Letter Solution

Welcome to "Letter Solution" Everything is about letter and application writing.

Joint Account Application/Letter With Sample 3+

Joint bank account application with 3+ sample.

Table of Contents

Joint account application: Normally we open a joint account instead of two different accounts on two different names. As it is very hassle to maintain two different accounts, opening a joint account is the best way. Joint account is the best choice for the husband and wife. Besides it, partners of a business open this type of account to maintain or run the business.

If you have already an account, you do not have to open a new one. Just transfer the previous account into a joint account. Submit an application and the documents of the person whom you want to associate with your account and fulfill the formalities. Here you will get the application.

Unless you have an account, you have to apply and submit the documents for both of you.

Application/ Letter Format

Opening joint account Sample

The Manager

Central Cooperative Bank

Kaliachalk Branch

Date: 00/00/00

Sub: [Opening a joint account]

Respected Sir/Madam,

With due respect, we beg to state that we are the permanent residents of kaliachalk. We intend to open a jointly saving account with your bank in the name of ourselves Mr. Ajay Kumar Mandal and Mrs. Radhika Mandal (Husband and wife). We have all the necessary documents.

We can come to the branch to complete the formalities at any time of your convenience.

Thanking you

Yours sincerely

[Your name]

Request For Opening Joint Bank Account

The Bank Manager

State Bank of India

Sukantamore Branch

Sukantamore

Sub: [____________]

With a lot of respect, I beg to state that we are businessmen. We have run a business. We would like to open a joint bank account in the names of ourselves Amit Dey and Arjun Karmakar (Business partner) with your branch for our business purpose. We have attached all the necessary document copies along with this application.

We, therefore, request you to co-operate us opening a joint bank account.

[Name of the applicent]

Application For Joint Bank Account

The Branch Manager

Bank of India

Harish Chandra Pur Branch

Harish Chandra Pur

Sub: [ ______________ ]

Dear Sir/Madam,

I am writing this letter to inform you that I am an account holder with your branch. My account number is XXXXXXXXXX. Now I would like to associate my son [Ashutosh Kumar Saha] as a joint account holder of my account. The required documents of my son have been enclosed with the application.

Please do the needful at your earliest and provide ATM card, passbook, cheque book, to my son as a new account holder.

Yours faithfully

FAQ’s Joint Bank Account Application

Can a couple open a joint bank account?

Answer: Yes. A couple can open a joint account. A joint account can be opened with a son, daughter, wife and any other relatives. Even business partners can open it.

How can I write a letter from bank to single account to joint account?

Answer: It is very easy to write a letter. You can follow the format that has been presented in our blog and get an idea about it. Then you can write a new letter by yourself.

How do I apply for a joint account?

Answer: You should write an application mentioning the reason of opening a joint account. And then go to the bank manager and talk about it.

Can you open joint account without being married?

Answer: Yes you can open a joint account without being married. You can do it with your relatives and business partners.

Which bank is best for joint account?

Answer: It is totally depends on you. All banks provide this facility to the customers.

Does joint account have ATM card?

Answer: Yes. Joint account holders have ATM cards. They can withdraw money from the funds.

Does a joint account need both signatures?

Answer: Both signatures are equal for the activities of the bank.

Who can close a joint account?

Answer: The co-owner of the account can close a joint account.

Can joint account convert to single?

Answer: Yes you can convert your joint account into a single account but you have to go to the branch and talk with the manager and submit a letter and fulfill the formalities of the bank.

Read More Post Related Banking Issue:

- Transfer your bank account

- A new pass book

- New cheque book

- Current account opening

- Opening a joint account

- Bank statement

- Hire a locker

- Change specimen signature

- Renewal of fixed deposit account

- Complaining non-receipt of pass-book

- Stop payment of a lost check

- Reopen account

- Change registered mobile number

I hope you have got the right information and chosen the sample and format for the Joint account application. If you like the post, you can do a little help by sharing it with your friends, relatives and do comment in the below comment box.

- Application For Money Deduction With Format /Sample

- Change Specimen Signature Bank Letter With 3+ Sample

You May Also Like

Renewal of F.D Account Letter/Application With Format

Application For New Passbook With 6+ Sample

Application For New ATM Card With 5+ Formats

Request Letters

Request Letter to Bank for Opening a Bank Account

When you’re planning a move to a new place, one of the most important tasks on your checklist is opening a bank account. Whether it’s for managing personal savings or facilitating business transactions, having a local bank account is essential for a smooth transition. Not only does it provide convenience, but it also allows you to anticipate and address any potential financial issues that may arise in the future.

If you’re considering opening a bank account with a new establishment, you’ll need to familiarize yourself with the process of submitting a request letter to the bank. This article aims to guide you through the steps of drafting an effective letter and highlight the key information you should include to make a strong case for opening the account.

Letters to Bank for Opening a Bank Account

Letter for Opening Bank Account from Company

A Letter for Opening Bank Account from Company is a formal document sent by a company to a bank, requesting the establishment of a new bank account. It typically outlines the company’s details, the type of account desired, account features, and the authorized signatories, among other pertinent information. This letter is used when a company intends to initiate banking relations with a new financial institution or when it wishes to open an additional account within an existing banking framework.

Letter to Open a Bank Account for Business

A Letter to Open a Bank Account for Business is a formal document sent by a business owner or representative to a bank, expressing the intention to open a business bank account. It typically outlines the nature of the business, provides relevant details like the business registration number and type, and may include necessary documentation for the bank’s verification process. This letter is used when a business seeks to establish a new banking relationship or when it expands its operations requiring additional financial services.

Letter to Open a Personal Bank Account

A Letter to Open a Personal Bank Account is a formal written request submitted to a banking institution by an individual wishing to establish a new account. This letter typically outlines the applicant’s personal details, desired account type, initial deposit amount, and any other specific requirements or services needed. It often accompanies necessary identification and supporting documentation, serving as an introduction and a clear statement of intent for the banking relationship. Such letters are used when initiating the process of account creation, especially in scenarios where personal appearance at the bank may not be feasible or when additional clarity is desired.

This template serves as a comprehensive guide for individuals seeking to open a new bank account, ensuring they convey all pertinent information and inquiries clearly and professionally. By following this structured format, the reader can efficiently communicate their requirements and questions to the banking institution, eliminating potential ambiguities or omissions. It's particularly helpful for those who are unfamiliar with the banking process, ensuring they not only request account opening but also gain clarity on the features, benefits, and requirements associated with their desired type of account. Whether approaching a new bank or transitioning to a different financial institution, this template aids in making the account opening process seamless and straightforward.

What to Include in Your Request Letter

There are many ways to draft a request letter to the bank. However, the basic format for this letter consists of the following key elements:

- The bank’s address

- The bank’s name

- The recipient’s title, e.g. ‘to The Branch Manager’

- An appropriate subject

- Personal information i.e., your name and address

- Your contact information e.g., your email address and phone number

- Your full name and signature

- Relevant attachments

Try to find out the bank’s branch name and address, so your letter is delivered to the intended recipient.

