- News & Blog

11 Corporate Turnaround Success Stories

Even the most successful businesses have failed at some point in time.

However, if handled correctly, rock bottom could serve as the first stepping stone a company needs to begin climbing back up to the top.

Here are 11 of the most inspiring stories of turnaround success by companies you’ve definitely heard of.

Probably the most well-known turnaround success story is the rise of tech company Apple.

Apple went into a decade-long downward spiral after CEO Steve Jobs left the company in 1985 and lower-priced products from competitors, like Microsoft Windows , took over the personal computer market.

For 12 years its innovation, popularity and sales continued to plummet, almost reaching bankruptcy until Jobs rejoined the company in 1997.

The company was able to turn itself around with a successful rebrand and new technology like the first iMac.

Now, Apple is one of the most well-known and valuable companies in the world, raking in almost $300 billion in revenue each year.

FedEx was founded in 1971 by Frederick Smith with $4 million of inheritance money and $80 million in loans and investments.

Smith first proposed the idea behind FedEx in a writing assignment for one of his classes at Yale University, for which he earned a C.

During the first two years in business, the company accumulated enormous amounts of debt due to rising fuel prices and was at the edge of bankruptcy.

When funds dwindled down to just $5,000, Smith decided to fly to Las Vegas and gamble with the last of the money in an attempt to double it.

Incredibly, Smith managed to turn $5,000 into $27,000 and was able to save the company by raising another $11 million.

By 1976 FedEx had produced its first profit of $3.6 million.

Seven years later FedEx became the first U.S. company to reach revenues of $1 billion within 10 years of the startup with no merger or acquisition and has been thriving ever since.

Reddit, a popular website for news and discussion, was founded in 2005 by Steve Huffman and Alexis Ohanian .

When it first launched, it had zero visitors, leading the founders to create several fake accounts to hold fake discussions until visitors eventually started trickling in.

Eventually, Reddit became wildly popular and was bought by Condé Nast , the owner of 20 other brands and media like Vanity Fair , Vogue and The New Yorker .

As of February 2018, Reddit has almost 550 million active users and is ranked as the fourth most visited website in the U.S. and sixth in the world.

Sometimes you just have to fake it until you make it.

When Airbnb launched in 2008 it struggled to find investors, forcing founders Brian Chesky and Joe Gebbia to create custom cereal boxes to raise funds.

With Barack Obama and John McCain as inspiration, they created “Obama-Os” and “Cap’n McCains.”

Within two months, they’d raised over $30,000 and got invited to a training session for a startup incubator, which provided them with training and $20,000 in funding.

The company was able to grow exponentially and by the next year, the Airbnb website had 10,000 users and 2,500 listings.

The company now has over 4 million listings around the world and rakes in over $2.5 billion in annual revenue.

5. Evernote

Evernote, the app designed for taking notes, organizing and making lists, was founded in 2008 by Stepan Pachikov .

Within the same year, Pachikov made the decision to shut the company down because he believed it would never take off.

However, before he shut it down, an overseas investor pledged $500,000 to give Evernote a chance to succeed, and it did.

Despite the recent trouble, Evernote is a leader in note-taking and organization software and has raised hundreds of millions in funding, attracting over 20 million users.

6. General Motors

Perhaps the most dramatic turnaround success story is that of General Motors (GM).

GM was founded by William C. Durant in 1908 and was initially a holding company.

Just two years later in 1910, Durant lost control of GM to a bankers’ trust due to massive amounts of debt and a collapse in car sales.

After a dramatic proxy war in 1915, he was able to regain control, only to lose it again for good in 1918 after the new vehicle market collapsed again.

Then, Alfred P. Sloan took over and led the company into global dominance, which lasted well into the 1980s.

On June 1, 2009, GM went bankrupt, stripping stockholders of almost all of their investment and closing down several brands like Saturn, Pontiac and Hummer.

A month later, the U.S. Treasury invested $50 billion in GM and recovered $39 billion when it sold its shares later that year.

The Treasury invested an additional $17.2 billion into GM’s former financing company, GMAC (now Ally ). The shares in Ally were sold on December 18, 2014, for $19.6 billion netting $2.4 billion.

A study by the Center for Automotive Research found that the GM bailout saved 1.2 million jobs and preserved $34.9 billion in tax revenue.

In 2010, the reorganized GM made an initial public offering that was one of the world’s top five largest IPOs to date and returned to profitability later that year.

Today, GM produces over 9 million vehicles annually, employs almost 200,000 people and brings in $150 billion in annual revenue.

Marvel was founded in 1939 by Martin Goodman and saw instant success with its creation of the Human Torch, Sub-Mariner and Captain America.

Sales amounted to almost $1 million in the first two years of business and continued to rise for decades until the 1980s.

In 1986 Marvel made its first attempt at a film with the theatrical release of Howard the Duck , which was an astronomical flop (even though it was produced by George Lucas ).

The film cost $30 million to make and only grossed $15 million, earning a spot on the list for costliest box-office flops of all time.

Shortly after, Marvel began to lose ground to its rival, DC Comics , when DC began producing series like Watchmen , Batman: The Dark Knight Returns and Superman .

Marvel’s financial success began to peak in the early 90s until it suffered a huge blow in 1992 when some its greatest writers left to form their own company.

A year later, the comic book market crashed and Marvel was forced to file Chapter 11 bankruptcy in 1996.

With the new millennium, Marvel was able to bounce back from bankruptcy by a merger with Toy Biz and began producing successful film franchises like Spider-Man and X-Men .

Finally, in 2009 Marvel was bought by Disney for $4 billion and has since seen overwhelming success with movies like Iron Man , Guardians of the Galaxy , The Incredible Hulk and Black Panther .

Impressively, the Marvel Cinematic Universe now encompasses 18 films, 10 TV series and a slate of movies planned until 2020.

8. Starbucks

Starbucks is one of the greatest examples of the rewards of hearing the voice of the customer.

Launched in 1971 by Jerry Baldwin , Zev Siegl and Gordon Bowker , Starbucks first became profitable in Seattle during the early 1980s.

In 1987 the original founders sold Starbucks to Howard Schultz for $3.8 million.

However, in the late 1980s, the company experienced a brief economic downturn after attempting to expand to the Midwest and British Columbia but made a comeback in the 1990s when it entered California.

By 2002, there were almost 6,000 stores worldwide, showing a 300% growth rate in 15 years.

But, when the financial crisis hit in 2008, Starbucks was forced to close almost 1,000 stores and experienced a 28% profit loss over the next two years.

During this time Schultz took back control of the company and sent out a message to all employees on his first day back: “The company must shift its focus away from bureaucracy and back to its customers.”

Only two months later, the company implemented a new strategy based on technology, free thinking and community involvement.

“ My Starbucks Idea ” was rolled out in March 2008 to give customers a chance to have a say in the direction Starbucks went as a company. Over 90,000 ideas were shared via social media and raised page views per month to over 5 million.

Through this campaign, Starbucks implemented over 100 ideas and developed a community of like-minded baristas and coffee lovers.

Today, the company employs 250,000 people at 27,000 locations worldwide, owns several successful subsidiaries and continues to grow into new markets.

9. Delta Air Lines

Delta began as a crop dusting operation in Macon, Georgia, in 1924.

In 1928 the company was purchased by Collett E. Woolman and began to expand rapidly in South until its service was terminated in 1930.

This led the company to suspend its passenger service until the Air Mail scandal in 1934 when Woolman secured a low-bid contract for airmail service and resumed passenger services.

Over the next few decades, Delta expanded rapidly through additions of routes and the acquisition of several other airlines until 2004.

In an effort to avoid bankruptcy, Delta began a company-wide restructure, which included numerous job cuts and an expansion of operations in Atlanta.

The next year in another desperate attempt to avoid bankruptcy, Delta sold Atlantic Southeast Airlines to SkyWest Airlines for half of what it was worth.

Finally, on Sept. 14, 2015, Delta filed Chapter 11 bankruptcy for its debts amounting to almost $30 billion.

Over the next few years, Delta cut costs by billions and was able to emerge from bankruptcy in 2007 stronger than ever.

