Full Report - OKTA - Defining An Industry (1/3)

At a modest valuation, there is a huge room for okta to continue to grow as the sector defining vendor..

Sources of Alpha: Complexity of the Business

Expected Price Appreciation: 110% from $220 within 3 years

A brief review of the mega trends propelling Identity Management to growing importance within the cybersecurity industry.

OKTA’s CEO & Founder, Todd, McKinnon, has a grandiose and differentiated vision for the role of identity and aims for OKTA to define the industry’s standards.

A technical dive into the progression of identity and how it works.

An assessment of OKTA’s dominance in its core IAM market and likely success entering into neighbouring IGA and PAM markets.

We view high growth, improving profitability, and gradual multiple contraction will generate market-beating investor returns over a long horizon.

Year founded : 2009

Headquarters : San Francisco

IPO date : 7th April 2017

Overall market : Identity Management. Size estimated to be around $80bn. At a high-level the market is divided in Workforce Identity ($50bn) and Customer Identity ($30bn). Identity is rapidly growing in importance within the cybersecurity industry.

Sub-Markets : Okta’s ( OKTA ) core market is in Workforce Identity. They rose to success in delivering Identity & Access Management (IAM), a market worth an estimated $35bn. OKTA has recently announced they’ll be entering into neighbouring workforce identity markets with full suites within the next few quarters – Identity Governance & Administration (NYSE: IGA ) and Privileged Access Management (NYSE: PAM ), estimated to be worth c. $8bn and $7bn, respectively. They’ve also recently made a strong move into Customer Identity (CIAM) by acquiring a market leader.

Competitors : The main private IAM rivals are OneLogin and ForgeRock. The main public IAM rivals are Microsoft and Ping Identity. The main IGA rival is SailPoint (public). The main PAM rival is CyberArk (public).

M&A : In March, 2021, OKTA bought market leading CIAM provider, Auth0, for $6.5bn, all paid for in stock.

Market cap, Share Price, & P/S : $37.3bn, $245/share, 42x.

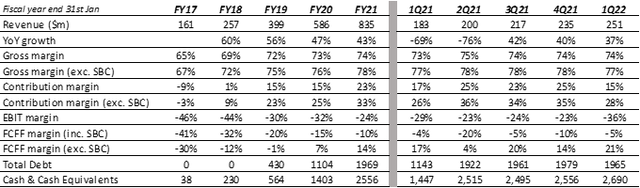

Financials :

Valuation : Our Enterprise DCF valuation has produced an intrinsic value of $469/share. We think a 2-to-3-year timeframe for this is achievable. For more detail, please see the Valuation section.

In recent years, OKTA has emerged as the leader IAM. They came to market with a divergent cloud-centric approach that offered enterprises an easier, more streamlined, more secure, and more cost-effective solution than the legacy on-prem IAM systems managed by Oracle and IBM. Being the first to fully leverage the cloud to deliver better IAM has given them first-mover advantages that are hard for rivals to overcome. And by building their entire software stack on open-source standards such as SAML, 0Auth, and OpenID Connect, whereas competitors are primarily focused on proprietary source code or are entangled with legacy formats, OKTA has a tremendous sustainable advantage in terms of integration and extensibility. This means integrating their software with others is easier and the extensibility part means that their software is designed to accommodate continual changes. Therefore, we view OKTA as nimbly adapting to the dynamic world of cybersecurity, and the probability that OKTA will ever become a future legacy software player is extremely unlikely.

OKTA has grown to be known as the outright leader in IAM and now they are planning ventures into neighbouring markets – IGA, PAM, and CIAM. The WFH conditions has expedited the importance of IGA and PAM, however, just like IAM back in the early 2010s, they are dominated by legacy players – SailPoint (NYSE: SAIL ) and CyberArk (NASDAQ: CYBR ), respectively. We expect OKTA’s cloud-first and divergent approach to IGA and PAM will outcompete these two legacy providers that have been way too slow in adapting to the cloud.

CIAM is a complete greenfield market opportunity. The main competition is that of enterprise’s own IT pride and the determination to build something in-house. Auth0, is a software platform that empowers developers to build their own apps and systems in a much easier fashion that puts the managing of customer identity at its core. Customer identity has been thrusted into the spotlight recently, as social distancing has caused consumers to demand better experiences online to compensate. Responding to this, organizations are looking for ways to enhance user experiences whilst delivering the highest levels of security and being compliant. Customer identity and access management, or CIAM, is designed to achieve this by bridging security and seamless user experience – and Auth0 are simply the best at doing this. And Auth0’s and OKTA’s software approaches, Go-to-Market (GTM) strategies, and complimentary skill sets, will make the deal a huge success, in our opinion.

Intro to Identity

Identity management is all about making access to apps/websites/systems easier for the user and more difficult for bad actors. It’s also about unburdening IT admins with voluminous, repetitive, tasks so they can refocus on higher-value adding activities for their organizations.

As COVID-19 triggered the WFH trend, identity has taken on a new level of importance. It’s emphasized that the best way to protect a corporation’s customers, employees, and data, amid distributed business environments is to protect user identities and make sure people are only accessing the data that they are entitled to. Identity has become integral to various cybersecurity trends and is critical in seamlessly bridging security and user experience.

Mega Trends

There are various mega trends that are thrusting the role of identity into the spotlight, today and into the future. These will be strong tailwinds for broad-scale consolidator identity providers, like OKTA, as well as for emerging BoB niche players.

Cloud Adoption

Without the emergence of cloud computing, identity management would have remained a niche area of cybersecurity. It is only because of cloud computing that organizations can scale their apps and websites to billions of users dispersed around the globe. However, the shift to cloud computing and the explosion of SaaS and internal apps, has led to widespread improper access levels – basically, too many people were given too many privileges to too many things. This was an easier topic to address in narrower computing environments. Technologies like Cloud Access Security Brokers (NASDAQ: CASB ) and zero trust are solutions to these problems; however, they need to work in conjunction with identity providers to deliver effective security. So, as we are still relatively early on in the cloud transformation journey, expect demand for identity management solutions to grow in lockstep with cloud adoption – well, in fact, at a faster rate in order for security to catch up.

When the world suddenly switched to remote work, companies made a beeline for VPN solutions. They served a purpose as a quick-fix but they do contain inherent security weaknesses and degrade the user experience. They are commonly the weakest link that lead to data breaches.

VPNs tunnel remote employees’ connection into the private corporate network - this poses a couple of problems.

1) They give access to the entire corporate network, meaning if a cybercriminal hacked the connection, they would gain access to traverse the whole network and snoop around for valuable data.

2) If the remote employee wants to connect to SaaS apps, then connecting to the corporate network before being backhauled to the public cloud adds latency and degrades user experience.

Zero trust, which is predicated on identity, resolves these problems by only giving employees access to the apps they want to use, not the entire corporate network. Secondly, zero trust provides direct-to-cloud connectivity to SaaS apps, thereby improving latency and user experience.

Many security and productivity issues during the depths of the pandemic were a result of VPN solutions and our research suggests only a small proportion have decided to alleviate the issues with a zero trust architecture.

The core principle of zero trust is to approach each and every counterparty to a connection as untrustworthy until identities (users, apps, machines, etc.) have been authenticated. Therefore, it’s clear to see why zero trust is dependent on identity management. Expect BoB identity names to prosper in the next few years.

OKTA is an ideal stock for exposure to the zero trust trend. Most identity providers interoperate with zero trust providers, but OKTA has its own embedded solution, which gives it a material advantage. It’s noteworthy, that many zero-trust providers also build their software with OKTA as the top integration priority. So, OKTA is grabbing the zero-trust market from many angles.

Data Privacy

Catalyzed by regulations such as GDPR, HIPAA, PCI, and CCPA, data privacy is a topic of increasing importance and complexity that organizations need to continually keep on top of. Again, user identity is the key piece of information that ties all the requirements together in order to be compliant. Identity providers are in an advantageous position to not only efficiently comply themselves, but also to assist customers and partners remain compliant.

