Mastering the Pricing Case Study: A Comprehensive Guide

- Last Updated November, 2022

Setting the optimal pricing for products or services is important for a company as it directly impacts profitability. So every management consulting firm helps its clients with pricing strategies. The primary goal of a pricing case is to recommend a price that maximizes profit, taking costs for product/service and market considerations into account.

A typical pricing case interview would start something like this –

A manufacturer of kitchen knives sells a range of products, from low-end to professional, to customers at different price points. They’ve developed a new line of knives in collaboration with a celebrity chef and would like help setting the prices for these products.

Pricing cases might not seem straightforward initially, but with the right frameworks and practice cases, we will help you prepare for it.

In this article, we’ll discuss:

- Examples of pricing cases.

- The alternative pricing methods.

- How to approach a pricing case interview.

- An end-to-end pricing case example.

Let’s get started!

Pricing Case Examples

How to approach a pricing case interview, what are the most common pricing strategies, an end-to-end pricing case example, the relevant pricing strategy for our pricing case examples, 6 tips for solving a pricing case interview.

As companies mature, pricing becomes more complex because:

- Companies develop multiple products with different cost structures.

- Clients have different product/service needs and price sensitivities.

Pricing can also be a source for driving revenue growth if you can identify opportunities to price based on value to the customer or in a way that optimizes the tradeoff between revenue and costs. Let’s explore a few situations where consultants can help with pricing:

New Art Museum

A new modern art museum is scheduled to open next year in a major European city. The project lead has requested your help with the pricing of the admission tickets. He has two questions: How would you approach selecting a pricing method for the museum? What price would you recommend and why?

Nail the case & fit interview with strategies from former MBB Interviewers that have helped 89.6% of our clients pass the case interview.

Animal Healthcare

Our client provides healthcare services for animals and develops veterinary drugs. The client has recently developed a product that enables cows to increase milk production by 20%. They have turned to you to figure out how to price this new product in order to maximize profits.

California Municipality

Your client is a local municipality in California. The town recently built a complex of six parking lots, encircling a nearby community center and outdoor mall, which features shopping, restaurants, and some light attractions. In total there are 20,000 parking spots in these lots. Our client wants to maximize the profit it generates from the parking lots with a focus on revenue generation. How would you think about different types of pricing structures and revenue models for the parking lots?

In most pricing case questions, you’ll have to work through one or a combination of the following pricing strategies:

Most companies use a combination of these alternative pricing strategies to maximize profitability. For example, a manufacturer of diet pills that costs $10 to produce may be able to charge $100 per bottle if the target customers have low-price sensitivity and high perceived value (a savings of many hours working out in the gym and/or eliminating the negative health effects of being overweight).

Note that for these examples, multiple correct solutions are possible. The important thing in pricing case interviews is to back up your answer well with analysis and logic.

Relevant pricing strategies + sample approach:

- Since the costs of running the museum are mostly fixed (e.g., staff, maintenance, and utilities), a cost-based pricing strategy will not provide much insight.

- The new museum should therefore use a combination of demand-pull and market-based pricing.

- Since the museum is new, they should set their pricing below the average market price in order to draw in early customers to check out the museum and spread awareness to their friends.

- Do a check that the proposed price point will cover a good portion of the museum’s costs with expected attendance numbers.

- Note that for a museum, ticket sales are probably not expected to fully cover costs. Exhibit sponsors, grants, and donations will be additional sources of funding.

Our client provides healthcare services for animals and develops veterinary drugs . The client has recently developed a product that enables cows to increase milk production by 20%. They have turned to you to figure out how to price this new product in order to maximize profits.

- The cost of making a dose is $30.

- The competition charges $300 per dose.

- Clients are willing to pay $300 per dose because the 20% increase in their revenues will more than offset the product’s price.

- Therefore, the client should set its price based on a combination of market-based pricing and demand-pull.

- The recommendation of whether to price above or below the competitor’s $300 price depends upon how our product compares to theirs. If the client’s product is superior in any way, we may be able to command a higher price. If we are entering the market late and with a comparable product, we’ll need to set our price lower in order to provide an incentive for customers to try our product.

- At $300, this will provide a very attractive gross margin of close to 90%.

Your client is a local municipality in California. The town recently built a complex of six parking lots, encircling a nearby community center and outdoor mall, which features shopping, restaurants, and some light attractions. In total there are 20,000 parking spots in these lots. Our client wants to maximize the profit it generates from the parking lots with a focus on generating additional revenue. How would you think about different types of pricing structures and revenue models for the parking lots?

- Costs are mostly fixed (staff salaries and bond payments for garage construction), so a cost-based strategy doesn’t provide much insight.

- Competitive garages are priced similarly, but less convenient for shoppers.

- Excess capacity provides the opportunity to identify additional revenue sources by driving higher utilization of the parking spaces and offering customers additional services while parked in the garage.

- Brainstorming options to increase revenue identifies a variety of options (offer monthly passes, charge stores monthly fees to validate customer parking, provide valet parking and car washing, use excess capacity for concerts, fairs, or other large events that require parking spaces.)

- Do a check that the proposed price point, including value-added services, will cover salary and bond payments.

Like any other case interview, you want to spend the first few moments thinking through all the elements of the problem. Also, there is no one right way to approach a pricing case study but it should include the following:

- Cost-based: What is the cost of making the product or delivering the service?

- Market-based: What is the pricing of a comparable product or service? Can we price above what the competition is charging?

- Value-based: What is the customer’s willingness to pay? Will we lose customers if we charge higher prices? Are there incremental services we could provide that customers would value?

- What is the volume impact of the alternative pricing model? What is the incremental revenue expected?

- What significant costs will be incurred if the pricing model changes?

- What revenues and costs will be realized if value-added services are launched?

- It can be hard to raise prices once customers are used to a low price. Price anchoring (establishing a higher price but discounting it) may be needed for some time to transition customer expectations.

- What is the expected response from the competition?

- What is the impact on the brand if we reduce prices?

- What is the impact on volume if we increase prices?

Let’s go through the pricing case for the California municipality with 6 parking lots. Remember that the instructions said to focus on incremental revenue. As you develop your structure for the case, remember the key components of our pricing issue tree approach:

- Pricing strategies including offering value-added services

- Financial Impact

Tailor Your Pricing Case Approach for this Client

The first thing you will need to do in a pricing case study, as well as any other consulting case, is to ensure you understand the problem you need to solve by repeating it back to your interviewer. If you need a refresher on the 4 Steps to Solving a Consulting Case Interview , check out our guide.

Second, you’ll structure your approach to the case. Stop reading for a moment and consider how you’d structure your analysis of this case. We gave you some hints in our sample cases section. After you’ve outlined your approach, read on and see what issues you addressed, and which you missed. Remember that you want your structure to be MECE and to have a couple of levels in your Issue Tree .

- What is the municipality’s cost structure?

- How much revenue is required to cover costs?

- How much of a profit expectation does the municipality have? Do they want to generate as much revenue as possible or cover their costs and provide a service to their community at an attractive price?

- What are the municipality’s current pricing structure and prices?

- How do the municipality’s current prices compare to alternative parking options?

- What alternative pricing structures could the municipality use (hourly rates, daily rates, monthly rates, store validation, etc.)

- What non-price considerations are there? (Proximity to popular destinations, roof vs. no roof, lighting/safety, cleanliness)

- What services could the parking lots provide in addition to the parking spot?

- How much space would providing additional services require?

- How much revenue would they generate?

- What are the expected revenues of alternative pricing models?

- What are the expected revenues of value-based services?

- Would additional costs be incurred?

- How might customers react to alternative pricing models?

- To value-based services?

- How might competitors react?

Pricing Case Brainstorming Exercise

After you structure your approach, the interviewer asks you to brainstorm some revenue growth opportunities for the California municipality. Again, stop reading for a moment to do this exercise yourself because you’ll learn more if you do. When you’re done, note the ideas you didn’t consider. Few candidates hit every possibility, but to move on to the next round of interviews, you’ll definitely want to go beyond the straightforward responses.

- Charge store owners for parking spots to offer free parking for visitors.

- Charge higher pricing for spots closest to the stores.

- Offer annual/monthly parking passes.

- Valet parking

- Car washing

- Quick car servicing (e.g., oil change)

- Locate public transportation/bus stops adjacent to the lots and provide parking to commuters at a monthly rate.

- Rent space to event attendees (e.g., sporting events, concerts, fairs).

When you ask about the municipality’s current pricing and parking space utilization rates, your interviewer provides you with the following exhibit and asks you to calculate the daily revenue. Note that the parking lot has two sources of revenue:

- Tourists/shoppers buying parking tickets for an hourly rate.

- Store owners buying monthly parking permits for their staff.

Calculation of current daily revenue:

- 3 hour parking: Revenue = (20,000 parking spots) * (30% of total lot occupancy for tourists/shoppers) * (75% of tourists/shoppers occupancy for 3hr parking) * ($2/hr) * (*3hrs) = $27,000

- 5 hour parking: Revenue = (20,000 parking spots) * (30% of total lot occupancy for tourists/shoppers) * (25% of tourists/shoppers occupancy for 5hr parking) * ($10 flat fee) * = $15,000

- Total tourist/shopper revenue – $42,000

- Store owners: Revenue = (20,000 parking spots) (5% lot occupancy for owners) *($240/month) (1/30 to convert to daily revenue) = $8,000

- Total tourist/shopper + store owner daily revenues= $50,000

Alternative Pricing Model: Store Validation

If we move to a store validation model, in which a store validates the ticket of any customer who buys something, the spots taken would increase to 10,000, or 50% of available capacity. This is because the cost of parking is currently a deterrent to customers shopping at this mall. More shoppers at the mall would be a significant benefit to store owners.

The cost per validation would be $5 to the store. Assume every person parking a car purchases something. The number of store owner permits would drop to 750 since store owners will likely decide to save money on permits to pay for visitor parking spots.

What would be the impact on daily revenue?

- Increase in the tourist/shopper revenues = $8,000 = (10,000 spots) * ($5 per spot) – $42,000

- Store owner revenues would decrease by $2,000= (750 permits) * ($240 per permit/30 days per month) – $8,000

- Change in total daily revenue = + $6,000

- A good candidate will recognize that the increase of 12% in daily revenues is a positive move forward.

