Market research on consumer products, commercial industries, demographics trends and consumer lifestyles in Kenya. Includes comprehensive data and analysis, tables and charts, with five-year forecasts.

Market research on consumer products, commercial industries, demo...

- Country Briefing

- Country Report

- Strategy Briefing

- Alcoholic Drinks

- Beauty and Personal Care

- Consumer Health

- Cooking Ingredients and Meals

- Dairy Products and Alternatives

- Economies and Consumers

- Packaged Food

- Soft Drinks

- Staple Foods

- Tissue and Hygiene

- Most Relevant

- Newest First

- Oldest First

- 10 Per Page

- 20 Per Page

- 50 Per Page

Income and Expenditure: Kenya

In 2023, Kenya ranked 19th among 25 Middle East and Africa nations in terms of average gross income, despite economic recovery and growth in key sectors. However, high public debt and global economic instability posed challenges. Furthermore, income…

Sweet Biscuits, Snack Bars and Fruit Snacks in Kenya

Sweet biscuits, snack bars, and fruit snacks in Kenya is undergoing a transformation driven by two key consumer trends in 2024: price sensitivity and a growing focus on health.

Sugar Confectionery in Kenya

Sugar confectionery in Kenya is experiencing significant growth, fuelled by a steadily expanding population and rising disposable incomes. This translates to increased consumer indulgence in sugary treats. The affordability of sugar confectionery…

Snacks in Kenya

Snacks in Kenya is undergoing a period of significant transformation, driven by a confluence of factors including inflation, evolving consumer preferences, and emerging trends. Inflationary pressures have led to increased production costs, prompting…

Savoury Snacks in Kenya

The economic landscape in Kenya is conducting the orchestra of consumer behaviour in packaged food, including savoury snacks, in 2024. Inflation has taken centre stage, leading to a heightened focus on affordability. Kenyans are becoming increasingly…

Ice Cream in Kenya

A confluence of factors, including rising inflation and increasing production costs, has made Kenyan consumers more sensitive to price in 2024. This newfound price consciousness is translating into a shift in purchasing behaviour, with consumers…

Gum in Kenya

Despite rising inflation and price increases across most consumer goods, the gum category is exhibiting resilience in Kenya in 2024. This can be attributed to the continued demand for gum due to its widespread availability in major retail channels…

Chocolate Confectionery in Kenya

The year 2024 has witnessed a significant increase in price sensitivity among consumers due to rising inflation, leading to a sharp rise in chocolate confectionery prices in Kenya. This has resulted in stagnant sales volume growth within the…

Wine in Kenya

Wine in Kenya is experiencing robust growth driven by the country’s expanding middle class who have an increasing appreciation for wine. This expansion is predominantly fuelled by increased consumer awareness, which in turn is a result of concerted…

Spirits in Kenya

Spirits in Kenya experienced significant growth in terms of total volume sales over the review period, fuelled by the growing popularity of international brands. Increased importation of a diverse range of international spirits has been instrumental…

Rtds in Kenya

In Kenya, consumers especially in younger generations are drawn towards RTDs. Sales are increasing in the off-trade channel as consumers embrace outdoor drinking and enjoy outdoor activities such as road trips, camping etc. E-commerce has emerged as…

Cider/Perry in Kenya

Characterised by fruity flavours and lower alcohol content, cider/perry is gaining popularity in Kenya, especially among female and younger consumers who may be new to alcohol. Notable brands like Savannah Premium Dry Cider, Hunter’s Gold from Kenya…

Beer in Kenya

Beer volume sales slowed considerably in Kenya over 2023 following two years of strong growth in the post-pandemic era. High inflation in the country continues to cut into disposable incomes, with beer consumers cutting back on consumption and…

Alcoholic Drinks in Kenya

Alcoholic drinks in Kenya is undergoing dynamic shifts, with spirits gaining popularity over beer in the current inflationary climate. Spirits, with their high alcoholic content, have set themselves apart in the market, offering consumers a…

Commodities: Kenya

The commodities country overview provides comprehensive data on production, consumption and price trends on key commodities markets. The commodities overview in Kenya covers production and consumption trends in agricultural commodities, energy…

Tobacco in Kenya

The tobacco industry in Kenya in 2023 continued to face significant challenges from illicit trade and regulatory uncertainties. This is impacting major players such as Mastermind Tobacco (K) Ltd and British American Tobacco Kenya Ltd, leading to…

Cigars, Cigarillos and Smoking Tobacco in Kenya

Sales in cigars, cigarillos, and smoking tobacco in Kenya managed to achieve small positive volume sales in 2023. This is attributed to similar sales in both cigars and cigarillos, while smoking tobacco is not significant enough to be covered by…

Cigarettes in Kenya

Cigarettes only managed sub-decimal growth in volume terms in Kenya in 2023, while value is better supported by price hikes. One key reason for the low volume performance is because the tobacco industry in Kenya faces significant challenges stemming…

Economy, Finance and Trade: Kenya

In 2023, Kenya’s economy grew by 4.7%, outperforming the average for the Middle East and Africa, driven by private spending, public consumption and a recovery in tourism. Despite challenges like high public debt and cost of living increases, the…

Sun Care in Kenya

Kenya’s sun care market saw consumers shift in line with prevailing industry-wide trends in 2023, as demand for cruelty-free, eco-friendly, and natural and organic ingredients continued to rise. Consumers are also seeking multifunctional variants,…

[email protected]

Market Research in Kenya, Africa

Market Research in Kenya

The Republic of Kenya is an East African country located to the north of Tanzania. It is east of Uganda and southeast of South Sudan. Ethiopia is to the north and Somalia to the northeast. The Indian Ocean is to the southeast.

Key Industries in Kenya

The Kenyan economy is agriculture-based. Agriculture accounts for a little over one-third of the GDP. The traditional exports are tea and coffee. Kenya also has a budding horticultural industry.

The agricultural sector consists of crop production, horticulture, livestock, forestry, and fisheries. Production of crops and horticulture add the most to the agricultural GDP. This sector provides a backbone for the Kenyan economy. It also offers a means of making a living for the population.

The industrial sector is also a huge contributor to the GDP. The country has a well-developed industrial sector, and it is the market leader in East Africa. This sector accounts for one-tenth of the GDP, and manufacturing is thriving.

The construction and real estate sectors are also growing. This growth is due in part to government investment in the public infrastructure. Kenyans are also putting money into real estate.

Due to the COVID-19 pandemic, experts expect Kenya’s growth to decline. The country has reduced trading. Also, the coronavirus has disrupted supply chains and domestic production. Despite this, the government remains hopeful. It is continuing to promote education, trade, and investment. They hope the economy can continue the upward trend seen before the pandemic.

Neighborhoods in Kenya

Kenya is has a vast amount of flora and fauna, which are part of the country’s natural beauty.

The main cities in Kenya are Nairobi, Mombasa, and Kisumu. Nairobi, the capital, is the largest. This city gives the nod to its colonial past by using many English place names. In Nairobi, the wealthier residents usually live in the west and north-central regions. The European settlers resided in these regions during colonial times. In contrast, the lower-middle and upper-middle-income neighborhoods are in the north-central areas of the city.

Mombasa, the second-largest city, is on the southeast coast of Kenya. It is tourism-based and has an international airport. It is also home to the third-largest port in Africa.

Kisumu, the third-largest city, is beautiful. The city is breathing new life into its downtown and lower town areas with an urban rejuvenation project. It is updating the look of the lakefront and easing the crowding of main streets, making them easier for pedestrians to navigate.

Over the past decade, Kenya has seen much economic growth. This growth is owing to the political and economic reforms which it achieved. Unfortunately, the ongoing pandemic has affected this growth.

The main development challenges include poverty and climate change. Kenya also has an unequal society, and private sector investments are low.

For now, Kenya’s economic outlook is bleak. Economists expect the country to make a slow recovery. The pandemic has wreaked havoc on Kenya’s exports and tourism. It has also hurt other domestic economic activities. Yet, Kenya has a long-term development plan that makes manufacturing a priority. The plan also includes universal healthcare, affordable housing, and food security.

