File Chapter 7 Bankruptcy?

- Can I Buy a Car After Bankruptcy?

- Should I File for Bankruptcy for Credit Card Debt?

- How Much Debt Do I Need To File for Chapter 7 Bankruptcy?

- Can I Get Rid of my Medical Bills in Bankruptcy?

Student Loans ➜

- Can You File Bankruptcy on Student Loans?

- Can I Discharge Private Student Loans in Bankruptcy?

- Navigating Financial Aid During and After Bankruptcy: A Step-by-Step Guide

- Filing Bankruptcy to Deal With Your Student Loan Debt? Here Are 3 Things You Should Know!

Debt Collectors and Consumer Rights ➜

- 3 Steps To Take if a Debt Collector Sues You

- How To Deal With Debt Collectors (When You Can’t Pay)

Taxes and Bankruptcy ➜

- What Happens to My IRS Tax Debt if I File Bankruptcy?

- What Happens to Your Tax Refund in Bankruptcy

Chapter 13 Bankruptcy ➜

- Chapter 7 vs. Chapter 13 Bankruptcy: What’s the Difference?

- Why is Chapter 13 Probably A Bad Idea?

- How To File Chapter 13 Bankruptcy: A Step-by-Step Guide

- What Happens When a Chapter 13 Case Is Dismissed?

Going to Court ➜

- Do You Have to Go To Court to File Bankruptcy?

- Telephonic Hearings in Bankruptcy Court

Divorce and Bankruptcy ➜

- How to File Bankruptcy After a Divorce

- Chapter 13 and Divorce

Chapter 11 Bankruptcy ➜

- Chapter 7 vs. Chapter 11 Bankruptcy

- Reorganizing Your Debt? Chapter 11 or Chapter 13 Bankruptcy Can Help!

State Guides ➜

- Connecticut

- District Of Columbia

- Massachusetts

- Mississippi

- New Hampshire

- North Carolina

- North Dakota

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- West Virginia

Upsolve is a 501(c)(3) nonprofit that started in 2016. Our mission is to help low-income families resolve their debt and fix their credit using free software tools. Our team includes debt experts and engineers who care deeply about making the financial system accessible to everyone. We have world-class funders that include the U.S. government, former Google CEO Eric Schmidt, and leading foundations.

To learn more, read why we started Upsolve in 2016, our reviews from past users, and our press coverage from places like the New York Times and Wall Street Journal.

Home > Amerinote Xchange Blog > Market Trends > Understanding Mortgage Assignment: How It Works and What You Need to Know

Understanding Mortgage Assignment: How It Works and What You Need to Know

Jennifer Park Published: July 15, 2024 | Updated: July 10, 2024

When a homebuyer gets a mortgage, they agree to pay back the money they borrowed from a lender, usually a bank. These payments are usually made over a period of many years with interest, which is how the lender makes money. If the borrower doesn’t make payments, the mortgage gives the lender the ability to foreclose on the property to recoup their investment.

Sometimes, though, the lender decides they don’t want to wait for those years of payments. Instead, they might choose to sell the mortgage to another company. This transfer is called a mortgage assignment, or in some states, an assignment of deed of trust. Here’s everything you should know about how mortgage assignments work.

What is an Assignment of Mortgage?

An assignment of mortgage, or assignment of deed of trust, is a process where the original lender transfers their interest in a mortgage to another party. This could be another bank, a special company that handles mortgages, or an investor interested in buying debts. The original lender sells the right to collect payments from the homebuyer to someone else. This is done with legal agreements to ensure everything is fair and follows the law.

This process is important for lenders because it allows them to get back much of the money they lent without waiting for the 20 or 30 years it might take the borrower to pay it all back. For the new owner of the mortgage, it’s a chance to invest in a steady flow of income.

Some mortgage lenders are homeowners who became mortgage note holders when they sold their house. If the prospective buyer is not able to secure a loan from a bank, these homeowners might choose to offer seller financing . In this arrangement, the seller acts as the lender, agreeing to sign over the house in return for receiving monthly payments until the value of the loan is paid off.

However, if circumstances change and the homeowner wants to receive a lump sum payment or no longer wants the responsibility of managing the loan, they might consider selling the mortgage note to an investor or a specialized company. This sale is facilitated through the mortgage assignment process, transferring all rights and responsibilities to the new owner.

The Mortgage Assignment Process

Let’s walk through what happens during a mortgage assignment:

- Decision to Sell the Mortgage: The lender decides they would like to sell the mortgage. This could be because they no longer want to bear the risk of the loan, or would like to receive a lump sum payment.

- Finding a Buyer: The lender looks for a party interested in buying your mortgage. This buyer could be another bank, a company that specializes in buying and managing mortgages, or even a group of investors. The important thing is that they have the money to buy the mortgage and are willing to take on the responsibility of collecting payments.

- Handling the Legal Paperwork: Once a buyer is found, there’s a lot of paperwork to handle. The most important piece is the “assignment of mortgage document or the “assignment of deed of trust”, a document that officially transfers the ownership of the mortgage from the old lender to the new one. This document must be signed and usually notarized, which means an official witness confirms that all parties signed willingly and correctly. There must also be a transfer of the promissory note, through a process known as mortgage endorsement .

- Notifying the Homeowner: After the mortgage is officially transferred to the new owner, the homeowner will be notified. This notification lets them know who the new owner of their mortgage is, their contact information and where to send their future mortgage payments.

Deed of Trust vs. Mortgage

In some states, instead of a mortgage note, the lender may have something called a deed of trust. This can also be transferred to a buyer in the same way. A deed of trust and a mortgage both serve the same purpose — to secure a loan on a property. There are some key differences in how they operate .

Deed of Trust

Involves Three Parties: A deed of trust involves three parties: the borrower, the lender and a trustee. The trustee holds the legal title to the property until the loan is fully paid off.

Non-Judicial Foreclosure: In most cases, a deed of trust allows for non-judicial foreclosure, meaning the trustee can sell the property without court involvement if the borrower defaults on the loan.

Involves Two Parties: A traditional mortgage involves just two parties: the borrower and the lender. The legal title remains with the borrower, and the lender has a lien on the property.

Judicial Foreclosure : Foreclosure under a mortgage typically requires going through the court, making it a longer and possibly more complicated process than with a deed of trust.

Legal and Regulatory Considerations

When a mortgage is assigned from one lender to another, several legal and regulatory considerations must be addressed to ensure the process is handled correctly. Each state has its own laws that affect how mortgages can be transferred, which is why it can be important to know your local rules before selling your mortgage note.

State Laws on Mortgage Assignment

State laws dictate how a mortgage assignment must be recorded and what documentation is required. For example, some states require that the assignment of the mortgage document be filed with the county where the property is located. This helps maintain a clear and public record of who owns the mortgage. Additionally, these laws ensure that the homeowner is protected and that the transfer of mortgage ownership is transparent.