The company established itself as an independent carrier, unveiled a new logo and eventually merged with Northwest Airlines to create the world’s largest airline.

10. Pabst Blue Ribbon

Pabst Brewing Company was founded 174 years ago by Jacob Best in Milwaukee, Wisconsin.

Pabst Blue Ribbon, named after Frederick Pabst , saw steady sales in the 20th century and gained a reputation as the “blue ribbon” beer for the blue ribbon that was tied around each bottle from 1882 to 1916.

Sales peaked at 18 million barrels in 1977, then began to fall until 2001 when sales were below a million barrels.

That year, Brian Kovalchuk took over as CEO and began to make drastic changes.

Sales began to increase again shortly after due to increasing popularity among urban hipsters and the company’s sponsorship of indie music, local businesses, facial hair clubs, dive bars, radio shows and sports teams.

Now, Pabst Blue Ribbon is known as the official hipster beer and is frequently referenced in pop culture, proving a successful company turnaround.

11. Netflix

Netflix was founded in 1997 by Reed Hastings and Marc Randolph to combat late fees for video rentals.

The company didn’t turn a profit until 2003, earning $6.5 million profit on revenues of $272 million.

By 2005 business was booming – Netflix was shipping out a million DVDs daily.

Netflix saw rapid growth until 2011 when CEO Hastings decided to split user subscriptions into two separate categories at a hiked price: DVD rentals and unlimited streaming services.

The company lost over 800,000 subscribers and its stock value dropped by 77% in only four months.

Although Hastings’ decision is now praised as a smart business move, at the time he and his company’s reputations suffered greatly.

“Whatever happened to Fortune’s Businessperson of the Year?” asked Wedbush research analyst Michael Pachter, referring to one of the many awards Hastings had received the year prior.

“Whatever happened to the guy who was invited to the boards at Facebook and Microsoft? What happened to that guy? Do you think Facebook would have invited him to their board now?”

Critics even nicknamed him “Greed” Hastings.

Then, on Sept. 1, 2011, Starz announced that it would pull its movies from Netflix, sending the company into further crisis.

To make matters even worse, Hastings decided to unveil Qwikster , a DVD-only service that only lasted three weeks, a month earlier than he’d originally planned.

The new service was introduced in a confusing, low-quality YouTube video that was later turned into a scathing Saturday Night Live skit .

Over the year, despite massive losses, Netflix was able to bounce back and improve its revenue by 47%.

One of the company’s smartest moves was introducing “ Netflix Original ” movies and TV shows, first launching House of Cards in 2013 to much success.

As of January 2018, Netflix has 120 million subscribers worldwide and generates over $12 billion in annual revenue.

Related Posts

Introducing the Brown & Joseph Web Portal 2.0

Brown & Joseph named 2021 Annual Awards of Business Excellence Honoree

Brown & Joseph Welcomes Mike McClellan

Business Turnaround Case Study (With Example)

A business turnaround case study is a detailed analysis of a business that has faced significant challenges and has been able to successfully recover.

The case study provides insights into the reasons behind the business’s struggles and its eventual turnaround. It also highlights the key strategies and tactics that were used to achieve business success like increased productivity or profitability, better reviews or feedback from customers, etc.

The case study can be an invaluable resource for business owners and managers who are seeking to improve their own business performance. By understanding the reasons behind a successful business turnaround, they can learn from the mistakes of others and apply those lessons to their own businesses.

Here’s one example of a business turnaround case study for a manufacturing company.

Manufacturing Company Turnaround Case Study

The challenge:.

- The business was unprofitable, cash negative, and losing customers. Management in conflict & demoralized.

- Customers were very unhappy and were reducing orders and changing suppliers.

- The manufacturing process consisted of extrusion and thermoforming , i.e. a linked batch operation.

- A disorganized and dirty factory that had been put on notice by BRC to improve in 6 months. Poor delivery lead time, weak safety, and bad maintenance.

- Order lead time was very long and OTIF very Management had therefore decided to make trays to a forecast and this had exacerbated the problem further and driven up WIP and FG. WIP and FG stocks were in excess of 6 months.

- Stock counts were uncontrolled and not carried out regularly at month-end.

- Although cash was very tight there was no effective cash forecast regime in place.

- There was an inadequate sales plan in place which was subsumed by the need to constantly deal with customer crises related to late delivery and quality problems. There was excessive dependence on two customers.

- Customers in the UK, Ireland, and Benelux.

The Solution:

- Reduced headcount from 138 to 65, dismissed all directors and two managers, and in the process eliminated two layers of management.

- Developed management team & strategic plan & implemented Lean. Reviewed sales & production through value stream analysis & drove the integration of these functions.

- Changed ‘make to forecast’ to ‘make to order. Reduced FG stock to 10 days & WIP to 5 days, eliminating a 3000 sqm store. Cut order delivery time to 24hrs on identified lines.

- Set up shop floor data collection and installed IT that provided real-time performance measurement on 2 extruders & 8 thermo-formers. Measured Availability, Speed, Quality & OEE reviewed by shift. Implemented asset care system. Improved availability & developed planned maintenance.

- Integrated the order entry and production planning processes, drastically improving service speed, flexibility, and order turnaround. OTIF 99%.

- This process together with Kaizens energized the shop floor and forged strong (e.g. T/F tool change cut from 4 hrs to 2 hrs then 15-30 mins).

- Reorganized management & segregation of rework and reduced bad waste to <0.1%.

- Implemented a safety improvement plan with monthly meetings. Guarding, ASIs, Risk assessments, changed material flow, implemented safe WIP roll handling. Removed FLTs from production areas.

- Reduced NPD lead times from months to 4 weeks through a key alliance with a toolmaker.

- Worked closely with sales team & key customers. Weekly reviews of existing customers and new business development.

- Established detailed monthly financial reporting & 12-month rolling cash flow updated daily.

- Reduced breakeven from £13m to £7m, brought the company to profit in 12 months and reduced stock by 80% in 8 months. Improved OEE by 73% in 18 months.

- Cash positive in 18 months.

- Direct labor reduced from £2.4m to £1m pa, and material cost decreased by 22% in 12 months.

- Reduced low margin business, grew sales profitably to £9m in 2 years.

In business, there are always ups and downs. Companies that can weather the storm and come out stronger on the other side are the ones that are leaders in their industry.

When a company is in trouble, it can be tempting to give up and liquidate assets. However, sometimes the best course of action is to go through a business turnaround.

This involves making changes to the way the business is run in order to get it back on track. Sometimes this means making cutbacks and reducing expenses. Other times, it might mean investing in new technology or expanding into new markets.

Whatever the case may be, a business turnaround can be a difficult but necessary process. If done correctly, it can help a company to come out of a difficult situation even stronger than before.

Written by Mike Stewart , BSc Chem Eng, MBA: Strong practical experience at MD level. International experience includes being ‘parachuted in’ on a number of occasions to turn around troubled companies, as well as entering new markets and growing businesses.

Led 3 turnarounds in 7 years at £40 -£60 m pa businesses (330-500 people). All were complex multi-site manufacturing businesses with very demanding JIT customer service requirements.

Turnaround Strategies: Explained with examples and case study

A turnaround strategy is a plan for reorganizing and revitalizing a struggling business or organization. The following steps can help in developing a turnaround strategy:

- Identify the root cause of the problem: The first step in developing a turnaround strategy is identifying the underlying issues causing the business to struggle. This could be a decline in sales, poor management, a flawed business model, or external factors such as competition.

- Conduct a SWOT analysis: A SWOT analysis (Strengths, Weaknesses, Opportunities, and Threats) can help you to identify the strengths and weaknesses of your business, as well as any opportunities or threats that exist in the market.

- Develop a plan: Once you have identified the issues and conducted a SWOT analysis, you must develop a plan to address the problems. This plan should include specific actions and timelines for implementation.

- Communicate the plan: It is important to communicate the turnaround plan to all stakeholders, including employees, customers, suppliers, and investors. This will help to build support and commitment to the plan.