Tips to Write a Request Letter to Open a Bank Account

A letter written to a bank is a formal correspondence. It should be written professionally using a business format. Additionally, you should use a courteous tone as you are making a request. This will increase your chances of receiving a positive response. Here are a few more tips to help you draft your request letter to bank for opening a bank account:

- Address the letter appropriately – This type of letter is often addressed to the bank or branch manager. If you don’t know their name, address your letter to ‘The Branch Manager’ and then use ‘Dear Sir/Madam’ as a salutation.

- Provide relevant information – This includes your name, company name, and address.

- Include a proper subject – This is a phrase indicating why you are writing your letter. Make it short, concise, and informational.

- Make your intentions clear in the first paragraph and elaborate in the body. Use the introductory line to introduce yourself or your business.

- Mention the type of account you would like to open. You can also briefly outline the type of transactions you will be performing through the account.

- Include the date of submission – This is the date on which you are drafting your request.

- Attach copies of relevant documents – These are documents related to an account application. Make sure they are not original copies.

- Provide your official name and signature at the end of the letter for authenticity.

- Include your full contact information and offer to provide further details, should they be necessary.

Letter to the Bank for Opening an Account

[Your Name] [Your Address] [City, State, Zip Code] [Email Address] [Phone Number] [Date]

[Bank Name] [Branch Address] [City, State, Zip Code]

Subject: Request for Opening a Bank Account

Dear [Bank Manager’s Name],

I hope this letter finds you in good health and high spirits. I am writing to express my interest in opening a new bank account at your esteemed banking institution, [Bank Name]. I have been searching for a reputable bank that offers a comprehensive range of financial services, and I believe that [Bank Name] fulfills my requirements.

I kindly request you to guide me through the account opening process and provide me with the necessary information and documentation requirements. I am particularly interested in the following type of account(s):

- [Type of Account 1]: (e.g., Savings Account, Current Account, Fixed Deposit, etc.)

- [Type of Account 2]: (if applicable)

Please provide detailed information about the features and benefits associated with the selected account(s), including but not limited to:

- Interest rates

- Minimum balance requirements

- Monthly maintenance fees

- ATM and online banking facilities

- Overdraft protection

- Mobile banking services

- Debit/Credit card offerings

- Any additional services or benefits

Furthermore, kindly inform me about the account opening procedure, including the required documents, such as identity proof, address proof, and any other specific requirements. In addition, I would like to know the estimated time for account activation.

I am looking forward to entrusting my financial needs to [Bank Name] and expect a secure and fruitful banking experience. Please let me know if you need any additional information or if there are any steps I should complete prior to visiting the branch.

Thank you for your attention to this matter. I appreciate your prompt response and assistance in opening my new bank account. Please feel free to contact me through the provided email address or phone number should you require any further clarification.

Yours sincerely,

[Your Name]

Sample Letter to the Bank for Opening an Account

21 July 2039

The Branch Manager

Texas National Bank

123 Garden Avenue

Main Branch

Dear Sir/Madam,

I am writing to submit a formal request on behalf of Specs IT Labs to open a new account with your esteemed bank. As we have recently relocated our business to Texas, it is crucial for us to partner with a reputable financial institution to handle our transactions efficiently and securely.

Please find attached copies of our company documents and the completed application form, which provide comprehensive information about Specs IT Labs.

Specs IT Labs is a leading technological company serving clients across the United States. With our extensive client base and a high volume of daily transactions, we recognize the importance of having a reliable and professional banking partner to streamline our financial operations.

We kindly request that an account be opened in the name of our company at your branch. Having a dedicated account with Texas National Bank will greatly facilitate our transactions and enable us to effectively manage our finances.

Our team at Specs IT Labs is committed to maintaining a strong and mutually beneficial relationship with your bank. We greatly value the quality of service and the range of financial products that Texas National Bank offers, and we believe that our partnership will contribute to the growth and success of both organizations.

Thank you for considering our request. We eagerly await a favorable reply from you. Should you require any additional information or have any questions, please do not hesitate to contact me directly at [Your Contact Information].

Cynthia Christen

Specs IT Labs

Bank Account Opening Letter Format in Word

When drafting a request letter to open a bank account, it is crucial to provide comprehensive information about your company while ensuring the protection of sensitive data. Begin by including pertinent details such as your company name, address, and contact information. Additionally, mention the projected turnover you anticipate and specify the number of authorized individuals who will conduct transactions through the account. Furthermore, you may want to outline any specific services or requirements you expect from the prospective bank.

However, exercise caution to avoid disclosing sensitive company information that is not necessary for the account opening process. Focus solely on providing relevant information that assists the bank in understanding your business needs and enables them to facilitate the account setup efficiently. By striking a balance between comprehensive details and data security, you can write a good request letter for opening a bank account.

How did our templates helped you today?

Opps what went wrong, related posts.

How to Write a Request Letter (Format and Samples)

Request for Approval: Template & Samples

Leave Application Cancellation Letter

Request Letter: Format, Template and Examples | (Word | PDF)

Permission Request Letter to Principal for Tour

Permission Request Letter to Principal for Late Payment of Fees

Leave Permission Request Letter to Principal

Sponsorship Request Letter Template and Examples

Thank you for your feedback.

Convert Joint Account to Single Account Letter Format – 13+ Examples

- Letter Format

- March 5, 2024

- Application Letters , Bank Letters , Request Letters

Joint Account to Single Account Letter Format: A joint bank account is a convenient way for two or more people to manage their finances together . Joint accounts are a popular way for couples, family members, or business partners to manage their finances together.

However, there may come a time when one of the account holders wishes to separate from the joint account and open an individual account. In such a scenario, a Joint Account to Single Account Letter Format is required to initiate the process. However, there may come a time when one of the account holders wants to separate their finances and close the joint account .

- 25+ NOC Letter Format For Bank Loan – Writing Tips, Email Template

- Rejoining Letter After Leave – 14+ Templates, Key Elements, Tips

- 20+ New ATM Card Request Letter Format SBI – How To Start, Examples

In such cases, it is necessary to write an application letter to the bank requesting that the joint account be converted to a single account. This letter should clearly state the reason for the request and provide any necessary information.

Joint Account to Single Account Letter Format Writing Steps

Content in this article

The Joint Account to Single Account Letter Format is a formal request letter that is written by one of the joint account holders to the bank or financial institution where the joint account is held. The letter outlines the request to remove one of the account holders from the joint account and convert it into a single account in the name of the remaining account holder.

The letter should include the following information:

- Account details: The account holder should include the joint account details, such as the account number, account name, and the names of all the joint account holders.

- Request for conversion: The account holder should clearly state the request to convert the joint account into a single account in their name.

- Reason for conversion: The account holder may include a brief explanation for the request. For example, if the joint account was held with a former partner or business associate who is no longer involved, the account holder may state this in the letter.

- Authorization: If the Request letter is being written by only one of the joint account holders, the letter should include authorization from the other account holder to remove their name from the account. This can be in the form of a signed letter or a consent form.

- Contact details: The account holder should provide their contact details, including their name, address, phone number, and email address. This information will help the bank or financial institution contact them if further information is needed.