Benefits and Strengths in the Market

The agricultural sector is the pride and joy of the Kenyan market. Kenya is the third-largest tea producer in the world. The services sector is also expanding. Its economy is crucial to the East-African community. It is Africa’s number-one common market and the seventh-largest African economy.

Consumer Base in Kenya

A small number of consumers in Kenya have benefitted from the rapid expansion of the economy. But a much larger number has seen little to no benefit. Thus, they suffer the effects of inflation. Poverty and malnutrition remain significant issues for many Kenyans.

Reasons to Grow Your Business in the Kenyan Market

Kenyan markets offer many cheap opportunities for investors. Kenya has lower operating costs than other emerging markets, and investors thus have a competitive edge on rent and labor costs.

Also, Kenya occupies a prime geographical location. It has access to the main shipping routes coming from both Europe and Asia. And, the Kenyan market is not very developed. Thus, new businesses will experience a lack of competition during startup. This situation increases the possibility of rapid growth within a short period. New companies can expect to get government support. The government is encouraging growth within various sectors.

About Market Research in Kenya

It’s essential to do Quantitative , Qualitative , and Strategy Research . Businesses should carry out these checks before entering any market. Doing market research on Kenya is particularly crucial. It helps new companies to determine the best market entry strategy.

Market research can involve visiting the market. Such visits help with the engagement of potential local partners. They aid in building relationships and finding market opportunities. Market Research can also involve Focus Groups, Interviews, and Surveys.

Expand globally with confidence. Contact SIS International today!

Subscribe to our newsletter.

SIS International is a leading provider of Customer Insights, Market Research, Data Collection & Analysis, and Strategy Consulting.

Privacy Policy

Free E-books & Resources

Register for Focus Groups

Participate in Focus Groups

+1 917 536 0640

© 2024 SIS International Market Research

Download our Profile

Infinite Insight is a full- service market research agency established in 2010. From our hub in Nairobi, we offer qualitative and quantitative research services across Sub- Saharan Africa. To date, we have carried out projects in 30 African markets in East, West, and Southern Africa.

We have put together a team of young, dynamic professionals, who are committed to delivering high quality results.

Capacity building is an ongoing process, to which we are thoroughly committed. In addition to project- specific briefings, we regularly organise training sessions on specific topics, both in qualitative and quantitative techniques and methodologies.

We adhere to the ICC/ESOMAR Code of Practice , the MSRA Code of Ethics , and the European Union’s General Data Protection Regulation , which is being embraced by an increasing number of African countries. Since the Kenyan Data Protection Act of 2019 ,came into effect, all projects in Kenya are guided by the regulation.

INSIGHT WELLS

Insight Wells Research and consulting, a subsidiary of CIO Africa, is a fully fledged market research agency registered as a limited company in Kenya, With footprint across East Africa and beyond.

Welcome to Insight Wells

Insight Wells Research and consulting, a subsidiary of CIO Africa, is a fully fledged market research agency registered as a limited company in Kenya, With footprint across East Africa and beyond.

Our Mission

To be the leading, most sort after, tech driven market research agency in Sub – Saharan Africa

Championing excellence in Market research practices across Africa and beyond

Our Confidence

Presenting your tomorrow today

Top 20 Market Research Companies in Kenya

- Market Research

The Best of September 2024

Looking for a top market research company in kenya.

Before you proceed with developing and marketing a new product or service, you need to make sure there is a viable market for success. The right market research company can help you with this process. Read more +

To assist you in your search for a partner, we’ve compiled this list of the top market research agencies in Kenya. Browse descriptions, feedback, and awards to find which can best suit your company’s needs.

List of the Best Kenya Market Research Agencies

Featured providers

Aryo Consulting Group

Service Excellence

Would Recommend

- Min. Project Size "> $10,000+

- Company Size "> 2 - 9 employees

- Location "> Boston, MA

- Consumer products & services " >

- Financial services " >

- Government " >

- Medical " >

- Hospitality & leisure " >

- Manufacturing " >

- Min. Project Size "> $25,000+

- Company Size "> 10 - 49 employees

- Location "> San Francisco, CA

Antedote is a strategic innovation and insight consultancy in San Francisco and London, United Kingdom. Founded in 2014, they have about 8 employees that serve enterprise and midmarket clients in a wide variety of industries. Services include business consulting and market research.

- Information technology " >

Research 8020 Limited

- Min. Project Size "> Undisclosed

- Location "> Nairobi, Kenya

Headquartered in Nairobi, Kenya, Research 8020 Limited is a market research company that offers social research and fieldwork services. Since 2017, their team of 10 services midmarket companies and small businesses.

- Safaricom Limited

- Business services " >

Get connected with a company for free

Tell us about your project, and we'll match you with vetted companies that meet your requirements.

Opinion Space LTD

Not yet reviewed.

- Min. Project Size "> $1,000+

- Company Size "> 50 - 249 employees

DMI Analytics

Datum Intel is a Nairobi, Kenya-based market research company. Launched in 2016, the small team offers market research, marketing strategy, business consulting, and transcription.

- Energy & natural resources " >

ReelAnalytics

- Advertising & marketing " >

Neotrends Research Africa Ltd

Daproim africa.

- Company Size "> 250 - 999 employees

Chora Digital Limited

- Min. Project Size "> $5,000+

- eCommerce " >

Morph Visuals

- Last Minute Mara

- Education " >

VoicesAfrica

Wpp-scangroup.

- Company Size "> 1,000 - 9,999 employees

Gina Din Group

Impact africa limited, adpro-consult group, the jitu staffing.

- Location "> Nyeri, Kenya

2020 Marketing

- Location "> Nairobi City, Kenya

TDF Group ltd

TDF Group ltd is a small branding company. They focus on branding, marketing strategy, media planning & buying, public relations, and more and were launched in 2008.

Bylac Limited

Scale pr & marketing solutions, royaltrendia - digital media marketing, web design & seo in kenya, star marketing company, accurate africa eservices ltd.

- Telecommunications " >

IQ Marketing Kenya

Get connected with the right company for you

We'll do the work for you – finding and connecting you with service providers that meet your exact requirements.

Related content

Mobile Application Marketing Companies in Kenya

Inbound Marketing Agencies in Kenya

Email Marketing Firms in Kenya

Digital Marketing Companies in Kenya

Event Marketing Companies in Kenya

Content Marketing Agencies in Kenya

Local SEO Agencies in Kenya

Mobile Optimization SEO Companies in Kenya

Recommended Digital Marketing Articles

Best local seo tools, 5 benefits of ppc management for small business, how to implement hyper-personalization strategies, how to reach more donors: seo for nonprofits.

Excellence is in the details

Acuity Market Research LTD is an independent Consumer, Trade, Market & Social Research organization.

With our head office in Nairobi, Kenya and network offices across Sub Saharan Africa, Acuity Market Research LTD offers survey management, Data Collection and Data delivery experience and capability.

To be Africa's preferred partner in providing premier Market and Social research solutions.

To deliver superior market and social research services, quality assurance and undivided customer support through professional expertise, experience, motivation and commitment.

Our Philosophy

We put our� Customers�first and strive to secure their loyalty through top quality service.

Products and services

As dedicated masters of Field and Tab in Sub Saharan Africa as well as a full service research company for the Kenyan market, Acuity Market Research LTD is experienced in Data Acquisition (DA), Project management, Data Analysis, Reporting and presentation across Sub Saharan Africa.

Why work with us

Our researchers have a wide knowledge, long past experiences and track record in conducting and carrying out successfully all our service offering for various companies. Through our hard work, we have established strong relationships with each one of them.

These are some of the clients we've done projects for:

Why work with us with us

BMI Research

BMi Research is a long standing full service research house specialising in qualitative and quantitative research solutions. The BMi team understands industrial and manufacturing research, wholesale to retail intelligence and shopper insights.

Plus 94 Research

Plus 94 Research is a market research company that is so unique in its thinking and vision it is set to significantly enhance the service experience of clients.

