How to do Market Research: a Step-by-Step Guide

14 min read

Looking for the best way to do market research? From framing your initial question to extracting valuable customer insights, we’ll walk you through the lean market research process step-by-step. You will learn effective techniques for collecting and analyzing data , with practical tips on applying your findings to benefit your SaaS. Get ready to empower your decisions with real-world market intelligence.

- Market research is vital for making informed business decisions, enabling companies to understand the market, target audience, and competitors, reducing risks, and optimizing marketing communications and product strategies .

- Effective market research requires clear and measurable objectives, guiding decision-making and ensuring relevance to the project’s needs, and should be accompanied by appropriate methods , including both primary and secondary research .

- Applying insights from market research to product development and marketing strategies can significantly enhance business growth. This allows businesses to tailor their offerings and engage more effectively with their target market.

Try Userpilot and Take Your Product Growth to the Next Level

- 14 Day Trial

- No Credit Card Required

What is market research

Essentially, market research is the process of understanding one’s target audience’s needs and wants to validate a new product, feature, or service idea. It involves probing and extracting answers based on empirical evidence instead of relying on hunches or speculative judgment.

Why should you do market research?

Understanding your consumers’ behavior and needs well through methodical market research is vital for informed decision-making when it comes to your product roadmap. These choices can make or break your SaaS company. Without thorough market research, you’re navigating blindly, basing crucial judgments on antiquated notions of customer habits, imprecise economic gauges, or untested assumptions rather than solid competitive analysis.

The outcome? Sharper marketing messages, savvy product development strategies, and an intimate grasp of both prospective buyers and existing customers’ preferences and needs.

Identifying your market research goals

Before you do anything – you need to determine specific and actionable goals of your market research project. Setting SMART (specific, measurable, achievable, relevant and time-bound) goals will help you stay on track, come up with better market research questions and achieve more reliable results faster.

For effective market research outcomes, your goals must be:

- Quantifiable .

- Attainable.

- Directly aligned with project requirements.

Having established unambiguous goals prior to delving into data analysis sets up a solid foundation ensuring pivotal questions, hypotheses, and indicators are systematically tackled during effective market research.

Market research methods

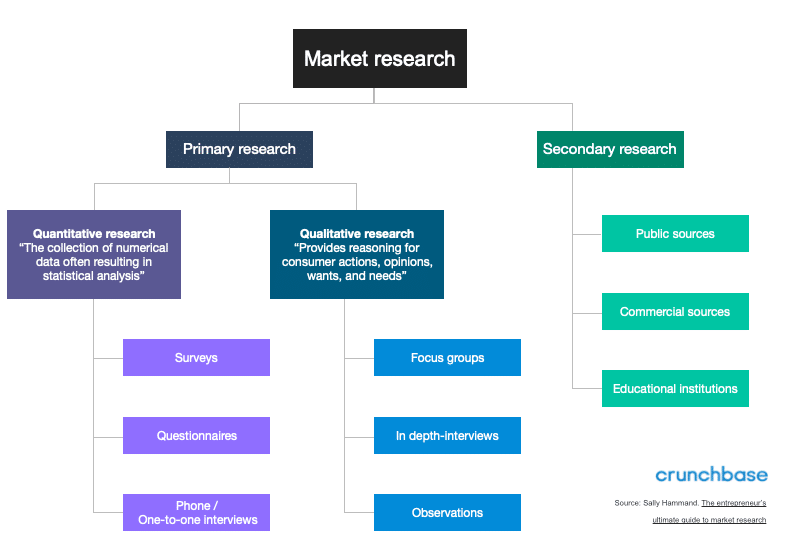

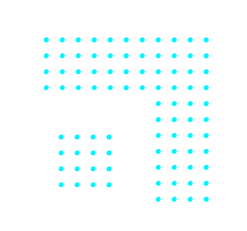

Now that you understand the role of well-defined research objectives, let’s examine the different types of market research and research techniques for realizing these goals. These methods are essentially your toolkit for extracting valuable insights and they fall into two broad categories: primary research and secondary research . Choosing between them depends on many factors such as your budget, time availability, and whether you’re looking for more exploratory research data or concrete answers.

Engaging in primary research is comparable to unearthing precious metals—it requires gathering new information straight from sources through several approaches including:

- Focus groups.

This approach gives you first-hand insight into your target audience.

Conversely, secondary research uses already established datasets of primary data – which can add depth and reinforcement to your firsthand findings. For a 360 view of your market trends, combine both techniques – exploratory primary research and secondary channels of inquiry.

Let’s look a bit deeper into them now.

What is primary market research?

Market research uses primary market research as an essential tool. This involves collecting new data directly from your target audience using various methods, such as surveys , focus groups, and interviews.

Each method has its benefits. For example, observational studies allow you to see how consumers interact with your product.

There are many ways to conduct primary research.

Focus Groups : Hold discussions with small groups of 5 to 10 people from your target audience. These discussions can provide valuable feedback on products, perceptions of your company’s brand name, or opinions on competitors.

Interviews : Have one-on-one conversations to gather detailed information from individuals in your target audience.

Surveys : These are a common tool in primary market research and can be used instead of focus groups to understand consumer attitudes. Surveys use structured questions and can reach a broad audience efficiently.

Navigating secondary market research

While market research using primary methods is like discovering precious metals, secondary market research technique is like using a treasure map. This approach uses data collected by others from various sources, providing a broad industry view. These sources include market analyses from agencies like Statista, historical data such as census records, and academic studies.

Secondary research provides the basic knowledge necessary for conducting primary market research goals but may lack detail on specific business questions and could also be accessible to competitors.

To make the most of secondary market research, it’s important to analyze summarized data to identify trends, rely on reputable sources for accurate data, and remain unbiased in data collection methods.

The effectiveness of secondary research depends significantly on how well the data is interpreted, ensuring that this information complements the insights from primary research.

The role of qualitative and quantitative data in market research

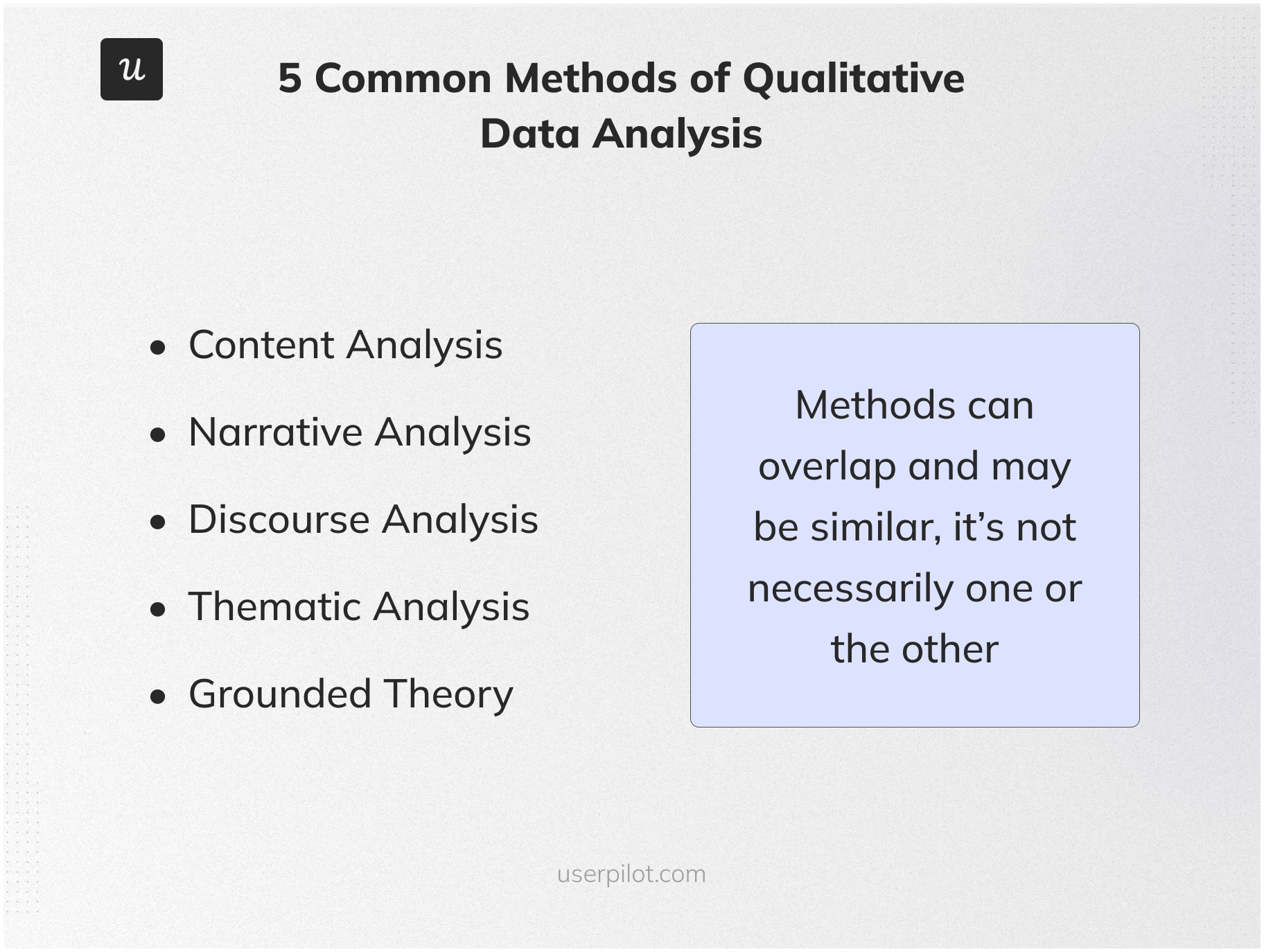

In market research, there are two main types of data: qualitative and quantitative. Qualitative data explores the reasons behind consumer actions, collecting non-numeric information to understand consumer behaviors and motivations. For more on gathering and analyzing qualitative data, see How to Analyse Qualitative Data . On the other hand, quantitative data uses numeric data to measure consumer preferences, behaviors, and market sizes. To learn more about handling this type of data, check out User Analytics .

A thorough market analysis usually combines both qualitative and quantitative data. This approach provides a full view of the market by merging detailed qualitative insights with concrete quantitative statistics. For more on combining these approaches, refer to Generative vs. Evaluative Research .

Gathering qualitative insights

Qualitative research involves direct engagement with customers, like having detailed discussions. It includes observational studies that capture genuine consumer reactions. This type of research provides deep insights into consumer perceptions, brand comparisons, consumer behavior, and feedback on specific product features.

Studies on customer satisfaction and loyalty reveal effective strategies for keeping customers and what keeps them loyal, such as loyalty programs and quality customer service. The strength of qualitative research lies in its ability to dig deeper than just numbers, reaching insights that quantitative data might miss. By using qualitative data to customize experiences, businesses can increase customer satisfaction, interaction , and loyalty, leading to greater business growth.

Analyzing quantitative data

Quantitative research provides precision and the ability to measure findings using structured data collection methods like polls and surveys. Product analytics tools such as Userpilot , Amplitude , Heap , and Mixpanel are highly effective for collecting and organizing quantifiable data. This type of data is crucial for identifying trends and insights, which can help businesses track important performance indicators such as conversion rates or customer lifetime value , supporting their growth strategies.

Quantitative research data is divided into two types: discrete data, which includes countable numbers, and continuous data, which consists of numbers that can have fractions or decimals. These are vital for revealing important demographic information.

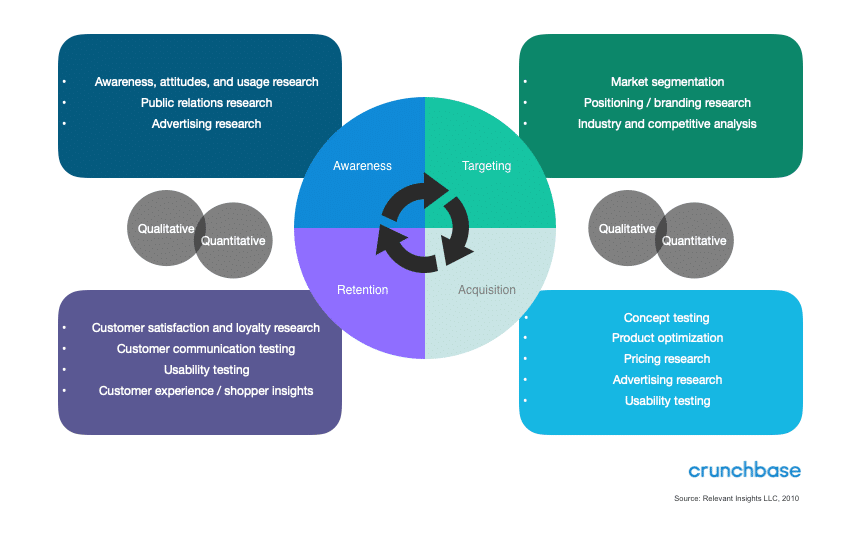

Segmenting your target market

Market research plays a key role in segmenting your target audience into manageable segments.

These market segments are typically grouped by similar needs or attributes, and display similar responses in marketing research surveys and initiatives. The full market segmentation process is vital for comprehensively grasping and satisfying the requirements of your targeted consumer base.

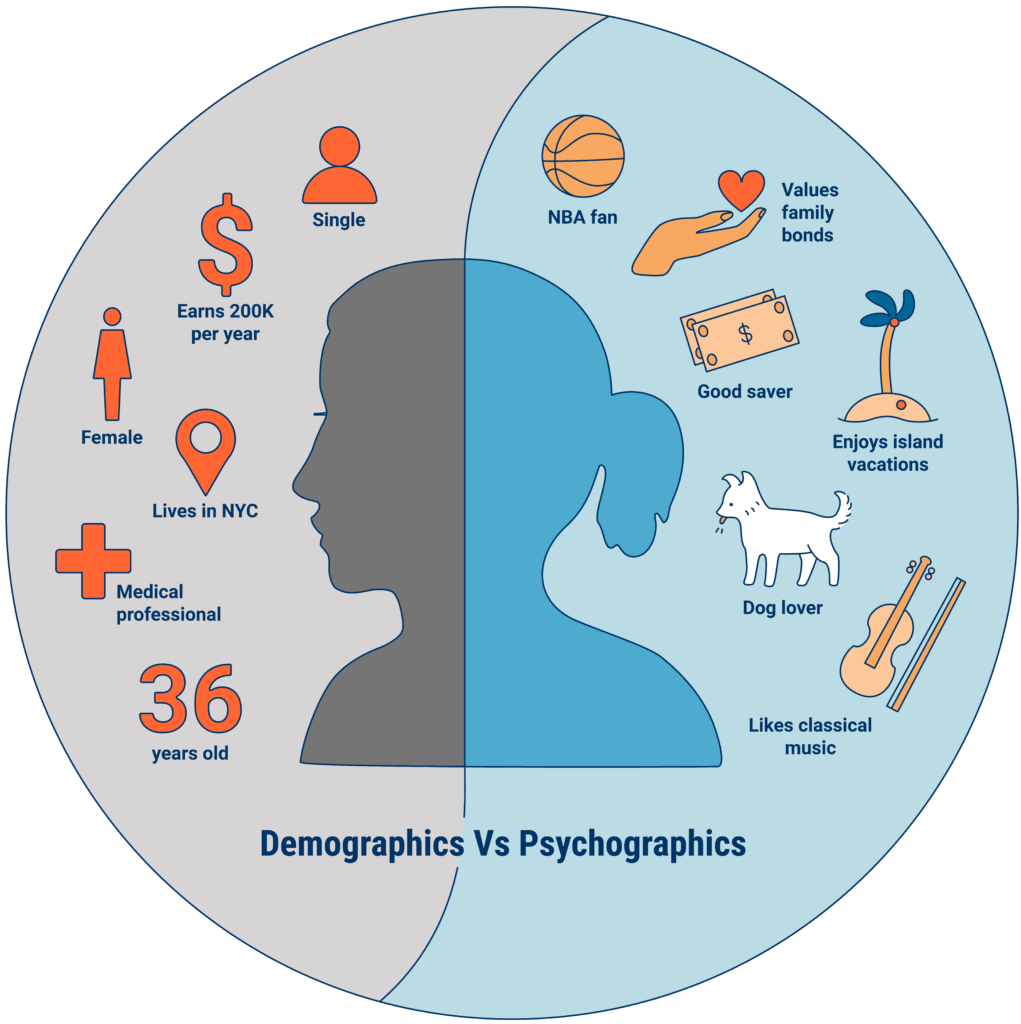

Accumulating demographic information forms the basis for executing effective market segmentation strategies. Businesses prioritize obtaining user data such as:

- Job functions.