Risks to the Change to a Validation Pricing Model

Do you see any risks to a validation pricing model? Do you think you’re likely to run into any resistance? From which types of stores and why?

- Stores with low price per transaction (such as ice cream shops) will likely lose money if they pay for the $5 validation fee, therefore 100% of stores will not be willing to participate.

- An alternative validation model would be to charge stores based on a percentage of transactions or profits. This would get less pushback.

- Under the percentage model, there would need to be a cap on the price charged to stores. A 5% charge on an ice cream may be reasonable but a 5% charge on a $1000 handbag would not be.

- You could note that while the focus of this case is on revenue generation, the costs to run a validation model might be slightly higher because the municipality will need to process the validation numbers and bill the stores.

Recommendation

Lastly, provide your recommendation for the client. Try coming up with your own before reading our sample.

The California Municipality should proceed with the transition to the validation pricing model because it provides an incremental $6000 per day or an increase in revenue of 12%. While doing this, it should study the risk of pushback from store owners with low transaction value and the possibility of charging based on a percentage of the transaction. Additionally, the municipality should roll out revenue growth opportunities such as renting out excess capacity and offering value-added services (e.g., valet parking) over time.

Determine the relevant pricing strategy to apply (e.g., cost-based vs. market-based or demand pull).

Brainstorm all possible changes in pricing methodologies that might bring in additional revenue (e.g., hourly, daily, or monthly pricing, a store-validation model for our parking lot case), don’t forget that charging for value-added services could be part of a broader pricing & revenue generation strategy (e.g., oil changes, car wash for our parking lot case)., calculate the incremental revenues from suggested changes in pricing., always have an answer to whether to proceed or not., detail the risks associated with the pricing changes..

– – – – –

In this article, we’ve covered:

- Examples of pricing cases

- Approaches for solving a pricing case

- Different pricing strategies

- Tips for solving a pricing case

Still have questions?

If you have more questions about pricing case study interviews, leave them in the comments below. One of My Consulting Offer’s case coaches will answer them.

Other people prepping for pricing case studies found the following pages helpful:

- Our Ultimate Guide to Case Interview Prep .

- Types of Case Interviews .

- Consulting Case Interview Examples .

- M&A Case Study Interview.

- Market Sizing Case Questions .

Help with Case Study Interview Prep

Thanks for turning to My Consulting Offer for advice on pricing case study interviews. My Consulting Offer has helped almost 85% of the people we’ve worked with to get a job in management consulting. We want you to be successful in your consulting interviews too. For example, here is how David was able to get his offer from Deloitte.

2 thoughts on “Mastering the Pricing Case Interview: A Comprehensive Guide”

In the Alternative Pricing Model: Store Validation

The original tourist/shopper revenue is $42,000 Under the alternative pricing model, (10,000 spots) * ($5 per spot) = $50,000, an $8,000 increase

The original store owner revenue is $8,000 Under the alternative pricing model, (750 permits) * ($240 per permit/30 days per month) = $6,000, a $2000 decrease.

The new total daily revenue = $56,000 Original daily revenue = $50,000

Shouldn’t the change in total daily revenue be = $56,000 – $50,000 = $6,000, a 12% increase?

I’m confused about the change in total daily revenue $2,000 and 4% numbers.

Yes, good catch! We’ll make the change. Sorry for the confusion.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

© My CONSULTING Offer

3 Top Strategies to Master the Case Interview in Under a Week

We are sharing our powerful strategies to pass the case interview even if you have no business background, zero casing experience, or only have a week to prepare.

No thanks, I don't want free strategies to get into consulting.

We are excited to invite you to the online event., where should we send you the calendar invite and login information.

- Launch a Business

- Roll out New Pricing

- Expand Globally

- Shift to Subscriptions

- Move Upmarket

- Introduce Self-Serve

- E-Publishing

- OTT & Video

- North America

- Asia Pacific

- Founder/CEO

- Learning Hub

- Documentation

- Product Documentation

- API Documentation

- Services & Implementation

- Help & Support

- Retention & Churn

- Revenue Growth

- Updates & News

Effective pricing strategies in marketing for business success

In the bustling marketplace, setting the right price for your product or service can feel like navigating through a dense fog. However, understanding the importance of pricing strategies in marketing is akin to having a compass that guides you towards business success. Whether you’re launching a new product or revisiting an existing offering’s pricing model, the strategy you choose plays a pivotal role in how your brand is perceived, how competitive you remain, and ultimately, your bottom line.

Let’s delve into the nuances of pricing strategies in marketing, shedding light on why they’re not just about numbers but about understanding market dynamics, consumer psychology, and your business goals.

Understanding the importance of pricing strategies in marketing

In marketing, pricing isn’t just a figure tagged on a product; it’s a multifaceted strategy that demands careful consideration and planning. Pricing strategies are essential for several reasons.

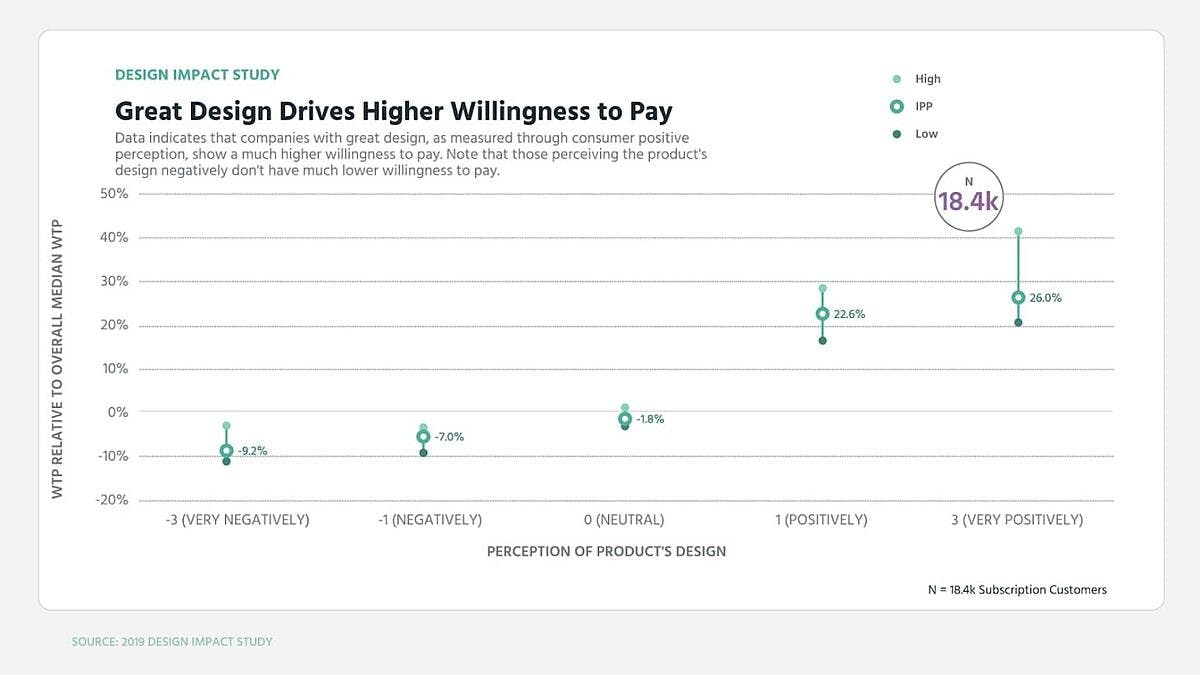

Moreover, understanding what pricing strategy is in marketing involves recognizing its impact on consumer perception. Price is often seen as a quality indicator, and a well-thought-out strategy can enhance perceived value, encouraging customers to choose your product over competitors’. Additionally, flexibility is key in your pricing plan . The market is ever-changing, with fluctuating costs, varying consumer demands, and evolving competitive landscapes. A dynamic pricing strategy allows you to adapt to these changes, ensuring your product remains relevant and competitively priced.

The art and science of pricing require a deep dive into market research, competitor analysis, and introspection into your brand’s value proposition. It’s about finding that sweet spot where your price covers costs, earns a profit, and resonates with your target audience, compelling them to choose your product as their preferred solution.

Embarking on the journey of setting the right price for your offerings can feel like navigating a labyrinth. Yet, with a solid grasp of different pricing strategies and their applications, you’re equipped with a map to guide you through.

Different types of pricing strategies and their applications

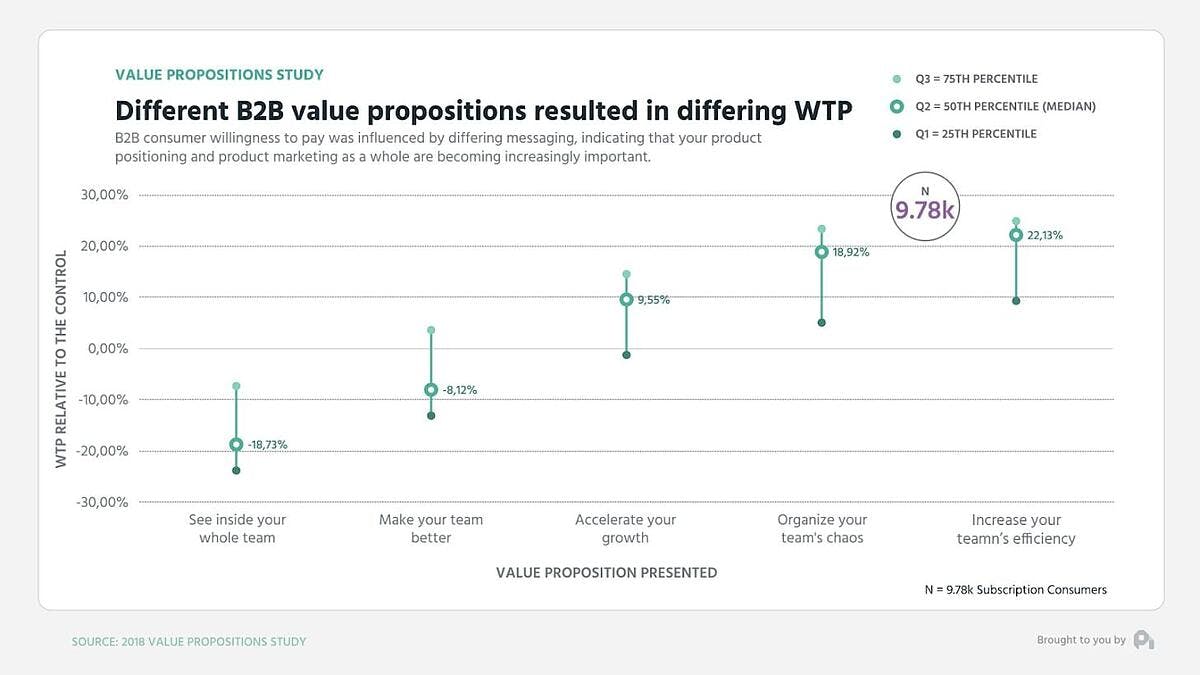

From the allure of luxury goods to the practical appeal of everyday items, product pricing strategies are tailored to meet the demands of different market segments. For instance, value-based pricing focuses on a product or service’s perceived worth to the customer, making it ideal for offerings with unique benefits or superior quality. This approach is particularly effective for businesses with a strong brand identity or specialized services.