Judicial vs. Non-Judicial Foreclosure Processes

Depending on the state, the foreclosure process can vary significantly. In judicial foreclosure states, the lender must go through the court system to foreclose on a home. This process can be lengthy and requires filing a lawsuit and getting a court judgment. In non-judicial foreclosure states, lenders can foreclose without court involvement if the mortgage agreement includes a power of sale clause. This clause allows the lender to sell the property to pay off the mortgage if the homeowner defaults.

Compliance Requirements

During a mortgage assignment, all parties must comply with federal and state regulations that protect homeowners. For instance, the Real Estate Settlement Procedures Act (RESPA) requires that borrowers be notified of any change in the ownership of their mortgage. This notification must be sent within 15 days after the mortgage has been sold or assigned. Ensuring compliance helps maintain trust and avoids legal complications.

Why Sell a Mortgage?

You might wonder why a lender would want to sell a mortgage to a mortgage note buyer instead of just waiting to collect all the payments. There are several reasons why selling the mortgage can be beneficial for the lender:

- Managing Financial Resources: By selling a mortgage, lenders can get a large amount of money upfront instead of waiting for monthly payments. This immediate influx of cash can help them invest in other areas, offer more loans, or strengthen their financial footing.

- Risk Management: Holding onto a mortgage comes with risks, especially if the homeowner has trouble making payments. By selling the mortgage, the original lender transfers this risk to the buyer of the mortgage. This can be a strategic move to manage the lender’s overall risk exposure.

- Investment Strategy: Lenders might sell mortgages as part of their investment strategy. Selling mortgages can help them diversify their investments and adjust their portfolios according to market conditions or their financial goals.

Choosing the Right Buyer For A Mortgage Note

For lenders, finding the right mortgage or deed of trust buyer is an important part of the assignment process. Here are some criteria to consider when selecting a mortgage note buyer :

- Reputation and Reliability: The reputation of the buyer is vital. Lenders should look for buyers who have a solid track record of fair dealings and reliability. A good indicator are reviews from actual buyers and a brand presence. This ensures that the mortgage will be managed properly after the assignment.

- Transparency: Transparency during the mortgage assignment process is essential for trust. Buyers who provide clear information about the terms of the purchase and who maintain open communication are preferable.

- Competitive Pricing: Finally, the price offered for the mortgage note is a critical factor. Lenders should seek buyers who offer competitive pricing, which reflects the value of the mortgage and the income it generates.

Jennifer Park

Jennifer is an expert writer who focuses primarily on writing finance, investing, and real estate topics. She has been working as a writer since 2013. See full bio.

Molly Corson

Molly Corson is the Co-Founder and Marketing Director at Amerinote Xchange. Molly's diversified background and experience lies in the areas marketing ad-tech, team-building, operations-management, sales and strategic relations management. Molly has a BA degree from Temple University. See full bio.

Financially Reviewed By

Abby Shemesh

Abby is the co-founder and Chief Acquisitions Officer at Amerinote Xchange. He has been operating within the mortgage market for over a decade. Abby was featured on industry publications like Yahoo! Finance, MSN Money, Realtor.com, and GOBankingRates.com. See full bio.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Copyright © 2024 Amerinote Xchange. All Rights Reserved.

Choose Your Legal Category:

- Online Law Library

- Bankruptcy Law

- Business Law

- Civil Law

- Criminal Law

- Employment Law

- Family Law

- Finance Law

- Government Law

- Immigration Law

- Insurance Law

- Intellectual Property Law

- Personal Injury Law

- Products & Services Law

- Real Estate Law

- Wills, Trusts & Estates Law

- Attorney Referral Services

- Top 10 Most Popular Articles

- Legal Dictionary

- How It Works - Clients

- Legal Center

- About LegalMatch

- Consumer Satisfaction

- Editorial Policy

- Attorneys Market Your Law Practice Attorney Login Schedule a Demo Now Did LegalMatch Call You Recently? How It Works - Attorneys Attorney Resources Attorney Success Stories Attorney Success Story Videos Compare Legal Marketing Services Cases Heatmap View Cases

- Find a Lawyer

- Legal Topics

- Real Estate Law

Mortgage Assignment Laws and Definition

(This may not be the same place you live)

What is a Mortgage Assignment?

A mortgage is a legal agreement. Under this agreement, a bank or other lending institution provides a loan to an individual seeking to finance a home purchase. The lender is referred to as a creditor. The person who finances the home owes money to the bank, and is referred to as the debtor.

To make money, the bank charges interest on the loan. To ensure the debtor pays the loan, the bank takes a security interest in what the loan is financing — the home itself. If the buyer fails to pay the loan, the bank can take the property through a foreclosure proceeding.

There are two main documents involved in a mortgage agreement. The document setting the financial terms and conditions of repayment is known as the mortgage note. The bank is the owner of the note. The note is secured by the mortgage. This means if the debtor does not make payment on the note, the bank may foreclose on the home.

The document describing the mortgaged property is called the mortgage agreement. In the mortgage agreement, the debtor agrees to make payments under the note, and agrees that if payment is not made, the bank may institute foreclosure proceedings and take the home as collateral .

An assignment of a mortgage refers to an assignment of the note and assignment of the mortgage agreement. Both the note and the mortgage can be assigned. To assign the note and mortgage is to transfer ownership of the note and mortgage. Once the note is assigned, the person to whom it is assigned, the assignee, can collect payment under the note.

Assignment of the mortgage agreement occurs when the mortgagee (the bank or lender) transfers its rights under the agreement to another party. That party is referred to as the assignee, and receives the right to enforce the agreement’s terms against the assignor, or debtor (also called the “mortgagor”).

What are the Requirements for Executing a Mortgage Assignment?

What are some of the benefits and drawbacks of mortgage assignments, are there any defenses to mortgage assignments, do i need to hire an attorney for help with a mortgage assignment.

For a mortgage to be validly assigned, the assignment document (the document formally assigning ownership from one person to another) must contain:

- The current assignor name.

- The name of the assignee.

- The current borrower or borrowers’ names.

- A description of the mortgage, including date of execution of the mortgage agreement, the amount of the loan that remains, and a reference to where the mortgage was initially recorded. A mortgage is recorded in the office of a county clerk, in an index, typically bearing a volume or page number. The reference to where the mortgage was recorded should include the date of recording, volume, page number, and county of recording.

- A description of the property. The description must be a legal description that unambiguously and completely describes the boundaries of the property.

There are several types of assignments of mortgage. These include a corrective assignment of mortgage, a corporate assignment of mortgage, and a mers assignment of mortgage. A corrective assignment corrects or amends a defect or mistake in the original assignment. A corporate assignment is an assignment of the mortgage from one corporation to another.

A mers assignment involves the Mortgage Electronic Registration System (MERS). Mortgages often designate MERS as a nominee (agent for) the lender. When the lender assigns a mortgage to MERS, MERS does not actually receive ownership of the note or mortgage agreement. Instead, MERS tracks the mortgage as the mortgage is assigned from bank to bank.