Brand Vision

Insightful research, Clear vision. We are an established worldwide group of marketing and research agencies that offer and develop international research and consulting solutions.

Tream Insight

Impact Research Centre

Leading Marketing and Social Research Firm. Providing research solutions that are actionable and which provide our clients with accurate information and guidance to enable them make informed decisions.

July 2010 Our Humble Beginnings

Proin iaculis purus consequat sem cure digni ssim. Donec porttitora entum suscipit aenean rhoncus posuere odio in tincidunt. Proin iaculis purus consequat sem cure digni ssim. Donec porttitora entum suscipit.

January 2011 Facing Startup Battles

Proin iaculis purus consequat sem cure digni ssim. Donec porttitora entum suscipit aenean rhoncus posuere odio in tincidunt. Proin iaculis purus consequat sem cure digni ssim. Donec porttitora entum suscipit aenean rhoncus posuere odio in tincidunt.

December 2012 Enter The Dark Days

Proin iaculis purus consequat sem cure digni ssim. Donec porttitora entum suscipit aenean rhoncus posuere odio in tincidunt. Proin iaculis purus consequat sem cure digni.

January 2013Our Triumph

Proin iaculis purus consequat sem cure digni ssim. Donec porttitora entum suscipit aenean rhoncus posuere odio in tincidunt. Proin iaculis purus consequat sem cure digni ssim. Donec porttitora entum suscipit aenean.

our amazing team

Proin iaculis purus consequat sem cure.

Kimberly Thompson

Rico Massimo

Graphic Designer

Proin iaculis purus consequat sem cure digni ssim donec porttitora entum suscipit aenean rhoncus posuere odio in tincidunt proin iaculis.

Get in touch with us

P.O Box 8260 - 00300

Nairobi, Kenya

(254) 020 4401535

Acuity Market Research Limited

Acuity Market Research

acuity_research

For your online queries, please use the contact form below:

Copyright Acuity Market Research 2015

SagaTracker

- Online Panels

- Qualitative

- Our offices

- Our presence

- In the News

Market research in Kenya

Kenya has witnessed extremely impressive growth over the past decade. This is in great part thanks to increasing political stability and economic reforms since the 2007 elections. The country however faces some challenges, such as poverty, corruption, and slow private sector investment.

About Kenya

Kenya, located in East Africa, is one of the most developed countries on the continent. Its economy, mostly dominated by agriculture, is diverse and growing. Nairobi, its capital, is a hub in the Horn of Africa for trade and culture. It shares borders with Tanzania, Uganda, South Sudan, Ethiopia, and Somalia. It also holds a coastline on the Indian Ocean. Kenya has an extremely rich and diverse nature and wildlife.

The country is eclectic, with port cities like Mombasa, savannahs and countryside with fertile soil and wildlife, and major urban centers in the plains of the Great Rift Valley like Nairobi or Kisumu on the banks of Lake Victoria.

Why conduct market research

The pandemic has also greatly impacted one of Kenya’s key sectors in tourism. As global travel came to a global halt, the service sector greatly suffered. However, a few industries are instrumental in maintaining growth in the Kenyan market, such as tea and coffee production. Furthermore, Kenya is the most important economy in the East-African community.

You will find industries from agribusiness and processing, aviation and parts, construction, education, and energy flourishing and providing investment opportunities. The government is also making conscious efforts to facilitate the inflow of foreign capital with the Public Private Partnership bill. The bill in question looks to enhance efficiency and streamline regulation. Furthermore, Kenya is a regional leader in the digital economy, making its consumer base conscious of global consumer trends.

Representative market data

Kenya’s population is extremely diverse, and is made up of over 40 ethnic groups. As a result, effectively capturing the essence of its consumer can prove very difficult. It is however key to do so in order to ensure the successful implementation or growth of your business in Kenya.

Here at Sagaci Research, we are able to give you the tools to truly understand Kenya’s diverse consumers and make informed decisions based on quantitative and qualitative data analysis. Here are some of our product offerings:

Market research methods in Kenya

Online panel.

You will gain access to thousands of our on-the-ground panel in Kenya, which will allow you to gain valuable information about consumers’ opinions across a number of demographics. Click here for more information .

Take an objective look at the health of your brand and turn the findings into valuable results. You can choose between receiving reports on a monthly, quarterly, or bi-annual basis. Start monitoring your brand health in Kenya today. Find out about your options here .

Gain access to a report about your target consumer’s consumption habits. Within your country of interest, you can pick from a list of over 140 items and download your report today! Gain access here.

You can get information about which retail channels are most effective for your products. Get direct measurements that are tailored to your needs. Contact us here .

More about syndicated research in Kenya

Ride-Hailing Services in Africa: 2024 market insights

Ride-hailing services in Africa are revolutionising urban transportation, fueled by growing connectivity and the rising demand for convenience. They seek to tackle the inefficiencies of public transport and often chaotic private transportation systems, providing a structured, technology-driven alternative. Leading players like Uber, Bolt, and Yango are at the forefront, driving the African ride-hailing market forward

The Young Kenyan Consumers: Shopping Habits and Attitudes

Who are the young Kenyan consumers, particularly upper-class men? What influences them the most? What are the consumption trends in Kenya for this segment? Thanks to SagaCube, the consumer habit tracker in Africa and our online panel in Kenya, we delve into the profile of Kenyan male consumers aged 18 to 25 from the highest

The largest product database in Africa

For over 12 years, Sagaci Research has curated the largest product database in Africa. Through the expansive reach of our pan-african online panel we consistently gather product data directly from consumers themselves. Today, our database boasts over 400,000 products sourced from 30+ African countries and across dozens of FMCG categories. Leveraging the largest product database

The top Foodservice brands in Kenya based on Customer Satisfaction

Today we explore the top foodservice brands in Kenya in terms of Customer Satisfaction. In a highly competitive fast food industry with new international players entering the market, it is even more critical for the various players to keep a close eye on their performance and consumers’ perception. Via the pan-african online panel SagaPoll, we track

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

- Webinar Archive

- Upcoming webinars

- Digital Library

- Our Clients

Public Policy & Social Research Our organization will help youlearn about people and societies so that they can design products/services that cater to various needs of the people

- Monitoring & Evaluation

- Impact Assessment

- Longitudinal Study

Social Research Enquiry

Consumer & market research this service evaluates communication process and examines the relationships among the media endeavors and the target audience..

- The Consumer

- Products or Services

- target Market

Market Research Enquiry

Omnibus do you want to conduct research but feel the burden of acquiring customized tools omnibus quicky helps you gain insights from the general public.

- Face to face and CATI

- High response rate

- Data collection tool design

- cost effective

Research Outsourcing This service evaluates communication process and examines the relationships among the media endeavors and the target audience.

- Call center with 50+ executives

- Record time research delivery

- Ad-hoc studies

Call Centre Enquiry

Understand the performance of your leader and county government.

NIGERIA STATETRAK

Understand the performance of your leader and state government.

The performance of your state government

Featured infotrak polls.

Infotrak Gen Z’s Poll Media Release July 18 2024

IntroductionWelcome to the Gen Z Poll Report for July 2024! We are thrilled to share the findings from our recent survey, which captures the thoughts and opinions of Gen Zs across Kenya. This report delves into their views on significant current issues, particularly the ongoing youth-led protests. Our goal...

THE INFOTRAK VOICE OF THE PEOPLE POLL RELEASE! JUNE 2024

As the Financial Year 2023/2024 nears its end, the latest Infotrak Voice of the People Poll has gathered citizenry views on the direction of the country, key issues of concern, and the Finance Bill 2024. Read more

Emerging Trends in Public Policy Research: The Role of Inferential Statistics in Evidence-Based Policymaking

Emerging Trends in Public Policy Research: The Role of Inferential Statistics in Evidence-Based Policymaking By Samson Omondi, Public Policy Researcher at Infotrak Research and Consulting. Date: 28th May 2024. Evidence-based policy making involves using rigorous data and research to inform policy decisions. Inferential statistics play a crucial role in this process...