On the other hand, competitive pricing involves setting prices based on what competitors are charging. This method is crucial for companies in highly saturated markets, where price plays a significant role in consumer decision-making. It requires continuous market analysis to ensure your pricing remains attractive yet profitable.

For businesses looking to penetrate new markets or launch innovative products, penetration pricing can be a game-changer. By initially setting lower prices, companies can quickly attract a broad customer base, creating brand awareness and loyalty. As market presence grows, prices can be adjusted to reflect the product’s established value.

Moreover, pricing techniques such as dynamic pricing allow businesses to adjust prices in real time based on market demand, competition, and other external factors. This strategy is particularly beneficial for industries like travel and e-commerce, where prices can significantly influence consumer choice.

Understanding the wide array of pricing strategies for services and products is crucial for businesses aiming to stand out in their respective markets. Whether it’s adopting a skimming strategy to maximize profits from new technology or employing bundle pricing to increase a service package’s perceived value, the right strategy can dramatically impact your business’s success. As you navigate the complex world of pricing, remember that the goal is not just to set a price but to communicate your offerings’ value in a way that resonates with your target audience.

How do companies formulate a pricing strategy for success

Formulating a successful pricing strategy requires a deep understanding of market demand, customer behavior, cost structures, and profit margins. By analyzing these key factors, companies can develop a pricing approach that aligns with their business goals and resonates with their target audience.

Analyzing market demand and customer behavior

At the heart of any successful pricing strategy lies a thorough analysis of market demand and customer behavior. These elements serve as the compass points that guide businesses in setting prices that cover costs, generate profit, and resonate with the target audience. Analyzing market demand involves examining the broader economic environment, industry trends, and the pricing of similar products. It’s about gauging what the market can bear and how price-sensitive potential customers are.

Understanding customer behavior delves into the psychological aspects of purchasing decisions, recognizing the factors that motivate customers to choose one product over another.

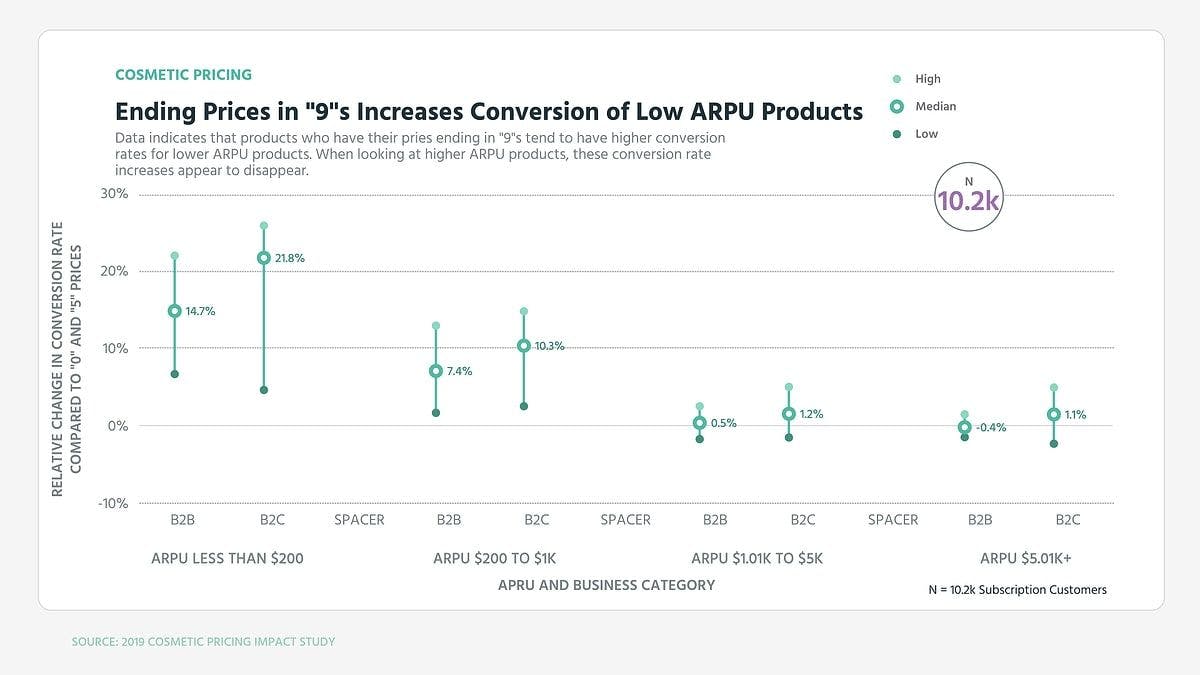

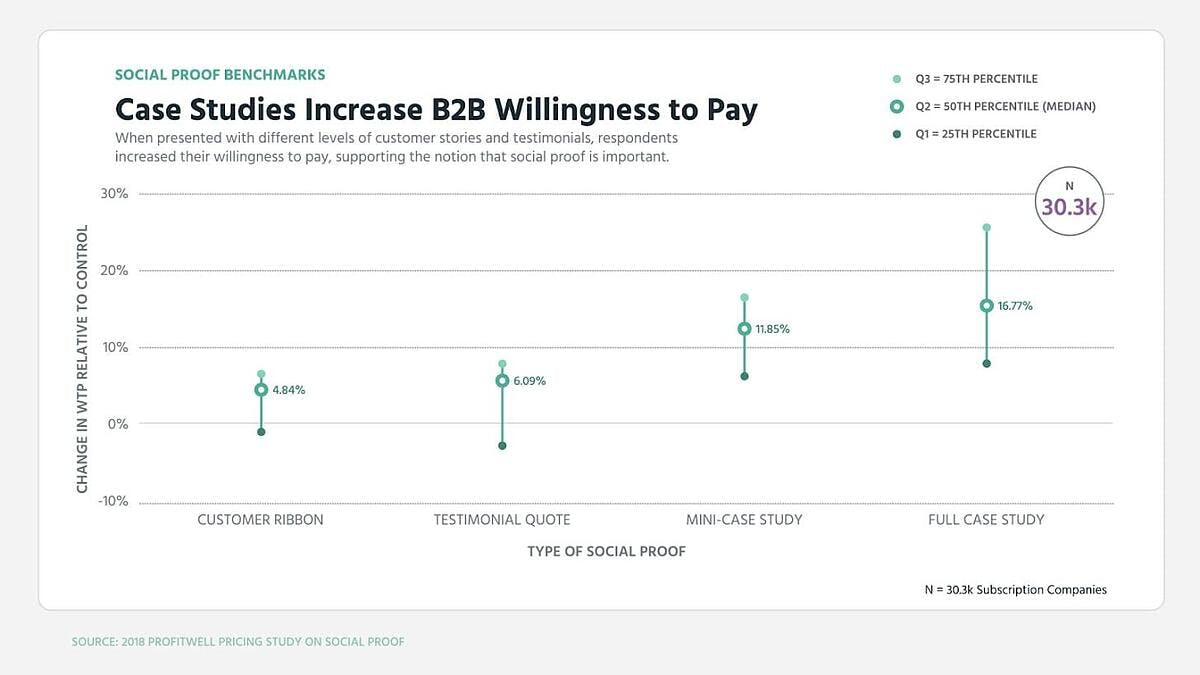

This is where pricing tactics come into play. Strategies like psychological pricing , which involves setting prices that have a psychological impact on consumers, can significantly influence buying behavior.

Moreover, pricing strategies in marketing must adapt to the ever-changing landscape of consumer preferences and competitive pressures. Dynamic pricing allows businesses to adjust prices in real-time based on demand, competition, and other external factors, providing a powerful tool to respond to market changes and maximize revenue opportunities.

Incorporating cost structures and profit margins

Understanding cost structures is essential for developing a successful pricing strategy. It involves a thorough analysis of the fixed and variable costs associated with producing a product or delivering a service. This clarity ensures that the pricing strategy covers all expenses and contributes to a healthy bottom line. However, it’s not just about covering costs; it’s about understanding how these costs interact with pricing strategies to create value for both the business and its customers.

Profit margins represent the percentage of each sale that exceeds costs, essentially measuring the efficiency of a pricing strategy. By aiming for optimal profit margins, businesses ensure that they not only survive but thrive. However, setting these margins requires a delicate balance. Pricing too high might deter potential customers, while pricing too low risks undervaluing the offering and squeezing profits.