- Implement the plan: The success of a turnaround strategy depends on the effective implementation of the plan. This requires strong leadership and the support of all stakeholders.

- Monitor progress: Monitoring progress regularly and making adjustments as needed is important. This will help you stay on track and ensure the turnaround plan achieves its goals.

- Evaluate and adapt: Finally, it is important to evaluate the effectiveness of the turnaround strategy and make any necessary adaptations to ensure continued success. This may require ongoing market analysis, competition, and internal business operations.

Types of Turnaround strategies

Turnaround strategies are plans businesses implement to reverse a decline in performance and improve profitability. Several types of turnaround strategies can be used depending on the specific circumstances of the business:

- Cost reduction involves reducing costs through measures such as layoffs, outsourcing, reducing operating expenses, and improving efficiency.

- Revenue growth involves increasing revenue through product innovation, expanding the product line, increasing market share, and increasing sales.

- Asset restructuring involves restructuring the company’s assets, such as divesting underperforming businesses, selling off assets, and merging with other companies.

- Financial restructuring involves changing the company’s capital structure, such as issuing new debt or equity, refinancing existing debt, or renegotiating contracts with creditors.

- Management restructuring involves changing the company’s leadership, such as replacing the CEO or other key executives and bringing in new management talent.

- Turnaround through acquisition involves acquiring another company to improve profitability or enter new markets.

- Bankruptcy or liquidation: As a last resort, a company may file for bankruptcy or liquidate its assets to settle debts and obligations.

Each of these turnaround strategies has its advantages and disadvantages, and the choice of strategy depends on the specific situation and needs of the business.

Examples of Turnaround Strategies

- The cost-cutting strategy focuses on reducing expenses by cutting unnecessary costs, such as layoffs, reducing inventory, renegotiating contracts, and downsizing.

- A diversification strategy involves expanding the business into new markets or products to reduce dependence on a single product or market.

- The operational restructuring strategy aims to improve the efficiency of the business by streamlining processes, improving quality control, and optimizing the supply chain.

- Brand repositioning strategy involves repositioning the brand to appeal to a new target market or changing consumer preferences.

- A financial restructuring strategy involves restructuring the company’s finances by refinancing debt, raising capital, or selling assets to improve liquidity.

- Innovation strategy focuses on developing new products or services to stay ahead of competitors and meet changing customer needs.

- Marketing strategy aims to increase sales and market share by improving the company’s marketing efforts, such as advertising, promotions, and pricing.

- Partnership or acquisition strategy involves partnering with or acquiring another company to expand the business’s capabilities, market share, or product line.

Case Study on Turnaround Strategy

Here is a case study on a turnaround strategy implemented by McDonald’s in the late 2000s:

Background: McDonald’s is a fast-food restaurant chain founded in 1940. By the 1990s, the company had become a global icon with over 30,000 locations worldwide. However, by the mid-2000s, the company faced several challenges, including declining sales and negative publicity over its unhealthy menu.

Challenge: McDonald’s was struggling to attract customers as it faced increased competition from other fast-food chains and changed consumer preferences towards healthier options. The company’s menu needed to be updated, and its image had become associated with unhealthy food.

Solution: In 2003, Jim Skinner was appointed as the CEO of McDonald’s, and he implemented a turnaround strategy called “Plan to Win.” The strategy focused on improving the brand’s quality, service, cleanliness, and value (QSCV).

Skinner realized that the company had to evolve to meet the changing consumer preferences and introduced several initiatives to address the challenges.

- Menu Innovation: McDonald’s introduced healthier menu items like salads, fruits, and yogurt to cater to health-conscious customers. They also revamped their existing menu items by improving the quality of ingredients and removing trans fats.

- Operational Efficiency: The company implemented a system called “Made for You,” which allowed customers to customize their orders, ensuring they received freshly prepared food—this reduced waste and improved efficiency, which allowed McDonald’s to serve food faster and more accurately.

- Marketing and Branding: McDonald’s launched several marketing campaigns to change its image from a fast-food chain that only served burgers and fries to a brand that provided various healthy options. They also started using digital media platforms to connect with their customers.

Results: The “Plan to Win” strategy successfully turned around the fortunes of McDonald’s. The company’s sales increased, and it regained market share from its competitors. In 2007, McDonald’s reported its highest-ever quarterly profits, and its stock price increased by over 50%.

McDonald’s has continued to innovate and adapt to changing consumer preferences, and today they are one of the largest fast-food chains globally, with over 38,000 locations in more than 100 countries.

Conclusion: McDonald’s turnaround strategy was successful because it focused on improving the quality, service, cleanliness, and value of the brand. By innovating its menu, improving operational efficiency, and investing in marketing and branding, McDonald’s was able to attract more customers and regain market share from its competitors.

The “Plan to Win” strategy is an excellent example of how a turnaround strategy can help companies facing challenges to reinvent themselves and stay relevant in a rapidly changing market.

Related Posts

How To Write A Comprehensive Business Plan For Your Startup

Corporate Governance

Strategy vs Strategic planning

Mapping Strategy

Cost reduction strategies in business

Loss Leader Pricing Strategy: Explained with Examples

Volume Discount Pricing Strategy

SaaS Pricing: Strategy | Models | Examples

Write a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

Type above and press Enter to search. Press Esc to cancel.

Discover the latest MyICAEW app for ACA students and members, available to download now. Find out more

- Benefits of membership

Gain access to world-leading information resources, guidance and local networks.

- Visit Benefits of membership

Becoming a member

98% of the best global brands rely on ICAEW Chartered Accountants.

- Visit Becoming a member

- Pay fees and subscriptions

Your membership subscription enables ICAEW to provide support to members.

Fees and subscriptions

Member rewards.

Take advantage of the range of value added or discounted member benefits.

- Member rewards – More from your membership

- Technical and ethics support

- Support throughout your career

Information and resources for every stage of your career.

Member Insights Survey

Let us know about the issues affecting you, your business and your clients.

- Complete the survey

From software start-ups to high-flying airlines and high street banks, 98% of the best global brands rely on ICAEW Chartered Accountants. A career as an ICAEW Chartered Accountant means the opportunity to work in any organisation, in any sector, whatever your ambitions.

Everything you need to know about ICAEW annual membership fees, community and faculty subscriptions, eligibility for reduced rates and details of how you can pay.

Membership administration

Welcome to the ICAEW members area: your portal to members'-only content, offers, discounts, regulations and membership information.

- Membership regulations

Members are required to supply certain information to the members’ registrar and to pay annual fees and subscriptions. These matters are governed by regulations.

- Continuing Professional Development (CPD)

Continuing Professional Development (CPD) is an integral part of being a successful ICAEW Chartered Accountant.

The ICAEW Chartered Accountant qualification, the ACA, is one of the most advanced learning and professional development programmes available. It is valued around the world in business, practice and the public sector.

ACA for employers

Train the next generation of chartered accountants in your business or organisation. Discover how your organisation can attract, train and retain the best accountancy talent, how to become authorised to offer ACA training and the support and guidance on offer if you are already providing training.

Digital learning materials via BibliU

All ACA, ICAEW CFAB and Level 4 apprenticeship learning materials are now digital only. Read our guide on how to access your learning materials on the ICAEW Bookshelf using the BibliU app or through your browser.

- Find out more

Take a look at ICAEW training films

Focusing on professional scepticism, ethics and everyday business challenges, our training films are used by firms and companies around the world to support their in-house training and business development teams.

Attract and retain the next generation of accounting and finance professionals with our world-leading accountancy qualifications. Become authorised to offer ACA training and help your business stay ahead.

CPD guidance and help

Continuing Professional Development (CPD) is an integral part of being a successful ICAEW Chartered Accountant. Find support on ICAEW's CPD requirements and access resources to help your professional development.

ICAEW flagship events

ICAEW boasts an extensive portfolio of industry-leading conferences. These flagship events offer the opportunity to hear from and interact with all the key players in the industry. Find out what's coming up.

Leadership Development Programmes

ICAEW Academy’s in-depth leadership development programmes take a holistic approach to combine insightful mentoring or coaching, to exclusive events, peer learning groups and workshops. Catering for those significant transitions in your career, these leadership development programmes are instrumental to achieving your ambitions or fulfilling your succession planning goals.