Get Started Now!

Register for the InfoTrak Newsletter and get regular tips and insights

- Top Digital Marketing Companies

- market research

Top Market Research Companies in Kenya

Are you searching for competent market research companies in Kenya? Your business needs a dynamic and boutique market research company that can unearth useful intelligence beneficial for your brand growth. It would help if you found such top market research companies in Kenya that can guarantee to offer innovative solutions for all your market research needs. GoodFirms has used its business intelligence to prepare the below list of marketing research firms in Kenya that provides all the information you need to form a reasonable choice. Use the data, analysis, and rankings to find the best market research agency in Kenya for your business.

- Most Reviews

Best Market Research Agency in Kenya | List of Marketing Research Firms Kenya

Jeder Agency

We are a customer-centric company that focuses on web design and content optimization through innovative products and services. To stand out from the rest, one must have an arsenal at your disposal that does things ... read more about Jeder Agency

DimeHub serves as a results-driven digital marketing company in 🇰🇪 Kenya which offers digital marketing services to better help you generate qualified Sales, 🕴️Potential Leads & 📈 boost Website traffic. DimeHub combines a data-driven approach with ... read more about Dimehub

Consumer Option

Consumer Options is a full service market research company. We deliver insights by combining research outcomes; real time data and smart thinking to enable you make insightful decisions. We have the flexibility of conducting Market ... read more about Consumer Option

Sagaci Research

With offices in 15 African countries and field operations in a further 11, Sagaci Research is the leading provider of African market data and analysis. Outside of Africa, we have offices in Barcelona, Paris, Hong ... read more about Sagaci Research

Frontier Consulting

Frontier Consulting Services Ltd is a pan- African based market research agency that is versatile enough to conduct 360º degree research projects anywhere in Africa and flexible enough to support unique data collection needs across ... read more about Frontier Consulting

Market data gathered by marketing experts to help businesses and buyers make the right decision. Know when to buy and where to buy. Gain a better understanding of the Kenyan market. Know the top players, ... read more about Inisights

SBO Research

SBO Research is a fast-growing Marketing and Social Research company founded in 1993 and headquartered in Kenya with a regional operational footprint that spans across 26 countries in Africa. We provide full consultancy service to ... read more about SBO Research

Infinite Insight

Infinite Insight is a full-service market research agency established in 2010. From our hub in Nairobi, we offer qualitative and quantitative research services across Sub-Saharan Africa. To date, we have carried out projects in 29 ... read more about Infinite Insight

Research 8020

Since 2017, Research 8020 has been offering a full range of qualitative and quantitative research solutions. We work with consumer and business to business audiences across sub-Saharan Africa. We also have market research solutions for ... read more about Research 8020

Consumer Trends Limited

Consumer Trends is a professional services firm specializing in Research services and business advisory specifically focusing on planning, strategy and training. The success of Consumer Trends in assignments can be pegged to offering quality services ... read more about Consumer Trends Limited

Neotrends Research Africa

Neotrends Research Africa is a market research data collection firm based in Nairobi, Kenya. It is one of the Africa’s fastest growing Market Research data collection firm with footprints and a field force of more ... read more about Neotrends Research Africa

DMI Analytics

We empower frontline teams with everything they need to know to drive growth, navigate the customer and competitive dynamics affecting your brand. We conduct market research in African countries and can measure in any other ... read more about DMI Analytics

Tabison Research

Tabison Research has been making inroads in the market research world for several years. We have innovative and seasoned group of Research professionals with experience in handling the needs of a variety of clients ranging ... read more about Tabison Research

Eujim Solutions Limited

As the digital landscape continues to evolve, businesses must adapt to meet the needs of their customers. At Eujim Solutions, we are dedicated to helping businesses in Kenya plan, design, and build digital products ... read more about Eujim Solutions Limited

Explosify Creative Solutions

Ready to ignite your business? Discover Explosify, the digital marketing agency that sets brands ablaze. If you are: Tired of ineffective marketing efforts that bring no leads? Ready to break free from the cycle of ... read more about Explosify Creative Solutions

DAROPO INSIGHTS CENTRE

Daropo Insights Center is an independent Market Research & Economic Development consultancy firm that provides a broad spectrum of comprehensive market research solutions with experience in Kenyan Market and across Sub-Saharan Africa and the continent ... read more about DAROPO INSIGHTS CENTRE

Oraund Digital Consulting

Oraund Digital Consulting is a digital marketing agency specializing in supporting individuals and businesses to optimize their online presence for branding purposes. Our expert teams deploy their expertise and creativity, along with innovative tools, to ... read more about Oraund Digital Consulting

Dotsavvy Limited

Dotsavvy is Kenya’s first digital business agency that provides integrated digital business solutions to some of Africa’s biggest businesses and most loved brands. We are driven by the challenge of reconciling our clients user needs ... read more about Dotsavvy Limited

Witflair Enterprise Ltd.

We are built for businesses looking to maintain and grow larger audiences through digital marketing. We help such businesses follow best practices with their branding and content marketing for improved sales. As a design agency ... read more about Witflair Enterprise Ltd.

Charleson Group

Charleson Group is the leading digital marketing agency in Nairobi, Kenya. We help businesses in Kenya increase their revenues 3x, 5x or even up to 10x through our proven digital marketing strategies.

Dodwell Solutions Limited

Dodwell Solutions Limited is an award winning digital marketing agency, top on the list of best digital marketing agencies in Kenya, that helps companies and institutions attract and retain customers all over the globe by ... read more about Dodwell Solutions Limited

East Africa Digital Marketers

East Africa Digital Marketers is a marketing company that deals with online marketing, with an interest in social media. We market for companies using online tools and softwares, and maintain social media accounts at affordable ... read more about East Africa Digital Marketers

Infinity Rayz

InfinityRayz is a marketing and branding agency where innovation meets impact in the digital realm. We are not just a marketing agency; we are architects of success, committed to guiding your brand to new heights. Customer-Centric ... read more about Infinity Rayz

TECHenya Solutions

TECHenya Solutions is a leading digital marketing agency based in Nairobi, Kenya, with a broad service reach extending to Kenya, Uganda, Tanzania, East Africa, and beyond, including markets in the United States, the United Kingdom, ... read more about TECHenya Solutions

We are strategists, researchers, writers, designers, and developers who craft custom digital experiences for publishers, nonprofit institutions, and brand. 5th Brand transforms online presence, publishing and content creation through the delivery of scalable digital solutions and products, exclusively built on WordPress. ... read more about 5th Brand

Digital Marketing in Kenya - Digitalke

Digital-ke is a digital marketing Consultant in Nairobi, Kenya offering consultation for online businesses,e-commerce solutions,social media marketing,Google & YouTube advertising,Website design,SEO,web banner ads, inbound marketing, email marketing, Mobile App Optimization, Graphic Design

Page Agency Kenya

At Page, we are a team of professional designers, developers, marketers, and IT specialists who are passionate about creating exceptional web designs and strategies that are customized to meet your business needs. Our services include ... read more about Page Agency Kenya

Digital Tailor Agency

Digital Tailor is Nairobi’s home of IT and Digital Marketing. We tailor custom software, design beautiful websites, provide secure hosting and integrate Mpesa payments. In digital marketing, we execute measurable marketing strategies with insightful analytics ... read more about Digital Tailor Agency

Zelisline Ltd

Zelisline is software development company that specializes in building custom software solutions for businesses. We have a team of highly skilled developers, designers and project managers who work together to deliver high-quality software products to ... read more about Zelisline Ltd

Can’t find the right partner for your project?

Get a list of best-fit companies handpicked by our experts that match your requirements.

PANORAMA RESEARCH IS KEEPING A CURIOUS EYE ON EMERGING MARKETS IN AFRICA

Build the best products, cause no unnecessary harm, use business to inspire research tools and implement solutions to the business-related challenges.

At PANORAMA RESEARCH We Value Our Clients

Our research process helps you produce innovative ideas, products and services that benefit both customer and company.

