- Start free trial

Unify online and in-person sales today.

Explore the Point of Sale system with everything you need to sell in person, backed by everything you need to sell online.

The Complete Guide to Market Research for Your Retail Business

Long gone are the days when price was a leading factor in consumers’ purchase decisions. While price still plays a role, today multiple factors are at play such as brand differentiation, reputation, and customer-centric return policies. But how do those considerations drive the purchase decision? It’s hard to read a customer’s mind, and it’s challenging for retailers to figure out where they fit when compared with their competition. Especially for retailers just starting out, it may feel like a lot of decisions are made on guesswork or instinct. Market research can remove much of this uncertainty by helping you understand your industry, your target customer, your competition, and your product. When you understand all that, your chances of success are a lot greater. There are many agencies that perform market research, and you can always get help from them. If you’re on a budget, however, you can do the research yourself. In this guide, we’ll show you how.

Long gone are the days when price was a leading factor in consumers’ purchase decisions. While price still plays a role, today multiple factors are at play such as brand differentiation, reputation, and customer-centric return policies.

But how do those considerations drive the purchase decision? It’s hard to read a customer’s mind, and it’s challenging for retailers to figure out where they fit when compared with their competition. Especially for retailers just starting out, it may feel like a lot of decisions are made on guesswork or instinct.

Market research can remove much of this uncertainty by helping you understand your industry, your target customer, your competition, and your product. When you understand all that, your chances of success are a lot greater.

There are many agencies that perform market research, and you can always get help from them. If you’re on a budget, however, you can do the research yourself. In this guide, we’ll show you how.

Table of contents

What is market research?

Why is market research important.

- How to do market research for your retail business

Primary market research methods

Secondary market research methods.

Market research is the study of a target market, including companies and people involved, to understand its needs and preferences.

Essentially, it gives you an understanding of the cultural, societal, socioeconomic, geographic, and personal makeup of your target customers. It will help you understand whether there’s a demand for your product, how big that demand is, and who is generating the demand. It’ll also help you understand the competitive landscape.

Market research, in other words, is research about the world of your retail business. Among other essential details, it will provide you with data on your target shopper’s buying power, shopping preferences, and relationship with competitors.

With this information, you’ll be able to create products that provide solutions, market to consumers effectively, and increase your chances for success.

Put simply, retail market research tells you who your target consumers are and why they’d want to buy from you.

The 2022 Shopify Future of Commerce report reveals that availability of marketplaces and advancements in technology have lowered the barrier to entry. As more retailers enter the market, competition is only going to grow.

Fortunately, market research can help you not just effectively grow brand awareness but also stand out and make loyal customers .

Here are some things it can help you do:

Better understand your target market

Market research gives you insights on the size of the market you’re targeting, how competitive it is, and where there’s room for improvement. This information can help you create a SWOT analysis , which in turn helps you devise strategies to penetrate the market effectively .

Get a strong grip on your target buyer

With market research, learn where and how to find your customers and how to present your product to them. With the insights that you gather, you can work out audience-resonating smart product pricing , and effective brand positioning.

Validate product idea(s)

By digging into consumer shopping preferences and interests, you can validate and refine your ideas. Consumer feedback on sample products and new concepts can help you launch products already proven to succeed.

Stand out from competitors

Competitor analysis as part of retail market research tells you how fierce the competition is and what others are doing to market and retain their buyers.

It also reveals your competitors’ product quality and shortcomings, helping you design better product and customer experiences.

Understanding the competition, then, helps you figure out how to differentiate your brand and develop a unique selling proposition to stand out from the crowd and attract customers.<

How to do market research for your retail business (+ tools)

While some business owners opt to hire a market research firm or consultant, it’s entirely possible to conduct this research yourself. In fact, many retailers prefer to own the market research process as they enjoy spending time with customers and learning more about how consumers view their businesses.

If you’re wearing the researcher’s hat yourself, know that there are two elements of market research: primary and secondary research. We encourage you to begin your research by reviewing secondary research materials: industry reports, trends, and case studies. By starting with this established data that someone else has collected, you’ll learn more about how you’d like to conduct your lengthier, more expensive primary research.

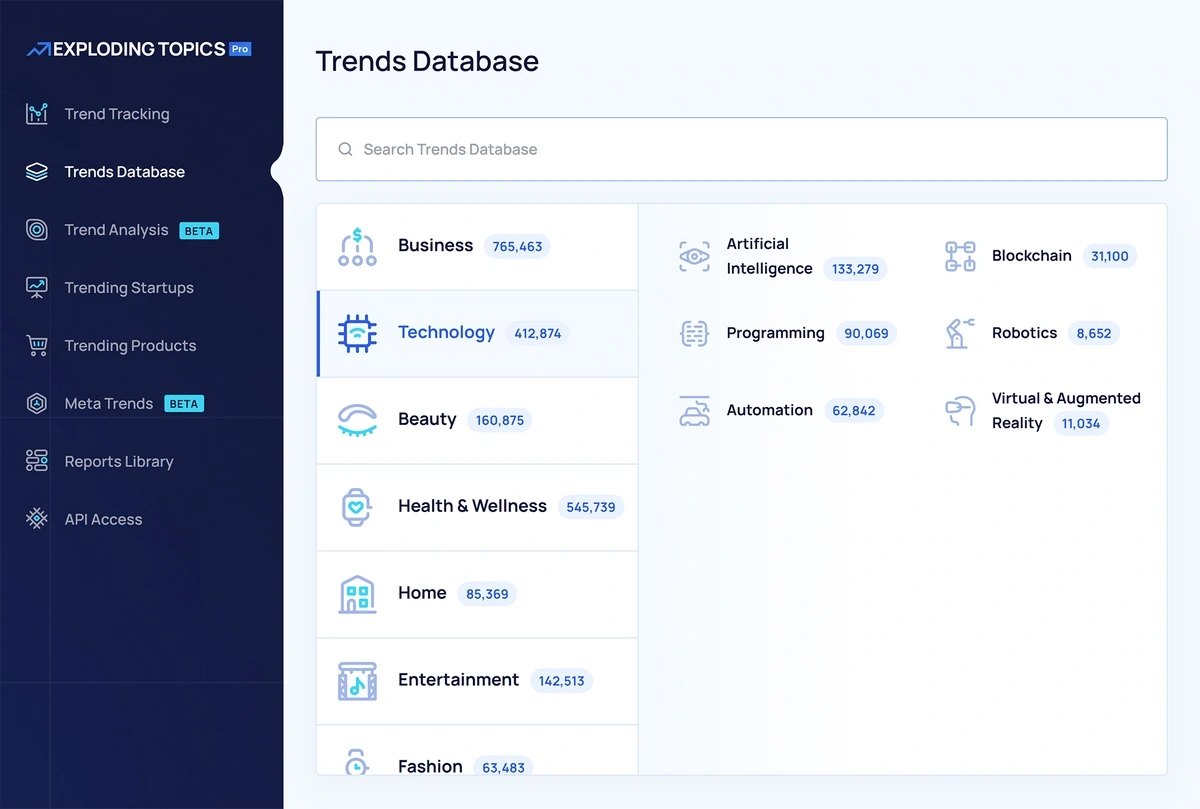

Here are some tools and sources for secondary market research:

Nielsen : Nielsen has research reports and studies on consumer behavior across more than 100 countries.

Pew Research Center : Pew also conducts scientific studies, many of which provide insight into consumer behavior and trends.

D&B Hoovers : You can purchase reports from D&B, a company which has researched over 85 million corporations, 100 million people, and 1,000 industries. Expect to find insights ranging from consumer behavior to competitive analysis and industry trends.

MarketResearch.com : Much like D&B, MarketResearch.com has tons of independently conducted research and analysis reports you can purchase. Retailers can start by checking out their list of consumer goods reports .

US Census Bureau : The US Census Bureau provides a holistic look at the American economy. Use it in your market research to understand the state of your industry both in the United States and internationally (they have a whole section on retail trade .

US Small Business Administration : The SBA offers resources to help American-based retailers understand their target market and current economic conditions. The SBA’s free SizeUp tool is a great way to see how you stack up against your competition.