- Organizational scale.

- Customer demographics profiles.

- Lifestyle choices.

- Values systems.

- Product usage patterns.

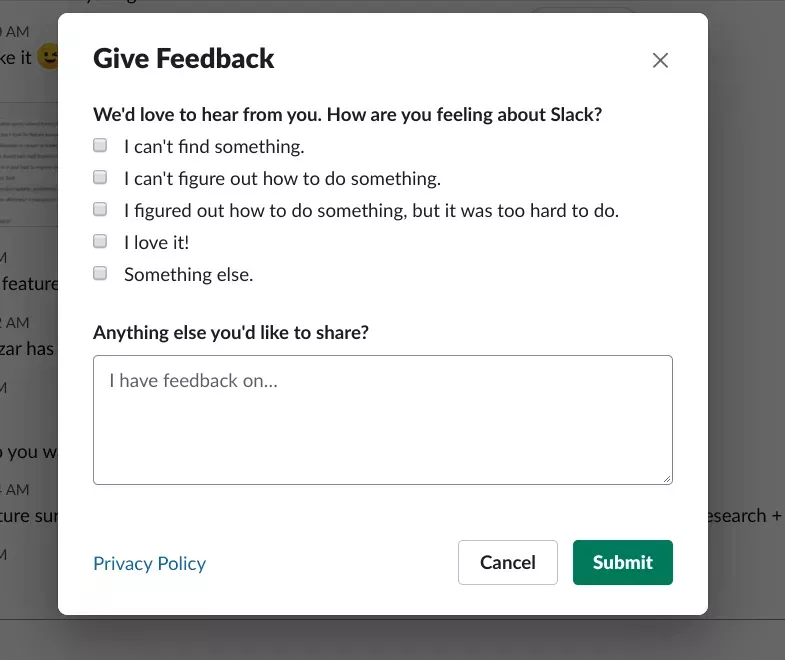

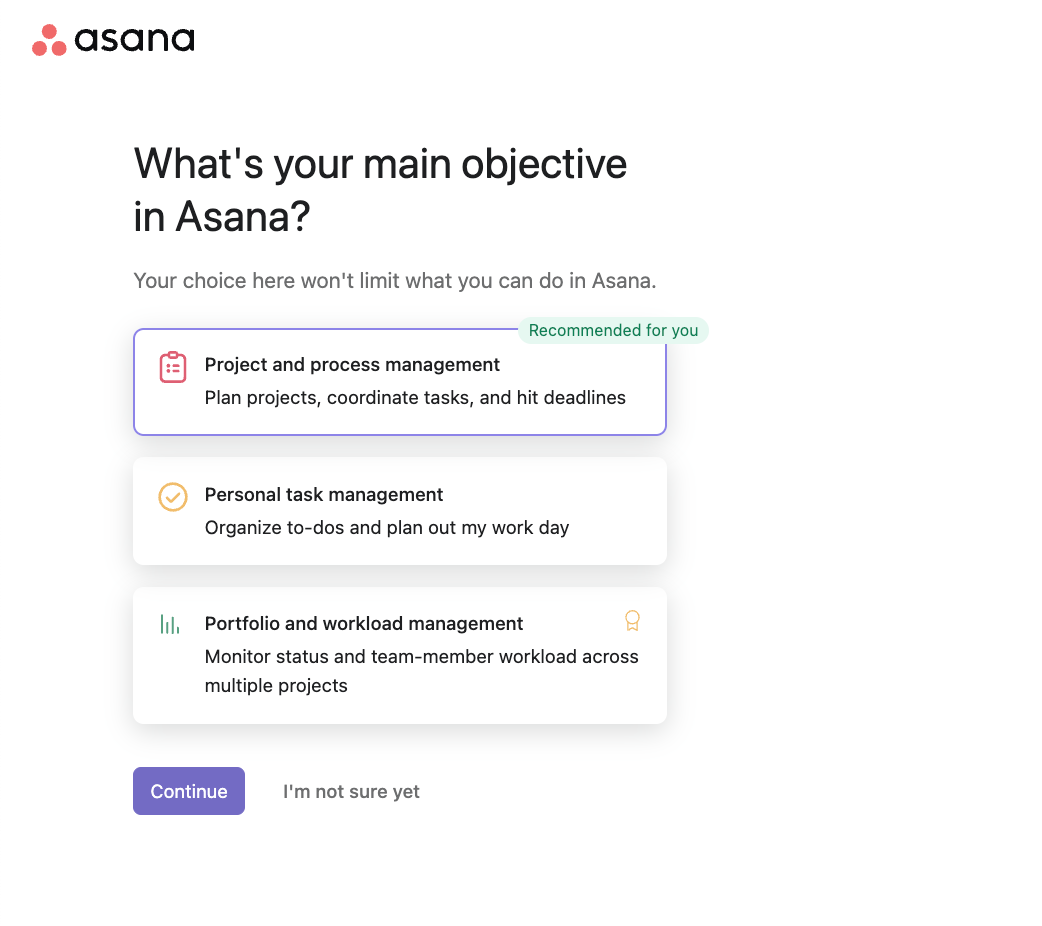

This information can be collected in the initial sign-up flow (through a signup flow survey; see the Asana example below) or by conducting comprehensive market research surveys .

At its core, successful market segmentation enables businesses to communicate effectively in their target customers’ dialects while catering explicitly to their distinct demands.

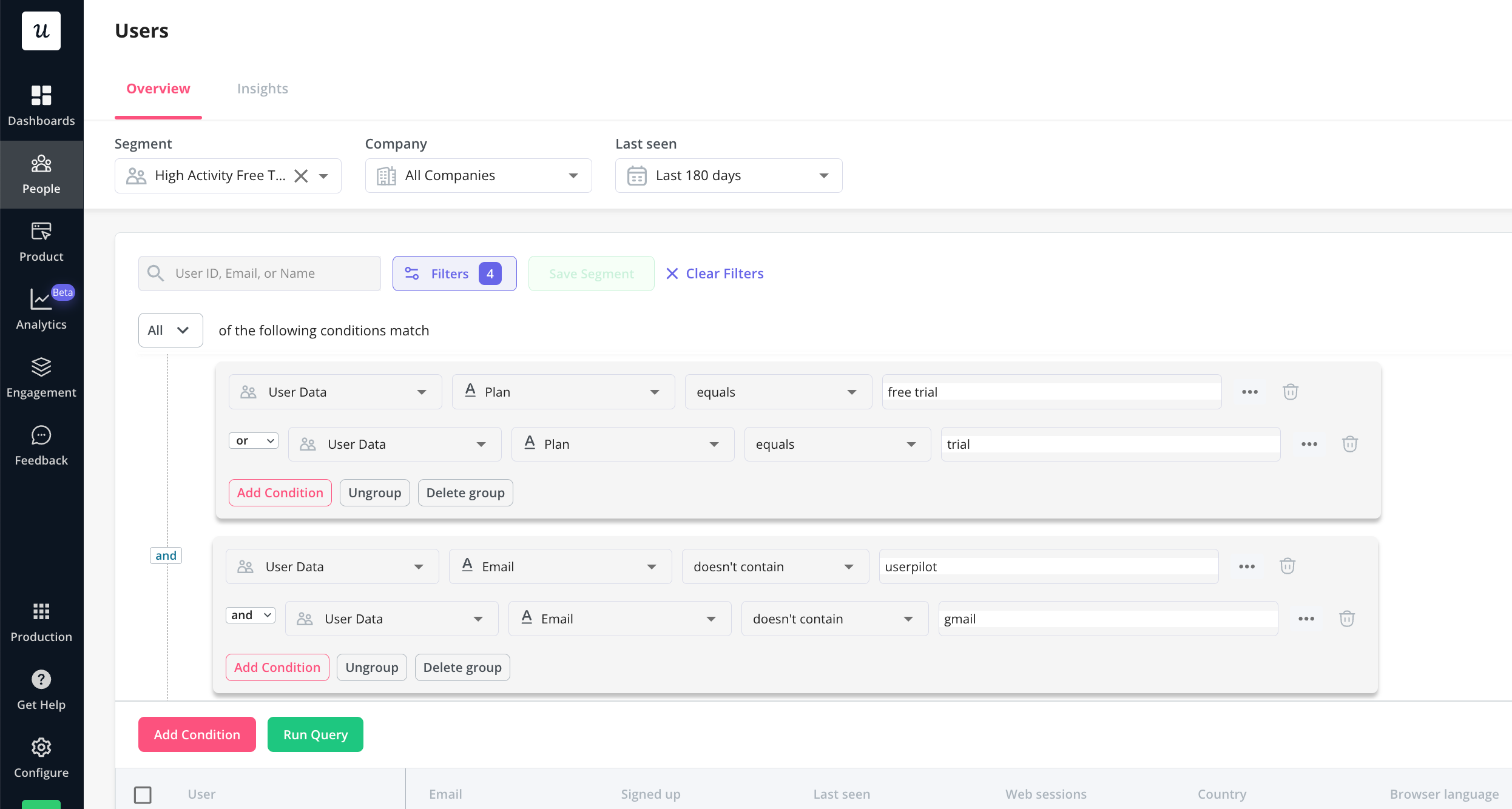

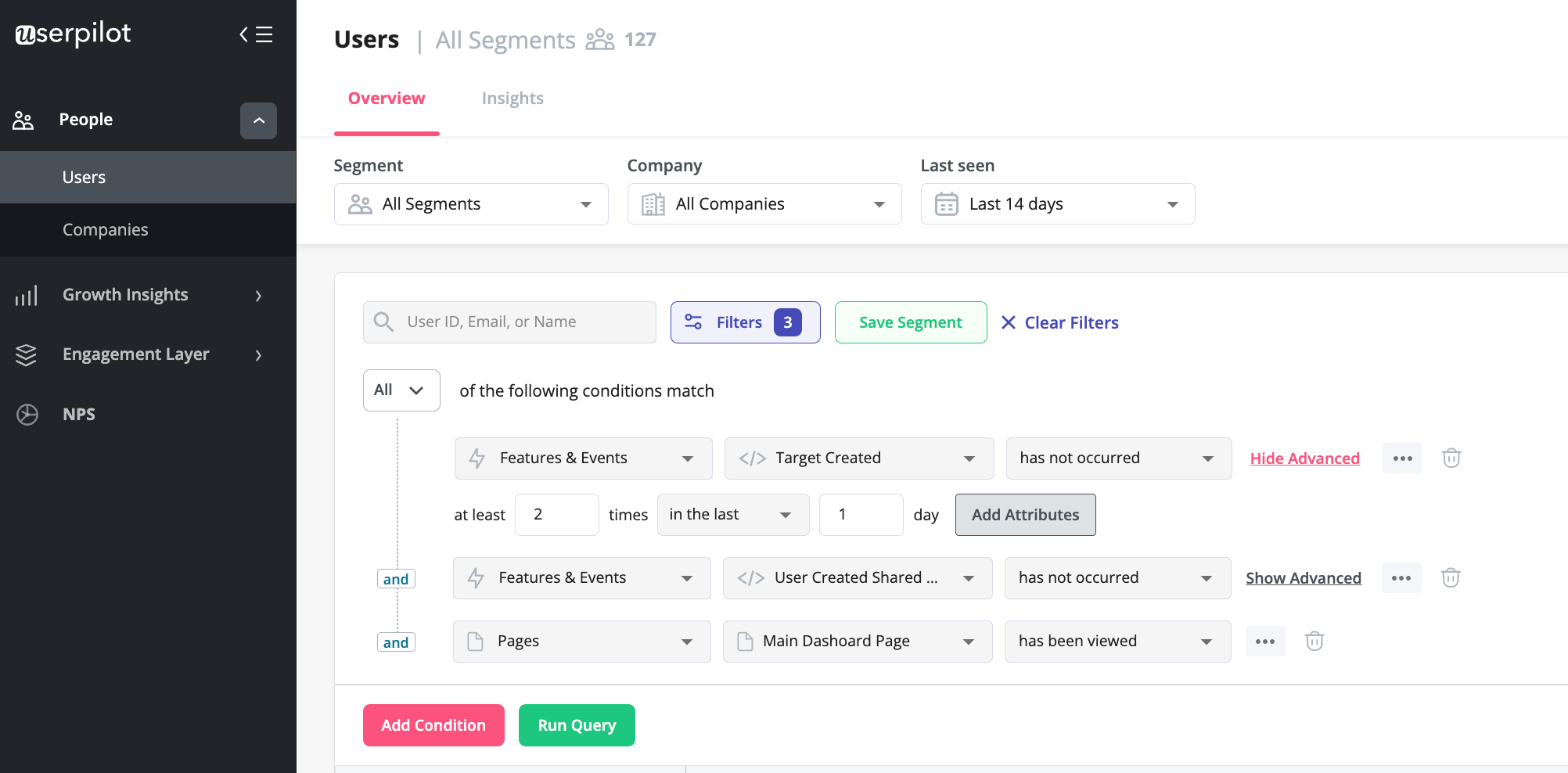

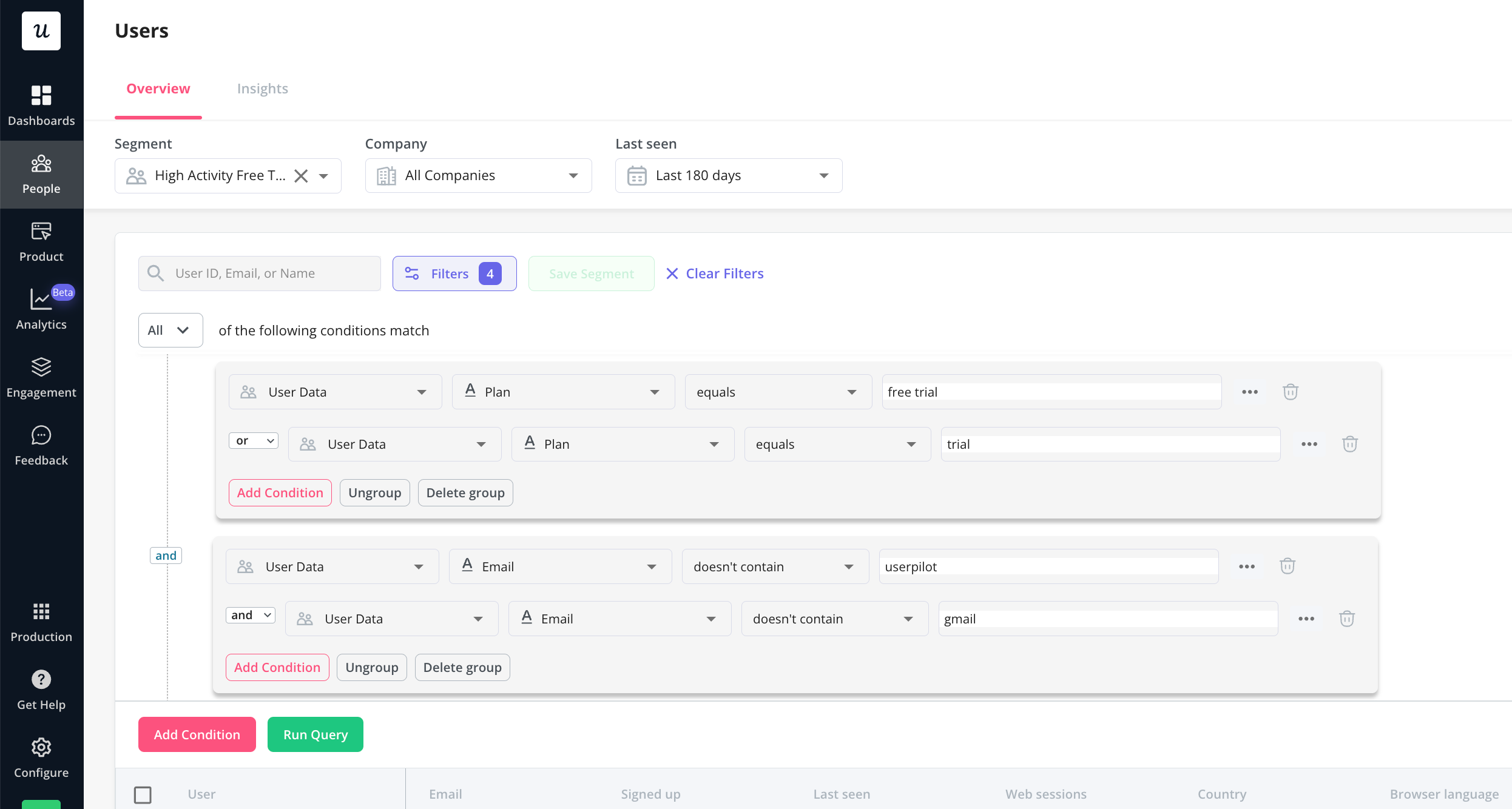

Userpilot allows you to easily segment your users not only by demographic information, company size, plan, or role – but also by their in-app engagement ( behavioral segmentation ):

In summary, the techniques used to create detailed analyses, like conducting specialized surveys and carefully collecting relevant participant information, are crucial for identifying groups within a larger target population. These groups are defined by usage patterns and broad demographic and economic indicators, enabling companies to not only reach but also deeply connect with each niche market they aim to capture.