We Exist Because our Clients Believe In Us.

Customer service plays a major role in your business. It's the leading indicator for measuring customer loyalty. Identify your unhappy customers, reduce the churn, and increase the revenue. It's also a key point of differentiation which helps to attract fresh customers in a competitive business environment. There are a number of reasons why good customer service is important. Businesses know that providing positive experiences for buyers can dramatically impact their growth. But often customer service takes a back seat to the daily demands of running a business. ... This approach helps businesses engage customers and build strong relationships.

How We Do It

At Panorama Research, We have a hybrid research methodology that addresses all your research questions and provides insights that fuels your growth

- Quantitative Research

In this, we undertake: U & A Studies, Central Location Testing, Mystery Shopping, Retail Audit and Store Census.

- Qualitative Research

On qualitative research, we are specialized in undertaking: Focus Group Discusions, Indepth Interviews, Ethnography and Observation.

Focus Sectors

Our main focus sectors include but are not limited to; FMCG, Technology & Innovation, Banking & Finance, Healthcare & Pharma Research, Media & Advertising Research, Automotive Research, Textile & Apparel, Real Estate & The Built Environment.

PANORAMA IS A CREATIVE RESEARCHER

Study Implications. The purpose of research is to inform action. Thus, your study should seek to contextualize its findings within the larger body of research. Research must always be of high quality in order to produce knowledge that is applicable outside of the research setting. Let us team up and make a difference.

Basically its quite important to carry out research to investigate any claim or feedback to improve your business Work together with Panorama Research to achieve this.

Market Research

Identify the problem areas in your business. Understand the needs of existing customers.

Social Research

The market and social research industry is a community of professionally curious to investigate new changes.

Retail Audit and Census

Retail audit is very important for a brand's health, as regular check ups for a human's health.

Media Monitoring

Media monitoring is an important aspect of your marketing strategy. Monitoring will keep your brand health up to date.

Research Training

The Importance of Basic Science and Research Training for the Next Generation is innevitable.

We cover various sectors in a number of industries.

Panorama Methodologies

We uniquely employ a multiplicity of methodologies and methods to stitch up insights to panoramically answer all your research questions

- All Research Methods

Qualitative Study

Quantitative study.

To understand how consumers really think and feel, it's important to go beyond words~ Katja Bresette

Our African Footprint

The firm & why us.

Panorama Research is a full-service pan-African market and social research company based in Kenya, and which was founded out of the need to support international (market research) firms undertake market research in emerging markets like Kenya and Africa by extension. The name Panorama defines our inimitable fashion of addressing our clients’ research problems with a holistic 360˚ approach. In order to serve our clients with a pan-African reach, we leverage an expansive field network of well-trained in- country coordinators and enumerator teams in over 25 markets across sub-Saharan Africa as well as S.E Asia, Latin America, UAE & the Levant region. We deliver insights from emerging markets across a multiplicity of industries and sectors.

We are a market research company with operations in Nairobi, Kenya but with an expansive network of in-country teams in a number of countries across Africa and the world by extension. We employ unique methodologies to unearth latent insights across different consumer audiences in multiple industries and sectors.

The 21st Century Consumer As An Insights Partner

We place high premium on the 21 st Century consumer as the progenitor of sound business decisions. Further, our corporate culture is anchored on the core premises of continuous insight-innovation (through mobile technology), agility in project-execution and the high premium we place on quality in every step of the research process, including needless to say, client-outputs. We view the neo-consumer as a partner in insight acquisition, and not just a purveyor of data to drive business decisions that he is not part of. When it comes to cultivating consumer relationships, we have in place a ‘buddy methodology’ which is a sui generis constellation of different frontline consumer personas (alpha users) who constitute proprietary panels drawn from our varied industries of coverage.

- Innovative company.

- Easy to use tools.

- Real time studies.

- Granular feedback.

Our Process

We employ an elaborate research process that is collaborative, intuitive, empathetic, iterative, and which is optimized for all your business needs

Find more information about Panorama Research, We value you as our Customer and Partner Work with self motivated team at Panorama

Our Top Skills

Our history.

We love technology and its impact in the world. ... A: The value of technology is to make work easier to manage and to accomplish tasks

We do it with less effort and greater flexibility.

Emerging technologies are technologies that are perceived as capable of changing the status quo. .

Emerging technologies include a variety of technologies such as educational technology

Technology trend awareness as a skill refers to being mindful of the technology that is recently becoming popular and is readily accepted in the market or industry. ..

Ideal technology trend awareness skills would mean a person's ability to either correspond to the industry.

Here are upcoming / emerging technologies in software industry to dominate 2018 and make headlines.

Seamless Voice Recognition (Conversation with Machines)

How we work

Our time of operation, responding to clients querries.

Here is a photographic documentation of our success stories

MOBILE PENETRATION

Sub-Saharan Africa ... The GSMA Mobile Economy series provides the latest insights on the state of the mobile industry worldwide. ... The global version of the report is published annually at Mobile World ... NET TOTALS - SUBSCRIBERS .... For more information, please visit the GSMA corporate website

Louise S. Morgan

Consumer Price Index CPI in Kenya increased to 194.14 Index Points in September from 192.18 Index Points in August of 2018. Consumer Price Index CPI in Kenya averaged 144.42 Index Points from 2009 until 2018, reaching an all time high of 195.05 Index Points in May of 2018 and a record low of 99 Index Points in January of 2009.

Latest Blogs

Keep abreast of the latest market news from all industries we are in and from all emerging markets in Africa.

While fresh products are gaining share in Africa market

Mobile money hits 1.7 trillion, mobile banking in kenya, get in touch.

Find us on the below address We are happy to work with you

Contact Information

- Login

- Register

Market Research Services Companies

Unearth Powerful Insights: Market Research Services Companies in Kenya, CDL Kenya

Feeling lost in a sea of data? Struggling to make informed decisions about your brand strategy in the Kenyan market? You’re not alone. But what if you could leverage expert Market Research Services Companies in Kenya to gain a crystal-clear understanding of your target audience and market trends?

Introducing CDL Research & Consulting: Your trusted partner for impactful Marketing Research Consulting in Kenya.

The challenge:.

Imagine Client X (Name Hidden for Privacy), a prominent fashion brand in Kenya, struggling with declining sales and a disconnect with their customer base. They lacked crucial insights into evolving consumer preferences and market trends.

Our Solution:

Client X found CDL Kenya through a Google search for “marketing & research consultants in Kenya.” We became their partner, providing a comprehensive research consulting package that included:

- In-depth needs assessment: We collaborated with Client X to understand their specific challenges and research objectives.

- Custom survey design: Our research experts crafted targeted surveys to gather valuable data from Kenyan consumers.

- Efficient data collection: We utilized proven methodologies to gather accurate and representative data.

- Meticulous data analysis: Our team of analysts transformed raw data into actionable insights.

- Clear and concise reporting: We presented findings in easy-to-understand reports with clear visualizations.

- Actionable recommendations: We translated insights into practical strategies for brand optimization.

The Impact:

CDL Kenya’s research consulting services empowered Client X to make data-driven decisions that significantly impacted their brand operations:

- Identified key consumer trends: Client X gained a deep understanding of their target audience’s preferences and buying habits.

- Developed targeted marketing campaigns: Armed with insights, Client X crafted highly effective marketing campaigns that resonated with Kenyan consumers.

- Optimized product offerings: Client X used research findings to refine their product line and cater to evolving customer demands.

- Increased brand loyalty: By understanding customer needs, Client X fostered stronger brand loyalty and customer engagement.

Ready to unlock the power of data-driven decision making?

CDL Research & Consulting is a leading provider of Marketing Research Consulting Services in Kenya. We go beyond data collection – we transform information into actionable strategies that propel your brand forward.

Our team of experienced researchers and consultants is dedicated to helping businesses in Kenya thrive. Let us be your partner in unearthing valuable insights that fuel your success.

Contact us today for a free consultation and discover how our research consulting services can empower your brand in the Kenyan market.