An advantage of a mortgage assignment is that the assignment permits buyers interested in purchasing a home, to do so without having to obtain a loan from a financial institution. The buyer, through an assignment from the current homeowner, assumes the rights and responsibilities under the mortgage.

A disadvantage of a mortgage assignment is the consequences of failing to record it. Under most state laws, an entity seeking to institute foreclosure proceedings must record the assignment before it can do so. If a mortgage is not recorded, the judge will dismiss the foreclosure proceeding.

Failure to observe mortgage assignment procedure can be used as a defense by a homeowner in a foreclosure proceeding. Before a bank can institute a foreclosure proceeding, the bank must record the assignment of the note. The bank must also be in actual possession of the note.

If the bank fails to “produce the note,” that is, cannot demonstrate that the note was assigned to it, the bank cannot demonstrate it owns the note. Therefore, it lacks legal standing to commence a foreclosure proceeding.

If you need help with preparing an assignment of mortgage, you should contact a mortgage lawyer . An experienced mortgage lawyer near you can assist you with preparing and recording the document.

Save Time and Money - Speak With a Lawyer Right Away

- Buy one 30-minute consultation call or subscribe for unlimited calls

- Subscription includes access to unlimited consultation calls at a reduced price

- Receive quick expert feedback or review your DIY legal documents

- Have peace of mind without a long wait or industry standard retainer

- Get the right guidance - Schedule a call with a lawyer today!

Need a Mortgage Lawyer in your Area?

- Connecticut

- Massachusetts

- Mississippi

- New Hampshire

- North Carolina

- North Dakota

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- West Virginia

Daniel Lebovic

LegalMatch Legal Writer

Original Author

Prior to joining LegalMatch, Daniel worked as a legal editor for a large HR Compliance firm, focusing on employer compliance in numerous areas of the law including workplace safety law, health care law, wage and hour law, and cybersecurity. Prior to that, Daniel served as a litigator for several small law firms, handling a diverse caseload that included cases in Real Estate Law (property ownership rights, residential landlord/tenant disputes, foreclosures), Employment Law (minimum wage and overtime claims, discrimination, workers’ compensation, labor-management relations), Construction Law, and Commercial Law (consumer protection law and contracts). Daniel holds a J.D. from the Emory University School of Law and a B.S. in Biological Sciences from Cornell University. He is admitted to practice law in the State of New York and before the State Bar of Georgia. Daniel is also admitted to practice before the United States Courts of Appeals for both the 2nd and 11th Circuits. You can learn more about Daniel by checking out his Linkedin profile and his personal page. Read More

Jose Rivera, J.D.

Managing Editor

Preparing for Your Case

- What to Do to Have a Strong Mortgage Law Case

- Top 5 Types of Documents/Evidence to Gather for Your Mortgages Case

Related Articles

- Assumable Mortgages

- Loan Modification Laws

- Behind on Mortgage Payments Lawyers

- Home Improvement Loan Disputes

- Reverse Mortgages for Senior Citizens

- Mortgage Settlement Scams

- Short Sale Fraud Schemes

- Deed of Trust or a Mortgage, What's the Difference?

- Owner Carryback Mortgages

- Contract for Deed Lawyers Near Me

- Mortgage Subrogation

- Property Lien Waivers and Releases

- Different Types of Promissory Notes

- Repayment Schedules for Promissory Notes

- Ft. Lauderdale Condos and Special Approval Loans

- Special Approval Loans for Miami Condos

- Removing a Lien on Property

- Mortgage Loan Fraud

- Subprime Mortgage Lawsuits

- Property Flipping and Mortgage Loan Fraud

- Avoid Being a Victim of Mortgage Fraud

- Second Mortgage Lawyers

- Settlement Statement Lawyers

- Loan Approval / Commitment Lawyers

- Broker Agreement Lawyers

- Truth in Lending Disclosure Statement (TILA)

- Housing and Urban Development (HUD) Info Lawyers

- Good Faith Estimate Lawyers

- Mortgage Loan Documents

Discover the Trustworthy LegalMatch Advantage

- No fee to present your case

- Choose from lawyers in your area

- A 100% confidential service

How does LegalMatch work?

Law Library Disclaimer

16 people have successfully posted their cases

💻 CE/CLE: Understanding Municipal Liens and Unrecorded Debt on Real Property - Thur. 8/22 @ 1 p.m. ET

- 941-444-7142

Promissory Notes, Mortgage Assignments, and MERS’ Role in Real Estate

After the fall out of the subprime mortgage crisis that triggered the Great Recession, the effects still linger when looking at homeownership statistics in the United States. Nearly 10 million homeowners lost their homes to foreclosure between 2006 and 2014. Damaged credit and traumatized psyches paired with stricter lending standards and soaring median home prices mean that some former homeowners will never own another home.

Today, the United States is seeing the highest rates of unemployment since the Great Depression at nearly 15% due to the COVID-19 pandemic, and of those who still own a home, nearly 4.1 million borrowers are struggling to make their monthly payments. Many are turning to forbearance for momentary relief from their mortgages.

For many homeowners, the question of what happens to their mortgage after closing day might not ever come up. Until the threat of foreclosure or the need for forbearance arises, most borrowers simply send in their monthly payments with no questions asked.

Now is a good time to consider the process after closing, and how it affects their property rights. Here are some of the questions to ask.

What happens after a real estate closing?

- At closing, the borrower signs the mortgage, the deed, and the promissory note

- The mortgage and the deed are recorded in the public record

- The promissory note is held by the lender while the loan is outstanding

- Payments are sent to the mortgage servicing company

- The mortgage may be securitized and sold to investors

- The mortgage may be transferred to another bank

- The mortgage servicing rights may change to another company

- When the mortgage is paid in full, a mortgage lien release or satisfaction with a number referencing the original mortgage loan is recorded in the public record to show the debt is no longer outstanding

- The promissory note is marked as paid in full and returned to the borrower

Banks often sell and buy mortgages from each other as a way to liquidate assets and improve their credit ratings. When the original lender sells the debt to another bank or an investor, a mortgage assignment is created and recorded in the public record and the promissory note is endorsed.

What are Loan Transfer Documents?

Assignments and endorsements prove who owns the debt and subsequently who has the authority to bring foreclosure action.

Mortgage Assignments

A Mortgage Assignment is a document showing a mortgage loan has been transferred from the originator to a third party.

Note Endorsements

In addition to the assignment, the originator of the loan or the most recent holder of the loan must endorse (or sign over) the promissory note whenever the loan changes hands. Sometimes, the note is endorsed “in blank,” which means that any party that possesses the note has the legal authority to enforce it.

While these documents are supposed to be recorded in the public land records systems, sometimes there’s a “break” in the chain. A missing mortgage satisfaction or assignment can cause a huge headache for homeowners when they go to sell. Without knowing who the official mortgage lienholder of the property is, the home can’t be sold. The title agent in charge of the closing is tasked with fixing the issue so that clear ownership rights can be established and the final mortgage payoff can be sent to the right lender if needed.