Bureau of Labor : The Bureau of Labor has an abundance of resources to help you learn about employment in the U.S. They provide employment rates and statistics on topics like occupational employment and wages, labor demand and turnover, and the dynamic state of the labor market.

Office for National Statistics : UK-based retailers can use the numerous resources here to learn about their industry, the economy, employment information, and consumer demographics.

FedStats : This is another great US-based resource for statistics and trends that cover a variety of topics and findings from trusted sources.

Consumer Price Index : The Consumer Price Indexes (CPI) program produces monthly data on changes in the prices paid by urban consumers for a representative basket of goods and services. This is a great way to learn how to set prices for your products.

Consumer Spending : The US Bureau of Economic Analysis has personal consumption expenditures (PCE) resources that you can use to learn about how to price your products, similar to the CPI.

American FactFinder : The US Census Bureau has a whole library of facts that can be especially helpful in researching the demographics of your target customers.

Consumer Product Safety Commission : This US agency reports injury statistics based on product category and by hazard category. It helps estimate how many injuries caused by products will be treated in the emergency room each year. You can use this information in a variety of ways, from determining your selling proposition as a safe product provider to understanding how to communicate the safety of your product to customers.

Next, go down into the trenches and study the market directly. Use the following methods for primary research:

1. Customer surveys

Customer surveys are a way to gather data on your target market. Depending on the questions you ask in your survey, you can not only understand your target market and its competitiveness but also get feedback on your product.

Several free tools such as Google Forms and SurveyMonkey are available to help you conduct customer surveys. Use them if you already have an engaged audience, such as an active email list or social following.

Don’t have an audience yet? Share the survey in relevant Facebook Groups, online forums, and Slack channels.

If you need to get the survey out to more people, pay for a service like Google Surveys , which also allows you to add targeting parameters to get more specific and relevant insights.

💡 PRO TIP: Sending digital receipts via email is a great way to organically collect customer contact information at checkout and build an email list to fuel your retention marketing. Just make sure they’ve opted in to hearing from you before sending them anything.

2. In-depth customer interviews

Customer interviews are one-on-one interviews with customers. You can conduct video chats or meet customers in person or over the telephone.

Since customer interviews are direct conversations, they provide unparalleled insights about your consumers, their shopping motivations, and feedback on your brand and product(s).

Customer interviews can help you make smarter business decisions. For example, paying attention to the language your target shoppers use during the interview can help you create audience-resonating marketing copy and store layouts.

The key is to ask open-ended questions that encourage interviewees to give longer responses instead of plain “yes” and “no” answers. For example, instead of asking whether they prefer to tap or insert their card when paying, ask them what they think about contactless payments .

Making this kind of subtle change in the way you frame your interview questions will get the interviewee thinking, getting you excellent insights.

Keep in mind that customer interviews don’t have to be long. Also, you can incentivize consumers with something valuable for taking the time to talk to you. This could be anything from a gift card to a free product or lifetime membership.

3. Customer reviews

Customer reviews can offer a treasure trove of actionable consumer insights.

You don’t have to stop at studying your own business: analyzing competitor reviews can tell you what customers like and dislike the most about them, what they commonly complain about, and how those retailers handle negative reviews.

What’s more, the insights you uncover here can guide your product creation and give you ideas for improving the customer experience.

Make sure you gather reviews from various channels such as social media and review sites (think: Yelp, Amazon, and Google).

Having a large and diverse pool of customer reviews coming from people who represent your customer base helps reduce the odds of bias in review analysis.

It’s also helpful to study reviewer profiles. Record reviewers’ age, location, gender, items purchased, and date of purchase. This extra layer of data will help you identify trends based on customer profiles.

4. Contextual inquiry

Contextual inquiry is a user research technique that involves observing and interviewing people while they perform tasks in context. It helps validate product ideas and improve prevailing user journeys such as how customers navigate your store layout .

By observing how participants complete a task—ask them, for example, to describe how they navigate your point-of-sale (POS) system —you can easily learn how consumers use and feel about your store, products, and purchase processes.

Don’t forget to carefully observe participants’ nonverbal cues such as their body language. This helps you track and understand their habits and how their mood changes as they interact with a product display or in-store event

The best part? Contextual inquiries aren’t very formal, which helps you get your hands on more realistic data.

5. Mystery shopping

Another useful market research method is to send undercover researchers as customers to stores—yours or your competitors’—to evaluate store operations and customer experience.

Secret shopping gives you the benefit of learning from interacting with store employees in real time. It also helps you study your competition and access information only available to their customers.

Most important of all, mystery shoppers can study any and every aspect of the customer experience, including:

- Greeting and wait times

- Staff knowledge and helpfulness

- Product variety and availability

- Store design including cleanliness, product display, and window display

You can always pre-script the visit (ask researchers to evaluate specific details) or keep it open, encouraging researchers to share whatever they experienced.

Secret shopping isn’t limited to store visits. Mystery shoppers can buy and return merchandise to understand how a store handles return exchanges . They can also make phone calls or contact specific departments via website forms or emails to evaluate performance.

6. Focus groups

Focus groups bring together a group of 6-10 people to gather feedback on a product, service, idea, or marketing campaign from them.

People interviewed in focus groups are systematically selected based on their demographic traits. The questions are scripted beforehand, and the interviewer’s role is to elicit responses from all participants.

Focus group sessions are a low-cost, high-accuracy market research method, delivering insights in the respondents’ own words.

You can hire an agency to conduct in-depth research via focus groups. Or create an online focus group for learning consumers’ thoughts on whatever you want.

Hair care brand Ceremonia's founder, Babba Riversa, created an online community of influencers for planning her brand launch. Initially, the group met in person to give Riversa feedback on products. Later, when the pandemic hit, the group went virtual, meeting weekly on Geneva .

7. Sales records

This involves studying customer and sales information already available, and works best for established retail stores.

These sales records, covering customer purchase dates, amount, payment method, returns, and other information, provide a goldmine of data. The data is also proprietary and unique to your business—no one else has that information.

Analyze it to identify your loyal customers and customer-favorite products, and use the insights you gain to plan marketing approaches that will most likely resonate with these customers.

💡 PRO TIP: Only Shopify POS unifies your online and retail store data into one back office–customer data, inventory, sales, and more. View easy to understand reports to spot trends faster, capitalize on opportunities, and jumpstart your brand’s growth.

8. Employees

Finally, ask sales associates for their findings on the floor, whether it’s commonly asked questions from customers or observations in customer behavior.

Staff research can uncover insights that not only help you better understand your customers but also learn how effective your visual merchandising , store layout, and sales promotions are.

By asking staff to observe customer motivations and what products they frequently buy together, you can train them to upsell and create hot-selling product bundles .

Improve your retail business with market research

In a nutshell, market research is essential. It can show you how to create customer-favorite products, beat your competitors, and provide an exceptional customer experience.

Market research also never ends. You should conduct market research on an ongoing basis: the market changes frequently, and you need to be on top of those changes to stay ahead of the curve.

- How to Build a Brand Story for Your Retail Store in 2024

- Pop-Up Shop Ideas: 19 Examples from Real-World Retailers

- Discount Strategy in Retail: How to Offer Discounts & Markdowns Without Slashing Profits

- What is Cost of Goods Sold (COGS) and How Can I Calculate It?

- Foot Traffic: The Ultimate Guide to Bringing More People Into Your Retail Store

- How to Calculate Your Break Even Point in Retail [Quickstart Guide

- A/B Testing: How Retailers Can Optimize Their Sales With Experimentation

- 24 Retail Blogs Every Small Business Entrepreneur Should Be Reading

- Cause Marketing: What It Is, How To Do It, and Why It Matters

- Hyper-Personalization: 4 Examples of Retailers Doing it Right

Market research FAQ

What are the 4 types of market research.

- Primary Research: This type of research involves collecting data directly from the source, such as surveys, interviews, focus groups, and observation.

- Secondary Research: This type of research involves collecting data from existing sources such as books, magazines, newspapers, and online sources.

- Qualitative Research: This type of research involves collecting data in the form of opinions, beliefs, and attitudes. It is used to gain insight into customer behavior.

- Quantitative Research: This type of research involves collecting data in the form of numbers and statistics. It is used to measure the size, location, and distribution of a target market.

What do you mean by market research?