Convert Joint Account to Single Account Letter Format – Sample Format

Below is a sample format for a letter to convert a joint account to a single account:

[Your Name] [Your Address] [City, State, ZIP Code] [Email Address] [Phone Number] [Date]

[Bank Name] [Branch Address] [City, State, ZIP Code]

Subject: Conversion of Joint Account to Single Account

Dear [Bank Manager’s Name],

I am writing this letter to request the conversion of our joint savings account to a single account. The details of the account are as follows:

Account Holder 1: Name: [Your Full Name] Account Number: [Joint Account Number] [Your Signature]

Account Holder 2: Name: [Co-account Holder’s Full Name] Account Number: [Joint Account Number] [Co-account Holder’s Signature]

I would like to inform you that due to personal reasons, [Co-account Holder’s Full Name] and I have decided to convert our joint savings account to a single account under my name, and I will be the sole account holder going forward.

I request your assistance in facilitating the necessary changes and providing guidance on any additional documentation required for this conversion process. Please let me know if there are any specific forms or procedures that I need to follow to complete this request.

I understand that there might be certain formalities and documentation involved in this process, and I am willing to comply with all the necessary requirements. Additionally, please provide information on any changes that may occur in terms of account numbers, online banking access, or any other relevant details.

I appreciate your prompt attention to this matter and look forward to a smooth transition of the account. If there are any fees associated with this conversion, kindly inform me in advance.

Thank you for your cooperation, and I am available at [Your Phone Number] or [Your Email Address] for any further clarification or assistance.

[Your Full Name] [Your Signature]

[Enclosures: Copy of ID/Passport, Joint Account Debit Card (if applicable)]

Email Format about Convert Joint Account to Single Account Letter Format

Here’s an Email Format of Convert Joint Account to Single Account Letter Format:

Subject: Request to Convert Joint Account to Single Account

Dear [Bank Name],

I am writing to request the conversion of my joint account [Account Number] with my former partner [Partner’s Name] to a single account in my name only. I would appreciate your prompt attention to this matter.

Please let me know what documents I need to provide and any additional steps I need to take to complete this process. I understand that there may be fees associated with this request, and I am willing to pay any necessary fees.

I look forward to hearing from you soon regarding this matter. Thank you for your assistance.

Sincerely, [Your Name]

Email Format about Convert Joint Account to Single Account Letter Format

Request Letter To Remove Joint Account Holder

Here’s a Request letter To Remove Joint Account Holder:

[Your Name] [Your Address] [City, State ZIP Code] [Date]

[Bank Name] [Bank Address] [City, State ZIP Code]

Dear Sir/Madam,

I am writing this letter to request the removal of the joint account holder [Joint Account Holder’s Name] from my account [Account Number]. The reason for this request is that the joint account holder and I have decided to separate, and we no longer wish to have a joint account.

Please take the necessary steps to remove [Joint Account Holder’s Name] from my account as soon as possible. I have enclosed a copy of my ID and signature for verification purposes.

Thank you for your assistance in this matter.

[Your Name and Signature]

Request Letter to Convert Joint Account to Single Account

Here’s a Request Letter to Convert Joint Account to Single Account:

I am writing to request the conversion of our joint account [Account Number] to a single account under my name [Your Name]. The reason for this request is that the joint account holder [Joint Account Holder’s Name] has passed away.

I understand that there are certain procedures that need to be followed to complete this request, and I am willing to provide any necessary documents and information. Please let me know the steps that need to be taken and the documents that are required to process this request.

Convert Joint Account to Single Account Letter Format – Template

Here is a template for a letter to convert a joint account to a single account:

Subject: Request for Conversion of Joint Account to Single Account

I hope this letter finds you well. I am writing to formally request the conversion of our joint savings account to a single account. The details of the account are as follows:

Account Holder 1:

- Name: [Your Full Name]

- Account Number: [Joint Account Number]

- [Your Signature]

Account Holder 2:

- Name: [Co-account Holder’s Full Name]

- [Co-account Holder’s Signature]

Due to personal circumstances, [Co-account Holder’s Full Name] and I have decided to proceed with the conversion of the joint account to a single account under my name. I kindly request your assistance in facilitating this process and providing guidance on any required documentation.

I am aware that there may be certain formalities involved, and I am prepared to fulfill all necessary requirements. Additionally, please inform me of any changes that may occur, such as new account numbers or modifications to online banking access.

If there are any fees associated with this conversion, please provide details in advance. I am committed to completing this process smoothly and promptly.

I appreciate your attention to this matter and look forward to your guidance on the necessary steps. Feel free to contact me at [Your Phone Number] or [Your Email Address] for any further clarification or information.

Thank you for your cooperation.

Joint Account Conversion Request Letter

This is a Joint Account Conversion Request Letter:

[Your Name] [Your Address] [City, State, Zip Code] [Your Email Address] [Your Phone Number] [Date]

[Bank Name] [Bank Address] [City, State, Zip Code]

I hope this letter finds you well. I am writing to request the conversion of my joint savings account with the following details:

Account Holder Names: [Your Name] and [Joint Account Holder’s Name] Account Number: [Account Number] Type of Account: Savings Account

Due to personal reasons, I kindly request that my joint savings account be converted into a single account under my name only. I have discussed this matter with the joint account holder, and we both agree to this change.

I would like to request your assistance in facilitating the process of converting the joint account to a single account in my name. Please provide me with the necessary forms and instructions to complete the conversion process.

I understand that there may be certain formalities and documentation required for this conversion, and I am prepared to fulfill any requirements as per your instructions.

I would appreciate it if you could expedite this request and inform me of the steps I need to take to complete the conversion process at the earliest convenience.

Thank you for your attention to this matter. Should you require any further information or documentation from my end, please do not hesitate to contact me.

Yours sincerely,

[Your Signature (if sending by mail)]

[Your Name]

Single Account Conversion Letter to Bank

Here’s a Single Account Conversion Letter to Bank:

I trust this letter finds you well. I am writing to formally request the conversion of my joint savings account into a single account.

After discussing this matter with the joint account holder, we have mutually agreed to convert the joint account to a single account under my name only.

I kindly request your assistance in providing the necessary forms and guidance to complete the conversion process. I understand that there may be specific requirements and documentation needed for this purpose, and I am willing to comply with any such procedures.

Please let me know if there are any fees associated with this conversion, and I am prepared to settle them promptly.

I appreciate your prompt attention to this matter and would like to complete the conversion process at the earliest convenience. Your cooperation in this regard will be highly appreciated.

Thank you for your understanding and cooperation.

Bank Letter for Converting Joint Account to Single Account

This is a Bank Letter for Converting Joint Account to Single Account:

I hope this letter finds you in good health. I am writing to formally request the conversion of my joint savings account into a single account.

After careful consideration, both account holders have mutually agreed to convert the joint account to a single account under my name only.

I kindly request your assistance in providing the necessary forms and guidance to complete the conversion process. I understand that there may be specific requirements and documentation needed for this purpose, and I am prepared to comply with any such procedures.

Please inform me of any fees associated with this conversion, and I am ready to settle them promptly.

Thank you for your understanding and assistance.

Convert Joint Account to Single Account Letter Format – Example

Here’s an Example of Convert Joint Account to Single Account Letter Format:

After careful consideration, both account holders have decided to convert the joint account to a single account under my name only.