What is Mortgage Securitization?

In the last 30 years or so, the buying and selling of mortgage loans between lenders, banks, and investors has grown more complicated. When a mortgage is turned into a security, it’s pooled with similar types of loans and sold on the secondary mortgage market. The purchasers or investors in these securities receive interest in principal payments.

Securitization is good for lenders because it allows them to sell mortgage loans from their books and use that money to make more loans.

Where securitization goes wrong, as we saw during the housing crisis, is when bad or “toxic” assets are pooled together and sold on the secondary market to unsuspecting investors. Subprime mortgage-backed securities had received high ratings from credit agencies and offered a higher interest rate, but they also were the first to hemorrhage losses when borrowers began defaulting on homes with underwater mortgages.

Securitization isn’t an inherently good or bad process, it’s simply a mechanism by which banks liquidize assets, increase their credit and ratings, and clear their balance sheets.

For homeowners, securitization means that the mortgage isn’t owned by a single lender and is instead part of a pool of mortgages owned by investors. A mortgage service company is responsible for collecting the mortgage payments and sending it to the proper investors. Securitization also means that tracking the note and who has the authority to enforce it can get messy.

What is the Mortgage Electronic Registration System, Inc. or MERS?

The MERS system is a private, third-party database system used to track servicing rights and ownership of mortgages in the United States. This system of registering the promissory note and mortgage was created to make transferring these documents easier on the secondary mortgage market.

How does MERS work?

For some real estate transactions, the mortgage originator will designate MERS as the mortgagee at closing. These loans are called MERS as Original Mortgagee (MOM) loans. When buying a home, a borrower should see clear language on the mortgage or deed of trust document granting and conveying legal title of the mortgage to MERS as mortgagee. This gives the company the right to act on behalf of the current and subsequent owners of the loan.

In other transactions, the loan may be assigned to MERS in the public record at a later date after closing.

After MERS is designated as a nominee to act on behalf of the lender, it tracks the transfers of the loans between parties and acts as a nominee for each holder. This eliminates the need to file separate assignments in the public record each time the loan is transferred. If a lender sells the loan, MERS will update this information in their system.

Even though MERS is designated as the mortgagee, it doesn’t own the debt or hold the promissory note. MERS doesn’t service mortgages or collect payments on mortgages.

Benefits of MERS

Some of the benefits of the MERS system include:

- No document drafting fees

- Eliminates the need for multiple assignments each time the loan changes hands

- Reduces recording costs

- Saves time and administrative costs for lenders and servicers

- Provides the identification of servicers and investors for free for homeowners and lenders

- Used by Lenders to find undisclosed liens

- Used by municipalities to find companies responsible for maintaining vacant and abandoned properties

- Mortgage Identification Numbers (MIN) are assigned to each loan for easy tracking

- Selling of loans and servicing transfers are more efficient in the secondary market

- Obtaining lien releases when a lender goes out of business is simplified

- Cost savings by the mortgage industry is theoretically passed on to homeowners

Does MERS really save consumers money?

The MERS system is not meant to act as a replacement for public land records. However, some states, including Kentucky, New York, Texas, Alabama, and Delaware have sued the company that controls MERS for lost revenue from missing record filing fees. In the case of Kentucky , the state alleged that MERS did not record mortgage assignments with Kentucky County Clerks as they were transferred between banks. At $12 a recording, all those transfers without corresponding mortgage assignments add up to big bucks.

Despite numerous lawsuits challenging MERS over its mortgage assignment authority, the company that controls MERS usually receives favorable judgments . In 2016, courts in Texas ruled that MERS’ mortgage assignments were valid and dismissed two cases. County recorders in Pennsylvania also brought cases claiming that MERS and MERS System members failed to record mortgage assignments when transferring promissory notes, a violation of Pennsylvania recording laws. MERS emerged as the winner of these lawsuits as well.

Kentucky and other states argue that skipping out on these fees hurt the consumers and taxpayers in their states.

What is MERS role in foreclosures?

Depending on the state, a foreclosure process might be either judicial (reviewed by a judge in court) or nonjudicial. In the past, MERS, acting on behalf of lenders, has been named as the plaintiff in foreclosure proceedings. Sometimes MERS was even listed as the beneficiary in nonjudicial notices.

Whether or not MERS has the authority to file foreclosure as either the plaintiff or beneficiary is hotly contested. Some states have ruled that MERS doesn’t have standing to foreclose since it doesn’t have any financial interest in either the property of the promissory note.

MERS Splits the note and the mortgage

A court case from 1872, Carpenter v. Longan , established that where the promissory note goes, a deed of trust or mortgage must follow and, according to the United State’s Uniform Commercial Code (UCC) , the promissory note must also have a clear chain of title.

Foreclosure proceedings during the Great Recession proved to be complicated by the MERS system. Within the MERS system, a note and mortgage may be transferred multiple times, so to avoid an endorsement each time, the note is “endorsed in blank.” In one foreclosure after the other, borrowers were able to demonstrate that the subsequent assignments of the promissory note had gone unendorsed.

Although the MERS systems has helped the mortgage industry, title agents, and even borrowers better manage and understand who has the servicing rights and holds the authority to foreclose, several borrowers facing foreclosure have argued that the system impermissibly “splits” the note and the mortgage between the note holder and MERS as the beneficiary of the deed of trust or mortgage.

This process of bifurcation, it’s claimed, causes the relationship between the mortgage and note to become defective and subsequently unenforceable.

Homeowners facing foreclosure, especially in the aftermath of the housing bubble burst of 2008, were successful in delaying or avoiding foreclosure by arguing that the authority to foreclose was not satisfactorily established due to breaks in the chain of assignments and endorsements.

However, Article 3 of the UCC establishes anyone who possesses the note has the legal authority to enforce it. So foreclosing parties have countered that possession of the note should be enough.

As a result, some states, like Michigan, have ruled in favor of these borrower’s arguments by requiring reunification through valid assignment before foreclosures may proceed. Others have ruled that reunification is not necessary since MERS would be authorized to foreclose for the note holder on their behalf. In 2015, The Nevada Supreme Court actually clarified previous rulings by stating that the involvement of MERS actually cures the defect. This is because the note holder could potentially or theoretically direct or compel MERS to assign the deed of trust, resulting in reunifying the instruments.

Homebuyers should always ask questions

With the advent of eClosing solutions, eNotes, eVaults, and the MERS eRegistry , the real estate, title, and mortgage industry continues to build systems that improve the homebuying experience.

Despite all the advancements, homebuying can be a confusing and overwhelming process. It’s important to ask questions of the right real estate professionals. Hiring your own attorney to represent your interests in the real estate transaction is always a good idea.

While the pros and cons of MERS is debated, homeowners today will want to keep up with recommendations from the CFPB should they fall behind on their mortgage payments and reach out to their mortgage servicer as soon as possible.

Keep Reading

Is release tracking part of your post-closing process?