Specialist Finance Qualifications & Programmes

Whatever future path you choose, ICAEW will support the development and acceleration of your career at each stage to enhance your career.

Why a career in chartered accountancy?

If you think chartered accountants spend their lives confined to their desks, then think again. They are sitting on the boards of multinational companies, testifying in court and advising governments, as well as supporting charities and businesses from every industry all over the world.

- Why chartered accountancy?

Search for qualified ACA jobs

Matching highly skilled ICAEW members with attractive organisations seeking talented accountancy and finance professionals.

Volunteering roles

Helping skilled and in-demand chartered accountants give back and strengthen not-for-profit sector with currently over 2,300 organisations posting a variety of volunteering roles with ICAEW.

- Search for volunteer roles

- Get ahead by volunteering

Advertise with ICAEW

From as little as £495, access to a pool of highly qualified and ambitious ACA qualified members with searchable CVs.

Early careers and training

Start your ACA training with ICAEW. Find out why a career in chartered accountancy could be for you and how to become a chartered accountant.

Qualified ACA careers

Find Accountancy and Finance Jobs

Voluntary roles

Find Voluntary roles

While you pursue the most interesting and rewarding opportunities at every stage of your career, we’re here to offer you support whatever stage you are or wherever you are in the world and in whichever sector you have chosen to work.

ACA students

"how to guides" for aca students.

- ACA student guide

- How to book an exam

- How to apply for credit for prior learning (CPL)

Exam resources

Here are some resources you will find useful while you study for the ACA qualification.

- Certificate Level

- Professional Level

- Advanced Level

Digital learning materials

All ACA learning materials are now digital only. Read our guide on how to access your learning materials on the ICAEW Bookshelf via the BibliU app, or through your browser.

- Read the guide

My online training file

Once you are registered as an ACA student, you'll be able to access your training file to log your progress throughout ACA training.

- Access your training file

- Student Insights

Fresh insights, innovative ideas and an inside look at the lives and careers of our ICAEW students and members.

- Read the latest articles

System status checks

Getting started.

Welcome to ICAEW! We have pulled together a selection of resources to help you get started with your ACA training, including our popular 'How To' series, which offers step-by-step guidance on everything from registering as an ACA student and applying for CPL, to using your online training file.

Credit for prior learning (CPL)

Credit for prior learning or CPL is our term for exemptions. High quality learning and assessment in other relevant qualifications is appropriately recognised by the award of CPL.

Apply for exams

What you need to know in order to apply for the ACA exams.

The ACA qualification has 15 modules over three levels. They are designed to complement the practical experience you will be gaining in the workplace. They will also enable you to gain in-depth knowledge across a broad range of topics in accountancy, finance and business. Here are some useful resources while you study.

- Exam results

You will receive your results for all Certificate Level exams, the day after you take the exam and usually five weeks after a Professional and Advanced Level exam session has taken place. Access your latest and archived exam results here.

Training agreement

Putting your theory work into practice is essential to complete your ACA training.

Student support and benefits

We are here to support you throughout your ACA journey. We have a range of resources and services on offer for you to unwrap, from exam resources, to student events and discount cards. Make sure you take advantage of the wealth of exclusive benefits available to you, all year round.

- Applying for membership

The ACA will open doors to limitless opportunities in all areas of accountancy, business and finance anywhere in the world. ICAEW Chartered Accountants work at the highest levels as finance directors, CEOs and partners of some of the world’s largest organisations.

ACA training FAQs

Do you have a question about the ACA training? Then look no further. Here, you can find answers to frequently asked questions relating to the ACA qualification and training. Find out more about each of the integrated components of the ACA, as well as more information on the syllabus, your training agreement, ICAEW’s rules and regulations and much more.

- Anti-money laundering

Guidance and resources to help members comply with their legal and professional responsibilities around AML.

Technical releases

ICAEW Technical Releases are a source of good practice guidance on technical and practice issues relevant to ICAEW Chartered Accountants and other finance professionals.

- ICAEW Technical Releases

- Thought leadership

ICAEW's Thought Leadership reports provide clarity and insight on the current and future challenges to the accountancy profession. Our charitable trusts also provide funding for academic research into accountancy.

- Academic research funding

Technical Advisory Services helpsheets

Practical, technical and ethical guidance highlighting the most important issues for members, whether in practice or in business.

- ICAEW Technical Advisory Services helpsheets

Bloomsbury – free for eligible firms

In partnership with Bloomsbury Professional, ICAEW have provided eligible firms with free access to Bloomsbury’s comprehensive online library of around 80 titles from leading tax and accounting subject matter experts.

- Bloomsbury Accounting and Tax Service

Country resources

Our resources by country provide access to intelligence on over 170 countries and territories including economic forecasts, guides to doing business and information on the tax climate in each jurisdiction.

Industries and sectors

Thought leadership, technical resources and professional guidance to support the professional development of members working in specific industries and sectors.

Audit and Assurance

The audit, assurance and internal audit area has information and guidance on technical and practical matters in relation to these three areas of practice. There are links to events, publications, technical help and audit representations.

The most up-to-date thought leadership, insights, technical resources and professional guidance to support ICAEW members working in and with industry with their professional development.

- Corporate Finance

Companies, advisers and investors making decisions about creating, developing and acquiring businesses – and the wide range of advisory careers that require this specialist professional expertise.

- Corporate governance

Corporate governance is the system by which companies are directed and controlled. Find out more about corporate governance principles, codes and reports, Board subcommittees, roles and responsibilities and shareholder relations. Corporate governance involves balancing the interests of a company’s many stakeholders, such as shareholders, employees, management, customers, suppliers, financiers and the community. Getting governance right is essential to build public trust in companies.

Corporate reporting

View a range of practical resources on UK GAAP, IFRS, UK regulation for company accounts and non-financial reporting. Plus find out more about the ICAEW Corporate Reporting Faculty.

Expert analysis on the latest national and international economic issues and trends, and interviews with prominent voices across the finance industry, alongside data on the state of the economy.

- Financial Services

View articles and resources on the financial services sector.

- Practice resources

For ICAEW's members in practice, this area brings together the most up-to-date thought leadership, technical resources and professional guidance to help you in your professional life.

Public Sector

Many ICAEW members work in or with the public sector to deliver public priorities and strong public finances. ICAEW acts in the public interest to support strong financial leadership and better financial management across the public sector – featuring transparency, accountability, governance and ethics – to ensure that public money is spent wisely and that public finances are sustainable.

Sustainability and climate change

Sustainability describes a world that does not live by eating into its capital, whether natural, economic or social. Members in practice, in business and private individuals all have a role to play if sustainability goals are to be met. The work being undertaken by ICAEW in this area is to change behaviour to drive sustainable outcomes.

The Tax area has information and guidance on technical and practical tax matters. There are links to events, the latest tax news and the Tax Faculty’s publications, including helpsheets, webinars and Tax representations.

Keep up-to-date with tech issues and developments, including artificial intelligence (AI), blockchain, big data, and cyber security.

Trust & Ethics

Guidance and resources on key issues, including economic crime, business law, better regulation and ethics. Read through ICAEW’s Code of Ethics and supporting information.

Communities

ICAEW Communities

Information, guidance and networking opportunities on industry sectors, professional specialisms and at various stages throughout your career. Free for ICAEW members and students.

- Discover a new community

ICAEW Faculties

The accountancy profession is facing change and uncertainty. The ICAEW Faculties can help by providing you with timely and relevant support.

- Choose to join any of the faculties

UK groups and societies

We have teams on the ground in: East of England, the Midlands, London and South East, Northern, South West, Yorkshire and Humberside, Wales and Scotland.

- Access your UK region

- Worldwide support and services

Support and services we offer our members in Africa, America, Canada, the Caribbean, Europe, Greater China, the Middle East, Oceania and South East Asia.