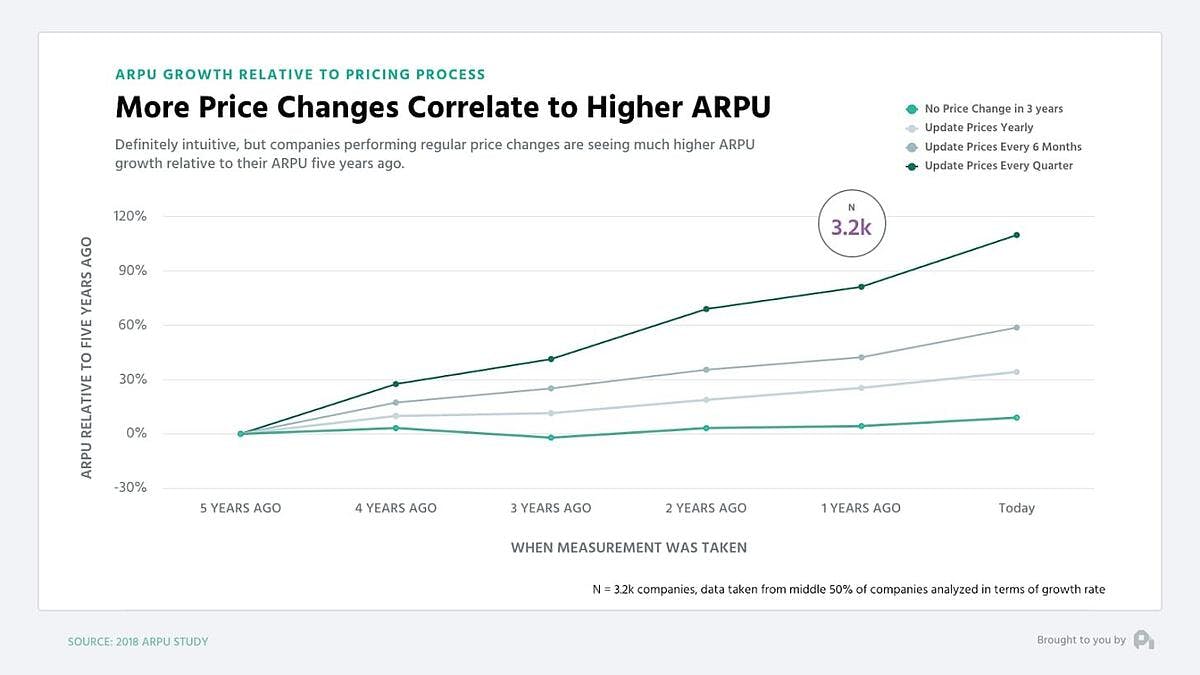

Integrating cost structures and profit margins into pricing strategies is an ongoing process. Market conditions change, costs fluctuate, and consumer preferences evolve. Therefore, regularly revisiting these elements and adjusting pricing accordingly is crucial for maintaining competitiveness and profitability.

Examples of successful pricing strategies in various industries

The landscape of pricing strategies in marketing is vast and varied, with each industry having its unique set of challenges and opportunities. Let’s explore some examples of successful pricing strategies across different sectors.

Case studies of effective pricing strategies in technology

In the technology sector, companies like Apple have mastered the art of premium pricing, where the perceived value of their products allows them to set higher price points, reinforcing their brand’s prestige. On the other hand, subscription-based services like Netflix have leveraged penetration pricing to initially attract a large subscriber base with affordable rates before gradually increasing prices as the value of their service became apparent to users.

Another notable example is the freemium model used by companies such as Spotify. By offering a basic service for free and charging for premium features, Spotify was able to attract a vast user base, capitalizing on the pricing strategy to convert free users into paying subscribers over time.

Examining pricing strategies in the service sector

In the service sector, where intangible offerings like expertise, time, and experience are traded, pricing strategies take on a unique complexity. Services often require a value-based pricing strategy, where the price is set based on the perceived worth of the service to the customer rather than the cost of delivery. This approach emphasizes the benefits and outcomes that the service provides, aligning the price with the customer’s expectations and willingness to pay.

Service sector pricing strategies may also incorporate dynamic or tiered pricing models to cater to different customer segments or adjust for demand fluctuations. For instance, a consultancy firm might offer different pricing tiers based on the scope of service, expertise level, and project duration, providing flexibility and options for clients with varying needs and budgets. Similarly, businesses like airlines and hotels often employ dynamic pricing, adjusting rates in real-time based on demand, seasonality, and booking patterns to maximize revenue and occupancy rates.

Adopting the right pricing strategies in the service sector ensures that businesses cover their costs, achieve desired profit margins, and strengthen customer relationships by aligning price with value. It requires ongoing market research, competitor analysis, and customer feedback to strike a delicate balance.

RELATED BLOGS

Shaoli Paul, an accomplished Fintech content writer, leverages 3+ years of SaaS content writing expertise to weave compelling narratives with a strong background in Fintech. Her expertise is crafting thought leadership content, including blogs, ebooks, and whitepapers. Her impactful writing has forged lasting customer relationships and left a profound mark on the Fintech industry. A dedicated reader of thrillers and mysteries, Shaoli infuses her work with an element of suspense. Off the screen, she’s a culinary enthusiast, using the art of cooking to fine-tune her content.

Learning Materials

- Business Studies

- Combined Science

- Computer Science

- Engineering

- English Literature

- Environmental Science

- Human Geography

- Macroeconomics

- Microeconomics

- Pricing Strategy of Nestle Company

The moment you make a mistake in pricing, you're eating into your reputation or your profits.”

Millions of flashcards designed to help you ace your studies

Review generated flashcards

to start learning or create your own AI flashcards

Start learning or create your own AI flashcards

- Business Case Studies

- Amazon Global Business Strategy

- Apple Change Management

- Apple Ethical Issues

- Apple Global Strategy

- Apple Marketing Strategy

- Ben and Jerrys CSR

- Bill And Melinda Gates Foundation

- Bill Gates Leadership Style

- Coca-Cola Business Strategy

- Disney Pixar Merger Case Study

- Enron Scandal

- Franchise Model McDonalds

- Google Organisational Culture

- Ikea Foundation

- Ikea Transnational Strategy

- Jeff Bezos Leadership Style

- Kraft Cadbury Takeover

- Mary Barra Leadership Style

- McDonalds Organisational Structure

- Netflix Innovation Strategy

- Nike Marketing Strategy

- Nike Sweatshop Scandal

- Nivea Market Segmentation

- Nokia Change Management

- Organisation Design Case Study

- Oyo Franchise Model

- Porters Five Forces Apple

- Porters Five Forces Starbucks

- Porters Five Forces Walmart

- Ryanair Strategic Position

- SWOT analysis of Cadbury

- Starbucks Ethical Issues

- Starbucks International Strategy

- Starbucks Marketing Strategy

- Susan Wojcicki Leadership Style

- Swot Analysis of Apple

- Tesco Organisational Structure

- Tesco SWOT Analysis

- Unilever Outsourcing

- Virgin Media O2 Merger

- Walt Disney CSR Programs

- Warren Buffett Leadership Style

- Zara Franchise Model

- Business Development

- Business Operations

- Change Management

- Corporate Finance

- Financial Performance

- Human Resources

- Influences On Business

- Intermediate Accounting

- Introduction to Business

- Managerial Economics

- Nature of Business

- Operational Management

- Organizational Behavior

- Organizational Communication

- Strategic Analysis

- Strategic Direction

- Katharine Paine

In 2019, Nestle earned half of its worldwide sales in America. It had a cumulative revenue of about 92.6 billion Swiss Francs that year. How was Nestle able to generate that much revenue ? What is their pricing strategy? Let’s find out!

Case Study on Nestle

Nestle was founded in Switzerland by Heinrich Nestle in 1866. Nestle is one of the oldest multinational companies. From the early stages, Nestle wanted to take advantage of growth opportunities in different countries. In 1905, it merged with Anglo-Swiss condensed milk, broadening its product range to include infant formulas and condensed milk. Nestle currently has 447 factories, with operations in 189 countries.

In this case study, we will focus on Nestle's pricing strategies. Pricing is the most important element for maximising revenues. According to Harvard studies, if there is a 1% improvement in pricing, it leads to an 11% increase in profits (approx.). If the pricing structure is incorrect, the business loses profit with each transaction made. Therefore, correct pricing is critical.

Nestle is a multinational brand with a present net worth of about $270 billion. The success that the brand has is due to its pricing strategy. The revenue of Nestle is continuously growing, this depicts the successful identification and placement of its products in the market. Generally speaking, Nestle’s products are pricier in comparison to the products of the retailing brand.

Nestle’s pricing strategy is fairly distinctive in contrast with other brands. It merely hinges on recognition which is attributed to the apparent quality of the product. Based on this quality and the attitude of the customers, Nestle assesses the pricing strategy it wants to implement.

Nestle’s pricing strategies

Here are some of the strategies implemented by Nestle in order to achieve its targets and goals.

Nestle Price skimming

Price skimming is a pricing strategy in which a company charges a high price initially and lowers it over time.

Nestle uses price skimming for some of its products when it enters the market of a country.

Nestle believed that the target consumers for Nescafe coffee were upper-middle-class consumers. Later, with the success of this approach and strategy, they lowered the prices and targeted the middle class.

Inexpensive pricing strategy

Amongst its wide range of brands, Nestle offers a fair price for quite a few of its brands and products. Pricing is based on market segmentation . Market segments generally involve a target audience.

Market segmentation is the practice to divide the target market into subgroups. It forms subsets depending on needs, psychographic, behavioral, and demographic criteria.

If Nestle is trying to target the mass market, then they implement an inexpensive pricing strategy instead of an expensive one.

This happened in the case of Nestle's Maggi noodles. It is considered affordable in comparison to other products of Nestle. However, if the price of Maggi is compared globally with other noodle brands, then it can be perceived as a little pricey.

Bundle price strategy

With time Nestle has understood that people do not usually do their groceries every day, instead, they prefer purchasing in bundles. Therefore, Nestle implemented the bundle packs approach.

Initially, Maggi was sold in a single pack but later on, Nestle offered a 16 pack which eventually increased the sales.

Penetration pricing strategy

Penetration pricing is a pricing strategy that an organisation uses to offer new products at lower prices in an attempt to attract more customers away from rivals.

When Nestle introduced a new flavor of Maggi instant noodles, they were sold at a low price of £2.25 to entice new customers. Nestle’s strategy was to lure more customers away from its rivals which offered alike flavors priced at £3.25. Nonetheless, when Nestle gained a greater customer base they increased the price to £3.

Psychological pricing strategy

Psychological pricing facilitates in creating a positive psychological influence on the consumer and attracts them to buy the product.