What the Experts are Saying About This Year’s State of the Industry for 2024

Reflecting on 2023’s Biggest Moments

What The Experts Are Saying About This Year’s State of Title – Technology and AI

How To Avoid Quiet Title

2023 State of the Title Industry Survey Webinar Recap

Remote Online Notarization Tools: eSeals, eJournals, & Digital Certificates

What Kind of Land Survey Do I Need?

Amanda Farrell is a digital media strategist at PropLogix. She enjoys being a part of a team that gives peace of mind for consumers while making one of the biggest purchases of their lives. She lives in Sarasota with her bunny, Buster, and enjoys painting, playing guitar and mandolin, and yoga.

Deed of Assignment: Everything You Need to Know

A deed of assignment refers to a legal document that records the transfer of ownership of a real estate property from one party to another. 3 min read updated on January 01, 2024

Updated October 8,2020:

A deed of assignment refers to a legal document that records the transfer of ownership of a real estate property from one party to another. It states that a specific piece of property will belong to the assignee and no longer belong to the assignor starting from a specified date. In order to be valid, a deed of assignment must contain certain types of information and meet a number of requirements.

What Is an Assignment?

An assignment is similar to an outright transfer, but it is slightly different. It takes place when one of two parties who have entered into a contract decides to transfer all of his or her rights and obligations to a third party and completely remove himself or herself from the contract.

Also called the assignee, the third party effectively replaces the former contracting party and consequently assumes all of his or her rights and obligations. Unless it is stated in the original contract, both parties to the initial contract are typically required to express approval of an assignment before it can occur. When you sell a piece of property, you are making an assignment of it to the buyer through the paperwork you sign at closing.

What Is a Deed of Assignment?

A deed of assignment refers to a legal document that facilitates the legal transfer of ownership of real estate property. It is an important document that must be securely stored at all times, especially in the case of real estate.

In general, this document can be described as a document that is drafted and signed to promise or guarantee the transfer of ownership of a real estate property on a specified date. In other words, it serves as the evidence of the transfer of ownership of the property, with the stipulation that there is a certain timeframe in which actual ownership will begin.

The deed of assignment is the main document between the seller and buyer that proves ownership in favor of the seller. The party who is transferring his or her rights to the property is known as the “assignor,” while the party who is receiving the rights is called the “assignee.”

A deed of assignment is required in many different situations, the most common of which is the transfer of ownership of a property. For example, a developer of a new house has to sign a deed of assignment with a buyer, stating that the house will belong to him or her on a certain date. Nevertheless, the buyer may want to sell the house to someone else in the future, which will also require the signing of a deed of assignment.

This document is necessary because it serves as a temporary title deed in the event that the actual title deed for the house has not been issued. For every piece of property that will be sold before the issuance of a title deed, a deed of assignment will be required.

Requirements for a Deed of Assignment

In order to be legally enforceable, an absolute sale deed must provide a clear description of the property being transferred, such as its address or other information that distinguishes it from other properties. In addition, it must clearly identify the buyer and seller and state the date when the transfer will become legally effective, the purchase price, and other relevant information.

In today's real estate transactions, contracting parties usually use an ancillary real estate sale contract in an attempt to cram all the required information into a deed. Nonetheless, the information found in the contract must be referenced by the deed.

Information to Include in a Deed of Assignment

- Names of parties to the agreement

- Addresses of the parties and how they are binding on the parties' successors, friends, and other people who represent them in any capacity

- History of the property being transferred, from the time it was first acquired to the time it is about to be sold

- Agreed price of the property

- Size and description of the property

- Promises or covenants the parties will undertake to execute the deed

- Signatures of the parties

- Section for the Governors Consent or Commissioner of Oaths to sign and verify the agreement

If you need help understanding, drafting, or signing a deed of assignment, you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- Define a Deed

- Contract for Deed California

- Contract for Deed in Texas

- Assignment Law

- Deed Contract Agreement

- Assignment Of Contracts

- Legal Assignment

- Deed vs Agreement

- Assignment Legal Definition

- Contract for a Deed

What Is the Difference Between the Deed of Absolute Sale and the Deed of Assignment?

Deeds are generally used to prove a transfer of real estate.

Jupiterimages/Comstock/Getty Images

More Articles

- 1. Certificate of Title Vs. Deed

- 2. Assignment of Deed of Trust Vs. Deed or Grant Deed

- 3. What Is a Quitclaim Assignment?

The deed of absolute sale, which is used in most real estate purchases, transfers property without any conditions beyond satisfaction of the purchase price. A deed of assignment, by contrast, can be used any time one party wants to transfer contractual rights to another. Deeds of assignment are common between mortgage lenders.

The difference between a deed of sale and a deed of assignment is that the deed of sale is used once and has no conditions other than the purchase price of the property, while the deed of assignment can be used anytime to transfer contractual rights from one party to another.

Absolute Sale Deeds

The deed of absolute sale is used in many real estate sales. A deed is a document that states that one party is transferring his real estate property rights to another. The deed proves the transfer, but, if properly recorded with the county recorder, it serves to give other prospective purchasers notice that all of the seller's rights in the property have now passed on to another party. An "absolute sale" deed is defined by having no conditions attached to the sale except the buyer's payment of the purchase price. When the seller signs and delivers the absolute sale deed, this is generally recognized by law as the moment of sale.

Deed Requirements

To be valid, an absolute sale deed must clearly describe the property being transferred, either by address or other distinguishing information. The deed must also clearly identify the seller and purchaser, the date on which the transfer becomes legally effective and pertinent information such as the purchase price. In modern real estate transactions, the parties often get around trying to cram all of this information into the deed by having an ancillary real estate sales contract. However, the deed must reference the information contained in the contract.

Understanding Assignment

Assignment is slightly different from an outright transfer. An assignment occurs when two parties are in a contractual relationship and one party wants to give all of his contractual rights to a third party and entirely remove himself from the contract. The new party, known as the "assignee," effectively replaces the old contracting party, taking on not only his rights under the contract but his obligations as well. Typically, unless the original contract states otherwise, both parties to the original contract must approve an assignment before it can take place.

Deed of Assignment

The deed of assignment is the document used to transfer the contracting party's rights. The parties may also choose to accomplish assignment via an assignment contract. In real estate, the deed of assignment often shows up in mortgage transactions. Mortgage lenders hold certain rights to property, notably the right to foreclose if the borrower fails to make payments. Lenders frequently wish to sell or purchase rights in a mortgaged property. The deed of assignment transfers or "assigns" the seller's rights in the property to another lender.

- U.S. Legal: Absolute Sale Law and Legal Definition

- U.S. Legal: Assignments

- NOLO: What's the Difference Between a Mortgage Assignment and an Endorsement (Transfer) of the Note?

- The Free Dictionary: Absolute Deed

- Reference: What Is a Deed of Assignment?

Erika Johansen is a lifelong writer with a Master of Fine Arts from the Iowa Writers' Workshop and editorial experience in scholastic publication. She has written articles for various websites.