What is an example of market research, what are the 4 main purposes of market research.

- Identifying and understanding customer needs and preferences: Market research can help companies identify and understand customer needs, preferences, and trends, as well as their buying behavior and habits.

- Tracking customer satisfaction: Market research can also be used to track customer satisfaction and loyalty. This can help a company determine whether customers are happy with its products and services, and if not, what changes can be made to improve them.

- Measuring the effectiveness of marketing campaigns: Market research can be used to measure the effectiveness of marketing campaigns and determine what strategies are working and which ones are not.

- Improving product development and innovation: Market research can help a company to better understand customer needs and preferences, which in turn can help it develop new products and services that meet those needs. It can also help a company to better understand the competitive landscape and what its competitors are offering.

Grow your retail business

Get exclusive behind-the-scenes merchant stories, industry trends, and tips for creating standout brick-and-mortar experiences.

No charge. Unsubscribe anytime.

popular posts

The point of sale for every sale.

Latest from Shopify

Aug 8, 2024

Jul 25, 2024

Jul 24, 2024

Jul 22, 2024

Jul 15, 2024

Sell anywhere with Shopify

Learn on the go. Try Shopify for free, and explore all the tools you need to start, run, and grow your business.

Retail Market Research: Benefits, Trends & 5 Real-Life Examples

Figure 1. Popularity of retail market research on Google search engine in the US between 2016-2023

A recent McKinsey report highlights a dramatic shift in customer behavior, with 50% of customers changing their brand preferences in 2022, and 90% indicating they’ll continue to switch brands. 1 This trend points to a volatile retail market, where some brands may decline while others rise, underlining the importance for retailers to adapt and innovate to maintain customer loyalty. With evolving consumer preferences, conducting market research through customer surveys becomes increasingly critical.

This article highlights the importance of market research for retail business, methods, trends, and some real-life examples.

If you wish to use a market research tool, here is a guide comparing the top tools on the market .

Why is market research important for retail companies?

1- better understand your target market and customers.

Market research provides retailers with insights into customer behavior, enabling them to adapt their products, services, and marketing to align with market trends. This knowledge is essential for everything from product development to pricing and even store design, ensuring that retailers can create an experience that truly connects with their customers.

Real-life example

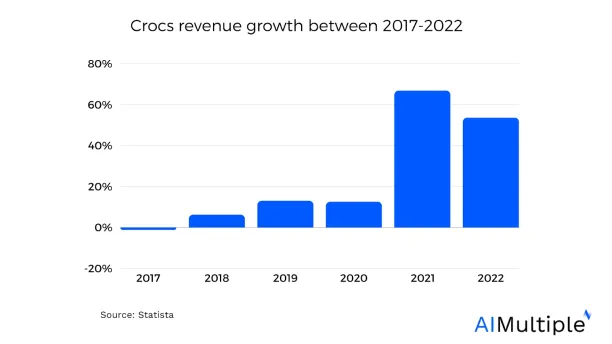

Source: Statista 2

Figure 2. Crocs YoY revenue growth between 2017-2022

Crocs has experienced a nearly 200% increase in sales since 2019, outperforming other brands that peaked during quarantine. 3 Emphasizing digital marketing, market research, and celebrity endorsements, Crocs continues to adapt to consumer preferences, moving towards a more fashion-forward market and maintaining relevance despite changing trends.

2- Increase product launch success

Introducing a new product to the market is a high-stakes endeavor, often accompanied by considerable financial risk. Conducting thorough market research is key to mitigating these risks. By delving into consumer desires, market trends, and unmet needs, retailers can gain valuable insights that guide product development.

A recent survey by the Toy Association found that more than 40% of adult parents are buying toys for themselves. 4 This trend, known as the “kidult” market, has seen growth, particularly during the pandemic. Retailers like Walmart are responding by marketing toys and games directly to adults, tapping into this nostalgic consumer segment.

3- Stay informed about and ahead of competitors & retail industry trends

Staying abreast of industry trends and understanding what rivals are doing is crucial in retail. Retailers must be aware of their competitors’ offerings and identify areas where they can differentiate themselves, be it in product characteristics, customer experience, or communication strategies.

Home Depot identified a trend towards convenient and seamless shopping experiences and responded by integrating advanced technologies. 5 They developed a versatile mobile app that facilitates price comparison and in-store pickups, augmented reality for visualizing products in a space, and location-based services within the app to enhance in-store navigation and offer real-time deals to customers.

4- Improve marketing messaging and customer relationships

Through market research, retailers can gain insights into consumer behaviors, preferences, and purchasing motivations. This information is invaluable for developing targeted marketing campaigns that resonate with consumers, enhancing the overall customer experience, and building lasting relationships. Understanding customer needs and preferences allows retailers to communicate more effectively, personalize their marketing efforts, and align their products and services with consumer expectations, thereby fostering customer loyalty and driving sales.

McDonald’s responded to customer feedback about the lack of healthy and organic options on its menu. 6 As a result, McDonald’s introduced healthier items like apple slices and launched an advertising campaign to highlight the real meat content in its chicken nuggets and patties, demonstrating its commitment to addressing customer concerns.

5- Validate product idea(s)

Market research helps in understanding whether there is a real demand for the product and if it meets the needs and expectations of potential customers. By effectively analyzing market trends, consumer behaviors, and preferences, retailers can reduce the risk of introducing products that may not resonate with the market.

Quibi, a mobile-focused streaming service, shut down after just six months due to its failure to attract a significant audience, despite raising $1.8 billion and being positioned as the next big service company in modern entertainment. 7 The company’s leaders later acknowledged that the idea behind Quibi wasn’t strong enough to justify a stand-alone streaming service. This highlights how even well-funded ventures can falter without adequate market research to validate the product’s fit and demand in the market.

Primary vs. secondary research

In retail market research, primary and secondary research serve distinct yet complementary purposes. This distinction ensures a holistic approach to the market research process to understand both the micro (customer-specific) and macro (industry-wide) aspects of the retail market.

Primary research

Primary research is essential for obtaining fresh, direct feedback from customers. Through methods like surveys and interviews, retailers can gain valuable insights into consumer preferences, purchasing habits, and attitudes. This firsthand information is crucial for grasping customer behavior nuances and shaping product and marketing strategies accordingly.

Secondary research

Secondary research plays a key role in comprehensively understanding the retail sector. By analyzing existing data from sources like trade journals, government reports, and consumer studies, retailers can identify current trends, challenges, and potential opportunities for growth within the industry.

Market research methods for the retail industry

1- customer surveys.

These are questionnaires designed to collect feedback from customers about their experiences, preferences, and opinions. Surveys can be conducted online, in-store, or via email and are useful for collecting quantitative data. They help retailers understand customer satisfaction, product preferences, and areas for improvement.

2- Sentiment analysis

Sentiment analysis often uses natural language processing (NLP) and machine learning to categorize opinions as positive, negative, or neutral. This method is particularly useful in understanding how customers feel about a brand or product and can be instrumental in identifying areas for improvement, gauging customer satisfaction, and monitoring the impact of marketing campaigns or new product launches.

Check out our research on retail sentiment analysis for more information.

3- In-depth customer interviews

This method involves conducting one-on-one interviews to gain detailed insights into customer attitudes, experiences, and behaviors. These interviews can uncover deeper insights than surveys, as they allow for more nuanced discussions and exploration of topics.

4- Social media monitoring

By observing and analyzing conversations and trends on social media platforms, retailers can gauge public sentiment about their brand, competitors, and the industry at large. This method provides real-time feedback and insight into emerging trends and customer preferences.

5- Focus groups

Focus groups involve gathering a small, diverse group of people to discuss and provide feedback on products, services, or marketing campaigns. This method allows for interactive discussions and can provide rich qualitative data about consumer attitudes and behaviors.

6- Sales records

Reviewing and analyzing sales data helps retailers understand which products are selling well and which are not. This method provides concrete evidence of consumer purchasing patterns and preferences, helping retailers make informed decisions about inventory, pricing, and promotions.

Retail market trends

Retail market trends are currently shaped by several factors that companies should keep in mind when they conduct market research Here are a few:

Use of AI and technology

Artificial intelligence (AI) is revolutionizing inventory management , customer service (through chatbots ), and personalized shopping experiences (through NLP). Retailers are also experimenting with augmented reality (AR/VR) to enhance product visualization online.