We are a one-stop shop for all your Human Resource related queries and advocate for mandatory Human Resource practices while going the extra mile to proactively address workers needs in order to achieve optimum productivity.

Quick Links

- Employers Package

- Resume Builder

- Latest Jobs

- Clients Feedback

- Privacy Policy

Our Main Services

- Recruitment Services

- Payroll Processing Services

- HR Consultancy Services

- Corporate Trainings Services

- Psychometric & Personality Testing

- Research & Consulting Services

- Business Outsourcing Services

Send to a friend

What We Can Do For You

Market and Social Research

Capacity Building

Marketing Consultancy

Brand Development

Who is ConsumerPro

ConsumerPro Limited is a Market& Social Research Consultancy Company aimed at providing research- based market insights and business solutions that inform decision making and organizational growth. ConsumerPro offers Market Research, Marketing, training and Business Solutions among other services to organizations in different sectors, helping them better understand their market, make informed decisions and become more competitive and customer-centric. ConsumerPro helps you to always be one step ahead of the competition by understanding the heart and the minds of your consumers. Let us help you build sustainable businesses, for the social and economic growth for all your stakeholders.

Company mission

“To provide research-based market insights and business solutions that inform decision-making and business growth.”

Company Vision

“Inspiring consumer-centric businesses for a satisfied African market”

Our Clients

Follow us on facebook.

Consumerpro Ltd

Quick Contacts

+254 20 52 80 165 +254-723-835-847 [email protected]

- Call: 0716 555 388

- [email protected]

- Rhapta Heights 6th Floor, Westlands, Nairobi City

call us now

0716 555 388

drop an email

Accelerate Your Brand Growth with data-driven Insights from PARS Research

Make informed decisions based on expert research-findings. PARS (Pan African Research Services Ltd.) is among the leading research companies in Africa.

Google Rating

Customer Satisfaction & Perception Survey

Market Definition & Exploration Studies

Positioning and Segmentation Studies.

Employee Satisfaction & Engagement Surveys

Mid Term and End Term Evaluations

Human-Centered Research Experiences

PARS is committed to working with all its clients to improve their ability to make informed timely decisions. The company also offers custom research services to companies that do not need the whole research process.

ACCURACY Get accurate data that you can rely on!

Our team analyzes what other organizations in your industry are doing to stay competitive in the complicated world of business.

Next, we use smart tools and our long experience in practice to provide you with credible data that will guide you in making your next decision.

INNOVATION Reinventing research in Africa as we know it

PARS is one of the most innovative research companies in Africa that integrates modern technology in almost all aspects of research. We pride ourselves in development of effective channels of customer engagement and data collection.

Our Innovative team speeds up what used to be the traditional market research methodology by replacing it with tech-driven market research. This not only saves time and money but also guarantees accuracy in data collection.

Customer Satisfaction & Perception Surveys

In an increasingly competitive world, customer satisfaction is vital in building customer loyalty and sales growth.

PARS is renowned for carrying out in-depth customer satisfaction research across Africa. This type of study establishes satisfaction levels and tracks changes over time.

Market Exploration & Definition Studies

PARS Research ltd has a knack for establishing gaps & opportunities in African markets. In this type of research, we explore potential gaps & opportunities in African marketplace.

The qualitative research method is mainly used in market exploration.

Image & Brand Equity Studies and Surveys

Worried about how your brand or company is perceived in Kenya, South Africa, or any other African country?

Let PARS carry out a brand image and consumer behavior study for you. In this type of study, we evaluate how a product, service, or organization is perceived by users and the public at large.

Baseline surveys, Mid-term & End-Term Evaluations.

Baseline surveys are among the most common type of social research carried out by project implementers.

They are often done to collect basic information to get demographic and other baseline data before the introduction of particular community services or projects.

People Real people are always at the heart of our data.

People around the world have participated in our Researches.

Backed by real people, our global panels provide critical data validation and ensure representation.

Employees power our business globally

Our passionate workforce drives a better business future across 57 countries.

Businesses and Companies trust us with their researches.

Members of these groups help us bring our best to the communities we measure.

Who we work with

What can we help you achieve?

Want to participate in a survey.

Stay current with our latest insights

Useful Links

- Privacy policy

- Cookie preferences

- Terms of use

- Market Research

- Social Research

- Research Methods

- Rhapta Heights on Rhapta road, 6th Floor, Nairobi, Kenya.

- +254716555388

© 2024 PARS Research and/or its subsidiaries. All rights reserved.

Web Design by Qodewire

Get in Touch

List Of Best Market Research Companies In Kenya

This is a list of best market research companies in Kenya. Market research is the activity of gathering information about the needs and preferences of consumers. Therefore, market research companies deliver insights by combining research outcomes, real-time data and the most precise measurement to meet the needs of consumers and help established businesses to understand the emerging trends in the market.

Here is a list of the best market research companies in Kenya.

1. Infotrak

It is a full-service research company that was established in 2004 to provide the Pan African Market with suitable information solutions to sustain the ever-growing economies in the content.

Location: Off James Gichuru Road, Nairobi

Contact: +254 202338988

Email: [email protected]

2. Consumer Options

It is a full-service market research company with the flexibility of conducting market research in East Africa and the rest of the world.

Location: International House, 6th Floor, Mama Ngina Street, Nairobi

Contacts: +254 20 331 7709/ +254 724 255 543

Email: [email protected]

Ipsos is one of the leading research companies in Kenya that provides accurate and reliable information that will aid one to make smarter decisions and more consistently across markets.

Location: Lavington, Nairobi

Contacts: +254 20 386 272133

4. Infinite Insight

Infinite Insight is a full-service market research agency that offers qualitative and quantitative research services across Sub-Saharan Africa.

Location: Mirage Tower 1, Chiromo Road

Contacts: +254 774 157 784

Email: [email protected]

5. SBO Research

It is a market and social research company with a regional operational footprint that spans across 23 countries in Africa. It provides full consultancy service to all business sectors with solutions grounded on excellence, efficiency and innovation.

Location: Off Ring Road, Kilimani

Contacts: +254 020 214 5668/ +254 020 210 1916/7

Email: [email protected]

6. Nielsen Kenya

Nielsen is a global measurement and data analytics company that provides the most complete and trusted view available of consumers and markets worldwide.

Location: 14 Riverside Drive, Nairobi

Contacts: +254 20 444 0293/ 444 0547

7. Indepth Research Services Ltd

Location: Westlands, Rhapta Road

Contacts: +254 715 077 817/ +254 792 516 000

Email: [email protected]

8. Dalberg Africa Research Solutions

Location: 5th Floor, The Atrium, Chaka Road, Kilimani

Contacts: +254 727 370 022/ +254 202 590 002

9. Survey & Statistics Solutions

Location: Eldoret Town

Contacts; +254 724 704 828/ +254 733 493 316

Email: [email protected]

10. Consumer Insight Africa

It is a reliable research company that heavily relies on technology-based methods and quality assurance measures to offer customised research and in-house research solutions.

Contacts: +254 722 202 313/ +254 202 146 540

Email: [email protected]

Zack Abuyeka

I am the third eye.My duty is to keep you updated of the current trends and events happening round the globe.

Related Posts

List Of Best Tyre Dealers And Distributors In Kenya

List of Affordable Honeymoon Destinations in Mombasa Kenya

Kenya Institute Of Management (KIM) Fees Structure 2022

Functions Of Rural Electrification & Renewable Energy Corporation

Visualdo Institute Courses and Fees Structure

List Of Sub Counties In Laikipia County

Discover and browse our entire catalog of service providers.

Post a new project now and find service providers that best match your needs.

Our industry experts help you choose the provider that suits you best. Free.

Drive revenue like never before.

Flexible plans that grow with you.

Comprehensive guides and tips for getting started in marketing.

Turning marketing & B2B numbers into accessible reports.

Discover how we help people finding the right agency for their project.

Advice and answers from the Sortlist Team.

Top Market Research Companies in Kenya

All market research firms in kenya.

Towards Excellency Service!