Related Articles

Certificate of title vs. deed, assignment of deed of trust vs. deed or grant deed, what is a quitclaim assignment, warranty deed vs. deed of trust, what are instruments of conveyance & transfer, what is the redemption period in tennessee, is it necessary to have an attorney at closing in florida, what is an assignment of trust deed, what is an authorization to release from a short sale, the seller's rights in a land contract mortgage, foreclosure right of redemption & tenant's rights in maryland, what does the 45 days mean on the short sale addendum.

Zacks Research is Reported On:

Zacks Investment Research

is an A+ Rated BBB

Accredited Business.

Copyright © 2024 Zacks Investment Research

At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1986 it has nearly tripled the S&P 500 with an average gain of +26% per year. These returns cover a period from 1986-2011 and were examined and attested by Baker Tilly, an independent accounting firm.

Visit performance for information about the performance numbers displayed above.

NYSE and AMEX data is at least 20 minutes delayed. NASDAQ data is at least 15 minutes delayed.

| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

Deed Of Trust: What It Is And How It Works

Updated: Mar 2, 2023, 3:15am

Buying property usually comes with an avalanche of paperwork. It can be a confusing process, especially when it comes to knowing the difference between the various documents you sign. If there’s one contract that’s important to understand, however, it’s the deed of trust.

Depending on your lender and the state you live in, you may or may not need a deed of trust when financing a home purchase. Here’s what you should know about this contract and how it differs from a mortgage .

What Is a Deed Of Trust?

When you finance the purchase of a property, you will sign either a mortgage or deed of trust—but not both. You can take out a mortgage in all 50 U.S. states, while a deed of trust is only available in some states.

A deed of trust is a legal document that secures a real estate transaction. It works similarly to a mortgage, though it’s not quite the same thing. Essentially, it states that a designated third party holds legal title to your property until you’ve paid it off according to the terms of your loan. Deeds of trust are recorded in public records just like a mortgage.

How Does a Deed of Trust Work?

A deed of trust exists so that the lender has some recourse if you don’t pay your loan as agreed. There are three parties involved in a deed of trust: the trustor, the beneficiary and the trustee.

The three parties involved in a deed of trust for a real estate transaction are a:

- Trustor. This is the person whose assets are being held in the trust, also known as the borrower (i.e., you). The title to your home is held by the trust until the loan is paid off. Even so, you remain the equitable owner as long as you keep paying the loan according to the terms outlined in the deed of trust. That means you enjoy all the benefits of being the homeowner, such as the right to live there and gain equity, even though you aren’t the legal title holder.

- Beneficiary. The beneficiary is the party whose investment interest is being protected. Usually, that’s the lender, though it also can be an individual with whom you have a contract.

- Trustee. The trustee holds the legal title of the property while you’re making payments on the loan. Trustees often are title companies, but not always. Once you’ve paid off your loan, the trustee is responsible for dissolving the trust and transferring the title to you.

If you sell the property before it’s paid off, the trustee will use proceeds of the sale to pay the lender the remaining balance (you keep the profits). If you fail to meet your payment obligations and default on the mortgage, the property would go into foreclosure , and the trustee would be responsible for selling the property.

What Is Included in a Deed of Trust

A deed of trust includes many important details about your property, loan and related terms and conditions—much of the same information you would find in your mortgage. Typically, you’ll find the following outlined in a deed of trust:

- The names of the parties involved (the trustee, trustor and beneficiary)

- The original loan amount and repayment terms

- A legal description of the property

- The inception and maturity dates of the loan

- Various clauses, such as acceleration and alienation clauses

- Any riders regarding the clauses outlined

It’s common for a deed of trust to include acceleration and alienation clauses. If you’re delinquent on your loan, it can trigger the acceleration clause—essentially a demand for immediate repayment of the loan. Depending on the terms, this can happen after missing just one payment, though lenders often give a few months of leeway to allow the borrower to catch up on payments. If you fail to do so under the terms outlined in the acceleration clause, the next step is formal foreclosure proceedings.

An alienation clause is also known as a due-on-sale clause and it prevents anyone who buys the property to take on the loan under its current terms. Instead, the alienation clause would dictate that the loan must be paid in full if you sell the property.

Depending on your state, the deed of trust may also include a power of sales clause. This allows for a much faster foreclosure process than if your lender had to involve the state courts in a judicial foreclosure. That said, you won’t be foreclosed on overnight under a power of sales clause; the exact process differs by state and lender. Still, if you’re facing a nonjudicial foreclosure, it can happen in a matter of months. If you want to formally fight the foreclosure, you’ll need to hire a lawyer.

States that allow power of sale foreclosures include: Alabama, Alaska, Arizona, Arkansas, California, Colorado, District of Columbia, Georgia, Hawaii, Idaho, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, North Carolina, Oregon, Rhode Island, South Dakota, Tennessee, Texas, Utah, Washington, West Virginia and Wyoming.

Faster, easier mortgage lending

Check your rates today with Better Mortgage.

Deed of Trust Vs. Mortgage

The terms “deed of trust” and “mortgage” are often used interchangeably, but they’re really two different things. That said, there are also some similarities. To review, here are the key ways a mortgage and deed of trust are similar as well as different.

Similarities

- Public record: Both documents are recorded with the county clerk.

- Subject to state law: The exact terms of a mortgage or a deed of trust depend on the local state law.

- Contracts, not loans: Neither document serves as the actual loan agreement; a deed of trust or mortgage is a contract that places a lien on your property and dictates how your lender can repossess the property through foreclosure.

Differences

- Parties involved: A mortgage is an agreement between a borrower and lender, while a deed of trust involves a trustor, beneficiary and trustee.

- Foreclosure type: A mortgage requires a judicial foreclosure, while a deed of trust allows for a nonjudicial foreclosure.

- Foreclosure timeline: Judicial foreclosure on a mortgage can be a lengthy process, while nonjudicial foreclosure through a deed of trust is much faster.

What’s the Advantage of a Trust Deed Over a Mortgage?

If the borrower defaults, a trust deed makes it possible for the lender to sell the property without having to go to court. With a mortgage, the lender has to file a foreclosure claim in court and secure a judge’s approval to sell the property. This can mean a lot of expenses for both the borrower and the lender.

If you are investing in a real estate project, a trust deed also has a few advantages over a mortgage. This is because the investor is considered the lender in the transaction, and their name is recorded on the trust deed as such. The investor can receive interest on their “loan” and the principal is repaid in full once the property has been built.

Warranty Deed Vs. Deed of Trust

Both a warranty deed and deed of trust are used to transfer the title of a property from one person to another. However, the difference between these two contracts is who is protected. As you now know, a deed of trust protects the beneficiary (lender). A warranty deed, on the other hand, protects the property owner.

When a property title is transferred with a warranty deed, ownership goes from the seller (also known as the grantor) to the buyer (also known as the grantee). The warranty deed guarantees that the previous owners, or grantor, had full ownership of the property and right to transfer it. In other words, it promises that you won’t inherit any liens or future claims against the property. It provides peace of mind that you own the property outright once the title is in your name.