Since the pandemic there has been renewed focus on improving the online customer experience (NYSE: CX ) or user experience (commonly referred to UX to encompass employees as well). This has been brought to the fore to compensate for the limited in-person service interactions customers/users can have during social distancing.

Identity management is pivotal for companies to deliver streamlined and secure experiences to customers/users – it is the bridge between experience and security. Also, various lines of business will begin using data managed by identity providers to enhance experiences and generate greater revenue. OKTA’s acquisition of Auth0 is a crucial strategic move to capitalize on these trends. The complexity of omnichannel communications is compelling companies to create unique customer engagement systems which require customized identity solutions – a perfect backdrop for OKTA and Auth0.

Biden’s Executive Order for Cybersecurity

In May-21, President Biden released an executive order pushing federal agencies to strengthen their security posture with various technologies including zero trust architectures and Multifactor Authentication (NYSE: MFA ). OKTA currently has FedRamp Moderate Authorization and has High Authorization on the near-term roadmap. Therefore, this is a long-tail of incremental growth for OKTA and other BoB identity providers.

SolarWinds Attack

Following the SolarWinds attack, unveiled in Dec-20, there is a long-tail of incremental growth for the cybersecurity industry. The attack emphasized the systemic issues embedded in many organizations’ security posture, and will not be resolved simply by purchasing more defenses or changing vendors. Consultations, assessments, and responses have been underway but the process will be drawn out as the security revamps require organization-wide reviews. Therefore, expect broad enterprise demand tailwinds as we move into the second half of 2021 and beyond.

Continuous Adaptive Risk & Trust Assessment, aka CARTA, is an emerging framework for corporations to balance security and user experience. Binary-like decisions related to black and white lists (websites, signatures, etc.) and denying or allowing access are suboptimal in the new dispersed digital world. CARTA pertains to real-time monitoring of threats and applying various contextual data (user, device, browser, location, time, etc.) to continually assess risk levels for every connection and event and permit access accordingly. For example, if there is unusual user behaviour (different time of access) but everything else looks like baseline behaviour, then the CARTA system may allow instantaneous limited access to protect the data whilst maintaining satisfied user experience, and then reinstate full privileges once the user has completed MFA.

Identity and zero trust are at the heart of CARTA. As the industry evolves companies will expand their identity and zero trust solutions into comprehensive CARTA frameworks. By default, OKTA will benefit from the growing recognition of CARTA, however, we see that they could go a step further by padding out their technology into a fully-fledged CARTA platform to further differentiate themselves within the cybersecurity industry.

McKinnon’s Vision

OKTA’s CEO & Founder, Todd McKinnon, has a vision that eclipses the leaders of all other identity players we’ve reviewed. His vision is to cement OKTA as the primary cloud of computing and define the identity standard. Identity has long been a peripheral aspect of security, however, the altering landscape, expedited by COVID-19, is changing the perception.

We agree with McKinnon that identity is on the path to being the nucleus of security operations that also provides the bridge for seamless user experiences. With this in mind, having identity as the primary cloud that seamlessly connects across a distributed and multi-cloud environment is very believable. In essence, identity management will become the centre of computer networks and enable all business functions to be more productive.

McKinnon has also discussed how he intends OKTA to be the most connected and easiest-to-work-with company around. In effect, he aims for OKTA to be at the heart of digital operations but at the same time be invisible. No other identity CEOs are describing their vision like this.

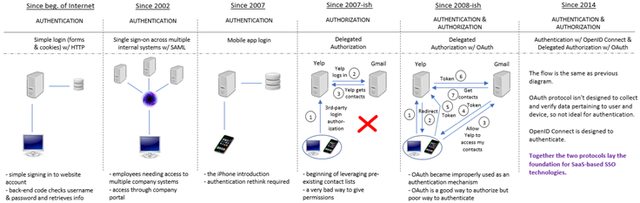

Identity & Access: A Brief History

In the beginning of the Internet identity use cases pertained to one-dimensional authentication only. Users inputted their username and password into an online form, the server will check for a match in the database, and grant or deny access accordingly. This flow would apply for consumers accessing online accounts and employees accessing internal company systems/applications alike. And the only necessary protocols for such rudimentary authentication was HTTP and ethernet.

In the 2000s, however, use cases became increasingly complex. In 2002, the Security Assertion Markup Language, or SAML, was introduced to enable a Single Sign-On ( SSO ) framework to authenticate the identity of employees accessing multiple internal company systems. Then, in 2007, the advent of the iPhone caused developers to rethink authentication for various reasons including the fact that cookies didn’t work as well on mobile devices as they did in the desktop browser. Then around the same time, socially-oriented online companies made the first attempts for gaining user permission, or authorization, so they could leverage their users’ contact lists from elsewhere.

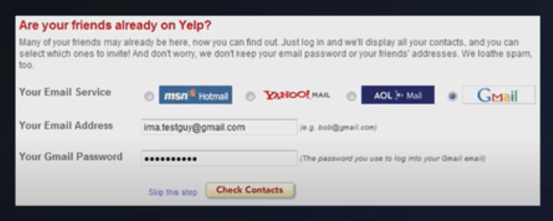

Yelp were one of the first companies to leverage pre-existing contact lists of their new users, but did it in a really bad way. Yelp asked their users for permission in using their Hotmail/Yahoo/Gmail email address and password so they can access the users’ contact lists. They would literally login to user email accounts to collect contacts, on the promise that they will not store their credentials afterwards.

Figure 1 - The First Attempts at Authorization

Clearly, from many angles, this is not a secure way to access users’ contacts stored with 3rd parties. OAuth, was an open-source protocol introduced in 2006 designed to add security to this authorization process. Instead of Yelp going to Google and logging into Gmail accounts, it entailed:

Yelp redirecting the user to Google servers (with a callback attached).

Then, Google confirming the user agrees to sharing their contacts with Yelp.

Upon user permission, Google sends the user back to Yelp (using the callback) with an access token.

Then, Yelp connects to the Google servers showing the access token.

Google verifies the access token.

And upon verification, Google sends Yelp the user’s contact list.

This is much more secure way to share contact lists because Yelp (or any other socially-oriented vendor) isn’t given the email account password.

You may notice how the concept of SAML (corporate network SSO) and the OAuth protocol (gaining authorization across the web) provided a springboard to how SaaS-based SSO is conducted today. There has been some problems enroute to modern SSO, however. SAML has always been a tricky protocol for developers to work with and isn’t ideal for the internet. And OAuth became a victim of its own success, because subsequently it was widely used for other use cases that it wasn’t designed for. Eventually, OAuth was applied to authentication as much as it was for authorization. But as OAuth isn’t able to collect identity data, related to user and device, to complete authentication, there were a few years whereby developers came up with complex, ad hoc, workarounds.

In 2014, OpenID Connect was another open-source protocol introduced to resolve the headaches involving 3rd party authentication. In essence, it is a protocol that is laid atop OAuth that only adds c. 10% extra code for the developer, but provides a standardized way for letting users securely access their account with a different account’s login credentials.

And it is the combination of SAML, OAuth and OpenID Connect that enables the likes of OKTA to provide enterprises and consumers with SSO technologies, and in effect, created the both the IAM and CIAM markets.

The following diagram attempts to summarize the aforementioned. Apologies for the font size; if you want a closer look, I’ll send you an email. Ask me at [email protected] .

Figure 2 – Evolution of Use Cases for Authentication & Authorization

Source: Convequity

A SSO provider provides users with a single interface to login once and access all their applications. They utilize SAML and OpenID Connect so they can authenticate the user for each app they’re accessing, and they utilize OAuth to make sure the user is properly authorized and can only work with data that has been scoped out to them. SSO technology greatly enhances the productivity of both IT admins and the general workforce. It liberates IT admins from repetitive low-value tasks such as password resets so they can deliver more value to their employers, and by removing multiple logins each day employees become more engaged and productive.