Omnichannel retailing practices

The line between online and offline shopping is blurring in the digitalized age. For instance, 70% of millennials and Gen Z customers rely on social channels for shopping. 8 Besides, 500+ million people engage with Nike through the apps.g. 9 Retailers are integrating their online and physical stores to provide a cohesive customer experience. This trend includes features like buy-online-pick-up-in-store (BOPIS) and the use of digital tools in physical stores.

Sustainable products & ethical practices

Increasingly, consumers are gravitating towards brands that demonstrate environmental responsibility and ethical business practices. This shift is leading retailers to adopt more sustainable practices , from sourcing to packaging, and transparently communicate their efforts to consumers.

Personalized products & services

With access to more customer data, retailers are tailoring shopping experiences to individual preferences. This trend involves using data analytics to offer personalized product recommendations, targeted marketing, and customized shopping experiences.

If interested, here is our data-driven list of survey participant recruitment services and survey tools .

For those interested, here is also our data driven list of market research tools .

If you need guidance in vendor selection, feel free to reach us:

External Links

- 1. “ Retail reset: A new playbook for retail leaders “. McKinsey . July 10, 2023. Retrieved December 3, 2023.

- 2. “ Year-on-year revenue growth of Crocs worldwide from 2017 to 2022 “. Statista . February, 2023. Retrieved December 2,2023.

- 3. “ People Started Buying Crocs During the Pandemic. They Can’t Stop “. The New York Times . March 27, 2023. Retrieved December 2, 2023.

- 4. “ Halloween Is for Kids. ‘Kidults’ Too. “. The New York Times . Retrieved December 2, 2023.

- 5. “ The Meaning of Digital Transformation in the Retail Industry: Examples, Benefits & Trends “. ionic . Retrieved December 2, 2023.

- 6. “ 6 Famous Brands That Depend on Market Research “. DriveResearch . September 14, 2023. Retrieved December 2, 2023.

- 7. “ Testing Business Ideas With Market Validation “. Antler . April 18, 2023. Retrieved December 2, 2023.

- 8. “ Turning consumer and retail companies into software-driven innovators “. McKinsey . September 6, 2023. Retrieved December 3, 2023.

- 9. “ NIKE, INC. Reports Fiscal 2023 Fourth Quarter and Full Year Results “. NIKE . September 29, 2023. Retrieved December 3, 2023.

Next to Read

In-depth guide into ux survey in 2024, top 12 chatgpt survey research use cases in 2024, market research survey in 2024: benefits, 3 use cases & tips.

Your email address will not be published. All fields are required.

Related research

Top 6 Market Research Software in 2024 Based on +250 Reviews

11 Online Survey Challenges in 2024

Retail Market Research: Specifics, Challenges, and Tips

- by Alice Ananian

- May 29, 2024

The retail industry is a bustling marketplace where competition is fierce and customer preferences are constantly evolving. To thrive and grow in such a dynamic environment, market research is not just beneficial – it’s a necessity. Retail market research involves gathering, analyzing, and interpreting data related to consumer behavior, market trends, and competitor strategies. For entrepreneurs, market analysts, and small business owners within the retail sector, understanding the specifics and best practices of retail market research can be a game-changer.

This comprehensive guide looks at the power of retail market research, how to approach it effectively, tools to simplify the process, featuring a case study, and tackle the challenges head-on.

What Makes Market Research for Retail Unique?

Market research in the retail industry is marked by several distinct features that set it apart from other sectors. Understanding these unique aspects is crucial in conducting research that yields actionable insights.

1. Hyper-focus on the Customer

Retailers are laser-focused on understanding their target customers . This goes beyond demographics to encompass shopping habits, preferences, and even emotional drivers behind purchases.

2. The Competitive Landscape

The retail world is crowded and fiercely competitive. Market research helps identify what competitors are doing well (or poorly) and allows retailers to differentiate themselves [4].

3. The Importance of Experience

In today’s retail world, the customer experience is paramount. Retail research goes beyond product desire and explores factors like store layout, online usability, and even employee interaction.

4. Keeping Up with Trends

Retail is a dynamic industry, and what’s hot today can be yesterday’s news tomorrow. Market research helps retailers identify emerging trends and adapt their offerings accordingly.

5. The Blend of Online and Offline

Modern retail isn’t just about brick-and-mortar stores or websites anymore. It’s a seamless blend of the two. Retail research needs to consider how these channels interact and how customers navigate between them.

By considering these unique aspects, retailers can leverage market research to make smarter decisions about everything from product selection to store layout and marketing campaigns.

How to Conduct Market Research for Retail Businesses [Step-by-Step Guide]

Effective retail market research is a systematic process that involves several key steps. By breaking down the process, you can conduct thorough research that informs smart business decisions.

Step 1: Define Your Research Goals & Target Audience

Goal Setting: What do you want to learn? Is it understanding customer preferences for a new product line, analyzing competitor strengths, or gauging interest in a new store location? Clearly defined goals will guide your research methods.

Target Audience: Who are you selling to? Define your ideal customer profile by demographics (age, income, location), interests, and shopping habits. This helps tailor your research methods to reach the right people.

Example: A clothing boutique wants to launch a new activewear line. Their target audience might be young professionals (22-35) who are health-conscious and shop online and in-store.

Step 2: Develop Your Research Plan

Primary vs. Secondary Research: As with any industry, primary research involves collecting your own data (surveys, interviews). Secondary research involves leveraging existing data (industry reports, government statistics).

Example: For the yoga wear example, primary research could involve focus groups with potential customers to understand their preferences for materials, styles, and price points. Secondary research might involve looking at industry reports on the growth of the eco-friendly clothing market.

Pro tip: Gathering primary research can cost you a lot of time and money. To better coordinate your efforts, make sure you use tools that do the leg work for you. For example, instead of creating templates and funneling all your findings manually into an Excel sheet, consider launching your product.

Prelaunching, i.e., creating a landing page with Prelaunch , opens up a world of insights into your target audience, best iterations of your product, and price point. All this information is neatly collected in a Dashboard, so all you have to do is analyze your data.

Step 3: Gather Your Information – Primary Research Methods

Surveys & Online Polls: Develop targeted online surveys or polls to gather customer opinions on product ideas, pricing, and brand perception. Tools like Google Forms or SurveyMonkey can help create and distribute these.

In-Store Observations: Observe how customers interact with your products or competitor products in physical stores. Note what attracts them, what they try on, and where they spend time.

Focus Groups: Conduct small group discussions with potential customers to gain deeper qualitative insights into their needs, motivations, and pain points.

Action Step: Merge the processes of surveys, online polls, and focus groups with a singular platform that helps you do it all. Setting up a concept-validating landing page on Prelaunch gives you access to real-time insights. Surveys are an embedded part of Prelaunch’s funnel.

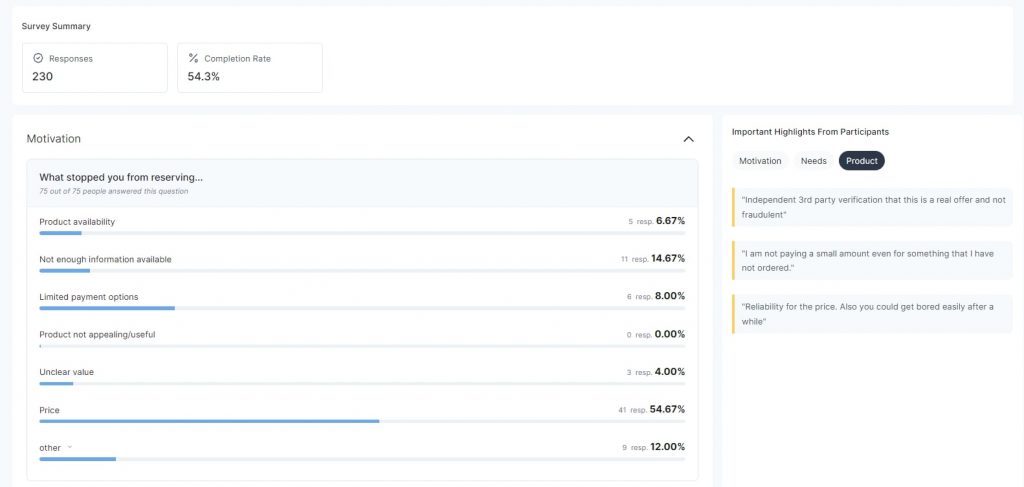

For instance, the Reservation Survey is displayed on the Thank You page following a potential customer’s reservation of the product. This enables you to pose questions aimed at enhancing the product and identifying the customer profile.