Redefining Marketing and Social Research

Your well-being is our priority

Innovative and Infinite Tech Solutions

All your marketing solutions

Content that drives ROI

Building sustainable online presence for businesses of all sizes

Struggling to choose? Let us help.

Post a project for free and quickly meet qualified providers. Use our data and on-demand experts to pick the right one for free. Hire them and take your business to the next level.

- Market Expansion Companies

- Online panels

- Data-Collection Services

- Full-Service Research

- Global Omnibus

- Case Studies

- Quality Assurance

- Work with us

- Affiliation

- TGM Content Hub

- Bid Request

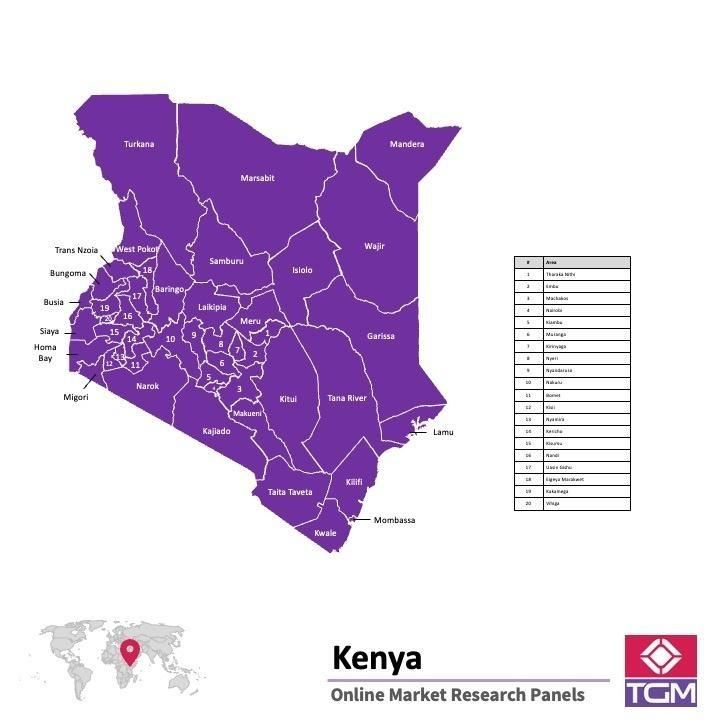

ONLINE PANEL IN KENYA | Market Research in Kenya

Kenya at a glance

Internet Users

Laptop / PC Users

Smartphone Users

Active Social Media Users

GDP Total (PPP)

$190.182 billion / $3,868 (per Capita)

Kenya's National motto

Harambee / Let us all pull together

Native name

Capital of Kenya

52M / urban 27%

20.0 years old

Local language

Swahili / English

Nairobi, Mombasa, Kisumu, Nakuru

Want to Dive Deeper into Our Kenya Research Expertise?

Learn more about our online research capabilities in Kenya:

Our online panel in kenya.

Recruitment Process

Quality Standards

Our mission is to provide our clients with the highest possible quality. At TGM Research, everything adheres to the strict code of conduct established by ESOMAR. Whether it's building and managing online panels in Kenya, collecting and processing data, or storing personal information, we ensure that everything is held to the highest industry standards. Our team members speak the local language and are familiar with the local conditions in Kenya. As a result, we can offer high-quality guidance for projects conducted on our panel in Kenya. This enables you to connect with your audience and uncover the insights necessary to make informed strategic decisions

Expert Panel Management

Consumer Panel Profiling

| Category: | Profiling information: |

|---|---|

| age, gender, geographic region, income range, level of education, occupation, marital status, size of the household, and the number and genders of children in the household, along with their ages. | |

| vehicle ownership status, brand of car owned, age of the car, and whether the car was bought new or used. | |

| smartphone ownership, brand of phone used, social networks, Internet usage, etc. | |

| ownership of domestic appliances, the decision-making process for purchases, and home ownership status | |

| travel habits, preferred modes of transportation, frequency of travel, the nature of travel, and the allocated travel budget | |

| utilization of financial services, the number and types of bank accounts held, and the use of credit and debit cards. | |

| employment status, job profile, professional role, industry of employment, and the size of the company | |

This list is not comprehensive since profiling questions for each category are regularly updated. This enables us to quickly adapt to specific client requests and save valuable time for respondents. If you would like to know more, contact us.

OUR ONLINE PANEL IN KENYA

Why use tgm mobile and online panel in kenya.

Maximum monthly sample delivery:

Age group distribution

| Age | TGM | Census |

|---|---|---|

| 15-19 | 9% | 19% |

| 20-24 | 43% | 16% |

| 25-29 | 23% | 13% |

| 30-34 | 27% | 14% |

| 35-39 | 5% | 10% |

| 40-49 | 4% | 14% |

| 50+ | 1% | 15% |

Gender distribution of panelist

| Gender | TGM | Census |

|---|---|---|

| Male | 69% | 50% |

| Female | 31% | 50% |

Discover the Power of TGM Mobile and Online Panel in Kenya:

Your gateway to invaluable insights.

Nationwide reach

No need to focus on one specific city or province of Kenya. With TGM's mobile panel, you can interview people from everywhere in Kenya; which means a better sampling plan, better representation and better data extrapolation for your quantitative research analysis, or qualitative research projects.

Because surveys are self-administrated, your fieldwork costs are much lower. You can do agile research, more often, with a bigger sample size fitting your needs.

Using mobile and online technology, you can reach thousands of respondents at a glance to fill in your survey in hours and fulfill your quotas.

Sample quality

Lower costs should not be impacting the quality of your online surveys. At TGM Research, we take data quality very seriously with one centralized and standardized strict procedure for panel recruitment, panel management, and quality checks during the whole market research survey.

We use our unique digital fingerprinting technology and logical tests to measure engagement and trust for each of the respondents who will fill in your online surveys.

Respondent experience

Participants are the fuel of our industry. At TGM, not only do we think mobile first for respondents, but we also design optimized and fun studies for our panelists.

Thanks to our generous reward scheme that truly rewards respondents for their time and efforts, TGM is one of the fast-growing online research companies globally with the highest response rates and satisfaction scores.

We offer multiple options in terms of rewards redemption: by PayPal, GCodes®, in cash, as mobile top-ups, using Transferwise, wire transfer or through online vouchers

Different types of market research available

With our market research panel in Kenya, you can conduct both quantitative research and qualitative market research projects - including popular consumer market research surveys, as well as more specialized (healthcare research, retail research, technology research, social research services and other)

Do you have a business enquiry?

Do you want to participate in surveys, trusted by the best.

Simplify your entire market research process through:

EMPOWERMENT

Interested in conducting research in specific geography?

- ASIA PACIFIC

- THE AMERICAS

TGM Research panels in Africa

Read more about our panels and data sampling methods.

TGM Research panels in Europe

Read more about our panels and data sampling methods .

TGM Research panels in Asia Pacific

TGM Research panels in Mena

TGM Research panels in The Americas

Articles to read

- Research Offer

- Add Business

All Categories

- Help Services

- Appliances Repair & Services

- Furniture Dealers

- Packers and Movers

- Pest Control

- Solar Product Dealers

- Interior Designers

- Plumbing Contractors

- Modular Kitchen

- Internet Service Providers

Market Research Companies in Kenya

Provided services.

- Quantitative research

- Qualitative research

- Online research

- CATI research

- Social media research

Address: 14048 - 00400 Nairobi, Kenya

Bamba, a TechStars company, is a real-time data gathering platform for market research clients to target and engage unique demographics of panelists in the emerging markets. ...

- Write Review

Infinite Insight Ltd.

Address: Nairobi, Kenya

Infinite Insight is a full service market research agency, operating across the African continent. We have assembled a strong team of professionals with thorough first hand knowledge of African… ...

Research International East Africa Ltd

Address: 00200 Nairobi, Kenya

Research International East Africa is a leading Social and Market research agency in East and Central Africa. It is a wholly owned subsidiary of Research International Group Ltd and we are part of… ...