SSO technology streamlines access to apps but doesn’t address the threat of passwords being compromised. Notwithstanding strong password principles, hackers are employing increasingly sophisticated twists on brute force attacks, phishing, malware keyloggers, and offline cracking to get the passwords. Multifactor Authentication ( MFA ), is a layer of security to thwart the bad actors attempts at finding the passwords. MFA requires the user to verify another identity factor such as inputting an OTP code sent to their mobile device, answering a secret question, or using biometric information (fingerprint, facial recognition).

SSO and MFA form the core of the IAM industry, as together the facilitate speedy access, appropriate authorization, and high levels of security.

Home-Grown IAM Solutions?

Given the complexity behind IAM, it is very difficult for businesses to develop home-grown solutions. Not only does it require ample resources to launch an IAM system, keeping things up-to-date in regards to hashing standards for passwords and regulations for storing users’ information (GDPR, CCPA, HIPAA etc.) are extremely time-consuming. Furthermore, adding to the troubles in IT departments attempting to build something in-house, is the substantial fuzziness in regards to the OAuth spec and lots of overly complicated jargon and contradictory advice online. It’s hard to imagine any organization producing a higher ROI by operating a home-grown IAM system compared to using a specialist provider like OKTA.

This complexity is a very strong tailwind for the future growth of the IAM industry. The sudden shift to highly dispersed work environments has forced organizations to adopt IAM frameworks, however, they simply don’t have the in-house resources and expertise to run it themselves.

Ready for more?

Compounder Fund: Okta Investment Thesis

Compounder fund: okta investment thesis - 06 sep 2020.

Data as of 5 September 2020

Okta (NASDAQ: OKTA) is one of the 40 companies in Compounder Fund’s initial portfolio . This article describes our investment thesis for the company..

Company description

Okta’s vision is to enable any organisation to use any technology. To fulfill its vision, Okta provides the Okta Identity Cloud software platform where all its products live. Okta’s cloud-based software products help other companies manage and secure access to applications for their employees, contractors, partners, and customers.

The internal use-cases, where Okta’s solutions are used by organisations to manage and secure software-access among their employees, contractors, and partners, are referred to as workforce identity by Okta. An example of a workforce identity customer is 20th Century Fox . The external-facing use cases are known as customer identity, and it is where Okta’s solutions are used by its customers to manage and secure the identities and service/product access of their customers. Adobe is one of the many customers of Okta’s customer identity platform.

There’s a rough 80:20 split in Okta’s revenue between the workforce identity and customer identity solutions.

At the end of FY2020 (fiscal year ended 31 January 2020), Okta had more than 7,950 customers. These customers come from nearly every industry and range from small organisations with less than 100 employees to the largest companies in the world.

For a geographical perspective, Okta sourced 84% of its revenue in FY2020 from the US.

Investment thesis

We have laid out our investment framework in Compounder Fund’s website and will use the framework to describe our investment thesis for Okta.

1. Revenues that are small in relation to a large and/or growing market, or revenues that are large in a fast-growing market

Okta estimates that its market opportunity for workforce identity is U$30 billion today. This is up from US$18 billion around three years ago. The company arrived at its current workforce identity market size of US$30 billion in this way: “50,000 US businesses with more than 250 employees (per 2019 US.Bureau of Labor Statistics) multiplied by 12-month ARR [annual recurring revenue] assuming adoption of all our current products, which implies a market of [US]$15 billion domestically, then multiplied by two to account for international opportunity.”

For customer identity, Okta estimates the addressable market to be US$25 billion. Here’s Okta’s description of the method behind its estimate: “Based on 4.4 billion combined Facebook users and service employees worldwide multiplied by internal application usage and pricing assumptions.” We are taking Okta’s estimate of its customer identity market with a pinch of salt. But we’re still confident that the opportunity is huge, given the growth and size of the entire SaaS (software-as-a-service) market. For perspective, a July 2020 forecast from market research firm Gartner sees global SaaS spending growing by more than 11% annually from US$$102 billion in 2019 to US$141 billion in 2022.

In the 12 months ended 31 July 2020, Okta’s revenue was just US$703.7 million, which barely scratches the surface of its total estimated market opportunity of US$55 billion. We also think it’s likely that Okta’s market is poised for growth. Based on Okta’s studies, the average number of apps that companies are using has increased by 52% from 58 in 2015 to 88 in 2019. In April 2020, Okta’s co-founder and CEO, Todd McKinnon, was interviewed by Ben Thompson for the latter’s excellent tech newsletter, Stratechery. During the interview, McKinnon revealed that large companies (those with over 5,000 employees) typically use thousands of apps. And because of COVID-19 and the resulting work-from-home movement, Okta also mentioned earlier this year that it saw a substantial increase between February and March in the number of apps deployed by companies.

The high and growing level of app-usage among companies means it can be a massive pain for an organisation to manage software-access for its employees, contractors, partners, and customers. This pain-point is what Okta Identity Cloud is trying to address. By using Okta’s software, an organisation does not need to build custom identity management software – software developers from the organisation can thus become more productive. The organisation would also be able to scale more efficiently.

And speaking of COVID-19, Okta’s management believes that the pandemic has accelerated the trends that were already in the company’s favour. We agree. Here’s what management said in Okta’s recent earnings conference calls (for the first and second quarters of FY2021):

“[First quarter of FY2021] The megatrends of increased adoption of Cloud and hybrid IT, digital transformation and Zero Trust security have been driving our business for the past several years and will continue to drive our business well into the future. In fact, once we emerge from the crisis stage of the pandemic, we expect to see an acceleration of these trends. These trends resonate now more than ever, and our leadership position going into this crisis will be further enhanced as we expand our presence and product offerings.” “[Second quarter of FY2021] We believe that the world will not return to the pre-COVID work environment. In fact, the three mega-trends that have been driving our business for the past several years, the adoption of cloud and hybrid IT, digital transformation and zero-trust security, are being accelerated by the COVID environment as organizations are rapidly evolving their digital strategy to survive the pandemic while their remote work environments continue to grow. During this crisis, our customers are using Okta’s platform more than ever.”

2. A strong balance sheet with minimal or a reasonable amount of debt

As of 31 July 2020, Okta held US$2.51 billion in cash and short-term investments. This is significantly higher than the company’s total debt of US$1.73 billion (all of which are convertible notes that are due in 2023, 2025, or 2026), and means the company has a robust balance sheet.

For the sake of conservatism, we also note that Okta had US$189.2 million in operating lease liabilities. But the company’s cash and short-term investments still comfortably outweigh the sum of its debt and operating lease liabilities (US$1.92 billion)

3. A management team with integrity, capability, and an innovative mindset

On integrity

Todd McKinnon cofounded Okta in 2009 with Frederic Kerrest. McKinnon, who’s 48 years old, has served as Okta’s CEO since the company’s founding. He has a strong pedigree in leading software companies, having been with salesforce.com from 2003 to 2009, and serving as its Head of Engineering prior to founding Okta. salesforce.com is one of the pioneering software-as-a-service companies, and is also one of the companies in Compounder Fund’s initial portfolio. Kerrest, 43, is Okta’s COO (chief operating officer) and has been in the role since the year of the company’s founding. Kerrest is also a salesforce.com alumni; he joined in 2002 and stayed till 2007, serving as a senior executive. In our view, the young ages of McKinnon and Kerrest, as well as their long tenures with Okta, are positives.

The other important leaders in Okta include:

(We note that Race is planning to retire early in FY2022, and Okta is in the process of searching for its next go-to market leader. The departure of Race is well-telegraphed and Okta has a lot of time for succession planning, so we’re not concerned with this particular leadership turnover.)

In FY2020, Okta’s senior leaders each received total compensation that ranged from US$2.9 million to US$9.0 million. These are reasonable sums compared to the scale of Okta’s business. Furthermore, 84% to 92% of their total compensation was in the form of stock awards and stock options that vest over four years. This means that the compensation of Okta’s senior leaders are tied to the long run performance of the company’s stock price, which is in turn driven by the company’s business performance. So we think that Compounder Fund’s interests as a shareholder of Okta are well-aligned with the company’s management.