Creating buyer personas based on your market research

Creating buyer personas is a strategic process that helps businesses better understand and cater to their target customers. Here’s how you can systematically approach creating effective buyer personas:

- Gather Initial Data : Start by collecting basic demographic information such as age, gender, location, and education level. This can come from existing customer databases, market research, or industry reports.

- Segment the Audience : Based on the collected data, segment your audience into distinct groups. Each segment should represent a type of customer with similar characteristics and behaviors. This segmentation helps in personalizing marketing and sales strategies effectively.

- Build Detailed Personas : For each segment, create a detailed persona that includes not only demographic and behavioral traits but also psychographics like interests, values, and lifestyle. Each persona should tell the story of an ideal customer, making them relatable for your marketing team.

- Refine Over Time : Buyer personas are not static. As you gather more data and the market evolves, revisit and refine your personas to keep them relevant and accurate.

- Utilize Tools Like Userpilot : Tools such as Userpilot can enhance this process by providing analytics that reveal how users interact with your product. This can confirm hypotheses or uncover new insights about user preferences and behaviors, which can be integrated into existing personas to make them even more accurate.

By carefully crafting and continually updating buyer personas, businesses can achieve a deeper understanding of their customers. This enables them to tailor their offerings and communications effectively, thereby enhancing customer engagement and satisfaction.

Recruiting participants for primary research

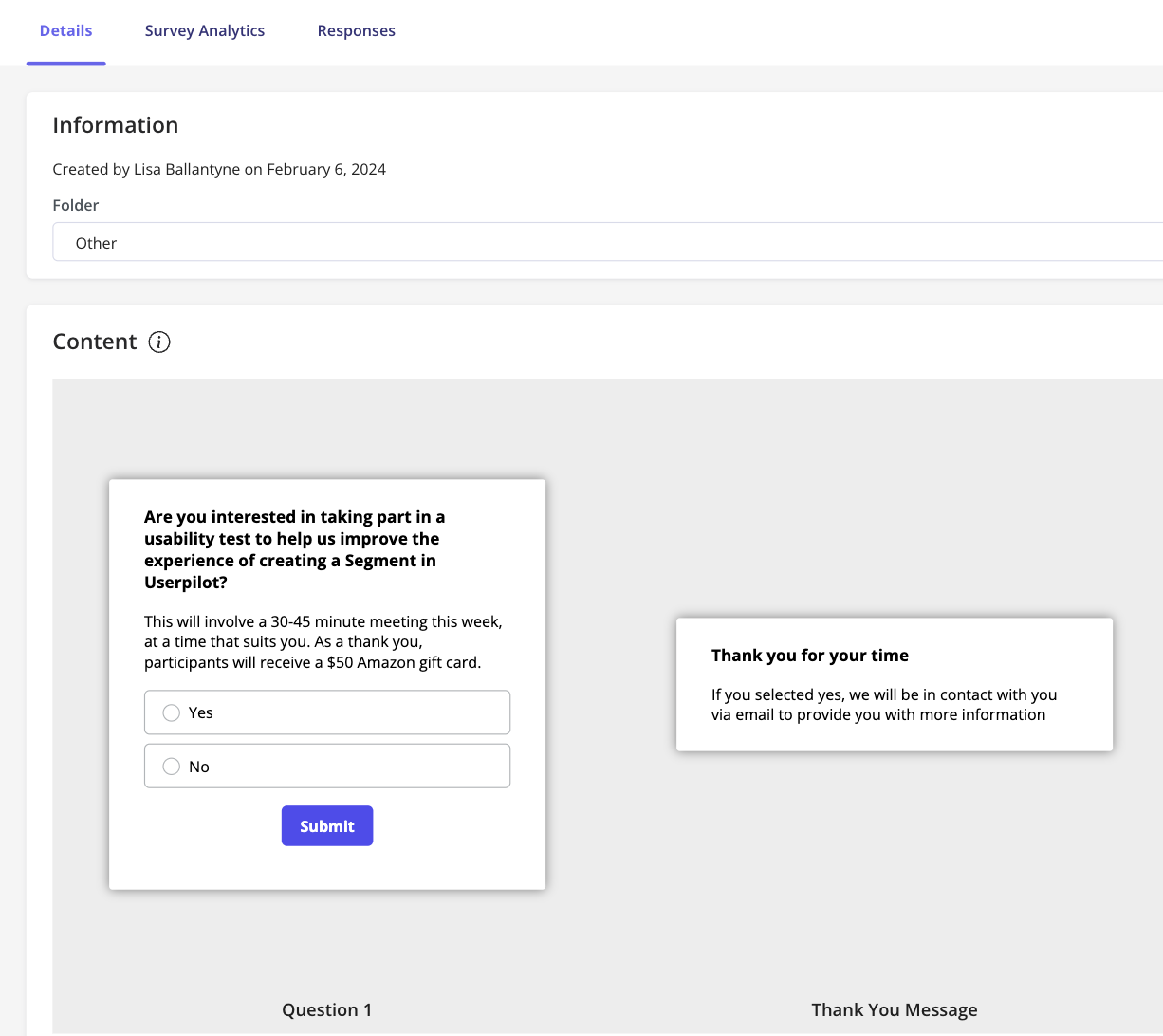

Choosing the right participants for primary research is a crucial step in market research. It’s important to find individuals who can provide relevant and meaningful consumer feedback, on your product or service, as this feedback is key to developing accurate user personas.

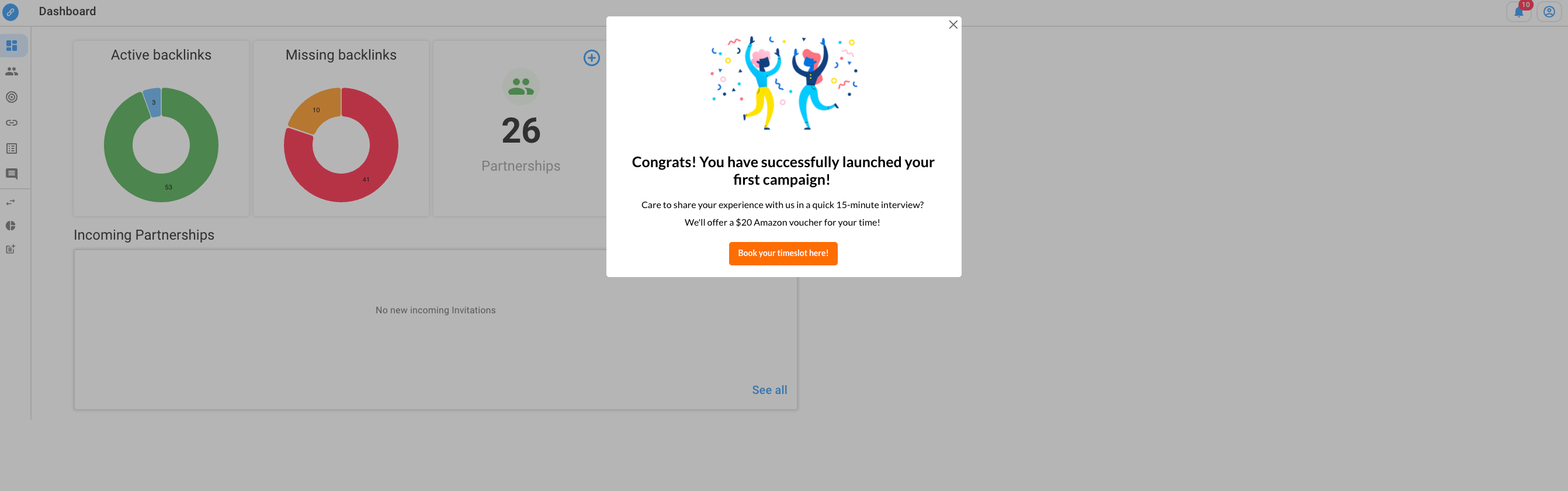

Userpilot can be instrumental in this process. It collects data on how users interact with and use your products, helping you identify who might be the best candidates for more detailed studies, such as interviews.

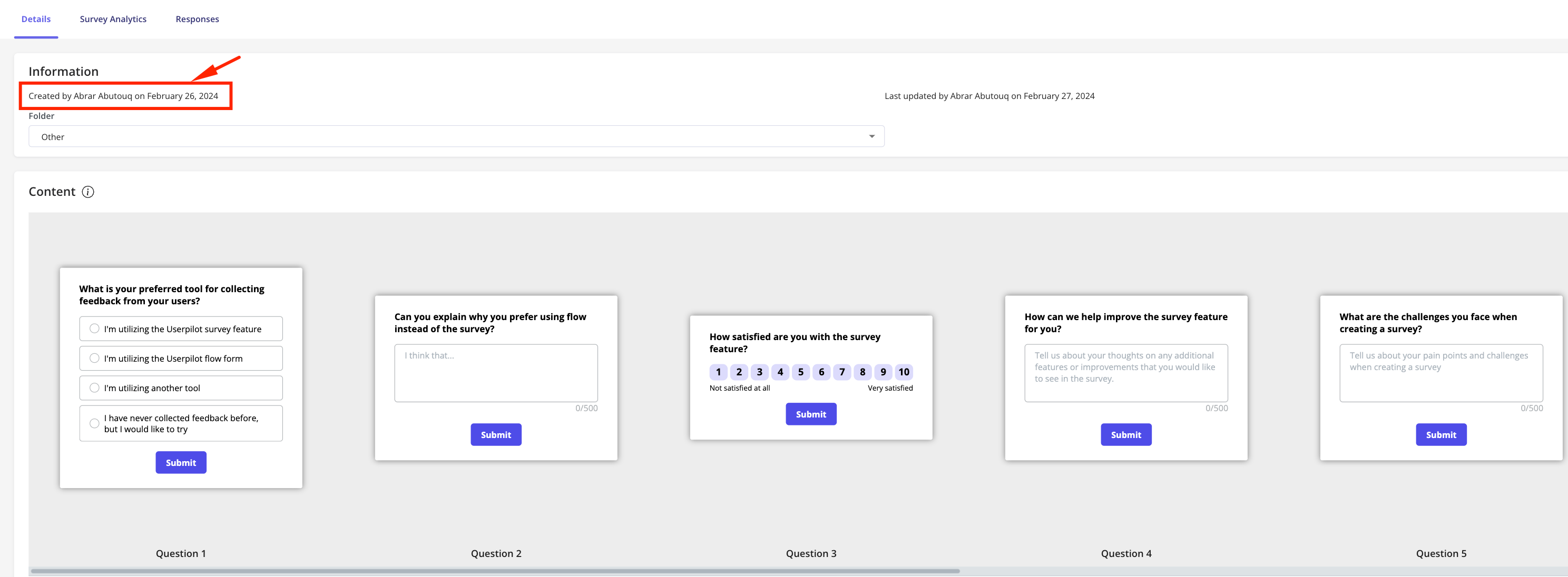

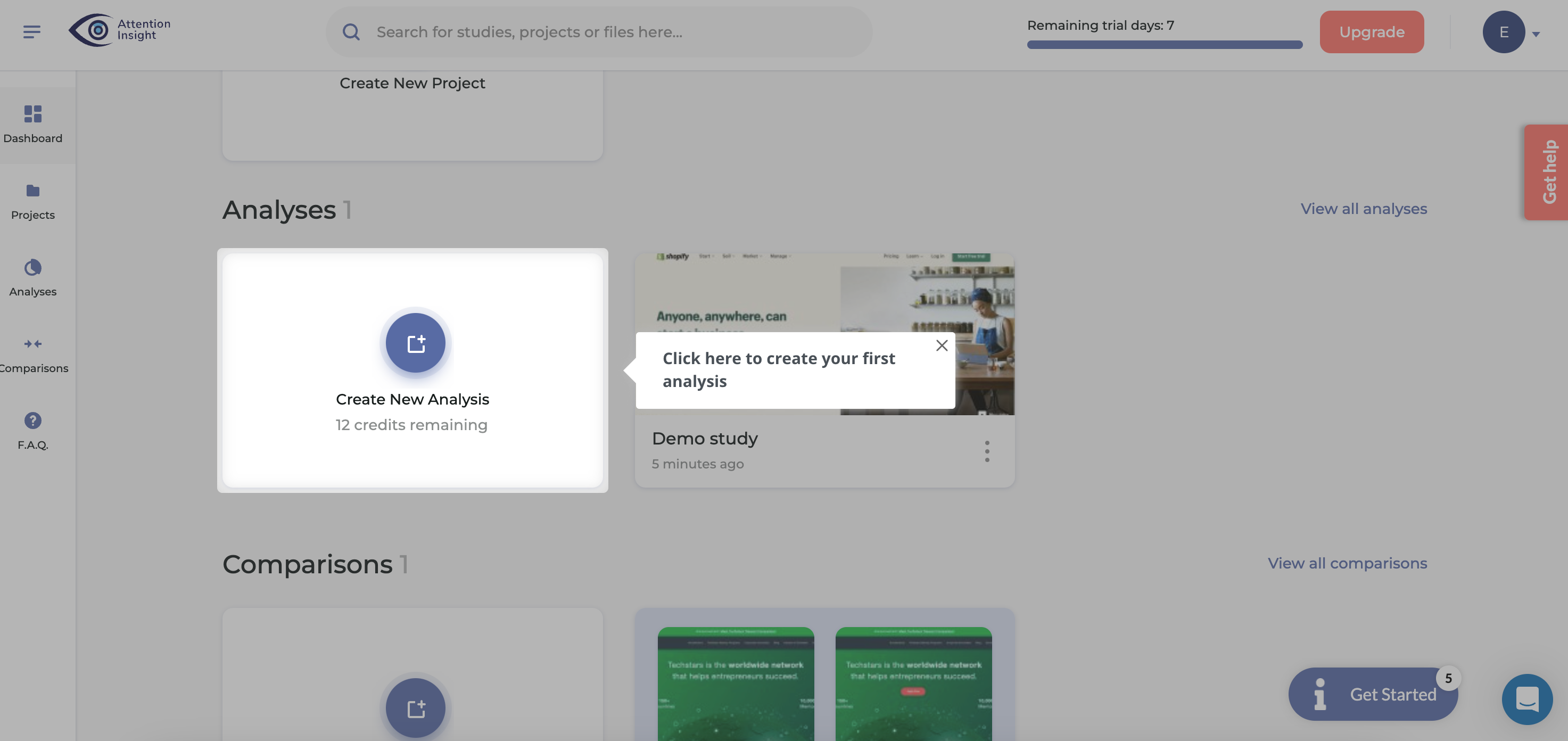

To efficiently recruit participants for interviews, Userpilot’s in-app features, such as in-app modals with embedded surveys can be extremely useful. You can use these tools to engage directly with users who meet your specific criteria, right within your app.