I kindly request your assistance in providing the necessary forms and guidance to complete the conversion process. I am aware that specific requirements and documentation may be needed, and I am prepared to fulfill any such criteria.

Kindly inform me of any fees associated with this conversion, and I am ready to settle them promptly.

Account Holder Change Request Letter

This is an Account Holder Change Request Letter:

Subject: Account Holder Change Request

I hope this letter finds you well. I am writing to request a change in the primary account holder for my bank account.

Current Account Details: Account Holder’s Name: [Current Account Holder’s Name] Account Number: [Account Number] Type of Account: [e.g., Savings Account]

Proposed Changes: New Primary Account Holder’s Name: [New Account Holder’s Name] Relationship with Existing Holder: [e.g., Spouse, Family Member] New Mailing Address (if applicable): [New Address, if changed]

I kindly request your assistance in processing this change. I understand that there may be specific forms or documentation required for such a request, and I am prepared to provide any necessary information.

I would appreciate it if you could inform me of any fees or charges associated with this account holder change.

Please consider this letter as formal notification, and I am available for any further steps or requirements in this process.

Thank you for your prompt attention to this matter.

Letter to Convert Joint Savings Account to Single

Here’s a Letter to Convert Joint Savings Account to Single:

Subject: Request to Convert Joint Savings Account to Single

I trust this letter finds you in good health. I am writing to request the conversion of our joint savings account to a single account.

Current Joint Account Details: Account Holders’ Names: [Joint Account Holder 1’s Name] and [Joint Account Holder 2’s Name] Account Number: [Account Number] Type of Account: Savings Account

Proposed Changes: Account Holder’s Name (to remain): [Your Name] Removal of Co-Account Holder: [Joint Account Holder 2’s Name]

I understand that the process for converting a joint account to a single account may involve certain formalities and documentation. I am prepared to provide any necessary information or complete required forms promptly.

Additionally, I would appreciate it if you could inform me of any fees or charges associated with this account conversion.

I kindly request your assistance in expediting this request and ensuring a smooth transition. Please let me know if there are any specific steps or documentation needed from my end.

Thank you for your attention to this matter, and I look forward to a prompt resolution.

FAQS for Convert Joint Account to Single Account Letter Format – Examples

How do i start a convert joint account to single account letter format .

This Convert Joint Account To Single Account Letter Format Begin with a formal salutation, such as “Dear [Bank Manager’s Name],” and clearly state your intention to convert the joint account to a single account.

What details should be included in the Convert Joint Account To Single Account Letter Format?

In this Convert Joint Account To Single Account Letter Format Include your current joint account details (account holders’ names, account number, type of account) and specify the proposed changes, such as the account holder’s name to remain and the removal of the co-account holder.

Is it necessary to mention the reason for converting the joint account to a single account?

While it’s not mandatory, you may choose to briefly mention the reason for the conversion, such as changes in financial arrangements or personal circumstances.

Should I inquire about any fees or charges associated with the Convert Joint Account To Single Account Letter Format?

Yes, it’s advisable to politely ask about any fees or charges that may be incurred during the account conversion process. This Convert Joint Account To Single Account Letter Format shows your awareness and readiness to comply.

Is there a specific tone to be maintained in the Convert Joint Account To Single Account Letter Format?

Maintain a polite and formal tone throughout the Convert Joint Account To Single Account Letter Format. Clearly express your request and willingness to provide any necessary information or complete required forms promptly.

What steps can I take to expedite the joint account conversion process?

This Convert Joint Account To Single Account Letter Format Express your willingness to cooperate and provide any necessary documentation promptly. Follow up with the bank after submitting the letter to ensure a smooth and timely process.

When writing a Convert Joint Account to Single Account Letter Format, it is important to be clear and concise about your intention to remove your name from the account, provide the necessary details and any supporting documentation, and request confirmation from the bank.

Follow the step-by-step guide we provided to ensure that your Convert Joint Account To Single Account Letter Format is properly formatted and that the bank processes your request in a timely and accurate manner . With this Convert Joint Account To Single Account Letter Format, you can effectively and professionally communicate your desire to change your joint account into a single account .

Related Posts

24+ Car Parking Letter Format – How to Write, Email Templates

15+ Business Letter Format Class 12 – Explore Writing Tips, Examples

20+ Comp Off Leave Letter – Check Meaning, How to Apply, Email Ideas

11+ Authorized Signatory Letter Format – Templates, Writing Tips

Write 1 Hour Permission Letter Format for Office – 14+Templates

20+ Warranty Letter Format – How to Write, Examples, Email Ideas

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Name *

Email *

Add Comment

Save my name, email, and website in this browser for the next time I comment.

Post Comment

Ultimate Letter

Letter For Everyone

7 Samples Of Application For Opening Bank Account

Need to open a new savings bank account? We are giving you test application letters to the bank office chief for opening a financial balance for yourself, your children, your mom, your dad, kin, your better half, or some other relatives of your loved ones. The financial balance can be opened for a solitary individual or a joint ledger like you, your girl, and your child.

So, in this article, I am going to give 7 samples of application for opening bank account . So, see below the samples…

Table of Contents

Documents Required To Open A Bank Account:

If you do not have a bank account yet and you also want to open a new saving bank account, then you may also need to write a letter to the bank manager to open a new bank account.

To open a new bank account, you can write a letter to bank manager requesting him to open a new saving account in your name in his branch. With this, you can use the facilities of that bank

Before writing the application letter for opening a savings account with the bank, you have to collect all the vital and important documents for opening a new personal bank account. For those who want to open their bank account for the first time, the below-mentioned documents are required.

- After filling out the bank account opening form, it has to be signed.

- Opening an account with a bank also requires someone who signs your account opening form as the introduction.

- Copy of your Aadhar Card and Address Proof document.

- Copy of your PAN card.

- Your 2 passport size photographs.

After collecting all these documents you will have to write a letter to open a savings account in the bank.

Mr. Branch Manager

[Name Of The Bank]

[Branch Address]

Subject: Application For Opening A Bank Account

It is a humble request that I [Your Name] open a savings account in your bank and I can take advantage of the facility of your bank, so it is requested that open my new account. For which I will be forever grateful to you.

Yours Faithfully.

[Your Name]

[Your Address]

[Mobile Number]

[Signature]

Download Application For Opening A Bank Account In MS Word File

The Branch Manager

[Address Of The Bank]

Subject: Application For A Opening Bank Account

Humble request that I [Your Name] need to open a new account in your bank. So that I can take advantage of the facilities of the bank. I have attached all the required documents with the application form for opening the account . Please kindly pay attention to my application and help me to open my account at the earliest.

So I kindly request you to open the account. For which I will always be grateful to you.

[Bank Name]

I kindly request that I [Your Name] want to open an account at your bank.

Therefore, you are requested to open a bank account at your bank in my name. For this, I will be forever grateful to you.

Download Application For Opening A Savings Account In MS Word File

List Of Official Letter

Branch Manager

Subject: Application For Bank Account Opening

With this letter, I would like to request you to open a new savings account with your bank so that I can avail the facilities of the bank. My name is [Your Name] am a resident of [Your City] and [State] . I am enclosing the vital and important documents and address proof along with the account opening form.