Nestle Aero bliss was sold for £8.99 instead of £9. This pricing strategy will have a positive psychological impact on the consumer and will encourage them to purchase the product.

Stock keeping units

Nestle does not want to lose any customers, so it has diverse pricing for every stock-keeping unit, allowing it to reach a bigger consumer base. From Maggi noodles to Cereals, Nestle has it all covered, whereby the company offers different sizes of packs.

Nestle’s cereal is slightly pricey in comparison to other brands. Hence, it started offering mini pouches for everyday consumption. This has made the pouches a lot cheaper than larger packs, hence allowing different segments of customers to buy Nestle’s products.

Discounts offered

Nestle offers discounts in various retail stores. Nestle products are often bundled and come with a 5% or 10% discount.

Coffee and creamer, as a bundle, is cheaper than buying the two items separately.

Competitive pricing strategy

Another general approach that Nestle follows is analyzing the pricing strategies of its rivals. Nestle has several brands and for every brand, it has separate departments that assess the pricing strategies of its rivals. Besides that, it examines the marketing style, sales, and innovation of rivals. The competitive pricing strategy assists in achieving Nestle's desired position as they acknowledge the preferences of the consumers.

Global pricing strategies of Nestle

Globally, Nestle attempts to ensure the pricing strategies that will assist it in achieving its financial objectives . These strategies typically involve the penetration and skimming strategy. The price of Nestle products automatically rises when they are exported to other regions. Alternatively, it also implements price skimming, as it sets a higher price at the start and then ultimately reduces the price based on the customer demand.

Over the years, Nestle has become one of the leading parent brands with successful divisions under its name. What has made Nestle successful with consumers is that it adapts to different pricing strategies according to the regions its selling and according to the product offered. It gives preference to the demands of its customers and tries to provide the best quality products at different price ranges so that all segments of consumers are able to afford its products, hence, increasing the sales and profits for the company.

Pricing Strategy of Nestle Company - Key takeaways

Nestle was founded in Switzerland by Heinrich Nestle in 1866.

Heinrich originally created Nestle for distributing milk food for newborns and found that it could be created from powdered milk, sugar, and other natural food.

Nestle is a multinational brand with a present net worth of about $270 billion. The success that the brand has is due to its pricing strategy.

Nestle’s pricing strategy is fairly distinctive in contrast with other brands.

Nestle uses various pricing strategies including price skimming, inexpensive and bundles pricing strategy, penetration pricing strategy, stock keeping units, psychological pricing strategy, discounts, and competitive pricing strategy.

Howandwhat, https://howandwhat.net/marketing-mix-nestle/

The Strategy Watch, https://www.thestrategywatch.com/pricing-strategy-nestle/

Price intelligently, https://www.priceintelligently.com/blog/bid/182007/6-must-read-pricing-strategy-quotes

StuDocu, https://www.studocu.com/my/document/tunku-abdul-rahman-university-college/pricing strategy/bbdt3193-pricing-strategy-for-the-company-nestle/18242524

Studymode, https://www.studymode.com/essays/Nestle-Pricing-Strategy-1058790.html

Iide, https://iide.co/case-studies/nestle-marketing-strategy/

Iide, https://iide.co/case-studies/marketing-mix-of-nestle/

Learn with 0 Pricing Strategy of Nestle Company flashcards in the free Vaia app

We have 14,000 flashcards about Dynamic Landscapes.

Already have an account? Log in

Frequently Asked Questions about Pricing Strategy of Nestle Company

What are the strategies of Nestle company?

What are the 5 pricing strategies?

Five major pricing strategies including price skimming, inexpensive and bundles pricing strategy, penetration pricing strategy, psychological pricing strategy, and discounts.

Discover learning materials with the free Vaia app

Vaia is a globally recognized educational technology company, offering a holistic learning platform designed for students of all ages and educational levels. Our platform provides learning support for a wide range of subjects, including STEM, Social Sciences, and Languages and also helps students to successfully master various tests and exams worldwide, such as GCSE, A Level, SAT, ACT, Abitur, and more. We offer an extensive library of learning materials, including interactive flashcards, comprehensive textbook solutions, and detailed explanations. The cutting-edge technology and tools we provide help students create their own learning materials. StudySmarter’s content is not only expert-verified but also regularly updated to ensure accuracy and relevance.

Vaia Editorial Team

Team Business Studies Teachers

- 7 minutes reading time

- Checked by Vaia Editorial Team

Study anywhere. Anytime.Across all devices.

Create a free account to save this explanation..

Save explanations to your personalised space and access them anytime, anywhere!

By signing up, you agree to the Terms and Conditions and the Privacy Policy of Vaia.

Sign up to highlight and take notes. It’s 100% free.

Join over 22 million students in learning with our Vaia App

The first learning app that truly has everything you need to ace your exams in one place

- Flashcards & Quizzes

- AI Study Assistant

- Study Planner

- Smart Note-Taking

Privacy Overview

Understanding your options: Proven pricing strategies and how they work

“The single most important decision in evaluating a business is pricing power,” Warren Buffet, CEO Berkshire Hathaway, once said. “If you’ve got the power to raise prices without losing business to a competitor, you’ve got a very good business. And if you have to have a prayer session before raising the price by 10 percent, then you’ve got a terrible business.”

As the quote reflects, pricing is the most powerful lever for driving or destroying the operating margins of a company. In our experience, effective pricing strategies and tactics can deliver a 2 to 7 percent increase in return on sales.

In an analysis of hundreds of companies and pricing approaches, we found four pricing strategies that deliver sustainable results (see Exhibit 1). Not every strategy will be relevant or even feasible for every company – much depends on the market context, the business strategy, and your own capabilities. Still, we’ve found that periodically reviewing strategic options is helpful in challenging established thinking and sparking new ideas about how to approach pricing.

A. Margin Expanders

For many companies in mature markets where there is heavy competition, the prudent and realistic pricing strategy involves small, incremental steps to improve margins, usually within the existing segments, products, and pricing structure. This can mean expanding margins through small regular price increases, defending against unnecessary giveaways, segmenting the offering, applying surcharges, passing on changes in cost to serve, and pricing in additional sources of value (e.g., service). This approach allows companies to expand their profitability over time without disrupting competitive dynamics or customer expectations. To succeed, margin expanders must have clear insight into margin leakage (i.e., where, when, and how the “pennies roll off the table” and what the impact of that is) and relentless discipline in rectifying the issue.

Example—Dow Corning: Price and brand differentiation.

In the late 1990s and early 2000s, the silicone industry was seeing declining margins due to commoditization, unfavorable changes in legislation, and increased competition. As the company’s web site explains, Dow Corning did a deep analysis of their customer segments and discovered a large and emerging group of price-sensitive customers who were pulling prices down. Instead of succumbing to price pressure, Dow Corning introduced a different brand (Xiameter) with different service levels, different customer experience and lower price points. The tiered pricing and positioning strategy allowed Dow Corning to target a much broader part of the market while protecting the profits of its existing offering. 1

B. Pricing Disrupters

Companies in new categories or in categories under significant threat often look to bolder, disruptive pricing strategies to define or defend their business model. These approaches are often founded in a belief that more value can be unlocked for the customer and the supplier through a new model that reduces the downside or increases the upside for either party. These models can include profit sharing with customers, pricing agreements that factor in risk (e.g., cost-of-materials triggers), and changes in the unit sales model (e.g., per hour of use vs. per box). To succeed with this strategy, companies need to conduct in-depth analytics and model scenarios to understand the range of outcomes for both sides. In addition, they need to be thoughtful about how to manage the downside, how competitors will respond (disruptors can face dramatic reactions from competitors), and what to do if / when others follow suit. Companies can gain an early advantage by disrupting the pricing model, but keeping that advantage can be difficult.

Example—BASF: Change in business model by moving to a pay-for-results pricing model

BASF, like many of its competitors, used to sell car paint at a price per gallon to OEMs and automotive dealerships. Quite naturally, workshops wanted to keep paint consumption at a minimum to reduce costs, which led to lower-quality paint jobs, reflecting poorly on the customer and, by extension, on BASF. As BASF’s web site details, the company decided to go from being a paint supplier for automotive OEMs to a solutions partner with its customers to improve the final product, so they moved from price per gallon to price per painted car. Taking over the OEM’s paint shops to deliver painted cars also removed a distraction from the customers’ core business, allowing the car-painting process to become better managed. The impact? With the new pricing model, BASF reduced paint consumption per car by 20 percent and saw 20 percent higher margins and a 40 percent increase in its European market share.