Moreover, both McKinnon and Kerrest own significant stakes in Okta. As of 1 April 2020, McKinnon and Kerrest controlled 7.80 million and 3.42 million shares of the company, respectively. These shares have a collective value of US$2.36 billion at Okta’s share price of US$203 as of 5 September 2020. The high stakes that Okta’s two key leaders have lend further weight to our view that management’s interests are aligned with the company’s other shareholders.

We want to highlight that the shares held by McKinnon and Kerrest are mostly of the Class B variety. Okta has two share classes: (1) Class B, which are not traded and hold 10 voting rights per share; and (2) Class A, which are publicly traded and hold just 1 vote per share. McKinnon and Kerrest only controlled 8.9% of Okta’s total shares as of 1 April 2020, but they collectively held 49.9% of the company’s voting power. In fact, all of Okta’s senior leaders and directors together controlled 52.6% of Okta’s voting rights as of 1 April 2020. The concentration of Okta’s voting power in the hands of management (in particular McKinnon and Kerrest) means that we need to be comfortable with the company’s current leadership. We are.

On capability

From FY2015 to the first half of FY2020, Okta has seen its number of customers increase seven-fold (42% per year) from 1,320 to 8,950. So the first thing we note is that Okta’s management has a terrific track record of growing its customer count.

To win customers, Okta currently offers over 6,500 integrations with IT (information technology) infrastructure providers, and cloud, mobile, and web apps. This is up from over 5,000 integrations as of 31 January 2017. The companies that are part of Okta’s integration network include services from tech giants such as Microsoft, Alphabet, Amazon.com, salesforce.com (all four companies are also in Compounder Fund’s initial portfolio) and more. Impressively, software providers are increasingly being told by their customers that they have to be integrated with Okta before the software can be accepted.

In our view, the integration also creates a potentially powerful network effect where more integration on Okta’s network leads to more customers, and more customers leads to even more integration. During the aforementioned Stratechery interview , McKinnon shared about the competitive edge that Okta enjoys because of its efforts in integrating thousands of apps:

“[Question]: The average enterprise — maybe it’s hard to say because it varies so widely — how many SaaS services does a typical enterprise subscribe to? [Todd McKinnon] TM: Especially for any company with over 5,000 employees, it’s thousands of apps. Apps that they’ve purchased commercially, the big ones you’ve heard of, the ones that are in niche industries or verticals you haven’t heard of, and then the ones built themselves, it’s thousands. [Question]: And then Okta has to build an integration with all of those [Todd McKinnon] TM: Yeah. One of the big things we did very early on was we got really good at a metadata-driven integration infrastructure, which allowed us to have this burgeoning catalog of pre-packaged integrations, which was really unique in the industry because it is a hundreds or for a big company, it’s thousands of applications. [Question] And it ends up being a bit of a moat, right? It’s a traditional moat where you dig it up with hard work where you actually went in and you built all of these thousands of integrations, and anyone that wants to come along, if they have a choice of either recreating all the work you did or, we should just use Okta and it’s already sort of all taken care of. [Todd McKinnon] TM: Yeah, and it’s one of the things people misunderstand on a couple of different levels. The first level is they just get the number wrong. “I think there’s ten, right?” Or I’ve heard of ten big applications, so I think if I connected the ten, that would be enough, which is just off by multiple orders of magnitude. And then the second thing they get wrong is they think that, especially back in the day it was like, “Oh, there it’s going to be standards that do this.” It’s going to be SAML as a standard. There’s this standard called Open ID. And what we’ve found is that the standards were very thin, meaning they didn’t cover enough of the surface area of what the customers needed, so it might do simple login but it didn’t do directory replication, or not enough of the applications adhere to the standard. So there’s a lot more heterogeneity than people thought of so that moat was a lot wider, a lot faster than people expected. [Question] Is it fair to say that it’s your goal or maybe it has happened that people thought there would be a standard like SAML that would take care of all of this, but it’s going to end up being that Okta as the standard? [Todd McKinnon] TM: That is the goal and I think it’s evolving to where there are de facto standards. A big shift is that we have big companies that tell software vendors that if you want to sell to us, you have to integrate to Okta and they have to go to our platform, build the integration, have it be certified. So that’s not a technical standard per se, but it’s a de facto standard of an application that can be sold to a large enterprise.”

There’s more to Okta’s network effect. That’s because the more integrations and customers there are within Okta, the more signals there are that Okta can learn from and the more use cases Okta can build that benefit its customers. This virtuous cycle is shown in the graphic below:

We also credit Okta’s management with the success that the company has found with its land-and-expand strategy. The strategy starts with the company landing a customer with an initial use case, and then expanding its relationship with the customer through more users and/or more use cases. The success can be illustrated through Okta’s strong dollar-based net retention rates (DBNRRs). The metric is a very important gauge for the health of a SaaS company’s business. It measures the change in revenue from all of Okta’s customers a year ago compared to today; it includes positive effects from upsells as well as negative effects from customers who leave or downgrade. Anything more than 100% indicates that the company’s customers, as a group, are spending more – Okta’s DBNRRs have been in the high-teens to high-twenties range over the past few years. There has been a noticeable but slight downward trend in Okta’s DBNRR, but the figure of 121% for the first half of FY2021 is still impressive.

The way that Okta has stepped up to the plate in the current COVID-19 pandemic has given us even more confidence in management’s abilities. Here are a few instances:

- In the first quarter of FY2021, Okta helped Fedex to deploy Okta Identity Cloud within 36 hours (that’s just three days!) to enable more than 85,000 of Fedex’s remote and essential employees to connect to critical applications.

- When COVID-19 started flaring up in the USA, the state of Illinois needed a way to securely manage its digital infrastructure and the digital identities of state employees, state agencies, contractors, and citizens. Illinois chose Okta to provide this important service.

- Prior to the first quarter of FY2021, the US-based wireless provider T-Mobile had already been a customer of Okta for sometime. When T-Mobile recently completed its merger with peer-company Sprint, T-Mobile relied on Okta to manage the digital identities of an additional 30,000 employees.

- In the past few months, Okta successfully handled an incredible level of usage from its customers. Here’s management’s comment on the matter in Okta’s FY2021 second-quarter earnings conference call: “From March through July, there was a one-day record of over 145 million logins, and the number of unique app logins increased by almost 70% to nearly 16 billion. Total MFA [multi-factor authentication] usage increased nearly three times over the same period last year.”

- In early-July 2020, Okta announced “a major milestone in cloud reliability and uptime, offering 99.99% uptime to all customers in every region of the world at no additional cost.”

- Okta ended FY2020 with a headcount of over 2,200. In the first half of FY2021, with COVID-19 as a backdrop , the company has impressively increased its headcount by around 300 in its customer-facing and innovation teams. Instead of retreating at a time of widespread economic distress, Okta went on the offensive.

We also want to point out the presence of Ben Horowitz on Okta’s board of directors. Horowitz is a co-founder and partner in a venture capital firm we admire and that was partly named after him, Andreessen Horowitz (the firm, popularly known as a16z, is an early investor in Okta). Horowitz has served as a director of Okta since February 2010 and we think having him on Okta’s board allows the company’s management to tap on a valuable source of knowledge.