Consumer Options Ltd

Address: 20610-00200 Nairobi, Kenya

Consumer Options Ltd was founded in 2004, Consumer Options is one of the fastest growing market research agencies in East Africa. Our focus is to understand and translate consumer habits into… ...

Consumer Insight

Address: 27766-00506 Nairobi, Kenya

We know Africa. Africa is home, it’s where we were born, raised and reside. We understand the market nuances and dynamism that others would overlook or undervalue ...

Voices Africa Limited

VoicesAfrica is an online research panel focused on Africa. We're the largest on the continent. Combining 250,000+ panelists with strong panel, quality control, a high response rate and a presence in all major African markets, ours is a service that offers companies a platform for entry into Africa ...

QNR Data Kenya

QNR has established a foundation for market coverage that reflects exactly what client organisations expect from a fieldwork partner on the African continent. Our core competencies include field and tab, scripting, and statistical analysis- i.e. correlations, regression analysis, group comparisons. ...

GfK in Kenya

GfK is the trusted source of relevant market and consumer information that enables its clients to make smarter decisions. ...

KASI Insight Africa

KASI Insight is one of Africa’s most innovative research and advisory firms! We solve problems that present challenges for most firms doing business in Africa – lack of fresh local market data, slow project turnarounds, and a need for contextual insight and innovative research methods. ...

Research Solutions Africa Ltd.

Address: PO box 16832-00620 Nairobi, Kenya

Research Solutions Africa is a high quality research supplier founded in 1996 and offering research services to clients across Africa. The Company has local field forces in over 20 African countries… ...

- chevron_right

copyrights © 2018 Market-Research-Companies.in. All rights reserved.

Get a Quote

- --> Advertising

- --> Agriculture Equipment

- --> Alcoholic Beverages

- --> Animal Care

- --> Automotive and Automotive Components

- --> Baby Care

- --> Banking

- --> Chemicals

- --> Clean Technology

- --> Construction Materials

- --> Consumer Electronics

- --> Consumer Services

- --> Cosmetics and Personal Care

- --> Crop Protection

- --> Dairy Products

- --> Defense

- --> Diagnostics

- --> Education

- --> Farming

- --> Films And Animation

- --> Financial Services

- --> Food Services

- --> Gaming and Gambling

- --> General Food

- --> General Healthcare

- --> General Transportation

- --> Home and Office Furnishings

- --> Industrial Engineering

- --> Information Services, Newspaper and Magazines

- --> Infrastructure

- --> Insurance

- --> IT and ITES

- --> Legal Services

- --> Loans and Advances

- --> Logistics and Shipping

- --> Luxury Goods

- --> Machinery and Parts

- --> Medical Devices

- --> Metals & Minerals

- --> Non Alcoholic Beverages

- --> Other Manufacturing Activities

- --> Pharmaceuticals

- --> Public Services

- --> Real Estate

- --> Recruitment

- --> Religion

- --> Security Devices

- --> Sports Equipments

- --> Telecommunications and Networking

- --> Textile, Apparel and Footwear

- --> Tobacco Products

- --> Tourism

- --> TV, Radio and Broadcasting

- --> Wholesale and Retail

- Access Control

- Active Pharmaceutical Ingredient

- Adhesive and Sealants

- Aerospace Products

- Aesthetic Laser

- Agricultural Implements And Equipments

- Agriculture Chemical

- Air Purifier and Freshner

- Aircraft Components

- Airlines Travel

- Animal Feed

- Animal Health

- Apparel and Footwear

- Apparel and Textile

- Artwork Products

- Athletic Apparel

- Audio Systems

- Auto Components

- Automation and Modernization

- Automobiles

- Baby Apparel and Footwear

- Baby Equipment

- Baby Personal Care

- Ballistic Protection

- Bauxite Mining

- Biopsy Devices

- Biotechnology

- Blood Product

- Bone Growth Stimulators

- Bottled Water

- Bricks and Blocks

- Carbon Fibre

- Carbonated Soft Drinks

- Cardiovascular

- Cloud Services

- Coal Mining

- Combat Vehicles

- Combine Harvesters

- Communication

- Computers and Peripherals

- Confectionary

- Construction

- Construction Chemicals

- Construction Machinery

- Consumables

- Conventional Seed

- Cooking Oil

- Copper Mining

- Corporate Education

- Cosmeceuticals

- Country Liquor

- Credit Rating

- Cruises and Yachts

- Cyber Security

- Data Center Market

- Dental Equipment

- Departmental Stores

- Diagnostic Imaging

- Diagnostic Lab

- Disposable Consumer Products

- Drilling and Exploration

- Electric Material

- Electric Vehicle

- Electricity Generation and Transmission

- Elevator and Escalator

- Embeded Systems

- Employment Services

- Energy & Sports Drink

- Engineering and Consulting

- Environment Testing Services

- Equipments and Services

- Executive Education

- Facility Management

- Field Crops

- Financial Advisory

- Financial Brokerage

- Fine Chemicals

- Fire Safety

- Fitness Services

- Flavors & Fragrance

- Flour Products

- Food & Other Services

- Food Ingredients

- Food Kiosks

- Freight Forwarding

- Frozen Food

- Fruits and Vegetables

- Fuel Dispenser

- Gems and Jewelry

- General Insurance

- Gold Mining

- Green building

- Hardware Materials

- Health Insurance

- Healthcare IT

- Herbal Products

- Higher Education

- Home Appliances

- Home Automation

- Home Healthcare

- Hospitals and Clinics

- Hot Beverage

- Household utilities

- Housing Loan

- Hybrid Seed

- Hybrid Vehicles

- Iced Tea and Coffee

- In Vitro Diagnostics

- Industrial Automation

- Intelligence and Analytics

- Interior Designing

- Intrusion Alert

- Inverter and UPS

- Investment Banking

- Iron Ore Mining

- IT Security

- Kitchenware

- Large Appliances

- Life Insurance

- Luggage and bags

- Machinery Components

- Manufacturing Plant

- Marbles and Granite

- Maternity Products

- Medical Tourism

- Military Ammunition

- Mobile Broadband

- Mobile Phone and Accessories

- Motor Insurance

- MRO Services

- Music Stores & Instruments

- Natural Gas

- Navigational Instruments

- Networking and Communication Equipment

- Neurology Devices

- Nutritional and Dietary Supplements

- Oil Storage

- Old Age Homes

- On-Demand Services

- Online Advertising

- Online Banking

- Online Education Financing

- Online Gaming

- Online Loans

- Online Music

- Organic Chemicals

- Organic Food

- Osteoporosis

- Other Medical Related Equipments

- Other Mining

- Outdoor Advertising

- Outdoor Payment Terminal

- Packaged food

- Personal Accessories

- Personal Protective Equipment

- Petrochemicals

- Petroleum Fuels

- Pharmaceutical

- Pharmacy Stores

- Pipe and Valve

- Plantations

- Polymer Materials

- Postal Services

- Power Components

- Power Tools

- Pre Primary

- Prescribed Drug

- Private Equity

- Process Outsourcing

- Processed Food

- Protected Cultivation

- Quick Service Restaurant

- Ready to Eat

- Real Estate Consultancy

- Real Estate Investment Trust

- Refractory Materials

- Reinsurance

- Research Institutes

- Reservoir development

- Residential

- Respiratory

- Retail Banking

- Roofing Products

- Sanitaryware

- Semiconductor

- Shipbuilding

- Skim Milk Powder

- Sleep Apnea

- Smokeless Tobacco

- Software and Digital Content

- Specialty Chemicals

- Sports Goods

- Stamping Machine

- Stock Broking

- Store Cards

- Teacher Training

- Technology Hardware

- Test Preparation

- Third-party logistics 3 PL

- Transportation

- used car market

- Used Vehicles

- Value Added Services

- Vehicle Loan

- Vending Machine

- Vending Machines

- Video Rental

- Video Survelliance

- Vocational Education

- Warehousing

- Waste Management

- Water Purifier

- Wealth Management

- Whey Powder

- Whole Milk Powder

- Windows and Doors

- Central and South America