This method not only simplifies the recruitment process but also ensures that you’re interacting with the most relevant users. By leveraging these features, you can gather deep insights that significantly enhance the development of your user personas, ensuring your research is both timely and informed.

Competitive analysis for strategic advantage

Competitive analysis helps businesses understand their rivals’ strategies. It involves identifying which industries or markets to target and listing key competitors to gain a clear view of the competitive environment. This includes evaluating competitors’ market share, strengths, weaknesses, and potential entry barriers, often using tools like SWOT analysis.

By understanding competitors’ operations and past marketing efforts, businesses can craft new strategies, pinpoint opportunities, and learn from competitors’ mistakes. Employing market research, brand perception surveys, and market statistics, alongside analytical frameworks like Porter’s Five Forces Model, helps businesses uncover new opportunities and maintain a competitive advantage.

Ultimately, competitive analysis uses the understanding of competition to fuel business growth.

Conducting effective market research surveys

Primary market research often uses surveys as a cost-effective way to gather data. These surveys reach wide audiences and provide quick feedback. It’s crucial to carefully plan the creation and distribution of these surveys to ensure they are effective. Given the high amount of web traffic from mobile devices, it’s particularly important to make surveys mobile-friendly.

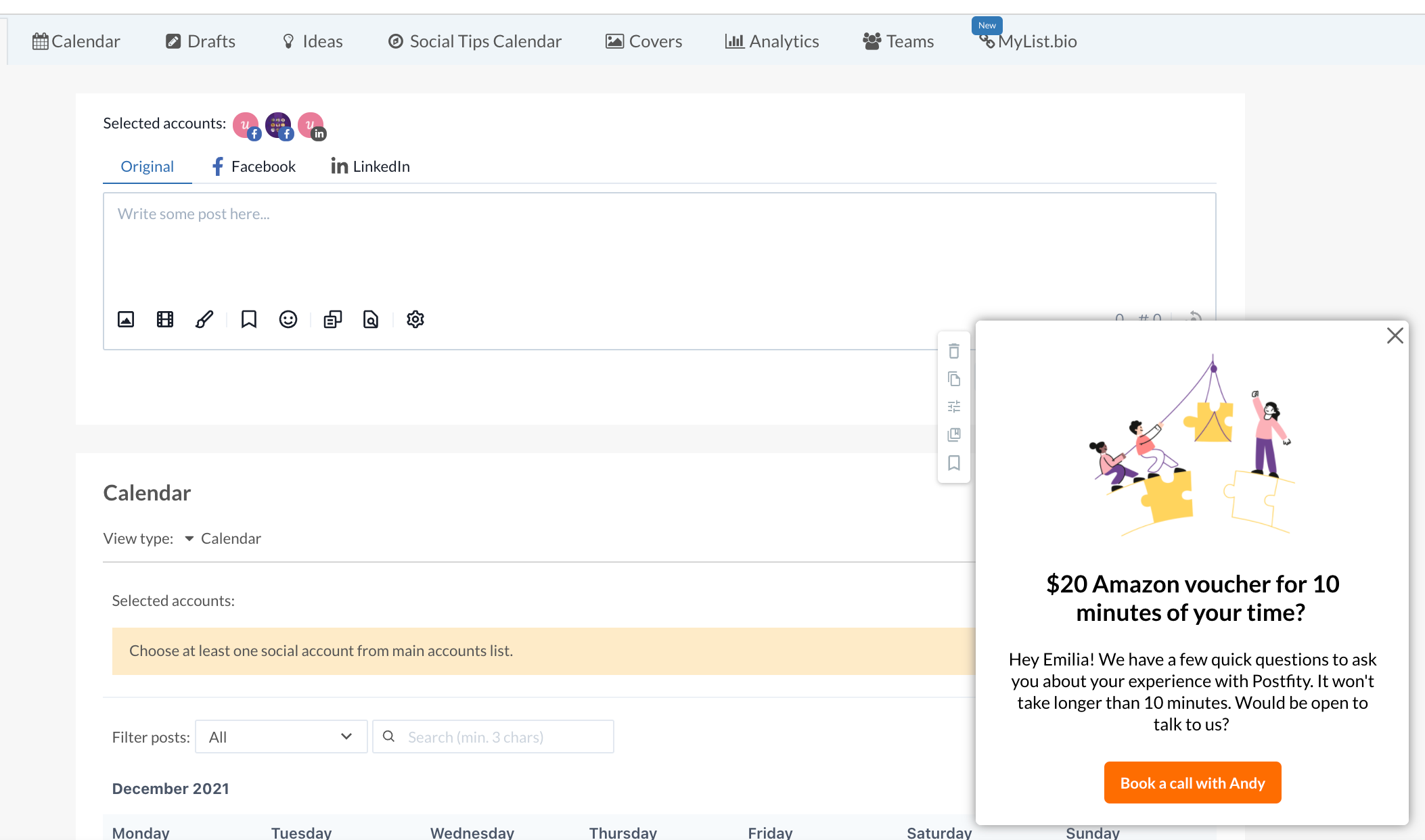

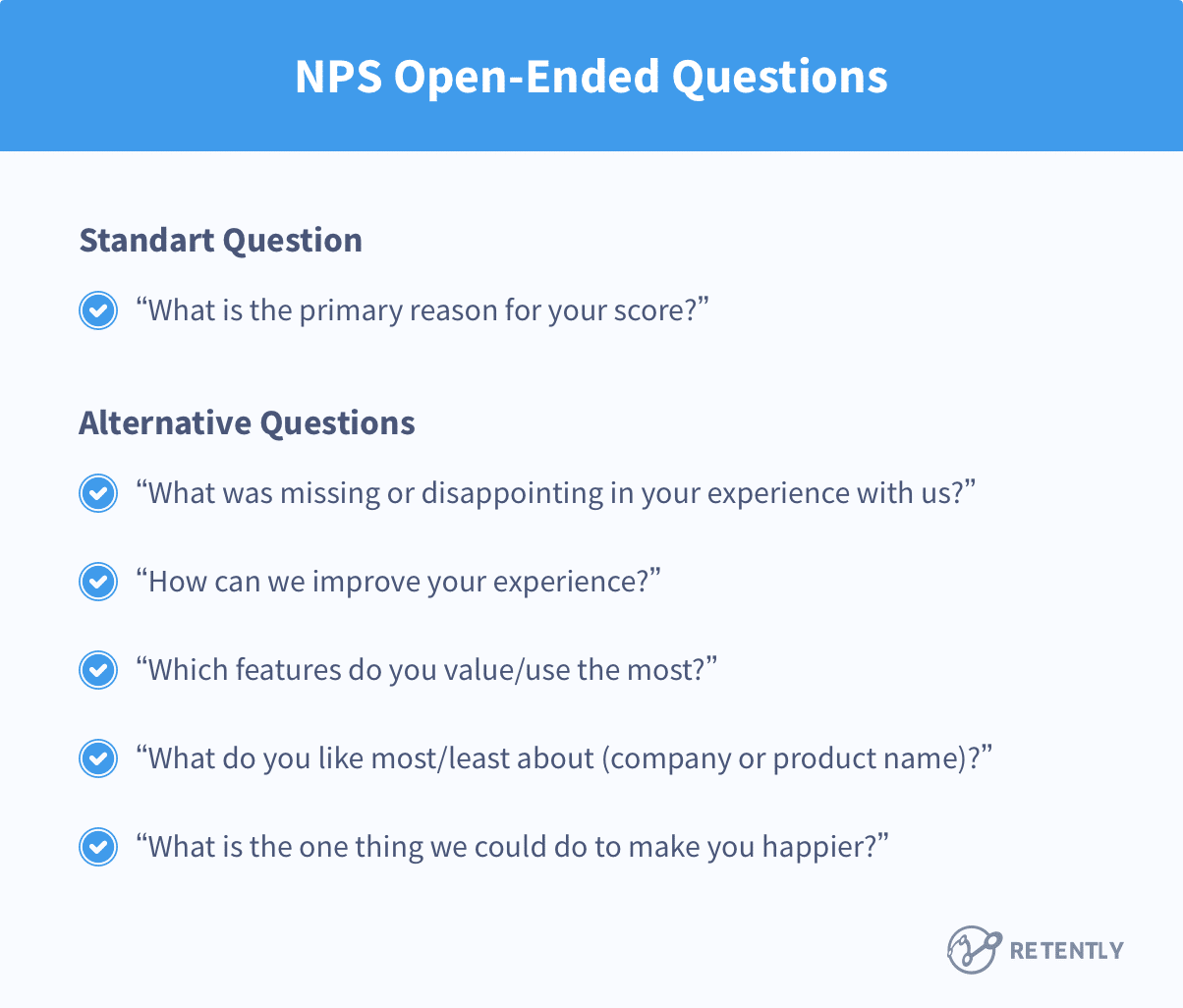

To get the most comprehensive data, include both quantitative (closed-ended) and qualitative (open-ended) questions in your survey . Offering incentives like financial compensation or vouchers can encourage participation, but it’s important to manage these carefully to avoid biasing the responses.

Well-designed surveys are like direct interviews with your target audience and are key to obtaining valuable insights about their views and experiences.