- Discover our services

ICAEW Faculties are 'centres of technical excellence', strongly committed to enhancing your professional development and helping you to meet your CPD requirements every year. They offer exclusive content, events and webinars, customised for your sector - which you should be able to easily record, when the time comes for the completion of your CPD declaration. Our offering isn't exclusive to Institute members. As a faculty member, the same resources are available to you to ensure you stay ahead of the competition.

Communities by industry / sector

Communities by life stage and workplace, communities by professional specialism, local groups and societies.

We aim to support you wherever in the world you work. Our regional offices and network of volunteers run events and provide access to local accounting updates in major finance centres around the globe.

Election explainers

ICAEW experts offer simple guides to help understand the technical, economic jargon that will be at the heart of political debates in the coming weeks.

Insights pulls together the best opinion, analysis, interviews, videos and podcasts on the key issues affecting accountancy and business.

- See the latest insights

ICAEW podcasts

ICAEW produces two podcast series that count towards your CPD: Accountancy Insights for news from across the profession, and The Tax Track for specialist analysis from the ICAEW Tax Faculty.

Professional development and skills

With new requirements on ICAEW members for continuing professional development, we bring together resources to support you through the changes and look at the skills accountants need for the future.

- Visit the hub

- Diversity and Inclusion

Diversity and inclusion is a key pillar of ICAEW's strategy. Discover the latest insights on equality, diversity and inclusion. You can also join our Diversity & Inclusion Community.

- Find out more on our hub

- Join the community

Insights specials

A listing of one-off Insights specials that focus on a particular subject, interviewing the key people, identifying developing trends and examining the underlying issues.

Top podcasts

Insights by topic.

ICAEW Regulation

- Regulatory News

View the latest regulatory updates and guidance and subscribe to our monthly newsletter, Regulatory & Conduct News.

- Regulatory Consultations

Strengthening trust in the profession

Our role as a world-leading improvement regulator is to strengthen trust and protect the public. We do this by enabling, evaluating and enforcing the highest standards in the profession.

Regulatory applications

Find out how you can become authorised by ICAEW as a regulated firm.

ICAEW codes and regulations

Professional conduct and complaints, statutory regulated services overseen by icaew, regulations for icaew practice members and firms, additional guidance and support, popular search results.

- Practice Exam Software

- Training File

- Ethics Cpd Course

- Routes to the ACA

- ACA students membership application

- Join as a member of another body

- How much are membership fees?

- How to pay your fees

- Receipts and invoices

- What if my circumstances have changed?

- Difficulties in making changes to your membership

- Faculty and community subscription fees

- Updating your details

- Complete annual return

- Promoting myself as an ICAEW member

- Verification of ICAEW membership

- Become a life member

- Become a fellow

- Request a new certificate

- Report the death of a member

- Practising certificates

- Advancement to fellowship regulations

- Regulations relating to membership cessation, readmission and resignation

- ICAEW's guide to directors' duties and responsibilities

- Information to be supplied by members

- Payment of annual subscription

- Power to change subscription fees

- New members

- Career progression

- Career Breakers

- Volunteering at schools and universities

- ICAEW Member App

- Working internationally

- Self employment

- Support Members Scheme

- Your guide to CPD

- CPD learning resources

- Online CPD record

- How to become a chartered accountant

- Register as a student

- Train as a member of another body

- More about the ACA and chartered accountancy

- How ACA training works

- Become a training employer

- Access the training file

- Why choose the ACA

- Training routes

- Employer support hub

- Get in touch

- Apprenticeships with ICAEW

- A-Z of CPD courses by topic

- Firms' guide to CPD

- ICAEW Business and Finance Professional (BFP)

- ICAEW Annual Conference 2024

- Restructuring & Insolvency Conference

- Virtual CPD Conference

- Virtual Healthcare Conference 2024

- All our flagship events

- Financial Talent Executive Network (F-TEN®)

- Developing Leadership in Practice (DLiP™)

- Network of Finance Leaders (NFL)

- Women in Leadership (WiL)

- Mentoring and coaching

- Partners in Learning

- Board Director's Programme e-learning

- Corporate Finance Qualification

- Diploma in Charity Accounting

- ICAEW Certificate in Insolvency

- ICAEW Data Analytics Certificate

- Financial Modeling Institute’s Advanced Financial Modeler Accreditation

- ICAEW Sustainability Certificate for Finance Professionals

- ICAEW Finance in a Digital World Programme

- All specialist qualifications

- Team training

- Start your training

- Improve your employability

- Search employers

- Find a role

- Role alerts

- Organisations

- Practice support – 11 ways ICAEW and CABA can help you

- News and advice

- ICAEW Volunteering Hub

- Support in becoming a chartered accountant

- Vacancies at ICAEW

- ICAEW boards and committees

- Exam system status

- ICAEW systems: status update

- Changes to our qualifications

- How-to guides for ACA students

- Apply for credits - Academic qualification

- Apply for credits - Professional qualification

- Credit for prior learning (CPL)/exemptions FAQs

- Applications for Professional and Advanced Level exams

- Applications for Certificate Level exams

- Tuition providers

- Latest exam results

- Archived exam results

- Getting your results

- Marks feedback service

- Exam admin check

- Training agreement: overview

- Professional development

- Ethics and professional scepticism

- Practical work experience

- Access your online training file

- How training works in your country

- Student rewards

- TOTUM PRO Card

- Student events and volunteering

- Xero cloud accounting certifications

- Student support

- Join a community

- Wellbeing support from caba

- Student mentoring programme

- Student conduct and behaviour

- Code of ethics

- Fit and proper

- Level 4 Accounting Technician Apprenticeship

- Level 7 Accountancy Professional Apprenticeship

- AAT-ACA Fast Track FAQs

- ACA rules and regulations FAQs

- ACA syllabus FAQs

- ACA training agreement FAQs

- Audit experience and the Audit Qualification FAQs

- Independent student FAQs

- Practical work experience FAQs

- Professional development FAQs

- Six-monthly reviews FAQs

- Ethics and professional scepticism FAQs

- Greater China

- Latin America

- Middle East

- North America

- Australasia

- Russia and Eurasia

- Southeast Asia

- Charity Community

- Construction & Real Estate

- Energy & Natural Resources Community

- Farming & Rural Business Community

- Forensic & Expert Witness

- Global Trade Community

- Healthcare Community

- Internal Audit Community

- Manufacturing Community

- Media & Leisure

- Portfolio Careers Community

- Small and Micro Business Community

- Small Practitioners Community

- Travel, Tourism & Hospitality Community

- Valuation Community

- Audit and corporate governance reform

- Audit & Assurance Faculty

- Professional judgement

- Regulation and working in audit

- Internal audit resource centre

- ICAEW acting on audit quality

- Everything business

- Latest Business news from Insights

- Strategy, risk and innovation

- Business performance management

- Financial management

- Finance transformation

- Economy and business environment

- Leadership, personal development and HR

- Webinars and publications

- Business restructuring

- The Business Finance Guide

- Capital markets and investment

- Corporate finance careers

- Corporate Finance Faculty

- Debt advisory and growth finance

- Mergers and acquisitions

- Private equity

- Start-ups, scale-ups and venture capital

- Transaction services

- Board committees and board effectiveness

- Corporate governance codes and reports

- Corporate Governance Community

- Principles of corporate governance

- Roles, duties and responsibilities of Board members

- Stewardship and stakeholder relations

- Corporate Governance thought leadership

- Corporate reporting resources

- Small and micro entity reporting

- UK Regulation for Company Accounts

- Non-financial reporting

- Improving Corporate Reporting

- Economy home

- ICAEW Business Confidence Monitor

- ICAEW Manifesto 2024

- Economy explainers

- Spring Budget 2024

- Energy crisis

- Levelling up: rebalancing the UK’s economy

- Resilience and Renewal: Building an economy fit for the future

- Social mobility and inclusion

- Investment management

- Inspiring confidence

- Setting up in practice

- Running your practice

- Supporting your clients

- Practice technology

- TAS helpsheets

- Support for business advisers

- Join ICAEW BAS

- Public Sector hub

- Public Sector Audit and Assurance

- Public Sector Finances

- Public Sector Financial Management

- Public Sector Financial Reporting

- Public Sector Learning & Development

- Public Sector Community

- Latest public sector articles from Insights

- Making COP count

- Climate hub

- Sustainable Development Goals

- Accountability

- Modern slavery

- Resources collection

- Sustainability Committee

- Sustainability & Climate Change community

- Sustainability and climate change home

- Tax Faculty

- Budgets and legislation

- Business tax

- Devolved taxes

- Employment taxes

- International taxes

- Making Tax Digital

- Personal tax

- Property tax

- Stamp duty land tax

- Tax administration

- Tax compliance and investigation

- UK tax rates, allowances and reliefs

- Artificial intelligence

- Blockchain and cryptoassets

- Cyber security

- Data Analytics Community

- Digital skills

- Excel community

- Finance in a Digital World

- IT management

- Technology and the profession

- Trust & Ethics home

- Better regulation

- Business Law

- UK company law

- Data protection and privacy

- Economic crime

- Help with ethical problems

- ICAEW Code of Ethics

- ICAEW Trust and Ethics team.....