The Cancellation Survey is presented when someone selects the “No, thanks” option on the Reservation page. This offers insights into their reasons for not reserving the product and what changes could potentially change their mind.

The Prelaunch platform is also set up to conduct focus groups which can be organized remotely and from a group of potential buyers that have already confirmed their purchase intent. The result is the most accurate data you could ever wish for.

Step 4: Gather Your Information – Secondary Research Methods

Industry Reports: Look for reports from market research firms or industry associations that provide data on retail trends, consumer behavior, and market size for your specific niche.

National Retail Federation (NRF) : Publishes annual reports on retail industry trends, consumer spending, and economic forecasts. They also offer specific reports on various retail sectors like grocery, apparel, or electronics.

Euromonitor International : Provides market research reports on various consumer goods sectors, including retail. Their reports offer in-depth analysis of market size, growth projections, and consumer trends across different regions.

McKinsey & Company : Produces research reports on retail industry disruption, e-commerce trends, and the future of shopping. Their insights are valuable for understanding the broader forces shaping the retail landscape.

Trade Publications: Stay updated on industry trends and competitor news by following relevant publications and websites.

Retail Dive : A leading online publication that covers retail news and trends across all sectors, from e-commerce to brick-and-mortar operations. They offer insightful articles, data analysis, and interviews with retail industry leaders.

Chain Store Age : A trade publication focused on news and strategies for multi-location retail chains. Their content covers topics like store operations, merchandising, and supply chain management.

STORES Magazine : Published by the National Retail Federation, STORES Magazine covers retail technology, marketing trends, and omnichannel strategies.

News Articles

- The Wall Street Journal – Retail & Wholesale : This section of the Wall Street Journal features news articles on major retail companies, industry mergers and acquisitions, and the impact of economic factors on the retail sector.

- Reuters Retail : Reuters provides breaking news and analysis on retail companies, consumer spending patterns, and global retail trends.

- Local Business Journals: Many local business journals (e.g https://www.bizjournals.com/ ) have sections dedicated to retail news within their specific metropolitan areas. These can provide valuable insights into consumer trends and local retail developments.

Action Step: Subscribe to newsletters from industry research firms like Nielsen or Euromonitor . Look for government data on the US Census Bureau website or your national statistical office.

Step 5: Analyze Your Findings

Organize your data: Put all your research findings (surveys, reports, observations) in a central location for easy analysis.

Identify trends and patterns: Look for recurring themes across your data sets.

Example: Analyze survey data to see if the price is a major concern for eco-conscious yoga wear consumers. Combine this with industry report data on the growing market for premium eco-friendly clothing.

Step 6: Present Your Findings and Take Action

Create a clear and concise report: Summarize your research methods, key findings, and actionable insights.

Develop a plan: Based on your research, decide what to stock, how to price products , and how to market your eco-friendly yoga wear line.

Example: Your research might reveal a strong demand for high-quality, ethically sourced yoga wear at a premium price point. This can guide your product selection, marketing message, and in-store presentation.

Pro tip: Actionable insights are easier to arrive at when you have Customer Personas. On Prelaunch, these are AI-developed personas based on the customer profiles that your campaign has provided. Simply put, when potential customers interact with your landing page, they provide clues and insights into the best way to market your product (e.g. what pain points they have, what features really make a difference.)

Based on these insights Prelaunch builds customer personas which give you a clear idea of who and how to target your marketing efforts.

Tools and Resources for Retail Market Research

Retailers today have an array of tools and resources at their disposal to carry out comprehensive market research. From traditional methods to cutting-edge analytics, choosing the right tools can make a significant impact on the quality and efficiency of your research.

Primary Research Methods

Surveys & Questionnaires: Gather a large pool of data on customer demographics, shopping habits, and brand preferences.

Tools: SurveyMonkey, Typeform, Google Forms

Focus Groups: Conduct guided discussions with a small group of customers to gain deeper insights and understanding of their motivations.

Tools: Prelaunch.com : This concept validation platform is a one-stop-shop for marketers. By creating a landing page with your concept and gauging customer response, you gain real-time insights into demand, iterate on your design based on feedback, and avoid investing heavily in an idea that might flop. This direct interaction with potential customers makes pre-launching a powerful primary research tool.

In-Store Observations: Observe how customers interact with your store or competitor stores. This can reveal product placement issues or areas where customer service can be improved.

Unfortunately, there aren’t many tools that can help optimize this process, which is why it’s imperative to optimize as many primary research methods as possible. (See pro tip above☝)

Secondary Research Methods

Industry Reports: Published by research firms or industry associations, these reports provide valuable data on market size, trends, and competitor analysis.

Resources: Euromonitor , Gartner L2 , IBISWorld

Government Statistics: Government websites often provide demographic and spending data that can be helpful in understanding your target market.

Resources: US Census Bureau , UK Office for National Statistics

Competitor Analysis: Research your competitors’ offerings, pricing strategies, and marketing campaigns.

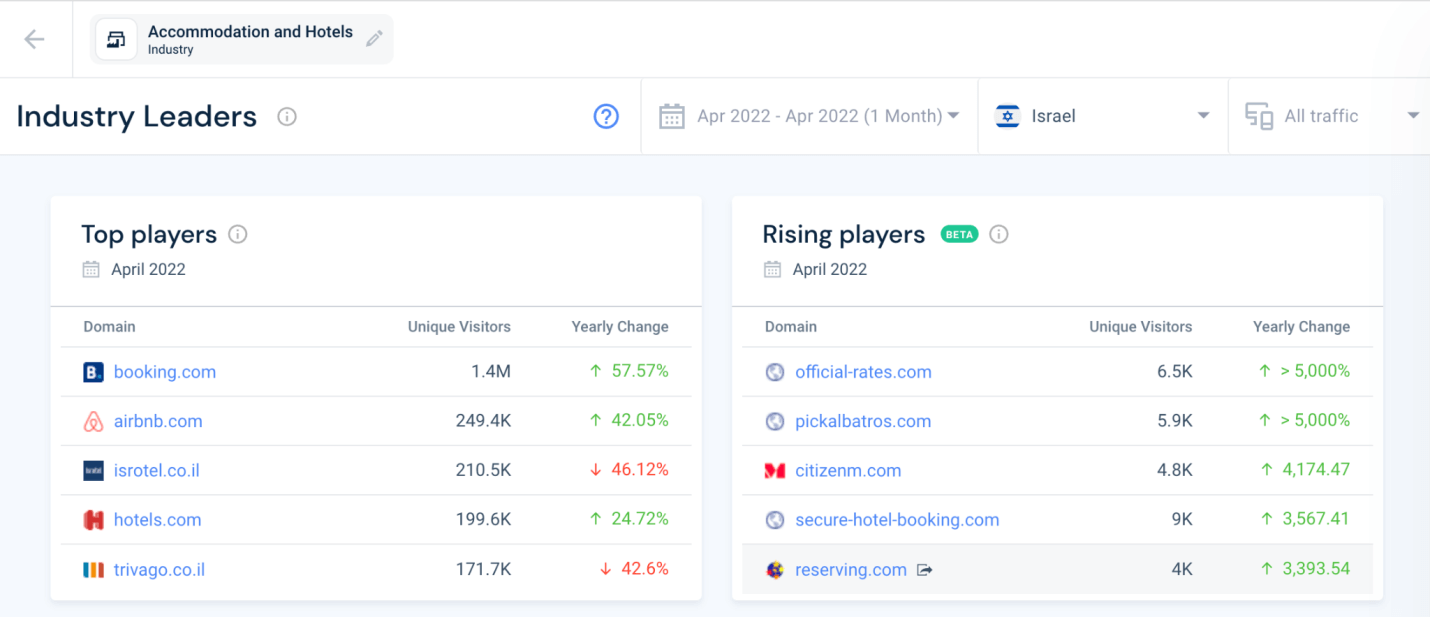

Tools: Similarweb , SEMrush

Social Media Listening: Monitor online conversations to understand customer sentiment and identify emerging trends.