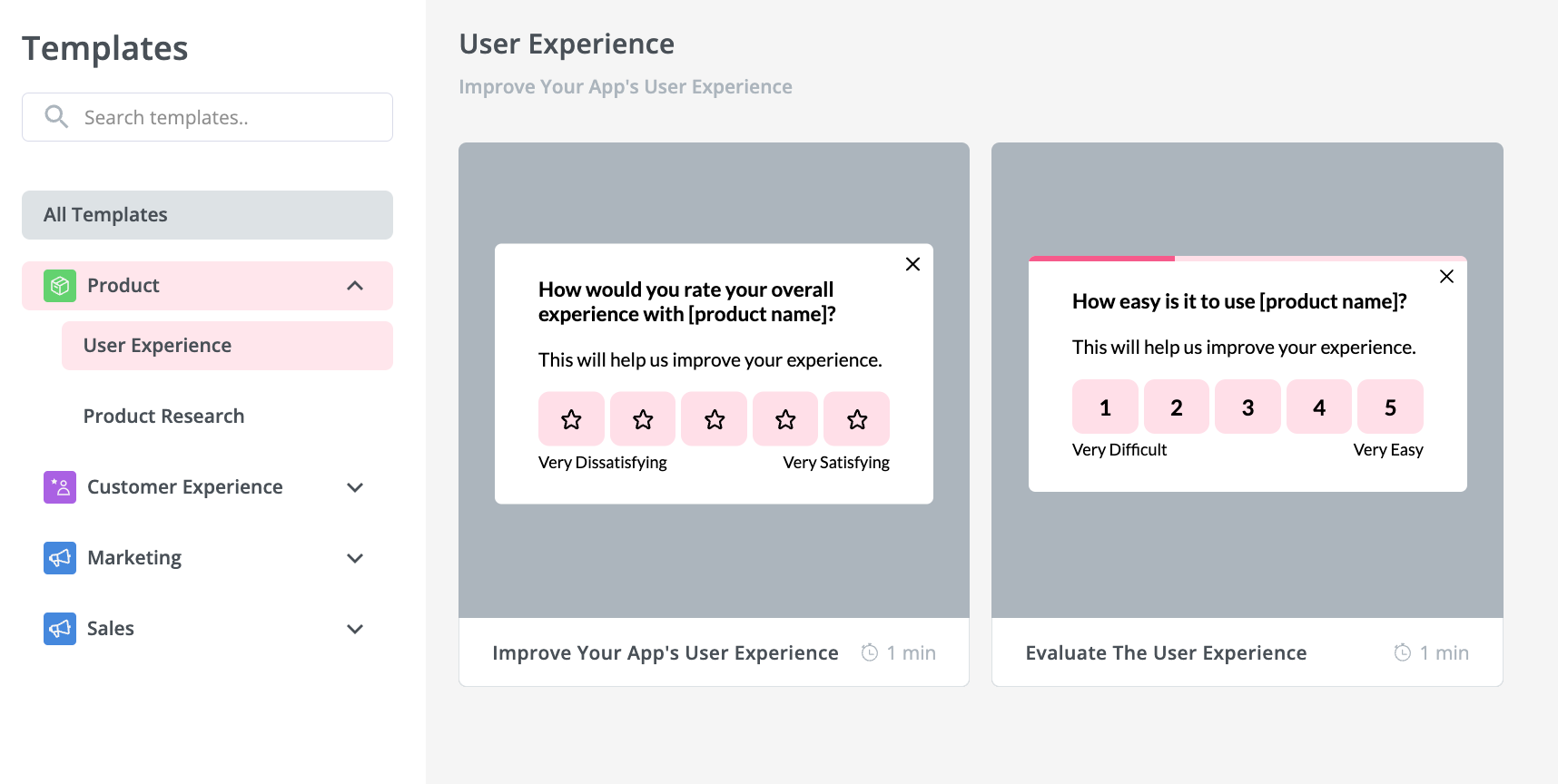

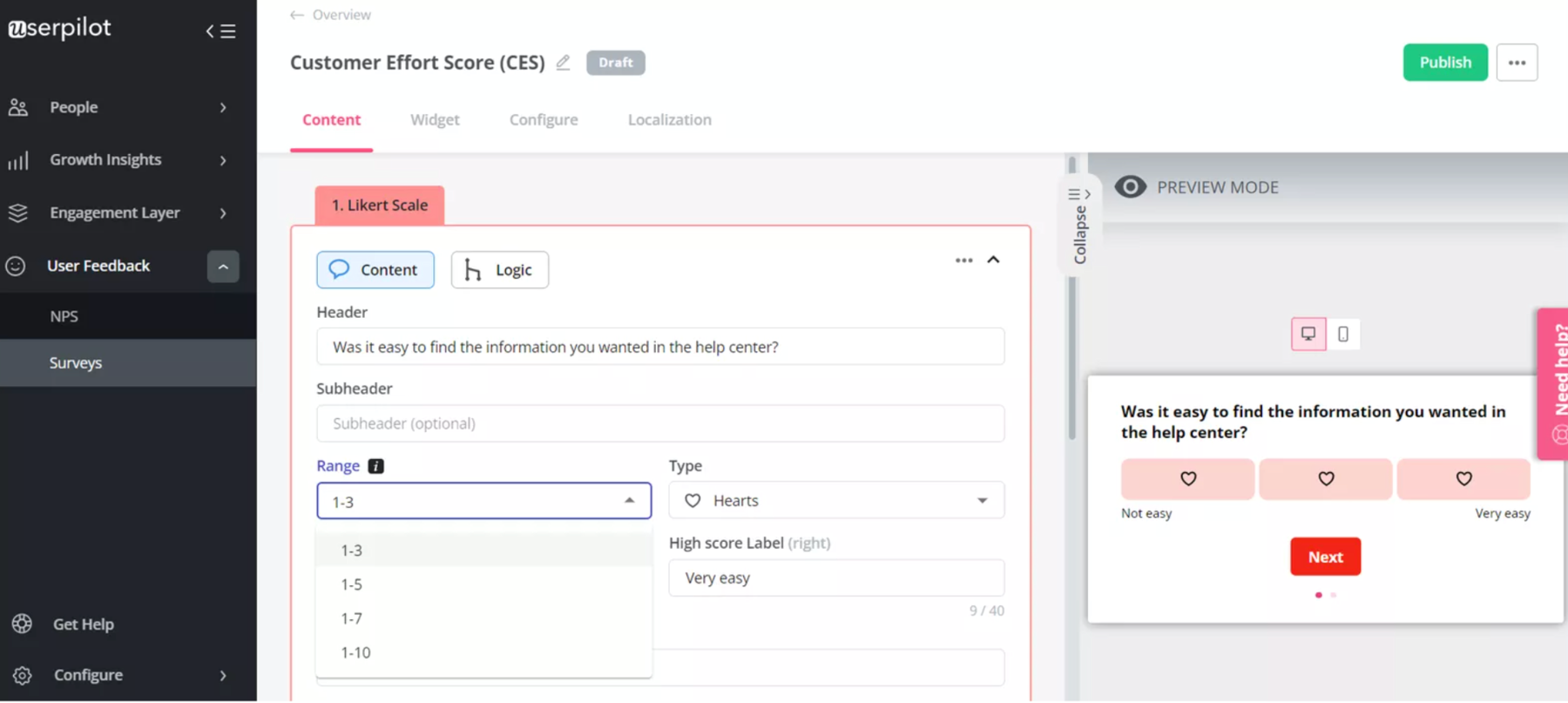

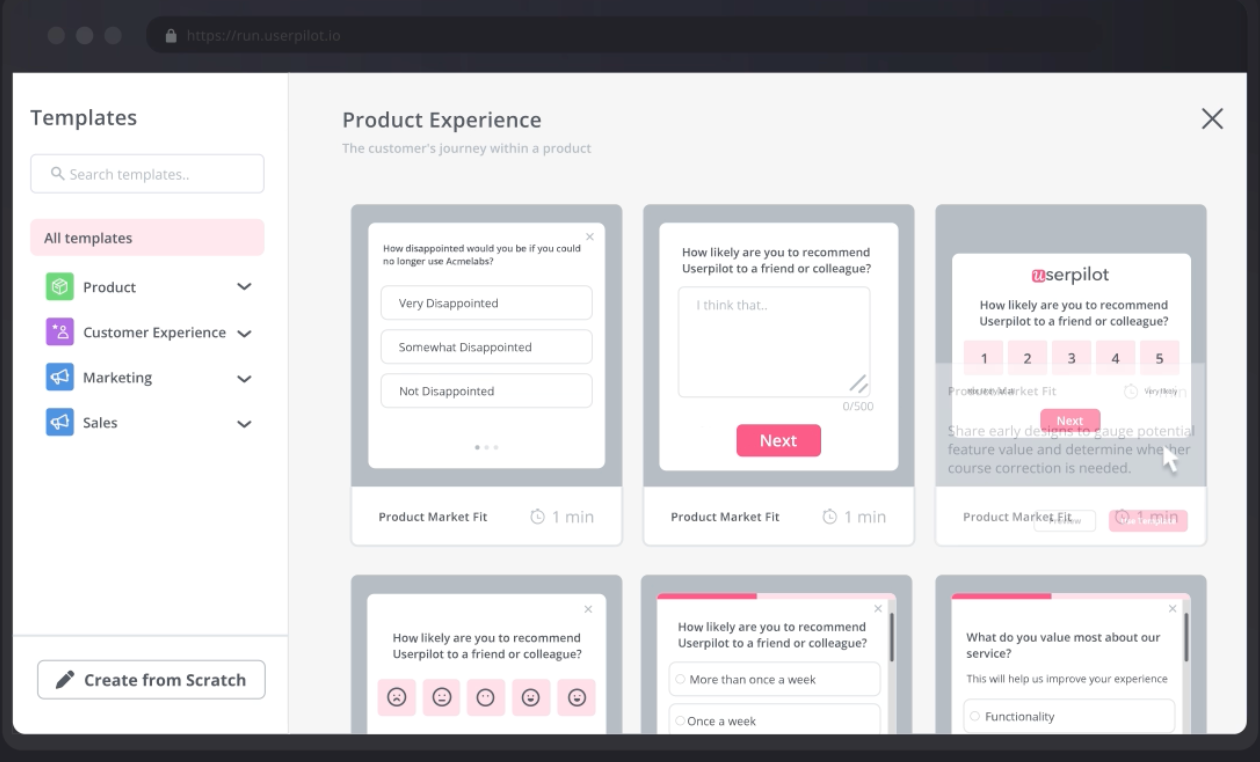

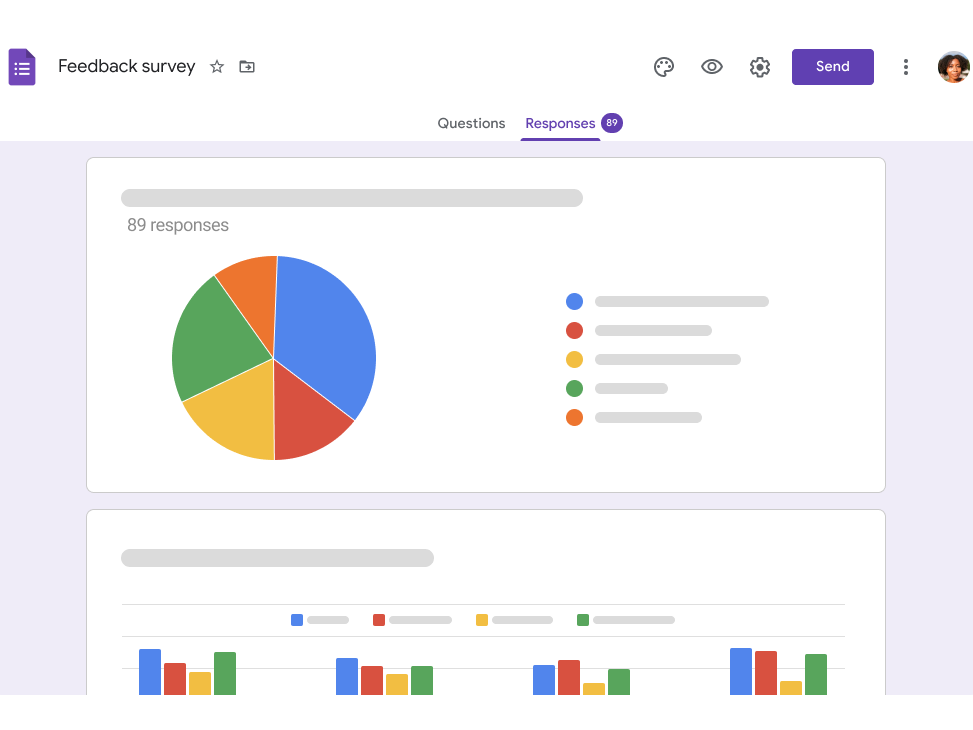

Userpilot offers over 50 in-app survey templates along with a bespoke builder, which are important tools for collecting the right responses. These features allow you to tailor surveys precisely to your needs, ensuring you gather accurate and relevant data directly from your users. By leveraging these templates and customizing them with the bespoke builder, you can effectively engage your audience and enhance the quality of insights you receive. This setup is crucial for conducting efficient and effective market research.

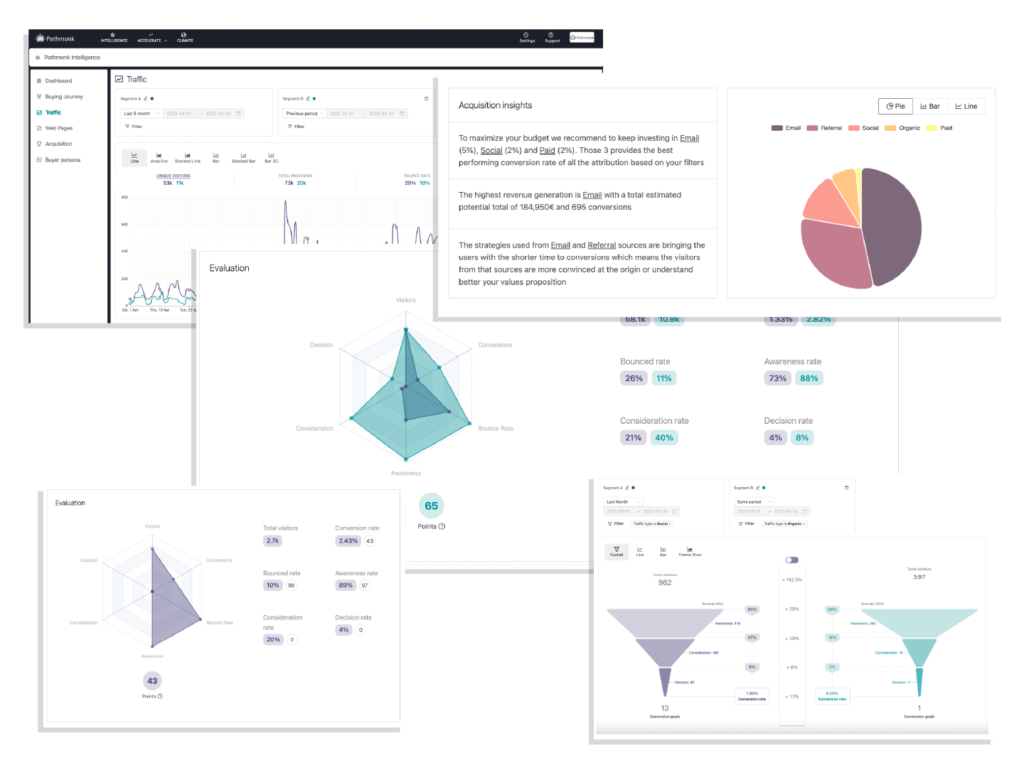

Analyzing and interpreting market research data

Once you have collected data through surveys, market research data analysis is the next critical step. It involves identifying patterns, establishing connections, and extracting insights that inform business decisions.

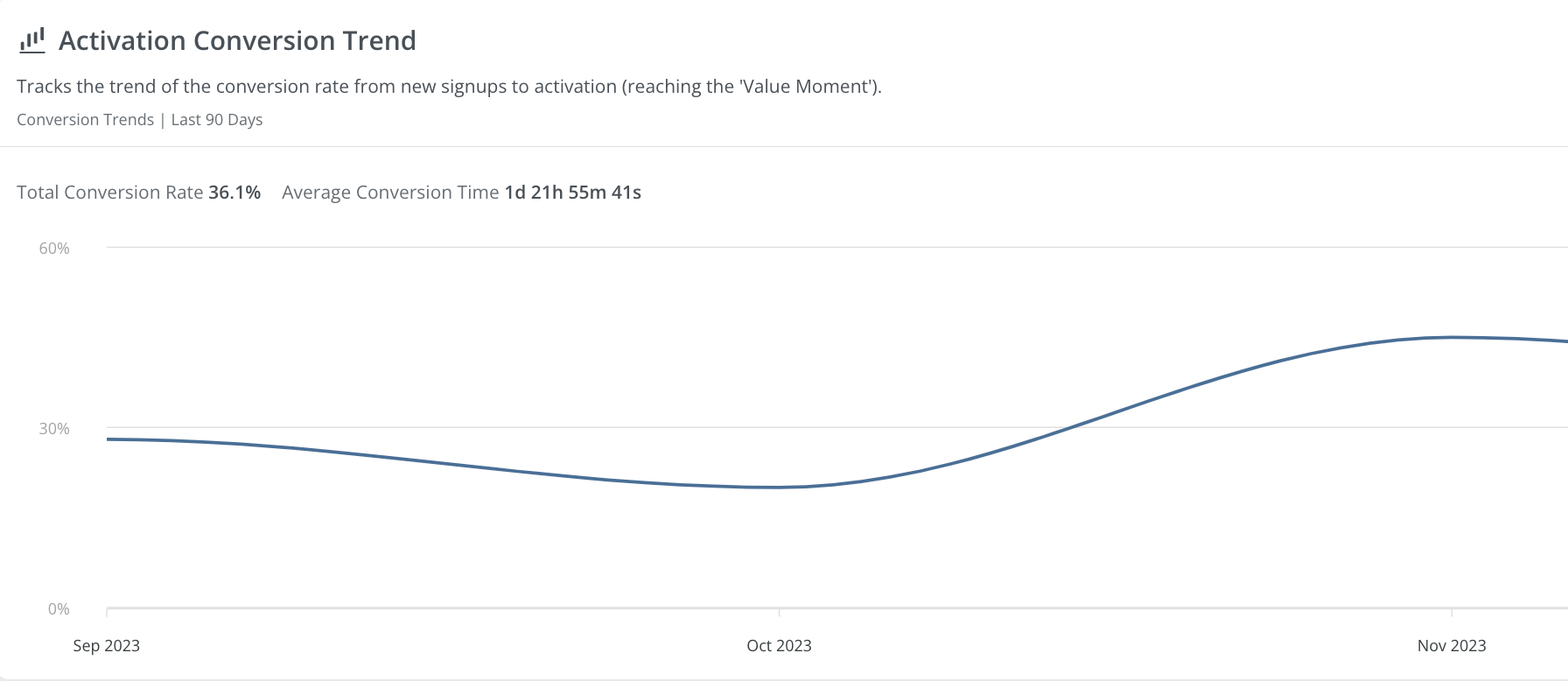

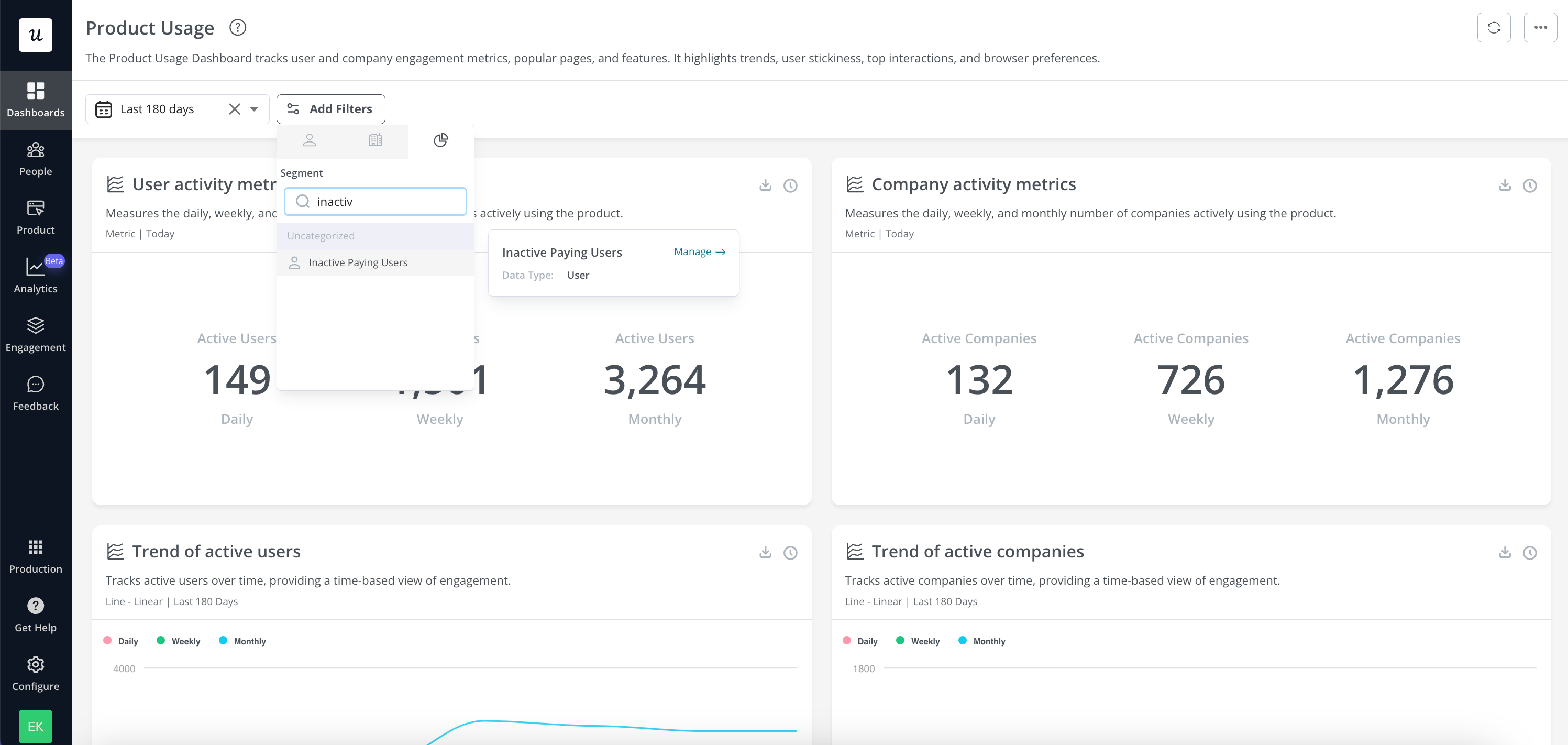

Userpilot’s analytics suite offers deep and easily accessible insights into your market research data:

This process starts with preparing the data by cleaning and organizing it to ensure accuracy and ease of analysis. Depending on the study’s goals, various analytical methods can be used, from simple descriptive statistics to complex multivariate analyses, all chosen to provide meaningful insights.