- Solicitors Community

- Forensic & Expert Witness Community

- Latest articles on business law, trust and ethics

- Audit and Assurance Faculty

- Corporate Reporting Faculty

- Financial Services Faculty

- Academia & Education Community

- Construction & Real Estate Community

- Entertainment, Sport & Media Community

- Retail Community

- Black Members Community

- Career Breakers Community

- Diversity & Inclusion Community

- Women in Finance Community

- Personal Financial Planning Community

- Restructuring & Insolvency Community

- Sustainability and Climate Change Community

- London and East

- South Wales

- Yorkshire and Humberside

- European public policy activities

- ICAEW Middle East

- Latest news

- The World’s Fastest Accountant

- Access to finance special

- Attractiveness of the profession

- Audit and Fraud

- Audit and technology

- Adopting non-financial reporting standards

- Cost of doing business

- Mental health and wellbeing

- Pensions and Personal Finance

- Ukraine crisis: central resource hub

- More specials ...

- The economics of biodiversity

- How chartered accountants can help to safeguard trust in society

- Video: The financial controller who stole £20,000 from her company

- It’s time for chartered accountants to save the world

- Video: The CFO who tried to trick the market

- Video: Could invoice fraud affect your business?

- Business confidence, local authority finance, probate delays, and tax reform

- Why are female-led startups so underfunded?

- How to get Britain growing

- Groupthink: the boardroom’s most pervasive problem?

- Corporate reporting update and VAT on private hire vehicles

- AI in audit: the good, the bad and the ugly

- Company size thresholds and CGT on residences

- Lessons in leadership from ICAEW's CEO

- So you want to be a leader?

- A busy new tax year, plus progress on the Economic Crime Act

- Does Britain have a farming problem?

- More podcasts...

- Top charts of the week

- EU and international trade

- CEO and President's insights

- Sponsored content

- Insights index

- Charter and Bye-laws

- Archive of complaints, disciplinary and fitness processes, statutory regulations and ICAEW regulations

- Qualifications regulations

- Training and education regulations

- How to make a complaint

- Guidance on your duty to report misconduct

- Public hearings

- What to do if you receive a complaint against you

- Anti-money laundering supervision

- Working in the regulated area of audit

- Local public audit in England

- Probate services

- Designated Professional Body (Investment Business) licence

- Consumer credit

- Quality Assurance monitoring: view from the firms

- The ICAEW Practice Assurance scheme

- Licensed Practice scheme

- Professional Indemnity Insurance (PII)

- Clients' Money Regulations

- Taxation (PCRT) Regulations

- ICAEW training films

- Helpsheets and guidance by topic

- ICAEW's regulatory expertise and history

- Quarterly, Issue 3

Case studies: Three successful turnarounds

quarterly issue 3

Author: ICAEW Insights

Published: 13 Sep 2020

VineyardsDirect.com

Share this article.

Joe McGrath on how online drinks retailer Vineyards.com, automotive giant Ford and coffee chain Starbucks turned business around after COVID-19 hit

With the enforced closure of pubs and restaurants as a result of COVID-19, orders into online drinks retailers soared. Alcohol sales for home consumption for the 17 weeks to 11 July 2020 were up £1.9bn compared with the previous year, according to US data company Nielsen.

One of the companies well-placed to benefit was FromVineyardsDirect.com, a wine distributor which had found itself in administration just 18 months earlier.

ICAEW members Lee De’ath and Richard Toone of CVR Global – Partner and Managing Partner respectively – oversaw a pre-pack sale of the company in September 2019 after the business had got into financial difficulty.

De’ath explains that the company, which specialises in selling hand-selected wines to the retail and wine merchant markets, had previously seen severely restricted cash flow.

“The company had fluctuating profitability from inception, which impacted working capital, ultimately resulting in the decision to seek the protection of an administration.”

However, by entering a formal administration process, it allowed the business to be sold to a new parent in The Wine Company Limited. The new owners have continued to operate the website and have invested heavily in growing the brand through a marketing programme which has set the business up for the busy period.

Tony Harrison, director of Harrisons, says the key to successfully saving a business through a formal insolvency process is to approach a licensed practitioner at the earliest opportunity, in order to weigh up all the options, including avoiding a formal insolvency.

“Get hold of an insolvency practitioner as soon as you can,” he says. “The reason for that is cash flow. When a business gets into difficulty, it enters a period of stress because the cash flow has gone. If you take advice at an earlier stage, you may be able to avoid a formal insolvency altogether.”

It’s really important to work out if you are legally allowed to continue to trade, says transformation consultant Hannah Keartland, and business owners may need to get third-party advice on this. “When making tough decisions it’s important to be clear on the overarching vision for the organisation — why does it exist, what is its purpose?

“Being really clear on that helps with making difficult judgement calls where there’s no clear answer. It may be that the route to delivering that purpose is not through continuing the activities or operations as before COVID-19 — eg a transformation, takeover, merger or asset sale may be the best route forward.”

Alcohol sales for home consumption were up £1.9bn for the 17 weeks to 11 July 2020 compared with the previous year.

The need for a change in corporate direction doesn’t always come with an immediate deadline. For Ford, one of the world’s largest car makers, it has invoked a transformation programme to strengthen long-term viability in an increasingly competitive market with changing customer priorities.

Unveiled in 2017, the company’s Creating Tomorrow, Together strategy is designed to reinvent the business as a leaner, efficient and futureproof organisation. Specifically, it has committed to scaling up its activities in electric vehicles and self-driving cars and to increase its focus on sustainable transport networks.

“We are moving with a renewed sense of urgency to improve the fitness of the business and improve our launches, while at the same time modernising Ford in a way that plays to our strengths,” CEO Jim Hackett explained in a company statement in April 2020.

The strategy includes a commitment to incorporate the UN’s sustainable development goals into the organisation’s thinking, particularly those on promoting well-being, innovation in industry, taking action on climate change and supporting the transition to sustainable cities and communities. Its commitment to the latter includes plans to help customers work in cities in a sustainable way, through the use of smaller mobility vehicles and measured reporting of its progress.

This focus on sustainability is certainly not unique to Ford. In fact, it has instigated transformations across multiple sectors in recent years as management teams recognise that customers and investors are demanding companies consider how environmental, social and governance issues will affect corporate viability in the long term.

“There is a growing body of evidence that organisations which have strong purpose, and look at more than just financial outcomes, are more successful in the long run,” says transformation consultant Hannah Keartland.

This trend was justified still further last year when the Harvard Law School Forum on Corporate Governance published a paper that showed that companies that are working to improve their scores on environmental, social and governance metrics outperform companies that are not.

Accountants and chartered practitioners who are keen to improve their skills in sustainable business transformation may want to visit The Finance Innovation Lab , which was originally set up as a joint venture between the World Wildlife Fund and the ICAEW. In 2015, it became fully independent but continues to offer a range of resources for those who are seeking more information about creating sustainable business models.

Ford is currently planning to increase its focus on electric and self-driving cars and sustainable transport networks.