C. Revenue Drivers

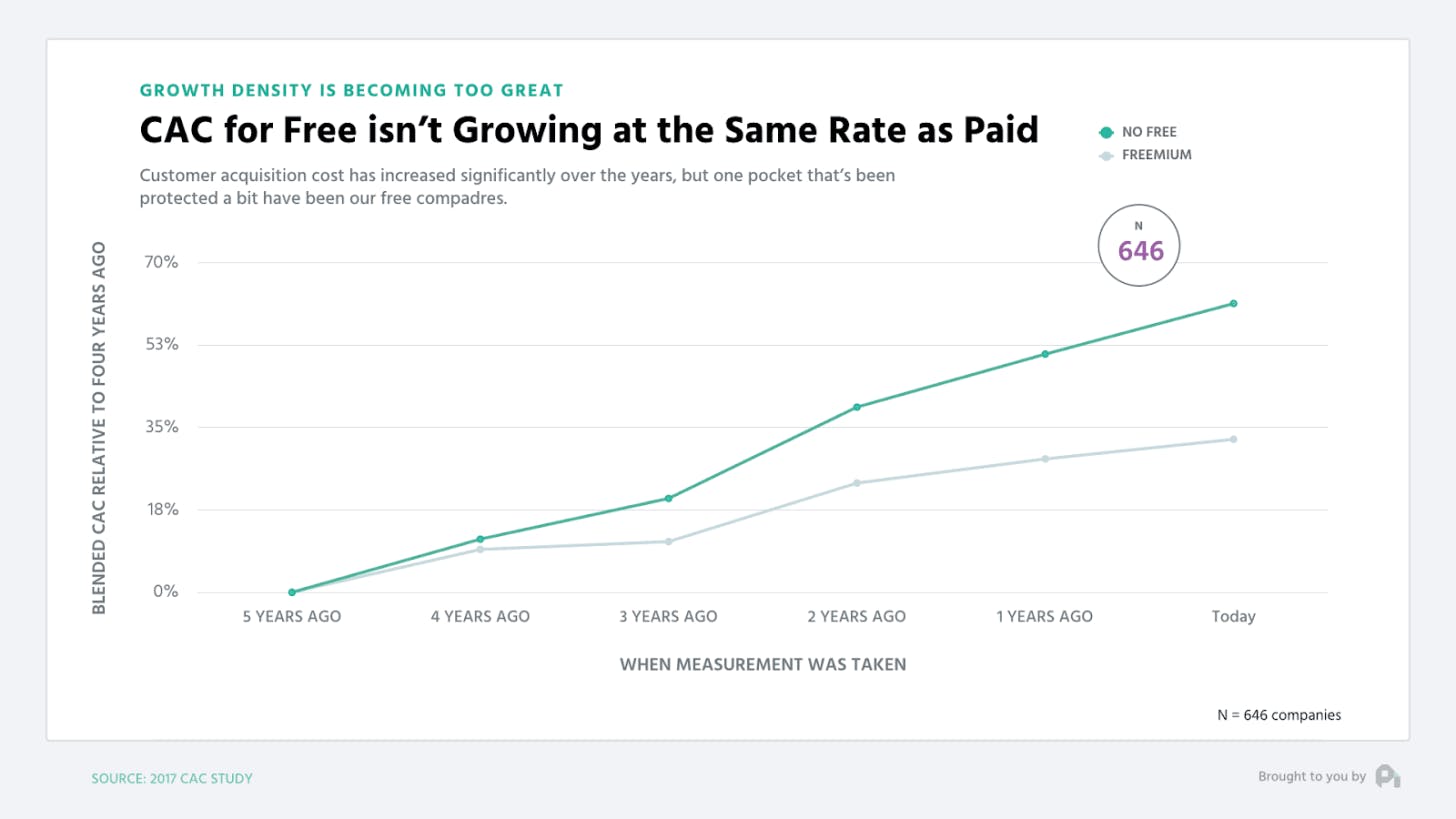

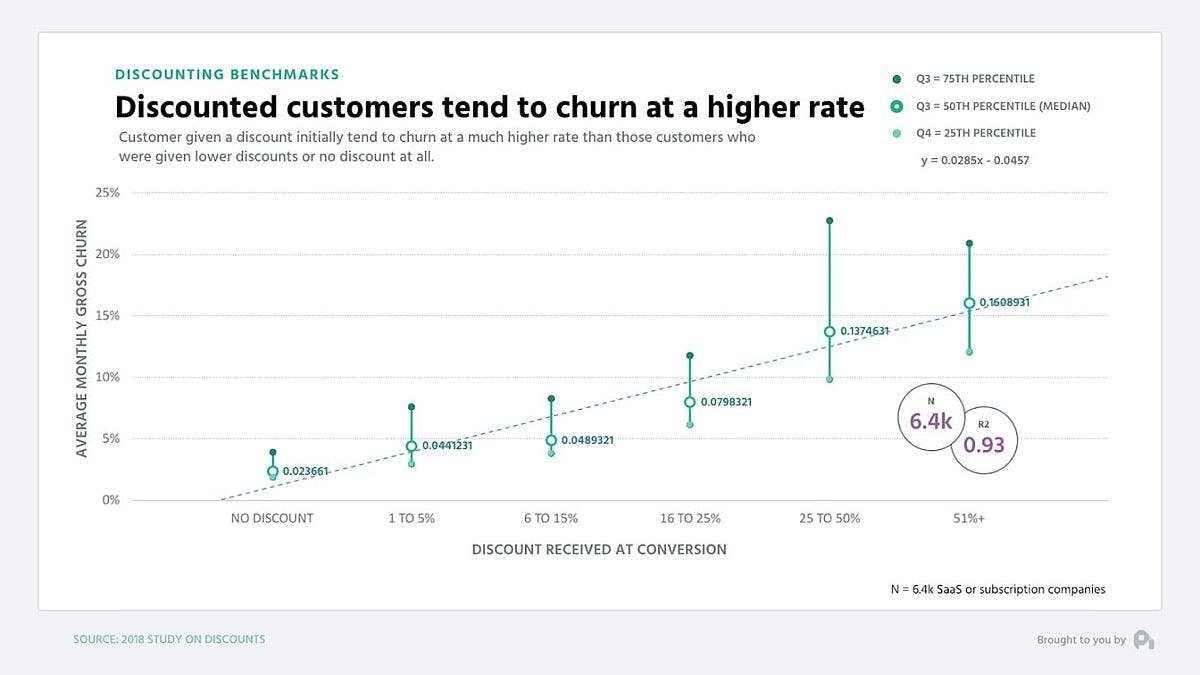

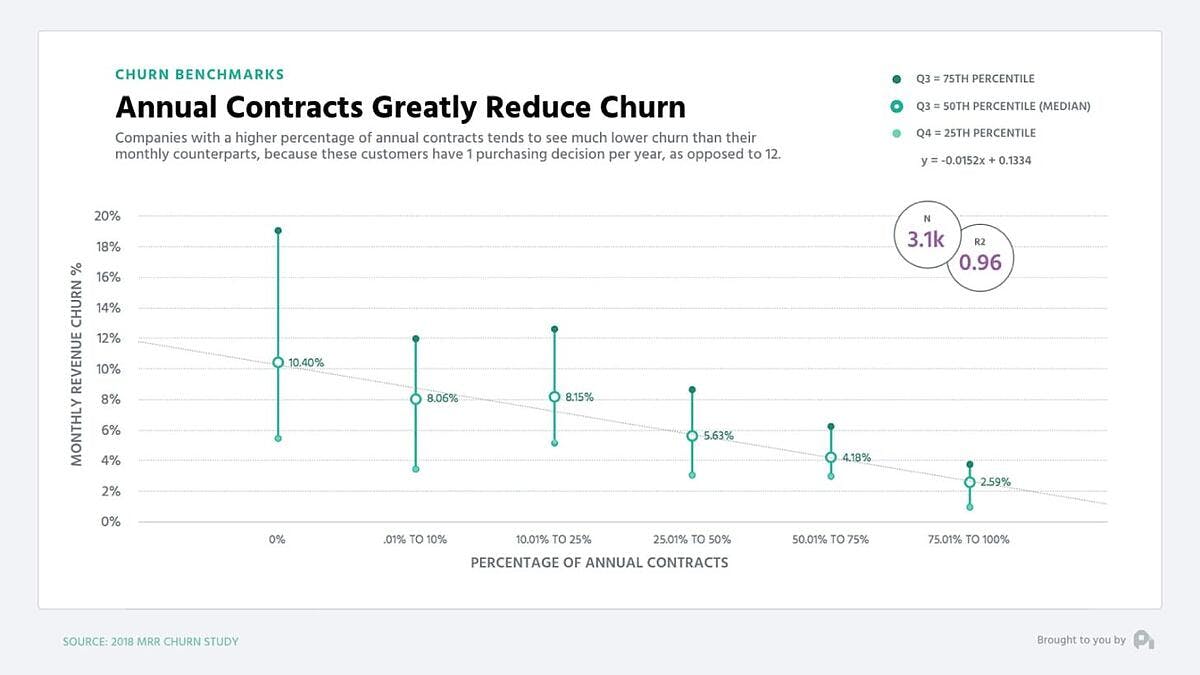

Pricing improvements that focus on growing revenue look at the pricing strategy as an enabler to bring in more business and drive deeper penetration in the existing customer base. This can mean providing introductory offers to bring in new customers, subscription models to build on an installed base, contracting to extend the lifetime value of a customer, and bundling to increase revenue per customer. Success in this model requires maintaining profitability (i.e., not giving away too much), keeping churn low, managing customer acquisition costs, and monitoring competitive dynamics to avoid price or share wars. “Freemium” pricing has quickly emerged as a popular pricing model in online service offerings. With the Internet pushing the marginal cost of content distribution close to zero, and a large number of new players competing for users, freemium pricing (giving the basic offering for free and charging for a premium version or additional content) has quickly caught on.

Example—Expensify: Freemium subscription model enabled fast market penetration.

Expensify, an online expense-reporting and management system established in 2008, uses a subscription model offering customers 10 free scans per month for its receipts-scanning and transaction-organizing service. Users can elect to upgrade to one of the tiered subscription models based on their needs. The service became hugely successful; by 2012 Expensify was used by over 100,000 companies.

D. Sales and Pricing Pioneers

Perhaps the most radical pricing strategy is to go after large-scale sales growth and radical margin change simultaneously. This is about more than just finding a new channel or replicating an established model from another sector; it’s a new way of thinking about pricing. Sales and Pricing Pioneers drive top-line growth by implementing completely different ways of working to find new pockets of growth and value, such as introducing new services or new business models that integrate new portions of the value chain. This approach is most often used in relation to new technological advances (e.g. tablets, apps, cloud computing) with the potential to disrupt the business environment. To succeed in this model, companies need to pay constant attention to balancing the objectives of sales growth with margin attainment while making selective adjustments to strategy when necessary.

Example: Rolls-Royce: New software advances to lure risk-averse customers.

The term “power-by-the-hour” first appeared in aircraft engine vocabulary in the 1960s. Rather than selling capital-intensive engines, Rolls Royce sold airlines “power-by-the-hour” contracts that charged a fee for every hour a plane flew. According to the company’s annual reports, it was an answer to the airlines’ capital shortage and its frustration with unpredictable service costs. It was a win for airlines since the more the plane flew, the more revenue they earned. Rolls Royce considered it a win, too, since the company had bolstered aircraft engine performance by acquiring software companies to collect cockpit data and monitor engines, allowing them to develop predictive maintenance technologies that kept aircraft flying more. In addition, Rolls Royce differentiated its services, offering four packages with increasing degrees of service. According to the company’s annual reports, the bundled solution increased customer loyalty with a more tailored offering (“Pay only for what you want”). This radical approach to pricing provided the company with underlying services revenue growth of 9 percent per year between 2004 and 2011 and led to a greater than 30 percent improvement in average time between engine removals.