I formally request you to provide a savings account in your branch in the name of [Candidate Name] . Please let me know at the provided number if anything is required.

I am waiting for your favorable reply.

Download Application For Opening Savings Account In MS Word File

The Bank Manager,

Subject: Application For Opening Young Kid Saving Account

I formally request you to open a young kid savings account for my 11-year-old daughter, [Name] , at [Name Of The Bank and Branch] . I declare myself as her sole source of income.

Attached with this application are the details of my account and a copy of my required documents, along with a copy of my pension book . If any documents are missing for this procedure, please let me know at the provided number.

Download Application For Opening Bank Account In MS Word File

I have read a lot about your bank’s success and customer service from my friends and on social media. It creates interest, so I also want to open a savings account in your bank, and I also want to enjoy your customer service.

I hope you will process my application for account opening as soon as possible.

Yours truly,

Subject: Application For Opening New Savings Bank Account

I hope you are doing well. I want to open an account in this bank . The type of account should be saved because the primary purpose of opening this account is that I am trying to save some money.

I have another account but could not manage to save the money. I have also been through your savings account benefits and like them the most. I have attached all required documents with this letter to open the account.

I hope you will proceed with my application as soon as possible. Again, I would be very thankful to you.

Q. How do I write a letter to open a bank account?

A. To open a bank account an application letter from your bank you might demand face to face at a bank office from one of the investors, by a call to the bank, and contingent upon the monetary foundation, through their web-based stage.

Q. Can I access my account information online?

A. You might have the option to really look at balances, move cash, get proclamations and take care of bills on the web. In the event that you don’t have simple admittance to a branch, online banking can be entirely important. Ensure you know your internet banking liabilities and ensure the occasion somebody falsely eliminates your assets through web-based administrations.

Q. What Is The Application For Opening A Bank Account?

A. Savings Account Opening Form means the standardized application form prescribed by the Management Company to be duly filled by the investors at the time of opening an account with the Fund.

Q. Can I apply for a bank account online?

A. You can start the cycle with only your portable number, and records, and by finishing up a structure. It should be in every way possible helpfully by means of our online entryway, permitting you to try not to need to genuinely go to the bank.

Our first bank account

A guide to opening your first joint bank account.

July 3, 2024 | 3 min read

Whether it’s saving for a big trip or making quick, on-the-go purchases, a joint checking or savings account can make certain aspects of money management a little easier. But you’ve got to know how it works and whether it makes sense for you.

What is a joint bank account?

A joint bank account is a shared bank account between two people. Sharing a bank account makes it possible for either party to deposit and withdraw funds, and usually provides full access to the shared account. No more having to transfer money back and forth or discuss who buys what. You can spend together and save together with joint checking and savings accounts.

Who owns the money in a joint bank account?

The beauty (and ease) of a joint bank account is that both of you can access it at any time. Since the account will belong to the two of you, you both have equal ownership. This means you can withdraw or deposit money whenever you see fit. 1

Say you’re saving for a dream vacation to the shores of Sicily. With two people making regular deposits toward a goal, reaching it may feel easier. You’ll not only see every deposit that’s made, but you can also cheer each other on with your eye on the prize.

On the flip side, your joint account holder can change their mind, withdraw that money or use it for something else entirely. Trust, therefore, is a must for anyone sharing a bank account. While it can be a good way to start building a financial partnership, it’s a big step for any relationship. Here are some pros and cons so you can decide for yourself:

Joint bank account pros and cons

- Couples can use cash in a joint checking account to cover shared expenses such as rent, bills and date nights.

- A joint savings account can help you save more easily together for any of your wants or needs.

- Each account holder is insured by the FDIC up to allowable limits, increasing the amount of total coverage. 2

- You can share responsibilities based on who’s best at any given task, such as paying bills on time or managing a budget.

- Finally, if one account holder passes away, the other may have access to the account without having to locate a will or involve a lawyer. 3

- One partner could overdraw the account , meaning you’d both be on the hook for potential fees.

- If one account holder lets debts go unpaid, creditors can pursue money in the account for settlements. 1

- Both account holders can see all transactions in the account, bringing certain obsessions with golf, shoes, books or video games out into the light of day.

- Individuals sharing the same joint account may have different tax obligations, so it may help to get advice from a pro come tax season.

Find the best joint bank account for you

Exploring bank accounts together is also a good opportunity to get comfortable talking about money. As you compare features that come with different accounts, you can decide what’s important to both of you. You can also discuss what the account will be used for. Will it be for everyday bills? Managing debt and savings ? Putting money away for a big event or purchase?

Once you find an account that works for both of you, follow the bank’s account opening process. Whether you open your joint account online or in person, you’ll probably both need your: 4

- Social Security number.

- Proof of address.

- Other general information, such as birth dates.

- Opening deposit (in some cases).

How to close a joint bank account

This may be surprising, but only one account holder may be needed to close a joint account . 5 Once you’re at a zero balance, you can take your ID to your branch and fill out the correct form. However, if you’re closing your joint account online, you may both be asked to sign in separately. In some cases, faxed or mailed requests are accepted, but not often.

Depending on where you are in your financial journey, a joint bank account may help you reach your goals, or at least get better at discussing and planning for them. Just make sure you consider the pros and cons and agree about how you’ll manage everything from saving to spending to handling mishaps.

A financial journey for two takes work—but has advantages that make it worthwhile for many.

Related Content

The ABCs of savings

The ins and outs of handling finances in marriage

How to open a checking account

This device is too small

If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience.

- Banking Guides and Tools

Joint Bank Accounts: What They Are and How to Open One

Kailey Hagen has been writing about small businesses and finance for almost 10 years, with her work appearing on USA Today, CNN Money, Fox Business, and MSN Money. She specializes in personal and business bank accounts and software for small to medium-size businesses. She lives on what's almost a farm in northern Wisconsin with her husband and three dogs.

See Full Bio

Our Banking Expert

Joint bank accounts offer a convenient way for two or more people to pool their money in one place. This makes managing household funds much easier, but it can also have some serious drawbacks if you choose the wrong person to share an account with.

Here's what you need to know to decide whether a joint bank account is right for you, as well as how to open a joint bank account.

What is a joint bank account?

A joint bank account is a bank account that's owned equally by two or more people. We often think of married couples who open a joint checking account or savings account , but this isn't the only way people use joint accounts. Some other examples of common use cases include:

- A parent who opens a joint account with their teen to monitor their spending

- An adult child who becomes joint owner of their aging parent's account to help them manage their finances

- Business partners who open a joint business bank account so each has access to the company's funds

Pretty much anyone can open a joint bank account. You don't have to be related. And you don't have to stop at two people either. Three or more people can share a joint bank account if they want.