The core of this analysis aims to uncover market trends and understand industry specifics, which can highlight key factors such as impactful customer experiences, profitable products or services, and effective marketing strategies. Communicating these findings effectively involves presenting them in clear reports and using visual aids while making practical recommendations and addressing any limitations in the research scope or methods. Ultimately, data analysis transforms raw data into compelling narratives that offer actionable business intelligence.

Applying market research to product or service development

Market research is much more than just collecting data and uncovering insights; it’s a vital tool for driving business growth and guiding product development at every stage. Here’s how market research supports business throughout the product lifecycle:

- Concept Creation : Helps identify market needs and opportunities to inform the initial product idea.

- Building a Business Case : Provides evidence and data to justify investment in the new product.

- Product Development : Offers insights into customer preferences and feedback for refining product features.

- Market Introduction : Aids in strategizing the launch, targeting the right audience, and setting the right price.

- Lifecycle Management : Continuously gathers data on customer usage and satisfaction to enhance the product over time.

Consider a B2B SaaS company that develops project management software. By engaging in targeted market research activities like surveys and doing focus group call groups among its business clients, the company can:

- Understand Business Needs : Gain insights into the specific project management challenges and needs of different industries.

- Refine Product Features : Discover which software features are most valued by businesses, such as integration capabilities, user-friendliness, or specific tools for collaboration.

- Tailor Marketing Strategies : Identify the most effective communication channels and messaging that resonate with business clients, such as emphasizing efficiency gains or return on investment.

Market research guides businesses from the initial idea through to launch and beyond, acting as a strategic tool that ensures all actions are aligned with market demands and customer needs , ultimately aiming for successful business outcomes.

Utilizing tools for efficient market research

Using tools like Userpilot, SurveyMonkey, Google Forms, and Typeform, market researchers can reach a wide audience and get fast responses. These platforms help to design, distribute, and analyze surveys efficiently.

Userpilot stands out by allowing businesses to create targeted in-app experiences that engage users directly where they are most active—within the app itself. This direct engagement method improves the quality of the feedback collected as it relates to specific features or user experiences.

Userpilot also offers features such as demographic filtering and behavioral-based segmentation, which speeds up the process of finding and recruiting the right participants for market research.

These tools are essential for performing detailed and effective market research. They break down geographic and cultural barriers, offer access to diverse user groups, and enable businesses to conduct deep, actionable analyses across different market segments.

Translating research findings into business growth

Market research does more than just gather and analyze data; it aims to transform these insights into tangible business improvements. This process is crucial in guiding product development and helping increase a company’s market share by informing targeted strategies. For instance, a B2B SaaS company could use market research to:

- Tailor marketing strategies specifically for key user personas.

- Identify the most valued features for your users.

- Develop pricing strategies that appeal to companies of different sizes.

- Gain insight into the specific needs and expectations of their customers.

By implementing effective market research techniques, companies can customize their products or services to better serve their target audience’s needs, fundamental for stimulating company growth . Conducting personalized market research adds value, while collaborating with specialized firms may yield additional profound insights.

Market research is not just about collecting data; it’s about deeply understanding your customers, spotting opportunities, and making informed decisions that drive your business forward. It provides essential insights into the market and business environment, influencing how potential clients perceive your company.

By conducting competitor analysis and market research, organizations can:

- Connect with their target audience.

- Understand their competitive position.

- Plan strategically for future initiatives.

- Gain insights into customer perceptions of their brand, uncovering new perspectives or opportunities for improvement.

Since competitors also use market research to their advantage, engaging in these analytical processes is crucial for a comprehensive marketing strategy, aimed at business growth.

Start your own market research and journey today to pave the way to success.

Frequently asked questions

What is market research and why is it important.

Understanding their target market through collected information and insights, businesses can make informed decisions, diminish risks, and enhance marketing strategies with the aid of market research. This ensures that choices are based on reliable data, which is crucial for business success.

What is the difference between primary and secondary research?

To summarize, primary research entails the gathering of original data directly from the source, whereas secondary research utilizes previously compiled data sources to add perspective and reinforce conclusions derived from primary research.

How does market research guide product development?

By offering critical data on consumer habits and preferences, market research steers the enhancement of product features, thereby influencing decisions across all stages of a product’s life cycle and aiding in the evolution of product development.

What tools can be used for efficient market research?

Platforms such as Userpilot, SurveyMonkey, Google Forms, and Typeform can be leveraged alongside technologies that are driven by data to simplify the process of crafting, disseminating, and examining online surveys which play a crucial role in conducting market research effectively.

How can market research translate into business growth?

By informing product development, marketing strategies, and identifying opportunities for growth through enlightened decision-making, market research results can propel business expansion.

Leave a comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Get The Insights!

The fastest way to learn about Product Growth,Management & Trends.

The coolest way to learn about Product Growth, Management & Trends. Delivered fresh to your inbox, weekly.

The fastest way to learn about Product Growth, Management & Trends.

You might also be interested in ...

Product marketing messaging framework: key elements & examples, product marketing strategy: definition, steps, and examples.

Aazar Ali Shad

16 Best Product Marketing Campaigns To Inspire Your Own

Brandwatch has just been named The Best Social Media Monitoring Software by the Martech Breakthrough Awards 🏆

- · Brandwatch Academy

- Forrester Wave

Brandwatch Consumer Research

Formerly the Falcon suite

Formerly Paladin

Published October 17 th 2023

10 Essential Methods for Effective Consumer and Market Research

When it comes to understanding the world around you, market research is an essential step.

We live in a world that’s overflowing with information. Sifting through all the noise to extract the most relevant insights on a certain market or audience can be tough.

That’s where market research comes in – it’s a way for brands and researchers to collect information from target markets and audiences.

Once reliant on traditional methods like focus groups or surveys, market research is now at a crossroads. Newer tools for extracting insights, like social listening tools, have joined the array of market research techniques available.

Here, we break down what market research is and the different methods you can choose from to make the most of it.

What is market research, and why is it critical for you as a marketer?

Market research involves collecting and analyzing data about a specific industry, market, or audience to inform strategic decision-making. It offers marketers valuable insights into the industry, market trends, consumer preferences, competition, and opportunities, enabling businesses to refine their strategies effectively.

By conducting market research, organizations can identify unmet needs, assess product demands, enhance value propositions, and create marketing campaigns that resonate with their target audience.

This practice serves as a compass, guiding businesses in making data-driven decisions for successful product launches, improved customer relationships, and a stronger positioning in the business landscape.

For marketers and insights professionals, market research is an indispensable tool. It helps them make smarter decisions and achieve growth and success in the market.

These 10 market research methods form the backbone of effective market research strategies.

Continue reading or jump directly to each method by tapping the link below.

- Focus groups

- Consumer research with social media listening

- Experiments and field trials

- Observation

- Competitive analysis

- Public domain data

- Buy research

- Analyze sales data

Use of primary vs secondary market research

Market research can be split into two distinct sections: primary and secondary. These are the two main types of market research.

They can also be known as field and desk, respectively (although this terminology feels out of date, as plenty of primary research can be carried out from your desk).

Primary (field) research

Primary market research is research you carry out yourself. Examples of primary market research methods include running your own focus groups or conducting surveys. These are some of the key methods of consumer research. The ‘field’ part refers to going out into the field to get data.

Secondary (desk) research

Secondary market research is research carried out by other people that you want to use. Examples of secondary market research methods include studies carried out by researchers or financial data released by companies.

10 effective methods to do market research

The methods in this list cover both areas. Which ones you want to use will depend on your goals. Have a browse through and see what fits.

1. Focus groups

It’s a simple concept but one that can be hard to put into practice.

You bring together a group of individuals into a room, record their discussions, and ask them questions about various topics you are researching. For some, it’ll be new product ideas. For others, it might be views on a political candidate.

From these discussions, the organizer will try to pull out some insights or use them to judge the wider society’s view on something. The participants will generally be chosen based on certain criteria, such as demographics, interests, or occupations.

A focus group’s strength is in the natural conversation and discussion that can take place between participants (if they’re done right).

Compared to a questionnaire or survey with a rigid set of questions, a focus group can go off on tangents the organizer could not have predicted (and therefore not planned questions for). This can be good in that unexpected topics can arise; or bad if the aims of the research are to answer a very particular set of questions.

The nature of the discussion is important to recognize as a potential factor that skews the resulting data. Focus groups can encourage participants to talk about things they might not have otherwise, and others might impact the group. This can also affect unstructured one-on-one interviews.

In survey research, survey questions are given to respondents (in person, over the phone, by email, or via an online form). Questions can be close-ended or open-ended. As far as close-ended questions go, there are many different types:

- Dichotomous (two choices, such as ‘yes’ or ‘no’)

- Multiple choice

- Rating scale

- Likert scale (common version is five options between ‘strongly agree’ and ‘strongly disagree’)

- Matrix (options presented on a grid)

- Demographic (asking for information such as gender, age, or occupation)

Surveys are massively versatile because of the range of question formats. Knowing how to mix and match them to get what you need takes consideration and thought. Different questions need the right setup.

It’s also about how you ask. Good questions lead to good analysis. Writing clear, concise questions that abstain from vague expressions and don’t lead respondents down a certain path can help your results reflect the true colors of respondents.

There are a ton of different ways to conduct surveys as well, from creating your own from scratch or using tools that do lots of the heavy lifting for you.

3. Consumer research with social media listening

Social media has reached a point where it is seamlessly integrated into our lives. And because it is a digital extension of ourselves, people freely express their opinions, thoughts, and hot takes on social media.

Because people share so much content on social media and the sharing is so instant, social media is a treasure trove for market research. There is plenty of data to monitor , tap into, and dissect.

By using a social listening tool, like Consumer Research , researchers can identify topics of interest and then analyze relevant social posts. For example, they can track brand mentions and what consumers are saying about the products owned by that brand. These are real-world consumer research examples.

View this post on Instagram A post shared by Brandwatch (@brandwatch)

Social media listening democratizes insights, and is especially useful for market research because of the vast amount of unfiltered information available. Because it’s unprompted, you can be fairly sure that what’s shared is an accurate account of what the person really cares about and thinks (as opposed to them being given a subject to dwell on in the presence of a researcher).

You might like

Your complete social listening guide.

Learn how to get started with social listening

4. Interviews

In interviews, the interviewer speaks directly with the respondent. This type of market research method is more personal, allowing for communication and clarification, making it good for open-ended questions. Furthermore, interviews enable the interviewer to go beyond surface-level responses and investigate deeper.

However, the drawback is that interviews can be time-intensive and costly. Those who opt for this method will need to figure out how to allocate their resources effectively. You also need to be careful with leading or poor questions that lead to useless results. Here’s a good introduction to leading questions .

5. Experiments and field trials

Field experiments are conducted in the participants’ environment. They rely on the independent variable and the dependent variable – the researcher controls the independent variable in order to test its impact on the dependent variable. The key here is to establish whether there’s causality.

For example, take Hofling’s experiment that tested obedience, conducted in a hospital setting. The point was to test if nurses followed authority figures (doctors) and if the authority figures’ rules violated standards (The dependent variable being the nurses, the independent variable being a fake doctor calling up and ordering the nurses to administer treatment.)

According to Simply Psychology , there are key strengths and limitations to this method.

The assessment reads:

- Strength: Behavior in a field experiment is more likely to reflect real life because of its natural setting, i.e., higher ecological validity than a lab experiment.

- Strength: There is less likelihood of demand characteristics affecting the results, as participants may not know they are being studied. This occurs when the study is covert.

- Limitation: There is less control over extraneous variables that might bias the results. This makes it difficult for another researcher to replicate the study in exactly the same way.

There are also massive ethical implications for these kinds of experiments and experiments in general (especially if people are unaware of their involvement). Don’t take this lightly, and be sure to read up on all the guidelines that apply to the region where you’re based.

6. Observation

Observational market research is a qualitative research method where the researcher observes their subjects in a natural or controlled environment. This method is much like being a fly on the wall, but the fly takes notes and analyzes them later. In observational market research, subjects are likely to behave naturally, which reveals their true selves.

They are not under much pressure. However, if they’re aware of the observation, they can act differently.

This type of research applies well to retail, where the researcher can observe shoppers’ behavior by day of the week, by season, when discounts are offered, and more. However, observational research can be time-consuming, and researchers have no control over the environments they research.

7. Competitive analysis

Competitive analysis is a highly strategic and specific form of market research in which the researchers analyze their company’s competitors. It is critical to see how your brand stacks up to rivals.

Competitive analysis starts by defining the product, service, brand, and market segment. There are different topics to compare your firm with your competitors. It could be from a marketing perspective: content produced, SEO structure, PR coverage, and social media presence and engagement. It can also be from a product perspective: types of offerings, pricing structure. SWOT analysis is key in assessing strengths, weaknesses, opportunities, and threats.

We’ve written a whole blog post on this tactic, which you can read here .

8. Public domain data

The internet is a wondrous place. Public data exists for those strapped for resources or simply seeking to support their research with more data. With more and more data produced every year, the question about access and curation becomes increasingly prominent – that’s why researchers and librarians are keen on open data.

Plenty of different types of open data are useful for market research: government databases, polling data, “fact tanks” like Pew Research Center, and more.

Furthermore, APIs grant developers programmatic access to applications. A lot of this data is free, which is a real bonus.

9. Buy research

Money can’t buy everything, but it can buy research. Subscriptions exist for those who want to buy relevant industry and research reports. Sites like Euromonitor, Statista, Mintel, and BCC Research host a litany of reports for purchase, oftentimes with the option of a single-user license or a subscription.

This can be a massive time saver, and you’ll have a better idea of what you’re getting from the very beginning. You’ll also get all your data in a format that makes sense, saving you effort in cleaning and organizing.

10. Analyze sales data

Sales data is like a puzzle piece that can help reveal the full picture of market research insights. Essentially, it indicates the results. Paired with other market research data, sales data helps researchers better understand actions and consequences. Understanding your customers, their buying habits, and how they change over time is important.

This research will be limited to customers, and it’s important to keep that in mind. Nevertheless, the value of this data should not be underestimated. If you’re not already tracking customer data, there’s no time like the present.

Choosing the right market research method for your strategy

Not all methods will be right for your situation or your business. Once you’ve looked through the list and seen some that take your fancy, spend more time researching each option.You’ll want to consider what you want to achieve, what data you’ll need, the pros and cons of each method, the costs of conducting the research, and the cost of analyzing the results.

Get it right, and it’ll be worth all the effort.

Former Brandwatch Employee

Share this post

Brandwatch bulletin.

Offering up analysis and data on everything from the events of the day to the latest consumer trends. Subscribe to keep your finger on the world’s pulse.

New: Consumer Research

Make the world your focus group.

With Brandwatch Consumer Research, you can turn billions of voices into valuable insights.

More in marketing

14 social media holidays to celebrate this september.

By Yasmin Pierre Aug 13

10 Social Listening Tools and Who They’re Best for

By Brandwatch Jul 14

18 Social Media Holidays to Celebrate This August

By Yasmin Pierre Jul 10

Social Media Consultant: Key Strategies for Digital Success

By Brandwatch Jun 27

We value your privacy

We use cookies to improve your experience and give you personalized content. Do you agree to our cookie policy?

By using our site you agree to our use of cookies — I Agree

Falcon.io is now part of Brandwatch. You're in the right place!

Existing customer? Log in to access your existing Falcon products and data via the login menu on the top right of the page. New customer? You'll find the former Falcon products under 'Social Media Management' if you go to 'Our Suite' in the navigation.

Paladin is now Influence. You're in the right place!

Brandwatch acquired Paladin in March 2022. It's now called Influence, which is part of Brandwatch's Social Media Management solution. Want to access your Paladin account? Use the login menu at the top right corner.