Tools: Brandwatch , Sprout Social

Additional Resources

Retail Trade Associations: Many retail trade associations offer resources and research specific to your industry segment.

- National Retail Federation (NRF) : The world’s largest retail trade association, offering resources and research on various retail sectors.

- Retail Industry Leaders Association (RILA) : Represents leading retailers in the US, providing insights on public policy, consumer trends, and emerging technologies .

- International Council of Shopping Centers (ICSC) : Focuses on shopping centers and real estate, offering data and reports on shopping center performance and consumer behavior.

- Grocery Manufacturers Association (GMA) : Represents the food, beverage, and consumer product industry, providing insights on consumer trends and purchasing habits in the grocery sector.

News and Publications: Stay up-to-date on industry trends by following relevant publications and news websites.

- Retail Dive : Provides news and analysis on the retail industry, covering trends in e-commerce, omnichannel retailing, and technology.

- Chain Store Age : Offers news and insights for retail executives, covering topics like store operations, marketing, and technology.

- Supermarket News : Focuses on the grocery industry, providing news and analysis on trends, consumer behavior, and supply chain issues.

- Women’s Wear Daily (WWD) : Covers the fashion and beauty industry, offering insights on consumer trends, fashion weeks, and retail strategies.

By combining these tools and resources, you can conduct comprehensive retail market research that empowers you to make strategic decisions and gain a competitive edge.

Case Study: Home Depot Leverages Market Research to Drive In-Store Tech Adoption

Home Depot , a leading home improvement retailer, recognized the growing importance of technology in the customer journey. However, they needed to understand how customers interacted with technology in-store and how to encourage its adoption.

Research Methods

In-Store Observations: Researchers observed how customers navigated stores, interacted with kiosks and digital signage, and sought assistance from employees.

Customer Surveys: Surveys were conducted to understand customer attitudes towards technology in-store, their preferred ways to access information, and any pain points they encountered.

Focus Groups: Focus groups with DIY enthusiasts explored their comfort level with technology and their ideal in-store tech experience.

Key Findings

Customers were receptive to using technology in-store, especially for tasks like product research, checking inventory, and accessing project guides.

Traditional methods of getting help, like flagging down employees, were still important, but customers appreciated the ability to access information independently through kiosks and digital signage.

There was a gap between customer needs and existing technology offerings. The in-store tech felt clunky and not user-friendly for some customers.

Actions Taken

Improved In-Store Kiosks: Home Depot upgraded their kiosks with a more intuitive interface and a wider range of functionalities, allowing customers to browse products, compare features, and access how-to videos.

Enhanced Digital Signage: Digital signage was revamped to display targeted product information, special promotions, and DIY project inspiration, aligned with the customer’s location in the store.

Employee Training: Employees were trained on the new technology and empowered to guide customers towards using the kiosks and digital signage for a more efficient shopping experience.

Increased Customer Satisfaction: Surveys showed a significant increase in customer satisfaction with the in-store shopping experience, particularly regarding ease of finding information and getting help.

Improved Sales Conversion: Data indicated that customers who interacted with the in-store technology were more likely to purchase.

Enhanced Brand Image: Home Depot positioned itself as a leader in integrating technology to improve the customer experience in the home improvement sector.

Lessons Learned

This case study highlights the importance of market research in understanding customer needs and effectively integrating technology in a traditional retail setting. By actively listening to their customers, Home Depot identified opportunities to bridge the gap between traditional and digital shopping experiences, ultimately leading to increased customer satisfaction and sales.

Cracking the Code: Overcoming Challenges in Retail Market Research

Retail market research is essential for staying ahead of the curve in this dynamic industry. However, gathering valuable customer insights can be tricky. Here, we explore some common challenges and how to overcome them:

Challenge 1: Capturing Elusive Customers

The Problem: Today’s consumers are busy and have short attention spans. Traditional methods like in-person surveys can have low response rates.

The Solution: Embrace online research tools like Prelaunch.com’s Idea Validation feature . The tool allows you to put together a sharable page that sums up and presents your product to an audience. The process takes less than 10 minutes and lets you capture your idea in a way that’s short, sweet and to the point. Based on how they engage with the page, you’ll be able to know whether your idea is valid or not.

Challenge 2: Keeping Pace with Change

The Problem: Retail trends evolve rapidly. Research based on outdated data can lead to missed opportunities.

The Solution: Build a culture of continuous research. Conduct regular pulse surveys to track changing preferences and use social listening tools to monitor online conversations about your brand and industry.

Challenge 3: Omnichannel Mystery

The Problem: The retail journey spans multiple channels – online stores, physical stores, and mobile apps. Understanding customer behavior across these touchpoints can be complex.

The Solution: Employ a mix of research methods. Combine online surveys with website behavior tracking and in-store observation to get a holistic view of the customer experience.

Challenge 4: Data Overload & Analysis Paralysis

The Problem: With so much data available, it can be overwhelming to analyze it effectively and translate insights into actionable steps.

The Solution: Invest in data analytics tools. These tools can help you categorize, visualize, and identify key trends within your data sets. Focus on creating clear research questions to guide your analysis and prioritize actionable insights.

By understanding these challenges and implementing the suggested solutions, you can ensure your retail market research delivers valuable insights that drive better business decisions and keep your brand at the forefront of the ever-evolving retail landscape.

Retail market research is not a one-size-fits-all endeavor. It requires adaptability, creativity, and a commitment to understanding the intricate interaction between markets and consumers. By following the steps provided in this guide and combining it with the right tools and resources, you can unlock invaluable insights that will drive your retail business forward.

Remember that conducting comprehensive retail market research is an investment, not an expense. It is the foundation upon which successful retail strategies are built. By immersing yourself in the data and understanding the unique characteristics of retail market research, you are taking the first steps towards securing your position in the competitive retail industry.

Emerge as a leader in your segment by harnessing the power of retail market research. Your strategies should not only reflect market realities but should also anticipate and shape them. Take the time to master this critical component of retail, and watch as your business flourishes in response. Happy analyzing!

What is retail market research?

Retail market research is the systematic process of gathering information about the retail industry, specifically focusing on your target market and competitors. It helps you understand what customers want and need, how they shop, and what influences their buying decisions.

Who should conduct retail market research?

Ideally, anyone involved in making strategic decisions for a retail business can benefit from market research. This can include:

- Business Owners and Managers: Gain insights to improve product selection, pricing strategies, marketing campaigns, and overall customer experience.

- Marketing and Sales Teams: Understand customer needs and preferences to develop targeted marketing initiatives and improve sales conversion rates.

- Product Development Teams: Inform product development decisions based on real customer needs and emerging trends.

While some larger companies might have dedicated market research teams, smaller retailers can still conduct valuable research using a mix of free and paid tools and resources.

What types of market research are most appropriate for the retail industry?

Retail market research can leverage various methods, but some are particularly well-suited for the industry:

Primary Research: This involves collecting your own data directly from your target audience.

Examples: Customer surveys and questionnaires to understand shopping habits and preferences. Focus groups to gain deeper insights into customer motivations and product perceptions. In-store observations to analyze customer behavior and identify areas for improvement.

Secondary Research: This involves leveraging existing data collected by others.

Examples: Industry reports on market size, trends, and competitor analysis. Government statistics on demographics and spending habits in your target market. Competitor analysis to understand their offerings, pricing strategies, and marketing tactics. Social media listening to monitor online conversations and identify customer sentiment towards your brand and industry trends.

By combining primary and secondary research methods, retailers can gain a well-rounded understanding of their market and make informed decisions for long-term success.

Alice Ananian

Alice has over 8 years experience as a strong communicator and creative thinker. She enjoys helping companies refine their branding, deepen their values, and reach their intended audiences through language.

Related Articles

Automotive Market Research: Specifics, Challenges, and Tips

- June 5, 2024

The Ultimate List of 10 Best Banks for Startups

- by Larisa Avagyan

- February 8, 2024

How to Do Market Research: The Complete Guide

Learn how to do market research with this step-by-step guide, complete with templates, tools and real-world examples.