Compare checking accounts

We recommend comparing checking accounts to make sure you're getting the best fit for you. Here's a list of our favorite accounts .

| Account | APY | Promotion | Next Steps |

|---|---|---|---|

| On Chase's Secure Website. Member FDIC. Our ratings are based on a 5 star scale. 5 stars equals Best. 4 stars equals Excellent. 3 stars equals Good. 2 stars equals Fair. 1 star equals Poor. We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs. | On Chase's Secure Website. | ||

| On Discover Bank's Secure Website. Member FDIC. Our ratings are based on a 5 star scale. 5 stars equals Best. 4 stars equals Excellent. 3 stars equals Good. 2 stars equals Fair. 1 star equals Poor. We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs. | N/A | On Discover Bank's Secure Website. | |

| On Quontic's Secure Website. Member FDIC. Our ratings are based on a 5 star scale. 5 stars equals Best. 4 stars equals Excellent. 3 stars equals Good. 2 stars equals Fair. 1 star equals Poor. We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs. | $1 | On Quontic's Secure Website. |

How does a joint bank account work?

Joint bank accounts work exactly the same as sole bank accounts of the same type. The only difference is that all owners of the accounts can access the funds. So, for example, checking accounts enable all joint owners (account holders) to write checks and pay bills from the account and get a debit card to withdraw funds. And any account holder of a joint savings account can withdraw the funds at any time.

Joint money market accounts and certificate of deposit (CD) accounts are also possible, though these are less common. They also work the same as money market accounts and CDs owned by a single person.

Is a joint bank account right for you?

A joint bank account can make managing finances much easier, especially for couples, compared to transferring funds between individual accounts. All of the money is readily available for both to access as needed.

Opening a joint account also raises the FDIC insurance on that account. Normally, the FDIC insures your money up to $250,000 per account type per bank. But for joint accounts, it insures you up to $250,000 per depositor. So if a married couple opens a joint savings account, it's insured up to $500,000. That's a huge plus for those with large balances.

Since joint accounts give all parties equal access, it's crucial you choose your partners carefully. If you open a checking account online with your spouse, and they later drain the account, there isn't anything you can do about it.

You should only open a joint bank account with someone you trust completely. If you have any doubts about how they'll handle the money, make sure you lay out the ground rules before you open the account. Or don't open a joint bank account with them at all.

Another drawback is that joint bank accounts also don't allow for any privacy. Both parties can see all of the account's transactions. This can make it tricky if one person is trying to surprise the other with a gift. That's why some couples prefer to have a joint account for everyday expenses, but maintain separate accounts they can use for individual purchases or gifts.

How to open a joint bank account

To open a joint account, you'll simply choose a bank, gather the required documents, and fill out the application. Here's a closer look at those steps:

1. Choose the right bank and bank account.

Talk with your partner about what type of bank account you're interested in opening and agree on a bank to work with. Don't forget to consider account fees, access to funds, online and mobile banking tools, and customer service when deciding which bank is right for you.

To find an account that's right for you, check out our Best Joint Savings Accounts .

2. Gather your documents together.

Check with the bank to see what documents and information it requires and get this ready. You'll most likely need to provide personal information for all the co-owners of the account.

This includes each person's:

- Full legal name

- Phone number

- Social Security number

Most banks will require some form of government-issued identification, like a driver's license or a passport, from each person, and some also ask for a utility bill or another proof of address. Check with your bank to find out exactly what documents you'll need to apply.

3. Fill out the online application or make an appointment at a bank branch.

Select the "joint account" option and provide all necessary information to open the account.

4. Fund the account.

You can transfer money electronically or via wire transfer from another bank account. Some banks may also enable you to deposit a check or cash.

Once you've completed the steps above, you and your partner should be able to use the account just like any other bank account. Both people can set up direct deposit to the account and create online accounts where they can view their balance and pay bills. If the account allows for it, each person can order checks and a debit card for making withdrawals.

Yes, you can open a joint bank account with anyone. But you should only open a joint account with someone you trust completely. All parties listed as co-owners on the account are free to use the money however they want, and your bank isn't going to help you out if your partner drains the account behind your back.

Most banks will require some form of government-issued photo ID, like a driver's license or a passport, from all parties opening the account. And some may require a utility bill or other proof of address. You'll also need each person's full name, date of birth, Social Security number, and contact information.

A joint bank account works exactly like a solo bank account of the same type. For example, checking accounts enable you to withdraw funds via check or debit card while savings accounts let you earn interest on your funds. The only difference between solo and joint accounts is that joint accounts enable more than one person to access the funds.

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.

The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

Copyright © 2018 - 2024 The Ascent. All rights reserved.

- Search Search Please fill out this field.

- Who Should Open One?

- Opening a Joint Checking Account

Things To Consider

Keeping some money separate, the bottom line.

- Checking Accounts

How To Open a Joint Checking Account

Merging money is a big step for many couples. Here's how to do it.

Amy Fontinelle has more than 15 years of experience covering personal finance, corporate finance and investing.

:max_bytes(150000):strip_icc():format(webp)/fontinelle-5bfc262a46e0fb0083bf8446.jpg)

- What Is a Checking Account? Here's Everything You Need To Know

- 6 Different Checking Accounts

- Joint Checking Account CURRENT ARTICLE

- Account Balance

- Non-Sufficient Funds

- Routing Transit Number

- Overdraft Protection

- Overdraft Protection: Pros and Cons

- Overdraft Consequences

- The Documents You Need

- Pros and Cons of Checking Accounts

- Checking Account Beneficiaries

- What is a Check?

- Bounced Check

- Do Checks Expire?

- How to Write a Check

- Debit Cards

- Keeping Transactions Safe

- Prepaid Debit Card Precautions

- Best Checking Accounts for Teens

- Best Rewards Checking Accounts

- Best High-Interest Checking Accounts

Opening a joint bank account is a big step for a lot of couples. For some, it happens when they move in together, get engaged, or get married. Other times, couples keep their finances separate at first and then later decide that they want to mingle their money. (And sometimes, even married couples choose to keep all of their accounts separate.)

For people who share expenses, it's often easier and more practical to have at least some of their money in shared accounts, which makes it convenient to pay for joint expenses like housing, food, and other regular bills. While couples often share savings and investment accounts, too, a joint checking account can be a good place to start.

Key Takeaways

- Couples, parents with teenagers, and adult children with aging parents can benefit from the conveniences of a joint checking account.

- Opening a joint account is similar to opening a personal account and will require information from both partners.

- It may make sense to retain individual checking accounts, as well as share a joint checking account.

Who Should Open a Joint Checking Account?

Couples (whether married or not) who are in committed, long-term relationships are good candidates for joint accounts. You need to fully trust the person you open a joint account with because each account holder has full access to the money held by the account. That means that either person could withdraw money or even drain the account and close it without the other person's consent.

This equal access comes in handy during illness or other times of crisis; for example, if one of the account holders gets sick, the other can access funds and pay medical bills as well as keep the household running. And if one person dies, the other will have continued access to those joint funds without needing to deal with a will, probate court , or lawyer, as long as the account has the right of survivorship.

Newly married couples managing money together aren't the only people who will benefit from a joint account. Parents and teens—as well as adult children caring for their aging parents —may want to consider a joint checking account. The parent of a teenager can then monitor their child's account activity with this type of account and deposit money on their behalf. And caregivers of older or ill adults can easily access funds to pay for care .

Investopedia / NoNo Flores

Opening a joint checking account is very similar to opening an individual checking account . Select "joint account" when you fill out your application or, after you fill in one person's information, choose to add a co-applicant.