- Entrepreneurs

- News About Crunchbase

- New Features

- Partnerships

The Types of Market Research [+10 Market Research Methods]

- Market research

Jaclyn Robinson, Senior Manager of Content Marketing at Crunchbase

Market research can help startups understand where they should be placing their resources and time. It can tell you everything from how people are perceiving your company, as well as which features to drop or continue developing. And while there are plenty of ways to conduct market research, not every market research method is right for every situation.

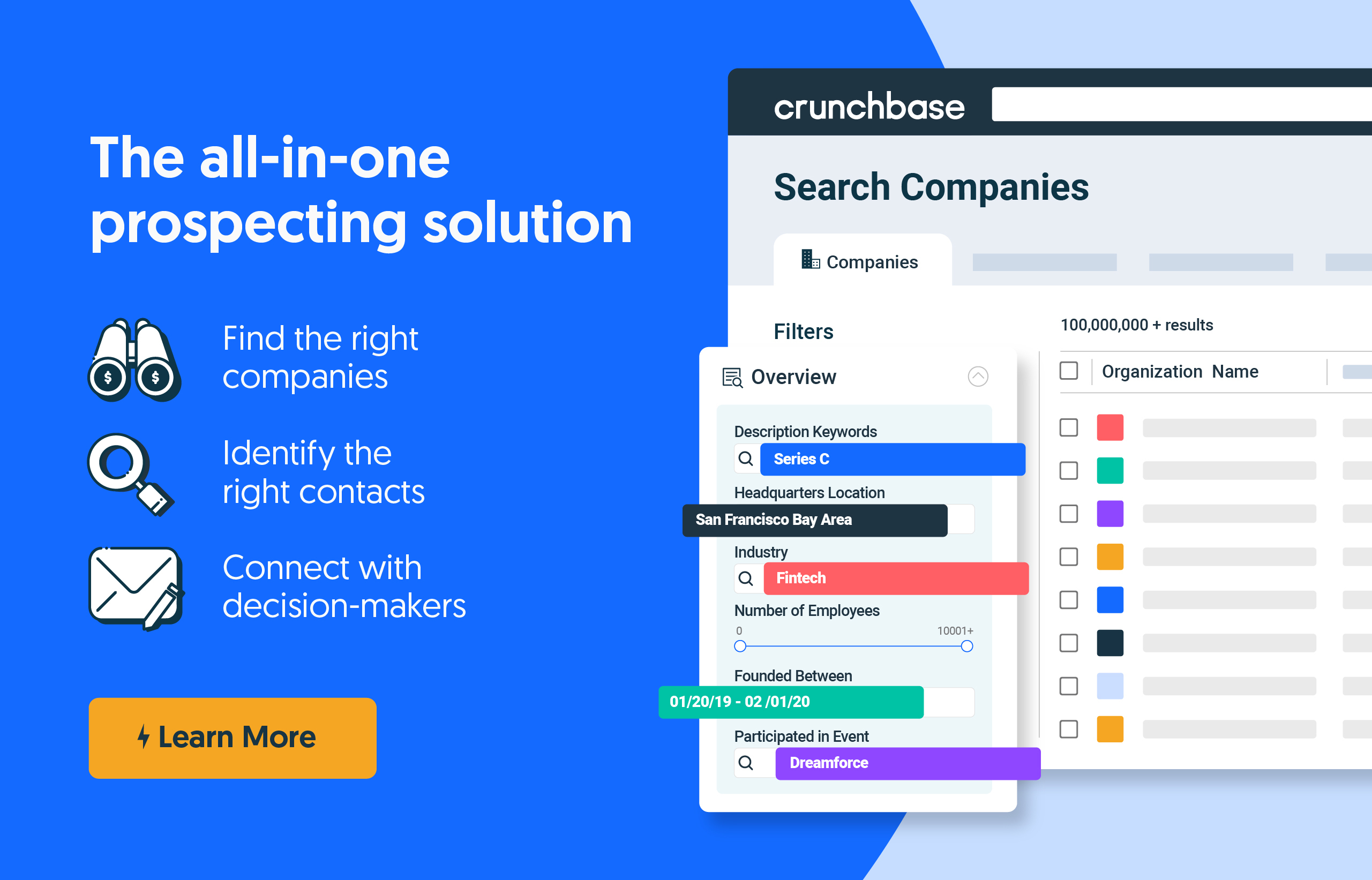

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

Market research can help play a major role in developing your product, marketing, and overall business strategy. Understanding the different market research methods can be the difference between wasting months of engineering time or exceeding your ambitious revenue targets.

We review the types of market research as well as the market research methods you can pursue based on your primary objectives and business goals.

The 2 types of market research

All market research falls under two distinct categories: primary research and secondary research.

Primary research looks at any data you collect yourself (or someone you pay). It encompasses analyzing current sales, metrics, and customers. It also takes into account the effectiveness of current practices, while taking competitors into account.

Secondary research looks at data that has already been published by others. It includes reports and studies from other companies, government organizations, and others in your industry.

10 market research methods

The type of data you need will decide which market research technique to use. Here are the most commonly used market research methods:

Primary research methods

These primary research methods will help you identify both qualitative and quantitative data. Qualitative data is information that cannot be measured while qualitative data is taken from a large sample size and is a statistically significant mathematical analysis.

1. Interviews

Great for: expert advice

Consisting of one-on-one discussions, interviews are a great source of qualitative data. You can either perform interviews by telephone, video conference, or face-to-face. Interviews are great for an in-depth look for target audience insights.

In-depth interviews are great when expert advice is needed or when discussing highly complex or sensitive topics. Interviews are usually 10 to 30 minutes long with 25 to 75 respondents.

Great for: understanding brand awareness, satisfaction and loyalty analysis, pricing research, and market segmentation .

One of the most commonly used market research methods, Surveys are an easy way to understand your target audience and allow you to test a large sample size to determine if findings are true across a larger segment of your customers.

3. Questionnaires

Great for: Customer feedback and satisfaction surveys (NPS surveys), and when you want more detail on your target audience and customer base.

Do not confuse questionnaires for surveys ! While surveys are aggregated for statistical analysis, questionnaires are a set of written questions used for collecting information.

Questionnaires are used to collect information rather than draw a conclusion. Surveys can include a questionnaire, but a survey must aggregate and analyze the responses to the questions.

When writing questionnaires for market research, keep the number of questions in mind.

In one study, SurveyMonkey found that questionnaires with 40 questions have about a 10% lower response rate than questionnaires with 10 questions . The more questions, the less likely people will finish your questionnaire.

4. Focus groups

Great for: Price testing, advertising concepts, product/messaging testing

Even with the rise of big data, focus groups have remained an integral part of how companies build their products, strategy, and messaging. Focus groups are intentionally compromised by a group of purposefully selected individuals. Above all, the collaborative setting ensures that members of the group are able to interact and influence each other.

Typically these open and interactive groups are composed of around five to 12 screened individuals . Make sure that your participants are diverse so you can get a range of opinions and you have enough representation from several segments of your market.

Many smaller startups will conduct DIY focus groups and will use video conferencing technology, which is one of the most cost-effective and time-efficient market research methods.

This is a great resource to see some good questions to ask your focus groups as well as what topics focus groups should touch on.

5. User groups

Great for: Feature testing, UX and web design feedback

User groups are used to gather UX data and provide insight for website design. User groups usually meet regularly to discuss their experience with a product, while researchers capture their comments.

Here’s a great guide on how to format questions for user groups .

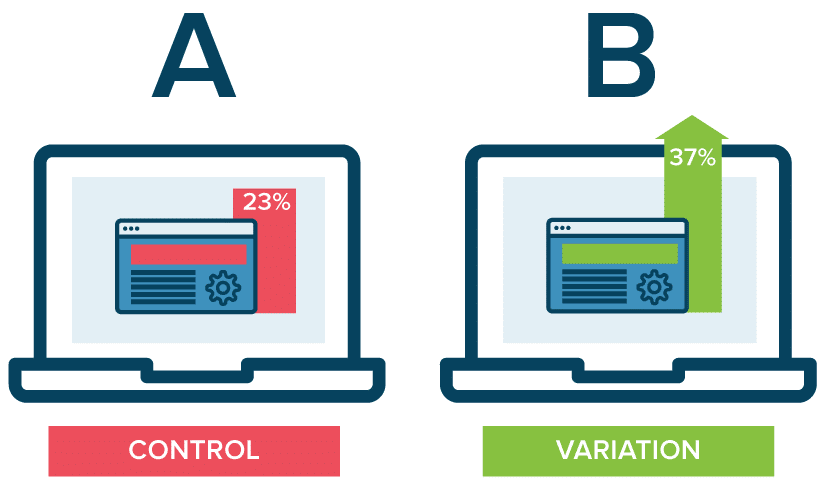

6. Test markets

Great for: Testing new marketing campaigns

Test markets represent a larger market. Using a test group as well as a control group can show you the success of a new landing page, messaging copy, or CTA button. We particularly like the free version of Google Optimize to get quantitative data on how your experiment is performing based on a specific goal.

Secondary research methods

Secondary research can help establish a starting point prior to diving into more expensive primary research techniques. While there is a lot of data on the web regarding basic statistics, you may have to purchase a distinct data provider for a more in-depth look at your market.

Crunchbase Pro and Marketplace partners are a great and inexpensive way to start your secondary research directly on Crunchbase.com.

7. Competitor benchmarks

Great for: Understanding your revenue, churn, operating costs, sales, profit margin, and burn rate.

Competitor benchmarks are the most valuable and widely used of the secondary research methods. Moreover, competitor benchmarks measure specific growth metrics or key performance indicators in comparison to business within the same industry and of a similar size.

You can use Crunchbase Pro to find how much companies in a certain industry are raising and who are the leading players with our global coverage on companies ranging from pre-seed to late-stage. So, as one of the most informative of the market research methods, competitive benchmarks are a great way to inform your business strategy.

Free Crunchbase registered users have access to revenue estimates as well as web traffic data.

8. Sales data

Great for: Understanding your audience and where to place marketing efforts.

Taking a look at internal sales data not only reveals profitability but also helps market researchers segment customer trends.

However, taking a look at competitive sales data is a great way to make sure that you’re meeting the numbers you should be targeting as well as capturing the full potential of the market

9. Government publications and statistics

Great for: General demographic information and larger trends

The U.S. Census Bureau is a great resource of national demographic data. You can also review patents as a preview of industry trends and future innovation.

Also, you can find additional data and research from Data.gov , The World Bank , as well as the Pew Research Center to help inform your market research decisions.

10. Commercial data

Great for: Greater insight into industry trends and reports

If you’re interested in purchasing secondary market research, commercial data is available. For comprehensive reports, Mintel and IBISWorld are both traditional market research companies that provide commercial data.

Additionally, to choose which type of market research method is best for your goal, follow this graph from Relevant Insights. Begin with the metric you’re trying to move and then backtrack into a targeted market research method.

How can Crunchbase help with my market research?

Crunchbase gives market researchers flexible access to Crunchbase’s complete company data. Innovative teams and leaders in market research rely on Crunchbase’s live company data to build powerful internal databases and research insights in respective industries. Learn more about how Crunchbase can help you with your market research .

- Originally published March 14, 2019, updated April 26, 2023

You may also like

- 10 min read

How to Do Market Research for a Startup: Tips for Success

Eastern Europe Industry Review: Russia-Connected SPACs, New VC Darlings, Food Delivery Disruption

By Adrien Henni, Chief Editor, East-West Digital News

Women In Russian VC: How Gender Stereotypes Hinder Investment

Daria Zharkova, Senior Research Manager at Dsight

The all-in-one prospecting solution

- Find the right companies

- Identify the right contacts

- Connect with decision-makers

New ebook : 10 Best Practices to Optimize Your Product Org

The Ultimate Guide to Market Research: Examples and Best Practices

Market research plays a vital role in the success of any business. It helps companies understand their target market, gather valuable insights, and make informed decisions. In this ultimate guide, we will demystify market research, explore different research methods, discuss the importance of selecting the right market research partner, and provide real-life examples and best practices.

Market Research Demystified

Market research is the process of collecting, analyzing, and interpreting data about a particular market, industry, or target audience . By conducting market research, companies gain a deeper understanding of market trends, customer preferences, and competitive landscape, allowing them to make informed strategic decisions and create effective marketing campaigns.

Market research can be classified into two main categories: primary and secondary research. Both approaches provide valuable information, but they differ in their data collection methods and purpose.

Unveiling the Importance of Marketing Research

Market research is crucial for businesses because it helps them stay competitive, identify new opportunities, and minimize risks. By conducting thorough market research, companies can understand their customers' needs and preferences, develop products or services that meet those needs, and position themselves effectively in the market.

Market research also helps businesses identify their target audience and determine the most effective ways to reach them. It provides insights into consumer behavior, buying patterns, and market trends, allowing companies to tailor their marketing strategies and messages accordingly.

Primary vs Secondary Market Research: Understanding the Difference

Primary market research involves collecting data directly from the source. This can be done through surveys, interviews, observations, or experiments. Primary research provides firsthand information that is specific to the research objectives and allows businesses to gather data tailored to their needs.

Secondary market research, on the other hand, involves using existing data that has already been collected by someone else for a different purpose. This can include published reports, industry studies, government data, or customer feedback. Secondary research is cost-effective, saves time, and provides access to a wide range of data.

Both primary and secondary research have their advantages and limitations. The choice between the two depends on several factors, including the research objectives, budget, and time constraints. In many cases, a combination of both approaches yields more comprehensive and accurate results.

Case Studies: Insights from Successful Market Research

Real-life case studies can provide valuable insights into the effectiveness of market research. Let's explore two examples of companies that used market research to drive their success.

Case Study 1: Company XYZ, a startup in the fashion industry, conducted extensive market research before launching their line of sustainable clothing. Through surveys and focus groups , they identified a growing demand for eco-friendly fashion among millennials. This research allowed them to create a unique brand positioning and design products that resonated with their target audience. As a result, they gained a competitive advantage and achieved rapid growth in the market.

Case Study 2: Company ABC, a multinational consumer goods company, used market research to enter a new international market. They conducted thorough market analysis, including competitor analysis, consumer behavior research, and cultural studies. This research helped them tailor their product offering and marketing strategy to suit the local market preferences. As a result, they successfully launched their products and gained a significant market share.

These case studies illustrate the power of market research in driving business success and making informed decisions. Regardless of the industry or size of the company, market research can provide valuable insights and guide strategic planning.

Expanding on the importance of market research, it is worth noting that in today's rapidly evolving business landscape, staying ahead of the competition is more challenging than ever. Market research plays a vital role in helping companies gain a competitive edge by providing them with valuable information about their target market and customers. By understanding the needs, preferences, and behaviors of their target audience, companies can develop products and services that meet their customers' expectations and stand out in the market.

Furthermore, market research can also help businesses identify emerging trends and opportunities. By analyzing market data and consumer insights, companies can spot gaps in the market and capitalize on them. This proactive approach allows businesses to stay ahead of the curve and adapt their strategies to changing market dynamics.

Another aspect of market research that is worth exploring is the role it plays in risk mitigation. By conducting thorough market research, companies can identify potential risks and challenges before they become major issues. This allows them to make informed decisions and develop contingency plans to mitigate those risks. Market research acts as a compass, guiding businesses through uncertain terrain and helping them navigate potential obstacles.

Decoding Qualitative and Quantitative Research Methods

Market research methods can be broadly classified into two categories: qualitative and quantitative research. Let's dive deeper into each approach and understand their benefits and applications.

Diving Deep into Qualitative Research Techniques

Qualitative research focuses on understanding human behavior , motivations, attitudes, and perceptions. It provides insights into the "why" behind consumer actions and helps uncover underlying emotions and motivations.

Qualitative research methods include focus groups, interviews, observations, and case studies. These methods allow researchers to gather rich and detailed information, explore participants' thoughts and opinions in depth, and uncover new insights that may not be captured by quantitative research alone. For example, in a focus group, participants can engage in open-ended discussions, allowing for a deeper exploration of their experiences and perspectives.

Moreover, qualitative research is especially useful in the early stages of product development or when exploring new market segments. By conducting interviews or observations, researchers can gain a nuanced understanding of consumer needs, preferences, and pain points. This knowledge can then be used to develop products and services that truly resonate with the target audience.