Are Trust Deeds a Good Idea?

Trust deeds could be a good idea if you are an investor searching for options to earn passive income, while also being protected via the deed. However, investing in real estate is unpredictable and returns are never guaranteed. A trust deed does not reduce the probability of default or ensure that you will recoup your initial investment.

Consult with a financial advisor or investment professional before going down this route.

Personal finance writer Casey Bond contributed to this article.

Get Forbes Advisor’s ratings of the best mortgage lenders, advice on where to find the lowest mortgage or refinance rates, and other tips for buying and selling real estate.

Frequently Asked Questions (FAQs)

What is an assignment of deed of trust.

An assignment of trust deed is necessary if a lender sells a loan secured by a trust deed. It assigns the trust deed to whoever buys the loan (such as another lender), granting them all the rights to the property. It is recorded along with the original, making it a matter of public record.

What happens with the deed of trust after you pay off your mortgage?

Once you pay off your loan, the trustee is responsible for releasing the trust and transferring the title to you. You now have full ownership of the home.

Can you sell a house with a deed of trust?

Yes, you can. However, if you are selling the house for less than the loan amount, you will need the lender’s approval. Once the property is sold, the trustee uses the proceeds to pay the lender what they are still owed. The borrower then gets any money that is left over.

How long does a deed of trust last?

A deed of trust, like a mortgage, typically has a maturity date, which is when the loan must be paid off in full. That date will vary transaction to transaction. Sometimes a deed of trust won’t have a maturity date. In this scenario, state law dictates the number of years a deed of trust lasts, anywhere from 10 to 60 years after it was recorded.

What is a purchase money deed of trust?

A purchase money deed of trust secures the funds used to buy the property. It also gives the buyer priority over any liens or encumbrances against them

Does a deed of trust show ownership?

No. A deed of trust is a legal document that secures a real estate transaction. It only shows that a designated third party holds legal title—i.e. ownership—to your property until you’ve paid it off, according to the terms of your loan.

- Best Mortgage Lenders

- Best Online Mortgage Lenders

- Best Construction Loan Lenders

- Best Reverse Mortgage Companies

- Best Mortgage Refinance Companies

- Best VA Loan Lenders

- Best Mortgage Lenders For First-Time Buyers

- Best USDA Lenders

- Current Mortgage Rates

- Current Refinance Rates

- Current ARM Rates

- VA Loan Rates

- VA Refinance Rates

- Mortgage Calculator

- Cost Of Living Calculator

- Cash-Out Refinance Calculator

- Mortgage Payoff Calculator

- Loan Prequalification Calculator

- Mortgage Refinance Calculator

- Zillow Home Loans

- Mr Cooper Mortgage

- Rocket Mortgage

- Sage Mortgage

- Veteran United Home Loans

- Movement Mortgage

- Better Mortgage

- Pay Off Mortgage Or Invest

- Things To Know Before Buying A House

- What Is Recasting A Mortgage?

- After You Pay Off Your Mortgage

- When Should You Refinance Your Mortgage?

- How To Choose A Mortgage Lender?

- Will Interest Rates Go Down In 2024?

- Cost Of Living By State

- Will Housing Market Crash In 2024?

- Best Cities To Buy A House In 2024

- Average Down Payment On a House In 2024

- Largest Mortgage Lenders In The US

Next Up In Mortgages

- Best Mortgage Lenders Of August 2024

- Best Mortgage Lenders For First-Time Homebuyers Of August 2024

- How Much House Can I Afford? Home Affordability Calculator

- Mortgage Calculator: Calculate Your Mortgage Payment

- Rocket Mortgage Review

- USAA Mortgage Review

Mortgage Rates Today: August 20, 2024—Rates Remain Fairly Steady

Mortgage Rates Today: August 19, 2024—Rates Remain Fairly Steady

Mortgage Rates Today: August 15, 2024—Rates Remain Fairly Steady

Mortgage Rates Today: August 14, 2024—Rates Remain Fairly Steady

Mortgage Rates Today: August 13, 2024—Rates Move Up

Mortgage Rates Today: August 12, 2024—Rates Remain Fairly Steady

Brai is the founder of SW4 Insights, a public policy advisory firm based in Washington D.C. He has over a decade of experience as a journalist and consultant covering finance and economic policy, with a particular focus on distilling complex topics to inform readers' decision-making.

Partnership

Sole proprietorship, limited partnership, compare businesses, employee rights, osha regulations, labor hours, personal & family, child custody & support, guardianship, incarceration, civil and misdemeanors, legal separation, real estate law, tax, licenses & permits, business licenses, wills & trusts, power of attorney, last will & testament, living trust, living will.

- Share Tweet Email Print

REAL ESTATE LAW

What is a deed of trust with assignment of rents.

By Rebecca K. McDowell, J.D.

February 24, 2020

Reviewed by Michelle Seidel, B.Sc., LL.B., MBA

Learn About Our Review Process

Our Review Process

We write helpful content to answer your questions from our expert network. We perform original research, solicit expert feedback, and review new content to ensure it meets our quality pledge: helpful content – Trusted, Vetted, Expert-Reviewed and Edited. Our content experts ensure our topics are complete and clearly demonstrate a depth of knowledge beyond the rote. We are incredibly worried about the state of general information available on the internet and strongly believe our mission is to give voice to unsung experts leading their respective fields. Our commitment is to provide clear, original, and accurate information in accessible formats. We have reviewed our content for bias and company-wide, we routinely meet with national experts to educate ourselves on better ways to deliver accessible content. For 15 years our company has published content with clear steps to accomplish the how, with high quality sourcing to answer the why, and with original formats to make the internet a helpful place. Read more about our editorial standards .

- What Is a Corporate Assignment of Deed of Trust?

A deed of trust is a written instrument granting a lien on real property. While slightly different from a mortgage, they are functionally nearly the same. Some states use deeds of trust instead of mortgages while others allow both. Either way, a deed of trust used to secure a commercial loan may also include an assignment of rents , which gives the lender the right to collect rental income from the property in the event of default.

What Is a Deed of Trust?

A deed of trust is a document that a borrower may execute in favor of a lender to give the lender a lien on a parcel of real estate. Like a mortgage, a deed of trust secures the loan by allowing the lender to foreclose on the real estate if the loan isn't paid (although in some states that use deeds of trust, a foreclosure isn't necessary).

Read More: How to Research a Deed of Trust

Deed of Trust vs. Mortgage

A deed of trust is very similar to a mortgage in that it pledges property to secure a loan. A mortgage, however, is simpler; the property owner executes a mortgage document in favor of the lender, and the lender records the mortgage and has a lien , but the property owner still holds title to the property.

A deed of trust, on the other hand, grants an actual ownership interest in the property to a trustee, who holds the property in trust for the lender until the obligation is paid.

What Is an Assignment of Rents?

An assignment of rents is extra security granted to a lender that provides a commercial loan. Commercial loans are loans that are not made for family or household use but for business purposes.