Both people may need their Social Security number, birthdate, mailing address, photo ID, and information for the accounts you plan to use to fund your new account. Another option is to add one partner to the other partner's existing account.

In a joint bank account, each account holder is insured by the FDIC . That means the total insurance on the account is higher than it is in an individual account.

Managing money as a couple requires clear communication and expectations. It's important to discuss how you'll each deposit money into the account and use the money once it's there, ideally before you open the account. Remember, each person can access joint funds and talk to the bank without notifying the other person. Additionally, any money in a joint account may become vulnerable if one person has unpaid debts, as creditors can, in some cases, go after money in the joint account.

Opening a joint checking account doesn't mean you need to close your individual accounts. Many couples keep individual accounts for personal expenses, as well as joint ones for household and other joint expenses. In some cases, each partner contributes an equal sum to the account each month. Or, each person contributes an equal percentage of their take-home pay . Whichever path you choose, be sure to clearly lay out the expectations for both deposits and withdrawals.

What Do You Need To Open a Joint Checking Account?

What is needed to open a joint checking account is the same as what's needed to open a regular checking account. These items include proof of identification of both individuals, personal identification such as Social Security numbers, proof of address, and possibly cash to fund the account.

Can I Open a Joint Checking Account With Anyone?

Yes, individuals can open a joint account with anyone. Most often, however, joint checking accounts are opened between partners or family members, but any two people can open one together.

Do Both Parties Need To Be Present To Open a Joint Checking Account?

Both parties do not necessarily need to be present to open a joint checking account. Many accounts today can be opened online, therefore, both parties do not need to be present but the identification of both parties will need to be provided.

What Are the Negatives of Having a Joint Checking Account?

Joint accounts can cause problems at times because they generally provide all parties unlimited access to the funds. So, if one spouse has difficulty controlling their spending habits, this may affect the other spouse, who may be more frugal. The frugal spouse can't challenge the withdrawals or transactions of the other spouse with the bank because they are listed as a joint account holder.

A joint checking account can be a good place to start for couples looking to merge their finances. Having a joint checking account comes with many benefits, such as better protection and an easier way to pay for joint expenses.

Consumer Financial Protection Bureau. " I Have a Joint Checking Account. The Other Person Closed the Account Without Telling Me. Is That Allowed? "

Consumer Financial Protection Bureau. " I Have a Joint Account With Someone Who Died. What Happens Now ?"

FDIC. " Your Insured Deposits ."

Nolo. " Bank Levies on Joint Accounts (Spouse) ."

:max_bytes(150000):strip_icc():format(webp)/happyyoungmanwithdebitcardandcomputer-88fbe079805a4f56ad6233de658586de.jpeg)

- Terms of Service

- Editorial Policy

- Privacy Policy

How to Open a Joint Bank Account

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on September 08, 2023

Get Any Financial Question Answered

Table of contents, what are joint banks accounts.

A joint bank account is a shared bank account that allows two or more individuals to have equal access to the funds within it.

These individuals, known as co-owners, have the right to deposit and withdraw money, make transactions, and monitor the account's activities collectively.

Joint accounts are typically utilized by couples, family members, business partners, or friends who wish to pool their resources for a common purpose, such as managing household expenses, saving for a shared goal, or handling business finances.

The procedure for opening a joint bank account is relatively straightforward, but it is crucial to approach it with careful consideration and transparency.

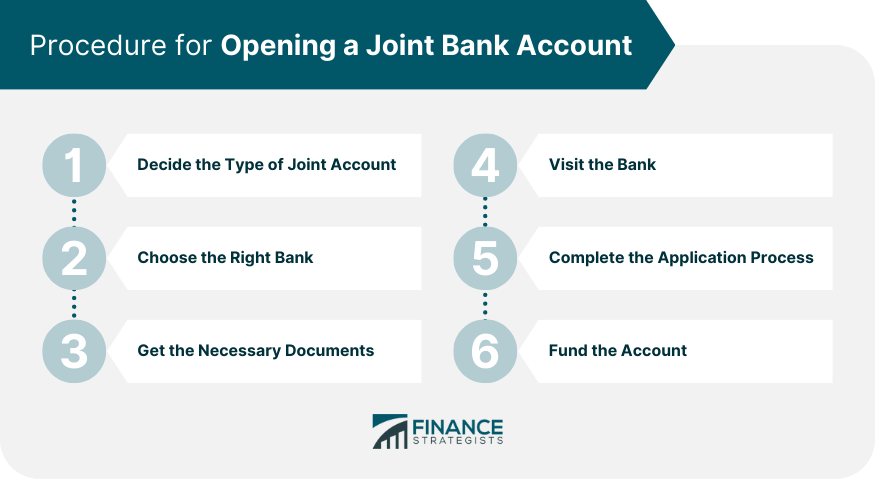

Procedure for Opening a Joint Bank Account

Decide the type of joint account.

Before you embark on the journey of opening a joint bank account, it is essential to understand the different types of joint accounts available.

The two most common types are "Joint Tenants with Rights of Survivorship" and "Joint Tenants in Common." In the former, if one account holder passes away, the surviving account holder automatically inherits the entire account.

In contrast, a Joint Tenancy in Common allows each account holder to leave their share of the account to a beneficiary of their choice in their will .

Choose the Right Bank

Choosing the right bank or credit union for your joint account is a crucial step. Look into factors such as the bank's reputation, customer service, access to branches and ATMs, digital banking features, and any fees associated with the account.

Additionally, consider the interest rates on savings accounts if you plan on saving together.

Get the Necessary Documents

Opening a joint bank account requires providing several key documents. Usually, you and the other account holder will need to provide proof of identity, such as a passport or driver's license, social security numbers , and proof of address.

The specific requirements may vary slightly between banks.

Visit the Bank

Although some banks allow online applications, most require at least one visit to a branch to open a joint account. It's typically a straightforward process where you fill out an application and provide the necessary documents.

Complete the Application Process

After submitting your documents, the bank will process your application. The process includes a verification check of your provided details. Once this is completed, your joint account will be activated.

Fund the Account

Most banks require an initial deposit to open the account. Be sure to check if there's a minimum deposit requirement. You can fund the account through cash , check , or an electronic transfer from another account.

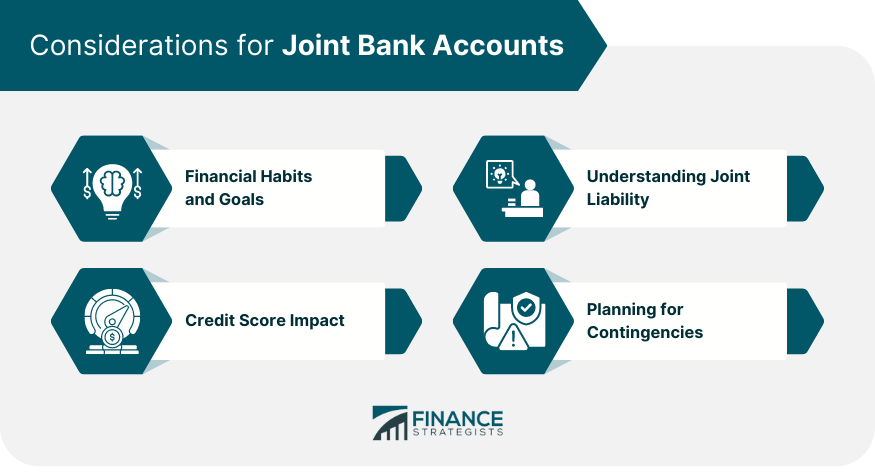

Considerations for Joint Bank Accounts

Financial habits and goals.