On innovation

Okta is a pioneer in its field. It was one of the first companies that realised that a really important business could be built on the premise of a cloud-based software that secures and manages an individual’s digital identity for cloud-based applications. To us, that is fantastic proof of the innovative ability of Okta’s management. Stratechery’s interview of Todd McKinnon provided a great window on the thinking of him and his team in the early days of Okta’s founding:

“[Question] When Okta first came on the scene, it was Single Sign-on, so you could sign on in one place and then you’d be logged into other places, now it’s an Identity Cloud. Is that an actual shift in the product or strategy or is that just a shift in a marketing term? [Todd McKinnon] TM: It’s interesting. When we started the company, you could see that cloud was going to be the future. We started 11 years ago, so in 2009, Amazon Web Services was out, Google Apps for Domains was out. So you could kind of see that infrastructure was going to go to the cloud, you could see that collaboration apps were going to go to the cloud. I was working at Salesforce at the time, so it was really clear that the apps stack was going to be in the cloud and we got really excited about what could be possible or what new types of platforms could be built to enable all this. When we started, it’s funny, we called the first product, which was going to be a cloud single sign-on, we called it Wedge One. So not only was it the wedge, but it was like the first, first wedge. Now it turns out that in order to build cloud single sign on you had to build a lot of pretty advanced stuff behind the scenes to make that simple and seamless, you had to build a directory, you had to build a federation server, you had to build multi-factor authentication, and after we were into it for two or three or four years, we realized that there’s a whole identity system here so it’s much more than a wedge. In fact, it really can be a big part in doing all that enablement we set out to do. [Question] That’s very interesting, so are you still on Wedge One? Did you ever make it to Wedge Two? [Todd McKinnon] TM: (laughs) The Wedge keeps getting fatter. The Identity Cloud is pretty broad these days. It’s directory service, it’s reporting analytics, it’s multi-factor authentication, it does API Access Management. It’s very flexible, very extensible, so really the Identity Cloud now is an Identity Platform, it’s striving to really address any kind of identity use cases a customer has, both on the customer side, customer identity, and on the workforce side. What’s interesting about it is that at the same time over the last eleven years, identity has gone from being something that’s really important maybe for Windows networks or around your Oracle applications to there are so different applications connected from so many types of devices and so many networks that identity is really critical, and we’re in this world now where ten years ago people were telling me “Hey, I’m not sure if it’s possible to build an independent identity company” to now it’s like everyone says, “Oh, it’s such an obvious category that the biggest technology companies in the world want to own it.” So it has been quite a shift.”

We also want to surface a comment that McKinnon made in Okta’s FY2021 second-quarter earnings conference call that we think brilliantly highlights the forward-thinking nature of the company’s leadership team:

“While we’re hyper-focused on executing in today’s environment, I thought it would be helpful to share some of my thoughts around the long-term vision for Okta. So if you look out a little further on the time horizon, as cloud adoption continues to proliferate, five-plus years from now, we see a world where there are just a few first-class clouds that really matter inside a company. These clouds might be for collaboration, CRM, infrastructure, and ERP, for example. Our long-term vision is for identity to be one of these first-class clouds. We believe identity is key because it facilitates choice and flexibility while enhancing security and reducing risk in all other technologies. In our long-term vision, we see Okta establishing itself as a standard for digital identity. In order to achieve this, we will continue to grow aggressively by adding more users, more customers, particularly large enterprise customers, expanding internationally, adding more strategic partners, and increasing the use cases that come from building out our platform and accelerating the network effects that I mentioned earlier. I hope that gives you a little better understanding of how we’re thinking about building Okta into the next iconic cloud company.”

4. Revenue streams that are recurring in nature, either through contracts or customer-behaviour

Okta runs its business on a SaaS model and generates most of its revenue through multi-year subscriptions, which are recurring in nature. In FY2020, 94% of Okta’s total revenue of US$586.1 million came from subscriptions. The company’s average subscription term was 2.6 years as of 31 January 2020 and interestingly, Okta’s contracts are non-cancelable. The remaining 6% of Okta’s revenue in FY2020 was from professional services, where the company earns fees from helping its customers implement and optimise the use of its products.

It’s important to us too that there’s no customer concentration in Okta’s business. No single customer accounted for more than 10% of the company’s revenue in each year from FY2018 to FY2020. We also want to highlight that Okta has a diversified customer base by industry and that most of its customers are large enterprises. To us, these traits are further positive signs on the resilience of Okta’s revenue streams.

5. A proven ability to grow

There isn’t much historical financial data to study for Okta, since the company was only listed in April 2017. But we do like what we see:

A few key points to note about Okta’s financials:

- Okta has compounded its revenue at an impressive annual rate of 70.2% from FY2015 to FY2020. The rate of growth has slowed in recent years, but was still really strong at 46.7% in FY2020.

- Okta is still making losses, but the good thing is that it started to generate positive operating cash flow in FY2019 and positive free cash flow in FY2020..

- The company’s balance sheet remained robust throughout the timeframe under study, with significantly more cash and investments than debt.

- At first glance, Okta’s diluted share count appeared to increase sharply by 29.5% from FY2018 to FY2019. (We only started counting from FY2018 since Okta was listed in April 2017, which is in the first quarter of FY2018.) But the number we’re using is the weighted average diluted share count. Right after Okta got listed, it had a share count of around 91 million. Moreover, Okta’s weighted average diluted share count showed an acceptable growth rate (acceptable in the context of the company’s rapid revenue growth) of 9% in FY2020.

At a time when the US economy is suffering because of COVID-19 (US GDP fell by 9.1% year-on-year in the second quarter of 2020), Okta has managed to continue posting strong revenue growth in the first half of FY2021. In addition, the company is starting to even more heavily flex its cash-flow-muscle. These are all shown in the table below.

6. A high likelihood of generating a strong and growing stream of free cash flow in the future

Okta has already started to generate positive operating cash flow and free cash flow. We think it’s likely that Okta’s free cash flow will increase at a rapid clip in the future for two reasons.

First, it looks likely to us that Okta will be producing impressive top-line growth in the years ahead. As we discussed earlier, COVID-19 has not dented Okta’s growth and may even be a positive catalyst for its business. But even when the pandemic blows over, we think Okta is set to capitalise on strong secular tailwinds with the growing adoption of cloud services making it necessary for companies to become more efficient at managing the digital identities of their employees, contractors, partners, and customers.

Second, we think Okta can enjoy a higher free cash flow margin in the future as its business scales. Right now, Okta has a poor trailing free cash flow margin (free cash flow as a percentage of revenue) of just 7.9%. But we think there’s ]plenty of room for improvement given the typically asset-light nature of a software business. And for perspective, Veeva Systems , a SaaS company serving the life sciences industry and another of Compounder Fund’s holdings in the initial portfolio, has an average free cash flow margin of 29% in its last five completed fiscal years.

We completed our purchases of Okta shares with Compounder Fund’s initial capital in late July 2020. Our average purchase price was US$210 per Okta share. At our average price and on the day we completed our purchases, Okta shares had a trailing price-to-sales (P/S) ratio of around 40. We like to keep things simple in the valuation process. In Okta’s case, we think the P/S ratio is an appropriate metric to value the company, since the company has yet to produce much free cash flow.

The P/S ratio of 40 is pretty darn high. For perspective, if we assume that Okta has a 25% free cash flow margin today, then the company would have a price-to-free cash flow ratio of 160 based on the current P/S ratio (40 divided by 25%). Moreover, the P/S ratio of 40 is high when compared to history. The chart below shows Okta’s P/S ratio from its listing to 5 September 2020:

But there are strong positives in Okta’s favour. The company has: (1) Revenue that is low compared to a large and possibly fast-growing market; (2) a software product that is mission-critical for users; (3) a large and rapidly expanding customer base; and (4) sticky customers who have been willing to significantly increase their spending with the company over time. We believe that with these traits, there’s a high chance that Okta will continue posting excellent revenue growth – and in turn, excellent free cash flow growth – in time to come.

Indeed, Okta has a target to grow its revenue by 30% to 35% annually from now till FY2024, and to have a free cash flow margin of between 20% and 25% at the end of that period. These goals were communicated by management in April 2020 during Okta’s Investor Day event. For perspective, Okta projected revenue growth of 37% for the whole of FY2021 in the fiscal year’s second-quarter earnings update; this is up from a revenue-growth outlook of between 31% and 33% given in the first quarter.

For perspective, Okta carried a P/S ratio of 36.1 at the 5 September 2020 share price of US$203.

The risks involved

There are five key risks we’re watching with Okta.

The first is Okta’s short history in the stock market, given that its IPO was just three years ago in April 2017. But we are willing to back Okta because we think its business holds promise for fast-growth for a long period of time (the company’s identity-as-a-service business is very important for the digital transformation that so many companies are currently undergoing).