Access best-in-class company data

Get trusted first-party funding data, revenue data and firmographics

Market research is the systematic process of gathering, analyzing and interpreting information about a specific market or industry.

What are your customers’ needs? How does your product compare to the competition? What are the emerging trends and opportunities in your industry? If these questions keep you up at night, it’s time to conduct market research.

Market research plays a pivotal role in your ability to stay competitive and relevant, helping you anticipate shifts in consumer behavior and industry dynamics. It involves gathering these insights using a wide range of techniques, from surveys and interviews to data analysis and observational studies.

In this guide, we’ll explore why market research is crucial, the various types of market research, the methods used in data collection, and how to effectively conduct market research to drive informed decision-making and success.

What is market research?

The purpose of market research is to offer valuable insight into the preferences and behaviors of your target audience, and anticipate shifts in market trends and the competitive landscape. This information helps you make data-driven decisions, develop effective strategies for your business, and maximize your chances of long-term growth.

Why is market research important?

By understanding the significance of market research, you can make sure you’re asking the right questions and using the process to your advantage. Some of the benefits of market research include:

- Informed decision-making: Market research provides you with the data and insights you need to make smart decisions for your business. It helps you identify opportunities, assess risks and tailor your strategies to meet the demands of the market. Without market research, decisions are often based on assumptions or guesswork, leading to costly mistakes.

- Customer-centric approach: A cornerstone of market research involves developing a deep understanding of customer needs and preferences. This gives you valuable insights into your target audience, helping you develop products, services and marketing campaigns that resonate with your customers.

- Competitive advantage: By conducting market research, you’ll gain a competitive edge. You’ll be able to identify gaps in the market, analyze competitor strengths and weaknesses, and position your business strategically. This enables you to create unique value propositions, differentiate yourself from competitors, and seize opportunities that others may overlook.

- Risk mitigation: Market research helps you anticipate market shifts and potential challenges. By identifying threats early, you can proactively adjust their strategies to mitigate risks and respond effectively to changing circumstances. This proactive approach is particularly valuable in volatile industries.

- Resource optimization: Conducting market research allows organizations to allocate their time, money and resources more efficiently. It ensures that investments are made in areas with the highest potential return on investment, reducing wasted resources and improving overall business performance.

- Adaptation to market trends: Markets evolve rapidly, driven by technological advancements, cultural shifts and changing consumer attitudes. Market research ensures that you stay ahead of these trends and adapt your offerings accordingly so you can avoid becoming obsolete.

As you can see, market research empowers businesses to make data-driven decisions, cater to customer needs, outperform competitors, mitigate risks, optimize resources and stay agile in a dynamic marketplace. These benefits make it a huge industry; the global market research services market is expected to grow from $76.37 billion in 2021 to $108.57 billion in 2026 . Now, let’s dig into the different types of market research that can help you achieve these benefits.

Types of market research

- Qualitative research

- Quantitative research

- Exploratory research

- Descriptive research

- Causal research

- Cross-sectional research

- Longitudinal research

Despite its advantages, 23% of organizations don’t have a clear market research strategy. Part of developing a strategy involves choosing the right type of market research for your business goals. The most commonly used approaches include:

1. Qualitative research

Qualitative research focuses on understanding the underlying motivations, attitudes and perceptions of individuals or groups. It is typically conducted through techniques like in-depth interviews, focus groups and content analysis — methods we’ll discuss further in the sections below. Qualitative research provides rich, nuanced insights that can inform product development, marketing strategies and brand positioning.

2. Quantitative research

Quantitative research, in contrast to qualitative research, involves the collection and analysis of numerical data, often through surveys, experiments and structured questionnaires. This approach allows for statistical analysis and the measurement of trends, making it suitable for large-scale market studies and hypothesis testing. While it’s worthwhile using a mix of qualitative and quantitative research, most businesses prioritize the latter because it is scientific, measurable and easily replicated across different experiments.

3. Exploratory research

Whether you’re conducting qualitative or quantitative research or a mix of both, exploratory research is often the first step. Its primary goal is to help you understand a market or problem so you can gain insights and identify potential issues or opportunities. This type of market research is less structured and is typically conducted through open-ended interviews, focus groups or secondary data analysis. Exploratory research is valuable when entering new markets or exploring new product ideas.

4. Descriptive research

As its name implies, descriptive research seeks to describe a market, population or phenomenon in detail. It involves collecting and summarizing data to answer questions about audience demographics and behaviors, market size, and current trends. Surveys, observational studies and content analysis are common methods used in descriptive research.

5. Causal research

Causal research aims to establish cause-and-effect relationships between variables. It investigates whether changes in one variable result in changes in another. Experimental designs, A/B testing and regression analysis are common causal research methods. This sheds light on how specific marketing strategies or product changes impact consumer behavior.

6. Cross-sectional research

Cross-sectional market research involves collecting data from a sample of the population at a single point in time. It is used to analyze differences, relationships or trends among various groups within a population. Cross-sectional studies are helpful for market segmentation, identifying target audiences and assessing market trends at a specific moment.

7. Longitudinal research

Longitudinal research, in contrast to cross-sectional research, collects data from the same subjects over an extended period. This allows for the analysis of trends, changes and developments over time. Longitudinal studies are useful for tracking long-term developments in consumer preferences, brand loyalty and market dynamics.

Each type of market research has its strengths and weaknesses, and the method you choose depends on your specific research goals and the depth of understanding you’re aiming to achieve. In the following sections, we’ll delve into primary and secondary research approaches and specific research methods.

Primary vs. secondary market research

Market research of all types can be broadly categorized into two main approaches: primary research and secondary research. By understanding the differences between these approaches, you can better determine the most appropriate research method for your specific goals.

Primary market research

Primary research involves the collection of original data straight from the source. Typically, this involves communicating directly with your target audience — through surveys, interviews, focus groups and more — to gather information. Here are some key attributes of primary market research:

- Customized data: Primary research provides data that is tailored to your research needs. You design a custom research study and gather information specific to your goals.

- Up-to-date insights: Because primary research involves communicating with customers, the data you collect reflects the most current market conditions and consumer behaviors.

- Time-consuming and resource-intensive: Despite its advantages, primary research can be labor-intensive and costly, especially when dealing with large sample sizes or complex study designs. Whether you hire a market research consultant, agency or use an in-house team, primary research studies consume a large amount of resources and time.

Secondary market research

Secondary research, on the other hand, involves analyzing data that has already been compiled by third-party sources, such as online research tools, databases, news sites, industry reports and academic studies.

Here are the main characteristics of secondary market research:

- Cost-effective: Secondary research is generally more cost-effective than primary research since it doesn’t require building a research plan from scratch. You and your team can look at databases, websites and publications on an ongoing basis, without needing to design a custom experiment or hire a consultant.

- Leverages multiple sources: Data tools and software extract data from multiple places across the web, and then consolidate that information within a single platform. This means you’ll get a greater amount of data and a wider scope from secondary research.

- Quick to access: You can access a wide range of information rapidly — often in seconds — if you’re using online research tools and databases. Because of this, you can act on insights sooner, rather than taking the time to develop an experiment.

So, when should you use primary vs. secondary research? In practice, many market research projects incorporate both primary and secondary research to take advantage of the strengths of each approach.

One rule of thumb is to focus on secondary research to obtain background information, market trends or industry benchmarks. It is especially valuable for conducting preliminary research, competitor analysis, or when time and budget constraints are tight. Then, if you still have knowledge gaps or need to answer specific questions unique to your business model, use primary research to create a custom experiment.

Market research methods

- Surveys and questionnaires

- Focus groups

- Observational research

- Online research tools

- Experiments

- Content analysis

- Ethnographic research

How do primary and secondary research approaches translate into specific research methods? Let’s take a look at the different ways you can gather data:

1. Surveys and questionnaires

Surveys and questionnaires are popular methods for collecting structured data from a large number of respondents. They involve a set of predetermined questions that participants answer. Surveys can be conducted through various channels, including online tools, telephone interviews and in-person or online questionnaires. They are useful for gathering quantitative data and assessing customer demographics, opinions, preferences and needs. On average, customer surveys have a 33% response rate , so keep that in mind as you consider your sample size.