Moving up the curve

While these four models show different pricing strategies, which strategy to choose depends on the depth of a company’s commercial capabilities, its customers, the marketplace, and the appetite for risk.

We have found that companies generally progress along three phases of a maturity curve, each with its own set of goals and necessary capabilities:

- Phase 1: Ticket to play. These companies have emerging-to-strong analytic capabilities that help them form and execute against a pricing strategy. They are aware of the pricing situation in the market and understand the pricing schemes of their competitors and of companies they aspire to emulate. This basic competitive intelligence, however, does not necessarily extend deeply into pricing, and companies at this level rarely have experts dedicated to pricing analytics and insights about pricing behaviors.

- Phase 2: Pushing the boundaries. Here companies are masters of the traditional pricing model and are experimenting with new variations—bundling, segmented offers, partnerships, etc. This approach requires more sophisticated capabilities and tools that move beyond analysis to developing even more granular views of prices and needs by product, customer, channel, and region. Those insights feed into product development, marketing messages, sales-force quotas, and overall company aspirations. These companies have instituted a systematic process for reviewing deal wins and losses, checking competitor pricing, understanding what customers want, and making the necessary price adjustments. Their pricing teams push to understand what is driving the customer. An effective organization in this phase has cross-functional teams who meet at least monthly to discuss pricing, analyze historical data, and decide on actions to take based on the insights derived from analysis

- Phase 3. Pioneering new models. Companies at this level have stretched the traditional pricing model as far as they can (or want to), and have decided to differentiate themselves with a new model. This requires a common commitment to the importance of pricing, dedicated pricing leaders, well-defined pricing processes, and performance management that supports those goals. These more innovative companies embrace a test-and-learn approach, where new pricing models are quickly tested on the front lines, results reviewed, and adjustments made. They understand that innovation doesn’t happen in a vacuum so they invest in experiments, learn from them, and develop a comfort with failure. In many cases, there are dedicated and nimble cross-functional teams tasked with driving innovation. When ready to commit to a new opportunity, for example, these companies are able to identify and secure the necessary talent (either from within the organization or outside) and get them on the job quickly. Speed and action are at the heart of these organizations.

Companies considering evolving and deepening their pricing capabilities need to understand how pricing fits into the business’s overall strategy. Only at that point does it make sense to evaluate various pricing models and develop a forward-thinking commercial organization that sets prices, and doesn’t just take them.

- Gary, Loren, " Dow Corning's Big Pricing Gamble ," Harvard Business School, Mar. 7, 2005.

Related Articles

eBook: The hidden power of pricing: How B2B companies can unlock profit

How to price risk to win and profit

Three ways tools & technology can help manage and track pricing performance

Hacking the Case Interview

Pricing consulting cases are one of the most common types of case interviews. You will most likely see at least one pricing strategy case in your upcoming interviews.

A pricing case interview may look something like the following:

Apple is about to launch their latest version of the iPhone. What is the optimal price that they should set for this new product?

Fortunately, pricing cases follow a predictable pattern. Once you have practiced a few pricing cases, you should be able to solve any pricing case interview.

In this article, we’ll cover:

- A comprehensive pricing case interview framework

- The 7 steps to solve any pricing case interview

- A full-length pricing case interview example

- Recommended pricing case interview resources

If you’re looking for a step-by-step shortcut to learn case interviews quickly, enroll in our case interview course . These insider strategies from a former Bain interviewer helped 30,000+ land consulting offers while saving hundreds of hours of prep time.

Pricing Case Interview Framework

The best pricing case interview framework looks like the following:

The framework starts by looking more closely at the company and product. Understanding the company and product better will help you get a sense for how you should be pricing the product.

Afterwards, the framework covers the three different ways to price a product or service. We’ll cover each of these pricing strategies in detail so you can fully understand how to use this framework. You’ll likely use a combination of all three of these strategies to solve a pricing consulting case.

- Pricing based on costs

The simplest way to price a product is to look at the costs to produce a product and set a higher price. If the company has a specific profit margin figure in mind, they can set a price to reach their profit margin goals.

Example: If it costs Apple $200 to produce their iPhone and they are aiming for at least a 20% profit margin, they would need to price their iPhone for at least $240.

Pricing based on costs ensures that the company will be profitable from selling the product. It does not make sense to price a product lower than its costs because the company would be losing money on each sale.

Pricing based on costs sets the lower end of the pricing range you should consider.

- Pricing based on value provided

Pricing based on value provided is the most complex way of pricing. To price a product using this strategy, you need to identify all of the benefits that the product provides and quantify how much value these benefits provide to customers.

This will equal the customer’s maximum willingness to pay. For example, if a product provides $800 of value to the customer, they will not be willing to pay more than $800 for it. It does not make sense to price the product for more than this because no customers would buy it.

Example: The iPhone provides various benefits such as entertainment, productivity, communication, and status. If customers get $300 of value from entertainment, $200 of value from productivity, $400 value from communication, and $100 value from status, customers would be willing to pay a maximum of $1,000.

Pricing based on costs helps set the upper end of the pricing range you should consider.

- Pricing based on competition

Pricing based on competition will help you determine where in between your lower and upper range of prices you should price your product for. To price based on competition, you will need to identify competitor products that are substitutes for your product.

Pricing based on competition is based on two factors, the price that competitors set for their product and the customer’s maximum willingness to pay for their products.

The difference between these two numbers is the amount of value the customer captures from purchasing the competitor’s product. In economics terms, this is known as consumer surplus.

In order for customers to purchase your product, you will need to give customers more value than they get from purchasing a competitor’s product.

Example: Apple’s main competitor, Samsung, has a competing smartphone that they are selling for $400. This product provides customers a value of $600 from the benefits it provides. Therefore, customers get $200 in value from purchasing this product.

If Apple’s customers get a value of $1,000 from purchasing an iPhone, Apple will need to give customers at least $200 of value to make customers purchase an iPhone instead of a Samsung smartphone. Therefore, Apple can charge a maximum of $800 for their iPhone.

The 7 Steps to Solve any Pricing Case Interview

1. Understand the goal or objective of the company

The first step to solving any pricing strategy case interview is to determine the goal or objective of the company.

Most of the time, the company is looking to price a product to maximize profits. However, there are times when a company may be looking to maximize revenues, market share, or number of customers.

Your pricing strategy will differ tremendously based on the company’s specific goals. Therefore, it is important that you understand what the company’s exact goals are.

2. Develop a framework

Next, develop a framework to help you structure your approach to solving this pricing case.

Depending on how much context of the company or product that you have, you may also need to understand the company or product better. These could be the first one or two areas of your framework.

The rest of your framework should include the three different pricing strategies we have covered:

Make sure to walk the interviewer through your framework to see if they agree with your approach. They may provide feedback or offer a few suggestions.

3. Determine the minimum price point

Using the pricing based on costs strategy, determine what the minimum price point of your product should be. Remember, price needs to be greater than costs in order for the company to achieve a profit.

4. Determine the maximum price point

Next, use the pricing based on value provided strategy to determine what the maximum price point of your product should be.

Identify all of the benefits that the product provides customers. Then, quantify these benefits into a dollar value. The sum of the value of the benefits represents the customer’s maximum willingness to pay.

5. Determine the optimal price point

Afterwards, use the pricing based on competition strategy to determine which price point between your lower and upper price points is optimal.

Identify competitor products that are substitutes for your product. Quantify the benefits that competitor products provide customers and compare that to the prices they are set at.

The difference between these two values is the minimum amount of value that you need to give to customers in order for them to want to purchase your product.

6. Consider additional pricing factors

Now that you have an idea for the optimal price, you can consider additional pricing factors:

- Are there additional products that the company can cross-sell or up-sell?

- Can different versions of the product be sold at different price points?

- How do you think competitors will respond to your pricing decisions?

All of these considerations may change the price point that you set.

- If you can cross-sell or up-sell additional products, you may be willing to lower the price of your product further if it means generating more overall profits

- If there are multiple customer segments with different needs and willingness to pay, it may make sense to have multiple versions of the product to sell at different price points

- If you set a price that undercuts competitors, they may also cut prices to compete with you. Therefore, you should anticipate the consequences of the price point that you set

For simple pricing cases, you may not need to look at any of these considerations. However, more complex pricing cases may require you to think more creatively or thoroughly on what other factors may dictate the price point the company should set.

7. Deliver a recommendation

At the end of the pricing case interview, you’ll synthesize all of the work you have done to deliver a clear, concise recommendation.

You should try to structure your recommendation in the following way:

- Recommend the optimal price point or price range

- Provide the two to three reasons that support this

- Propose next steps

Next steps can include areas of your framework that you have not covered yet, additional pricing considerations, or any open questions that you don’t have answers to.

If you can’t think of next steps, ask yourself what you would need to know to make you more confident in your recommendation. This is a helpful way to generate ideas for next steps.

Pricing Case Interview Example

Watch the video below for a comprehensive example of a pricing case interview. This example came from BCG’s interactive case interview library.

For more practice, check out our article on 23 MBA consulting casebooks with 700+ free practice cases .

In addition to pricing case interviews, we also have additional step-by-step guides to: profitability case interviews , market entry case interviews , growth strategy case interviews , M&A case interviews , operations case interviews , marketing case interviews , and private equity case interviews .

Recommended Consulting Interview Resources

Here are the resources we recommend to land your dream consulting job:

For help landing consulting interviews

- Resume Review & Editing : Transform your resume into one that will get you multiple consulting interviews

For help passing case interviews

- Comprehensive Case Interview Course (our #1 recommendation): The only resource you need. Whether you have no business background, rusty math skills, or are short on time, this step-by-step course will transform you into a top 1% caser that lands multiple consulting offers.

- Case Interview Coaching : Personalized, one-on-one coaching with a former Bain interviewer.

- Hacking the Case Interview Book (available on Amazon): Perfect for beginners that are short on time. Transform yourself from a stressed-out case interview newbie to a confident intermediate in under a week. Some readers finish this book in a day and can already tackle tough cases.