Competition is another risk we’re keeping an eye on. In its FY2018 and FY2019 annual reports, Okta named technology heavyweights such as Alphabet, Amazon, IBM, Microsoft, and Oracle as competitors. In its FY2020 annual report, Okta singled out Microsoft as its “principal competitor.” All of them have significantly stronger financial might compared to Okta. But we’re comforted by Okta’s admirable defense of its turf – the proof is in Okta’s strong DBNRRs and impressive growth in customer-numbers over the years. Moreover, in late 2019, market researchers Gartner and Forrester also separately named Okta as a leader in its field .

Okta’s high valuation is the third risk. The high valuation adds pressure on the company to continue executing well; any missteps could result in a painful fall in its stock price. This is a risk we’re comfortable taking.

Hacking is also a risk we’re watching. Logging into applications is often a time-sensitive and mission-critical part of an employee’s work. Okta’s growth and reputation could be severely diminished if the company’s service is disrupted, leading to customers being locked out of the software they require to run their businesses for an extended period of time.

COVID-19 is the fifth risk. The pandemic has resulted in severe disruptions to economic activity in many parts of the world, the USA included. We think that the mission-critical nature of Okta’s service means that its business is less likely to be harmed significantly by any coronavirus-driven recession. Okta’s recent earnings updates have shown this to be the case. In the company’s FY2021 second-quarter earnings conference call, CFO William Losch said that Okta has “not experienced any degradation in gross renewal rates during the pandemic and continue to experience strength with customer upsells, particularly with… enterprise customers.” But there may still be headwinds in the future.

Ultimately, we will consider parting ways with Okta if we see any or all of the following signs from the company: (1) The DBNRR comes in at less than 100% for an extended period of time; (2) it fails to increase its number of customers; and (3) it’s unable to convert revenue into free cash flow at a healthy clip in the future.

Summary and allocation commentary

In summary, Okta has:

- A valuable cloud-based identity-as-a-service software platform that is often mission-critical for customers;

- high levels of recurring revenue;

- outstanding revenue growth rates;

- positive operating cash flow and free cash flow, with the potential for much higher free cash flow margins in the future;

- a large, mostly untapped addressable market that could potentially grow in the years ahead;

- an impressive track record of winning customers and increasing their spending; and

- capable leaders who are in the same boat as the company’s other shareholders

Okta does have a rich valuation, so we’re taking on valuation risk. There are also other risks to note, such as Okta’s short listing history, competitors with heavy financial muscle, hacking, and potential headwinds because of COVID-19.

After weighing the pros and cons, we initiated a 2.0% position – a medium-sized allocation – in Okta with Compounder Fund’s initial portfolio. We think Okta scores well in terms of having a sizeable market opportunity and a high probability of being able to grow into its market. But our enthusiasm for the company is also tempered by its high valuation.

And here’s an important disclaimer: None of the information or analysis presented is intended to form the basis for any offer or recommendation; they are merely our thoughts that we want to share.

Chong Ser Jing

Is Okta (OKTA) a Leading Investment in IDaaS?

Market position and growth, identity-as-a-service (idaas) leadership.

Okta holds a dominant position in the IDaaS market, with a 26.91% market share, making it the largest publicly traded company in this sector. Despite facing competition from OneLogin, which holds over 50% of the market share, Okta’s leadership is underscored by its extensive customer base and continuous innovation in identity management solutions.

Customer Base and Adoption

As of August 2024, Okta’s customer base includes over 18,000 companies, with significant growth in the adoption of security and compliance tools among small and midsize businesses (SMBs). The company’s customer count increased by 6% year-over-year to 19,100, with a notable rise in customers with more than $100K in Annual Contract Value (ACV), totaling 4,550. This growth reflects Okta’s ability to attract and retain high-value customers, further solidifying its market position.

Institutional Ownership and Credibility

Okta’s significant institutional ownership, at 84%, indicates strong confidence from institutional investors. The top 13 shareholders collectively own 50% of the company, with The Vanguard Group, Inc. being the largest shareholder at 9.9%. This high level of institutional ownership suggests credibility and stability, although it also means that institutional decisions can significantly impact the stock price.

Financial Performance and Analyst Sentiment

Revenue and earnings growth.

Analysts forecast Okta’s upcoming Q2 earnings report to show earnings of $0.61 per share, representing a year-over-year increase of 96.8%. Expected revenues are projected to be $632.24 million, reflecting a 13.7% increase compared to the same quarter last year. This strong financial performance is indicative of Okta’s ability to generate consistent revenue growth and improve profitability.

Key Financial Metrics

Okta’s financial health is further highlighted by its market capitalization of $16 billion and a revenue growth rate of approximately 19.11% as of April 30, 2024. Despite a net margin of -6.48%, the company’s return on equity (ROE) of -0.68% and return on assets (ROA) of -0.45% indicate room for improvement in profitability. However, Okta’s low debt-to-equity ratio of 0.21 and early debt repurchase resulting in a $106 million gain demonstrate financial robustness and prudent management.

Analyst Ratings and Price Targets

Analyst sentiment on Okta is generally positive, with 10 analysts providing recent evaluations: 4 bullish, 3 somewhat bullish, and 3 indifferent, with no bearish sentiments reported. The 12-month average price target for Okta is $121.70, with a high estimate of $140.00 and a low estimate of $100.00. Key analyst actions include:

- Casey Ryan from WestPark Capital maintains a Buy rating with a price target of $140.00.

- John Difucci from Guggenheim also maintains a Buy rating at $130.00.

- Matthew Hedberg from RBC Capital maintains an Outperform rating at $125.00.

- Keith Bachman from BMO Capital lowered his rating to Market Perform with a target of $100.00.

- Brian Essex from JP Morgan raised his rating to Neutral with a target of $110.00.

These ratings reflect a generally optimistic outlook, with analysts recognizing Okta’s strong market position and growth potential.

Market Trends and Competitive Landscape

Growing demand for security solutions.

The increasing adoption of digital technologies and the rise in cyber threats have driven demand for robust identity management solutions. Okta’s focus on securing digital interactions positions it well to capitalize on this trend. The company’s offerings, such as multi-factor authentication (MFA) and passwordless solutions, are gaining traction among SMBs and larger enterprises alike.

Competitive Dynamics

While Okta faces competition from OneLogin and other identity management providers, its continuous innovation and strong customer relationships provide a competitive edge. The company’s ability to integrate with a wide range of applications and its recognition as a Leader in the Gartner® Access Management Magic Quadrant™ for the seventh consecutive year further reinforce its market leadership.

Technological Advancements

Okta’s investment in technology, such as the Okta Integration Network and Okta Workflows, enhances its value proposition. The company’s ability to process billions of authentications per month and save customers approximately $5 billion and 130 million hours through automation showcases the impact of its technological advancements.

Risks and Challenges

Profitability concerns.

Despite strong revenue growth, Okta’s negative net margin and low ROE and ROA indicate challenges in achieving profitability. The company needs to focus on improving operational efficiency and cost management to enhance its bottom line.

Market Volatility

High institutional ownership means that Okta’s stock price can be significantly influenced by institutional decisions. Additionally, market volatility and broader economic conditions can impact investor sentiment and stock performance.

Competitive Pressure

While Okta holds a strong market position, the competitive landscape in the IDaaS space is dynamic. The company must continue to innovate and differentiate its offerings to maintain its leadership and fend off competition.

Actionable Insights and Recommendations

Focus on profitability.

Okta should prioritize initiatives to improve profitability, such as optimizing operational efficiency and reducing costs. Enhancing margins and achieving positive net income will strengthen investor confidence and support long-term growth.

Expand Customer Base

Okta should continue to expand its customer base, particularly among high-value customers with significant ACV. Targeted marketing and sales efforts, along with strategic partnerships, can help attract new customers and increase market penetration.

Invest in Innovation

Continuous investment in technology and innovation is crucial for maintaining a competitive edge. Okta should focus on developing advanced security solutions, enhancing integration capabilities, and leveraging emerging technologies such as artificial intelligence and machine learning.