Before opening a joint account, it's crucial to have an open and honest discussion about your financial habits and goals.

It's important to ensure both parties are on the same page about budgeting , spending, and saving.

Understanding Joint Liability

Joint bank accounts come with joint liability. This means both account holders are responsible for any overdrafts or debts, regardless of who incurred them. It's vital to understand this responsibility before opening the account.

Credit Score Impact

A joint account can potentially impact your credit score . If the account becomes overdrawn and the debt isn't paid, it could harm both account holders' credit scores.

Planning for Contingencies

Discuss and plan for potential future situations, such as a disagreement about money management, divorce, or the death of one account holder. Planning for these contingencies can prevent future financial conflicts.

Benefits and Risks of Joint Bank Accounts

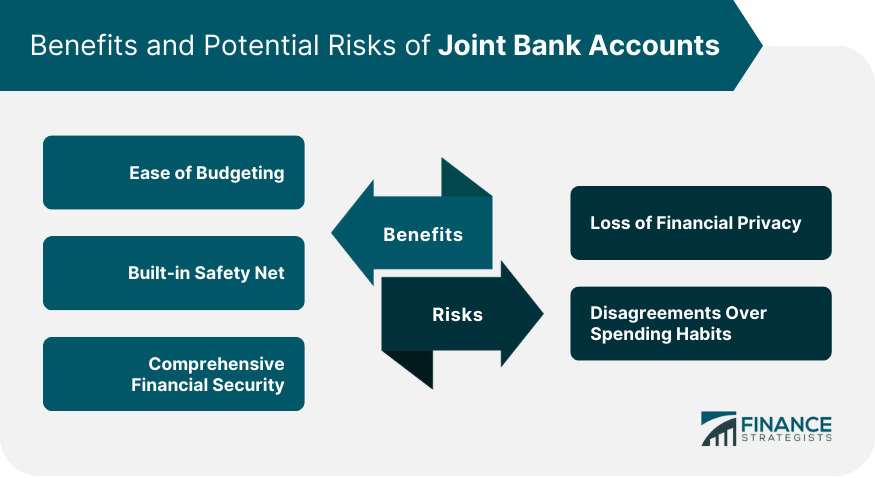

Joint bank accounts, without a doubt, come with a host of advantages that make financial management simpler for those sharing expenses.

One of the foremost benefits is the ease of budgeting. With all shared expenses flowing from one account, tracking spending becomes straightforward, offering a comprehensive view of where the money is going.

Furthermore, the account provides a built-in safety net in emergency situations. Since both individuals have equal access to the funds, either person can handle unexpected expenses without delay.

This accessibility offers a sense of financial security, knowing that resources are readily available when needed.

One significant risk is the loss of financial privacy. With a joint account, every transaction can be seen by both account holders.

This transparency might be uncomfortable for those who prefer to keep some aspects of their financial lives private.

Additionally, disagreements over spending habits or financial decisions can arise, potentially leading to relationship strains.

Therefore, communication is key when managing a joint account to ensure both parties feel comfortable and in agreement about financial decisions.

Alternatives to Joint Bank Accounts

If a joint account doesn't seem like the right fit, there are alternatives. Separate accounts with authorized users can give access without full joint liability.

Linked accounts offer another option where separate accounts are connected for the purpose of transferring funds. Moreover, numerous financial apps are designed to help manage shared expenses.

Final Thoughts

Opening a joint bank account is a significant financial decision that requires careful consideration and planning.

The process involves deciding on the type of joint account, choosing the right bank, providing necessary documents, and understanding the implications of joint liability.

A joint bank account can simplify financial management for shared expenses, offer a sense of financial security, and serve as a valuable resource during emergencies.

However, it also entails potential risks such as loss of financial privacy and potential for disputes over spending habits. Additionally, it's crucial to understand the potential impact on your credit score and to plan for various contingencies.

For those who prefer not to merge their finances fully, alternatives such as separate accounts with authorized users, linked accounts, or financial apps for managing shared expenses can be considered.

The decision ultimately depends on your financial habits, goals, and comfort level with shared financial responsibility.

While a joint account can offer many benefits, it's vital to thoroughly discuss and agree on its use to ensure it serves its purpose effectively and harmoniously.

How to Open a Joint Bank Account FAQs

Can a joint account be opened online.

While some banks do offer the option to open a joint account online, many still require at least one in-person visit to a branch. It's best to check with your chosen bank to understand their specific process.

What happens to a joint account when one owner passes away?

If the joint account is a "Joint Tenants with Rights of Survivorship" account, the surviving account holder automatically inherits the entire account. However, if it's a "Joint Tenancy in Common," the deceased owner's share of the account can be left to a chosen beneficiary.

How to resolve disputes over a joint account?

Disputes over a joint account can be challenging to resolve. It's essential to have clear communication and mutual agreement on the use of the account from the outset. If disagreements arise, you may consider seeking financial counseling or legal advice.

How can a joint bank account impact my credit score?

A joint bank account can impact your credit score if the account becomes overdrawn and the debt is not promptly paid. Both account holders are jointly responsible for any debts, and any failure to repay them could negatively affect both account holders' credit scores.

Are there alternatives to opening a joint bank account?

Yes, there are several alternatives to joint bank accounts. You might consider having separate accounts with authorized users, linking individual accounts for easier fund transfers, or using financial apps designed to manage shared expenses. The best choice depends on your specific needs and comfort levels.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Bad Credit Score

- Benefits of a Small Business Loan From a Credit Union

- BlueOr Bank Review

- Business vs Personal Bank Account

- Can a Debt Collector Withdraw Money From Your Bank Account?

- Credit Union Loan for Bad Credit

- Credit Union Marketing Strategies to Improve Engagement

- Credit Union Mobile Deposit Funds Availability

- Credit Union Routing Number

- Does Closing a Credit Card Hurt Your Credit Score?

- Does Credit Score Affect Car Insurance Rates?

- FICO Score vs Credit Score

- Frozen Bank Account

- Good Credit Score

- History of Credit Scores

- How Does Debt Consolidation Affect Your Credit Score?

- How a Missed Payment Affects Your Credit Score

- How to Deposit at Any Credit Union

- How to Finance Your Car With No or Low Credit

- How to Join a Credit Union

- How to Join a Credit Union Online

- How to Open a Credit Union Account

- How to Open a Credit Union Business Account

- How to Switch From Personal to Business Bank Account

- Ideal Credit Score to Buy a Car

- Ideal Credit Score to Buy a House

- Importance of a Credit Score

- Largest Credit Unions in the USA

- Opening a Bank Account Without a Job

- What Affects a Credit Score?

Ask a Financial Professional Any Question

Find bank branches and atms near you.

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.