- The Ultimate Case Interview Workbook (available on Amazon): Perfect for intermediates struggling with frameworks, case math, or generating business insights. No need to find a case partner – these drills, practice problems, and full-length cases can all be done by yourself.

For help passing consulting behavioral & fit interviews

- Behavioral & Fit Interview Course : Be prepared for 98% of behavioral and fit questions in just a few hours. We'll teach you exactly how to draft answers that will impress your interviewer.

Land Multiple Consulting Offers

Complete, step-by-step case interview course. 30,000+ happy customers.

Pricing plays a crucial role in a company's profitability as it directly contributes to it. For this reason, establishing optimal prices for products or services is of great importance. Business consultants therefore assist their clients in developing pricing strategies.

A case study on pricing is an analysis focusing on the pricing of a product or service. It can stand alone or be part of a broader case, such as entering a new market .

In a case interview , you can approach this case type in three steps:

1. Investigate The Company

At the outset of your case, you should gain a solid understanding of your client's business model .

- What products does the company sell and where does the company stand in the market? For instance, is the company a market leader? In terms of volume or quality or both?

- What is the company’s key objective? Profits? Market share? Growth ? Brand positioning? Make sure to clarify the objective before starting the analysis.

2. Investigate The Product

After familiarizing yourself with the company's business model, it's time to learn more about the product . When examining the product, it's important to pay attention to the following aspects:

- Product differentiation: Analyze how the client's product differs from those of competitors. Explore not only the product's features but also its production processes and methods.

- Unique Selling Proposition (USP): Identify the unique selling point of the product. What makes it unique and attractive to potential customers?

- Alternatives and substitutes: Consider alternative or substitute products in the market as well. How do they compare to the client's product?

- Product lifecycle : Determine the stage of the product lifecycle. This can influence the pricing and marketing strategy.

- Predictability of supply and demand : Examine whether supply and demand for the product are predictable. This can help assess risks in pricing and take appropriate measures.

Once you've thoroughly assessed these aspects, you'll have a clearer understanding of the product and its positioning in the market, which will inform your pricing strategy recommendations.

3. Choose a Pricing Strategy

The choice of strategy depends on the information gathered in the first two steps. There are three important pricing strategies:

(1) Competitor-based pricing ( Benchmarking ): With this strategy, the price is determined based on the prices set by our competitors. So, you want to find out:

- Are there comparable products/services?

- If yes, how do they compare to the client's product?

- What are their prices? Important: Keep in mind that competitors are likely to adjust their prices once the client introduces their product.

(2) Cost-based pricing:

With cost-based pricing, the price of a product or service is set based on the accumulated item costs (break-even) plus a reasonable profit margin. This strategy varies by industry due to different cost structures and margins. Therefore, it's important to understand the specific customer costs before setting a price (taking into account fixed and variable costs ).

Although cost-based pricing offers a simple and transparent method, it does not consider the perceived value of the product or service to customers and may be less effective in certain markets. To determine customer willingness to pay, it's important to consider this and possibly break down the price into different components, such as a separate price for the product and delivery costs.

(3) Value-based pricing:

Value-based pricing is a strategic approach based on assessing the customer's perception of the product or the amount customers are willing to pay. Different customer segments may have different willingness to pay . This means that companies can set different prices for different customer segments by adjusting the perceived value to justify price changes.

A good example of this is the iPhone, a highly differentiated product for which customers are often willing to pay significantly more than the pure costs plus a "typical" margin. This illustrates how customers are inclined to accept a higher price for products they perceive as particularly valuable or differentiated .

Key Takeaways

From what we've learned previously, we can now extract the following insights as key takeaways:

- There are three key pricing strategies: Competitor-based pricing, cost-based pricing, and value-based pricing . Cost-based pricing alone is sometimes considered insufficient.

- Understand the primary objective of the company (profit, market share, growth, brand positioning) as the basis for the pricing strategy.

- Know the business model, products/services, and market position of the company and consider it in your strategic approach.

Understand the customers' willingness to pay and needs, and adjust the pricing strategy to customer preferences and market conditions.

You Are Looking for More Pricing Cases to Practice with?

Check out our recommended resources or browse the Case Library for all cases on this topic.

👉 Company Case by INVERTO : VacuLuxe Innovations' Supply Chain Makeover

👉 Expert Case by Hagen : Retail Banking Profitability

👉 PrepLounge Case: Deep Water Rescue

Related Cases

Simon-Kucher Case: GST Cruise Company

Bank envelope, shaving & co.

MBB Final Round Case – Non-Profit Museum Revenue Increase

- Select category

- General Feedback

- Case Interview Preparation

- Technical Problems

The pricing strategy guide: Choosing pricing strategies that grow (not sink) your business

Choosing the pricing strategy for your business requires research, calculation, and a good amount of thought. Simply guessing may put you out of business. Here's what you need to know.

Definition of pricing

What are pricing strategies.

- Importance of pricing strategy

Top 7 pricing strategies

- 3 real-world examples

- How to create your strategy

- Determine value metric

- Customer profiles & segments

- User research & experiments

- Bonus: 10 data-driven tips

- Industry differences

- Final takeaway

Pricing strategies FAQs

Join our newsletter for the latest in SaaS

By subscribing you agree to receive the Paddle newsletter. Unsubscribe at any time.

Too many businesses set their pricing without putting much thought into it. This is a mistake causing them to leave money on the table from the beginning. The good news is that taking the time to get your product pricing right can act as a powerful growth lever. If you optimize your pricing strategy so that more people are paying a higher amount, you'll end up with significantly more revenue than a business who treats pricing more passively. This sounds obvious, but it's rare for businesses to put much effort into finding the best pricing strategy.

This guide will cover everything you need to know about setting a pricing strategy that works for your business.

Check out this introduction video made by the Paddle Studios team.

Price Intelligently is Paddle’s dedicated team of pricing and packaging experts for SaaS and subscription companies. We combine unrivaled expertise and first-party data to solve your unique pricing challenges, break the mold, and catapult your growth. Learn more

Pricing is defined as the amount of money that you charge for your products, but understanding it requires much more than that simple definition. Baked into your pricing are indicators to your potential customers about how much you value your brand, product, and customers. It's one of the first things that can push a customer towards, or away from, buying your product. As such, it should be calculated with certainty.

Pricing strategies refer to the processes and methodologies businesses use to set prices for their products and services. If pricing is how much you charge for your products, then product pricing strategy is how you determine what that amount should be. There are different pricing strategies to choose from but some of the more common ones include:

- Value-based pricing

- Competitive pricing

- Price skimming

- Cost-plus pricing

- Penetration pricing

- Economy pricing

- Dynamic pricing

Pricing is an underutilized growth lever

Many companies focus on acquisition to grow their business, but studies have shown that small variations in pricing can raise or lower revenue by 20-50%. Despite that, even among Fortune 500 companies, fewer than 5% have functions dedicated to setting the best price possible. There's a missed opportunity in the business world to see immediate growth for relatively little effort.

Navigating PLG billing and pricing? Read our latest guide on product-led SaaS

Because most businesses spend less than 10 hours per year thinking about pricing, there's a lot of untapped growth potential in optimizing what you charge. In fact, choosing the best pricing method is a more powerful growth lever than customer acquisition. In some cases, it can be up to 7.5 times more powerful than acquisition.

The importance of nailing your pricing strategy

Having an effective pricing strategy helps solidify your position by building trust with your customers, as well as meeting your business goals. Let's compare and contrast the messaging that a strong pricing strategy sends in relation to a weaker one.

A winning pricing strategy:

- Portrays value

The word cheap has two meanings. It can mean a lower price, but it can also mean poorly made. There's a reason people associate cheaply priced products with cheaply made ones. Built into the higher price of a product is the assumption that it's of higher value.

- Convinces customers to buy

A high price may convey value, but if that price is more than a potential customer is willing to pay, it won't matter. A low price will seem cheap and get your product passed over. The ideal price is one that convinces people to purchase your offering over the similar products that your competitors have to offer.

- Gives your customers confidence in your product

If higher-priced products portray value and exclusivity, then the opposite follows as well. Prices that are too low will make it seem as though your product isn't well made.

A weak pricing strategy:

- Doesn't accurately portray the value of your product

If you believe you have a winning product, and you should if you are selling it, then you need to convince customers of that. Setting prices too low sends the opposite message.

- Makes customers feel uncertain about buying

Just as the right price is one that customers will pull the trigger on quickly, a price that's too high or too low will cause hesitation.

- Targets the wrong customers

Some customers prefer value, and some prefer luxury. You have to price your product to match the type of customer it is targeted towards.

Let's now take a closer look at the seven most common pricing strategies that were outlined above with more from Paddle Studios .

Click on any of the links below for a more in-depth guide to that particular pricing strategy.

1. Value-based pricing

With value-based pricing, you set your prices according to what consumers think your product is worth. We're big fans of this pricing strategy for SaaS businesses.

2. Competitive pricing

When you use a competitive pricing strategy, you're setting your prices based on what the competition is charging. This can be a good strategy in the right circumstances, such as a business just starting out , but it doesn't leave a lot of room for growth.

3. Price skimming

If you set your prices as high as the market will possibly tolerate and then lower them over time, you'll be using the price skimming strategy. The goal is to skim the top off the market and the lower prices to reach everyone else. With the right product it can work, but you should be very cautious using it.

4. Cost-plus pricing

This is one of the simplest pricing strategies. You just take the product production cost and add a certain percentage to it. While simple, it is less than ideal for anything but physical products.

5. Penetration pricing

In highly competitive markets, it can be hard for new companies to get a foothold. One way some companies attempt to push new products is by offering prices that are much lower than the competition. This is penetration pricing. While it may get you customers and decent sales volume, you'll need a lot of them and you'll need them to be very loyal to stick around when the price increases in the future.

6. Economy pricing

This strategy is popular in the commodity goods sector. The goal is to price a product cheaper than the competition and make the money back with increased volume. While it's a good method to get people to buy your generic soda, it's not a great fit for SaaS and subscription businesses.

7. Dynamic pricing

In some industries, you can get away with constantly changing your prices to match the current demand for the item. This doesn't work well for subscription and SaaS business, because customers expect consistent monthly or yearly expenses.

Three real-world pricing strategy examples