2. Interviews

Interviews are in-depth conversations with individuals or groups to gather qualitative insights. They can be structured (with predefined questions) or unstructured (with open-ended discussions). Interviews are valuable for exploring complex topics, uncovering motivations and obtaining detailed feedback.

3. Focus groups

The most common primary research methods are in-depth webcam interviews and focus groups. Focus groups are a small gathering of participants who discuss a specific topic or product under the guidance of a moderator. These discussions are valuable for primary market research because they reveal insights into consumer attitudes, perceptions and emotions. Focus groups are especially useful for idea generation, concept testing and understanding group dynamics within your target audience.

4. Observational research

Observational research involves observing and recording participant behavior in a natural setting. This method is particularly valuable when studying consumer behavior in physical spaces, such as retail stores or public places. In some types of observational research, participants are aware you’re watching them; in other cases, you discreetly watch consumers without their knowledge, as they use your product. Either way, observational research provides firsthand insights into how people interact with products or environments.

5. Online research tools

You and your team can do your own secondary market research using online tools. These tools include data prospecting platforms and databases, as well as online surveys, social media listening, web analytics and sentiment analysis platforms. They help you gather data from online sources, monitor industry trends, track competitors, understand consumer preferences and keep tabs on online behavior. We’ll talk more about choosing the right market research tools in the sections that follow.

6. Experiments

Market research experiments are controlled tests of variables to determine causal relationships. While experiments are often associated with scientific research, they are also used in market research to assess the impact of specific marketing strategies, product features, or pricing and packaging changes.

7. Content analysis

Content analysis involves the systematic examination of textual, visual or audio content to identify patterns, themes and trends. It’s commonly applied to customer reviews, social media posts and other forms of online content to analyze consumer opinions and sentiments.

8. Ethnographic research

Ethnographic research immerses researchers into the daily lives of consumers to understand their behavior and culture. This method is particularly valuable when studying niche markets or exploring the cultural context of consumer choices.

How to do market research

- Set clear objectives

- Identify your target audience

- Choose your research methods

- Use the right market research tools

- Collect data

- Analyze data

- Interpret your findings

- Identify opportunities and challenges

- Make informed business decisions

- Monitor and adapt

Now that you have gained insights into the various market research methods at your disposal, let’s delve into the practical aspects of how to conduct market research effectively. Here’s a quick step-by-step overview, from defining objectives to monitoring market shifts.

1. Set clear objectives

When you set clear and specific goals, you’re essentially creating a compass to guide your research questions and methodology. Start by precisely defining what you want to achieve. Are you launching a new product and want to understand its viability in the market? Are you evaluating customer satisfaction with a product redesign?

Start by creating SMART goals — objectives that are specific, measurable, achievable, relevant and time-bound. Not only will this clarify your research focus from the outset, but it will also help you track progress and benchmark your success throughout the process.

You should also consult with key stakeholders and team members to ensure alignment on your research objectives before diving into data collecting. This will help you gain diverse perspectives and insights that will shape your research approach.

2. Identify your target audience

Next, you’ll need to pinpoint your target audience to determine who should be included in your research. Begin by creating detailed buyer personas or stakeholder profiles. Consider demographic factors like age, gender, income and location, but also delve into psychographics, such as interests, values and pain points.

The more specific your target audience, the more accurate and actionable your research will be. Additionally, segment your audience if your research objectives involve studying different groups, such as current customers and potential leads.

If you already have existing customers, you can also hold conversations with them to better understand your target market. From there, you can refine your buyer personas and tailor your research methods accordingly.

3. Choose your research methods

Selecting the right research methods is crucial for gathering high-quality data. Start by considering the nature of your research objectives. If you’re exploring consumer preferences, surveys and interviews can provide valuable insights. For in-depth understanding, focus groups or observational research might be suitable. Consider using a mix of quantitative and qualitative methods to gain a well-rounded perspective.

You’ll also need to consider your budget. Think about what you can realistically achieve using the time and resources available to you. If you have a fairly generous budget, you may want to try a mix of primary and secondary research approaches. If you’re doing market research for a startup , on the other hand, chances are your budget is somewhat limited. If that’s the case, try addressing your goals with secondary research tools before investing time and effort in a primary research study.

4. Use the right market research tools

Whether you’re conducting primary or secondary research, you’ll need to choose the right tools. These can help you do anything from sending surveys to customers to monitoring trends and analyzing data. Here are some examples of popular market research tools:

- Market research software: Crunchbase is a platform that provides best-in-class company data, making it valuable for market research on growing companies and industries. You can use Crunchbase to access trusted, first-party funding data, revenue data, news and firmographics, enabling you to monitor industry trends and understand customer needs.

- Survey and questionnaire tools: SurveyMonkey is a widely used online survey platform that allows you to create, distribute and analyze surveys. Google Forms is a free tool that lets you create surveys and collect responses through Google Drive.

- Data analysis software: Microsoft Excel and Google Sheets are useful for conducting statistical analyses. SPSS is a powerful statistical analysis software used for data processing, analysis and reporting.

- Social listening tools: Brandwatch is a social listening and analytics platform that helps you monitor social media conversations, track sentiment and analyze trends. Mention is a media monitoring tool that allows you to track mentions of your brand, competitors and keywords across various online sources.

- Data visualization platforms: Tableau is a data visualization tool that helps you create interactive and shareable dashboards and reports. Power BI by Microsoft is a business analytics tool for creating interactive visualizations and reports.

5. Collect data

There’s an infinite amount of data you could be collecting using these tools, so you’ll need to be intentional about going after the data that aligns with your research goals. Implement your chosen research methods, whether it’s distributing surveys, conducting interviews or pulling from secondary research platforms. Pay close attention to data quality and accuracy, and stick to a standardized process to streamline data capture and reduce errors.

6. Analyze data

Once data is collected, you’ll need to analyze it systematically. Use statistical software or analysis tools to identify patterns, trends and correlations. For qualitative data, employ thematic analysis to extract common themes and insights. Visualize your findings with charts, graphs and tables to make complex data more understandable.

If you’re not proficient in data analysis, consider outsourcing or collaborating with a data analyst who can assist in processing and interpreting your data accurately.

7. Interpret your findings

Interpreting your market research findings involves understanding what the data means in the context of your objectives. Are there significant trends that uncover the answers to your initial research questions? Consider the implications of your findings on your business strategy. It’s essential to move beyond raw data and extract actionable insights that inform decision-making.

Hold a cross-functional meeting or workshop with relevant team members to collectively interpret the findings. Different perspectives can lead to more comprehensive insights and innovative solutions.

8. Identify opportunities and challenges

Use your research findings to identify potential growth opportunities and challenges within your market. What segments of your audience are underserved or overlooked? Are there emerging trends you can capitalize on? Conversely, what obstacles or competitors could hinder your progress?

Lay out this information in a clear and organized way by conducting a SWOT analysis, which stands for strengths, weaknesses, opportunities and threats. Jot down notes for each of these areas to provide a structured overview of gaps and hurdles in the market.

9. Make informed business decisions

Market research is only valuable if it leads to informed decisions for your company. Based on your insights, devise actionable strategies and initiatives that align with your research objectives. Whether it’s refining your product, targeting new customer segments or adjusting pricing, ensure your decisions are rooted in the data.

At this point, it’s also crucial to keep your team aligned and accountable. Create an action plan that outlines specific steps, responsibilities and timelines for implementing the recommendations derived from your research.

10. Monitor and adapt

Market research isn’t a one-time activity; it’s an ongoing process. Continuously monitor market conditions, customer behaviors and industry trends. Set up mechanisms to collect real-time data and feedback. As you gather new information, be prepared to adapt your strategies and tactics accordingly. Regularly revisiting your research ensures your business remains agile and reflects changing market dynamics and consumer preferences.

Online market research sources

As you go through the steps above, you’ll want to turn to trusted, reputable sources to gather your data. Here’s a list to get you started:

- Crunchbase: As mentioned above, Crunchbase is an online platform with an extensive dataset, allowing you to access in-depth insights on market trends, consumer behavior and competitive analysis. You can also customize your search options to tailor your research to specific industries, geographic regions or customer personas.