The coronavirus pandemic has been unkind to many businesses with a large high-street presence, and coffee retailers are no different. But despite a significant drop in sales, Starbucks can take some comfort in the fact that its most recent major transformation started during the last global financial crisis, when the previous CEO Howard Shultz closed hundreds of stores, laid off hundreds of middle managers and employees and embarked on a major acquisition trail of smaller drinks businesses.

When Shultz began the 2008 transformation, he started by slashing more than $500m in costs throughout the business. He used some of this money to reinvest into the workforce through training and enhanced employee benefits.

Key to the changes was encouraging a new corporate culture which, he said at the time, would be felt by customers in stores. The company’s leadership was told to focus more on developing its diversity and inclusion programme and encourage transparent engagement, communication and collaboration.

In July 2020, the Thinking Ahead Institute published a study looking at the importance of corporate culture in successful businesses. It concluded that, to be successful, transformational leadership involves “writing wide-scale change and motivating the organisation to do more than happens incrementally”.

Marisa Hall, Co-Head of the Thinking Ahead Institute, distils the best corporate cultures into three categories. According to Hall: “The goals of organisations should focus on sympathetically combining three things: building a diverse array of people that make up the organisation, recognising identity, and treating people with decency.”

In the Thinking Ahead Institute report, it concludes that achieving a change in culture, however, means challenging prior assumptions and beliefs, which requires innovative thinking. So, while the benefits of a strong and collaborative corporate culture are many, achieving a change can be tough for leadership teams to achieve.

“It has to come right from the top,” says transformation consultant Hannah Keartland. “It has to be something they believe deep in their bones. They may have to go through personal change and that’s hard.

“It involves being humble and recognising the leader they were before is not necessarily who they need to be now. It means working differently and it needs to feel like they’re working differently.”

Starbucks is building its corporate culture around transparent engagement, communication and collaboration.

These case studies are accompanied by this feature on successful business transformation and strategy amid COVID-19.

- Adapting to COVID-19: the Jacobs story

- Cyprus’ financial response to COVID-19

- COVID-19 is changing the way global supply chains work

- The UK’s financial response to COVID-19

- Adapting to COVID-19: the Tesco story

Previous Article

Career coach: Straight from school

Next Article

CMI CEO Ann Francke on how COVID-19 can make companies more diverse

Add Verified CPD Activity

Introducing AddCPD, a new way to record your CPD activities!

Add this page to your cpd activity, step 1 of 3, download recorded, download not recorded.

Please download the related document if you wish to add this activity to your record

Step 2 of 3

Add activity to my record, step 3 of 3, activity added, an error has occurred please try again.

Read out this code to the operator.

Turnaround Strategy: A Guide To Efficient Execution

When business throws you curveballs, your response time is the difference between a swing and a miss or a home run. The subtle art? Noticing the delicate wobble of change before the pitch even reaches you.

In the intense world of business, those who anticipate and strategically recalibrate don't just stay in the game—they set the rules. Whether you're feeling the squeeze or just a gentle pinch, now's the time to rewrite your playbook.

In this article, we’ll show you how to execute an effective turnaround strategy and give examples of how other businesses have successfully executed theirs.

What Is A Business Turnaround Strategy?

A business turnaround strategy is a set of actions and initiatives to steer a company out of financial distress or prolonged challenges, leading it back to profitability and resilience. Some common challenges include:

- Persistent decrease in sales

- Mounting losses

- Cash flow problems

- Poor management

Turnaround strategies have specific short-term strategic objectives that aim to increase revenue, cut expenses, and restore the business’ former viability after identifying the cause of the issues.

💡A turnaround strategy is different from a change management strategy. Turnaround strategies are reactive and have a sense of urgency involved. Change management strategy , on the other hand, is a proactive approach that can be applied to situations like growth initiatives and process improvements.

When Is The Right Time For A Turnaround Strategy?

The right time for intervention varies based on each business's unique situation. However, you'll have better chances of success with early intervention. Here are indicators that your business needs to pursue a turnaround strategy:

- A consistent decline in financial performance over an extended period, evidenced by decreasing revenue, profitability, and cash flow.

- Growing losses that impact financial stability and hinder the ability to meet financial obligations, such as paying bills, meeting payroll, and investing in necessary capital expenditures.

- Increasing liabilities that become unsustainable, especially when servicing the debt becomes a significant burden.

- Significant market disruptions that cause the existing business model to become less competitive or obsolete, leading existing products to lose market share.

- An underperforming management team that finds it challenging to make effective decisions or adjust to rapidly changing situations.

- Operational inefficiencies from outdated processes, excessive costs, and declining competitiveness.

- External factors like recessions, economic downturns, regulatory changes, and natural disasters.

Types Of A Turnaround Recovery Strategy

There are several types of turnaround strategies based on the approach and focus:

- Operational cost efficiency: This strategy focuses on improving internal processes, efficiency, and cost reduction. It often involves restructuring operations, optimizing supply chains , and eliminating waste.

- Financial restructuring: This concentrates on improving the company’s financial health, with tactics like debt restructuring, cost-cutting, refinancing, and managing cash flow.

- Strategic turnaround management: This entails re-evaluating and adjusting the company’s overarching business strategy . Actions include entering new markets, discontinuing unprofitable products or services, and diversifying product lines.

- Market repositioning: This strategy concentrates on revitalizing the company’s marketing and sales tactics. It involves rebranding, pricing strategies, and sales force improvements.

- Asset retrenchment strategy: This strategy emphasizes optimizing existing assets, such as real estate, equipment, and intellectual property. Actions include selling or leasing underutilized assets to boost cash flow and improve liquidity.

- Senior management reorganization: This addresses leadership and management deficiencies and involves changes in top management, leadership training, and organizational reforms.

- Product and service innovation: This focuses on developing new products or services that improve existing ones.

- Crisis management : This strategy is executed during an acute crisis, such as a safety scandal, product recall, or PR disaster. It emphasizes reputation management, crisis communication, and taking corrective actions.

5 Steps Of A Turnaround Strategy

While there may be different types of turnaround strategies, each follows the same basic steps below.

1. Analyze the data to pinpoint the problem

Take a deep dive into your core business metrics , from revenue and profit margins to customer satisfaction scores.

Don't go at it alone, however. Engage with key stakeholders, including employees, investors, and customers to gain valuable insights and create a shared understanding of the challenge ahead.

To collect and analyze data in minutes instead of weeks, use Cascade's Metrics Library to centralize all your key business metrics. This will give you better visibility into your business’s overall health and quickly identify areas of concern.

📽Watch this short and informative video giving you a walkthrough of the Metrics Library.

2. Apply decision-making models to identify the next steps

In times of crisis, you can't afford to suffer from decision paralysis. Delays can result in missed opportunities and deepen financial losses. Indecision also leads to inefficient resource use, with capital trapped in unviable projects.

Use decision-making models and tools to quickly assess your situation and determine the next steps. Tools like a decision matrix , cost-benefit analysis, and SWOT analysis can help you prioritize and choose the most critical focus areas.

💡Speed is essential during a turnaround. Crises can evolve rapidly and what might have been an effective decision now, may not be the right move tomorrow.