When a borrower grants a mortgage or deed of trust on real estate and the real estate has tenants who pay rent, the lender can demand an assignment of rents in addition to the mortgage or deed of trust.

The assignment of rents means that if the borrower defaults on the loan, the lender can step in and collect the rents directly from the tenants.

Deed of Trust With Assignment of Rents

A deed of trust may contain an assignment of rents clause for that same property. In addition to a clause in the deed of trust, the lender may also require the borrower to execute a separate document called an "Assignment of Rents" that is recorded with the register of deeds.

Whether the assignment is written in the deed of trust only or is also contained in a separate document, it is binding on the borrower as long as its language is clear and sufficient to create an assignment under state law.

Exercising an Assignment of Rents

When a lender decides to collect the rents on the borrower's property, the lender is said to be exercising the assignment of rents. The lender cannot exercise the assignment unless the borrower has defaulted on the loan. Once that happens, the lender can send a written demand to the tenant or tenants, requiring that the rents be paid directly to the lender.

Absolute Assignments of Rents

An assignment of rents most likely will contain language that the assignment is an absolute assignment . In most states, an absolute assignment gives the lender an immediate interest in the rents. This means that the lender actually owns the rents and is simply allowing the borrower to collect them on license until an event of default. Once a default occurs, the lender can intercept the rents without taking any court action; a letter to the tenants is all that's needed.

Every state's laws are different; the law of the state where the property is located will dictate how a lender can exercise an assignment of rents.

Read More: What Is the Difference Between a Deed and a Deed of Trust?

- Companies Incorporated: Mortgage States and Deed of Trust States

- American Bar Association: Commercial Real Estate FAQs

- Schulte Roth & Zabel: Sixth Circuit Upholds Assignment of Rents to Secured Lender

- Findlaw: California Civil Code - CIV § 2938

- Legal Beagle: What Is the Difference Between a Deed and a Deed of Trust?

- Legal Beagle: How to Research a Deed of Trust

- Legal Beagle: Documents Needed to Refinance a Mortgage

- Legal Beagle: How to File a Property Lien

Rebecca K. McDowell is a creditors' rights attorney with a special focus on bankruptcy and insolvency. She has a B.A. in English from Albion College and a J.D. from Wayne State University Law School. She has written legal articles for Nolo and the Bankruptcy Site.

Related Articles

- Who Can Act As Trustee in a Texas Deed of Trust?

- The Definition of a Leasehold Deed of Trust

- How to Waive Right of Redemption After Foreclosure

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

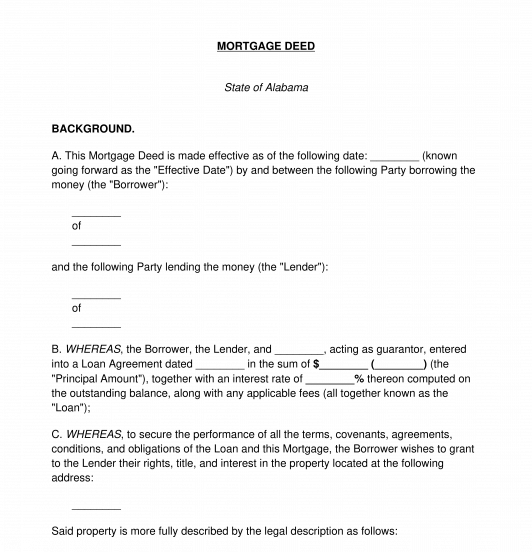

Mortgage Deed

A Mortgage Deed , also known as a Mortgage Agreement, is a document where a borrower of money grants the lender of that money conditional ownership in a property as a security interest against the loan until the loan is paid in full . If the borrower fails to repay the money as agreed, the lender then becomes the owner of the property used as security and will have the power to sell it to recoup the costs of the unpaid loan. This document is separate from a Secured Promissory Note or Loan Agreement , which creates the actual loan and more fully sets out the terms and conditions of the loan itself.

Mortgage Deeds are most commonly used to secure a loan taken out by the borrower to purchase a piece of property or home . The purchase of a property or home is often a big investment that involves a substantial amount of money. Lenders will want added security before loaning large sums of money to ensure that they will recoup their investment. A Mortgage Deed allows them to take possession and sell the property if the Borrower stops making loan payments. It also gives buyers the ability to borrow large sums of money and provides an incentive to make payments on the loan or risk losing their property. A Mortgage Deed is used specifically to put up a piece of real property, like land or a home, as security . To use personal items, such as jewelry or a car, to secure a loan, use a Security Agreement instead.

A Mortgage Deed is very similar to a Deed of Trust , but the two documents operate differently to serve similar purposes. A Mortgage Deed and a Deed of Trust both create a lien on a property to secure repayment of a loan. However, a Mortgage Deed is only between two parties – the Borrower and the Lender – whereas a Deed of Trust is between three parties – the Borrower, the Lender, and the Trustee . In a Deed of Trust, the Trustee holds the title to the property in trust for the Lender. A Deed of Trust also allows the Trustee to initiate a foreclosure sale on the property without a court order if the Borrower is in default on the loan – also called the "power of sale". In contrast, the Lender under a Mortgage Deed would have to initiate foreclosure proceedings through the courts unless the borrower agrees to grant them the power of sale in the Mortgage Deed.

How to use this document

This document contains all of the information necessary to use a piece of real property as security or collateral for a loan. The Mortgage Deed includes all of the important information, such as:

- Name and contact information for both Parties

- Description of the type of property being mortgaged, using its legal description, found on previous deeds or tax forms, and the location of the property

- Outline of the basic terms of the promissory note or loan agreement that is being secured by the property , such as how often payments will be made, the amount of the payments, and any applicable interest rates and/or penalties

Once the Mortgage Deed is completed, the borrower must sign and date it in front of a notary and have the document notarized . A notary page is included at the end of the document. After the Mortgage Deed is signed and notarized, it needs to be recorded in the county where the property is located . Often a small fee must be paid at the time of filing. The county will keep the original copy of the Deed, but the Parties should keep a copy of the Deed in a safe and secure location for their records and in case of future dispute.

Applicable law

Mortgage Deeds are governed by state law . Different states have different requirements for when and how the Deed should be filed. Contact the local county Register of Deeds to get information about which governmental agency should be given the Deed to file and record before being returned to the parties.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

- Mortgage Deed vs. Deed of Trust

- Foreclosure and Eviction FAQ

Mortgage Deed - FREE - Sample, template - Word and PDF

Country: United States

Housing and Real Estate - Other downloadable templates of legal documents

- Security Deposit Return Letter

- Lease Assignment Agreement

- Rent Payment Plan Letter

- Residential Lease Agreement

- Sublease Agreement

- Tenant Maintenance Request Letter

- Rent Receipt

- Late Rent Notice

- Notice of Intent to Vacate

- Roommate Agreement

- Quitclaim Deed

- Parking Space Lease Agreement

- Short-Term Lease Agreement

- Tenant Security Deposit Return Request