The Power of Numbers: Quantitative Research Explained

Quantitative research, on the other hand, focuses on numerical data and statistical analysis . It aims to quantify consumer opinions, behaviors, and preferences using structured questionnaires or surveys.

Quantitative research methods include online surveys, face-to-face interviews, and experiments. These methods allow researchers to collect data from a large sample size, analyze trends and patterns , and make statistically valid conclusions. For instance, by distributing an online survey to a large number of respondents, researchers can obtain a representative sample and generate reliable statistical data.

Furthermore, quantitative research is particularly useful when measuring customer satisfaction, conducting market segmentation, or evaluating the impact of marketing campaigns. By using rating scales or Likert-type questions, researchers can assign numerical values to different variables, enabling them to analyze and compare data objectively. This data-driven approach provides valuable insights that can guide strategic decision-making.

Both qualitative and quantitative research methods have their strengths and limitations. Combining both approaches can provide a holistic understanding of consumer behavior and inform strategic decision-making. By triangulating data from multiple sources, researchers can validate findings, identify patterns, and gain a comprehensive view of the market landscape. This integrated approach enhances the reliability and robustness of research outcomes, enabling businesses to make informed and data-driven decisions.

Unleashing the Potential of Market Research Tools

Market research tools can enhance the efficiency and effectiveness of the research process. Here, we will explore the benefits of using market research tools and highlight the role of Userpilot in enhancing market research.

Market research tools play a crucial role in helping businesses understand market trends, consumer behavior, and competitive landscapes. They provide valuable data that can guide strategic decision-making, product development, and marketing campaigns. By utilizing these tools, companies can gain a competitive edge and stay ahead in today's dynamic business environment.

Enhancing Market Research with Userpilot

Userpilot is a market research tool that allows businesses to collect feedback, conduct surveys, and analyze user behavior. It provides valuable insights into user preferences, pain points, and feature requests.

One of the key advantages of using Userpilot is its user-friendly interface and easy integration with existing software platforms. It allows companies to create personalized surveys, collect real-time feedback, and analyze data in a centralized dashboard.

By leveraging Userpilot, businesses can gather actionable insights, improve their product or service offerings, and enhance the overall customer experience. Userpilot streamlines the market research process, saving time and resources, and enabling companies to make data-driven decisions.

Furthermore, Userpilot offers advanced analytics capabilities that help businesses track user engagement, retention rates, and conversion metrics. This data-driven approach empowers companies to optimize their marketing strategies, tailor their products to meet customer needs, and drive business growth.

Your Comprehensive Guide to the Market Research Process

The market research process involves several key steps, from defining research objectives to analyzing and interpreting the data. Let's explore each step in detail:

Step-by-Step: Navigating the Market Research Journey

- Define the research objectives: Clearly state the purpose and goals of the research.

- Identify the target audience: Determine the specific group of people or businesses you want to gather insights from.

- Select research methods: Choose the appropriate qualitative or quantitative research methods based on your objectives.

- Design the research instrument: Develop surveys, questionnaires, or interview protocols that align with your research goals.

- Collect data: Implement the research methods and collect data from the identified target audience.

- Analyze and interpret the data: Use statistical analysis or qualitative techniques to analyze the collected data and derive meaningful insights.

- Draw conclusions and make recommendations: Summarize the findings, draw conclusions, and make strategic recommendations based on the data analysis.

- Communicate and present the findings: Present the research results in a clear and concise manner, making it accessible to stakeholders and decision-makers.

The market research process is iterative and requires continuous monitoring and adjustment. By following these steps, businesses can ensure they gather accurate and valuable data to inform their decision-making processes.

Now, let's delve deeper into each step of the market research process to gain a comprehensive understanding:

1. Define the research objectives: In this crucial first step, it is essential to clearly define the research objectives. This involves identifying the specific information you aim to uncover and the goals you want to achieve through the research. By setting clear objectives, you provide a solid foundation for the entire market research process.

2. Identify the target audience: Once you have defined your research objectives, it is important to identify the target audience. This involves determining the specific group of people or businesses from whom you want to gather insights. Understanding your target audience helps ensure that the data collected is relevant and representative of the population you are studying.

3. Select research methods: After identifying your target audience, it is time to choose the appropriate research methods. Depending on your objectives, you may opt for qualitative methods, such as focus groups or interviews, or quantitative methods, such as surveys or experiments. Selecting the right research methods is crucial for obtaining accurate and reliable data.

4. Design the research instrument: With your research methods chosen, the next step is to design the research instrument. This involves developing surveys, questionnaires, or interview protocols that align with your research goals. Designing effective research instruments ensures that you collect the necessary data to answer your research questions and achieve your objectives.

5. Collect data: Once your research instruments are ready, it is time to implement them and collect data from your target audience. This may involve conducting interviews, administering surveys, or observing consumer behavior. Collecting data requires careful planning and execution to ensure that the data collected is accurate and representative of the target audience.

6. Analyze and interpret the data: After collecting the data, the next step is to analyze and interpret it. This involves using statistical analysis or qualitative techniques to uncover patterns, trends, and insights within the data. By analyzing and interpreting the data, you can derive meaningful and actionable insights that can inform your decision-making processes.

7. Draw conclusions and make recommendations: Once the data has been analyzed, it is time to draw conclusions and make recommendations based on the findings. This step involves summarizing the research results, identifying key insights, and drawing conclusions that address the research objectives. Additionally, you can make strategic recommendations based on the data analysis to guide future actions and decision-making.

8. Communicate and present the findings: The final step in the market research process is to communicate and present the findings. This involves presenting the research results in a clear and concise manner, making it accessible to stakeholders and decision-makers. Effective communication of the research findings ensures that the insights gained from the research are understood and utilized to drive informed decision-making.

Remember, the market research process is not a linear path but rather an iterative journey. Continuous monitoring and adjustment are necessary to ensure that the research remains relevant and aligned with changing business needs. By following these steps and adapting as needed, businesses can gather accurate and valuable data to inform their decision-making processes and gain a competitive edge in the market.

Overcoming Challenges and Embracing Best Practices in Market Research

Market research may present its fair share of challenges, but by embracing best practices, businesses can navigate these obstacles and optimize their research efforts. Let's explore some common challenges and best practices:

One common challenge in market research is the issue of data quality. Ensuring that the data collected is accurate and reliable is crucial for making informed business decisions. To address this challenge, businesses can implement rigorous data validation processes, conduct regular data audits, and invest in advanced analytics tools to identify and rectify any discrepancies in the data. By prioritizing data quality, businesses can enhance the credibility and effectiveness of their market research efforts.

Another challenge faced by businesses in market research is the rapid evolution of technology and consumer behavior. With the rise of digital platforms and social media, traditional market research methods may no longer provide a comprehensive understanding of consumer preferences and trends. To overcome this challenge, businesses can leverage advanced data analytics techniques, such as sentiment analysis and social listening, to gain valuable insights from online conversations and interactions. By staying abreast of technological advancements and consumer behavior shifts, businesses can adapt their market research strategies to remain competitive in the ever-changing marketplace.

From Data to Action: Real-Life Market Research Success Stories

Market research generates valuable insights, but the true value lies in how businesses leverage that data to drive action and make informed decisions. Here are two real-life success stories:

Finding Your Perfect Match: Selecting Market Research Tools

Choosing the right market research tools is essential for the success of your research endeavors. Consider the following factors when selecting a market research tool:

Evaluating the Impact of Your Market Research Efforts

Measuring the impact of market research is crucial to determine the effectiveness of your efforts and make informed decisions. Here are some key metrics to consider:

Wrapping It Up: Key Takeaways from Market Research

Market research is a powerful tool that enables businesses to understand their target market, gain valuable insights, and drive informed decision-making. By conducting thorough market research using both qualitative and quantitative methods, leveraging market research tools, and following best practices, businesses can position themselves for success in a competitive market landscape. Remember, the key is not just collecting data but transforming it into actionable insights that drive growth and profitability.

You might also like

A Comprehensive Guide to Collecting and Analyzing Qualitative Feedback

The Ultimate Guide to Analyzing Consumer Behavior

Mastering Data-Driven Decision-Making in Product Management

What is Market Research? Definition, Types, Process, Examples and Best Practices

By Nick Jain

Published on: June 21, 2023

Table of Contents

- बाजार अनुसंधान क्या है?

Types of Market Research

Market research process, examples of market research, market research methods, best practices for market research in 2023, what is market research.

Market research is defined as a systematic and strategic process of gathering, analyzing, and interpreting data about a target market, industry trends, and consumer behavior. It involves a deep dive into understanding the needs, preferences, and pain points of potential customers, as well as evaluating competitors and market dynamics.

By utilizing both qualitative and quantitative research methods, market research provides businesses with actionable insights that guide decision-making, drive product development, and shape marketing strategies. This process is essential for identifying market opportunities, minimizing risks, and achieving a competitive advantage in today’s rapidly changing marketplace.

Key elements of market research include segmenting the market, collecting data from primary and secondary sources, and applying advanced data analysis techniques to uncover patterns and trends. The ultimate goal of market research is to equip businesses with the knowledge they need to meet customer demands, enter new markets, and optimize their market positioning for sustained growth and success.

Key components of market research:

Market research typically involves several key components that contribute to a comprehensive understanding of the market and its dynamics. These components include:

- Market Segmentation: Identifying and dividing the target market into distinct segments based on demographics, psychographics, behavior, or other relevant characteristics. This helps tailor marketing strategies to specific customer groups.

- Data Collection: Gathering relevant data from primary and secondary sources. Primary data refers to information collected directly from the target market through surveys, interviews, observations, or experiments. Secondary data involves leveraging existing research, reports, industry databases, or government sources.

- Research Design: Developing a research plan that outlines the objectives, methodology, and timeline for conducting the research. This includes selecting appropriate research methods, determining the sample size, and defining the sampling technique.

- Qualitative Research: Utilizing techniques like interviews, focus groups , or observations to gain in-depth insights into consumer attitudes, opinions, motivations, and behaviors. Qualitative research helps explore underlying reasons and provides a richer understanding of the market.

- Quantitative Research: Employing surveys, questionnaires, or structured data analysis to gather numerical data on a larger scale. Quantitative research enables statistical analysis, measurement of market trends, and generation of quantitative insights and metrics.

- Competitive Analysis: Assessing competitors’ strategies, strengths, weaknesses, market positioning, and offerings. This helps identify market opportunities, potential threats, and areas for differentiation.

- Consumer Behavior Analysis: Examining consumer decision-making processes, buying habits, preferences, and satisfaction levels. Understanding consumer behavior is crucial for developing effective marketing strategies and targeted campaigns.

- Market Size and Forecasting: Estimating the total market size, growth potential, and future trends. Market sizing helps assess the market’s attractiveness and potential demand for products or services.

- Data Analysis: Applying statistical techniques and tools to analyze collected data and derive meaningful insights. This includes data cleaning, segmentation analysis, correlation analysis, regression analysis, and other statistical methods.

- Reporting and Presentation: Summarizing research findings, insights, and recommendations in a clear and concise manner. Effective communication of research results ensures that stakeholders can make informed decisions based on the findings.

These components work together to provide a holistic view of the market, consumer behavior, and competitive landscape, enabling businesses to make informed decisions and develop effective marketing strategies.

Primary Research: Primary research involves collecting data directly from the target market or consumer segment. It is customized and tailored to address specific research objectives. Primary research methods include surveys, interviews, focus groups , observations, and experiments. Primary research allows for the collection of firsthand data and offers more control over the research process.

Secondary Research: Secondary research involves gathering and analyzing existing data that has been previously collected by other sources. This data can include industry reports, government publications, academic studies, market research reports, and online databases. Secondary research helps to gain a broader understanding of the market, industry trends, and historical data. It is a cost-effective way to access existing information and can provide a foundation for further primary research.

Learn more: What is Customer Experience (CX) Research?

Step 1. Define Research Objectives

The first step in market research is to clearly define the research objectives. This involves identifying the specific information needed, the target audience, and the desired outcomes of the research.

Step 2. Design Research Plan

Once the objectives are defined, the next step is to design a research plan that outlines the methodology, data collection techniques, sample size, and timeline. The research plan should be tailored to address the research objectives and provide reliable and valid data.

Step 3 Data Collection

In this stage, data is collected using primary or secondary research methods. Primary research involves gathering data directly from respondents through surveys, interviews, focus groups , or observations. Secondary research involves gathering existing data from published sources, industry reports, or databases.

Step 4. Market research Analysis

Once the data is collected, it needs to be analyzed to identify patterns, trends, and insights. This can involve quantitative research and analysis, such as statistical techniques, or qualitative research and analysis, such as thematic coding or content analysis. The goal is to derive meaningful insights from the data that can inform decision-making.

Step 5. Final Market Research Insights

After analyzing the data, the next step is to interpret the findings and extract actionable insights. This involves drawing conclusions, identifying key trends, and relating them to the research objectives. The insights should provide valuable information that guides marketing strategies, product development, or business decisions.

Step 6. Reporting Research Findings

The final step is to present the research findings in a clear and concise manner. A market research report is typically prepared, which includes an executive summary, methodology, findings, insights, and recommendations. The report should effectively communicate the research results to stakeholders and provide actionable recommendations based on the insights.

Here are some examples of market research. These examples illustrate the diverse applications of market research across various industries and scenarios:

- Customer Satisfaction Market Research : A company conducts a customer satisfaction survey to gather feedback from its existing customers . The survey includes questions about their experience with the product or service, overall satisfaction, likelihood to recommend, and areas for improvement. The results help the company understand customer satisfaction levels, identify key drivers of satisfaction, and take action to enhance the customer experience .

- Pricing Market Research: A business is considering introducing a new product or service and wants to determine the optimal pricing strategy. They conduct pricing research, which involves surveys or conjoint analysis, to gather data on customer price sensitivity, willingness to pay, and perceptions of value. The research helps the company set competitive pricing that aligns with customer expectations and maximizes profitability.

- Market Trend Research: A market research firm monitors industry trends and analyzes market data to provide insights to clients. They track market size, growth rates, industry dynamics, and consumer preferences through secondary research. The analysis helps businesses understand market trends, identify emerging opportunities or threats, and make informed strategic decisions.

- Concept Testing Market Research: A company has developed several product concepts and wants to evaluate their potential success before investing in product development. They conduct concept testing research, which involves presenting the concepts to a target audience through surveys or focus groups . The research helps assess consumer interest, perceived benefits, and purchase intent for each concept, allowing the company to select the most promising one to pursue further.

- Competitor Market Research: A company wants to assess the strengths and weaknesses of its competitors in the market. They conduct competitor analysis, which involves gathering data on competitors’ products, pricing, distribution channels, marketing strategies, and customer perceptions. The insights obtained help the company benchmark against competitors, identify areas of competitive advantage and develop strategies to differentiate itself in the market.

- Ad Testing Market Research: A company is planning to launch a new advertising campaign and wants to assess its effectiveness. They conduct ad testing research, which involves presenting different versions of the ad to a sample audience and gathering user or customer feedback on message comprehension, brand recall, and emotional response. The research helps the company optimize the ad campaign by identifying the most impactful and persuasive elements.

- Market Segmentation Research: A company wants to understand its target market better and tailor marketing strategies to specific customer segments. They conduct market segmentation research, which involves analyzing demographic, psychographic, and behavioral data to identify distinct customer segments with different needs, preferences, and buying behaviors. The segmentation analysis helps the company develop targeted marketing campaigns, messages, and product offerings for each segment.

Learn more: What is Customer Feedback?

- Qualitative Market Research Methods

Qualitative market research methods focus on non-data intensive methods of information gathering and analysis. These methods focus on a small sample of respondents who are probed for an in-depth understanding of a subject. The goal of such a method is to gain an in-depth understanding of the market and consumer behavior based on open-ended questions and discussions.

For example, focus groups , one-on-one interviews, case studies, etc are popular qualitative methods of market research.

- Quantitative Market Research Methods

Quantitative market research focuses on data-intensive methods that return solid data that can be quantitatively analyzed in bulk. These methods often rely on a large sample of respondents who answer a common questionnaire, which may further have an internal logic to branch out to new questions based on answers to previous questions.