Strengthen Financial Position

Maintaining a strong financial position is essential for navigating market volatility and supporting growth initiatives. Okta should continue to manage its debt prudently and explore opportunities for strategic investments and acquisitions.

Enhance Stakeholder Communication

Transparent and effective communication with stakeholders, including investors, customers, and employees, is vital for building trust and confidence. Okta should provide regular updates on financial performance, strategic initiatives, and market developments.

Okta Inc. (OKTA) is well-positioned to capitalize on the growing demand for identity management solutions in an increasingly digital world. With a strong market position, significant institutional ownership, and positive analyst sentiment, the company has demonstrated robust growth and financial health. However, challenges related to profitability and competitive pressure must be addressed to sustain long-term success. By focusing on profitability, expanding its customer base, investing in innovation, strengthening its financial position, and enhancing stakeholder communication, Okta can continue to thrive and deliver value to its shareholders and customers.

Overall, the outlook for Okta remains positive, with substantial growth potential in the IDaaS market. As businesses continue to digitize operations and prioritize security, Okta’s comprehensive identity management solutions will play a critical role in enabling secure digital interactions and driving future growth.

RELATED ARTICLES

Akamai technologies (akam): analyzing analysts’ views and investment potential, ai technology investments: the growing adoption by major companies like apple and meta, ai boom drives data center and software investment surge, can datadog (ddog) overcome valuation challenges and maintain growth, is teradata (tdc) a top pick for tech in 2024, financial analysis report: datadog inc. (nasdaq: ddog).

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Biden Economy

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds Rates

- Top Mutual Funds

- Options: Highest Open Interest

- Options: Highest Implied Volatility

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Stock Comparison

- Advanced Chart

- Currency Converter

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Best Free Checking

- Student Loans

- Personal Loans

- Car insurance

- Mortgage Refinancing

- Mortgage Calculator

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Financial Freestyle

- Capitol Gains

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

Stay ahead of the game with okta (okta) q2 earnings: wall street's insights on key metrics.

Wall Street analysts forecast that Okta (OKTA) will report quarterly earnings of $0.61 per share in its upcoming release, pointing to a year-over-year increase of 96.8%. It is anticipated that revenues will amount to $632.24 million, exhibiting an increase of 13.7% compared to the year-ago quarter.

Over the past 30 days, the consensus EPS estimate for the quarter has remained unchanged. This demonstrates the covering analysts' collective reassessment of their initial projections during this period.

Prior to a company's earnings release, it is of utmost importance to factor in any revisions made to the earnings projections. These revisions serve as a critical gauge for predicting potential investor behaviors with respect to the stock. Empirical studies consistently reveal a strong link between trends in earnings estimate revisions and the short-term price performance of a stock.

While investors typically use consensus earnings and revenue estimates as indicators of quarterly business performance, exploring analysts' projections for specific key metrics can offer valuable insights.

That said, let's delve into the average estimates of some Okta metrics that Wall Street analysts commonly model and monitor.

Analysts predict that the 'Revenue- Subscription' will reach $618.50 million. The estimate indicates a year-over-year change of +14.1%.

The combined assessment of analysts suggests that 'Revenue- Professional services and other' will likely reach $13.69 million. The estimate indicates a change of -2.2% from the prior-year quarter.

The collective assessment of analysts points to an estimated 'Current remaining performance obligations (cRPO)' of $1.96 billion. Compared to the current estimate, the company reported $1.77 billion in the same quarter of the previous year.

Analysts forecast 'Remaining performance obligations' to reach $3.42 billion. Compared to the current estimate, the company reported $3.03 billion in the same quarter of the previous year.

Analysts' assessment points toward 'Gross margin- Subscription' reaching 78.2%. Compared to the present estimate, the company reported 77% in the same quarter last year. View all Key Company Metrics for Okta here>>> Over the past month, Okta shares have recorded returns of +4.3% versus the Zacks S&P 500 composite's +0.3% change. Based on its Zacks Rank #3 (Hold), OKTA will likely exhibit a performance that aligns with the overall market in the upcoming period. You can see the complete list of today's Zacks Rank #1 (Strong Buy) stocks here >>>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Okta, Inc. (OKTA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

We use cookies to understand how you use our site and to improve your experience. This includes personalizing content and advertising. To learn more, click here . By continuing to use our site, you accept our use of cookies, revised Privacy Policy and Terms of Service .

New to Zacks? Get started here.

Member Sign In

Don't Know Your Password?

- Zacks #1 Rank

- Zacks Industry Rank

- Zacks Sector Rank

- Equity Research

- Mutual Funds

- Mutual Fund Screener

- ETF Screener

- Earnings Calendar

- Earnings Releases

- Earnings ESP

- Earnings ESP Filter

- Stock Screener

- Premium Screens

- Basic Screens

- Thematic Screens

- Research Wizard

- Personal Finance

- Money Management

- Retirement Planning

- Tax Information

- My Portfolio

- Create Portfolio

- Style Scores

- Testimonials

- Zacks.com Tutorial

Services Overview

- Zacks Ultimate

- Zacks Investor Collection

- Zacks Premium

Investor Services

- ETF Investor

- Home Run Investor

- Income Investor

- Stocks Under $10

- Value Investor

- Top 10 Stocks

Other Services

- Method for Trading

- Zacks Confidential

Trading Services

- Black Box Trader

- Counterstrike

- Headline Trader

- Insider Trader

- Large-Cap Trader

- Options Trader

- Short Sell List

- Surprise Trader

- Alternative Energy

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. ZacksTrade and Zacks.com are separate companies. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating individual securities.

If you wish to go to ZacksTrade, click OK . If you do not, click Cancel.

Image: Bigstock

Okta (OKTA) Laps the Stock Market: Here's Why

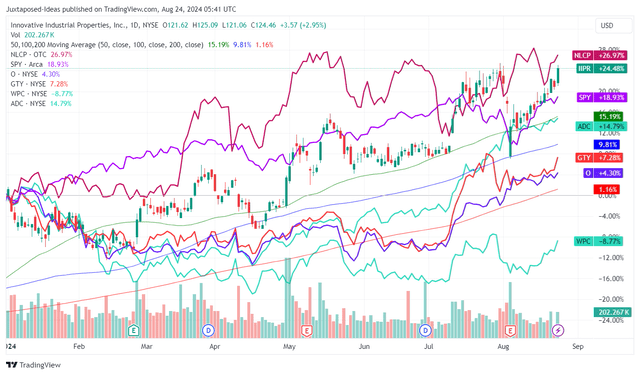

The most recent trading session ended with Okta ( OKTA Quick Quote OKTA - Free Report ) standing at $97.93, reflecting a +1.28% shift from the previouse trading day's closing. The stock's performance was ahead of the S&P 500's daily gain of 0.97%. Meanwhile, the Dow gained 0.58%, and the Nasdaq, a tech-heavy index, added 1.39%.

The cloud identity management company's shares have seen an increase of 2.83% over the last month, surpassing the Computer and Technology sector's loss of 5.36% and the S&P 500's loss of 1.85%.

Investors will be eagerly watching for the performance of Okta in its upcoming earnings disclosure. The company's earnings report is set to be unveiled on August 28, 2024. The company is expected to report EPS of $0.61, up 96.77% from the prior-year quarter. Meanwhile, the latest consensus estimate predicts the revenue to be $631.07 million, indicating a 13.5% increase compared to the same quarter of the previous year.

Regarding the entire year, the Zacks Consensus Estimates forecast earnings of $2.40 per share and revenue of $2.53 billion, indicating changes of +50% and +11.91%, respectively, compared to the previous year.

Investors should also note any recent changes to analyst estimates for Okta. These revisions typically reflect the latest short-term business trends, which can change frequently. As a result, we can interpret positive estimate revisions as a good sign for the company's business outlook.

Based on our research, we believe these estimate revisions are directly related to near-team stock moves. To benefit from this, we have developed the Zacks Rank, a proprietary model which takes these estimate changes into account and provides an actionable rating system.