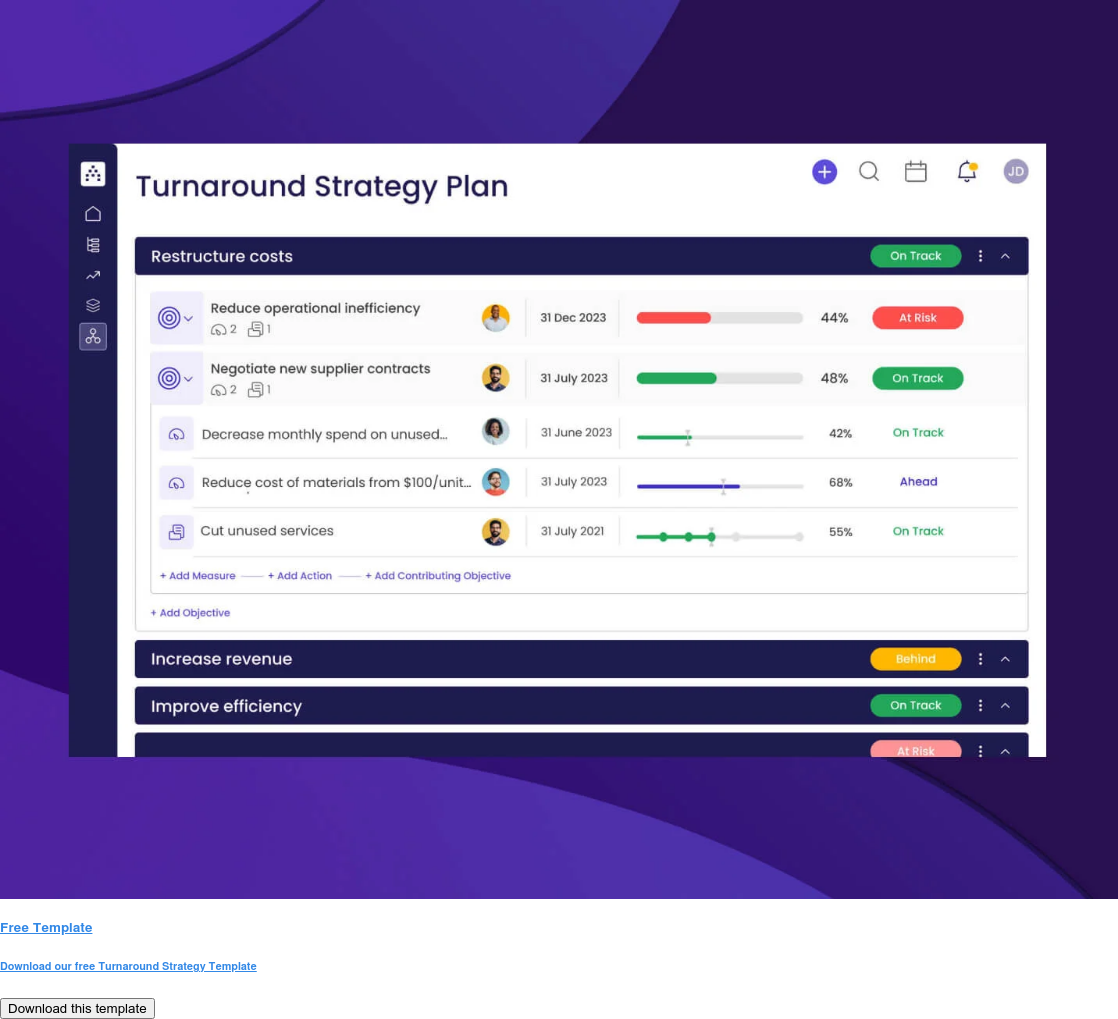

3. Build a turnaround plan

With a clear understanding of the problem and the critical actions needed, it's time to craft a detailed turnaround plan. A detailed plan should work like a roadmap, providing a clear direction to get from point A to point B.

An effective plan should include:

- Strategic objectives

- Key performance indicators (KPIs)

- Specific actions, initiatives , or projects

- Assigned owners

- Timeline with key milestones

- Dependencies, blockers, and risks

💡Use Cascade to translate complex strategies into simple, structured, and actionable plans so you can quickly move into the execution phase and track progress while including all the key elements above.

4. Align and execute your plan

Your turnaround plan is only as effective as your organization’s ability to execute it. Communicate the plan to all key stakeholders and prioritize organizational alignment .

Ensure that everyone understands key strategic objectives and uses them to guide their daily decision-making. In doing so, your key stakeholders can start moving in sync toward achieving a common goal. This will help you achieve your turnaround plan in the fastest time possible.

To achieve organizational alignment, you also need regular strategy review sessions, but more on that later.

%20(1).png)

Use tools like Cascade's Alignment Map to visualize how different parts of the organization work together to achieve corporate objectives. You can also break down a company-wide goal into operational and functional plans that are easier for team members to follow.

5. Monitor and adapt your strategy

Keep a close eye on key metrics , focusing on leading indicators that provide insights into future performance. Leading indicators will also help you measure what matters. Some examples of lead indicators include:

- Customer satisfaction

- Pipeline growth

- Employee engagement

- % of strategic projects prioritized

- Supplier risk

Continuous strategy assessments will help you identify potential risks and vulnerabilities early on so you can take corrective actions before they become major threats to your business. Here are examples of things to cover in strategy review meetings depending on the cadence you set:

Plus, strong and ongoing strategic control will ensure accountability to maintain the execution momentum on the ground.

Use Cascade's dashboards and reports to simplify monitoring, providing real-time insights into your company's performance.

.jpg)

You get an accurate picture of your business’s strategic performance so you can make quick impactful decisions. You can also easily share this information with key stakeholders in a format that is straightforward and provides context for each data point in your report or dashboard.

Case Studies Of Successful Business Turnarounds

No business is exempt from drastic changes, not even huge companies. The following businesses recognized a turnaround situation when it happened and took the risk to pursue new strategies.

.jpg)

Chocolate was a luxury item for the wealthy before Hershey made it affordable for the ordinary household. This increased competition as other brands cashed in on the opportunity with their delicious treats.

Hershey’s initial strategy to keep costs low was to focus on a few product lines and increase production capacity. However, the increased competition forced them to introduce new products and acquire new brands.

They also pursued diversification strategies, such as acquiring the right to produce other consumer favorites like Cadbury and KitKat, which eventually kept them on the top.

👉Get inspired by the Hershey Strategy Plan Template to put together your successful turnaround strategy.

.jpg)

In 2006, Ford was in danger of bankruptcy. The company experienced massive layoffs, billions of losses, and a lack of additional financing.

Bill Ford, the current CEO, recognized that the company needed a new leader and appointed Alan Mulally, a person with little automotive industry knowledge. Despite the shocking move, it proved lifesaving as the company adopted new strategic management practices that eventually turned their financial standing.

Alan Mulally created a culture of transparency that encouraged team members to seek support when they needed it. He replaced Ford’s pointless meetings with BPRs (Business Process Reviews) that helped leaders quickly identify areas that needed urgent attention using a streamlined prioritization method.

👉 Get inspired by the Ford Strategy Plan Template to put together your successful turnaround strategy.

.jpg)

By 2011, PC global sales had peaked and started a steady decline. Dell was severely impacted and even regarded as a dying company. As smartphones and tablets took center stage, Dell’s annual sales saw double-digit declines, and attempts to bounce back were embarrassingly unsuccessful. Dell’s Streak “phablet” and Venue smartphone were both failures.

Michael Dell took the company private despite huge pushback from investors. This complex corporate strategy proved successful because Dell could take calculated risks and expand its services to include software solutions that more than doubled its enterprise value.

Before privatization, Dell had made key acquisitions in enterprise software and hardware solutions such as cloud storage and management. When the deal was completed, Dell went full force and offered not just its low-budget PCs but a whole portfolio of solutions, including data storage, systems management, cloud, cybersecurity, and cutting-edge software.

Dell reinforced its existing salesforce and positioned itself as a trusted advisor for all things tech. In just eight years after privatization, Dell’s equity increased by 625% and enterprise value topped $100 billion.

👉 Get inspired by the Dell Strategy Plan Template to put together your successful turnaround strategy.

Execute Your Turnaround Strategy With Cascade 🚀

Challenges are inevitable in the business world, but with a well-executed turnaround strategy, you can transform adversity into an opportunity for growth and success.

A strategy rooted in data and fast execution can make all the difference in your business rebound.

Cascade’s powerful strategy execution platform unites your business information into a single view so you’ll know how the business performs at every level and make the right decisions at the right time.

Start today for free or book a 1:1 product tour with Cascade’s in-house strategy expert.

Popular articles

6 Steps To Successful Strategy Execution & Best Practices

.png)

McKinsey GE Matrix: Importance & How To Use It (2024)

.png)

How To Be More Strategic: 7 Tips & Best Practices For Leaders

.png)

Red Ocean Vs Blue Ocean Strategy Overview + Examples

Your toolkit for strategy success.

- SUGGESTED TOPICS

- The Magazine

- Newsletters