The Zacks Rank system, which varies between #1 (Strong Buy) and #5 (Strong Sell), carries an impressive track record of exceeding expectations, confirmed by external audits, with stocks at #1 delivering an average annual return of +25% since 1988. Within the past 30 days, our consensus EPS projection remained stagnant. Okta currently has a Zacks Rank of #3 (Hold).

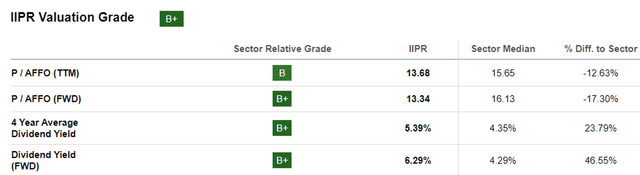

Valuation is also important, so investors should note that Okta has a Forward P/E ratio of 40.25 right now. This valuation marks a premium compared to its industry's average Forward P/E of 26.73.

Meanwhile, OKTA's PEG ratio is currently 1.63. This popular metric is similar to the widely-known P/E ratio, with the difference being that the PEG ratio also takes into account the company's expected earnings growth rate. The Internet - Software and Services was holding an average PEG ratio of 1.63 at yesterday's closing price.

The Internet - Software and Services industry is part of the Computer and Technology sector. This industry, currently bearing a Zacks Industry Rank of 98, finds itself in the top 39% echelons of all 250+ industries.

The Zacks Industry Rank gauges the strength of our individual industry groups by measuring the average Zacks Rank of the individual stocks within the groups. Our research shows that the top 50% rated industries outperform the bottom half by a factor of 2 to 1.

Don't forget to use Zacks.com to keep track of all these stock-moving metrics, and others, in the upcoming trading sessions.

See More Zacks Research for These Tickers

Normally $25 each - click below to receive one report free:.

Okta, Inc. (OKTA) - free report >>

Published in

This file is used for Yahoo remarketing pixel add

Due to inactivity, you will be signed out in approximately:

- Marketplaces

- Blockchain & Digital Currency

- Politics, Legal & Regulation

- Real Estate

- Artificial Intelligence

- Women Changing Finance

- Investment Crowdfunding Guide

- Reg A+ Investment Crowdfunding

- Submit Press Release

- Submit Your Event

- Press Releases

- Submit a Tip – Contact Us

SCB 10X Announces Participation in Funding Round for Ema, a GenAI Firm Creating Universal AI Employees of the Future

August 19, 2024 @ 8:16 am By Omar Faridi

SCB 10X , the technology investment arm of SCBX Group , has announced their participation in the series A funding round for Ema , a San Francisco-based generative AI company creating Universal AI Employees of the future .

The $36M Series A extension investment round , “co-led by Accel and Section 32 , with participation from SCB 10X, Prosus Ventures, Hitachi Ventures, Sozo Ventures, Wipro Ventures, Colle Capital, and Frontier Ventures, brings Ema’s total funds raised since inception to $61 million.”

The investment in Ema underscores SCB 10X’s “Moonshot Mission” in backing frontier technology startups globally, and their “conviction in the powerful breakthroughs generative AI will bring to enterprises.”

Ema’s agentic AI system transforms workplace productivity by “using a collection of AI agents, known as Ema’s Personas, to execute a wide range of complex tasks end-to-end.”

Notably, Ema’s platform requires “no coding, enabling enterprise users in any function to customize and deploy AI employees with a natural language interface.”

By removing the complexities to end users, Ema lowers “the barrier for businesses looking to adopt advanced AI solutions and becomes a powerful and easily accessible tool for employees to capitalize on.”

Since launch, Ema’s platform has “improved efficiency and boosted productivity for numerous organizations, offering seamless integration, data protection, and unparalleled accuracy.”

Their unique multi-agent architecture “overcomes the limitations inherent in traditional LLMs, such as inaccurate outputs, potential data security risks, and the lack of domain-specific insights necessary for informed decision-making, enabling Ema to provide functionalities static LLMs are unable to serve,” such as the ability to:

- Adapt to enterprise-specific data and workflows

- Leverage multiple LLMs based on accuracy, cost, and performance requirements

- Maintain data privacy and security by operating within the company infrastructure

- Provide explainable and verifiable outputs, crucial for business accountability

- Continuously update and learn from real-time enterprise data

- Execute complex and multi-step tasks autonomously

Surojit Chatterjee , CEO and Co-founder of Ema, said:

“Our goal is to revolutionize enterprises by enabling every employee to work more efficiently through easy-to-deploy and precise agents. Our universal AI employee will assist businesses in carrying out tasks in areas such as customer support, employee assistance, sales enablement, compliance, revenue operations, and beyond, freeing up teams to concentrate on the most strategic and valuable projects.”

Mukaya (Tai) Panich , CEO and Chief Venture and Investment Officer at SCB 10X, expressed:

“Congratulations to Surojit Chatterjee, Souvik Sen, and the Ema team on the successful fundraise. Ema’s innovative use of Generative AI to power enterprise workflow automation strongly aligns with our investment thesis in the Deep Tech space. Their platform, which combines proprietary Generative Workflow Engine™, Knowledge Graph, and EmaFusion™ Model, addresses critical challenges for enterprise AI adoption, while ensuring the highest levels of security and compliance. As SCBX Group aims to increase our AI-enabled revenue to 75% by 2028, we believe this partnership will provide valuable insights into deploying efficient, reliable, and compliant AI solutions. We’re excited to support Ema’s vision of transforming the future of work with Universal AI Employees and look forward to the innovations that lie ahead.”

Founded in 2023, Ema has achieved impressive traction “within the first year, securing enterprises in various sectors including IT, legal, financial services, and healthcare.”

The founding team’s track record in scaling products and technologies at companies “such as Google, Flipkart, Coinbase, and Okta sets Ema on a promising trajectory to capture the fast-growing autonomous AI and agents market, projected to reach $41 billion by 2029.”

As an enabler of agentic AI, Ema’s ability to customize and deploy “AI employees” or “Personas” for specific business functions will redefine the future of work across multiple industries.

Ema claims that it is leading a new era of collaboration “between human and AI employees, where innovation flourishes, and productivity skyrockets.”

As mentioned in the announcement, SCB 10X , a subsidiary of the SCBX Group, was established in January 2020 with a “Moonshot Mission” to achieve growth “through technology innovation and investment, focusing on disruptive technologies such as Web 3 (Blockchain, Digital Assets, Metaverse), Deep Tech AI/ML, and Fintech.”

Crowdfund Insider is the leading news website covering the emerging global industry of disruptive finance including investment crowdfunding, Blockchain, online lending, and other forms of Fintech.

© 2024 Crowded Media Group. All Rights Reserved.

You are using an outdated browser. Please upgrade your browser to improve your experience.

Looks like you have Javascript turned off! Please enable it to improve your browsing experience.

How to maximize CIAM’s security capabilities

Register now

We invest and support companies creating cutting edge technologies enabled by identity, security, and privacy

Benefits of partnering with okta.

Leverage unique access to Okta’s extensive APIs, technologies, and engineering expertise

Increase brand awareness with co-marketing opportunities through the Okta Integration Network

Join a mutually-supportive ecosystem driving innovation in the identity space

Okta customers in your pipeline and/or a path for Go-To-Market with Okta

Okta Ventures enables startups to accelerate GTM with Okta's 15,000+ customers and with the broader Okta team's expertise

Opportunity to improve customer experience with an Okta technical integration

Okta has 8,000+ technology integrations creating a compelling platform

Portfolio Companies

Trusted Key is an enterprise solution built to prevent identity fraud, improve security and enhance the consumer experience with password-less authentication and transaction authorization.

Acquired by Workday in 2019

Ockam builds trust for data-in-motion between applications. Open source tools and managed cloud services orchestrate end-to-end encryption, mutual authentication, credential management, and authorization policies across complex and distributed computing environments.

DataGrail is a data privacy platform that integrates with leading applications and infrastructure solutions to provide its customers with continuous compliance for current and future privacy regulations, such as the GDPR and CCPA.